Mergers & Acquisitions

April 12, 2023

Wanhua TDI Acquisition Approved

Wanhua Chemical acquires Yantai Juli approved, TDI giant position consolidated further

On April 9, Wanhua Chemical issued an announcement that the company recently received approval from the operators of the State Administration of Market Supervision and Administration, agreeing that Wanhua Chemical intends to acquire shares in Yantai Juli Fine Chemical Co., Ltd.; at the same time, the State Administration of Market Supervision and Administration agrees to the additional restrictive conditions of operator concentration.

Wanhua’s acquisition of Juli antitrust was approved, and the competition pattern of TDI continued to be optimized

Wanhua Chemical plans to acquire a stake in Yantai Juli and take sole control of Yantai Juli, while Wanhua Chemical and Yantai Juli submit a restrictive commitment to the General Administration of Market Supervision. The General Administration of Market Supervision decided to attach restrictive conditions to approve the concentration, requiring both parties and entities after the concentration to fulfill their relevant obligations, including that the annual average price of supplying TDI to customers in China’s domestic market shall not be higher than the average price for the 24 months before the commitment date (March 30, 2023) after the completion of the transaction, maintain or expand the production of toluene diisocyanate in China, and continue R&D and innovation. Supply TDI to customers in the domestic market of China in accordance with the principles of fairness, reasonableness and non-discrimination. Customers in the domestic market in China shall not be forced to purchase TDI products exclusively or carry out tying unless there are legitimate reasons.

Yantai Juli and its wholly owned subsidiary Xinjiang Heshan Juli have a nominal production capacity of 230kt/year of TDI. Through this acquisition, the proportion of Wanhua Chemical TDI capacity in China will further increase from 35-40% to 45-50%, the main competitors in the domestic market will also change from 6 to 5, and the domestic TDI competition pattern will continue to be optimized. At the same time, if factoring into the 250kt/year TDI project under construction in Fujian, the company’s total nominal capacity will reach 1.03 million tons/year (including Juli’s TDI capacity), accounting for 28% of the world, ranking first in the world, with significant scale advantages.

https://www.ccfgroup.com/newscenter/newsview.php?Class_ID=600000&Info_ID=2023041230005

April 6, 2023

Recticel Update

Update regarding the divestment of Recticel Engineered Foams to Carpenter

Regulated information, Brussels, 06/04/2023 — 06:59 CET, 06.04.2023

Recticel reports that the closing of the Engineered Foams divestment to Carpenter Co. has not taken place at the end of March 2023.

Parties continue to work towards a closing to take place as soon as possible.

https://www.recticel.com/update-regarding-divestment-recticel-engineered-foams-carpenter.html

March 14, 2023

Univar Solutions Going Private

Univar Solutions to be Acquired by Apollo Funds for

$8.1 Billion

3/14/2023

Shareholders to Receive $36.15 Per Share in Cash

DOWNERS GROVE, Ill. and NEW YORK, March 14, 2023 /CNW/ — Univar Solutions Inc. (NYSE: UNVR) (“Univar

Solutions” or the “Company”) and Apollo (NYSE: APO) announced today that funds managed by affiliates of Apollo

(the “Apollo Funds”) have entered into a definitive merger agreement to acquire the Company in an all-cash

transaction that values the Company at an enterprise value of approximately $8.1 billion. The transaction includes a

minority investment from a wholly owned subsidiary of the Abu Dhabi Investment Authority (“ADIA”).

The agreement provides that Univar Solutions shareholders will receive

$36.15 per share in cash, which represents a 20.6% premium to the Company’s

undisturbed closing stock price on November 22, 2022. The transaction

consideration also represents a premium of 33.6% to the volume-weighted average price of Univar Solutions for the

30 trading days ending on November 22, 2022.

“We are pleased to have reached this agreement with Apollo, which will provide immediate and certain cash value

for Univar Solutions shareholders,” said Chris Pappas, chairman of the Univar Solutions Board of Directors (the

“Board”). “The Board’s decision follows a comprehensive review of value creation opportunities for Univar

Solutions. We are conêdent this transaction is the right path forward and achieves our goal of maximizing value for

Univar Solutions shareholders.”

David Jukes, president and chief executive officer of Univar Solutions, said, “Over the last three years, we have

transformed the Company, putting the customer at the center of all we do, which has solidified our position as a

leading value-added service and solution provider. This transaction reflects the success of our strategy and delivers

substantial value to our shareholders. It is a testament to the tireless efforts of my colleagues, whose commitment

to our purpose of helping keep our communities healthy, fed, clean, and safe has enabled our success.

In Apollo, we are pleased to gain a partner to support continued investment in our portfolio and I look forward to working

closely with their team as we grow Univar Solutions and serve our key suppliers and customers globally.”

Apollo Private Equity Partner Sam Feinstein said, “Univar is a global leader in specialty chemicals and ingredients

distribution, fueling a vast array of industries with innovative, safe and sustainable solutions. In recent years, David

and his team have made tremendous progress enhancing the customer experience, and we believe Univar can

accelerate its long-term strategy as an Apollo Fund portfolio company. We look forward to leveraging our extensive

experience in the sector to support management in this exciting next phase.”

Transaction Details

The merger agreement, which has been unanimously approved by the Univar Solutions Board of Directors,

provides that Univar Solutions shareholders will receive $36.15 in cash for each share of common stock they own.

The transaction will be enhanced with equity provided by the Apollo Funds, a minority equity investment from a

wholly owned subsidiary of ADIA and a committed debt ênancing package.

The transaction is expected to close in the second half of 2023, subject to customary closing conditions, including

approval by Univar Solutions shareholders and receipt of regulatory approvals. The transaction is not subject to a

ênancing condition.

Upon completion of the transaction, shares of Univar Solutions common stock will no longer trade on the New York

Stock Exchange, and Univar Solutions will become a privately held company. Univar Solutions will continue to

operate under the Univar Solutions name and brand and maintain a global presence.

The foregoing description of the merger agreement and the transactions contemplated thereby is subject to, and is

qualified in its entirety by reference to, the full terms of the merger agreement, which Univar Solutions will file with

the U.S. Securities and Exchange Commission as an exhibit to a Current Report on Form 8-K.

March 1, 2023

Recticel Results

Recticel Annual Results 2022

Regulated information, Brussels, 28/02/2023 — 06:59 CET, 28.02.2023

- Net sales increase from €449.2 million in 2021 to €561.5 million (+25.0%) in 2022, of which €129.2 million contribution from Trimo and a €48.9 million reduction following the phasing out of sales of chemicals to divested Automotive companies

- Adjusted EBITDA: from €48.4 million to €62.2 million (+28.4%)

- Result of the period (share of the Group): from €53.5 million to €63.2 million

- Closing of the divestment of Engineered Foams expected at the end of 1Q2023

- Proposal to pay an increased gross dividend of €0.31 per share

Olivier Chapelle (CEO Recticel): “The European construction market has become increasingly challenging as the year 2022 unfolded, with growing economic uncertainties and historically high inflation and rising interest rates weighing progressively more and more on construction activities. In that environment, I am proud of all our employees and want to thank them. In 2022, their focus and contributions have allowed to deliver, when compared to 2021, slightly higher volumes in Insulation Boards and flat volumes in Insulated Panels. Reactivity on pricing and margin management have in turn contributed to deliver solid results.

The divestment of Engineered Foams is expected to close at the end of the first quarter of 2023. It follows the decision on 26 January 2023 by the Competition and Markets Authority in the UK, to approve the Final Undertakings, which execution is now entering its final phase.

With the acquisition of Trimo on 1 May 2022, now fully integrated, we have created a broader basis for further internal and external growth.

With regard to ESG and sustainable development, after having announced our commitment to the SBTi, we can report a 11.2% reduction in our Scope 1 & 2 carbon emissions in 2022 versus reference year 2021.”

OUTLOOK

The year 2022 has been very challenging due to the consequences of the geopolitical turmoil. During that year, our business has resisted well and is well positioned at the beginning of 2023, despite the current lack of visibility. Margin management, growth initiatives and further progress on ESG are the priorities in 2023.

At this stage, the Company does not provide guidance related to its full year 2023 expected results.

https://www.recticel.com/recticel-annual-results-2022.html-0

March 1, 2023

Bankruptcies Spike

US Bankruptcy Filings Surge At Fastest Pace Since 2009

by Tyler Durden

Wednesday, Mar 01, 2023 – 07:45 AM

For the past year, both the Biden White House and the Fed have been desperate to usher in a (mild) recession in the US to break the back of runaway inflation and the wage-price spiral with little success. But judging by the surge in bankruptcy filings, they are about to get their wish.

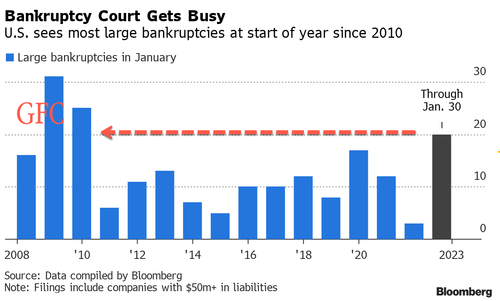

One month ago, when looking at the recent pace of large bankruptcy filings (those with more than $50MM in liabilities), we noted a troubling trend: in the first month of the year, the number of US bankruptcies topped 20, the highest in any other January dating back to 2010. Back then, 25 filings were seen as the economy was still reeling from the aftermath of the GFC.

The spike in defaults was not a fluke, and according to Bloomberg data, one month later – as of the end of February – no less than 39 large companies had filed for bankruptcy in the US so far this year, as February’s pace matches that of January; the YTD total represents the fastest pace of companies filing for bankruptcy since the immediate aftermath of the global financial crisis in 2009. By comparison, US bankruptcy courts had seen 63 large filings at this point in 2009.

Last week’s seven large filings — those tied to at least $50 million of liabilities — include the liquidation of generic drugmaker Akorn and the Chapter 11 filing of Covid-19 testmaker Lucira Health

This year, some of the most notable bankruptcy filings have been festive retailer Party City Holdco Inc, mattress maker Serta Simmons Bedding LLC, and cryptocurrency lender Genesis Global Holdco.

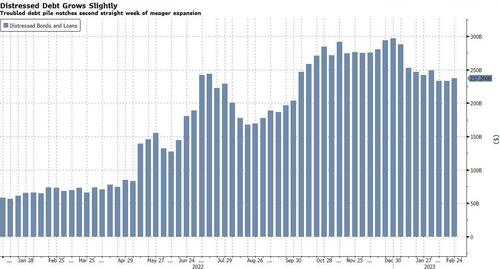

The pile of dollar-denominated corporate bonds and loans in the Americas trading at distressed levels rose to $237.2 billion in the week ended Friday, about a 1.63% increase from $233.4 billion a week earlier, according to BBG data.

Some more details from Bloomberg:

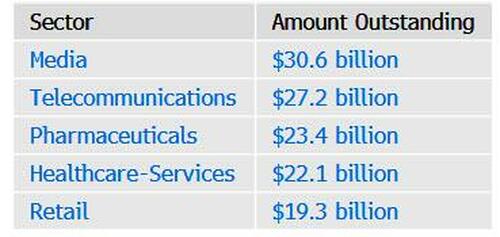

- The US accounts for the greatest volume of distressed debt in the Americas

- The media sector had the greatest amount of distressed debt as of the latest week

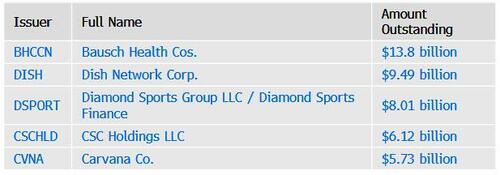

- Bausch Health Cos. had the most distressed debt outstanding of any issuer as of Feb. 17, data compiled by Bloomberg shows

https://www.zerohedge.com/economics/us-bankruptcy-filings-surge-fastest-pace-2009