Epoxy

July 28, 2022

Comments from BASF Investors Call

BASF SE (BASFY) CEO Martin Brudermüller on H1 2022 Results – Earnings Call Transcript

Jul. 27, 2022 11:00 AM ETBASF SE (BASFY), BFFAF1 Like

BASF SE (OTCQX:BASFY) H1 2022 Results Earnings Conference Call July 27, 2022 4:00 AM ET

Company Participants

Nina Schwab-Hautzinger – Senior Vice President, Corporate Communications and Government Relations

Martin Brudermüller – Chairman of the Board of Executive Directors

Hans-Ulrich Engel – Chief Financial Officer

Stefanie Wettberg – Senior Vice President Investor Relations

Martin Brudermüller

Good morning, ladies and gentlemen. On July 11, BASF released preliminary figures for the second quarter of 2022. Today, Has Engel and I will provide you with further details regarding our business development.

In the second quarter, BASF again delivered strong earnings despite continued high raw material costs and energy prices. To put the BASF team’s performance into perspective, let’s begin with a snapshot of the current macroeconomic environment.

Compared to quarter one 2022, the uncertainty and intransparency regarding the short- and mid-term economic development have increased. The main reasons for this are the ongoing war in Ukraine, the risks associated with natural gas supplies in Europe and the resulting high prices for raw materials and energy, as well as China’s zero COVID strategy and related lockdowns.

Despite these challenges, the demand from our customer industries remained generally solid. However, global automotive industry and production in the second quarter of 2022 declined by 6% compared with Q1 2022.

For 2022, IHS Markit has adjusted its forecast to about 80.8 million units. This is a reduction of around 2.1 million units compared with the forecast of the beginning of the year.

In the second quarter of 2022, China’s economic growth was negatively impacted by the severe lockdowns in several large cities, particularly in Shanghai. In the second half of 2022, China’s economic development is expected to improve, mainly due to a more differentiated strategy to tackle the coronavirus and dedicated financial stimulus measures by the Chinese government, particularly for the automotive industry. To counter high inflation, central banks have started to raise interest rates. This will increasingly impact demand in the coming months and reduce growth in 2023.

Let’s now briefly look at chemical production by region in Q2 2022 before we turn to the financial performance of BASF. According to the currently available data, global chemical production increased by just 1.3%. Despite a strong comparison base and the pandemic-related lockdown, chemical production in China increased by 3.1%, with 2.5% chemical production also grew in North America. By contrast, chemical production declined by 2.6% in Europe and by 0.6% in Asia excluding China.

I will now move on to the BASF business development in Q2 2022. Our upstream and downstream businesses successfully implemented further price increases and largely passed on the higher prices for raw materials and energy.

Due to the lockdowns in China, BASF sales volumes in the country declined by 17.4% in the second quarter of 2022 compared with an increase of 10.4% in Q2 2021. This change was driven by significantly lower sales volumes in April. Sequentially, however, sales volume recovered again strongly in May and June.

In Q2 2022, EBIT before special items was at the level of the very strong prior year quarter and amounted to €2.3 billion. The higher earnings were driven by the agricultural solutions, nutrition and care and industrial solution segments. Other also contributed to the positive performance in Q2 2022.

I would like to add that the positive business development in the second quarter of 2022 continued in July. Since we are often asked about this, I would like to stress once again. Currently, all of BASF European sites are supplied with natural gas in line with demand. We are monitoring developments very closely, in particular at our largest site in Ludwigshafen, where we use considerable amount of gas.

In this context, I will therefore briefly address the details of the alert level regarding gas supply declared by the German government on June 23, 2022. The second stage of the emergency plan for gas comprises four key measures that leave responsibilities and market mechanisms intact.

First, all market participants such as gas suppliers, gas traders, all network operators are obliged to take coordinated action to avoid temporary or regional gaps in supply in Germany and to achieve the target fill level of 85% for German gas storage facilities on October 1. To this end, the market area manager Trading Hub Europe has received an additional credit line of €15 billion from the federal government to purchase gas.

Second, market participants including BASF are obliged to participate in a crisis team that must report to the Federal Ministry of Economic Affairs on a daily basis.

Third, the German government is taking legal measures to restart coal-fired power plants in Germany to contribute to electricity production and safe gas in power production.

And fourth, Germany’s federal network agency wants to open a market platform where gas that is not required by companies can be auctioned.

In the following, I also want to commend on the third and final emergency stage of the emergency plan for gas. This stage comes into force when there is an unexceptionally high demand for natural gas, a significant disruption in natural gas supplies or other significant deterioration in the supply situation.

Then, according to the regulations, non-market-based measures must be taken to ensure natural gas supplies, in particular, to protected customers. According to the Ministry of Economic Affairs, the federal network agency will become the federal load dispatcher, and will regulate the distribution of natural gas in coordination with the network operators.

In this process, certain consumer groups are particularly protected. These groups include households, social institutions, such as hospitals and gas-fired power plants, that also supply heat to households, but they also include industrial companies that manufacture products that are crucial for society. In this case, gas is allocated according to the relevance of the company to society.

We are coordinating closely with the government agencies, suppliers and network operators. Should the German government declare the third and final emergency stage, we currently expect that BASF would still receive sufficient natural gas to maintain operations at the Ludwigshafen site at reduced load.

We are also confident with regard to Schwarzheide, our second largest site in Germany, here, for example, we are able to generate 100% of our power and steam demand using fuel oil. For BASF production sites outside of Europe, we expect hardly any impact in the event of a European gas shortage.

I will now provide you with further details regarding our natural gas demand in Europe and give an update on our mitigation measures in the event of natural gas supply shortages.

In 2021, BASF natural gas demand in Europe amounted to 48 terawatt hours, whereof 37 terawatt hours were consumed in Ludwigshafen. In Europe, we use around 60% of our natural gas demand to produce power and steam. The remaining 40% is used as feedstock.

At our Verbund site in Ludwigshafen, the split is around 50% for each of the two categories. If the natural gas supply does not fall below around 50% of our maximum demand, we will be able to operate the Verbund in Ludwigshafen at a reduced load.

Our mitigation measures include the following. Where technically feasible, the preparations to substitute natural gas, for example, to fuel oil are progressing well and technical optimizations are in place. In addition, we have developed scenarios and implemented measures to optimize production at our European sites. We are reducing production at facilities that require large amounts of natural gas such as ammonia plants. This is standard practice in the chemical industry, for example, when margins are not economically viable.

The graph on this slide shows the largest consumers of natural gas at the Ludwigshafen . Ammonia is the largest natural gas consumer, with around 50% of the total demand as feedstock.

In contrast to some other gas consumers at the Ludwigshafen site, external sourcing of ammonia is possible. Externally sourced ammonia is therefore an important element of our risk mitigation considerations in the event of a major curtailment of natural gas volume.

The second biggest consumer is the acetylene plant, followed by syngas production. Together, both plants account for almost another 25% of the total natural gas demand as a feedstock. Power and steam production at Ludwigshafen can partially be switched to fuel oil, and that’s substituting around 15% of the natural gas otherwise needed for this.

Compared with Q1 2022, natural gas prices declined slightly in the second quarter of 2022, but remained on very high level. In Q2 2022, the additional cost for BASF European sites amounted to €800 million compared with the same quarter of 2021. In comparison with the second quarter of 2020, the increase was €1 billion. To mitigate these higher costs, we have implemented and will continue to implement further price increase.

I will now move on to the volume development by segment. In the second quarter of 2022, sales volumes of BASF Group declined slightly. This was mainly due to a lower precious metal volumes, which accounted for 99% of the volume decline in the Surface Technologies segment. Excluding this effect, BASF sales volumes were almost stable with minus 0.2% compared with the second quarter of 2021.

On a segment level, Agricultural Solutions and Nutrition & Care saw a positive volume development.

Markus Mayer

One of several – more questions on the guidance basically. Have I understood it correctly that you are still confident to reach top end of your EBIT guidance range. And also, as an add-on question to this, the potential production cuts in BDO, ammonia and acetylene is already included in the guidance as in the lower end, I guess, or is it basically already still outside of the guidance? And also, the cost reduction measures, have they been already included in the guidance?

Martin Brudermüller

So, I think this is all I think a realistic picture. Yes, we think we can reach the upper level. Basically, I hope that was seen right from you, what we described as a kind of a soft landing towards the year end. So, nothing going rigorously down, but it is softening on the demand side. And that means supply/demand is softening, but that means also pricing power is softening. So, this all goes basically weaker and actually the idea is that when the softening and the weakening of the margins is counteracted by some of the cost reductions, this is partially postponement, which I think is also natural to think about, when do you need what when you are in a softer environment, but it also might come down to the point that we also think structurally to cut some of the costs and really go to lower overall cost basis. So, that includes certainly also our assumptions, which kind of products we might reduce and we might buy in, and ammonia, you mentioned, is actually the biggest factor here. So I think you should take that with a lot of positive confidence from our side.

July 28, 2022

Comments from BASF Investors Call

BASF SE (BASFY) CEO Martin Brudermüller on H1 2022 Results – Earnings Call Transcript

Jul. 27, 2022 11:00 AM ETBASF SE (BASFY), BFFAF1 Like

BASF SE (OTCQX:BASFY) H1 2022 Results Earnings Conference Call July 27, 2022 4:00 AM ET

Company Participants

Nina Schwab-Hautzinger – Senior Vice President, Corporate Communications and Government Relations

Martin Brudermüller – Chairman of the Board of Executive Directors

Hans-Ulrich Engel – Chief Financial Officer

Stefanie Wettberg – Senior Vice President Investor Relations

Martin Brudermüller

Good morning, ladies and gentlemen. On July 11, BASF released preliminary figures for the second quarter of 2022. Today, Has Engel and I will provide you with further details regarding our business development.

In the second quarter, BASF again delivered strong earnings despite continued high raw material costs and energy prices. To put the BASF team’s performance into perspective, let’s begin with a snapshot of the current macroeconomic environment.

Compared to quarter one 2022, the uncertainty and intransparency regarding the short- and mid-term economic development have increased. The main reasons for this are the ongoing war in Ukraine, the risks associated with natural gas supplies in Europe and the resulting high prices for raw materials and energy, as well as China’s zero COVID strategy and related lockdowns.

Despite these challenges, the demand from our customer industries remained generally solid. However, global automotive industry and production in the second quarter of 2022 declined by 6% compared with Q1 2022.

For 2022, IHS Markit has adjusted its forecast to about 80.8 million units. This is a reduction of around 2.1 million units compared with the forecast of the beginning of the year.

In the second quarter of 2022, China’s economic growth was negatively impacted by the severe lockdowns in several large cities, particularly in Shanghai. In the second half of 2022, China’s economic development is expected to improve, mainly due to a more differentiated strategy to tackle the coronavirus and dedicated financial stimulus measures by the Chinese government, particularly for the automotive industry. To counter high inflation, central banks have started to raise interest rates. This will increasingly impact demand in the coming months and reduce growth in 2023.

Let’s now briefly look at chemical production by region in Q2 2022 before we turn to the financial performance of BASF. According to the currently available data, global chemical production increased by just 1.3%. Despite a strong comparison base and the pandemic-related lockdown, chemical production in China increased by 3.1%, with 2.5% chemical production also grew in North America. By contrast, chemical production declined by 2.6% in Europe and by 0.6% in Asia excluding China.

I will now move on to the BASF business development in Q2 2022. Our upstream and downstream businesses successfully implemented further price increases and largely passed on the higher prices for raw materials and energy.

Due to the lockdowns in China, BASF sales volumes in the country declined by 17.4% in the second quarter of 2022 compared with an increase of 10.4% in Q2 2021. This change was driven by significantly lower sales volumes in April. Sequentially, however, sales volume recovered again strongly in May and June.

In Q2 2022, EBIT before special items was at the level of the very strong prior year quarter and amounted to €2.3 billion. The higher earnings were driven by the agricultural solutions, nutrition and care and industrial solution segments. Other also contributed to the positive performance in Q2 2022.

I would like to add that the positive business development in the second quarter of 2022 continued in July. Since we are often asked about this, I would like to stress once again. Currently, all of BASF European sites are supplied with natural gas in line with demand. We are monitoring developments very closely, in particular at our largest site in Ludwigshafen, where we use considerable amount of gas.

In this context, I will therefore briefly address the details of the alert level regarding gas supply declared by the German government on June 23, 2022. The second stage of the emergency plan for gas comprises four key measures that leave responsibilities and market mechanisms intact.

First, all market participants such as gas suppliers, gas traders, all network operators are obliged to take coordinated action to avoid temporary or regional gaps in supply in Germany and to achieve the target fill level of 85% for German gas storage facilities on October 1. To this end, the market area manager Trading Hub Europe has received an additional credit line of €15 billion from the federal government to purchase gas.

Second, market participants including BASF are obliged to participate in a crisis team that must report to the Federal Ministry of Economic Affairs on a daily basis.

Third, the German government is taking legal measures to restart coal-fired power plants in Germany to contribute to electricity production and safe gas in power production.

And fourth, Germany’s federal network agency wants to open a market platform where gas that is not required by companies can be auctioned.

In the following, I also want to commend on the third and final emergency stage of the emergency plan for gas. This stage comes into force when there is an unexceptionally high demand for natural gas, a significant disruption in natural gas supplies or other significant deterioration in the supply situation.

Then, according to the regulations, non-market-based measures must be taken to ensure natural gas supplies, in particular, to protected customers. According to the Ministry of Economic Affairs, the federal network agency will become the federal load dispatcher, and will regulate the distribution of natural gas in coordination with the network operators.

In this process, certain consumer groups are particularly protected. These groups include households, social institutions, such as hospitals and gas-fired power plants, that also supply heat to households, but they also include industrial companies that manufacture products that are crucial for society. In this case, gas is allocated according to the relevance of the company to society.

We are coordinating closely with the government agencies, suppliers and network operators. Should the German government declare the third and final emergency stage, we currently expect that BASF would still receive sufficient natural gas to maintain operations at the Ludwigshafen site at reduced load.

We are also confident with regard to Schwarzheide, our second largest site in Germany, here, for example, we are able to generate 100% of our power and steam demand using fuel oil. For BASF production sites outside of Europe, we expect hardly any impact in the event of a European gas shortage.

I will now provide you with further details regarding our natural gas demand in Europe and give an update on our mitigation measures in the event of natural gas supply shortages.

In 2021, BASF natural gas demand in Europe amounted to 48 terawatt hours, whereof 37 terawatt hours were consumed in Ludwigshafen. In Europe, we use around 60% of our natural gas demand to produce power and steam. The remaining 40% is used as feedstock.

At our Verbund site in Ludwigshafen, the split is around 50% for each of the two categories. If the natural gas supply does not fall below around 50% of our maximum demand, we will be able to operate the Verbund in Ludwigshafen at a reduced load.

Our mitigation measures include the following. Where technically feasible, the preparations to substitute natural gas, for example, to fuel oil are progressing well and technical optimizations are in place. In addition, we have developed scenarios and implemented measures to optimize production at our European sites. We are reducing production at facilities that require large amounts of natural gas such as ammonia plants. This is standard practice in the chemical industry, for example, when margins are not economically viable.

The graph on this slide shows the largest consumers of natural gas at the Ludwigshafen . Ammonia is the largest natural gas consumer, with around 50% of the total demand as feedstock.

In contrast to some other gas consumers at the Ludwigshafen site, external sourcing of ammonia is possible. Externally sourced ammonia is therefore an important element of our risk mitigation considerations in the event of a major curtailment of natural gas volume.

The second biggest consumer is the acetylene plant, followed by syngas production. Together, both plants account for almost another 25% of the total natural gas demand as a feedstock. Power and steam production at Ludwigshafen can partially be switched to fuel oil, and that’s substituting around 15% of the natural gas otherwise needed for this.

Compared with Q1 2022, natural gas prices declined slightly in the second quarter of 2022, but remained on very high level. In Q2 2022, the additional cost for BASF European sites amounted to €800 million compared with the same quarter of 2021. In comparison with the second quarter of 2020, the increase was €1 billion. To mitigate these higher costs, we have implemented and will continue to implement further price increase.

I will now move on to the volume development by segment. In the second quarter of 2022, sales volumes of BASF Group declined slightly. This was mainly due to a lower precious metal volumes, which accounted for 99% of the volume decline in the Surface Technologies segment. Excluding this effect, BASF sales volumes were almost stable with minus 0.2% compared with the second quarter of 2021.

On a segment level, Agricultural Solutions and Nutrition & Care saw a positive volume development.

Markus Mayer

One of several – more questions on the guidance basically. Have I understood it correctly that you are still confident to reach top end of your EBIT guidance range. And also, as an add-on question to this, the potential production cuts in BDO, ammonia and acetylene is already included in the guidance as in the lower end, I guess, or is it basically already still outside of the guidance? And also, the cost reduction measures, have they been already included in the guidance?

Martin Brudermüller

So, I think this is all I think a realistic picture. Yes, we think we can reach the upper level. Basically, I hope that was seen right from you, what we described as a kind of a soft landing towards the year end. So, nothing going rigorously down, but it is softening on the demand side. And that means supply/demand is softening, but that means also pricing power is softening. So, this all goes basically weaker and actually the idea is that when the softening and the weakening of the margins is counteracted by some of the cost reductions, this is partially postponement, which I think is also natural to think about, when do you need what when you are in a softer environment, but it also might come down to the point that we also think structurally to cut some of the costs and really go to lower overall cost basis. So, that includes certainly also our assumptions, which kind of products we might reduce and we might buy in, and ammonia, you mentioned, is actually the biggest factor here. So I think you should take that with a lot of positive confidence from our side.

July 28, 2022

BASF Results

German chemicals giant BASF reports profits based on price hikes

DPA – Yesterday 4:09 AM

German chemical company BASF said on Wednesday that it managed to boost net income by 26.3% in the second quarter thanks to “significant price increases.”

Net income came in at €2.1 billion ($2.13 billion). The comparison was with the second quarter of 2021.

“Despite the continued high raw materials and energy prices, we again achieved strong earnings in the second quarter,” said board chairperson Martin Brudermüller.

Like many industries, BASF is nervously watching rising gas prices spurred by Russia’s decision to limit shipments to Europe, a ruse that the West says is payback for Western sanctions. Those sanctions were laid down because of Russia’s invasion of Ukraine.

Gas is critical not only to power BASF factories, but is also a key ingredient in some processes. But the company reported strong sales to all of its key clients, except for the car sector, which has been hit hard by pandemic-related supply problems.

BASF also reported a 16.3% increase in sales to €23 billion. Earnings before interest and taxes (EBIT) came in at €2.3 billion, which matched levels in the the second quarter of 2021.

Sales in the chemicals segment grew 27.2%, while sales in the materials segment rose 29.9%. Sales in the industrial solutions segment rose by 12.1% and sales in the surface technologies segment increased by 7.6%. Nutrition and care segment sales rose by 30.9%.

Looking ahead to fiscal 2022, BASF now expects sales in the range of €86 billion-€89 billion, compared to prior outlook of €74 billion-€77 billion. EBIT before special items is expected between €6.8 billion and €7.2 billion.

July 28, 2022

BASF Results

German chemicals giant BASF reports profits based on price hikes

DPA – Yesterday 4:09 AM

German chemical company BASF said on Wednesday that it managed to boost net income by 26.3% in the second quarter thanks to “significant price increases.”

Net income came in at €2.1 billion ($2.13 billion). The comparison was with the second quarter of 2021.

“Despite the continued high raw materials and energy prices, we again achieved strong earnings in the second quarter,” said board chairperson Martin Brudermüller.

Like many industries, BASF is nervously watching rising gas prices spurred by Russia’s decision to limit shipments to Europe, a ruse that the West says is payback for Western sanctions. Those sanctions were laid down because of Russia’s invasion of Ukraine.

Gas is critical not only to power BASF factories, but is also a key ingredient in some processes. But the company reported strong sales to all of its key clients, except for the car sector, which has been hit hard by pandemic-related supply problems.

BASF also reported a 16.3% increase in sales to €23 billion. Earnings before interest and taxes (EBIT) came in at €2.3 billion, which matched levels in the the second quarter of 2021.

Sales in the chemicals segment grew 27.2%, while sales in the materials segment rose 29.9%. Sales in the industrial solutions segment rose by 12.1% and sales in the surface technologies segment increased by 7.6%. Nutrition and care segment sales rose by 30.9%.

Looking ahead to fiscal 2022, BASF now expects sales in the range of €86 billion-€89 billion, compared to prior outlook of €74 billion-€77 billion. EBIT before special items is expected between €6.8 billion and €7.2 billion.

July 27, 2022

BASF Production Update

BASF Prepares To Slash Ammonia Production In Germany Amid Worsening NatGas Crunch

by Tyler DurdenWednesday, Jul 27, 2022 – 08:30 AM

German chemicals company BASF SE paid an extra 800 million euros ($809.5 million) to keep its plants operating in the second quarter compared with a year earlier amid skyrocketing natural gas prices. The impact of high energy prices has forced the company to make a difficult decision: slash the production of ammonia, which could have potential consequences for farming to the food industry.

“We are reducing production at facilities that require large volumes of natural gas, such as ammonia plants,” BASF Chief Executive Martin Brudermuller said in a conference call after an earnings report.

Brudermuller said BASF would tap external suppliers to fill the deficit as German plants reduced output. He warned about potential supply disruptions that could boost fertilizer costs for farmers.

Reuters details how ammonia plays a critical role in manufacturing nitrogen-based fertilizers, plastic-making, and diesel exhaust fluid. A byproduct of ammonia production is high-purity carbon dioxide (CO2) which is heavily used in the food industry.

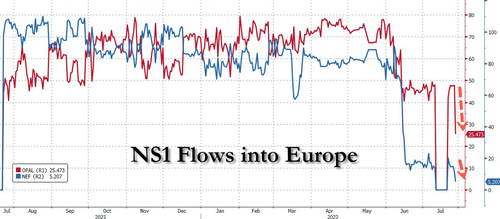

The news of BASF reducing ammonia production because of soaring NatGas prices comes as Russian state-owned energy producer Gazprom PJSC is expected to halve supplies via Nord Stream 1 to Europe to about 20% today. EU member states agreed Tuesday to reduce NatGas demand by 15% over the next eight months, though countries like Germany, without any liquefied natural gas (LNG) port terminals to replace Russian pipeline NatGas, might have to make more considerable sacrifices.

Benchmark NatGas prices in Europe at the Dutch TTF hub hit their highest level since March. Prices have shot up 35% in a week, over 200 euros per megawatt-hour (MWh), as Putin turns the screws on Europe by reducing pipeline capacity to Europe.

“Chemical companies are the biggest industrial natural-gas users in Germany, and ammonia is the single most gas-intensive product within that industry,” Reuters said.

Arne Rautenberg, a fund manager at Union Investment, said ammonia is a prime candidate by chemical companies to cut production first over the NatGas supply squeeze.

“In the northern hemisphere, nitrogen fertilizer is applied primarily during the spring. It can also be produced in the United States and shipped to Europe,” Rautenberg said, adding that the CO2 supply for the food industry could experience disruptions.

The chemical industry lobby VCI indicates German ammonia production has been curbed (some of which began last October) considerably because of soaring energy prices. This could soon impact industries that rely heavily on ammonia and ripple through the economy already facing recession.