The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

September 7, 2022

Japan, China On Edge After Record Dollar Surge Sparks “Explosive” Yen Plunge; China’s Yuan Not Far Behind

by Tyler DurdenWednesday, Sep 07, 2022 – 02:04 PM

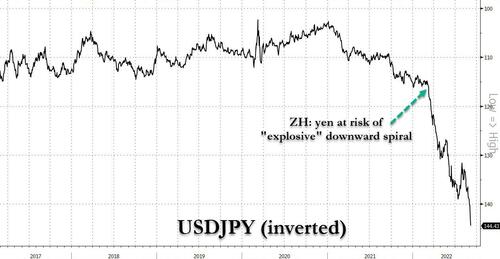

Back in late March, when USDJPY was at 121, we warned that the “Yen Was At Risk Of “Explosive” Downward Spiral With Kuroda Trapped… And Why China May Soon Devalue“, and since then the yen has… well, see for yourselves:

In short, we were right.

Having been in freefall for months, due to the “impossible dilemma” facing the BOJ which can’t have i) a stable currency and ii) yield curve control at the same time, the BOJ has clearly picked an interest rate cap instead of intervening in the yen, and containing the record freefall in the Japanese currency which is set for its worst annual drop on record – the yen this morning plunged as low as 144.99, the lowest level since 1998 and there is no end in sight to the drop.

Furthermore, and just to make it very clear that the BOJ sees nothing wrong with the precipitous drop in the yen which makes Japan seem like a B-grade emerging market, overnight the BOJ said it would buy 550BN yen of 5-10 year bonds at the latest scheduled operation, up from 500BN previously to protect the YCC yield caps; as Goldman notes, “BOJ is really the odd man out in global policy and it seems the market is piling on pressure into the yen ahead of the BOJ meeting at the end of this month.”

To be sure, the ongoing crash in the yen is not exactly shocking and is a result of Japan’s widening yield and policy divergence with the US. Still, the move which could unleash an inflationary shock across the otherwise sleepy, deflationary and demographically doomed islands, has prompted politicians to intervene if only verbally, and overnight, Japan’s top spokesman Hirokazu Matsuno said he was concerned about recent rapid, one-sided moves in yen and the government would need to take necessary action if these movements continue.

“We’re concerned about the rapid and one-sided moves being seen recently in foreign exchange markets,” Matsuno said at a press conference in Tokyo adding that “the government will continue to watch forex market moves with a high sense of urgency, and take necessary responses if this sort of move continues.”

Of course, it’s not just the yen that is getting demolished: with the Bloomberg dollar index hitting another, and another, and another all time high day after day with the Fed clearly oblivious of the impact its supertighte monetary policy is having on the world…

… it was China’s yuan that also got hammered overnight, and with the offshore currency trading just shy of 7.00, it forced the PBOC to scramble and stem the currency depreciation with a yuan fixing that was set at a record 454 pips stronger than the average estimate!

The good news is that as Bloomberg’s Simon Flint notes, the yuan tends to be rather dull after big gaps between offshore levels and the fix. To wit: “historical experience is that the yuan stabilizes after a similarly high premium is hit. Selecting for days with a similar (average) premium, I find 78 individual days when this occurred and more than 20 clusters since Bloomberg started to collect fixing consensus data. The average change in USD/CNH and CNH-CFETS was less than 0.1% one day, five days and 21 days after this premium was hit. It seems like a combination of the PBOC’s ability to pick tops in the dollar (as implied by stability in CFETS) and their resistance to appreciation is sufficient to stop the rot. Furthermore, the maximum range of outcomes over these periods is narrower than the series average. Of course, this episode may not be “average”. PBOC resistance has hit record breaking levels, suggesting a greater disconnect that the premium alone indicates.”

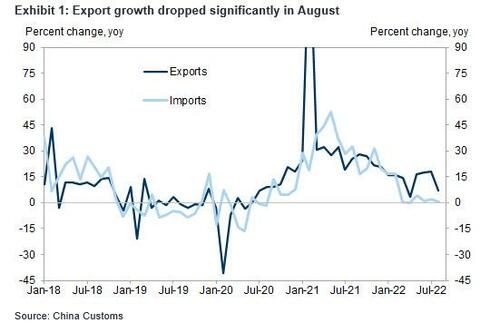

The bad news is that according to Goldman, it is only a matter of time before we trade through 7.00, for one simple reason: the collapse in China’s trade demands it and the export data in particular is a concern as the large trade surplus had been one of the main pushbacks to USDCNH going higher (the August surplus declined to 79.3BN vs 101BN last month). As Goldman concludes, “At this juncture it seems inevitable that China will have to accept a weaker currency to support trade/growth.“

For those who missed it, overnight China reported that export growth slowed more than expected in August, as the entire world careens into a recession. Specifically, China’s export growth dropped to +7.1% Y/Y in August, well below consensus expectations of a 13% increase and a sharp drop from the 18.0% in July. Import growth decelerated to +0.3% Y/Yin August, also missing the consensus estimate of 1.1%, and down from 2.3% in July.

According to Goldman, the large deceleration of year-over-year export growth was partially driven by a high base last August, when the adverse impact from Typhoon In-fa unwound. Trade surplus in August fell to US$79.4bn on weaker-than-expected exports.

That said – when setting the stage for a 7.00 yuan print – Goldman says that it isn’t such a big deal, and explains why:

In Aug 2019, when USDCNY first traded above 7, the PBoC issued comment that “7 is not the age of man”, by which they meant it is not a number from which there is no return. The PBoC has made it clear in the press conference earlier this week that China’s monetary policy is mainly serving domestic purpose and they still have ample room. The RMB weakness is mainly due to USD strength, with RMB outperforming non-USD majors and so far there has not been meaningful spillover impact from currency depreciation on other Chinese assets (SHCOMP has been outperforming SPX of late). Another indicator to look at is onshore 1m risk reversal, which came off the highs. All these suggest there is not much to worry onshore about the PBoC allowing USDCNY to trade above 7.0 amid continued USD strength.

All of the above is why Goldman has shifted its USDCNH target to 7.20 area.

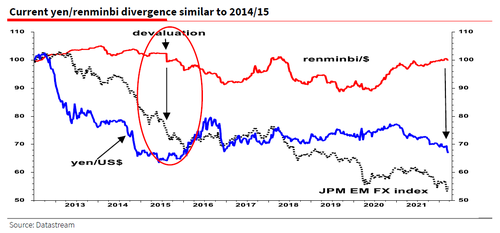

But perhaps an even bigger question is how China will react to the absolute monkeyhammering that the yen has taken in recent months, and as Albert Edwards noted back in March, maybe China will react just like they did in August 2015 when the PBoC devalued: “Back then persistent yen weakness had dragged down other competing regional currencies and left the renminbi overvalued.”

Wait, yen weakness leading to China devaluation? According to Edwards, that indeed was the sequence: as he shows in the chart below, the super weak yen of 2013-15, by driving down other competing Asian currencies, ultimately led us to the August 2015 renminbi devaluation.

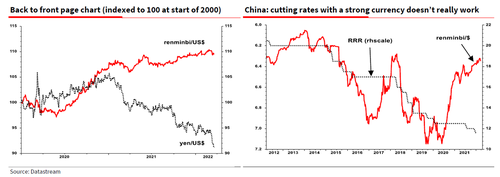

Fast forward to today when the aggressive relentless easing by the BoJ – which is terrified of losing control over the JGB curve – comes at a time when the PBoC has resolutely refused to join the global tightening posture and instead is shifting towards an easier stance (after all, China has an imploding property sector it must stabilize at any cost).

Edwards concluded that the one thing to watch out for, especially in the current febrile geopolitical environment, is if China once again is ‘forced’ to devalue because of the weak yen. Economists will tell you that cutting interest rates or the reserve requirement ratio (RRR- r/h chart below) is neutralized when you have a strong currency.

https://www.zerohedge.com/markets/japan-china-edge-after-record-dollar-surge-sparks-explosive-yen-plunge-chinas-yuan-not-far

September 7, 2022

11:45 AM | Tempur Sealy International, Inc. (TPX) | By: SA Editor Clark Schultz, SA News Editor Mattress stocks rallied on Wednesday after channel checks from Wedbush Securities indicated that mattress sales trends were flat to up low-single-digits for late-August through Labor Day at brick-and-mortar locations.

The pace of sales for the highest demand period of the year was noted to be a significant improvement from the low-double-digits declines for the Independence Day selling period and even the Memorial Day selling period.

Analyst Seth Basham: “We estimate year-over-year industry sales declines moderated following a difficult June comparison, going from HSD declines in June to -MSD in July and down low-to-mid single digits during August.”

Of note, high-end demand continues to outpace that of the broader industry and even improved somewhat in late summer as consumers returned from vacations. The trend appears very positive for Tempur-Sealy International (NYSE:TPX) and Sleep Number (SNBR), while the drop in demand for mid-priced bedding options is called a potential negative for Purple Innovation (PRPL).

Elsewhere on Wall Street, Truist Securities also pointed to strong Labor Day weekend sales for the mattress companies.

Shares of Sleep Number (SNBR) jumped 9.99% in late morning trading on Wednesday, while Tempur Sealy International (TPX) showed a 10.55% gain. Purple Innovation (PRPL) rallied 4.89% after the sector check from analysts.

https://mail.google.com/mail/u/0/#inbox/FMfcgzGqQSLWZpgkbSspzpstrnzDLptB

September 7, 2022

11:45 AM | Tempur Sealy International, Inc. (TPX) | By: SA Editor Clark Schultz, SA News Editor Mattress stocks rallied on Wednesday after channel checks from Wedbush Securities indicated that mattress sales trends were flat to up low-single-digits for late-August through Labor Day at brick-and-mortar locations.

The pace of sales for the highest demand period of the year was noted to be a significant improvement from the low-double-digits declines for the Independence Day selling period and even the Memorial Day selling period.

Analyst Seth Basham: “We estimate year-over-year industry sales declines moderated following a difficult June comparison, going from HSD declines in June to -MSD in July and down low-to-mid single digits during August.”

Of note, high-end demand continues to outpace that of the broader industry and even improved somewhat in late summer as consumers returned from vacations. The trend appears very positive for Tempur-Sealy International (NYSE:TPX) and Sleep Number (SNBR), while the drop in demand for mid-priced bedding options is called a potential negative for Purple Innovation (PRPL).

Elsewhere on Wall Street, Truist Securities also pointed to strong Labor Day weekend sales for the mattress companies.

Shares of Sleep Number (SNBR) jumped 9.99% in late morning trading on Wednesday, while Tempur Sealy International (TPX) showed a 10.55% gain. Purple Innovation (PRPL) rallied 4.89% after the sector check from analysts.

https://mail.google.com/mail/u/0/#inbox/FMfcgzGqQSLWZpgkbSspzpstrnzDLptB

September 6, 2022

- 05 September, 2022

- Anna Larionova

Evonik opens new Innovation Hub in Pennsylvania

MOSCOW (MRC) — Evonik, one of the world’s leading specialty chemicals companies, has opened a new Innovation Hub at its Allentown, Pa., site, said the company.

The Hub consists of several state-of-the-art testing and processing labs as well as a pilot plant. It also features a newly designed collaboration space to support a hybrid and creative work environment. The expansion will create 50 highly paid jobs for scientists, engineers, and lab technicians in the Lehigh Valley region around Allentown.

The Innovation Hub is part of a broader globalization strategy for Research, Development & Innovation (RD&I) at the Germany-based company. “We are strengthening regional RD&I hubs in Asia and North America to benefit from innovative ideas outside of Europe and be closer to our customers in those regions,” said Evonik Chief Financial Officer Ute Wolf at the Ribbon Cutting Ceremony for the Allentown Innovation Hub. “The new Hub will transform the Allentown site into our premier center for research, business, and innovation in North America.”

By 2030, Evonik aims to invest more than USD3 billion in Next Generation Solutions – products with superior sustainability benefits. Evonik will invest an additional USD700 million in Next Generation Technologies to optimize production processes and infrastructure and avoid CO2 emissions.

North America is an essential growth market for Evonik. The region contributed roughly a quarter (23%) to Evonik’s annual sales in 2021, making it the second-largest revenue source after Europe (EMEA). Evonik has invested several billion dollars in North America since 2017, when the company acquired the specialty additives business of Allentown-based industrial gas producer Air Products.

Evonik currently employs 300 people at the Allentown site, which is close to Philadelphia, New York City, and many premier research institutions.

Evonik’s new High Performance Polymers lab in Allentown allows the processing and testing of plastics for 3D printing, medical implants, or performance foams in airplanes or cars. Another lab enables the formulation and testing of additives for industrial coatings. Allentown’s best-in-class polyurethane spray foam testing and emission chamber helps Evonik customers meet environmental and emission standards.

The Innovation Hub also features a flexible collaboration space to support and enhance a hybrid work environment. The uniquely designed space offers open areas for employees to work onsite without needing individual offices. Employees have access to cutting-edge technology like digital whiteboards or tools for video conferencing.

The continued expansion of the Allentown site underscores Evonik’s commitment to the Lehigh Valley community, which goes beyond creating job opportunities. Evonik has recently donated $100,000 to support the Women in Science & Engineering (WISE) initiative of the Da Vinci Science Center, Allentown’s award-winning science museum. WISE was established as part of the Science Center’s broader commitment to supporting women and girls in STEM (Science, Technology, Engineering, and Math). The donation highlights Evonik’s ongoing support of education and diversity in STEM fields.

We remind, Evonik Coating Additives business expands production capacity in Taiwan. MOSCOW (MRC) — Business line Coating Additives of Evonik Industries AG (Essen, Germany) is expanding production capacity of ACEMATT precipitated matting agents at its Taiwan manufacturing facility. The significant capacity increase will help meet growing demand for matting agents in Asia, with the capacity expansion expected to be completed by the second half of 2023.

https://www.mrchub.com/news/403907-evonik-opens-new-innovation-hub-in-pennsylvania

September 6, 2022

- 05 September, 2022

- Anna Larionova

Evonik opens new Innovation Hub in Pennsylvania

MOSCOW (MRC) — Evonik, one of the world’s leading specialty chemicals companies, has opened a new Innovation Hub at its Allentown, Pa., site, said the company.

The Hub consists of several state-of-the-art testing and processing labs as well as a pilot plant. It also features a newly designed collaboration space to support a hybrid and creative work environment. The expansion will create 50 highly paid jobs for scientists, engineers, and lab technicians in the Lehigh Valley region around Allentown.

The Innovation Hub is part of a broader globalization strategy for Research, Development & Innovation (RD&I) at the Germany-based company. “We are strengthening regional RD&I hubs in Asia and North America to benefit from innovative ideas outside of Europe and be closer to our customers in those regions,” said Evonik Chief Financial Officer Ute Wolf at the Ribbon Cutting Ceremony for the Allentown Innovation Hub. “The new Hub will transform the Allentown site into our premier center for research, business, and innovation in North America.”

By 2030, Evonik aims to invest more than USD3 billion in Next Generation Solutions – products with superior sustainability benefits. Evonik will invest an additional USD700 million in Next Generation Technologies to optimize production processes and infrastructure and avoid CO2 emissions.

North America is an essential growth market for Evonik. The region contributed roughly a quarter (23%) to Evonik’s annual sales in 2021, making it the second-largest revenue source after Europe (EMEA). Evonik has invested several billion dollars in North America since 2017, when the company acquired the specialty additives business of Allentown-based industrial gas producer Air Products.

Evonik currently employs 300 people at the Allentown site, which is close to Philadelphia, New York City, and many premier research institutions.

Evonik’s new High Performance Polymers lab in Allentown allows the processing and testing of plastics for 3D printing, medical implants, or performance foams in airplanes or cars. Another lab enables the formulation and testing of additives for industrial coatings. Allentown’s best-in-class polyurethane spray foam testing and emission chamber helps Evonik customers meet environmental and emission standards.

The Innovation Hub also features a flexible collaboration space to support and enhance a hybrid work environment. The uniquely designed space offers open areas for employees to work onsite without needing individual offices. Employees have access to cutting-edge technology like digital whiteboards or tools for video conferencing.

The continued expansion of the Allentown site underscores Evonik’s commitment to the Lehigh Valley community, which goes beyond creating job opportunities. Evonik has recently donated $100,000 to support the Women in Science & Engineering (WISE) initiative of the Da Vinci Science Center, Allentown’s award-winning science museum. WISE was established as part of the Science Center’s broader commitment to supporting women and girls in STEM (Science, Technology, Engineering, and Math). The donation highlights Evonik’s ongoing support of education and diversity in STEM fields.

We remind, Evonik Coating Additives business expands production capacity in Taiwan. MOSCOW (MRC) — Business line Coating Additives of Evonik Industries AG (Essen, Germany) is expanding production capacity of ACEMATT precipitated matting agents at its Taiwan manufacturing facility. The significant capacity increase will help meet growing demand for matting agents in Asia, with the capacity expansion expected to be completed by the second half of 2023.

https://www.mrchub.com/news/403907-evonik-opens-new-innovation-hub-in-pennsylvania