The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 16, 2021

Indorama Ventures agrees to buy Brazil-based Oxiteno to create a unique portfolio in high-value surfactants

16 August 2021

Bangkok, Thailand – 16 August 2021 – Indorama Ventures Public Company Limited (IVL), a global chemicals producer, today announced it agreed to acquire Brazil-based Oxiteno S.A. Indústria e Comércio, a subsidiary of Ultrapar Participações S.A. The acquisition gives IVL a unique portfolio in high-value surfactants and significantly extends its existing Integrated Oxides and Derivatives (IOD) business.

Oxiteno is a leading integrated surfactants producer, catering to highly attractive end-use markets in LATAM. The acquisition brings an excellent management team, world-class expertise in green chemistry innovation, strong customer relationships in Brazil, Uruguay and Mexico, and substantial growth potential in attractive end markets, including the U.S. through a new facility in Pasadena, Texas. Oxiteno has a strong commitment to environmental governance, and its focus on lowering greenhouse gas emissions will also enhance IVL’s ESG credentials.

Through the acquisition, IVL will assume a unique market position in technologies catering to niche, IP-rich and value-added applications in home & personal care, agrochemicals, coatings and oil & gas markets. The surfactants market has seen consistent growth over the last decade, driven by trends in population growth, urbanization and increasing hygiene awareness amid the Covid-19 pandemic.

With 11 manufacturing plants, customers in 4 continents, and an experienced management team, Oxiteno will complement IOD’s footprint in the U.S and Latin America, while its 5 research and technology centers will add to IVL’s innovation credentials in green chemistry. The extended footprint has potential to drive expansion in Europe and Asia by leveraging on IVOX’s surfactants business in Australia and India and IVL’s global presence in 34 countries. IVL expects to realize synergies of US$100 million by 2025 through portfolio adjustments, asset optimization and operational excellence.

IVL will purchase Oxiteno for US$1.3 billion (subject to adjustments at closing), with a deferred payment of $150 million in 2024. The transaction is subject to customary conditions to closing, including approval of relevant regulatory authorities. The transaction is expected to close in Q1 2022 and will be earnings accretive immediately. Financing is secured through deferred payment, using existing extra cash on our balance sheet, free cash flow generated from existing businesses, short term loans against working capital and the balance as long-term debt.

Oxiteno and Indorama Ventures both have family-business origins and share a similar mindset, which positions people as a key business differentiator and values innovation and investments in an increasingly diversified and efficient portfolio.

Mr Aloke Lohia, IVL Group CEO, said, “This acquisition is a natural fit for us. We have a solid track record of continuously driving value for shareholders through successfully integrating 50 acquisitions over the past 20 years. With Oxiteno, we are creating a global leader in surfactants. By bringing our companies together, we are strengthening our customer value proposition, our market reach, and our experienced team. Like us, Oxiteno grew as a family enterprise with an entrepreneurial mindset. The combination of our teams is unmatched in our industry, and we look forward welcoming them to our family.”

Frederico Curado, CEO of Ultra Group, said, “It is important to ensure that Oxiteno will benefit from integrating the new majority shareholder into the business, which is strategically positioned to lead the company through its growth path.”

Oxiteno’s HVA growth portfolio complements IVL’s existing IOD business

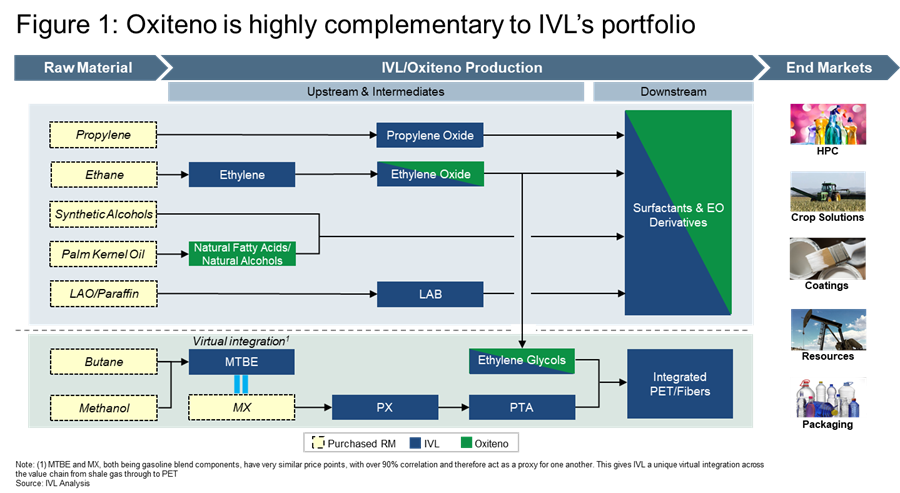

Oxiteno’s innovation-led HVA offering is a significant complement to IVL’s growth platform (Figure 1), and a key driver of IVL’s EBITDA projection over the next two years, which is 15% above the company’s forecast in January 2021. Together with IVL’s world-class assets, which were acquired from U.S.-based Huntsman in 2020 (Spindletop transaction), the acquisition of Oxiteno will lead IVL’s newest IOD business segment as a major high-margin growth driver alongside its traditional PET commodities business, creating a stronger and more resilient hybrid platform.

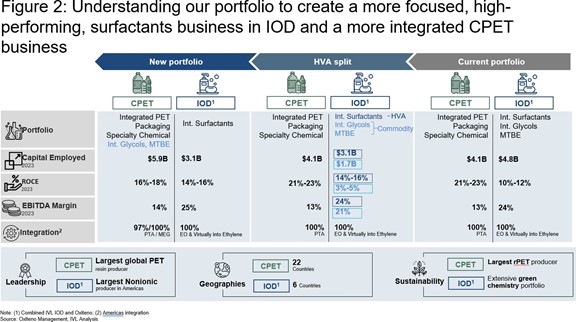

The linkages between IOD, Oxiteno’s high-performing surfactants, and the Combined PET businesses through their crude oil, shale and oleo feedstocks gives IVL integration benefits across the value chain, which is key to the company’s sustainable business model as the world’s largest producer of PET resin and a large geographic footprint in non-ionic surfactants in the Americas (Figure 2).

Oxiteno’s green chemistry innovation credentials also strengthen IVL’s ambitious sustainability objectives as a leader in PET circularity and bio-ingredients. Brazil is home to the largest inventory of ethanol, used to produce bio-ethylene to enhance EOD and PET sustainability. Today, IVL is the largest producer of resin used in recycled PET bottles and aims to recycle a minimum of 750,000 metric tons of PET globally by 2025, investing up to US$1.5 billion to achieve this goal.

Mr D K Agarwal, Chief Executive Officer of Combined PET, IOD and Fibers Business, said, “The combination of Oxiteno and IVL’s existing Integrated Oxides & Derivatives business is highly complementary. It gives us a presence in the high-growth Latin American markets, and we also become a more reliable supplier to our global customers, especially in Europe and the US. It will drive sustainable long-term value creation by accelerating our expansion in downstream chemicals, increasing our exposure to high-quality markets, and adding to our R&D and sustainability credentials. The portfolio will accelerate revenue and EBITDA growth, and deliver cost synergies.”

Driving enterprise growth through a proven strategy

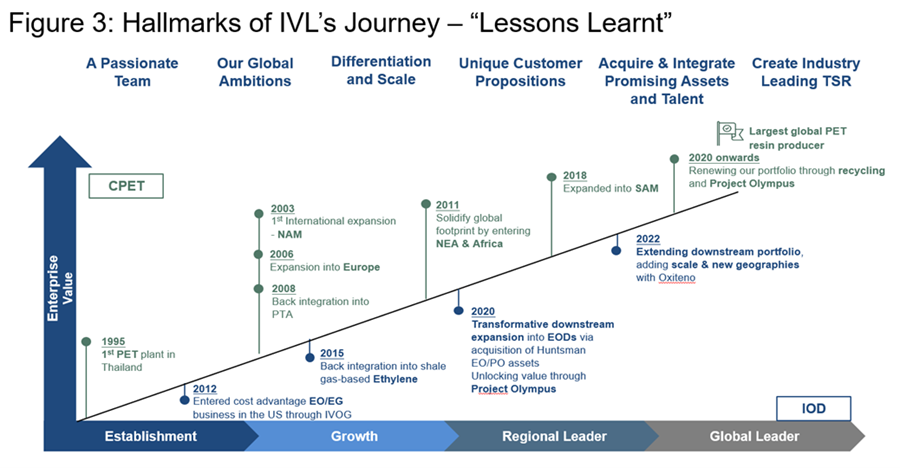

IVL has built a strong global platform based on some 50 successful acquisitions over 20 years, and is embarking on a program of continuous improvement through its 5 strategic priorities of costs transformation, asset optimization, adjacency growth, circularity, and organization excellence. These include significant investments in transformation, savings, and efficiency projects, which are driving expansion in IOD, strengthening its Fibers business segment, and enhancing value in its traditional Combined PET segment.

Mr Aloke Lohia, IVL Group CEO, added, “Since 2014 I have been very clear about our strategy of making big bets on HVA and innovation-led products that help us build global leadership positions. From our first PET plant in 1995, we have grown to our current global leadership position through a sound track record of acquiring and integrating new assets and teams that give us scale and differentiate us in the marketplace. This, and our focus on sustainable and circular models, our transformation and efficiency programs, and our ability to grow organically and from acquisitions, will continue to drive enterprise value.” (Figure 3)

August 6, 2021

Covestro reports second-quarter beat due to strong selling prices

By Zuzanna Szymanska, Anneli Palmen

3 Min Read

(Adds CFO quotes from call)

Aug 6 (Reuters) – German chemicals maker Covestro reported a better than expected final second-quarter profit on Friday as it maintained selling prices above raw material costs thanks to a continued demand recovery.

All industries including chemicals have been heavily affected by recent raw material price inflation, but Covestro, which makes foams and plastics for products including car seats and phone cases, said it was largely successful passing on the costs to customers in the second quarter.

“We produce things that are extremely important for our customers, such as adhesives or coatings, but which only account for a small part of the total cost of the product. This explains why they are willing to pay very high prices,” financial chief Thomas Toepfer told Reuters, adding Covestro was still far from the 2017-2018 historic selling price highs.

Asked about risks from the spread of the more contagious delta coronavirus variant, the CFO said Covestro’s product mix should help it resist the pressure as it did in late 2020.

“The high demand for such products as wind turbine coatings or light materials for electric cars is driven by sustainability trends that haven’t really been affected by the pandemic,” Toepfer said.

He added chip shortages in the automotive industry, which accounts for 20% of Covestro’s sales, have not hurt Covestro’s growth thanks to its solid order book.

“Since late 2020, we have been completely sold out as far as our production capacities are concerned, so getting fewer orders from automakers is almost a relief for us,” he said.

Covestro said its second-quarter net income came in at 449 million euros ($530.76 million), compared to the 433 million euros expected on average by analysts in a company-provided poll, and confirmed the preliminary core earnings and 2021 forecast it announced on July 12. ($1 = 0.8460 euros) (Reporting by Zuzanna Szymanska and Anneli Palmen; additional reporting by Veronica Snoj in Gdansk; Editing by Tomasz Janowski and David Evans)

https://www.reuters.com/article/covestro-results-idUSL8N2PD0R7

August 6, 2021

Covestro reports second-quarter beat due to strong selling prices

By Zuzanna Szymanska, Anneli Palmen

3 Min Read

(Adds CFO quotes from call)

Aug 6 (Reuters) – German chemicals maker Covestro reported a better than expected final second-quarter profit on Friday as it maintained selling prices above raw material costs thanks to a continued demand recovery.

All industries including chemicals have been heavily affected by recent raw material price inflation, but Covestro, which makes foams and plastics for products including car seats and phone cases, said it was largely successful passing on the costs to customers in the second quarter.

“We produce things that are extremely important for our customers, such as adhesives or coatings, but which only account for a small part of the total cost of the product. This explains why they are willing to pay very high prices,” financial chief Thomas Toepfer told Reuters, adding Covestro was still far from the 2017-2018 historic selling price highs.

Asked about risks from the spread of the more contagious delta coronavirus variant, the CFO said Covestro’s product mix should help it resist the pressure as it did in late 2020.

“The high demand for such products as wind turbine coatings or light materials for electric cars is driven by sustainability trends that haven’t really been affected by the pandemic,” Toepfer said.

He added chip shortages in the automotive industry, which accounts for 20% of Covestro’s sales, have not hurt Covestro’s growth thanks to its solid order book.

“Since late 2020, we have been completely sold out as far as our production capacities are concerned, so getting fewer orders from automakers is almost a relief for us,” he said.

Covestro said its second-quarter net income came in at 449 million euros ($530.76 million), compared to the 433 million euros expected on average by analysts in a company-provided poll, and confirmed the preliminary core earnings and 2021 forecast it announced on July 12. ($1 = 0.8460 euros) (Reporting by Zuzanna Szymanska and Anneli Palmen; additional reporting by Veronica Snoj in Gdansk; Editing by Tomasz Janowski and David Evans)

https://www.reuters.com/article/covestro-results-idUSL8N2PD0R7

August 4, 2021

In the eye of the congestion storm: Q&A with Port of LA’s Gene Seroka

Southern California gateway still clogged as wave of peak-season cargo looms

Greg Miller, Senior Editor Follow on Twitter Tuesday, August 3, 2021 6 minutes read

Peak season, for all practical purposes, is here. There are once again 25 or more container ships at anchor in San Pedro Bay off the ports of Los Angeles and Long Beach. Rail lines UP and BNSF were so backed up that they recently throttled container flows from Southern California to Chicago.

With no end in sight, how can West Coast ports handle the ongoing flood of imports?

To answer that question, American Shipper interviewed Gene Seroka, executive director of the Port of Los Angeles, on Wednesday. Following is an edited version of that conversion:

AMERICAN SHIPPER: There’s a parade of ships now headed from Asia to California. With peak season cargo coming in and new trans-Pacific services and extra loaders, is there any way for Los Angeles to squeeze out more productivity on the land side and dig out of this? Or does normalcy have to wait for imports to abate?

SEROKA: “The railroads are full. The warehouses are full. Port terminals are full. Ships are coming in and waiting to get worked. The factories are behind in orders. This incredible demand has got everybody in the entire value chain just clipping out at levels we never could have imagined — and it’s still not enough.

“We’ve still got so much cargo coming in. We were on the phone with a big retailer this morning and they said that they’re still going to need another year to get inventories up to a level they think is appropriate.

“Something’s got to ease. We’ve got 23 vessels scheduled to come into both ports over the next three days. That’s pretty high. We’ve now got 25 ships at anchor for both ports, 17 of which are directed to LA.

“But, for example, if we suddenly got a break in the warehouse system and a bunch of cargo was pushed out after being put in 53-foot boxes, we could have an immediate release valve on these terminals. One overnight run of 60,000 containers makes us look very, very different tomorrow than we do right now.”

AMERICAN SHIPPER: There have been several times when the number of ships at anchor dropped by 10 or more over a single weekend. Is that part of the strategy?

SEROKA: “Yes, it has been preprogrammed and planned. One of the things that’s difficult is getting the trucker community aligned with those additional gates and work times. Because these guys and ladies have the 11-hour federal mandate of work plus extra rest time. So, we’ve got to be in real synchronicity with these folks to say, ‘Hey, look, we’re going to be able to move a ton of cargo out on Saturday, Saturday night, Sunday, Sunday night. Can you have the power available?’ And they may forgo a little bit of work on Thursday and Friday, for example.”

AMERICAN SHIPPER: You just mentioned warehouses as a possible release valve. You’re implying more can be done at warehouses productivity-wise?

SEROKA: “Absolutely. It works on either end. If ships slow down for a week coming in, we could push out some of this cargo. There would be a little bit of a flow issue to direct the trucks and trains, but at least it would put a dent into the anchorages. Conversely, a similar outcome — maybe even with faster results — would be at the warehouses. You’ve got 2 billion square feet of space. If you were suddenly able to push out 53-foot domestic boxes at an abnormal pace — because these guys are only open from 8 to 5 — but if you added night shifts and weekend shifts, we could really release the air out of these terminals and get this port in better shape to welcome that next vessel.”

AMERICAN SHIPPER: There has been a shortage of job applicants across the country, in many different industries. How much is this a factor, not just in the warehouses, but across the entire land-based logistics system?

SEROKA: “I’ll break it down into three areas. The ILWU [longshore union] rank and file has been on the job between five and a half and six days a week since the pandemic began. We’ve added about 1,000 longshoremen and women during this process and it could be more. The employers and the union have to agree on those numbers within the collective-bargaining agreement, but if we can get more workers out there, even better in my view.

“On the trucking side, we’ve got about 18,000 truckers registered individually to do business at this port, only half of which call at the port at least once a week. With these terminals super-full with containers, that slows down truck times. Because we’re not getting four turns a day, we’re only getting two, we need more drivers and you still have half the population you can recruit into this business. How quickly individual companies and independent contractors want to [resume work at the port] remains the question.

“On the third segment, the warehousing guys, that’s been hit or miss all throughout COVID. You’ve got physical distancing and the teams that work in warehouses are now smaller and working farther apart. With stimulus, some may have forgone working in warehouses because those checks took care of the needs of them and their families. Now bringing them back are things like rent abatements and eviction moratoriums and unemployment benefits starting to wane and expire. So, you may see more people in the [warehouse labor] market.”

AMERICAN SHIPPER: There have also been huge challenges on the rail side. You reported in mid-June that Los Angeles’ on-dock rail time was still 12 days, not far from its peak earlier in the year. Then, in July, UP suspended Southern California-Chicago service for a week and BNSF rationed service for two weeks. How has that affected the port?

SEROKA: “That was a very difficult decision — pausing trains from Los Angeles/Long Beach to Chicago — and I think it had to be done. I talk to the senior guys and ladies at both companies, regularly, if not daily. What I learned from UP was that at the time that decision was made, they had 25 miles worth of trains sitting outside of Joliet. Lo and behold, very shortly thereafter, BNSF had 22 miles of trains sitting outside that facility.

“They are facing some of the same difficulties that we do here in LA. Their dwell time for containers, once a train gets discharged, was three times as long as it used to be, pre-pandemic, pre-surge. The expectation is that their customers come in within the day and pick up their boxes. It was going to three-plus days. And their on-the-street dwell time [at warehouses] was up to eight days, very similar to ours. So, they’re not getting equipment back nearly fast enough. Their normal model is about two days’ street dwell.

“These guys were saying, ‘How many more trains can I put in there because the guys in Southern California are screaming we need more rail cars, engine power and crews to get the next ship’s cargoes out. If [equipment] is just sitting in Chicago or other locations, I can’t get those assets and crews back.’ [Pausing service] was a painful decision they had to make.

“Combined, about 15% of our cargo was paused for that point in time. So, it didn’t decimate us, but every container that doesn’t move out of the port creates more of a clog right here. We’re once again sitting at about 95-98% of our land usage capacity and 80% is considered full-throttle for us.”

AMERICAN SHIPPER: How has this emergency pause in service affected rail dwell time at the port?

SEROKA: “For the small snapshot in time that they went into this pause, it increased dwell times, as you could imagine, because you’ve got containers that are not moving out. So, right now, we’re sitting at 13.1 days rail dwell and that’s just off the peak that we witnessed back in February. But then we will see it slide as these Midwest trains start to be built and move out.

“What it did was help clear out Joliet to an extent where it’s now manageable [in terms of] the cargo they can put through their terminal — and that will accelerate trains moving out of here going to Chicago.”

AMERICAN SHIPPER: Looking at all that’s happened already in 2021 — from the rail situation to the anchorages and all the other issues — it has really been an incredible year.

SEROKA: “And the story still has not been finished yet.”

August 4, 2021

In the eye of the congestion storm: Q&A with Port of LA’s Gene Seroka

Southern California gateway still clogged as wave of peak-season cargo looms

Greg Miller, Senior Editor Follow on Twitter Tuesday, August 3, 2021 6 minutes read

Peak season, for all practical purposes, is here. There are once again 25 or more container ships at anchor in San Pedro Bay off the ports of Los Angeles and Long Beach. Rail lines UP and BNSF were so backed up that they recently throttled container flows from Southern California to Chicago.

With no end in sight, how can West Coast ports handle the ongoing flood of imports?

To answer that question, American Shipper interviewed Gene Seroka, executive director of the Port of Los Angeles, on Wednesday. Following is an edited version of that conversion:

AMERICAN SHIPPER: There’s a parade of ships now headed from Asia to California. With peak season cargo coming in and new trans-Pacific services and extra loaders, is there any way for Los Angeles to squeeze out more productivity on the land side and dig out of this? Or does normalcy have to wait for imports to abate?

SEROKA: “The railroads are full. The warehouses are full. Port terminals are full. Ships are coming in and waiting to get worked. The factories are behind in orders. This incredible demand has got everybody in the entire value chain just clipping out at levels we never could have imagined — and it’s still not enough.

“We’ve still got so much cargo coming in. We were on the phone with a big retailer this morning and they said that they’re still going to need another year to get inventories up to a level they think is appropriate.

“Something’s got to ease. We’ve got 23 vessels scheduled to come into both ports over the next three days. That’s pretty high. We’ve now got 25 ships at anchor for both ports, 17 of which are directed to LA.

“But, for example, if we suddenly got a break in the warehouse system and a bunch of cargo was pushed out after being put in 53-foot boxes, we could have an immediate release valve on these terminals. One overnight run of 60,000 containers makes us look very, very different tomorrow than we do right now.”

AMERICAN SHIPPER: There have been several times when the number of ships at anchor dropped by 10 or more over a single weekend. Is that part of the strategy?

SEROKA: “Yes, it has been preprogrammed and planned. One of the things that’s difficult is getting the trucker community aligned with those additional gates and work times. Because these guys and ladies have the 11-hour federal mandate of work plus extra rest time. So, we’ve got to be in real synchronicity with these folks to say, ‘Hey, look, we’re going to be able to move a ton of cargo out on Saturday, Saturday night, Sunday, Sunday night. Can you have the power available?’ And they may forgo a little bit of work on Thursday and Friday, for example.”

AMERICAN SHIPPER: You just mentioned warehouses as a possible release valve. You’re implying more can be done at warehouses productivity-wise?

SEROKA: “Absolutely. It works on either end. If ships slow down for a week coming in, we could push out some of this cargo. There would be a little bit of a flow issue to direct the trucks and trains, but at least it would put a dent into the anchorages. Conversely, a similar outcome — maybe even with faster results — would be at the warehouses. You’ve got 2 billion square feet of space. If you were suddenly able to push out 53-foot domestic boxes at an abnormal pace — because these guys are only open from 8 to 5 — but if you added night shifts and weekend shifts, we could really release the air out of these terminals and get this port in better shape to welcome that next vessel.”

AMERICAN SHIPPER: There has been a shortage of job applicants across the country, in many different industries. How much is this a factor, not just in the warehouses, but across the entire land-based logistics system?

SEROKA: “I’ll break it down into three areas. The ILWU [longshore union] rank and file has been on the job between five and a half and six days a week since the pandemic began. We’ve added about 1,000 longshoremen and women during this process and it could be more. The employers and the union have to agree on those numbers within the collective-bargaining agreement, but if we can get more workers out there, even better in my view.

“On the trucking side, we’ve got about 18,000 truckers registered individually to do business at this port, only half of which call at the port at least once a week. With these terminals super-full with containers, that slows down truck times. Because we’re not getting four turns a day, we’re only getting two, we need more drivers and you still have half the population you can recruit into this business. How quickly individual companies and independent contractors want to [resume work at the port] remains the question.

“On the third segment, the warehousing guys, that’s been hit or miss all throughout COVID. You’ve got physical distancing and the teams that work in warehouses are now smaller and working farther apart. With stimulus, some may have forgone working in warehouses because those checks took care of the needs of them and their families. Now bringing them back are things like rent abatements and eviction moratoriums and unemployment benefits starting to wane and expire. So, you may see more people in the [warehouse labor] market.”

AMERICAN SHIPPER: There have also been huge challenges on the rail side. You reported in mid-June that Los Angeles’ on-dock rail time was still 12 days, not far from its peak earlier in the year. Then, in July, UP suspended Southern California-Chicago service for a week and BNSF rationed service for two weeks. How has that affected the port?

SEROKA: “That was a very difficult decision — pausing trains from Los Angeles/Long Beach to Chicago — and I think it had to be done. I talk to the senior guys and ladies at both companies, regularly, if not daily. What I learned from UP was that at the time that decision was made, they had 25 miles worth of trains sitting outside of Joliet. Lo and behold, very shortly thereafter, BNSF had 22 miles of trains sitting outside that facility.

“They are facing some of the same difficulties that we do here in LA. Their dwell time for containers, once a train gets discharged, was three times as long as it used to be, pre-pandemic, pre-surge. The expectation is that their customers come in within the day and pick up their boxes. It was going to three-plus days. And their on-the-street dwell time [at warehouses] was up to eight days, very similar to ours. So, they’re not getting equipment back nearly fast enough. Their normal model is about two days’ street dwell.

“These guys were saying, ‘How many more trains can I put in there because the guys in Southern California are screaming we need more rail cars, engine power and crews to get the next ship’s cargoes out. If [equipment] is just sitting in Chicago or other locations, I can’t get those assets and crews back.’ [Pausing service] was a painful decision they had to make.

“Combined, about 15% of our cargo was paused for that point in time. So, it didn’t decimate us, but every container that doesn’t move out of the port creates more of a clog right here. We’re once again sitting at about 95-98% of our land usage capacity and 80% is considered full-throttle for us.”

AMERICAN SHIPPER: How has this emergency pause in service affected rail dwell time at the port?

SEROKA: “For the small snapshot in time that they went into this pause, it increased dwell times, as you could imagine, because you’ve got containers that are not moving out. So, right now, we’re sitting at 13.1 days rail dwell and that’s just off the peak that we witnessed back in February. But then we will see it slide as these Midwest trains start to be built and move out.

“What it did was help clear out Joliet to an extent where it’s now manageable [in terms of] the cargo they can put through their terminal — and that will accelerate trains moving out of here going to Chicago.”

AMERICAN SHIPPER: Looking at all that’s happened already in 2021 — from the rail situation to the anchorages and all the other issues — it has really been an incredible year.

SEROKA: “And the story still has not been finished yet.”