The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 28, 2023

Mitchell Gold + Bob Williams abruptly ceases operations

By Larry Adams

August 26, 2023 | 9:49 pm CDT

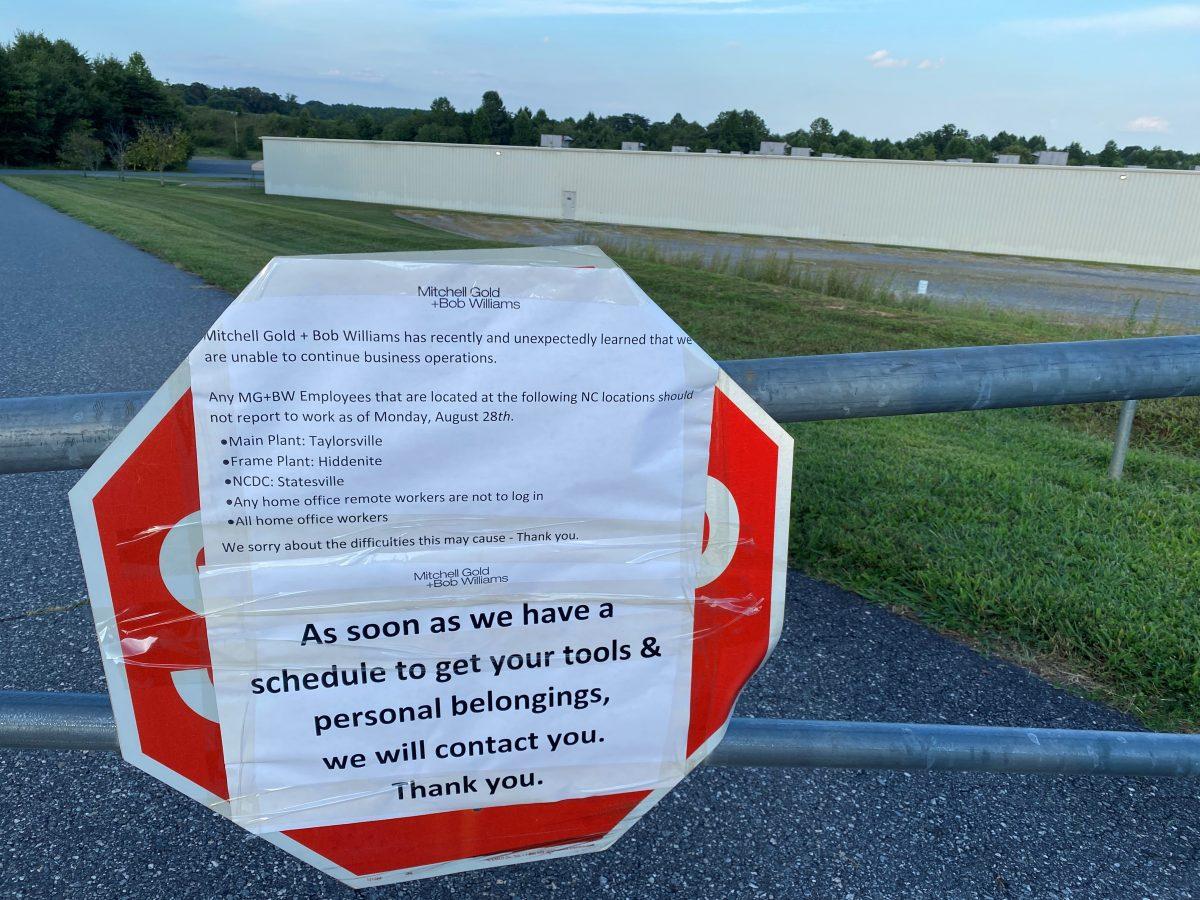

A sign informing workers and vendors that the company was closed.

Photo By Taylorsville Times

Mitchell Gold + Bob Williams has abruptly shut down its operations telling its employees by letter and email that the company has “recently and unexpectedly learned that we are unable to secure critical financing to continue business operations.

“In the wake of this unfortunate development, the Company will sadly need to wind down operations and terminate the employment of our employees beginning on August 26, 2023.”

According to the report in the Taylorsville Times, the company posted signs on the truck gate and office door of the Taylorsville plant at One Comfortable Place off Millersville Road dated Saturday, August 26.

The signs, according to images taken by Times reporters and posted to their website, said:

“Mitchell Gold + Bob Williams has recently and unexpectedly learned that we are unable to continue business operations.

“Any MG+BW employees that are located at the following NC locations should not report to work as of Monday, August 28th:

- Main Plant: Taylorsville

- Frame Plant: Hiddenite

- NCDC: Statesville

- Any home office remote workers are not to log in

- All home office workers.

“We are sorry about the difficulties this may cause.

“As soon as we have a schedule to get your tools & personal belongings, we will contact you. Thank you.”

A copy of the letter addressed to employees was taped to an entry door. Dated August 26, the letter was from Chris Moye, the interim CEO named to the post in April 2023, who said the current economic climate has presented significant challenges to the furniture industry.

According to the WARN notice letter:

“Because these events were unforeseen, we were unable to provide you and others before notice of this difficult decision.

“Your position will be affected by these events. And, your last day of employment with the company is expected to be on October 25, 2023. Unless you are asked to perform additional services during the 14-day period from that date, or your layoff date is otherwise revised from that date. We are sorry to have to bring you this news.

“There are no ‘bumping rights’ to determine who will be separated and this is a permanent separation.”

According to the notice, workers will receive final wages through their last day of employment. Benefits from the company including health insurance benefits will end on August 31, 2023.

Mitchell Gold was ranked #60 in the FDMC300 list of North American wood products companies. According to the most recent ranking, the company had annual sales of $197.2 million, employed 750 workers, and operated three manufacturing plants encompassing 579,500 total square footage.

This marks the third major company to shutter its doors in August. All three were ranked in the FDMC300 ranking. Of the three, two were North Carolina-based companies.

On Aug. 7, Asheboro, N.C.-based Klaussner Home Furnishings announced it was shuttering its operations effective immediately. The company ranked #36 on the FDMC 300 listing with estimated sales of more than $300 million in 2022.

Much like Mitchell Gold, the company pointed to “challenging and unexpected business circumstances” that impacted their business and forced them to “unexpectedly wind down the operations.” The closure impacted 884 workers, and, of those, more than 800 were employed at five Asheboro, North Carolina, plants, and 58 were employed at a Candor, North Carolina, facility.

Also in August, Solid Comfort, a Fargo, North Dakota-based company closed its doors and began the process of selling its manufacturing plant and auctioning its equipment.

According to its most recent FDMC 300 listing, the company ranked #191, had sales of $34 million, employed 125 workers, and had more than 225,000 square feet of manufacturing space.

August 28, 2023

3M Shares Jump As Litigation Payout On Defective Military Earplugs Viewed Favorably By Analysts

by Tyler Durden

Monday, Aug 28, 2023 – 07:45 AM

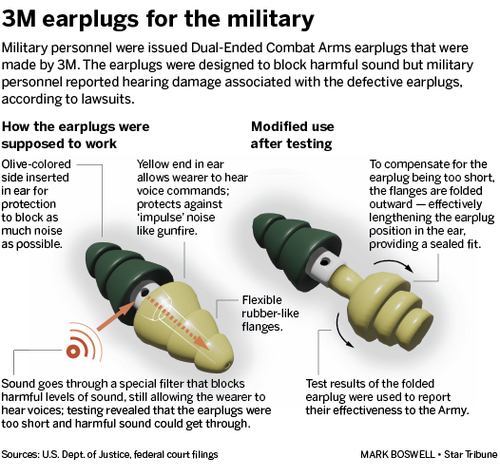

3M shares gained in premarket trading in New York after Bloomberg reported the company “tentatively agreed” to pay $5.5 billion to settle the largest mass tort in US history, with 300,000 lawsuits by veterans that claim earplugs made for combat failed to protect them from hearing loss.

Under the discussed terms, people familiar with the settlement said 3M would pay $5.5 billion, resolving the massive lawsuit overhang, which is half of the $10 billion some Wall Street analysts predicted. Shares are up 6% because of this.

“Sounds like 3M negotiated a pretty good deal for itself, given this litigation has been weighing on them for the better part of a decade,” Carl Tobias, a University of Richmond law professor who teaches about product liability cases, told Bloomberg.

Bloomberg Intelligence projected the possibility that 3M would have had to pay out around $9.5 billion, whereas Barclays analysts estimated $8 billion.

Commentary from Wall Street analysts was favorable regarding the smaller settlement (list provided via Bloomberg):

Citi (Neutral, PT $111)

- The potential settlement is smaller than some investors expected, analyst Andrew Kaplowitz writes in a note; could mark another step in 3M alleviating its legal burden and moving away from litigation noise that has been weighing on the valuation and could be received favorably by investors

- Notes 3M still faces uncertainty regarding its per- and polyfluoroalkyl substances related exposure

RBC (Underperform, PT $100)

- News of any settlement is typically initially seen as good news, since it represents some tangible progress toward resolving what is still expected to be a long litigation road ahead for 3M along multiple fronts, writes analyst Deane Dray

- Positive stock reaction is due to a combination of slightly lower than expected settlement figure and a positive reaction associated with the potential alleviation of one of its two legal headwinds

Bloomberg Intelligence (No rating)

- Analysts including Joel Levington say, “3 M’s $5.5 billion agreement to resolve 300,000 lawsuits over military earplugs, as reported by Bloomberg News, may not stop the A2/A- rated company’s ratings from being downgraded further”

Bloomberg noted, “3 M’s board still must sign off on the deal.” And comes as the company faces thousands of other lawsuits over PFAS “forever chemicals.”

August 24, 2023

Here’s how Art Van heirs, trustee settled bankruptcy lawsuit

Thomas Lester//Retail Editor//August 24, 2023

WILMINGTON, Del. — An $8 million settlement in federal bankruptcy court was reached on Aug. 23 between heirs of Art Van Elslander and trustee Alfred T. Giuliano, in relation to defunct retailer Art Van Furniture’s sale to private equity in 2017.

Under terms of the settlement, the majority of the settlement will be paid by National Union Fire Insurance Company. The agreement is not an admission by the parties of any of the allegations made, and the trustee released the defendants from all claims.

“Thanks to the parties for working through the issues. This obviously looks like a very sensible resolution,” Judge Craig Goldblatt of U.S. Bankruptcy Court in Delaware said last week when approving the settlement, according to The Detroit Free Press.

Gary Van Elslander, the son of Art Van Elslander, told The Free Press that the family is glad that the suit was settled, but it remains a painful final chapter for the family and employees of the former Warren, Mich.-based retailer.

“Who I feel really bad for is the employees of Art Van,” he told reporter J.C. Reindel. “My father always said that the heartbeat of the company was the people, and that was a fact — and they probably got hurt worse than anyone. The Van Elslander family, our feelings were hurt, my father’s legacy was hurt, but the pain that the employees felt was real, and that I think we probably feel worse about.”

Gary Van Elslander told The Free Press that, ultimately, the push for expansion and bringing in outside leadership helped doom the company.

“I think along the way that some of the culture of the business was lost,” he said. “We had a very driven culture, very hands-on among the executive team with our retail stores, and I think a lot of that was lost. There was management that was hired that was from outside the Detroit area. They really didn’t understand the legacy and the brand of Art Van Furniture as well as they could have, didn’t put enough importance on it.”

In the original complaint, filed March 7, 2022, Giuliano sought to recover more than $105 million in “fraudulent transfers” and more than $84.7 million in certain real properties, among recoveries.

The complaint alleged that Art Van’s sale to Thomas H. Lee Partners in 2017 for $620 million was a highly leveraged transaction, accomplished by stripping the value out of the debtors’ owned real properties and saddled the debtors with an unsustainable debt load for the benefit of the defendants and detriment of the debtors and their creditors.

It stated that prior to the acquisition, Art Van paid less than $23 million per year in total lease obligations and had $136.5 million in total future lease obligations. After a spate of sale/leaseback transactions, the debtors’ minimum lease obligations ballooned to $46 million per year and more than $877 million in total future operating lease obligations.

On March 8, 2020, Art Van filed for relief under Chapter 11 of Title 11 of the United States Code with the U.S. Bankruptcy Court for the District of Delaware. In April 2020, the Chapter 11 cases were converted to Chapter 7.

Just prior to beginning bankruptcy procedures, Art Van ranked No. 14 in Furniture Today’s 2020 Top 100 with $1.043 billion in sales across 192 stores in 2019.

“Eerily Simlar to Klaussner . . . “

August 23, 2023

US New Home Sales Soar To 17-Month Highs In July As Mortgage Rates Spike

by Tyler Durden

Wednesday, Aug 23, 2023 – 10:08 AM

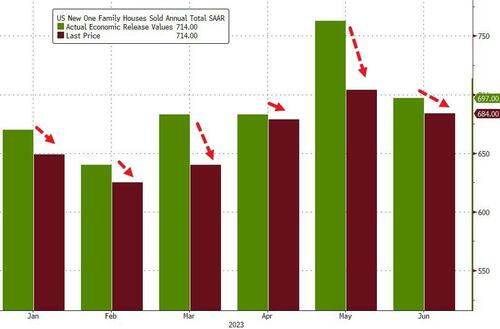

After the disappointing (but not unexpected) decline in existing home sales, new home sales – of course – saw a big upward surprise 4.4% MoM surge in sales, leaving year-over-year sales up an astonishing 31.5%…

Source: Bloomberg

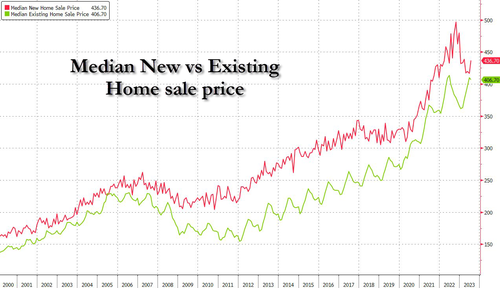

The divergence between new and existing home sales continues to gape wider…

Source: Bloomberg

As a reminder, we have seen huge downward revisions to new home sales figures this year…

Source: Bloomberg

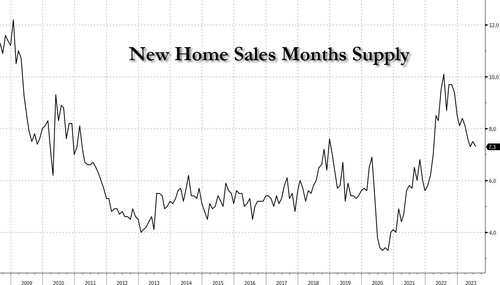

Supply continues to shrink…

Source: Bloomberg

…which helped push median new home sales prices back up in July – even as mortgage rates began to spike…

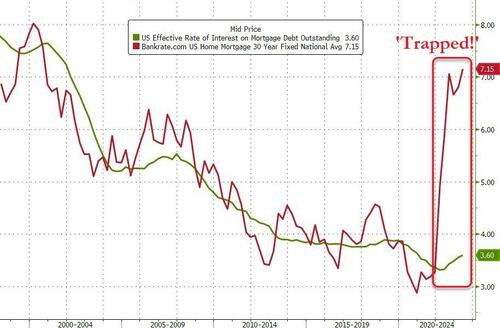

Finally, we note the dramatic gap between the current 30Y mortgage rate and the effective rates that borrowers are currently paying on their home loans…

Source: Bloomberg

The gap hasn’t been this wide since the early 1980s – which helps explain why inventories of existing homes for sale are so low… and thus ‘new homes’, subsidized by homebuilders, is the only option for many.

That’s quite subsidy…

Are home-builder stocks starting to catch on?

But how long can homebuilders continue bleeding profitability to fill that gap?

August 21, 2023

Jiahua announces a 20 Million USD expansion of North American operations

Jiahua announced today the expansion of their North American operations through the establishment of

our facility in Northern Mexico in Ramos Arizpe, Coahuila State. The new plant is owned by Jiahua’s US

subsidiary JCI Advanced Materials. The plant is set on 40,000 Sq meters of land with the initial factory

building being 5000 Sq meters. The plant is designed with 8 production trains that include mixing,

chemical reaction and storage of finished chemical products.

Jiahua is known as a leader in China in the area of Alkoxylation with 1.4 million metric tons of capacity in

6 different cities in China. This investment in North America is part of a globalization strategy being

employed currently by Jiahua. The main products of Jiahua are polyether polyols, amines and PCE’s

used in cement and admixtures, and surfactants used in a variety of applications.

Jiahua’s effort in the Americas has been underway for the last 4 years though it’s US subsidiary JCI

Advanced Technology. JCI has quickly established market share in the polyether polyol space through

development and implementation of a logistics and customer service network across the USA that

included shore tanks and a rail fleet. “As customer service is core to JCI’s value proposition, the

onshoring of the supply chain through the new plant in Mexico is just the next logical step in our growth

in the America’s” stated Timothy Earl Madden, CEO of Jiahua US Holdings and JCI Advanced Technology.

He added “while we focus on bringing up the Mexico plant by February 2024, we are also taking

additional steps that will further shore up our position in the Americas”.

About Jiahua: JIAHUA CHEMICALS INC. is a global chemical company based in Shanghai China. Jiahua is

dedicated to the research and development, production and sales of ethylene oxide and propylene

oxide downstream derivatives and other specialty chemicals. The company has set up five business

units: Construction Chemicals, Performance Materials, Care Chemicals, Coating and Industrial additives,

and Functional Materials. The products are widely used in construction, automobile, home furnishing,

coatings, oil fields, textile printing and dyeing, pesticides and other industries.