The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

October 23, 2021

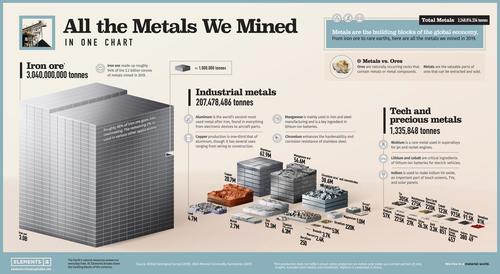

All The Metals Mined In One Visualization

by Tyler DurdenFriday, Oct 22, 2021 – 08:00 PM

Metals are all around us, from our phones and cars to our homes and office buildings. While we often overlook the presence of these raw materials, they are an essential part of the modern economy. But, as Visual Capitalist’s Govind Bhutada details below, obtaining these materials can be a complex process that involves mining, refining, and then converting them into usable forms.

So, how much metal gets mined in a year?

Metals vs Ores

Before digging into the numbers, it’s important that we distinguish between ores and metals.

Ores are naturally occurring rocks that contain metals and metal compounds. Metals are the valuable parts of ores that can be extracted by separating and removing the waste rock. As a result, ore production is typically much higher than the actual metal content of the ore. For example, miners produced 347 million tonnes of bauxite ore in 2019, but the actual aluminum metal content extracted from that was only 62.9 million tonnes.

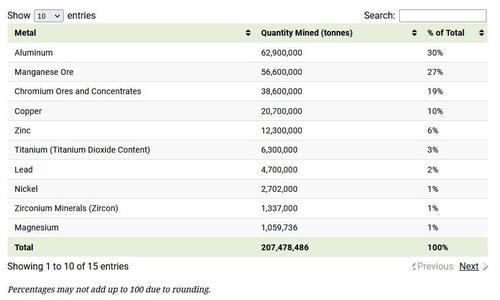

Here are all the metals and metal ores mined in 2019, according to the British Geological Survey:

Miners produced roughly three billion tonnes of iron ore in 2019, representing close to 94% of all mined metals. The primary use of all this iron is to make steel. In fact, 98% of iron ore goes into steelmaking, with the rest fulfilling various other applications.

Industrial and technology metals made up the other 6% of all mined metals in 2019. How do they break down?

Industrial Metals

From construction and agriculture to manufacturing and transportation, virtually every industry harnesses the properties of metals in different ways.

Here are the industrial metals we mined in 2019.

It’s no surprise that aluminum is the most-produced industrial metal. The lightweight metal is one of the most commonly used materials in the world, with uses ranging from making foils and beer kegs to buildings and aircraft parts.

Manganese and chromium rank second and third respectively in terms of metal mined, and are important ingredients in steelmaking. Manganese helps convert iron ore into steel, and chromium hardens and toughens steel. Furthermore, manganese is a critical ingredient of lithium-manganese-cobalt-oxide (NMC) batteries for electric vehicles.

Although copper production is around one-third that of aluminum, copper has a key role in making modern life possible. The red metal is found in virtually every wire, motor, and electrical appliance in our homes and offices. It’s also critical for various renewable energy technologies and electric vehicles.

Technology and Precious Metals

Technology is only as good as the materials that make it.

Technology metals can be classified as relatively rare metals commonly used in technology and devices. While miners produce some tech and precious metals in large quantities, others are relatively scarce.

Tin was the most-mined tech metal in 2019, and according to the International Tin Association, nearly half of it went into soldering.

It’s also interesting to see the prevalence of battery and energy metals. Lithium, cobalt, vanadium, and molybdenum are all critical for various energy technologies, including lithium-ion batteries, wind farms, and energy storage technologies. Additionally, miners also extracted 220,000 tonnes of rare earth elements, of which 60% came from China.

Given their rarity, it’s not surprising that gold, silver, and platinum group metals (PGMs) were the least-mined materials in this category. Collectively, these metals represent just 2.3% of the tech and precious metals mined in 2019.

A Material World

Although humans mine and use massive quantities of metals every year, it’s important to put these figures into perspective.

According to Circle Economy, the world consumes 100.6 billion tonnes of materials annually. Of this total, 3.2 billion tonnes of metals produced in 2019 would account for just 3% of our overall material consumption. In fact, the world’s annual production of cement alone is around 4.1 billion tonnes, dwarfing total metal production.

The world’s appetite for materials is growing with its population. As resource-intensive megatrends such as urbanization and electrification pick up the pace, our material pie will only get larger.

https://www.zerohedge.com/markets/all-metals-mined-one-visualization

October 22, 2021

A Record $22 Billion Worth Of Cargo Is Now Stuck On Container Ships Off California

by Tyler DurdenFriday, Oct 22, 2021 – 08:31 AM

By Greg Miller of FreightWaves,

There was fleeting hope that Southern California port congestion had turned the corner. The number of container ships waiting offshore dipped to the low 60s and high 50s from a record high of 73 on Sept. 19, trans-Pacific spot rates plateaued, the Biden administration unveiled aspirations for 24/7 port ops, and electricity shortages curbed Chinese factory output.

The reality is that the port congestion crisis in Southern California is not getting any better.Container ships off Los Angeles/Long Beach on Wednesday. Map: MarineTraffic

The time ships are stuck waiting offshore continues to lengthen. There are simply too many vessels arriving with too much cargo for terminals, trucks, trains and warehouses to handle. There were 103 container ships at Los Angeles/Long Beach terminals or waiting offshore on Wednesday, an all-time high.

Offshore, the number of ships at anchor or in holding patterns is once again nearing record territory. According to the Marine Exchange of Southern California, 70 container ships were waiting off Los Angeles and Long Beach on Monday, 67 on Tuesday and 71 Wednesday (not including other cargo ships that are loaded with boxes).Chart: American Shipper based on data from Marine Exchange of Southern California. Data bi-monthly April-Nov 2020; daily Dec 2020-present

Massive value of cargo stuck offshore

Marine Exchange data shows that ships waiting offshore on Tuesday — including container ships, general cargo vessels and other ships carrying containers — had aggregate capacity of 512,843 twenty-foot equivalent units. To put that in perspective, that is 10% more than the Port of Los Angeles imported during the entire month of September.

Assuming ships are at capacity, how much cargo value is out there in the “floating warehouse”? What’s in each box, and its value, varies dramatically — it can be worth a few thousand dollars or several hundred thousand dollars. But Port of Los Angeles stats provide a good guide.

The total customs value of the Port of Los Angeles’ containerized imports in 2020 was $211.9 billion. Given that imports totaled 4,827,040 TEUs, this equates to an average of $43,899 per import TEU. (Several other sources also estimated average cargo value at around $40,000 per TEU.)

This suggests that the cargo currently waiting off the ports of Los Angeles and Long Beach is worth around $22 billion, roughly the equivalent of the annual revenues of McDonald’s or the GDP of Iceland.

Imports trapped on ships for over a month

Data from the Signal platform shows that wait time from anchorage to a berth in Los Angeles rose to an all-time high 13 days on Wednesday, up 65% from the beginning of September.Chart: American Shipper based on data from Los Angeles Signal. Note: Average is 30-day trailing average.

But the average wait time doesn’t tell the full story. Ships have been sitting in San Pedro Bay for more than twice that long.

Most of the vessels that still have no terminal berth assignments despite extended wait times are small ships operated by Chinese players such as BAL Container Line that entered the trans-Pacific market for the first time this year. Some of the ships stuck in the queue have been chartered at exorbitant rates, raising the question of whether charterers accounted for such lengthy delays.

American Shipper was contacted by a U.S. manufacturer who has over 100 containers of goods trapped aboard the Chinese-owned Zhong Gu Jiang Su. The ship has been waiting offshore for over five weeks, since Sept. 13, and has yet to obtain a berth assignment, according to the Marine Exchange master queuing list.

The U.S. manufacturer, who booked through a freight forwarder, spoke on condition of anonymity. “This is really impacting our production,” he said, noting that the trapped goods are “a major component” in his company’s manufacturing process.

“We can’t get any type of help or get any type of escalation from anyone,” he said. He was told that the ship operator “hadn’t negotiated with the terminals for a berth” before arrival, which led to the extended delay.

Among the Chinese-linked ships with no berth assignment stuck in the queue, the Martinique has been waiting the longest, since Sept. 9. Loadstar reported that it is on charter to Transfer, which is owned by a Chinese logistics provider that is in turn partially owned by Chinese e-commerce giant Alibaba.

The BAL Peace has been waiting without a berth assignment since Sept. 25, as has the S Santiago.

According to Alphaliner, BAL is chartering the S Santiago for around $125,000 a day. An industry source told American Shipper the rate was $135,000 per day. So far, that ship has been waiting — and not loading any more revenue-generating cargo — for 26 days straight.

https://www.zerohedge.com/economics/22-billion-worth-cargo-now-stuck-container-ships-california

October 22, 2021

A Record $22 Billion Worth Of Cargo Is Now Stuck On Container Ships Off California

by Tyler DurdenFriday, Oct 22, 2021 – 08:31 AM

By Greg Miller of FreightWaves,

There was fleeting hope that Southern California port congestion had turned the corner. The number of container ships waiting offshore dipped to the low 60s and high 50s from a record high of 73 on Sept. 19, trans-Pacific spot rates plateaued, the Biden administration unveiled aspirations for 24/7 port ops, and electricity shortages curbed Chinese factory output.

The reality is that the port congestion crisis in Southern California is not getting any better.Container ships off Los Angeles/Long Beach on Wednesday. Map: MarineTraffic

The time ships are stuck waiting offshore continues to lengthen. There are simply too many vessels arriving with too much cargo for terminals, trucks, trains and warehouses to handle. There were 103 container ships at Los Angeles/Long Beach terminals or waiting offshore on Wednesday, an all-time high.

Offshore, the number of ships at anchor or in holding patterns is once again nearing record territory. According to the Marine Exchange of Southern California, 70 container ships were waiting off Los Angeles and Long Beach on Monday, 67 on Tuesday and 71 Wednesday (not including other cargo ships that are loaded with boxes).Chart: American Shipper based on data from Marine Exchange of Southern California. Data bi-monthly April-Nov 2020; daily Dec 2020-present

Massive value of cargo stuck offshore

Marine Exchange data shows that ships waiting offshore on Tuesday — including container ships, general cargo vessels and other ships carrying containers — had aggregate capacity of 512,843 twenty-foot equivalent units. To put that in perspective, that is 10% more than the Port of Los Angeles imported during the entire month of September.

Assuming ships are at capacity, how much cargo value is out there in the “floating warehouse”? What’s in each box, and its value, varies dramatically — it can be worth a few thousand dollars or several hundred thousand dollars. But Port of Los Angeles stats provide a good guide.

The total customs value of the Port of Los Angeles’ containerized imports in 2020 was $211.9 billion. Given that imports totaled 4,827,040 TEUs, this equates to an average of $43,899 per import TEU. (Several other sources also estimated average cargo value at around $40,000 per TEU.)

This suggests that the cargo currently waiting off the ports of Los Angeles and Long Beach is worth around $22 billion, roughly the equivalent of the annual revenues of McDonald’s or the GDP of Iceland.

Imports trapped on ships for over a month

Data from the Signal platform shows that wait time from anchorage to a berth in Los Angeles rose to an all-time high 13 days on Wednesday, up 65% from the beginning of September.Chart: American Shipper based on data from Los Angeles Signal. Note: Average is 30-day trailing average.

But the average wait time doesn’t tell the full story. Ships have been sitting in San Pedro Bay for more than twice that long.

Most of the vessels that still have no terminal berth assignments despite extended wait times are small ships operated by Chinese players such as BAL Container Line that entered the trans-Pacific market for the first time this year. Some of the ships stuck in the queue have been chartered at exorbitant rates, raising the question of whether charterers accounted for such lengthy delays.

American Shipper was contacted by a U.S. manufacturer who has over 100 containers of goods trapped aboard the Chinese-owned Zhong Gu Jiang Su. The ship has been waiting offshore for over five weeks, since Sept. 13, and has yet to obtain a berth assignment, according to the Marine Exchange master queuing list.

The U.S. manufacturer, who booked through a freight forwarder, spoke on condition of anonymity. “This is really impacting our production,” he said, noting that the trapped goods are “a major component” in his company’s manufacturing process.

“We can’t get any type of help or get any type of escalation from anyone,” he said. He was told that the ship operator “hadn’t negotiated with the terminals for a berth” before arrival, which led to the extended delay.

Among the Chinese-linked ships with no berth assignment stuck in the queue, the Martinique has been waiting the longest, since Sept. 9. Loadstar reported that it is on charter to Transfer, which is owned by a Chinese logistics provider that is in turn partially owned by Chinese e-commerce giant Alibaba.

The BAL Peace has been waiting without a berth assignment since Sept. 25, as has the S Santiago.

According to Alphaliner, BAL is chartering the S Santiago for around $125,000 a day. An industry source told American Shipper the rate was $135,000 per day. So far, that ship has been waiting — and not loading any more revenue-generating cargo — for 26 days straight.

https://www.zerohedge.com/economics/22-billion-worth-cargo-now-stuck-container-ships-california

October 22, 2021

Wanhua Chemical deploys new high-end chemical materials

Echemi 2021-10-22

01 Strategic cooperation with Hikvision

On October 13, Wanhua Chemical Group Co., Ltd. and Hangzhou Hikvision Digital Technology Co., Ltd. signed a strategic cooperation agreement at the global headquarters of Wanhua Chemical Group in Yantai.

Based on their respective deep accumulations in the industrial and technological fields, the two parties have reached strategic cooperation in the following two aspects:

Research and development of new high-end chemical materials

Wanhua Chemical will continue to cooperate with Hikvision on the structural material upgrade of hardware products.

02 Chemical safety production control

Hikvision regards chemical companies as providing AI-based production assistance, safety control and perception solutions, and using technological integration and innovation to help Wanhua Chemical’s digital and intelligent transformation.

Under the dual carbon goal, China’s chemical industry is in the process of replenishing and strengthening the chain. As a new chemical material company operating globally, Wanhua Chemical can rely on continuous innovation of core technology, industrialized equipment and efficient operation mode to promote the research and development and mass production of new high-end chemical materials, and help the development of high-tech products in structural materials. upgrade.

Green development and artificial intelligence have become important engines for the high-quality development of the chemical industry. The chemical industry is accelerating digitalization and continuously promoting innovation. The Internet of Things + AI has become an important bridge to realize digital transformation. As a builder of full-stack spectrum IoT capabilities and a partner in enterprise digital transformation, Hikvision can help users in the chemical industry realize scene IoT and intelligent perception, reduce the risk of enterprise accidents, and improve the company’s daily security and production safety early warning capabilities .

The cooperation agreement signed by the two parties this time can be said to be very strategic.

02 Jointly with Hillhouse to invest in Shanghai Leju

On October 12, Shanghai Leju Technology Co., Ltd. announced the completion of its B round of over 100 million yuan financing. This round of financing was jointly invested by Wanhua Chemical and Hillhouse Ventures. Leju had previously received Series A financing from Sinopec and Shangnan Group. It is understood that the funds raised by Le Orange in this round of financing will be mainly used for system algorithm research and development, packaging material technology investment and reverse logistics system construction.

Leju was established in 2018 and positioned as a supply chain infrastructure service company based on smart packaging and smart logistics. Leo Orange has products such as Yelopack Le Orange Yunguo, Yelotour Le Orange Yuntu, Yelolife Le Orange Newborn, and Yeloant Le Orange Carbon Ant. Its packaging products are recycled in accordance with national standards, aiming to promote the recycling of plastic products. Protect the natural environment to the limit and save resources.

In the context of the “first year of carbon neutrality” in 2021, Leju provides solutions to help customers achieve carbon neutrality goals and propose effective solutions from the three aspects of intelligence, renewable raw materials, and carbon reduction.

I believe that Wanhua Chemical’s investment in Leju will also help us realize our mission of chemistry and a better life.

03 Expansion of 250,000 tons/year TDI project

On September 23, the Fuzhou Municipal Bureau of Ecology and Environment announced the environmental impact assessment document for Wanhua Chemical (Fujian) Co., Ltd.’s expansion of the 250,000 tons/year TDI project (replacement of the existing 100,000 tons and approved 150,000 tons of TDI capacity).

Introduction to the basic situation of the project

1. Project name: Wanhua Chemical (Fujian) Co., Ltd. expands 250,000 tons/year TDI project;

2. Construction unit: Wanhua Chemical (Fujian) Co., Ltd.;

3. Construction nature: reconstruction;

4. Project construction site: Jiangyin Gangcheng Economic Zone, Fuzhou;

5. Project investment: The total investment of the project is 1927.3779 million yuan;

6. Floor area: The total land area is 62,313 square meters;

7. Estimated construction period: 2 years.

Introduction to the use of TDI

Toluene diisocyanate (TDI) is the basic raw material of polyurethane, which is mainly used to produce flexible polyurethane foam (soft foam, sponge), polyurethane elastomer, coating, adhesive, sealant and elastic polyether. Among them, flexible polyurethane foam, as the traditional consumption field of TDI, is widely used in furniture mattresses, carpets, internal components of vehicles, trains and airplanes, toys, etc., accounting for more than 70% of the total TDI consumption. Different raw materials used and changes in formula can be made into soft, semi-rigid polyurethane foam and other varieties.

In less than a month, Wanhua Chemical can be said to be constantly moving in different fields. Regardless of whether it is cooperation, investment or expansion, I believe Wanhua Chemical is a comprehensive consideration of integrating its own development into the development trend of the times.

October 22, 2021

Wanhua Chemical deploys new high-end chemical materials

Echemi 2021-10-22

01 Strategic cooperation with Hikvision

On October 13, Wanhua Chemical Group Co., Ltd. and Hangzhou Hikvision Digital Technology Co., Ltd. signed a strategic cooperation agreement at the global headquarters of Wanhua Chemical Group in Yantai.

Based on their respective deep accumulations in the industrial and technological fields, the two parties have reached strategic cooperation in the following two aspects:

Research and development of new high-end chemical materials

Wanhua Chemical will continue to cooperate with Hikvision on the structural material upgrade of hardware products.

02 Chemical safety production control

Hikvision regards chemical companies as providing AI-based production assistance, safety control and perception solutions, and using technological integration and innovation to help Wanhua Chemical’s digital and intelligent transformation.

Under the dual carbon goal, China’s chemical industry is in the process of replenishing and strengthening the chain. As a new chemical material company operating globally, Wanhua Chemical can rely on continuous innovation of core technology, industrialized equipment and efficient operation mode to promote the research and development and mass production of new high-end chemical materials, and help the development of high-tech products in structural materials. upgrade.

Green development and artificial intelligence have become important engines for the high-quality development of the chemical industry. The chemical industry is accelerating digitalization and continuously promoting innovation. The Internet of Things + AI has become an important bridge to realize digital transformation. As a builder of full-stack spectrum IoT capabilities and a partner in enterprise digital transformation, Hikvision can help users in the chemical industry realize scene IoT and intelligent perception, reduce the risk of enterprise accidents, and improve the company’s daily security and production safety early warning capabilities .

The cooperation agreement signed by the two parties this time can be said to be very strategic.

02 Jointly with Hillhouse to invest in Shanghai Leju

On October 12, Shanghai Leju Technology Co., Ltd. announced the completion of its B round of over 100 million yuan financing. This round of financing was jointly invested by Wanhua Chemical and Hillhouse Ventures. Leju had previously received Series A financing from Sinopec and Shangnan Group. It is understood that the funds raised by Le Orange in this round of financing will be mainly used for system algorithm research and development, packaging material technology investment and reverse logistics system construction.

Leju was established in 2018 and positioned as a supply chain infrastructure service company based on smart packaging and smart logistics. Leo Orange has products such as Yelopack Le Orange Yunguo, Yelotour Le Orange Yuntu, Yelolife Le Orange Newborn, and Yeloant Le Orange Carbon Ant. Its packaging products are recycled in accordance with national standards, aiming to promote the recycling of plastic products. Protect the natural environment to the limit and save resources.

In the context of the “first year of carbon neutrality” in 2021, Leju provides solutions to help customers achieve carbon neutrality goals and propose effective solutions from the three aspects of intelligence, renewable raw materials, and carbon reduction.

I believe that Wanhua Chemical’s investment in Leju will also help us realize our mission of chemistry and a better life.

03 Expansion of 250,000 tons/year TDI project

On September 23, the Fuzhou Municipal Bureau of Ecology and Environment announced the environmental impact assessment document for Wanhua Chemical (Fujian) Co., Ltd.’s expansion of the 250,000 tons/year TDI project (replacement of the existing 100,000 tons and approved 150,000 tons of TDI capacity).

Introduction to the basic situation of the project

1. Project name: Wanhua Chemical (Fujian) Co., Ltd. expands 250,000 tons/year TDI project;

2. Construction unit: Wanhua Chemical (Fujian) Co., Ltd.;

3. Construction nature: reconstruction;

4. Project construction site: Jiangyin Gangcheng Economic Zone, Fuzhou;

5. Project investment: The total investment of the project is 1927.3779 million yuan;

6. Floor area: The total land area is 62,313 square meters;

7. Estimated construction period: 2 years.

Introduction to the use of TDI

Toluene diisocyanate (TDI) is the basic raw material of polyurethane, which is mainly used to produce flexible polyurethane foam (soft foam, sponge), polyurethane elastomer, coating, adhesive, sealant and elastic polyether. Among them, flexible polyurethane foam, as the traditional consumption field of TDI, is widely used in furniture mattresses, carpets, internal components of vehicles, trains and airplanes, toys, etc., accounting for more than 70% of the total TDI consumption. Different raw materials used and changes in formula can be made into soft, semi-rigid polyurethane foam and other varieties.

In less than a month, Wanhua Chemical can be said to be constantly moving in different fields. Regardless of whether it is cooperation, investment or expansion, I believe Wanhua Chemical is a comprehensive consideration of integrating its own development into the development trend of the times.