Epoxy

July 13, 2022

Q2 Chemical M&A Activity

Chemical Deal Results

| Seller | Buyer | Business | Date |

|---|---|---|---|

| EverZinc (OpenGate Capital) | US Zinc (Aterian) | zinc oxide, zinc dust, and zinc metal products used in the tire, chemical, coatings and agriculture markets | 2nd Quarter 2022 |

| Noramco | Pharmaron Beijing | API site in Rhode Island | 2nd Quarter 2022 |

| DSM/Firmenich | Firmenich/DSM | merger of the 2 companies (animal nutrition, perfume and delivery, food and beverage, health and nutrition) – $13,000s combined | 2nd Quarter 2022 |

| Noble Gas Solutions | Air Water America | specialty gases, medical gases and industrial gases | 2nd Quarter 2022 |

| Cary Compounds | Geon (SK Capital) | PVC compounds | 2nd Quarter 2022 |

| Johnson Matthey | Nano One Materials | Battery Materials Canada (LFP facility in Canada) – $8v | 2nd Quarter 2022 |

| DSM | Lanxess/Advent JV | Engineered Materials (polyamides (PA6, PA66) as well as various specialty materials (PA46, PA410) and specialty polyesters as well as PPS) – €1,500s/€3.700v | 2nd Quarter 2022 |

| Alliance Adhesives | Applied Adhesives (Arsenal Capital) | regional supplier of adhesives and dispensing equipment solutions located in FL | 2nd Quarter 2022 |

| Trecora | Balmoral | high purity hydrocarbons and other petroleum-based products (including isopentane, normal pentane, isohexane and hexane) and synthetic waxes – $301s/$247v | 2nd Quarter 2022 |

| United Gilsonite Laboratories | Sika | coatings for consumer and DIY waterproofing applications | 2nd Quarter 2022 |

| Seller | Buyer | Business | Date |

|---|---|---|---|

| Lonza | Microsize | particle size reduction and control plant in PA | 2nd Quarter 2022 |

| OC Flavors | Shore Capital | natural and organic-compliant liquid and powdered flavors | 2nd Quarter 2022 |

| Perstorp | Petronas | acquisition of whole company (solutions with focus on the Resins & Coatings, Engineered Fluids and Animal Nutrition markets) – €1,334s/€2,300v | 2nd Quarter 2022 |

| HIG Capital | SK Capital | Valtris (plastic additives) | 2nd Quarter 2022 |

| Benjamin Moore | Gemini Coatings | Lenmar® Wood Finishes & Coatings | 2nd Quarter 2022 |

| Arsenal Capital (CPS Performance Technologies) | Cadre Holdings | Cyalume Technologies (light sticks) – $25s/$35v | 2nd Quarter 2022 |

| Carmelina Capital | SK Capital | Florachem (natural plant-based ingredients including citrus, pine, and specialty rosin resins) | 2nd Quarter 2022 |

| Mosaic Materials | Baker Hughes | carbon-dioxide capturing materials based on metal-organic frameworks | 2nd Quarter 2022 |

| Health Wright Products | IFF | custom formulations, encapsulation and packaging for the dietary supplement industry | 2nd Quarter 2022 |

| DSM | Avient | Protective Materials (including Dyneema brand high strength fiber) – $415s/$1,485v | 2nd Quarter 2022 |

http://www.chemicaldeals.com/Results.aspx?searchtext=&quarter=2nd+Quarter+2022

July 13, 2022

Container Rates Falling

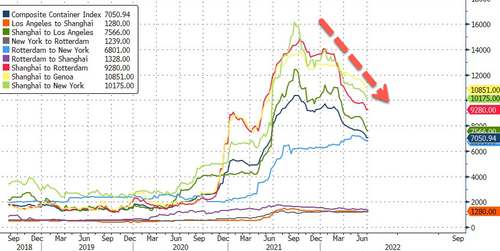

Container Rates Slump As “Bullwhip Effect” Enters Terminal Phase

by Tyler DurdenTuesday, Jul 12, 2022 – 08:25 PM

The infamous “bullwhip” effect strikes as inventory gluts force U.S. importers to dial back shipments from overseas, driving down rates for ocean freight, which could end up causing a so-called “freight recession.”

WSJ reports U.S. companies are renegotiating shipping agreements they made during the virus pandemic highs. Some are hedging in the spot market to reduce costs associated with long-term contracts.

San Francisco-based freight forwarder Flexport said softening demand lowers freight rates but remains well above pre-pandemic levels.

Last week, the spot rate to ship a container from China to the U.S. West Coast was still four times higher than the same period in July 2019, online freight marketplace Freightos’ data shows.

A recent shipment by Carbochem Inc., an importer of activated carbon used in water treatment, cost around $16k from China to Chicago, down from $21k a year ago.

“We need to be looking at probably less than $10,000 to get anywhere close to the levels we were before and be competitive,” the firm’s president, Gavin Kahn, said.

Shipping data from Bloomberg shows international freight rates have slumped over the last six months, mainly because of China shutdowns. However, U.S. importers reducing demand for cargo ships has accelerated the downward move.

The $1.5bln slide in U.S. consumer goods in May might have been a clear indication that demand for overseas products was waning and comes as Americans reduced spending on durable goods, something Target and Walmart pointed out last month.

We have detailed for readers in the last two months the terminal phase of the bullwhip effect was upon us:

- Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff

- Deflationary Tsunami On Deck: A “Tidal Wave” Of Discounts And Crashing Prices

- Michael Burry Agrees: “Bullwhip Effect” Will Force Powell To Pivot On Rate Hikes And Q.T.

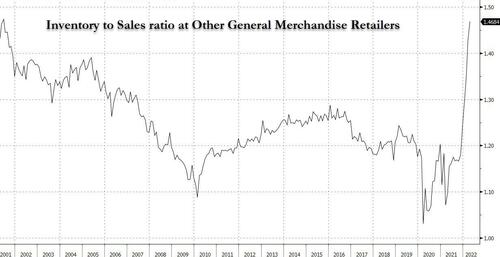

The side effect of soaring inventory to sales ratios is that retailers must liquidate inventories as consumer spending habits change. This causes retailers to reduce demand from overseas suppliers (read: Samsung Asks Component Makers To Delay Shipments Amid Build-Up In Inventories), which diminishes the need for ocean freight shipping.

In late March, FreightWaves CEO Craig Fuller warned that retailers would need to unload inventory amid signs of demand destruction. He correctly said this would cause a freight recession now could be coming true as container rates decline.

https://www.zerohedge.com/markets/shipping-rates-slump-bullwhip-effect-enters-terminal-phase

July 13, 2022

Container Rates Falling

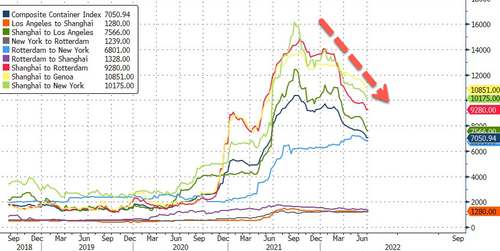

Container Rates Slump As “Bullwhip Effect” Enters Terminal Phase

by Tyler DurdenTuesday, Jul 12, 2022 – 08:25 PM

The infamous “bullwhip” effect strikes as inventory gluts force U.S. importers to dial back shipments from overseas, driving down rates for ocean freight, which could end up causing a so-called “freight recession.”

WSJ reports U.S. companies are renegotiating shipping agreements they made during the virus pandemic highs. Some are hedging in the spot market to reduce costs associated with long-term contracts.

San Francisco-based freight forwarder Flexport said softening demand lowers freight rates but remains well above pre-pandemic levels.

Last week, the spot rate to ship a container from China to the U.S. West Coast was still four times higher than the same period in July 2019, online freight marketplace Freightos’ data shows.

A recent shipment by Carbochem Inc., an importer of activated carbon used in water treatment, cost around $16k from China to Chicago, down from $21k a year ago.

“We need to be looking at probably less than $10,000 to get anywhere close to the levels we were before and be competitive,” the firm’s president, Gavin Kahn, said.

Shipping data from Bloomberg shows international freight rates have slumped over the last six months, mainly because of China shutdowns. However, U.S. importers reducing demand for cargo ships has accelerated the downward move.

The $1.5bln slide in U.S. consumer goods in May might have been a clear indication that demand for overseas products was waning and comes as Americans reduced spending on durable goods, something Target and Walmart pointed out last month.

We have detailed for readers in the last two months the terminal phase of the bullwhip effect was upon us:

- Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff

- Deflationary Tsunami On Deck: A “Tidal Wave” Of Discounts And Crashing Prices

- Michael Burry Agrees: “Bullwhip Effect” Will Force Powell To Pivot On Rate Hikes And Q.T.

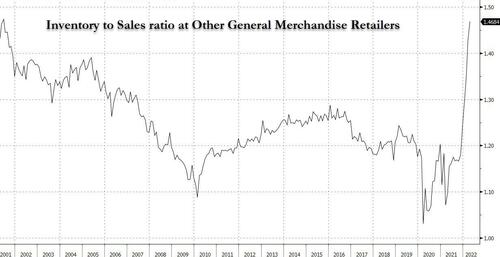

The side effect of soaring inventory to sales ratios is that retailers must liquidate inventories as consumer spending habits change. This causes retailers to reduce demand from overseas suppliers (read: Samsung Asks Component Makers To Delay Shipments Amid Build-Up In Inventories), which diminishes the need for ocean freight shipping.

In late March, FreightWaves CEO Craig Fuller warned that retailers would need to unload inventory amid signs of demand destruction. He correctly said this would cause a freight recession now could be coming true as container rates decline.

https://www.zerohedge.com/markets/shipping-rates-slump-bullwhip-effect-enters-terminal-phase

July 11, 2022

Sherwin Williams Acquisition

The Sherwin-Williams Company is excited to announce we have completed the acquisition of Dur-A-Flex, Inc. effective July 1, 2022.

Through the acquisition, we bring two great floor coating companies together to support and help grow your business.

Dur-A-Flex brings more than 55 years of resinous flooring expertise with industry-leading technology – including its Poly-Crete® cementitious urethane concrete coatings, Accelera® polyurea performance topcoats, and fast-cure methyl methacrylate (MMA) systems – supported by a relentless focus on training and execution excellence.

We are very excited and confident that the combination of Sherwin-Williams and Dur-A-Flex will allow us to provide additional value and a stronger level of service as your go-to partner in resinous flooring. Here are just a few benefits our customers will experience as we integrate the two teams:

- Relentless focus on making our customers successful and accelerating their growth

- Enhanced resinous product portfolio unrivalled in the industry

- Formidable specification position supported by a dedicated spec-driving project development team

- An exceptional mix of industry subject matter expertise, and dedicated R&D and sales teams

- Sherwin-Williams’ unmatched distribution platform

- Integrated lead generation capabilities to drive additional business growth for our customers

- A culture of product innovation to delivers high-performing flooring solutions to create efficiencies in our customers’ operations

For more information about both organizations, click on the links below:

Sherwin-Williams High Performance Flooring

Dur-A-Flex

https://pages.s-w.com/na-us-en-resin-flooring-acquisition.html

July 11, 2022

Sherwin Williams Acquisition

The Sherwin-Williams Company is excited to announce we have completed the acquisition of Dur-A-Flex, Inc. effective July 1, 2022.

Through the acquisition, we bring two great floor coating companies together to support and help grow your business.

Dur-A-Flex brings more than 55 years of resinous flooring expertise with industry-leading technology – including its Poly-Crete® cementitious urethane concrete coatings, Accelera® polyurea performance topcoats, and fast-cure methyl methacrylate (MMA) systems – supported by a relentless focus on training and execution excellence.

We are very excited and confident that the combination of Sherwin-Williams and Dur-A-Flex will allow us to provide additional value and a stronger level of service as your go-to partner in resinous flooring. Here are just a few benefits our customers will experience as we integrate the two teams:

- Relentless focus on making our customers successful and accelerating their growth

- Enhanced resinous product portfolio unrivalled in the industry

- Formidable specification position supported by a dedicated spec-driving project development team

- An exceptional mix of industry subject matter expertise, and dedicated R&D and sales teams

- Sherwin-Williams’ unmatched distribution platform

- Integrated lead generation capabilities to drive additional business growth for our customers

- A culture of product innovation to delivers high-performing flooring solutions to create efficiencies in our customers’ operations

For more information about both organizations, click on the links below:

Sherwin-Williams High Performance Flooring

Dur-A-Flex

https://pages.s-w.com/na-us-en-resin-flooring-acquisition.html