Epoxy

July 27, 2022

BASF Production Update

BASF Prepares To Slash Ammonia Production In Germany Amid Worsening NatGas Crunch

by Tyler DurdenWednesday, Jul 27, 2022 – 08:30 AM

German chemicals company BASF SE paid an extra 800 million euros ($809.5 million) to keep its plants operating in the second quarter compared with a year earlier amid skyrocketing natural gas prices. The impact of high energy prices has forced the company to make a difficult decision: slash the production of ammonia, which could have potential consequences for farming to the food industry.

“We are reducing production at facilities that require large volumes of natural gas, such as ammonia plants,” BASF Chief Executive Martin Brudermuller said in a conference call after an earnings report.

Brudermuller said BASF would tap external suppliers to fill the deficit as German plants reduced output. He warned about potential supply disruptions that could boost fertilizer costs for farmers.

Reuters details how ammonia plays a critical role in manufacturing nitrogen-based fertilizers, plastic-making, and diesel exhaust fluid. A byproduct of ammonia production is high-purity carbon dioxide (CO2) which is heavily used in the food industry.

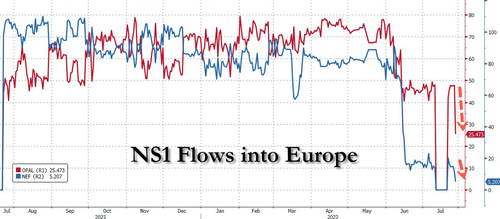

The news of BASF reducing ammonia production because of soaring NatGas prices comes as Russian state-owned energy producer Gazprom PJSC is expected to halve supplies via Nord Stream 1 to Europe to about 20% today. EU member states agreed Tuesday to reduce NatGas demand by 15% over the next eight months, though countries like Germany, without any liquefied natural gas (LNG) port terminals to replace Russian pipeline NatGas, might have to make more considerable sacrifices.

Benchmark NatGas prices in Europe at the Dutch TTF hub hit their highest level since March. Prices have shot up 35% in a week, over 200 euros per megawatt-hour (MWh), as Putin turns the screws on Europe by reducing pipeline capacity to Europe.

“Chemical companies are the biggest industrial natural-gas users in Germany, and ammonia is the single most gas-intensive product within that industry,” Reuters said.

Arne Rautenberg, a fund manager at Union Investment, said ammonia is a prime candidate by chemical companies to cut production first over the NatGas supply squeeze.

“In the northern hemisphere, nitrogen fertilizer is applied primarily during the spring. It can also be produced in the United States and shipped to Europe,” Rautenberg said, adding that the CO2 supply for the food industry could experience disruptions.

The chemical industry lobby VCI indicates German ammonia production has been curbed (some of which began last October) considerably because of soaring energy prices. This could soon impact industries that rely heavily on ammonia and ripple through the economy already facing recession.

July 26, 2022

Natural Gas Spreads Between Europe and U.S.

EU Natural Gas Prices Soar As Gazprom Readies Nord Stream Cuts, US NatGas Hits 14-Year High

by Tyler DurdenTuesday, Jul 26, 2022 – 09:16 AM

European natural gas futures extended gains by 12% after Russian state-owned energy producer Gazprom PJSC unexpectedly announced it would halt a Nord Stream 1 turbine at its Portovaya compressor station from Wednesday. Simultaneously, US NatGas futures have spiked to 14-year highs.

Russian NatGas supplies to Europe via Nord Stream pipeline fell to 38% capacity from 40% on Tuesday, ahead of a more significant cut from current levels to just 20% on Wednesday.

In a statement, Gazprom said the Nord Stream pipeline would be pumping 33 million cubic meters a day, or 20% of capacity, from Wednesday, adding another turbine for the pipeline will be taken offline due to maintenance work.

Kremlin spokesman Dmitry Peskov said another Nord Stream turbine has “problems” and will be taken offline for maintenance.

Peskov noted a turbine sent to Canada earlier is “en route” but didn’t specify its exact location.

Western sanctions prolonged the average maintenance time of the Nord Stream.

“The situation is critically aggravated by the restrictions and sanctions imposed against our country,” the Kremlin spokesman continued.

Russian state media reported Monday that the turbine recently serviced in Canada by Siemens Energy AG had finally received export paperwork that will allow it to be shipped from Germany to Helsinki, Finland.

Nord Stream’s upcoming capacity declines sent Wholesale European NatGas futures up 12% to 196 euros. Prices have jumped more than 20% in two sessions and are near highs seen last winter at more than 200 euros.

EU Natgas prices are trading at an oil-barrel-equivalent price of $333….

Across the Atlantic, US NatGas futures extended gains, up more than 10% to $9.62, a 14-year high, amid concerns about hot weather and tight supplies.

“Although the magnitude and speed of recent natural gas price gains point to contributing non-fundamental market dynamics, supportive fundamentals are nonetheless the primary driver,” EBW Analytics Group wrote in a note to clients.

“Fundamentally, scorching hot weather is the predominant bullish driver,” the firm added.

There’s also reason to believe that tighter European supplies would result in more US LNG exports abroad.

For more context, European NatGas 1m forward is trading at a massive $48 spread over front-month US NatGas futures – almost 5x its historical peak…

Europe’s energy crisis continues to worsen, and there is no immediate relief in sight as this coming winter could be a cold one.

“This is not the end of Russia’s weaponization of natural gas flows, in our view, and there remain few near-term alternatives for even current reduced flows to the EU – lending [to] ongoing upside price risks,” RBC wrote last week in a note to clients.

July 26, 2022

Natural Gas Spreads Between Europe and U.S.

EU Natural Gas Prices Soar As Gazprom Readies Nord Stream Cuts, US NatGas Hits 14-Year High

by Tyler DurdenTuesday, Jul 26, 2022 – 09:16 AM

European natural gas futures extended gains by 12% after Russian state-owned energy producer Gazprom PJSC unexpectedly announced it would halt a Nord Stream 1 turbine at its Portovaya compressor station from Wednesday. Simultaneously, US NatGas futures have spiked to 14-year highs.

Russian NatGas supplies to Europe via Nord Stream pipeline fell to 38% capacity from 40% on Tuesday, ahead of a more significant cut from current levels to just 20% on Wednesday.

In a statement, Gazprom said the Nord Stream pipeline would be pumping 33 million cubic meters a day, or 20% of capacity, from Wednesday, adding another turbine for the pipeline will be taken offline due to maintenance work.

Kremlin spokesman Dmitry Peskov said another Nord Stream turbine has “problems” and will be taken offline for maintenance.

Peskov noted a turbine sent to Canada earlier is “en route” but didn’t specify its exact location.

Western sanctions prolonged the average maintenance time of the Nord Stream.

“The situation is critically aggravated by the restrictions and sanctions imposed against our country,” the Kremlin spokesman continued.

Russian state media reported Monday that the turbine recently serviced in Canada by Siemens Energy AG had finally received export paperwork that will allow it to be shipped from Germany to Helsinki, Finland.

Nord Stream’s upcoming capacity declines sent Wholesale European NatGas futures up 12% to 196 euros. Prices have jumped more than 20% in two sessions and are near highs seen last winter at more than 200 euros.

EU Natgas prices are trading at an oil-barrel-equivalent price of $333….

Across the Atlantic, US NatGas futures extended gains, up more than 10% to $9.62, a 14-year high, amid concerns about hot weather and tight supplies.

“Although the magnitude and speed of recent natural gas price gains point to contributing non-fundamental market dynamics, supportive fundamentals are nonetheless the primary driver,” EBW Analytics Group wrote in a note to clients.

“Fundamentally, scorching hot weather is the predominant bullish driver,” the firm added.

There’s also reason to believe that tighter European supplies would result in more US LNG exports abroad.

For more context, European NatGas 1m forward is trading at a massive $48 spread over front-month US NatGas futures – almost 5x its historical peak…

Europe’s energy crisis continues to worsen, and there is no immediate relief in sight as this coming winter could be a cold one.

“This is not the end of Russia’s weaponization of natural gas flows, in our view, and there remain few near-term alternatives for even current reduced flows to the EU – lending [to] ongoing upside price risks,” RBC wrote last week in a note to clients.

July 26, 2022

New Home Sales Update

New Home Sales & Prices Plunged In June As Pulte Admits Order Cancellations Are Soaring

by Tyler DurdenTuesday, Jul 26, 2022 – 10:06 AM

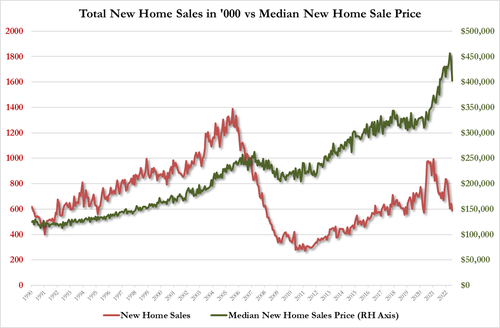

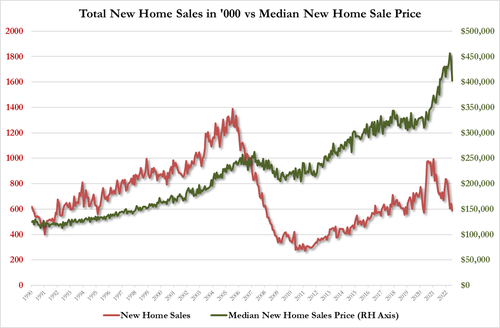

Amid a plunge in homebuilder confidence, record low affordability, tumbling single-family starts and permits, and multi-decade lows in mortgage applications, it is no surprise that analysts expected a 5.9% MoM plunge in new home sales in June (especially after the surprise 10.7% MoM panic-buying surge in May). The consensus was right in direction but off in magnitude as new home sales plunged 8.1% MoM in June and the 10.7% surge in May was revised down to just +6.3% MoM…

Source: Bloomberg

New Home Sales have fallen for 5 of the last 6 months and the last few months have seen a one-way street of downwards revisions…

The New Home Sales SAAR has tumbled to its lowest since the nadir of the COVID lockdowns in April 2020…

Source: Bloomberg

A potential silver lining is that inventory is finally on the rise with 9.3 months of supply seen in June, up from 8.4 in the prior month.

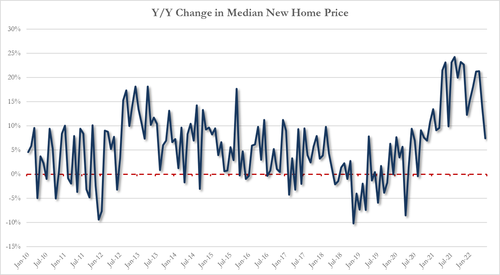

And the best news of all – the median new home price tumbled 9.5% MoM to $402,400…

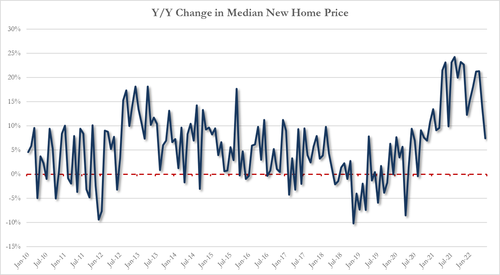

With median home price gains slowing dramatically YoY…

This new home sales print comes on the day that Pulte Homes admits buyers have hit a wall and is “dialling back” its spec-home-starts, noting that the homebuilder’s cancellation rate more than doubled to 15% in Q2 from 7% in the year-ago quarter, as soaring home prices and mortgage rates hinder affordability.

“The recent 200-basis point increase in mortgage rates has impacted affordability, but we continue to believe the desire for homeownership is high and the long-term outlook for housing remains positive,” said CEO and President Ryan Marshall.

Source: Bloomberg

Most notably perhaps was Marshall’s admission that the uptick in cancellations has been in the last 30-60 days, perhaps mirroring the plunge in homebuilder confidence (and Walmart) as the ‘strong American consumer’ appears to have pulled back into its shell.

July 26, 2022

New Home Sales Update

New Home Sales & Prices Plunged In June As Pulte Admits Order Cancellations Are Soaring

by Tyler DurdenTuesday, Jul 26, 2022 – 10:06 AM

Amid a plunge in homebuilder confidence, record low affordability, tumbling single-family starts and permits, and multi-decade lows in mortgage applications, it is no surprise that analysts expected a 5.9% MoM plunge in new home sales in June (especially after the surprise 10.7% MoM panic-buying surge in May). The consensus was right in direction but off in magnitude as new home sales plunged 8.1% MoM in June and the 10.7% surge in May was revised down to just +6.3% MoM…

Source: Bloomberg

New Home Sales have fallen for 5 of the last 6 months and the last few months have seen a one-way street of downwards revisions…

The New Home Sales SAAR has tumbled to its lowest since the nadir of the COVID lockdowns in April 2020…

Source: Bloomberg

A potential silver lining is that inventory is finally on the rise with 9.3 months of supply seen in June, up from 8.4 in the prior month.

And the best news of all – the median new home price tumbled 9.5% MoM to $402,400…

With median home price gains slowing dramatically YoY…

This new home sales print comes on the day that Pulte Homes admits buyers have hit a wall and is “dialling back” its spec-home-starts, noting that the homebuilder’s cancellation rate more than doubled to 15% in Q2 from 7% in the year-ago quarter, as soaring home prices and mortgage rates hinder affordability.

“The recent 200-basis point increase in mortgage rates has impacted affordability, but we continue to believe the desire for homeownership is high and the long-term outlook for housing remains positive,” said CEO and President Ryan Marshall.

Source: Bloomberg

Most notably perhaps was Marshall’s admission that the uptick in cancellations has been in the last 30-60 days, perhaps mirroring the plunge in homebuilder confidence (and Walmart) as the ‘strong American consumer’ appears to have pulled back into its shell.