Epoxy

February 15, 2021

Lanxess to Acquire Emerald Kalama

LANXESS signs contract to acquire Emerald Kalama Chemical

CologneFebruary 14, 2021

Specialty chemicals company LANXESS signed an agreement to acquire US-based Emerald Kalama Chemical from affiliates of American Securities LLC. Emerald Kalama Chemical is one of the leading global manufacturers of specialty chemicals especially for the consumer segment.

Emerald Kalama employs worldwide approximately 500 employees and runs three production sites. The company reported 2020 sales of around USD 425 million and EBITDA pre exceptionals of approximately USD 90 million. Around 45 percent of its turnover is generated in North America.

The enterprise value amounts to USD 1,075 million. The transaction will be financed by LANXESS existing liquidity. Closing of the transaction is anticipated in the second half of 2021 and subject to the approval of the relevant regulatory authorities.

By acquiring Emerald Kalama Chemical, LANXESS strengthens its specialty chemical portfolio especially in the Consumer Protection segment and would materially expand into the growth markets food and animal nutrition.

February 15, 2021

Lanxess to Acquire Emerald Kalama

LANXESS signs contract to acquire Emerald Kalama Chemical

CologneFebruary 14, 2021

Specialty chemicals company LANXESS signed an agreement to acquire US-based Emerald Kalama Chemical from affiliates of American Securities LLC. Emerald Kalama Chemical is one of the leading global manufacturers of specialty chemicals especially for the consumer segment.

Emerald Kalama employs worldwide approximately 500 employees and runs three production sites. The company reported 2020 sales of around USD 425 million and EBITDA pre exceptionals of approximately USD 90 million. Around 45 percent of its turnover is generated in North America.

The enterprise value amounts to USD 1,075 million. The transaction will be financed by LANXESS existing liquidity. Closing of the transaction is anticipated in the second half of 2021 and subject to the approval of the relevant regulatory authorities.

By acquiring Emerald Kalama Chemical, LANXESS strengthens its specialty chemical portfolio especially in the Consumer Protection segment and would materially expand into the growth markets food and animal nutrition.

February 15, 2021

Cold Temperatures In Houston

Sub-freezing temps in US Gulf could disrupt plant operations, logistics

Author: Adam Yanelli

2021/02/12

HOUSTON (ICIS)–A cold front making its way across the US this weekend could disrupt plant operations or impact logistics if temperatures spend enough time below freezing.

But the impact on chemical plants along the US Gulf Coast, where sub-freezing weather is rare, could be limited if daytime highs rise above freezing.

Forecasts from the National Weather Service show overnight temperatures in some areas along the US Gulf could fall as low as 14 degrees Fahrenheit (-10 degrees Celsius) on Sunday and Monday nights.

The NWS forecast for Deer Park, Texas, calls for temperatures to drop below freezing on Sunday night and to stay there until Tuesday morning.

Forecasts can still change, and the daily highs could be warm enough to prevent plant shutdowns, said Brian Pruett, senior vice president of polyethylene (PE) and polypropylene (PP) with CDI.

Generally, plants are designed to run within a set range of temperatures, said James Wilson, senior analyst at ICIS. Below that range, some pieces of equipment may not run well and some lines can freeze.

In places such as Russia, companies design plants with cold temperatures in mind, Wilson said. Process lines are heavily insulated or even heat traced.

Such frigid temperatures are rare on the Gulf Coast. It is unlikely that chemical companies adopted such extra steps in the new units that they built during the past decade, said Kimberly Haberkost, director of olefins at CDI.

Idled plants could be more at risk of damage, a producer told ICIS, because they are not generating heat and they could have water in the pipes that could freeze and cause issues.

LOGISTICS, POWER LOSS

Even without any plant shutdowns, icy roads could slow down deliveries and keep workers from getting to the plants.

Freezing rain or sleet could weigh on trees, causing them to fall and possibly take down power lines.

The NWS forecast includes a 60% chance of snow or sleet overnight on Sunday through Monday.

Bitterly cold temperatures are causing logistical issues, as rivers connecting chemical production in the US Gulf with the Midwest region of the country begin to freeze.

PAST COLD-WEATHER SHUTDOWNS

The last time that frigid weather shut down plants on the Gulf Coast was in mid-January 2018.

On 17 January 2018, the temperatures ranged from 20-37 degrees Fahrenheit in Houston, according to the Weather Underground. On 18 January 2018, the range was 26-38 degrees Fahrenheit.

Before that, cold temperatures disrupted operations in 2011, when temperatures were 24-34 degrees Fahrenheit from 2-4 February.

Additional reporting by Al Greenwood and Antoinette Smith

February 15, 2021

Cold Temperatures In Houston

Sub-freezing temps in US Gulf could disrupt plant operations, logistics

Author: Adam Yanelli

2021/02/12

HOUSTON (ICIS)–A cold front making its way across the US this weekend could disrupt plant operations or impact logistics if temperatures spend enough time below freezing.

But the impact on chemical plants along the US Gulf Coast, where sub-freezing weather is rare, could be limited if daytime highs rise above freezing.

Forecasts from the National Weather Service show overnight temperatures in some areas along the US Gulf could fall as low as 14 degrees Fahrenheit (-10 degrees Celsius) on Sunday and Monday nights.

The NWS forecast for Deer Park, Texas, calls for temperatures to drop below freezing on Sunday night and to stay there until Tuesday morning.

Forecasts can still change, and the daily highs could be warm enough to prevent plant shutdowns, said Brian Pruett, senior vice president of polyethylene (PE) and polypropylene (PP) with CDI.

Generally, plants are designed to run within a set range of temperatures, said James Wilson, senior analyst at ICIS. Below that range, some pieces of equipment may not run well and some lines can freeze.

In places such as Russia, companies design plants with cold temperatures in mind, Wilson said. Process lines are heavily insulated or even heat traced.

Such frigid temperatures are rare on the Gulf Coast. It is unlikely that chemical companies adopted such extra steps in the new units that they built during the past decade, said Kimberly Haberkost, director of olefins at CDI.

Idled plants could be more at risk of damage, a producer told ICIS, because they are not generating heat and they could have water in the pipes that could freeze and cause issues.

LOGISTICS, POWER LOSS

Even without any plant shutdowns, icy roads could slow down deliveries and keep workers from getting to the plants.

Freezing rain or sleet could weigh on trees, causing them to fall and possibly take down power lines.

The NWS forecast includes a 60% chance of snow or sleet overnight on Sunday through Monday.

Bitterly cold temperatures are causing logistical issues, as rivers connecting chemical production in the US Gulf with the Midwest region of the country begin to freeze.

PAST COLD-WEATHER SHUTDOWNS

The last time that frigid weather shut down plants on the Gulf Coast was in mid-January 2018.

On 17 January 2018, the temperatures ranged from 20-37 degrees Fahrenheit in Houston, according to the Weather Underground. On 18 January 2018, the range was 26-38 degrees Fahrenheit.

Before that, cold temperatures disrupted operations in 2011, when temperatures were 24-34 degrees Fahrenheit from 2-4 February.

Additional reporting by Al Greenwood and Antoinette Smith

February 13, 2021

Container Traffic in CA

New Video Shows Massive California Container Ship Traffic Jam

by Tyler DurdenFriday, Feb 12, 2021 – 19:40

By Greg Miller of American Shipper

Newly released U.S. Coast Guard video offers visceral proof of just how extreme the congestion has become at the ports of Los Angeles and Long Beach. The new view from above reveals a vast armada of container ships scattered at anchor across California’s San Pedro Bay.

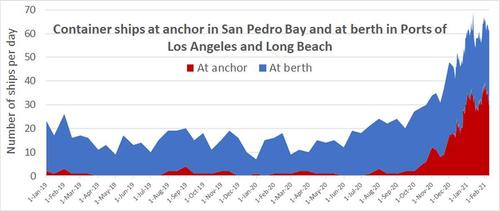

As the Coast Guard footage paints the picture, the latest data from the Port of Los Angeles and from the Marine Exchange of Southern California tells the story behind those images.

The data confirms that there has been no real let-up in the historic container-ship traffic jam off California’s coast.

As of Thursday, there were 25 container ships at berth in Los Angeles and Long Beach. Thirty-two container ships were at anchorage. That’s roughly the same level that has been at anchor since the beginning of this year. (The record of 40 container ships at anchor was hit on Feb. 1).

The Port of Los Angeles, via its platform, The Signal, recently began disclosing the number of days at anchor for specific container ships. The numbers confirm that some vessels are spending almost as much time at anchor as it takes to traverse the Pacific Ocean.

As of Thursday, the Ever Envoy, with a capacity of 6,332 twenty-foot equivalent units (TEUs), had been at anchor for 11 days. Other ships that had just gone to berth had been waiting just as long: As of Tuesday , the 9,400-TEU MSC Romane had been at anchor for 12 days. The 11,356-TEU CMA CGM Andromeda, 8,452-TEU Ever Liven and 4,888-TEU NYK Nebula for 11 days.

The Signal indicated that the average time at anchor for ships calling in Los Angeles was 8 days as of Thursday, up from 6.9 days on Tuesday. The Signal has provided information on ship waiting times since Jan. 27. Waiting time has remained at an average of around one week since then.

What’s Causing the Traffic Jam

Extended anchorage times have forced some ocean carriers to cancel multiple sailings this month. Not due to lack of cargo demand, but rather, due to lack of available ships to handle those services.

Delays on the landside are causing the logjam at sea. Extremely high inbound volumes combined with logistical complications both inside and outside the ports are causing the landside delays. One of the challenges inside the ports involves COVID infections among dockworkers. The International Longshore and Warehouse Union (ILWU) reported 694 of its members had tested positive as of Jan. 17. By Jan. 25, the number had jumped to 803.

Charting the course of congestion

As previously reported by American Shipper, the number of container ships at anchor already exceeds the number during the labor dispute between the ILWU and their employers in 2014-15.

The Marine Exchange provided American Shipper with historical data starting in January 2019 to put the current backlog of container ships into perspective.

The data shows that the number of container ships at berth started to ramp up in July. A steady rise in the number of ships at anchor began in November. By year end, the number of container ships at anchor had risen to 30. It has remained between the high 20s and up to 40 ships ever since. Meanwhile, the number of ships at the berths in Los Angeles and Long Beach has remained in the high 20s and low 30s.

Kip Louttit, executive director of the Marine Exchange of Southern California, told American Shipper: “We seem to have settled into a new, new normal of roughly 30 container ships at anchor. Whether that will continue or not, I don’t know.”

Consumers to see emptier shelves

That new, new normal will be increasingly felt by consumers. Lauren Brand, president of the National Association of Waterfront Employers, testified at a House subcommittee hearing on Tuesday that ships currently offshore hold around 190,000 truckloads of goods.

“Right now, there are containers holding parts for manufacturing and assembly sites in the United States. We’re going to see some of those start to falter in their schedules the longer this goes on.

“I asked one of my local retailers, Chico’s, if they had certain spring colors. They said ‘no,’ because they were stuck at the port,” said Brand.

“We’re seeing a decline in the fashion market. Maybe some Valentine’s Day goods are stuck. We’ll see Easter goods getting stuck. And we’ll see things that are actually arriving too late to go to market. So, there will be an economic impact, from consumer goods to manufacturing.”

https://www.zerohedge.com/commodities/new-video-shows-massive-california-container-ship-traffic-jam