Epoxy

December 20, 2021

Additional Arsenal Acquisitions

Arsenal’s Seal For Life Acquires Mascoat and Verdia NEW YORK, December 17, 2021 – Arsenal Capital Partners (“Arsenal”), a private equity firm that specializes in investments in industrial growth companies, announced today that its global industrial coatings platform, Seal For Life Industries (“Seal For Life”), has acquired Mascoat Ltd. (“Mascoat”) and Verdia, Inc. (“Verdia”), both privately owned specialty industrial coatings companies.

Mascoat, based out of Houston, TX, has been a leading manufacturer of thermal insulation coatings, anti-condensation, and sound damping coatings since 1995. The company serves a wide variety of industries with its coatings such as industrial, marine, commercial, and automotive applications. Mascoat has helped to develop new ways to solve corrosion under insulation with its insulation coatings and pioneered the use of its sound damping and anti-condensation coatings to the commercial and yacht sectors. The company has locations in The Netherlands and China, in addition to its base in Houston.

George More, President, CEO, and Founder of Mascoat, said, “We are delighted to become part of the Seal For Life platform. The combination of Mascoat’s industry-leading insulation and protective coatings with Seal For Life’s extensive coatings portfolio and global footprint will allow us to reach additional markets and customers, and will provide customers even more high-performance solutions to protect their critical infrastructure assets.”

Verdia is a leading polymer flooring manufacturer in the United States with deep expertise in polyurethane concrete flooring systems and offers a complete line of epoxies, polyurethane, and polyaspartics formulations. Inc. Magazine recognized Verdia as one of the Fastest Growing Companies in America for 2019. Verdia has been awarded USDA certification for its bio-based polyurethane floor coating produced from renewable and sustainable polymer sources. Verdia provides superior products, unparalleled customer service, and industry-leading technical support and focuses on providing long-lasting and environmentally conscious polymer solutions. The company is based in Conroe, TX.

Tony Crowell, President, CEO, and Founder of Verdia, remarked, “Joining the Seal For Life platform provides Verdia with the critical mass and market access it needs to continue its remarkable growth trajectory. Our customers consider polymeric floor coatings as critical technology for protecting their high-value infrastructure assets, and we look forward to expanding applications of our highly sustainable products around the world.”

Jeff Oravitz, CEO of Seal For Life, remarked, “We are very pleased to welcome the Mascoat and Verdia teams to the Seal For Life family, and look forward to working with them to accomplish our vision of being the leading global provider of protective coating and sealing solutions for infrastructure markets. The incorporation of these highly specialized industrial coatings companies into the Seal For Life platform increases our global scale and the ability to meet the needs of our many global customers.”

Aaron Wolfe, an Investment Partner of Arsenal, said, “Mascoat and Verdia bring exceptional coatings technologies to the Seal for Life platform and have an excellent market reputation for providing the highest level of performance and quality to meet demanding customer requirements. These businesses provide highly complementary technologies and build further scale for Seal For Life. We look forward to supporting these teams and investing in inorganic growth and completing additional acquisitions to continue to build Seal For Life’s position in the broader protective coatings and sealing solutions space for infrastructure applications.”

About Seal For Life Seal For Life provides corrosion prevention, waterproofing, fire and heat protection, and insulation products. The company offers industrial liquid coating products to protect critical infrastructure, heat shrink sleeves to protect pipeline joints from corrosion and degradation, cathodic protection products, visco-elastic adhesive solutions to protect assets from corrosion and water ingress; and cold-applied, single wrap and fused tape products. It offers products for many markets, such as marine, splash zone and underwater installation, renewable energy, onshore oil, gas, and water pipelines, insulation, casing filler, flooring, refinery, linings, cathodic protection, cables and wires, and waste water applications. Visit www.sealforlife.com for more information.

About Arsenal Capital Partners Arsenal is a leading private equity firm that specializes in investments in middle-market industrials and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds of more than $7.0 billion, completed more than 200 platform and add-on investments, and achieved more than 30 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value–add. For more information, please visit www.arsenalcapital.com.

December 20, 2021

Additional Arsenal Acquisitions

Arsenal’s Seal For Life Acquires Mascoat and Verdia NEW YORK, December 17, 2021 – Arsenal Capital Partners (“Arsenal”), a private equity firm that specializes in investments in industrial growth companies, announced today that its global industrial coatings platform, Seal For Life Industries (“Seal For Life”), has acquired Mascoat Ltd. (“Mascoat”) and Verdia, Inc. (“Verdia”), both privately owned specialty industrial coatings companies.

Mascoat, based out of Houston, TX, has been a leading manufacturer of thermal insulation coatings, anti-condensation, and sound damping coatings since 1995. The company serves a wide variety of industries with its coatings such as industrial, marine, commercial, and automotive applications. Mascoat has helped to develop new ways to solve corrosion under insulation with its insulation coatings and pioneered the use of its sound damping and anti-condensation coatings to the commercial and yacht sectors. The company has locations in The Netherlands and China, in addition to its base in Houston.

George More, President, CEO, and Founder of Mascoat, said, “We are delighted to become part of the Seal For Life platform. The combination of Mascoat’s industry-leading insulation and protective coatings with Seal For Life’s extensive coatings portfolio and global footprint will allow us to reach additional markets and customers, and will provide customers even more high-performance solutions to protect their critical infrastructure assets.”

Verdia is a leading polymer flooring manufacturer in the United States with deep expertise in polyurethane concrete flooring systems and offers a complete line of epoxies, polyurethane, and polyaspartics formulations. Inc. Magazine recognized Verdia as one of the Fastest Growing Companies in America for 2019. Verdia has been awarded USDA certification for its bio-based polyurethane floor coating produced from renewable and sustainable polymer sources. Verdia provides superior products, unparalleled customer service, and industry-leading technical support and focuses on providing long-lasting and environmentally conscious polymer solutions. The company is based in Conroe, TX.

Tony Crowell, President, CEO, and Founder of Verdia, remarked, “Joining the Seal For Life platform provides Verdia with the critical mass and market access it needs to continue its remarkable growth trajectory. Our customers consider polymeric floor coatings as critical technology for protecting their high-value infrastructure assets, and we look forward to expanding applications of our highly sustainable products around the world.”

Jeff Oravitz, CEO of Seal For Life, remarked, “We are very pleased to welcome the Mascoat and Verdia teams to the Seal For Life family, and look forward to working with them to accomplish our vision of being the leading global provider of protective coating and sealing solutions for infrastructure markets. The incorporation of these highly specialized industrial coatings companies into the Seal For Life platform increases our global scale and the ability to meet the needs of our many global customers.”

Aaron Wolfe, an Investment Partner of Arsenal, said, “Mascoat and Verdia bring exceptional coatings technologies to the Seal for Life platform and have an excellent market reputation for providing the highest level of performance and quality to meet demanding customer requirements. These businesses provide highly complementary technologies and build further scale for Seal For Life. We look forward to supporting these teams and investing in inorganic growth and completing additional acquisitions to continue to build Seal For Life’s position in the broader protective coatings and sealing solutions space for infrastructure applications.”

About Seal For Life Seal For Life provides corrosion prevention, waterproofing, fire and heat protection, and insulation products. The company offers industrial liquid coating products to protect critical infrastructure, heat shrink sleeves to protect pipeline joints from corrosion and degradation, cathodic protection products, visco-elastic adhesive solutions to protect assets from corrosion and water ingress; and cold-applied, single wrap and fused tape products. It offers products for many markets, such as marine, splash zone and underwater installation, renewable energy, onshore oil, gas, and water pipelines, insulation, casing filler, flooring, refinery, linings, cathodic protection, cables and wires, and waste water applications. Visit www.sealforlife.com for more information.

About Arsenal Capital Partners Arsenal is a leading private equity firm that specializes in investments in middle-market industrials and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds of more than $7.0 billion, completed more than 200 platform and add-on investments, and achieved more than 30 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value–add. For more information, please visit www.arsenalcapital.com.

December 19, 2021

Africa’s Largest Economies

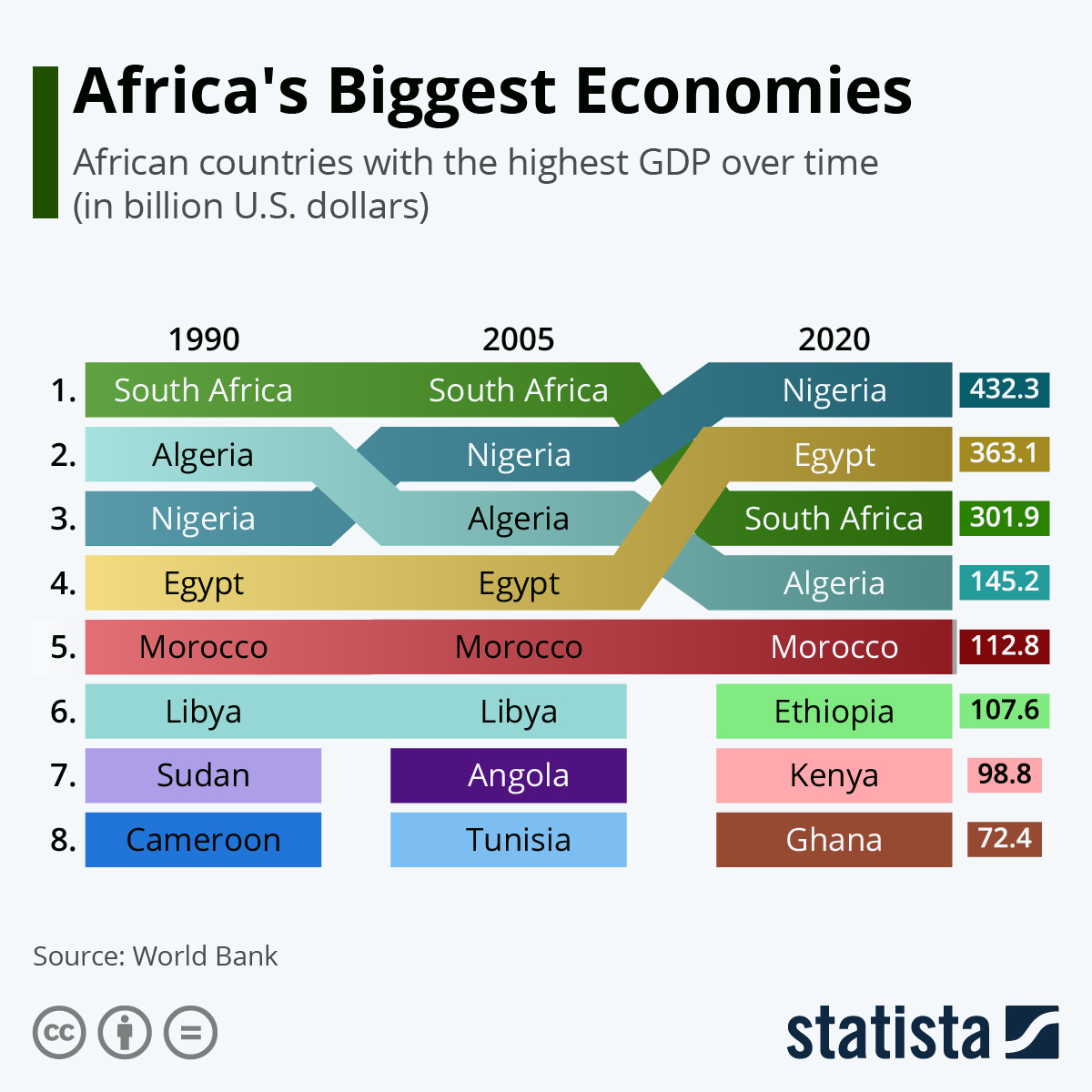

Africa’s Biggest Economies

by Tyler DurdenSunday, Dec 19, 2021 – 08:45 AM

With a total GDP of $432.3 billion, Nigeria has become the biggest economy on the African continent over the last 30 years. While the five highest spots on this ranking have been more or less constant over the last three decades, Statista’s Florian Zandt notes that the rest of the top 8 are subject to bigger fluctuations as our chart shows.

You will find more infographics at Statista

Libya, for example, managed to come in sixth in 1990 and 2005, but dropped out of the top 8 and only made the 17th rank in 2020. One of the most probable reasons for this dropoff is the Second Libyan Civil War. The multi-sided conflict started in 2014 in the aftermath of the election results of 2012 putting the General National Congress into power. Kenya, on the other hand, passed a new constitution in 2010 which limited the power held by the country’s president and enabled business and technology centers like Nairobi to grow. The city is now home to the African offices of Google, Coca-Cola, IBM and Cisco, among others.

Nigeria’s first place is largely attributable to its rapidly expanding financial sector, which grew from one percent of the total GDP in 2001 to ten percent in 2018, and its role as one of the world leaders in petroleum exports. The growing tech hub of Lagos, the second-largest metropolitan area in Africa and among the largest in the world, is also likely to further bolster Nigeria’s growth in the coming years, even though the divide between the part of the population living in slums without access to basic sanitation and its upper class making the city one of the most expensive in the world is likely to grow as well. This is also reflected in its comparably low GDP per capita of $2,100. When considering this indicator, Nigeria doesn’t even make the top 10 in Africa.

Of the 54 countries in Africa, only four countries made the top 50 of all nations with the highest GDP according to data from World Bank. The top spots on this list are reserved for the US, China, Japan and Germany, whose residents generate a combined GPD of $45 trillion, a whopping 50 percent of the global GDP.

https://www.zerohedge.com/economics/africas-biggest-economies

December 19, 2021

Africa’s Largest Economies

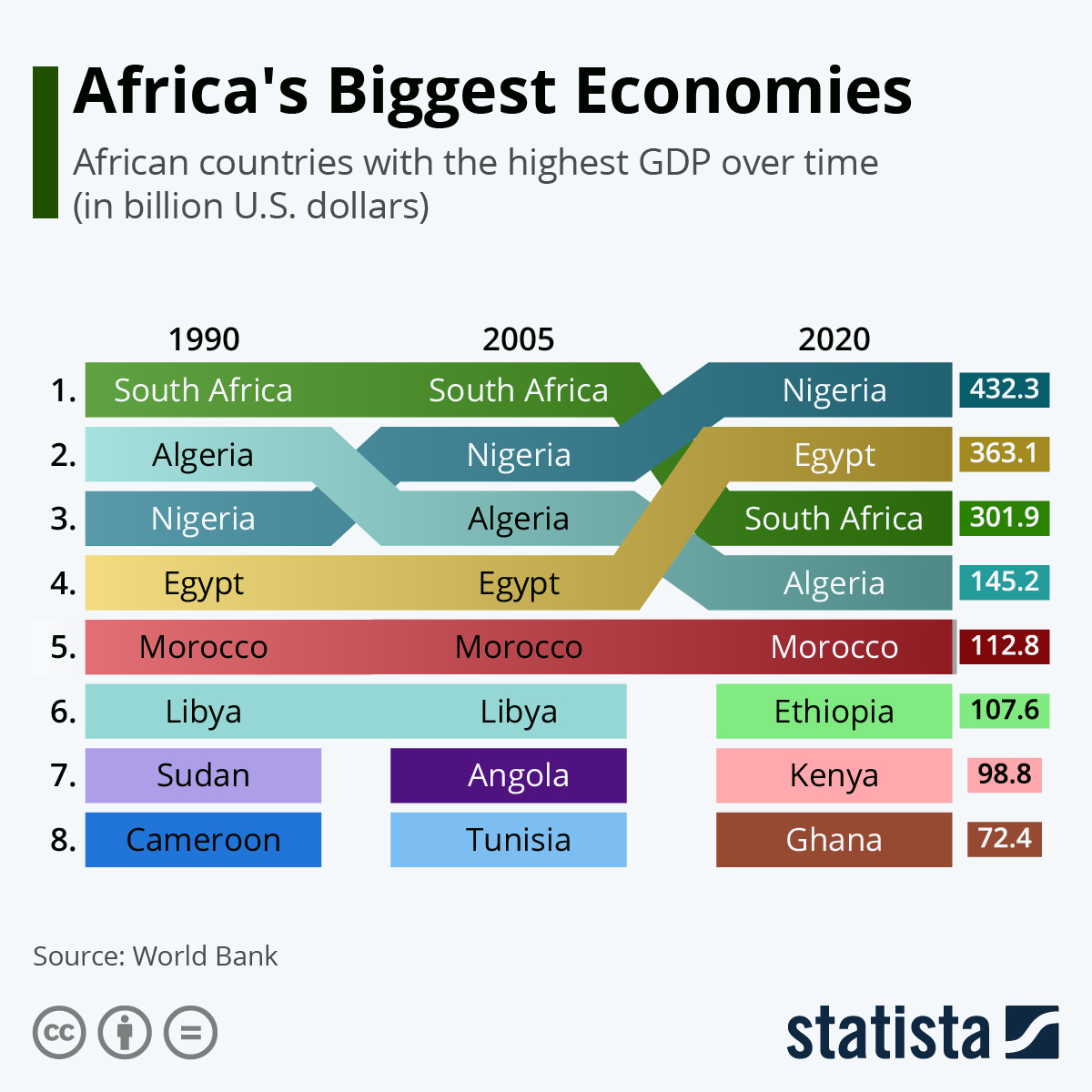

Africa’s Biggest Economies

by Tyler DurdenSunday, Dec 19, 2021 – 08:45 AM

With a total GDP of $432.3 billion, Nigeria has become the biggest economy on the African continent over the last 30 years. While the five highest spots on this ranking have been more or less constant over the last three decades, Statista’s Florian Zandt notes that the rest of the top 8 are subject to bigger fluctuations as our chart shows.

You will find more infographics at Statista

Libya, for example, managed to come in sixth in 1990 and 2005, but dropped out of the top 8 and only made the 17th rank in 2020. One of the most probable reasons for this dropoff is the Second Libyan Civil War. The multi-sided conflict started in 2014 in the aftermath of the election results of 2012 putting the General National Congress into power. Kenya, on the other hand, passed a new constitution in 2010 which limited the power held by the country’s president and enabled business and technology centers like Nairobi to grow. The city is now home to the African offices of Google, Coca-Cola, IBM and Cisco, among others.

Nigeria’s first place is largely attributable to its rapidly expanding financial sector, which grew from one percent of the total GDP in 2001 to ten percent in 2018, and its role as one of the world leaders in petroleum exports. The growing tech hub of Lagos, the second-largest metropolitan area in Africa and among the largest in the world, is also likely to further bolster Nigeria’s growth in the coming years, even though the divide between the part of the population living in slums without access to basic sanitation and its upper class making the city one of the most expensive in the world is likely to grow as well. This is also reflected in its comparably low GDP per capita of $2,100. When considering this indicator, Nigeria doesn’t even make the top 10 in Africa.

Of the 54 countries in Africa, only four countries made the top 50 of all nations with the highest GDP according to data from World Bank. The top spots on this list are reserved for the US, China, Japan and Germany, whose residents generate a combined GPD of $45 trillion, a whopping 50 percent of the global GDP.

https://www.zerohedge.com/economics/africas-biggest-economies

December 13, 2021

Central to Close

Central Freight Lines to shut down after 96 years

Clarissa Hawes, Senior Editor, Investigations and Enterprise Follow on Twitter Monday, December 13, 2021 5 minutes read

2,100 employees will be laid off right before Christmas. Central Freight Lines is the largest trucking company to close since Celadon ceased operations in 2019.

Waco, Texas-based Central Freight Lines has notified drivers, employees and customers that the less-than-truckload carrier plans to wind down operations on Monday after 96 years, the company’s president told FreightWaves on Saturday.

“It’s just horrible,” said CFL President Bruce Kalem.

A source close to CFL told FreightWaves that CFL had “too much debt and too many unpaid bills” to continue operating, despite exploring all available options to keep its doors open.

Kalem agreed.

“Years of operating losses and struggles for many years sapped our liquidity and we had no other place to go at this point,” Kalem told FreightWaves. “Nobody is going to make money on this closing, nobody.”

Central Freight will cease picking up new shipments effective Monday and expects to deliver substantially all freight in its system by Dec. 20, according to a company statement.

A source familiar with the company said he is unsure whether CFL will file Chapter 7 or “liquidate outside of bankruptcy,” but that the LTL carrier has no plans to reorganize.

The company reshuffled its executive team nearly a year ago in an effort to stay afloat, including adding the company’s owner, Jerry Moyes, as CFL’s interim president and chief executive officer. Moyes remained CEO after Kalem was elevated to president in July.

“I think it was surprising that there wasn’t a buyer for the entire company, but buyers were interested in certain pieces but not in the whole thing,” the source, who didn’t want to be identified, told FreightWaves. “Part of it could have been that just the network was so expansive that there was too much overlap with some of the buyers that they didn’t need locations or employees in the places where they already had strong operations.”

Third-party logistics provider GlobalTranz notified its customers that it had removed CFL as “a blanket and CSP carrier option immediately, to prevent any new bookings,” multiple sources told FreightWaves on Saturday.

CFL, which has over 2,100 employees, including 1,325 drivers, and 1,600 power units, is in discussions with “key customers and vendors and expects sufficient liquidity to complete deliveries over the next week in an orderly manner,” a CFL spokesperson said. Approximately 820 employees are based at the company headquarters in Waco.

Despite diligent efforts, CFL “was unable to gain commitments to fund ongoing operations, find a buyer of the entire business or fund a Chapter 11 reorganization,” another source familiar with the company told FreightWaves.

Kalem said the company had 65 terminals prior to its decision to shutter operations.

FreightWaves received a tip from a source nearly two weeks ago that CFL wasn’t renewing its East Coast terminal leases but was unable to confirm the information with CFL executives.

Another source told FreightWaves that some of the LTL carrier’s West Coast terminals had been sold recently, but that no reason was given for the transactions.

At that time, Kalem said the company was “working to find alternatives” and couldn’t speak because of non-disclosure agreements. He said executives at CFL, including Moyes, were trying to do everything to “save the company.”

“Jerry [Moyes] pumped a lot of money into the company, but it just wasn’t enough,” Kalem said.

Kalem said he’s aware that a large carrier is interested in hiring many of CFL’s drivers but isn’t able to name names at this point.

“Central Freight is in negotiations to sell a substantial portion of its equipment,” the company said in a statement. “Additionally, Central Freight is coordinating with other regional LTL carriers to afford its employees opportunities to apply for other LTL jobs in their area.”

As of late Saturday night, Kalem said fuel cards are working and drivers will be paid for freight they’ve hauled for the LTL carrier until all freight is delivered by the Dec. 20 target date.

“I’m going to work feverishly with the time I have left to get these good people jobs — I owe it to them,” Kalem told FreightWaves. “We are going to pay our drivers — that’s why we had to close it like we’re doing now. We are going to deliver all of the freight that’s in our system by next week and we believe we can do that.”

During the outset of the pandemic, Central Freight Lines was one of four trucking-related companies that received the maximum award of $10 million through the U.S. Small Business Administration’s Paycheck Protection Program (PPP). This occurred around the time that CFL drivers and employees were forced to take pay cuts, a move that didn’t go down well with drivers.

“It all went to payroll,” Kalem said about the PPP funds. “Yes, our employees and drivers did take a pay cut over the past few years, and we gave most of it back, even raised pay over the past several months but it just wasn’t enough to attract drivers.”

FreightWaves staffers Todd Maiden, Timothy Dooner and JP Hampstead contributed to this report.