The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

December 19, 2021

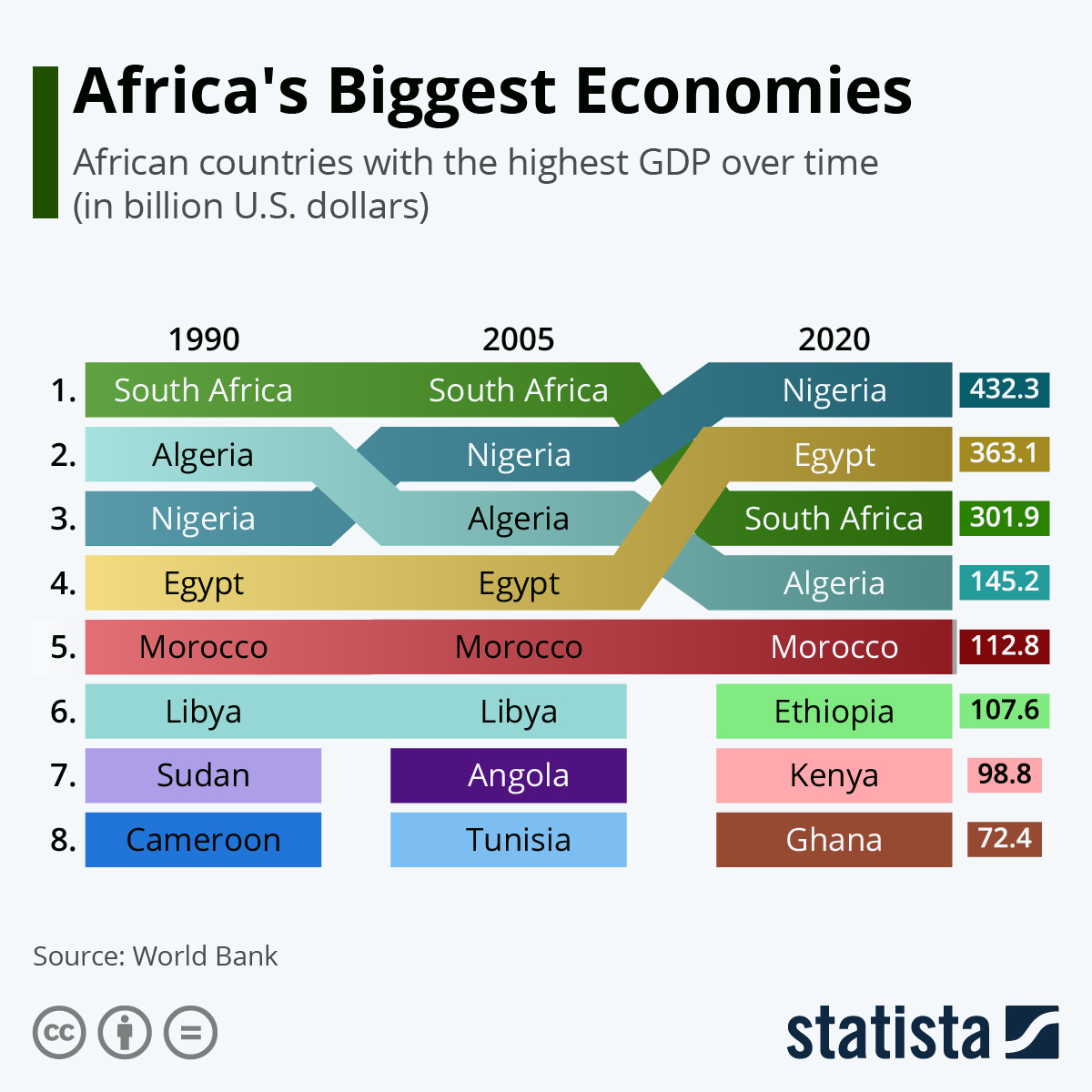

Africa’s Biggest Economies

by Tyler DurdenSunday, Dec 19, 2021 – 08:45 AM

With a total GDP of $432.3 billion, Nigeria has become the biggest economy on the African continent over the last 30 years. While the five highest spots on this ranking have been more or less constant over the last three decades, Statista’s Florian Zandt notes that the rest of the top 8 are subject to bigger fluctuations as our chart shows.

You will find more infographics at Statista

Libya, for example, managed to come in sixth in 1990 and 2005, but dropped out of the top 8 and only made the 17th rank in 2020. One of the most probable reasons for this dropoff is the Second Libyan Civil War. The multi-sided conflict started in 2014 in the aftermath of the election results of 2012 putting the General National Congress into power. Kenya, on the other hand, passed a new constitution in 2010 which limited the power held by the country’s president and enabled business and technology centers like Nairobi to grow. The city is now home to the African offices of Google, Coca-Cola, IBM and Cisco, among others.

Nigeria’s first place is largely attributable to its rapidly expanding financial sector, which grew from one percent of the total GDP in 2001 to ten percent in 2018, and its role as one of the world leaders in petroleum exports. The growing tech hub of Lagos, the second-largest metropolitan area in Africa and among the largest in the world, is also likely to further bolster Nigeria’s growth in the coming years, even though the divide between the part of the population living in slums without access to basic sanitation and its upper class making the city one of the most expensive in the world is likely to grow as well. This is also reflected in its comparably low GDP per capita of $2,100. When considering this indicator, Nigeria doesn’t even make the top 10 in Africa.

Of the 54 countries in Africa, only four countries made the top 50 of all nations with the highest GDP according to data from World Bank. The top spots on this list are reserved for the US, China, Japan and Germany, whose residents generate a combined GPD of $45 trillion, a whopping 50 percent of the global GDP.

https://www.zerohedge.com/economics/africas-biggest-economies

December 19, 2021

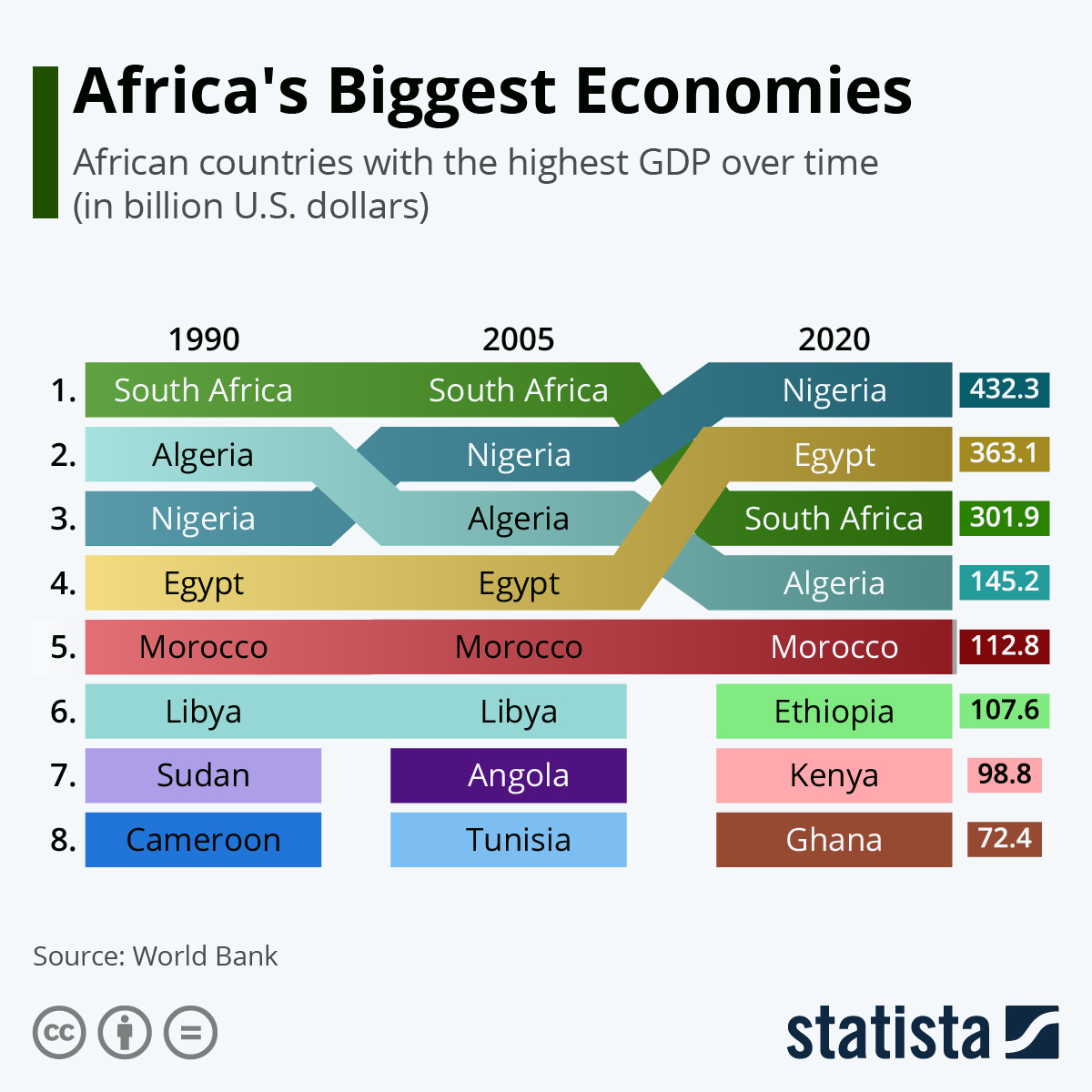

Africa’s Biggest Economies

by Tyler DurdenSunday, Dec 19, 2021 – 08:45 AM

With a total GDP of $432.3 billion, Nigeria has become the biggest economy on the African continent over the last 30 years. While the five highest spots on this ranking have been more or less constant over the last three decades, Statista’s Florian Zandt notes that the rest of the top 8 are subject to bigger fluctuations as our chart shows.

You will find more infographics at Statista

Libya, for example, managed to come in sixth in 1990 and 2005, but dropped out of the top 8 and only made the 17th rank in 2020. One of the most probable reasons for this dropoff is the Second Libyan Civil War. The multi-sided conflict started in 2014 in the aftermath of the election results of 2012 putting the General National Congress into power. Kenya, on the other hand, passed a new constitution in 2010 which limited the power held by the country’s president and enabled business and technology centers like Nairobi to grow. The city is now home to the African offices of Google, Coca-Cola, IBM and Cisco, among others.

Nigeria’s first place is largely attributable to its rapidly expanding financial sector, which grew from one percent of the total GDP in 2001 to ten percent in 2018, and its role as one of the world leaders in petroleum exports. The growing tech hub of Lagos, the second-largest metropolitan area in Africa and among the largest in the world, is also likely to further bolster Nigeria’s growth in the coming years, even though the divide between the part of the population living in slums without access to basic sanitation and its upper class making the city one of the most expensive in the world is likely to grow as well. This is also reflected in its comparably low GDP per capita of $2,100. When considering this indicator, Nigeria doesn’t even make the top 10 in Africa.

Of the 54 countries in Africa, only four countries made the top 50 of all nations with the highest GDP according to data from World Bank. The top spots on this list are reserved for the US, China, Japan and Germany, whose residents generate a combined GPD of $45 trillion, a whopping 50 percent of the global GDP.

https://www.zerohedge.com/economics/africas-biggest-economies

December 17, 2021

PCC Group: Substantial investment in production capacity

PCC Rokita and PCC Exol – listed companies of the PCC Group – announced that they have decided to implement the largest investment in the history of their activity, aiming at increasing production capacity and the range of manufactured products. The project is to be implemented in the chemical industrial park in Brzeg Dolny by PCC BD Sp. z o.o., whose partners are PCC Exol and PCC Rokita, both holding 50 % of shares.

“The new installation will be the first of its type in Poland, combining the production of ethoxylates and polyols,” said Wiesław Klimkowski, President of the Management Board of PCC Rokita S.A. “The adopted technological solutions and its versatility are to enable quick adaptation of the product portfolio to the dynamically changing needs of the market,” he added.

The installation is to produce a range of ethoxylates, polyether polyols and other ethoxylated products, including biodegradable products. It will use ethylene oxide supplied by PKN Orlen. The implementation of the investment will contribute not only to increasing the volume of products that can be offered but will also allow for the expansion of the product portfolio of the PCC Group companies as part of the continuation of the market strategy aimed at diversifying sales to many different industries characterised by different business cycles.

“Due to the appropriate combination of oxides and the use of new production technologies, the products produced with the use of the new installation will be characterised by lower emissions of volatile organic compounds and a shorter and low-waste production process. In addition, the shorter production process will reduce energy consumption,” said Dariusz Ciesielski, President of the Management Board of PCC Exol SA. “Additionally, due to the fact that ethylene oxide has a lower carbon footprint than propylene oxide, some products will have a lower carbon footprint,” he added.

The completion date of the investment is scheduled for mid-2026 and its value is estimated at PLN 351 million (~ EUR 75.9 million). The initially assumed average annual potential production capacity of the installation with the estimated portfolio will amount to approximately 50,000 – 55,000 t. At the same time, PCC Rokita plans to invest in renewable energy sources in order to reduce its corporate carbon footprint.

In recent years, PCC Rokita and PCC Exol have completed a number of investments in the chemical industrial park in Brzeg Dolny, Poland. The development goes hand in hand with intensively implemented investments, which not only increase production capacity but also act with regard to environmental issues, said the companies.

GreenLine products have been a part of the companies’ portfolio for a long time. At the moment, they already account for approximately 25 % of all products offered by the PCC Group. When creating products from this line, both the impact of their production on the natural environment and their life cycle stages are taken into account. Some examples include products with high biodegradability, a high natural origin index and low CO2 emissions.

PCC Rokita produces, among others, GreenLine chlorine and soda lye with the latest membrane technology. In addition, the energy used in this process has a guarantee of origin from renewable sources. PCC Exol is also building a range of products in line with the green chemistry trend. It provides its customers with BioRokamin, one of the most efficient and gentle ecological amphoteric surfactants, which is particularly desired in the cosmetics industry. For its actions, the company is regularly granted a gold level in recognition of its CSR EcoVadis rating.

The companies of the PCC Group have also been investing heavily in improving energy efficiency for many years now. One of the most important projects in this field was the transition by PCC Rokita to the production of chlorine based on environmentally friendly membrane technology, which allowed for the avoidance of over 140,000 t of CO2 emissions per year.

Various potential energy and efficiency projects are currently being reviewed. PCC Rokita is considering, among other things, the possibility of moving away from coal fuel by converting the existing grate boilers into gas boilers or replacing them with low-parameter gas boilers. The PCC Group companies do not exclude the possibility of investing in their own energy sources that reduce the carbon footprint. Investments in renewable energy sources seem to be the right direction.

The companies are considering the construction of several solar farms with a total capacity of approximately 30 MW, the largest of which are to be built on rehabilitated land. The goal is to build renewable energy sources directly connected with production installations. In the future, the group is also considering purchasing land dedicated to expanding the solar farms. At the same time, the company is discussing the possibility of building a wind farm. With this end in view, it has already selected attractive land and is currently analysing the feasibility and profitability of the project. The estimated potential of the selected locations equals to approximately 15 MW. It is possible to include external entities in these investments.

Both PCC Rokita and PCC Exol ended the past period with record-breaking results, with increased results recorded in most of the production segments. The very good financial results for the last three quarters of the year 2021 lay a good foundation for starting the development projects aimed at combining the development of production potential with the provision of sustainable sources of energy supply, said the company.

“Investments are a key element of our companies’ strategy. The financial results we achieve are their direct result. For three quarters of this year, the PCC Rokita Group generated a record-high consolidated EBITDA profit of over PLN 437 million (~ EUR 94.5 million), followed by a record-breaking net profit of PLN 236 million (~ EUR 51 million),” said Rafał Zdon, Vice President of the Management Board of the company. “Similarly, the PCC Exol Group closed three quarters of this year with EBITDA profit of nearly PLN 60 million (~ EUR 13 million). As a result, the consolidated net profit of the PCC Exol Group after three quarters of 2021 reached the highest amount in the history of the group, amounting to over PLN 35 million (~ EUR 7.6 million),” he added.

December 17, 2021

PCC Group: Substantial investment in production capacity

PCC Rokita and PCC Exol – listed companies of the PCC Group – announced that they have decided to implement the largest investment in the history of their activity, aiming at increasing production capacity and the range of manufactured products. The project is to be implemented in the chemical industrial park in Brzeg Dolny by PCC BD Sp. z o.o., whose partners are PCC Exol and PCC Rokita, both holding 50 % of shares.

“The new installation will be the first of its type in Poland, combining the production of ethoxylates and polyols,” said Wiesław Klimkowski, President of the Management Board of PCC Rokita S.A. “The adopted technological solutions and its versatility are to enable quick adaptation of the product portfolio to the dynamically changing needs of the market,” he added.

The installation is to produce a range of ethoxylates, polyether polyols and other ethoxylated products, including biodegradable products. It will use ethylene oxide supplied by PKN Orlen. The implementation of the investment will contribute not only to increasing the volume of products that can be offered but will also allow for the expansion of the product portfolio of the PCC Group companies as part of the continuation of the market strategy aimed at diversifying sales to many different industries characterised by different business cycles.

“Due to the appropriate combination of oxides and the use of new production technologies, the products produced with the use of the new installation will be characterised by lower emissions of volatile organic compounds and a shorter and low-waste production process. In addition, the shorter production process will reduce energy consumption,” said Dariusz Ciesielski, President of the Management Board of PCC Exol SA. “Additionally, due to the fact that ethylene oxide has a lower carbon footprint than propylene oxide, some products will have a lower carbon footprint,” he added.

The completion date of the investment is scheduled for mid-2026 and its value is estimated at PLN 351 million (~ EUR 75.9 million). The initially assumed average annual potential production capacity of the installation with the estimated portfolio will amount to approximately 50,000 – 55,000 t. At the same time, PCC Rokita plans to invest in renewable energy sources in order to reduce its corporate carbon footprint.

In recent years, PCC Rokita and PCC Exol have completed a number of investments in the chemical industrial park in Brzeg Dolny, Poland. The development goes hand in hand with intensively implemented investments, which not only increase production capacity but also act with regard to environmental issues, said the companies.

GreenLine products have been a part of the companies’ portfolio for a long time. At the moment, they already account for approximately 25 % of all products offered by the PCC Group. When creating products from this line, both the impact of their production on the natural environment and their life cycle stages are taken into account. Some examples include products with high biodegradability, a high natural origin index and low CO2 emissions.

PCC Rokita produces, among others, GreenLine chlorine and soda lye with the latest membrane technology. In addition, the energy used in this process has a guarantee of origin from renewable sources. PCC Exol is also building a range of products in line with the green chemistry trend. It provides its customers with BioRokamin, one of the most efficient and gentle ecological amphoteric surfactants, which is particularly desired in the cosmetics industry. For its actions, the company is regularly granted a gold level in recognition of its CSR EcoVadis rating.

The companies of the PCC Group have also been investing heavily in improving energy efficiency for many years now. One of the most important projects in this field was the transition by PCC Rokita to the production of chlorine based on environmentally friendly membrane technology, which allowed for the avoidance of over 140,000 t of CO2 emissions per year.

Various potential energy and efficiency projects are currently being reviewed. PCC Rokita is considering, among other things, the possibility of moving away from coal fuel by converting the existing grate boilers into gas boilers or replacing them with low-parameter gas boilers. The PCC Group companies do not exclude the possibility of investing in their own energy sources that reduce the carbon footprint. Investments in renewable energy sources seem to be the right direction.

The companies are considering the construction of several solar farms with a total capacity of approximately 30 MW, the largest of which are to be built on rehabilitated land. The goal is to build renewable energy sources directly connected with production installations. In the future, the group is also considering purchasing land dedicated to expanding the solar farms. At the same time, the company is discussing the possibility of building a wind farm. With this end in view, it has already selected attractive land and is currently analysing the feasibility and profitability of the project. The estimated potential of the selected locations equals to approximately 15 MW. It is possible to include external entities in these investments.

Both PCC Rokita and PCC Exol ended the past period with record-breaking results, with increased results recorded in most of the production segments. The very good financial results for the last three quarters of the year 2021 lay a good foundation for starting the development projects aimed at combining the development of production potential with the provision of sustainable sources of energy supply, said the company.

“Investments are a key element of our companies’ strategy. The financial results we achieve are their direct result. For three quarters of this year, the PCC Rokita Group generated a record-high consolidated EBITDA profit of over PLN 437 million (~ EUR 94.5 million), followed by a record-breaking net profit of PLN 236 million (~ EUR 51 million),” said Rafał Zdon, Vice President of the Management Board of the company. “Similarly, the PCC Exol Group closed three quarters of this year with EBITDA profit of nearly PLN 60 million (~ EUR 13 million). As a result, the consolidated net profit of the PCC Exol Group after three quarters of 2021 reached the highest amount in the history of the group, amounting to over PLN 35 million (~ EUR 7.6 million),” he added.

December 14, 2021