The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 6, 2021

From Europe:

Polyurethane: BASF’s TDI plant in Ludwigshafen is back in operation – 06/30/2021

As was learned upon request, BASF (Ludwigshafen) apparently restarted its large-scale TDI plant in Ludwigshafen a few days ago. The line had stood still since March – it was unclear whether it was solely because of the regular spring maintenance or because of acute need for repairs. The company was reluctant to make any statements in this regard. It is also not certain whether the system has now reached full load again.

Nevertheless, the restarted operation is likely to put further pressure on the TDI price, which had already reached a plateau in the past few weeks. Both the isocyanate and the entire flexible foam area have already settled down for the first time.

At the US site in Geismar, Louisiana, however, the group continues to struggle with problems in TDI production.

Polyurethan: TDI-Anlage von BASF in Ludwigshafen wieder in Betrieb

30.06.2021

TDI-Anlage in Geismar (Foto: BASF)

TDI-Anlage in Geismar (Foto: BASF)

Wie auf Nachfrage in Erfahrung gebracht, hat BASF (Ludwigshafen) seine TDI-Großanlage in Ludwigshafen vor wenigen Tagen offenbar wieder angefahren. Die Linie hatte seit März still gestanden – ob allein wegen der regulären Frühjahrswartung oder auch aufgrund akuter Reparaturbedürftigkeit, blieb unklar. Das Unternehmen hielt sich mit diesbezüglichen Aussagen zurück. Auch ob die Anlage nun wieder Volllast erreicht hat, ist nicht sicher.

Dennoch dürfte der wieder angelaufene Betrieb weiteren Druck auf den TDI-Preis ausüben, der in den vergangenen Wochen bereits ein Plateau erreicht hatte. Sowohl für das Isocyanat als auch für den gesamten Weichschaumbereich kam es bereits zu einer ersten Beruhigung.

Am US-amerikanischen Standort Geismar, Louisiana, kämpft der Konzern hingegen weiter mit Problemen in der TDI-Produktion.

July 6, 2021

From Europe:

Polyurethane: BASF’s TDI plant in Ludwigshafen is back in operation – 06/30/2021

As was learned upon request, BASF (Ludwigshafen) apparently restarted its large-scale TDI plant in Ludwigshafen a few days ago. The line had stood still since March – it was unclear whether it was solely because of the regular spring maintenance or because of acute need for repairs. The company was reluctant to make any statements in this regard. It is also not certain whether the system has now reached full load again.

Nevertheless, the restarted operation is likely to put further pressure on the TDI price, which had already reached a plateau in the past few weeks. Both the isocyanate and the entire flexible foam area have already settled down for the first time.

At the US site in Geismar, Louisiana, however, the group continues to struggle with problems in TDI production.

Polyurethan: TDI-Anlage von BASF in Ludwigshafen wieder in Betrieb

30.06.2021

TDI-Anlage in Geismar (Foto: BASF)

TDI-Anlage in Geismar (Foto: BASF)

Wie auf Nachfrage in Erfahrung gebracht, hat BASF (Ludwigshafen) seine TDI-Großanlage in Ludwigshafen vor wenigen Tagen offenbar wieder angefahren. Die Linie hatte seit März still gestanden – ob allein wegen der regulären Frühjahrswartung oder auch aufgrund akuter Reparaturbedürftigkeit, blieb unklar. Das Unternehmen hielt sich mit diesbezüglichen Aussagen zurück. Auch ob die Anlage nun wieder Volllast erreicht hat, ist nicht sicher.

Dennoch dürfte der wieder angelaufene Betrieb weiteren Druck auf den TDI-Preis ausüben, der in den vergangenen Wochen bereits ein Plateau erreicht hatte. Sowohl für das Isocyanat als auch für den gesamten Weichschaumbereich kam es bereits zu einer ersten Beruhigung.

Am US-amerikanischen Standort Geismar, Louisiana, kämpft der Konzern hingegen weiter mit Problemen in der TDI-Produktion.

July 2, 2021

INSIGHT: Surging chemical prices pressure construction costs

Author: Al Greenwood

2021/07/01

HOUSTON (ICIS)–Rising prices for chemicals and plastics used in construction are raising costs in that sector, and more increases could arrive later in the year.

The US Producer Price Index (PPI) for final demand in construction rose by 0.6% from April to May, according to the US Bureau of Labor Statistics. That compares with 0.8% for the US economy as a whole.

The Associated General Contractors of America (AGC), a trade group that represents contractors, conducted its own analysis based in the PPI figures released by the US. The AGC figures shows a much higher increase in prices for construction materials.

“The increase in producer prices for construction materials over the past year far outstrips contractors’ ability to charge more for projects,” said Ken Simonson, the association’s chief economist. “That gap means contractors are being hit with huge costs that they did not anticipate and cannot pass on.”

US-based adhesives producer HB Fuller is planning price increases worth $75m in August and September, on top of the $150m that took effect on 1 March through 15 July.

The price increases are in response to costs. HB Fuller expects its raw-material costs to rise by more than 10%, much larger than its earlier forecast of 5-8%.

HB Fuller is the first of the major US-based chemical companies to release their earnings. Its comments could presage more acknowledgements of cost pressure among other coatings, adhesives and sealants producers as they release their quarterly results later in the month.

Adhesives are made with vinyl acetate monomer (VAM), and ICIS assessed US spot export prices at an all-time high. On 22 June, ICIS assessments were up by more than 200% from the same time in 2020 and more than 175% from the same time in 2019.

Other chemicals and plastics used in construction are also at or near all-time highs.

– US spot prices for liquid epoxy resins (LER) rose by nearly 170% from the same time in 2020 and nearly 130% from the same time in 2019, based on ICIS’s assessment on 22 June. Epoxy resins are among the few chemicals for which June 2020 prices were lower than those in June 2019.

– US contract prices reached all-time highs for polyvinyl chloride (PVC), a plastic used to make pipes profiles and sidings.

– PVC products are made with plasticizers, and domestic producers still do not have enough supplies of plasticizers to meet demand, according to buyers. As a result, producers should maintain order controls in the near term.

– Polyurethanes are used in coatings, adhesives, sealants and insulation. One of the main polyurethanes feedstock, methylene diphenyl diisocycanate (MDI), is near previous record highs.

– Expandable polystyrene (EPS), another insulator, is near the record high set in May, according to ICIS. On 22 June, US spot prices for block EPS were up 84% year on year and 35% versus 2019.

– Quarterly US contracts for titanium dioxide (TiO2) hit record highs, although they are not much higher than in 2020 or 2019. TiO2 is a pigment used to make paints opaque.

TiO2 – and hence paints – could come under additional cost pressure because of the suspension of operations at a South African mine, which produces ilmenite and rutile ores used to make the pigment.

Rio Tinto, which operates Richards Bay Minerals, declared force majeure after the murder of the site’s general manager.

WHY ARE PRICES RISING

Several factors have contributed to the increase in prices for chemicals used in construction.

For unsaturated polyester resins (UPR), demand is high for boats and recreational vehicles (RV) as well as for construction.

For polyurethanes, both isocyanates and polyols are seeing increased demand from applications beyond construction, such as automobiles, appliances and mattresses.

For construction chemicals in general, homeowners took on do-it-yourself (DIY) projects while they were under coronavirus quarantines.

In the US, an active hurricane season caused many plants along the Gulf Coast to shut down.

Inventories were still recovering when Gulf Coast petrochemical plants suffered widespread outages in mid-February because of winter storm Uri.

Because inventories were already tight, many companies maintained force majeures and sales allocations for several weeks after they restored normal operations at their plants.

Fires and outages unrelated to bad weather have also shut down plants and further tightened supplies.

The shipping constraints and container shortages disrupting supply chains for other industries is restricting supplies for the petrochemical market.

Demand in general is high because of the opening of economy and government spending.

OUTLOOK

Markets could become more balanced in the upcoming weeks as companies lift the last force majeures and sales allocations.

Dow recently lifted its force majeure on VAM, which it declared in February after the winter storm.

US production of PVC continues to rise while weekly US PVC export prices have been falling.

US contract prices for ethylene have fallen to pre-storm levels, which should remove cost pressure on downstream producers.

If chemical plants can operate without any significant outages, they should be able to rebuild inventories, making supply chains more resilient against sudden disruptions.

The problem is that the petrochemical industry will remain vulnerable to shutdowns until the hurricane season ends on 30 November.

Meteorologists are predicting an above-average hurricane season. Already, a tropical storm made landfall in Louisiana, home to several petrochemical plants and refineries.

If a hurricane does damage plants, companies could need more time to resume operations. The same factors that have led to petrochemical shortages have lengthened lead times to make replacement parts for petrochemical plants.

Additional reporting by Stefan Baumgarten and Bill Bowen

By Al Greenwood

July 2, 2021

INSIGHT: Surging chemical prices pressure construction costs

Author: Al Greenwood

2021/07/01

HOUSTON (ICIS)–Rising prices for chemicals and plastics used in construction are raising costs in that sector, and more increases could arrive later in the year.

The US Producer Price Index (PPI) for final demand in construction rose by 0.6% from April to May, according to the US Bureau of Labor Statistics. That compares with 0.8% for the US economy as a whole.

The Associated General Contractors of America (AGC), a trade group that represents contractors, conducted its own analysis based in the PPI figures released by the US. The AGC figures shows a much higher increase in prices for construction materials.

“The increase in producer prices for construction materials over the past year far outstrips contractors’ ability to charge more for projects,” said Ken Simonson, the association’s chief economist. “That gap means contractors are being hit with huge costs that they did not anticipate and cannot pass on.”

US-based adhesives producer HB Fuller is planning price increases worth $75m in August and September, on top of the $150m that took effect on 1 March through 15 July.

The price increases are in response to costs. HB Fuller expects its raw-material costs to rise by more than 10%, much larger than its earlier forecast of 5-8%.

HB Fuller is the first of the major US-based chemical companies to release their earnings. Its comments could presage more acknowledgements of cost pressure among other coatings, adhesives and sealants producers as they release their quarterly results later in the month.

Adhesives are made with vinyl acetate monomer (VAM), and ICIS assessed US spot export prices at an all-time high. On 22 June, ICIS assessments were up by more than 200% from the same time in 2020 and more than 175% from the same time in 2019.

Other chemicals and plastics used in construction are also at or near all-time highs.

– US spot prices for liquid epoxy resins (LER) rose by nearly 170% from the same time in 2020 and nearly 130% from the same time in 2019, based on ICIS’s assessment on 22 June. Epoxy resins are among the few chemicals for which June 2020 prices were lower than those in June 2019.

– US contract prices reached all-time highs for polyvinyl chloride (PVC), a plastic used to make pipes profiles and sidings.

– PVC products are made with plasticizers, and domestic producers still do not have enough supplies of plasticizers to meet demand, according to buyers. As a result, producers should maintain order controls in the near term.

– Polyurethanes are used in coatings, adhesives, sealants and insulation. One of the main polyurethanes feedstock, methylene diphenyl diisocycanate (MDI), is near previous record highs.

– Expandable polystyrene (EPS), another insulator, is near the record high set in May, according to ICIS. On 22 June, US spot prices for block EPS were up 84% year on year and 35% versus 2019.

– Quarterly US contracts for titanium dioxide (TiO2) hit record highs, although they are not much higher than in 2020 or 2019. TiO2 is a pigment used to make paints opaque.

TiO2 – and hence paints – could come under additional cost pressure because of the suspension of operations at a South African mine, which produces ilmenite and rutile ores used to make the pigment.

Rio Tinto, which operates Richards Bay Minerals, declared force majeure after the murder of the site’s general manager.

WHY ARE PRICES RISING

Several factors have contributed to the increase in prices for chemicals used in construction.

For unsaturated polyester resins (UPR), demand is high for boats and recreational vehicles (RV) as well as for construction.

For polyurethanes, both isocyanates and polyols are seeing increased demand from applications beyond construction, such as automobiles, appliances and mattresses.

For construction chemicals in general, homeowners took on do-it-yourself (DIY) projects while they were under coronavirus quarantines.

In the US, an active hurricane season caused many plants along the Gulf Coast to shut down.

Inventories were still recovering when Gulf Coast petrochemical plants suffered widespread outages in mid-February because of winter storm Uri.

Because inventories were already tight, many companies maintained force majeures and sales allocations for several weeks after they restored normal operations at their plants.

Fires and outages unrelated to bad weather have also shut down plants and further tightened supplies.

The shipping constraints and container shortages disrupting supply chains for other industries is restricting supplies for the petrochemical market.

Demand in general is high because of the opening of economy and government spending.

OUTLOOK

Markets could become more balanced in the upcoming weeks as companies lift the last force majeures and sales allocations.

Dow recently lifted its force majeure on VAM, which it declared in February after the winter storm.

US production of PVC continues to rise while weekly US PVC export prices have been falling.

US contract prices for ethylene have fallen to pre-storm levels, which should remove cost pressure on downstream producers.

If chemical plants can operate without any significant outages, they should be able to rebuild inventories, making supply chains more resilient against sudden disruptions.

The problem is that the petrochemical industry will remain vulnerable to shutdowns until the hurricane season ends on 30 November.

Meteorologists are predicting an above-average hurricane season. Already, a tropical storm made landfall in Louisiana, home to several petrochemical plants and refineries.

If a hurricane does damage plants, companies could need more time to resume operations. The same factors that have led to petrochemical shortages have lengthened lead times to make replacement parts for petrochemical plants.

Additional reporting by Stefan Baumgarten and Bill Bowen

By Al Greenwood

July 2, 2021

Nigerian Influencer “Hushpuppi” Funded Life Of Luxury With Complex Email Schemes, FBI Alleges

by Tyler DurdenThursday, Jul 01, 2021 – 05:45 AM

For Instagram “influencer” Hushpuppi, also referred to as the “Billionaire Gucci Master” Ramon Olorunwa Abbas, living a life of private jet setting and luxury on Instagram in front of his 2 million followers turned out to not only be his claim to fame, but also the straw that broke the camel’s back for his empire. While many looked on at his life of luxury in awe, questions started to arise about how he obtained, and maintained his wealth. The answer lied in the evolution of the often mocked “Nigerian email scam” that we have all become used to.

Hushpuppi always maintained the questions about his wealth were “the jealousy of so many haters”, a lengthy new Bloomberg profile notes. “As I turn a year older into my 30s today, I want to celebrate all of you out there,” the influencer said to his fans on his 37th birthday. “Those of you who mostly I have never met, spoken to or anything but have been a strong supporter of me through every situation until this point and still riding for me, I want you to know wherever you are that I celebrate and appreciate you today, today is OUR DAY!”

It was one of many posts he made flaunting his wealth and engaging with his followers who supported him while he jet-setted, beefed with celebrities online, and did his best to side-step questions about where, exactly, his success came from.

His captions to his photos would make his life of luxury look like the honest success of the son of a taxi driver and bread salesman from Nigeria. But of those who he likely didn’t celebrate or appreciate was the FBI, who is the driving force behind United States of America v. Ramon Olorunwa Abbas, which alleged in a California federal court that Abbas engaged in “conspiracy to launder money obtained from business email compromise frauds and other scams”.

For example, a small sliver of the cash he received as part of these schemes was $922,857.76 sent by a New York law firm that was supposed to be sending it to one of its clients. A paralegal at the firm received a fax from “someone in Abbas’ orbit” directing her to send the payment to a Chase bank account and initiated the transfer without even thinking twice. The firm didn’t even notice the cash had been misallocated until later in the month.

The transfer was part of a relatively sophisticated “business email compromise” scheme that Abbas and his co-conspirators implemented around the world, the FBI alleged.

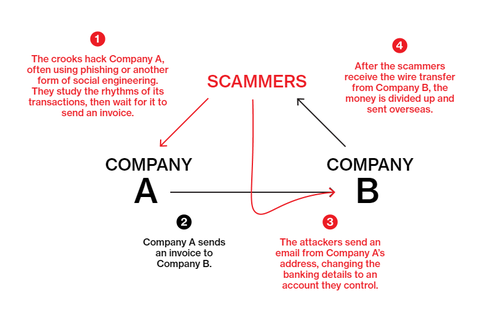

Bloomberg, in their profile, described how the BEC scam works:

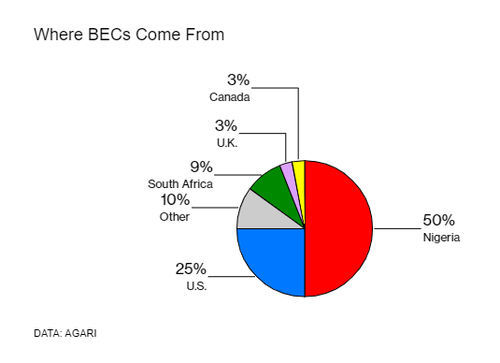

BEC attacks started appearing roughly a half-dozen years ago, escalating each year until they surpassed all other forms of internet fraud. The FBI reports there were almost 20,000 such scams against American businesses in 2020 alone, accounting for $1.8 billion in losses, though the variety of BEC crimes can make totals hard to pin down. Crane Hassold, the senior director of threat research at the cyberdefense company Agari Data Inc. and a former FBI analyst, likes to define a BEC as “a response-based impersonation attack that’s requesting something of value”—basically, posing as a legitimate business to trick people into giving away their money.

No matter the flavor, a BEC scam generally begins with someone hacking into a corporate email account often using social engineering tactics like phishing. Once inside, the perpetrators don’t steal anything, not at first. Instead they quietly begin forwarding copies of incoming and outgoing email to themselves. Then they wait. “They watch it for a number of weeks or months, looking for details of certain payments that are going out, understanding who their customers are, looking at communication patterns,” Hassold says. When they spot an invoice coming in or out, they “use that intelligence to insert themselves into an actual payment that is supposed to be due.”

Those who participate in the scheme are loosely networked and work together. There’s different roles for the scheme too: your hackers, your money mules, and even people tasked with controlling international bank accounts that can accept millions of dollars in transfers.

Crane Hassold, the senior director of threat research at the cyberdefense company Agari Data Inc. and a former FBI analyst, told Bloomberg: “These attacks are so realistic-looking, most people don’t give it a second thought. Because when you’re involved in payments like these, you see a lot of these emails every single day. And when it doesn’t raise any red flags, you are not going to go up the chain and do any confirmation. One would expect that when you get into larger and larger and larger amounts of money that are exchanging hands, that there would be some process that requires secondary authorization or something like that. But in many cases, that’s not what actually happens.”

He continued: “I think that most people think of BEC attacks as just basic, boring attacks, and most people don’t think it’s as big a problem as it actually is. When you look at the amount of money that is actually lost to ransomware, it’s a drop in the bucket compared to what’s lost in BEC attacks.”

“A lot of the same concepts that go into these BEC attacks, criminals and scammers in West Africa have been doing for decades at this point. Those were all individually targeted social engineering attacks. And essentially what happened was, around 2015, cybercriminals started seeing that they could make more money targeting businesses than they could targeting individuals,” he continued.

People from the neighborhood where Abbas grew up in Nigeria “began to drift into online scamming in the early 2000s”, the report notes. But since no one would associate with them once they revealed themselves as Nigerian, the schemes evolved. “Scams evolved over a decade from money-order fraud to check-cashing scams to romance scams to BECs,” the report notes.

In terms of motivation, aside from the obvious, Abbas appeared to take exception with the system where he grew up, saying in one Snapchat video: “My mother is from the Niger Delta part of Nigeria, where Nigeria’s oil comes from. She has never benefited one dollar. One dollar! And she is over 60 years old.”

Olayinka Akanle, a sociology professor at the University of Ibadan who’s studied youth and cybercrime said: “Cybercrime is a metaphor for a more deep-seated and deep-rooted problem in Nigeria. When people face survival challenges, they innovate. And when they innovate, if there is no system to address their innovation in a very decisive way, it becomes the norm.”

He started to show off the money he was making on Instagram as far back as 2012. Several years later, one of his close associates, Samson Oyekunle, after moving to Houston in 2017, was arrested and charged with “participating in multiple BEC frauds” and was sentenced to 5 years in jail. Abbas had moved to Dubai by then and the walls were closing in him, too. With evidence mounting about how he was making his income, his time ran out in 2020.

When Dubai police raided his hotel room and arrested him in 2020, they were so proud of the takedown, they took a page out of Abbas’ book: they posted the raid on social media. https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X2hvcml6b25fdHdlZXRfZW1iZWRfOTU1NSI6eyJidWNrZXQiOiJodGUiLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3R3ZWV0X2VtYmVkX2NsaWNrYWJpbGl0eV8xMjEwMiI6eyJidWNrZXQiOiJjb250cm9sIiwidmVyc2lvbiI6bnVsbH19&frame=false&hideCard=false&hideThread=false&id=1276133837374926850&lang=en&origin=https%3A%2F%2Fwww.zerohedge.com%2Fmarkets%2Finstagram-influencer-hushpuppi-lived-his-life-luxury-nigerian-business-email-compromise&sessionId=c48311dd53bbc040a94232a7a2bddc6e70430d6f&siteScreenName=zerohedge&theme=light&widgetsVersion=82e1070%3A1619632193066&width=550px

You can read the entire Bloomberg feature on Hushpuppi here.