The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

October 29, 2021

Trading update 3rd quarter 2021 – Strong performance despite significant cost inflation

Regulated information, Brussels, 29/10/2021 — 06:58 CET, 29.10.2021

- Net sales 3Q2021 increase from EUR 217.4 million in 3Q2020 to EUR 319.7 million (+47.1%), of which +15.8% organic growth, +0.5% currency effect and a EUR 66.1 million contribution from FoamPartner

- Year-to-date September 2021 net sales increase from EUR 591.6 million in 9M2020 to EUR 915.9 million (+54.8%), of which +31.2% organic growth, +0.2% currency effect and a EUR 138.0 million contribution from FoamPartner

- Net financial debt: EUR 189.0 million (30 June 2021: EUR 206.6 million)

Olivier Chapelle (CEO): “The positive sales trend observed during 1H2021 continued in 3Q2021, driven by very strong demand in Insulation. Demand in Engineered Foams and Bedding has stabilised, due to overall hesitating consumer confidence and global supply chain issues affecting among others the automotive production.

The chemical raw materials supply and prices are stabilizing, but volatility remains high given the recent steep inflation in energy costs affecting our suppliers. Our commercial teams continue to adapt pricing where necessary.

The integration of FoamPartner in Engineered Foams continues to progress according to plan.

The divestment process of our Bedding division is on track. It is the intention to sign a deal during 4Q2021 and to close the transaction in the course of 1Q2022.

The closing of the acquisition of the insulation board business of Gór-Stal is postponed sine die, as the owners have informed us recently that they do not want to proceed with the sale citing changed circumstances. Recticel will use all legal steps available to enforce the acquisition and obtain full damages.“

OUTLOOK

Despite declining momentum in some end-markets, reflecting a slowdown in economic recovery and supply chain disruptions, the Group confirms its expectation of an Adjusted EBITDA in a range between EUR 123 million to EUR 133 million for the full year 2021, including the contributions of FoamPartner (9 months) and its related synergies.

October 29, 2021

Huntsman Announces Improved Third Quarter 2021 Earnings; Repurchases Approximately $102 million of Shares During the Quarter; Wins Significant Arbitration Award Against Albemarle

Download as PDF October 29, 2021 6:00am EDT

Related Documents

Audio Earnings WebcastEarnings Slides PDF

THE WOODLANDS, Texas, Oct. 29, 2021 /PRNewswire/ —

Third Quarter Highlights

- Third quarter 2021 net income of $225 million compared to net income of $57 million in the prior year period; third quarter 2021 diluted earnings per share of $0.94 compared to diluted earnings per share of $0.22 in the prior year period.

- Third quarter 2021 adjusted net income of $239 million compared to adjusted net income of $70 million in the prior year period; third quarter 2021 adjusted diluted earnings per share of $1.08 compared to adjusted diluted earnings per share of $0.32 in the prior year period.

- Third quarter 2021 adjusted EBITDA of $371 million compared to $188 million in the prior year period.

- Third quarter 2021 net cash provided by operating activities from continuing operations was $186 million. Free cash flow from continuing operations was $110 million for the third quarter 2021.

- Balance sheet is strong with a net leverage of 0.9x and total liquidity of approximately $2 billion.

- Repurchased approximately 4 million shares for approximately $102 million in the third quarter 2021.

- On October 28, 2021, Huntsman won an arbitration award against Albemarle for fraud and breach of contract in excess of $600 million of which the Company expects to net in excess of $400 million after attorney’s fees.

| Three months ended | Nine months ended | |||||||

| September 30, | September 30, | |||||||

| In millions, except per share amounts | 2021 | 2020 | 2021 | 2020 | ||||

| Revenues | $ 2,285 | $ 1,510 | $ 6,146 | $ 4,350 | ||||

| Net income | $ 225 | $ 57 | $ 497 | $ 706 | ||||

| Adjusted net income(1) | $ 239 | $ 70 | $ 577 | $ 105 | ||||

| Diluted income per share | $ 0.94 | $ 0.22 | $ 2.02 | $ 3.13 | ||||

| Adjusted diluted income per share(1) | $ 1.08 | $ 0.32 | $ 2.60 | $ 0.47 | ||||

| Adjusted EBITDA(1) | $ 371 | $ 188 | $ 994 | $ 407 | ||||

| Net cash provided by operating activities from continuing operations | $ 186 | $ 65 | $ 163 | $ 110 | ||||

| Free cash flow from continuing operations(2) | $ 110 | $ 11 | $ (87) | $ (60) | ||||

| Adjusted free cash flow from continuing operations(6) | $ 110 | $ 189 | $ (84) | $ 128 | ||||

| See end of press release for footnote explanations and reconciliations of non-GAAP measures. |

Huntsman Corporation (NYSE: HUN) today reported third quarter 2021 results with revenues of $2,285 million, net income of $225 million, adjusted net income of $239 million and adjusted EBITDA of $371 million.

Peter R. Huntsman, Chairman, CEO and President, commented:

“We are pleased with the strong earnings we delivered in the third quarter. Despite pockets of disruption in our supply chain and cost inflation, we see strong pent-up demand across most of our businesses with favorable pricing dynamics. In addition, we are benefiting from cost reduction programs and synergies from the acquisitions we completed over the past 18 months. As indicated in our second quarter earnings call, we resumed share repurchases and we used free cash flow generated in the quarter to repurchase approximately $102 million of our stock during the quarter at an average price of $25.64 per share.

Since 2017, we have divested approximately 40% of our portfolio, including much of our commodity product lines, while adding numerous differentiated and higher margin products to the portfolio through bolt–on acquisitions. Our investment grade balance sheet remains strong and, together with our cash generation, provides us with the opportunity to continue to return capital to shareholders and further our portfolio transformation with additional bolt–on acquisitions when they make strategic and financial sense. In addition, we are investing in high return organic projects that will increase our total returns and improve margins over the next 24 to 36 months.

I also want to recognize the efforts of our corporate leadership team as well as our Board of Directors in connection with our arbitration award announced yesterday afternoon. This was a multi-year effort that could not have been won without their support, integrity and cohesion.

We have a bright future, remain focused on improving the quality of our margins, and look forward to discussing the Company’s strategy at our Investor Day on November 9th in New York City.”

Segment Analysis for 3Q21 Compared to 3Q20

Polyurethanes

The increase in revenues in our Polyurethanes segment for the three months ended September 30, 2021, compared to the same period of 2020 was largely due to higher MDI average selling prices and slightly higher sales volumes. MDI average selling prices increased in all our regions. Sales volumes increased primarily due to stronger demand in relation to the ongoing recovery from the global economic slowdown, partially offset by the impact of Hurricane Ida at our Geismar, Louisiana facility that occurred in the third quarter of 2021. The increase in segment adjusted EBITDA was primarily due to higher MDI margins resulting from higher MDI pricing and slightly higher sales volumes as well as stronger earnings from our PO/MTBE joint venture in China, partially offset by higher raw material costs.

Performance Products

The increase in revenues in our Performance Products segment for the three months ended September 30, 2021, compared to the same period of 2020 was primarily due to higher average selling prices and higher sales volumes. Average selling prices increased primarily due to stronger demand in relation to the ongoing recovery from the global economic slowdown as well as in response to an increase in raw material costs. Sales volumes also increased primarily due to stronger demand. The increase in segment adjusted EBITDA was primarily due to increased revenue and margins, partially offset by increased fixed costs.

Advanced Materials

The increase in revenues in our Advanced Materials segment for the three months ended September 30, 2021, compared to the same period in 2020 was primarily due to higher sales volumes, higher average selling prices and the favorable net impact of the Gabriel Acquisition and the sale of the India-based DIY business. Excluding our recent acquisition and divestiture, sales volumes increased across all of our specialty markets, primarily in relation to the ongoing recovery from the global economic slowdown. Average selling prices increased largely in response to higher raw material costs. The increase in segment adjusted EBITDA was primarily due to higher sales volumes and the benefit from our recent acquisition.

Textile Effects

The increase in revenues in our Textile Effects segment for the three months ended September 30, 2021, compared to the same period of 2020 was due to higher sales volumes and higher average selling prices. Sales volumes increased primarily due to increased demand resulting from the ongoing recovery from the global economic slowdown, particularly in the North Asia and Americas regions. Average selling prices increased primarily in response to higher freight and logistics costs. The increase in segment adjusted EBITDA was primarily due to higher sales revenues, partially offset by higher fixed costs.

Corporate, LIFO and other

For the three months ended September 30, 2021, adjusted EBITDA from Corporate and other decreased by $11 million to a loss of $48 million from a loss of $37 million for the same period of 2020.

Liquidity and Capital Resources

During the three months ended September 30, 2021, our adjusted free cash flow from continuing operations was $110 million as compared to $189 million in the prior year period. As of September 30, 2021, we had approximately $2 billion of combined cash and unused borrowing capacity.

During the three months ended September 30, 2021, we spent $76 million on capital expenditures as compared to $54 million in the same period of 2020. For 2021, we expect to spend approximately $350 million on capital expenditures.

Income Taxes

In the third quarter 2021, our adjusted effective tax rate was 15%. For 2021, our adjusted effective tax rate is expected to be approximately 19% to 20%. We continue to expect our forward adjusted effective tax rate will be approximately 22% to 24%

Albemarle Litigation

On October 28, 2021, a panel of three former federal judges sitting as arbitrators found that Albemarle (and its predecessor Rockwood) had defrauded Huntsman in connection with the sale of its pigments business in 2014, breached the contract under which the business was sold, and awarded Huntsman in excess of $600 million for the fraud and breach, inclusive of punitive damages and statutory interest at 9% of which the Company expects to net in excess of $400 million after attorney’s fees. The award is subject to confirmation and limited appeal in the New York state court.

Earnings Conference Call Information

We will hold a conference call to discuss our third quarter 2021 financial results on Friday October 29, 2021 at 10:00 a.m. ET.

Webcast link: https://78449.themediaframe.com/dataconf/productusers/hun/mediaframe/46827/indexl.html

| Participant dial-in numbers: | |

| Domestic callers: | (877) 402-8037 |

| International callers: | (201) 378-4913 |

The conference call will be accompanied by presentation slides that will be accessible via the webcast link and Huntsman’s investor relations website, www.huntsman.com/investors. Upon conclusion of the call, the webcast replay will be accessible via Huntsman’s website.

October 29, 2021

Huntsman Announces Improved Third Quarter 2021 Earnings; Repurchases Approximately $102 million of Shares During the Quarter; Wins Significant Arbitration Award Against Albemarle

Download as PDF October 29, 2021 6:00am EDT

Related Documents

Audio Earnings WebcastEarnings Slides PDF

THE WOODLANDS, Texas, Oct. 29, 2021 /PRNewswire/ —

Third Quarter Highlights

- Third quarter 2021 net income of $225 million compared to net income of $57 million in the prior year period; third quarter 2021 diluted earnings per share of $0.94 compared to diluted earnings per share of $0.22 in the prior year period.

- Third quarter 2021 adjusted net income of $239 million compared to adjusted net income of $70 million in the prior year period; third quarter 2021 adjusted diluted earnings per share of $1.08 compared to adjusted diluted earnings per share of $0.32 in the prior year period.

- Third quarter 2021 adjusted EBITDA of $371 million compared to $188 million in the prior year period.

- Third quarter 2021 net cash provided by operating activities from continuing operations was $186 million. Free cash flow from continuing operations was $110 million for the third quarter 2021.

- Balance sheet is strong with a net leverage of 0.9x and total liquidity of approximately $2 billion.

- Repurchased approximately 4 million shares for approximately $102 million in the third quarter 2021.

- On October 28, 2021, Huntsman won an arbitration award against Albemarle for fraud and breach of contract in excess of $600 million of which the Company expects to net in excess of $400 million after attorney’s fees.

| Three months ended | Nine months ended | |||||||

| September 30, | September 30, | |||||||

| In millions, except per share amounts | 2021 | 2020 | 2021 | 2020 | ||||

| Revenues | $ 2,285 | $ 1,510 | $ 6,146 | $ 4,350 | ||||

| Net income | $ 225 | $ 57 | $ 497 | $ 706 | ||||

| Adjusted net income(1) | $ 239 | $ 70 | $ 577 | $ 105 | ||||

| Diluted income per share | $ 0.94 | $ 0.22 | $ 2.02 | $ 3.13 | ||||

| Adjusted diluted income per share(1) | $ 1.08 | $ 0.32 | $ 2.60 | $ 0.47 | ||||

| Adjusted EBITDA(1) | $ 371 | $ 188 | $ 994 | $ 407 | ||||

| Net cash provided by operating activities from continuing operations | $ 186 | $ 65 | $ 163 | $ 110 | ||||

| Free cash flow from continuing operations(2) | $ 110 | $ 11 | $ (87) | $ (60) | ||||

| Adjusted free cash flow from continuing operations(6) | $ 110 | $ 189 | $ (84) | $ 128 | ||||

| See end of press release for footnote explanations and reconciliations of non-GAAP measures. |

Huntsman Corporation (NYSE: HUN) today reported third quarter 2021 results with revenues of $2,285 million, net income of $225 million, adjusted net income of $239 million and adjusted EBITDA of $371 million.

Peter R. Huntsman, Chairman, CEO and President, commented:

“We are pleased with the strong earnings we delivered in the third quarter. Despite pockets of disruption in our supply chain and cost inflation, we see strong pent-up demand across most of our businesses with favorable pricing dynamics. In addition, we are benefiting from cost reduction programs and synergies from the acquisitions we completed over the past 18 months. As indicated in our second quarter earnings call, we resumed share repurchases and we used free cash flow generated in the quarter to repurchase approximately $102 million of our stock during the quarter at an average price of $25.64 per share.

Since 2017, we have divested approximately 40% of our portfolio, including much of our commodity product lines, while adding numerous differentiated and higher margin products to the portfolio through bolt–on acquisitions. Our investment grade balance sheet remains strong and, together with our cash generation, provides us with the opportunity to continue to return capital to shareholders and further our portfolio transformation with additional bolt–on acquisitions when they make strategic and financial sense. In addition, we are investing in high return organic projects that will increase our total returns and improve margins over the next 24 to 36 months.

I also want to recognize the efforts of our corporate leadership team as well as our Board of Directors in connection with our arbitration award announced yesterday afternoon. This was a multi-year effort that could not have been won without their support, integrity and cohesion.

We have a bright future, remain focused on improving the quality of our margins, and look forward to discussing the Company’s strategy at our Investor Day on November 9th in New York City.”

Segment Analysis for 3Q21 Compared to 3Q20

Polyurethanes

The increase in revenues in our Polyurethanes segment for the three months ended September 30, 2021, compared to the same period of 2020 was largely due to higher MDI average selling prices and slightly higher sales volumes. MDI average selling prices increased in all our regions. Sales volumes increased primarily due to stronger demand in relation to the ongoing recovery from the global economic slowdown, partially offset by the impact of Hurricane Ida at our Geismar, Louisiana facility that occurred in the third quarter of 2021. The increase in segment adjusted EBITDA was primarily due to higher MDI margins resulting from higher MDI pricing and slightly higher sales volumes as well as stronger earnings from our PO/MTBE joint venture in China, partially offset by higher raw material costs.

Performance Products

The increase in revenues in our Performance Products segment for the three months ended September 30, 2021, compared to the same period of 2020 was primarily due to higher average selling prices and higher sales volumes. Average selling prices increased primarily due to stronger demand in relation to the ongoing recovery from the global economic slowdown as well as in response to an increase in raw material costs. Sales volumes also increased primarily due to stronger demand. The increase in segment adjusted EBITDA was primarily due to increased revenue and margins, partially offset by increased fixed costs.

Advanced Materials

The increase in revenues in our Advanced Materials segment for the three months ended September 30, 2021, compared to the same period in 2020 was primarily due to higher sales volumes, higher average selling prices and the favorable net impact of the Gabriel Acquisition and the sale of the India-based DIY business. Excluding our recent acquisition and divestiture, sales volumes increased across all of our specialty markets, primarily in relation to the ongoing recovery from the global economic slowdown. Average selling prices increased largely in response to higher raw material costs. The increase in segment adjusted EBITDA was primarily due to higher sales volumes and the benefit from our recent acquisition.

Textile Effects

The increase in revenues in our Textile Effects segment for the three months ended September 30, 2021, compared to the same period of 2020 was due to higher sales volumes and higher average selling prices. Sales volumes increased primarily due to increased demand resulting from the ongoing recovery from the global economic slowdown, particularly in the North Asia and Americas regions. Average selling prices increased primarily in response to higher freight and logistics costs. The increase in segment adjusted EBITDA was primarily due to higher sales revenues, partially offset by higher fixed costs.

Corporate, LIFO and other

For the three months ended September 30, 2021, adjusted EBITDA from Corporate and other decreased by $11 million to a loss of $48 million from a loss of $37 million for the same period of 2020.

Liquidity and Capital Resources

During the three months ended September 30, 2021, our adjusted free cash flow from continuing operations was $110 million as compared to $189 million in the prior year period. As of September 30, 2021, we had approximately $2 billion of combined cash and unused borrowing capacity.

During the three months ended September 30, 2021, we spent $76 million on capital expenditures as compared to $54 million in the same period of 2020. For 2021, we expect to spend approximately $350 million on capital expenditures.

Income Taxes

In the third quarter 2021, our adjusted effective tax rate was 15%. For 2021, our adjusted effective tax rate is expected to be approximately 19% to 20%. We continue to expect our forward adjusted effective tax rate will be approximately 22% to 24%

Albemarle Litigation

On October 28, 2021, a panel of three former federal judges sitting as arbitrators found that Albemarle (and its predecessor Rockwood) had defrauded Huntsman in connection with the sale of its pigments business in 2014, breached the contract under which the business was sold, and awarded Huntsman in excess of $600 million for the fraud and breach, inclusive of punitive damages and statutory interest at 9% of which the Company expects to net in excess of $400 million after attorney’s fees. The award is subject to confirmation and limited appeal in the New York state court.

Earnings Conference Call Information

We will hold a conference call to discuss our third quarter 2021 financial results on Friday October 29, 2021 at 10:00 a.m. ET.

Webcast link: https://78449.themediaframe.com/dataconf/productusers/hun/mediaframe/46827/indexl.html

| Participant dial-in numbers: | |

| Domestic callers: | (877) 402-8037 |

| International callers: | (201) 378-4913 |

The conference call will be accompanied by presentation slides that will be accessible via the webcast link and Huntsman’s investor relations website, www.huntsman.com/investors. Upon conclusion of the call, the webcast replay will be accessible via Huntsman’s website.

October 28, 2021

Shippers Fear “Catastrophic” Fallout From “Crazy” California Port Fees

by Tyler DurdenThursday, Oct 28, 2021 – 03:01 PM

By Greg Miller of FreightWaves,

The cure is worse than the disease, say critics of an emergency plan of the ports of Los Angeles and Long Beach backed by the Biden administration. If you think port congestion is bad now, just wait for what comes next.

On Wednesday, two days after the ports of Los Angeles and Long Beach announced a surprise emergency fee for containers lingering too long at terminals, the National Shippers Advisory Council (NSAC) held its inaugural meeting. NSAC, created to advise the Federal Maritime Commission, is composed of 12 U.S. importers and 12 exporters. Members include heavy hitters like Amazon, Walmart, Target, Office Depot and Ikea.

Council members had a lot to say about the California port fees — none of it good.Port of Long Beach

‘I think it will be catastrophic’

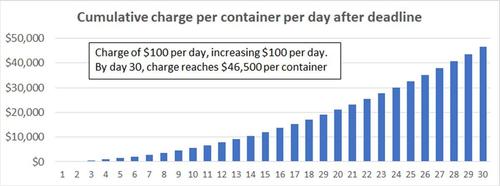

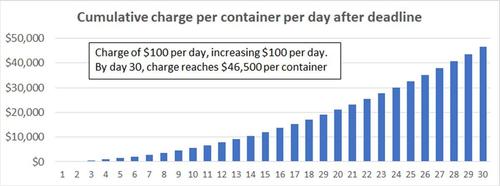

Starting Nov. 1, the ports of Los Angeles and Long Beach will charge $100 per container for boxes dwelling nine or more days that move by truck and those dwelling six days or more that move by rail.

The fee will increase $100 every day. It will be charged to carriers, which will then almost certainly pass the fee along to shippers, meaning it will be the equivalent of an escalating demurrage charge.

“As far as the ‘hyper-demurrage’ announced in Los Angeles/Long Beach, I think it will be catastrophic,” said Rich Roche, vice president of international transportation at Mohawk Global Logistics, during the NSAC meeting.

“Chassis are already in short supply and this will artificially suck out the rest of the containers that may be sitting in there [at terminals] that didn’t need to be on a chassis and now they’re going to be parked somewhere. It’s probably going to wipe out whatever’s left in terms of chassis,” predicted Roche.

According to Steve Hughes, representing the Motor Equipment & Manufacturing Association, “I’m concerned that this new fee is going to cause even more problems than it’s going to solve. I understand the logic behind it and it makes some sense, but unfortunately, because we don’t have the throughput at the front gate, I think this can cause us more problems than we have already.”

Bob Connor, executive vice president of global transportation at Mallory Alexander International Logistics, said, “This absolutely came out of left field. I don’t see this charge doing anything but adding more cost, and freight rates being what they are, this is the last thing we need.”

Both Connor and Roche urged that someone in government “step in and put the brakes on this.”

Carriers to pass along fees to shippers

NSAC members speaking during Wednesday’s meeting emphasized that the Los Angeles/Long Beach charges will ultimately be paid by shippers.

Daniel Miller, global container lead at Cargill, dubbed California’s emergency charges “crazy fees” and said, “We know this is all going to come back to us. I had a couple of calls with carriers yesterday and they’ve already admitted that yes, they are going to come back to us.”

Rick DiMaio, senior vice president of supply chain operations for Office Depot, said, “All fines and fees flow to us, to the beneficial cargo owner.”

According to Ken O’Brien, president of Gemini Shippers Group, “What was done this week at the ports of Los Angeles and Long Beach is effectively an indirect tax on the American consumer.”

Connor reported, “When we heard about the new charge, we immediately reached out to some of our contacts at the FMC. From the conversation we had, it was pretty obvious that the FMC was not forewarned that this thing was coming.”

Connor said that his company asked its FMC contacts whether the ports had to give 30-day notice to carriers before implementing the charge, and whether carriers had to give 30-day notice to pass the charge along to shippers. Connor said that it was his understanding that the ports could implement the charge without that notice, but carriers would have to give 30-day notice to shippers.

However, that’s not the case if carriers already have language in tariffs allowing them to pass along port charges immediately. Ocean carrier HMM’s current tariff includes a clause that states, “The shipper shall be liable for payment of any charges or surcharges imposed on the carrier by any marine terminal, port authority, government authorities or other third party.”

In an online post explaining the clause, Stephen Nothdurft, vice president of the Midwest region at HMM, said, “This new charge [by Los Angeles/Long Beach] is going to be a pass-through for all of the ocean carriers. The carriers will hit the mark with the invoices. As it relates to HMM specifically, this was created based on the strong chance of such surcharges. Such fees have been blowing in the wind for quite some time, so any carrier would be astute to protect their interests.”

Do fees incentivize faster moves?

The point of the “Hail Mary” Los Angeles/Long Beach fee plan is to forcibly unclog the terminals and get containers moving faster. The members of NSAC argued that these emergency port fees — as with traditional demurrage and detention fees — are not increasing container velocity given the current supply chain situation.

According to Miller, “I don’t think anybody on this committee would admit to using the port to let containers sit there because they want to. Everybody has the full intention to get these containers out, but they physically can’t.”

Adnan Qadri, director of global imports at Amazon, said, “In the past, the whole idea of detention and demurrage was incentivizing faster turns, returning of equipment and bringing fluidity into the network and the supply chain. But in its current state, the way supply chains are moving right now, I don’t think detention and demurrage are incentivizing anything.

“Folks are not sitting on returns because they want to. They’re sitting on them because they can’t get those containers returned. It is very difficult for us [Amazon] to wrap our heads around the idea of these detention and demurrage charges, which don’t drive any kind of positive behavior [given] the way the supply chain is currently set up.

“What concerns me is that these charges aren’t driving any benefit to the current state we’re in,” said the Amazon executive.

Carriers’ demurrage and detention fees have faced heavy criticism over the past year. They are a focus of FMC regulators as well as proposed legislation to reform the Ocean Shipping Act. And yet, the Los Angeles/Long Beach plan, with the explicit blessing of the Biden administration, will have the same effect as demurrage.

Nothdurft said in his online post, “It’s ironic that the international community has been pleading to the government about the absurdity of demurrage/detention charges only to have said government administer more of the same.”

https://www.zerohedge.com/markets/shippers-fear-catastrophic-fallout-crazy-california-port-fees

October 28, 2021

Shippers Fear “Catastrophic” Fallout From “Crazy” California Port Fees

by Tyler DurdenThursday, Oct 28, 2021 – 03:01 PM

By Greg Miller of FreightWaves,

The cure is worse than the disease, say critics of an emergency plan of the ports of Los Angeles and Long Beach backed by the Biden administration. If you think port congestion is bad now, just wait for what comes next.

On Wednesday, two days after the ports of Los Angeles and Long Beach announced a surprise emergency fee for containers lingering too long at terminals, the National Shippers Advisory Council (NSAC) held its inaugural meeting. NSAC, created to advise the Federal Maritime Commission, is composed of 12 U.S. importers and 12 exporters. Members include heavy hitters like Amazon, Walmart, Target, Office Depot and Ikea.

Council members had a lot to say about the California port fees — none of it good.Port of Long Beach

‘I think it will be catastrophic’

Starting Nov. 1, the ports of Los Angeles and Long Beach will charge $100 per container for boxes dwelling nine or more days that move by truck and those dwelling six days or more that move by rail.

The fee will increase $100 every day. It will be charged to carriers, which will then almost certainly pass the fee along to shippers, meaning it will be the equivalent of an escalating demurrage charge.

“As far as the ‘hyper-demurrage’ announced in Los Angeles/Long Beach, I think it will be catastrophic,” said Rich Roche, vice president of international transportation at Mohawk Global Logistics, during the NSAC meeting.

“Chassis are already in short supply and this will artificially suck out the rest of the containers that may be sitting in there [at terminals] that didn’t need to be on a chassis and now they’re going to be parked somewhere. It’s probably going to wipe out whatever’s left in terms of chassis,” predicted Roche.

According to Steve Hughes, representing the Motor Equipment & Manufacturing Association, “I’m concerned that this new fee is going to cause even more problems than it’s going to solve. I understand the logic behind it and it makes some sense, but unfortunately, because we don’t have the throughput at the front gate, I think this can cause us more problems than we have already.”

Bob Connor, executive vice president of global transportation at Mallory Alexander International Logistics, said, “This absolutely came out of left field. I don’t see this charge doing anything but adding more cost, and freight rates being what they are, this is the last thing we need.”

Both Connor and Roche urged that someone in government “step in and put the brakes on this.”

Carriers to pass along fees to shippers

NSAC members speaking during Wednesday’s meeting emphasized that the Los Angeles/Long Beach charges will ultimately be paid by shippers.

Daniel Miller, global container lead at Cargill, dubbed California’s emergency charges “crazy fees” and said, “We know this is all going to come back to us. I had a couple of calls with carriers yesterday and they’ve already admitted that yes, they are going to come back to us.”

Rick DiMaio, senior vice president of supply chain operations for Office Depot, said, “All fines and fees flow to us, to the beneficial cargo owner.”

According to Ken O’Brien, president of Gemini Shippers Group, “What was done this week at the ports of Los Angeles and Long Beach is effectively an indirect tax on the American consumer.”

Connor reported, “When we heard about the new charge, we immediately reached out to some of our contacts at the FMC. From the conversation we had, it was pretty obvious that the FMC was not forewarned that this thing was coming.”

Connor said that his company asked its FMC contacts whether the ports had to give 30-day notice to carriers before implementing the charge, and whether carriers had to give 30-day notice to pass the charge along to shippers. Connor said that it was his understanding that the ports could implement the charge without that notice, but carriers would have to give 30-day notice to shippers.

However, that’s not the case if carriers already have language in tariffs allowing them to pass along port charges immediately. Ocean carrier HMM’s current tariff includes a clause that states, “The shipper shall be liable for payment of any charges or surcharges imposed on the carrier by any marine terminal, port authority, government authorities or other third party.”

In an online post explaining the clause, Stephen Nothdurft, vice president of the Midwest region at HMM, said, “This new charge [by Los Angeles/Long Beach] is going to be a pass-through for all of the ocean carriers. The carriers will hit the mark with the invoices. As it relates to HMM specifically, this was created based on the strong chance of such surcharges. Such fees have been blowing in the wind for quite some time, so any carrier would be astute to protect their interests.”

Do fees incentivize faster moves?

The point of the “Hail Mary” Los Angeles/Long Beach fee plan is to forcibly unclog the terminals and get containers moving faster. The members of NSAC argued that these emergency port fees — as with traditional demurrage and detention fees — are not increasing container velocity given the current supply chain situation.

According to Miller, “I don’t think anybody on this committee would admit to using the port to let containers sit there because they want to. Everybody has the full intention to get these containers out, but they physically can’t.”

Adnan Qadri, director of global imports at Amazon, said, “In the past, the whole idea of detention and demurrage was incentivizing faster turns, returning of equipment and bringing fluidity into the network and the supply chain. But in its current state, the way supply chains are moving right now, I don’t think detention and demurrage are incentivizing anything.

“Folks are not sitting on returns because they want to. They’re sitting on them because they can’t get those containers returned. It is very difficult for us [Amazon] to wrap our heads around the idea of these detention and demurrage charges, which don’t drive any kind of positive behavior [given] the way the supply chain is currently set up.

“What concerns me is that these charges aren’t driving any benefit to the current state we’re in,” said the Amazon executive.

Carriers’ demurrage and detention fees have faced heavy criticism over the past year. They are a focus of FMC regulators as well as proposed legislation to reform the Ocean Shipping Act. And yet, the Los Angeles/Long Beach plan, with the explicit blessing of the Biden administration, will have the same effect as demurrage.

Nothdurft said in his online post, “It’s ironic that the international community has been pleading to the government about the absurdity of demurrage/detention charges only to have said government administer more of the same.”

https://www.zerohedge.com/markets/shippers-fear-catastrophic-fallout-crazy-california-port-fees