Epoxy

December 22, 2021

Nouryon Moves to Radnor

Nouryon signs lease in Radnor for its North American headquarters

By Natalie Kostelni – Reporter, Philadelphia Business Journal 3 hours ago

Nouryon, a specialty chemicals company owned by Carlyle Group Inc., has signed a lease in Radnor for its North American headquarters.

The company leased 50,000 square feet over two floors at Five Radnor Center at 100 Matson Ford Road. It expanded from 12,000 square feet within the office complex and committed to designate the space as its headquarters. Its global headquarters is in the Netherlands. Brandywine Realty Trust is the landlord of the Radnor property.

Carlyle bought Nouryon in 2018 from Akzo Nobel N.V., which is based in Amsterdam, for the equivalent of roughly $11 billion. Earlier this year, Nouryon spun out Nobian, its base chemicals business, though the unit remains owned by Carlyle. In September, Nouryon filed a registration statement with the Securities and Exchange Commission for an initial public offering.

Charlie Shaver is chairman and CEO of Nouryon. Prior to taking on that role, Shaver headed up Axalta Coating Systems Ltd., a Dow Chemical Co. spinout that was bought by Carlyle and taken public. Axalta had its headquarters in Philadelphia until November 2020 but continues to maintains an R&D facility at the Philadelphia Navy Yard.

Shaver also served as an operating partner at Carlyle and worked at Dow Chemical from 1980 until 1996.

December 22, 2021

Hurricane IDA Impacted Q3 Chemical Markets

Follow us

Lingering Impacts from Hurricane Ida Weighed on U.S. Chemical Production in October

CONTACT US

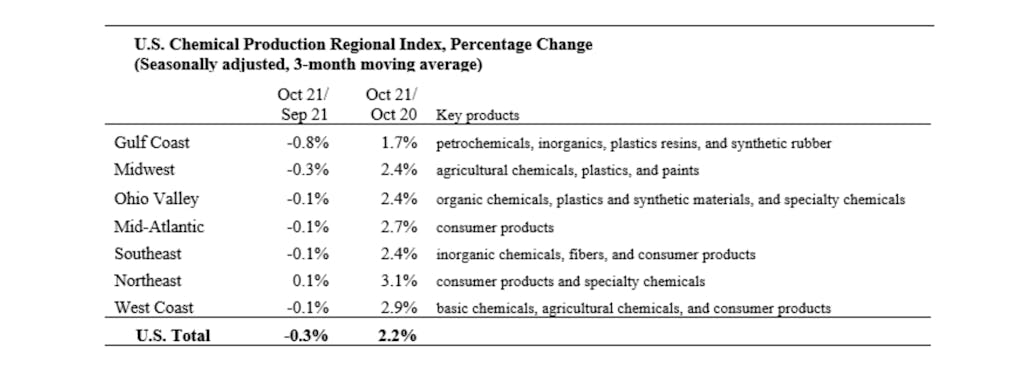

Jennifer Scott

WASHINGTON (December 1, 2021) – The U.S. Chemical Production Regional Index (U.S. CPRI) eased by 0.3% in October following a 1.6% decline in September and a 0.4% decline in August, according to the American Chemistry Council (ACC). Chemical output declined in all regions except the Northeast. With lingering hurricane and other supply chain disruptions, the largest decline was in the Gulf Coast region. The U.S. CPRI is measured as a three-month moving average (3MMA).

Chemical production was mixed in October (3MMA), with an improving trend in the production of synthetic rubber, manufactured fibers, other specialty chemicals, fertilizers, adhesives, coatings, and consumer products. These gains were offset by weakness in organic chemicals, plastic resins, basic inorganic chemicals, industrial gases, and crop protection chemicals.

US Chemical Regional Production Index

As nearly all manufactured goods are produced using chemistry in some form, manufacturing activity is an important indicator for chemical demand. Manufacturing output edged higher for a sixth consecutive month in October, by 0.1% (3MMA). The 3MMA trend in manufacturing production was mixed, with gains in the output of food and beverages, aerospace, construction supplies, fabricated metal products, machinery, computers, semiconductors, refining, iron and steel products, plastic products, rubber products, tires, paper, printing, apparel, and furniture.

Compared with October 2020, U.S. chemical production was ahead by 2.2%, a weaker comparison than last month, due to lingering impacts from Hurricane Ida. Chemical production continued to be higher than a year ago in all regions, however.

US Chemical Regional Production Index, Percentage Change – December 1, 2021

The chemistry industry is one of the largest industries in the United States, a $486 billion enterprise. The manufacturing sector is the largest consumer of chemical products, and 96% of manufactured goods are touched by chemistry. The U.S. CPRI was developed to track chemical production activity in seven regions of the United States. The U.S. CPRI is based on information from the Federal Reserve, and as such, includes monthly revisions as published by the Federal Reserve. The U.S. CPRI includes the most recent Federal Reserve benchmark revision released on May 28, 2021. To smooth month-to-month fluctuations, the U.S. CPRI is measured using a three-month moving average. Thus, the reading in October reflects production activity during August, September, and October.

Learn more at: https://www.americanchemistry.com/chemistry-in-america/news-trends/press-release/2021/lingering-impacts-from-hurricane-ida-weighed-on-us-chemical-production-in-october

December 22, 2021

Hurricane IDA Impacted Q3 Chemical Markets

Follow us

Lingering Impacts from Hurricane Ida Weighed on U.S. Chemical Production in October

CONTACT US

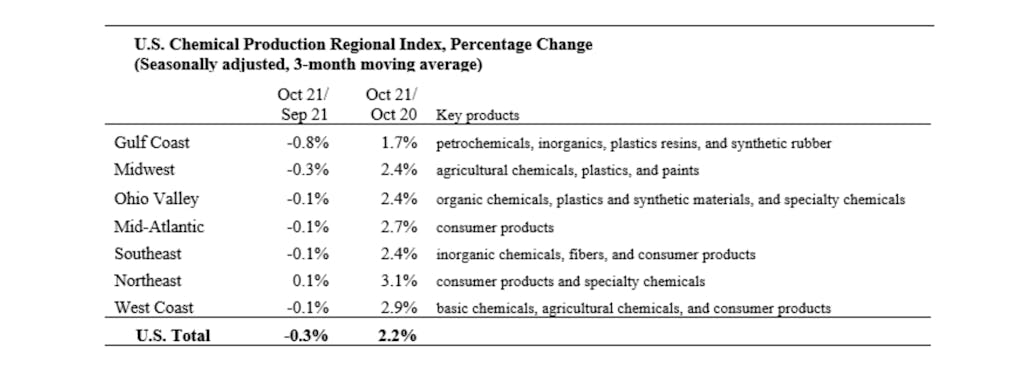

Jennifer Scott

WASHINGTON (December 1, 2021) – The U.S. Chemical Production Regional Index (U.S. CPRI) eased by 0.3% in October following a 1.6% decline in September and a 0.4% decline in August, according to the American Chemistry Council (ACC). Chemical output declined in all regions except the Northeast. With lingering hurricane and other supply chain disruptions, the largest decline was in the Gulf Coast region. The U.S. CPRI is measured as a three-month moving average (3MMA).

Chemical production was mixed in October (3MMA), with an improving trend in the production of synthetic rubber, manufactured fibers, other specialty chemicals, fertilizers, adhesives, coatings, and consumer products. These gains were offset by weakness in organic chemicals, plastic resins, basic inorganic chemicals, industrial gases, and crop protection chemicals.

US Chemical Regional Production Index

As nearly all manufactured goods are produced using chemistry in some form, manufacturing activity is an important indicator for chemical demand. Manufacturing output edged higher for a sixth consecutive month in October, by 0.1% (3MMA). The 3MMA trend in manufacturing production was mixed, with gains in the output of food and beverages, aerospace, construction supplies, fabricated metal products, machinery, computers, semiconductors, refining, iron and steel products, plastic products, rubber products, tires, paper, printing, apparel, and furniture.

Compared with October 2020, U.S. chemical production was ahead by 2.2%, a weaker comparison than last month, due to lingering impacts from Hurricane Ida. Chemical production continued to be higher than a year ago in all regions, however.

US Chemical Regional Production Index, Percentage Change – December 1, 2021

The chemistry industry is one of the largest industries in the United States, a $486 billion enterprise. The manufacturing sector is the largest consumer of chemical products, and 96% of manufactured goods are touched by chemistry. The U.S. CPRI was developed to track chemical production activity in seven regions of the United States. The U.S. CPRI is based on information from the Federal Reserve, and as such, includes monthly revisions as published by the Federal Reserve. The U.S. CPRI includes the most recent Federal Reserve benchmark revision released on May 28, 2021. To smooth month-to-month fluctuations, the U.S. CPRI is measured using a three-month moving average. Thus, the reading in October reflects production activity during August, September, and October.

Learn more at: https://www.americanchemistry.com/chemistry-in-america/news-trends/press-release/2021/lingering-impacts-from-hurricane-ida-weighed-on-us-chemical-production-in-october

December 21, 2021

Hexion To Be Sold

HOUSTON (ICIS)–US-based Hexion on Monday has entered into a definitive agreement to be acquired by private equity American Securities for $2.06bn, including the assumption of around $1.24bn in net debt for a total enterprise value of around $3.3bn.

The transaction is expected to close in the first half of 2022 and is conditioned upon the closing of Hexion’s previously announced sale of its epoxy business to Westlake Chemical.

The purchase price represents a 15% premium to the closing price as of 17 December and a 53% premium to the company’s closing share price on 30 July, the day prior to its announcement of its ongoing strategic review.

“This transaction, along with the pending sale of our epoxy business, is the conclusion of a comprehensive evaluation of strategic actions aimed at maximising value for our shareholders and best positioning the company for long-term growth,” said Hexion CEO Craig Rogerson.

Hexion, after agreeing in late November to sell its epoxy business for $1.2bn to Westlake, was planning an initial public offering (IPO) on the New York Stock Exchange along with a sale in a dual track. The remaining adhesives and versatic acids business had sales of $1.38bn and earnings before interest, tax, depreciation and amortisation (EBITDA) of $272m in 2020.

Earlier in a November interview with ICIS, Hexion CEO Craig Rogerson said he was considering a “sale of Hexion or either of the parts”. The company in April closed the sale of its phenolic specialty resins, hexamine and European-based forest products resins businesses to Black Diamond and Investindustrial for $425m.

www.icis.com/explore/resources/news/2021/12/20/10717799/private-equity-firm-acquires-hexion-for-2-06bn/

December 21, 2021

Hexion To Be Sold

HOUSTON (ICIS)–US-based Hexion on Monday has entered into a definitive agreement to be acquired by private equity American Securities for $2.06bn, including the assumption of around $1.24bn in net debt for a total enterprise value of around $3.3bn.

The transaction is expected to close in the first half of 2022 and is conditioned upon the closing of Hexion’s previously announced sale of its epoxy business to Westlake Chemical.

The purchase price represents a 15% premium to the closing price as of 17 December and a 53% premium to the company’s closing share price on 30 July, the day prior to its announcement of its ongoing strategic review.

“This transaction, along with the pending sale of our epoxy business, is the conclusion of a comprehensive evaluation of strategic actions aimed at maximising value for our shareholders and best positioning the company for long-term growth,” said Hexion CEO Craig Rogerson.

Hexion, after agreeing in late November to sell its epoxy business for $1.2bn to Westlake, was planning an initial public offering (IPO) on the New York Stock Exchange along with a sale in a dual track. The remaining adhesives and versatic acids business had sales of $1.38bn and earnings before interest, tax, depreciation and amortisation (EBITDA) of $272m in 2020.

Earlier in a November interview with ICIS, Hexion CEO Craig Rogerson said he was considering a “sale of Hexion or either of the parts”. The company in April closed the sale of its phenolic specialty resins, hexamine and European-based forest products resins businesses to Black Diamond and Investindustrial for $425m.

www.icis.com/explore/resources/news/2021/12/20/10717799/private-equity-firm-acquires-hexion-for-2-06bn/