Mergers & Acquisitions

March 14, 2023

Univar Solutions Going Private

Univar Solutions to be Acquired by Apollo Funds for

$8.1 Billion

3/14/2023

Shareholders to Receive $36.15 Per Share in Cash

DOWNERS GROVE, Ill. and NEW YORK, March 14, 2023 /CNW/ — Univar Solutions Inc. (NYSE: UNVR) (“Univar

Solutions” or the “Company”) and Apollo (NYSE: APO) announced today that funds managed by affiliates of Apollo

(the “Apollo Funds”) have entered into a definitive merger agreement to acquire the Company in an all-cash

transaction that values the Company at an enterprise value of approximately $8.1 billion. The transaction includes a

minority investment from a wholly owned subsidiary of the Abu Dhabi Investment Authority (“ADIA”).

The agreement provides that Univar Solutions shareholders will receive

$36.15 per share in cash, which represents a 20.6% premium to the Company’s

undisturbed closing stock price on November 22, 2022. The transaction

consideration also represents a premium of 33.6% to the volume-weighted average price of Univar Solutions for the

30 trading days ending on November 22, 2022.

“We are pleased to have reached this agreement with Apollo, which will provide immediate and certain cash value

for Univar Solutions shareholders,” said Chris Pappas, chairman of the Univar Solutions Board of Directors (the

“Board”). “The Board’s decision follows a comprehensive review of value creation opportunities for Univar

Solutions. We are conêdent this transaction is the right path forward and achieves our goal of maximizing value for

Univar Solutions shareholders.”

David Jukes, president and chief executive officer of Univar Solutions, said, “Over the last three years, we have

transformed the Company, putting the customer at the center of all we do, which has solidified our position as a

leading value-added service and solution provider. This transaction reflects the success of our strategy and delivers

substantial value to our shareholders. It is a testament to the tireless efforts of my colleagues, whose commitment

to our purpose of helping keep our communities healthy, fed, clean, and safe has enabled our success.

In Apollo, we are pleased to gain a partner to support continued investment in our portfolio and I look forward to working

closely with their team as we grow Univar Solutions and serve our key suppliers and customers globally.”

Apollo Private Equity Partner Sam Feinstein said, “Univar is a global leader in specialty chemicals and ingredients

distribution, fueling a vast array of industries with innovative, safe and sustainable solutions. In recent years, David

and his team have made tremendous progress enhancing the customer experience, and we believe Univar can

accelerate its long-term strategy as an Apollo Fund portfolio company. We look forward to leveraging our extensive

experience in the sector to support management in this exciting next phase.”

Transaction Details

The merger agreement, which has been unanimously approved by the Univar Solutions Board of Directors,

provides that Univar Solutions shareholders will receive $36.15 in cash for each share of common stock they own.

The transaction will be enhanced with equity provided by the Apollo Funds, a minority equity investment from a

wholly owned subsidiary of ADIA and a committed debt ênancing package.

The transaction is expected to close in the second half of 2023, subject to customary closing conditions, including

approval by Univar Solutions shareholders and receipt of regulatory approvals. The transaction is not subject to a

ênancing condition.

Upon completion of the transaction, shares of Univar Solutions common stock will no longer trade on the New York

Stock Exchange, and Univar Solutions will become a privately held company. Univar Solutions will continue to

operate under the Univar Solutions name and brand and maintain a global presence.

The foregoing description of the merger agreement and the transactions contemplated thereby is subject to, and is

qualified in its entirety by reference to, the full terms of the merger agreement, which Univar Solutions will file with

the U.S. Securities and Exchange Commission as an exhibit to a Current Report on Form 8-K.

March 1, 2023

Recticel Results

Recticel Annual Results 2022

Regulated information, Brussels, 28/02/2023 — 06:59 CET, 28.02.2023

- Net sales increase from €449.2 million in 2021 to €561.5 million (+25.0%) in 2022, of which €129.2 million contribution from Trimo and a €48.9 million reduction following the phasing out of sales of chemicals to divested Automotive companies

- Adjusted EBITDA: from €48.4 million to €62.2 million (+28.4%)

- Result of the period (share of the Group): from €53.5 million to €63.2 million

- Closing of the divestment of Engineered Foams expected at the end of 1Q2023

- Proposal to pay an increased gross dividend of €0.31 per share

Olivier Chapelle (CEO Recticel): “The European construction market has become increasingly challenging as the year 2022 unfolded, with growing economic uncertainties and historically high inflation and rising interest rates weighing progressively more and more on construction activities. In that environment, I am proud of all our employees and want to thank them. In 2022, their focus and contributions have allowed to deliver, when compared to 2021, slightly higher volumes in Insulation Boards and flat volumes in Insulated Panels. Reactivity on pricing and margin management have in turn contributed to deliver solid results.

The divestment of Engineered Foams is expected to close at the end of the first quarter of 2023. It follows the decision on 26 January 2023 by the Competition and Markets Authority in the UK, to approve the Final Undertakings, which execution is now entering its final phase.

With the acquisition of Trimo on 1 May 2022, now fully integrated, we have created a broader basis for further internal and external growth.

With regard to ESG and sustainable development, after having announced our commitment to the SBTi, we can report a 11.2% reduction in our Scope 1 & 2 carbon emissions in 2022 versus reference year 2021.”

OUTLOOK

The year 2022 has been very challenging due to the consequences of the geopolitical turmoil. During that year, our business has resisted well and is well positioned at the beginning of 2023, despite the current lack of visibility. Margin management, growth initiatives and further progress on ESG are the priorities in 2023.

At this stage, the Company does not provide guidance related to its full year 2023 expected results.

https://www.recticel.com/recticel-annual-results-2022.html-0

March 1, 2023

Bankruptcies Spike

US Bankruptcy Filings Surge At Fastest Pace Since 2009

by Tyler Durden

Wednesday, Mar 01, 2023 – 07:45 AM

For the past year, both the Biden White House and the Fed have been desperate to usher in a (mild) recession in the US to break the back of runaway inflation and the wage-price spiral with little success. But judging by the surge in bankruptcy filings, they are about to get their wish.

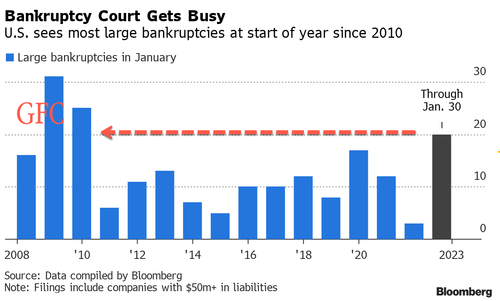

One month ago, when looking at the recent pace of large bankruptcy filings (those with more than $50MM in liabilities), we noted a troubling trend: in the first month of the year, the number of US bankruptcies topped 20, the highest in any other January dating back to 2010. Back then, 25 filings were seen as the economy was still reeling from the aftermath of the GFC.

The spike in defaults was not a fluke, and according to Bloomberg data, one month later – as of the end of February – no less than 39 large companies had filed for bankruptcy in the US so far this year, as February’s pace matches that of January; the YTD total represents the fastest pace of companies filing for bankruptcy since the immediate aftermath of the global financial crisis in 2009. By comparison, US bankruptcy courts had seen 63 large filings at this point in 2009.

Last week’s seven large filings — those tied to at least $50 million of liabilities — include the liquidation of generic drugmaker Akorn and the Chapter 11 filing of Covid-19 testmaker Lucira Health

This year, some of the most notable bankruptcy filings have been festive retailer Party City Holdco Inc, mattress maker Serta Simmons Bedding LLC, and cryptocurrency lender Genesis Global Holdco.

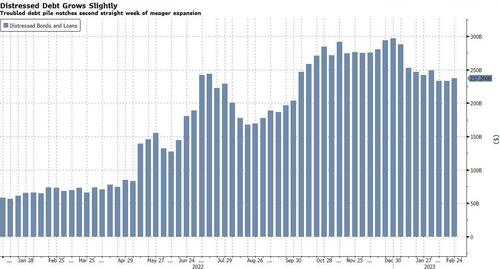

The pile of dollar-denominated corporate bonds and loans in the Americas trading at distressed levels rose to $237.2 billion in the week ended Friday, about a 1.63% increase from $233.4 billion a week earlier, according to BBG data.

Some more details from Bloomberg:

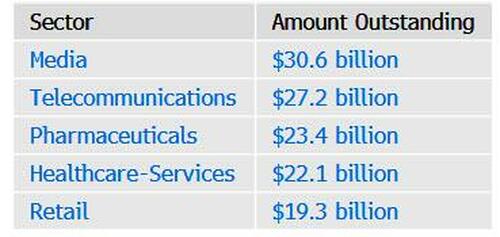

- The US accounts for the greatest volume of distressed debt in the Americas

- The media sector had the greatest amount of distressed debt as of the latest week

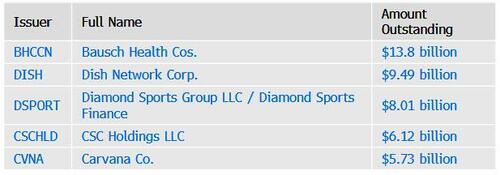

- Bausch Health Cos. had the most distressed debt outstanding of any issuer as of Feb. 17, data compiled by Bloomberg shows

https://www.zerohedge.com/economics/us-bankruptcy-filings-surge-fastest-pace-2009

February 13, 2023

Holcim Makes Another Acquisition

Holcim Acquiring Duro-Last in $1.29 Billion Agreement

The Swiss company makes another major acquisition to solidify its presence in North America’s roofing market

By Chris Gray

February 7, 2023

Holcim is further expanding its presence in North America with the acquisition of roofing systems manufacturer Duro-Last for $1.29 billion.

The Michigan-based Duro-Last currently employs around 840 workers and has an annual sales of roughly $540 million. The deal is expected to complement Holcim’s integrated roofing offerings, with expected synergies of $60 million per year.

“I’m excited to welcome Duro-Last into Holcim’s broad range of innovative and sustainable building solutions,” said Holcim CEO Jan Jenisch in a release. “Duro-Last is a perfect strategic fit for our roofing business. Its proprietary technologies and leading brands complement our offering in the fast-growing North American market. Its energy-efficient systems and excellence in recycling will further advance our leadership in sustainability.”

The acquisition is one of the largest deals Holcim has made in North America. In early 2022, it acquired Malarkey Roofing Products for $1.35 billion. Holcim also acquired Firestone Building Products in April 2021.

Duro-Last’s systems include cool roofs, enhancing buildings’ energy efficiency and its award-winning “Recycle Your Roof” program, which drives circularity in roofing. Duro-Last is the first company in the U.S. to offer third-party verified environmental product declarations for its thermoplastic roofing solutions.

“Over the past 45 years, our family business has continually reinvested in Duro-Last to create the solid, financially strong and well-recognized company we are today,” said Tom Saeli, CEO of Duro-Last, in a release. “We are delighted to be joining the Holcim family, which shares our core values, and we look to the future to accelerate our success. Holcim recognizes the opportunities at Duro-Last and we are confident it will support us in our future growth plans.”

Holcim expects its roofing systems will exceed $4 billion in net sales ahead of schedule. This acquisition advances Holcim’s “Strategy 2025 – Accelerating Green Growth” with the goal to expand its Solutions & Products business to 30% of Group net sales by 2025. The Duro-Last acquisition is expected to close by the second quarter of 2023.

https://www.roofingcontractor.com/articles/97911-holcim-acquiring-duro-last-in-129-billion-agreement

January 25, 2023

Serta Simmons Files for Chapter 11

Serta Simmons Files for Bankruptcy Amid Financing Controversy

Amelia Pollard and Luca Casiraghi

Tue, January 24, 2023 at 2:54 PM EST·4 min read

(Bloomberg) — The emergency funding that Serta Simmons Bedding received during the pandemic triggered a blowback that the company is still struggling to recover from.

The mattress manufacturer filed for bankruptcy on Monday, after clashes with lenders including Apollo Global Management Inc. left it with no other options for cutting its debt load while grappling with an economic slowdown that is crimping sales. Serta said the Chapter 11 filing will allow it to continue operating while it fixes its balance sheet, cutting debt to $300 million from $1.9 billion.

When the pandemic was raging in 2020 and the US economy had broadly shut down, Serta Simmons got $200 million of rescue financing to help it stay in business. The funding came from a group of lenders including Eaton Vance and Invesco Ltd., and featured a twist: the firms would be among the first in line to get repaid if the company failed.

Lenders excluded from that financing, including Apollo and Angelo Gordon & Co., responded by suing, arguing that other creditors had violated lending agreements by jumping ahead of them in the line to be repaid. Litigation tied to the transaction is still going on.

The mattress maker, assembled over a decade by private equity firms, faced heavy debt maturities this year. Alongside its Chapter 11 petition, Serta filed a lawsuit asking its bankruptcy judge to bless the 2020 financing that triggered litigation. Settling the fight over that deal is “critical” to the mattress maker’s restructuring, the company said in its lawsuit. The company’s planned deal is backed by a majority of lenders and shareholders.

Plan Details

The Serta litigation was the beginning of a series of clashes between lenders and companies with heavy debt loads that were struggling to navigate the pandemic. Creditors said that companies were pitting lenders against one another to get cheaper funding, and were hurting investors in the process.

Now Serta is trying to fix its financial difficulties with a bankruptcy plan that calls for repaying high-ranking lenders with new debt and stock in the restructured company, court papers show. Holders of more than $830 million of so-called first-lien-second-out debt are slated to get most of the company’s equity.

Loans pushed back in the repayment line in 2020 — more than $860 million of debt — would get a single-digit share of the stock in post-bankruptcy Serta. The plan also calls for paying the company’s continuing vendors in full, as long as they agree to favorable trade terms.

Nearly all of its top unsecured creditors are suppliers, with the top one listed owed more than $17 million, the filings show. The plan requires bankruptcy court approval and could change.

The creditor group has agreed to provide $125 million in the form of an asset-based loan to help the company fund itself in bankruptcy. Serta has also secured a commitment of $125 million in the same form once it exits bankruptcy.

The firm listed assets of $1 billion to $10 billion and liabilities in the same range in its petition. The company’s debt, which stems from a roughly $3 billion leveraged buyout by Advent International in 2012, has hobbled the retailer. Confidential talks over a restructuring plan started late last year, Bloomberg earlier reported.

Serta is working with advisers Weil, Gotshal & Manges, Evercore Group and FTI Consulting, according to the statement. Gibson Dunn & Crutcher and Centerview Partners are advising creditors, while Ropes and Gray are working with Advent.

Joining Forces

The mattress giant’s start can be traced back to the 1870s along the shores of Lake Michigan. There, Simmons first started producing coil spring mattresses, John Linker, the company’s chief financial officer, said in court papers.

The firm grew over the next century until it filed for bankruptcy during the fall-out of the financial crisis. Soon after, the firm combined with competitor Serta to establish the new company, Serta Simmons. In 2018, the company acquired Tuft & Needle, a maker of mattresses that get packaged in boxes and shipped directly to consumers’ homes.

Today, the firm is one of the largest mattress companies in the US, accounting for 19% of annual bedding sales, according to court papers. It operates 21 manufacturing facilities across the US and Canada and sells mattresses at 2,200 independent retailers.

But selling mattresses has grown more difficult, according to Serta. Rising interest rates have weighed on consumer spending, and the company has faced higher raw material costs and supply chain disruptions.

The case is Serta Simmons Bedding LLC, 23-90020, US Bankruptcy Court for the Southern District of Texas.

https://www.yahoo.com/now/mattress-maker-serta-simmons-files-044757930.html