The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 6, 2023

Yellow shutdown likely means LTL price increases, analysts say

The low-cost carrier’s rivals see an opportunity to bring in loads at higher rates as bankruptcy looms.

Published Aug. 4, 2023

David TaubeAssociate Editor

Yellow Corp.’s shutdown has left shippers without a major player in the less-than-truckload space — a development that means higher costs are likely in store, according to trucking industry analysts.

“There’s probably going to be an increase in the pricing charged to the shipper,” said Craig Decker, who leads investment banking activities across supply chain, logistics and transportation areas at Brown Gibbons Lang & Co.

The price difference could be a 20% to 25% price per pound increase depending on the circumstances, DAT Chief of Analytics Ken Adamo suggested on a weekly market update show. All together, he said the price increases could be 7% to 10% higher.

“[If] you decided late last week to send ArcBest, Old Dominion, XPO and FedEx Freight your data to get some rates back, probably by late this week you’re going to be fully processing the sticker shock of how much of a price increase you’re going to have to take over what Yellow was charging you,” Adamo said.

XPO executives noted Friday on a Q2 earnings call that Yellow’s shuttering is disrupting the market and accelerating their pricing. ““Our customers understand: When you take 10% of capacity out of the market, it’s going to cost more to move freight,” incoming CFO Kyle Wismans said.

The increase to rates comes as a result of Yellow’s role in the trucking market: Shippers who relied on the low-cost carrier are likely left with higher-priced alternatives, analysts said.

“As one of the US’ most cost-effective LTL transport companies, businesses switching from Yellow to a more expensive rival carrier will experience a twofold cost increase,” Charles Haverfield, CEO of U.S. Packaging & Wrapping, said in emailed comments.

Haverfield said this is particularly true if shippers have not built relationships with other carriers to secure discounted prices or if they switch to smaller trucking companies that cannot leverage Yellow’s economies of scale to lower prices for their services.

“The best approach is for businesses to adopt a comprehensive approach, encompassing both major carriers and smaller freight companies,” Haverfield said.

Shippers had been diverting freight to other carriers, brokers and the spot market even before Yellow confirmed it was shutting down terminal operations and laying off workers.

August 3, 2023

Green Bay Packers Acquires Foamation, Maker of PU foam Cheesehead Hats

The Green Bay Packers announced today the organization has acquired Foamation Inc., the company responsible for creating the original Cheesehead® hat, along with a wide variety of specialty foam products.

Foamation, based in Milwaukee, was founded by Ralph Bruno in 1987. Bruno first wore the Cheesehead hat to a Brewers game, after having the idea for the unique headwear while reupholstering his mother’s couch and seeking an opportunity to poke fun at the sports fans south of Wisconsin. He burned holes in the foam to give it a Swiss cheese-like appearance and painted it yellow to look like cheddar.

The one-of-a-kind hat turned out to be big hit while Bruno was tailgating before the game, and a new tradition began; the Cheesehead has since become a universally recognized symbol for Wisconsinites and Packers fans.

After more than 30 years of growing Foamation, which offered the hats and a variety of other specialty cheese-like foam products, the Brunos were ready to shift gears. Since the Packers were already the largest purchaser of their products – in order to keep them stocked in the Packers Pro Shop – the couple approached the team to determine the next steps for Foamation.

With an already beloved, iconic brand like the Cheesehead, the Packers were excited about the opportunity to continue growing the brand.

“The popular Cheesehead hats have come to represent Packers fans all over the world and we’re excited to officially welcome this special brand to the Packers organization,” said Packers vice president of marketing and fan engagement Gabrielle Dow. “We’re looking forward to building upon the legacy the Bruno family has created over the years and offering our fans even more Cheesehead items to love.”

The Packers have sold Foamation’s products in the Packers Pro Shop for several years. All Cheesehead hats and related foam products will continue to be manufactured in Wisconsin.

“After many years of working with family and friends to build the Cheesehead brand, we are pleased to pass it on to the Green Bay Packers,” said Ralph Bruno. “We have had a very special relationship with the Packers over the years, and my wife, Sue, and I are both very excited about what the Packers can do with the Cheesehead going forward.”

A variety of Cheesehead products are currently available in the Packers Pro Shop in-store and online at packersproshop.com, and the team is exploring several opportunities to grow the brand and create new products for fans to enjoy this coming season.

https://www.bizjournals.com/milwaukee/news/2023/07/24/green-bay-packers-acquire-cheesehead-maker.html

August 3, 2023

Covestro AG (CVVTF) Q2 2023 Earnings Call Transcript

Aug. 01, 2023 3:32 PM ETCovestro AG (CVVTF), COVTY

139.22K Followers

Covestro AG (OTCPK:CVVTF) Q2 2023 Earnings Conference Call August 1, 2023 9:00 AM ET

Company Participants

Ronald Koehler – Head of IR

Markus Steilemann – CEO

Thomas Toepfer – CFO

Markus Steilemann

Hello and a warm welcome also from my side to the results of our second quarter call. We are still operating in a challenging environment characterized by weak demand, de-stocking and industry wide price pressure. Consequently, our sales were significantly down year-on-year to €3.7 billion. In line with our guidance we achieved a second quarter EBITDA of €385 million. Free operating cash flows strongly improved year-on-year and was minus €10 million only slightly negative in a seasonal weak quarter. This was supported by a rigorous working capital management.

For full year 2023 we confirmed our guidance for all KPIs, however, we now expect to be rather at the lower half of the guidance ranges. Finally, we continued our 500 million share buyback program and brought back 1.2 million shares during the quarter.

On the next page, we’re coming now to the business and the volume development in the second quarter of 2023. Year-on-year, the global sales volumes decreased by 8%. This was caused by on-going demand weakness across all regions and limitations in our internal availability. Looking across the industries, we see quite a mixed development with auto and electro on a growth path, but furniture and construction with declining volumes.

Europe is continuing to be the weakest region with significant decreases in almost all industries important to Covestro, except automotive, where we had a slight increase. Part of the volume weakness was still caused by the known production limitations and chlorine in Germany. The gradual ramp-up of the production during the second quarter has been on schedule and we expect this to continue throughout the third quarter, resulting in a return to full output in the fourth quarter of 2023.

Sales volumes in North America also declined across most industries. Construction witnessed a significant decline, whereas electro and furniture were only slightly down. And in line with the global trend, auto transportation improved slightly. Against the overall declining trend in the other regions, Asia-Pacific showed a positive volume development. This was driven by a low comparison basis as we suffered from the COVID lockdowns last year. Compared to this low basis, electro, automotive and furniture achieved significant growth. However, despite the weak basis, construction still slightly declined.

With that summary of the demand development, I’m now handing over to Thomas, who will guide you through the financials.

Markus Steilemann

Thank you, Thomas. Now we’re coming on the next page to the outlook for Covestro’s core industries. Since beginning of the year, the outlook of the global GDP has slightly improved from 1.5% to now 2.4%. Although the message sent from this is positive, our core industries are not the beneficiary of this development.

After the end of the COVID pandemic, the service sector is more than proportionately benefiting from the regained freedom of travel and socializing, thus driving this GDP growth. Most of the producing sector remains stuck in the on-going demand weakness and destocking trend. It’s important to Covestro, we see that only automotive is expecting a further improved demand raised to 6% now.

The expectation for the construction industry has deteriorated and even turned negative. The reason for these trends are the high interest rates, higher cost for building materials and on-going destocking. The furniture industry is seeing a very similar trend with now an expected second year of declining markets. The demand expectations for electro were also adjusted downwards to almost no growth.

With this disappointing development of our core industries, let us now turn to the Covestro outlook for the third quarter and the full year 2023. On Page 15, you see as explained in the outlook for our core industries that we currently see the potential risk of a further deteriorating economic environment and on-going demand weakness for the remainder of the year.

Therefore, we currently expect our EBITDA to come out at the lower half of our guidance of €1.1 billion to €1.6 billion for the full year 2023. We expect now volumes to decrease mid-single digit percent year-on-year for the full year 2023. However, the second half of 2023 will result in higher available capacities from resolving our production limitations towards the first quarter 2023.

This should allow us to continue a slight quarter-over-quarter volume growth in 2023. The current mark-to-market calculation comes out at about €1.2 billion based on July margins flat forward. This is in line with the midpoint of the lower half of our EBITDA guidance. We are confirming the mid-cycle EBITDA level of €2.8 billion in 2024.

We are confident that we can achieve such an EBITDA level in a normal economic environment. The most important element of bridging the gap would be a high utilization rate of our plants.

Without further investments, we could grow our volumes by more than 20%. Even on today’s depressed product margins, this would translate into an additional EBITDA contribution of more than €1 billion.

Thomas Swoboda

Yes, good afternoon everybody. I will risk two questions, please. Firstly, on your guidance for Q3, it seems that you were pointing to a more negative pricing delta in Q3. Could you discuss where you see pricing pressure in particular on product, product and regional level, if possible.

My second question is — and I will risk asking on the current situation, but I will ask it indirectly. In terms of your of your long — mid to long-term growth ambitions do you currently face any limitations in terms of backward integration financing capabilities? Or how can I put it, being very being very exposed to the capital market that are limiting your growth vice versa, if you would have limited resources and would be shaded from the public a little bit more, would you be able to grow much, much faster than you would be — then you are able to grow currently in the mid to long-term. Thank you.

Thomas Toepfer

So Thomas, let me maybe take the first question with respect to the guidance in Q3 and also what that means with respect to the pricing delta. So first of all, I would confirm that for Q3, we’re expecting a negative pricing delta. If you look at it from a quarter-over-quarter perspective, so that could be somewhere in the region between €150 million to €200 million negative. If you look at it from a year-over-year perspective, I’d say it’s almost neutral.

So what is it that we’re seeing quarter-over-quarter is mainly a weakness in TDI, mainly in Europe, but also to some extent in other regions. The polio weakness will continue and there might be a little bit more downside in PCS commodities, while MDI, we rather would assume that it is flattish. So it’s a mix mainly coming from our quality businesses where as I said sequentially, we would see that there is a negative pricing delta, as you correctly said. However, again, year-over-year, it’s almost neutral.

Markus Steilemann

Thomas, this is Markus speaking. Thanks for your question and coming to the second question that you have asked. Covestro has a very clear strategy. It’s well positioned in the key regions. That means North America, Europe as well as Asia Pacific. And we have access to very competitive and sufficient and reliable raw materials, be it on smaller raw materials or strategic raw materials for our business.

And in that context, with regard to the limitations that you indicated also on growth, we do not see neither by the way how we are financed or let’s say, well, by the respective resources limitations on our growth opportunities.

Jaideep Pandya

And then the third question, I’m sorry to ask you this very directly now. But I mean what is your different strategy given that finally, somebody is knocking on your door little loudly. So if this is real, how are you defending this? Or are you just using the famous words, no comment and not talking. So can you please confirm what is official version from Covestro on ADNOC? And how are you defending it if it is real? Thanks.

Markus Steilemann

So that’s for your second question. And on the third question, I have to say that Covestro does not comment on rumors and that this is a general policy. And so I also, in this case, please bear with me if I say that Covestro does not comment on respective market rules.

Jaideep Pandya

Sorry to just – apologies for this but. So you’re basically saying you can even say, if you’ve got an offer or not, this is all market rumor. Is that how we should understand this comment?

Markus Steilemann

You should understand the comment as it says, Covestro does not comment on rumors.

Geoffery Haire

Hi, thank you for letting me ask a question. So I apologize in advance for the question. Leaving aside any potential bidder for Covestro and price. What does the Supervisory Board and the Management Board look for when it comes to a potential suitor?

Markus Steilemann

Well let me be very clear on that point. We are at any given time committed to all stakeholders. So we are at any given point in time looking at all options that make sense. And therefore, let me also hear rest assured the Board of management is fully aware of its fiduciary duties. And in this context, aligns any of its decision solidly with the interest of its shareholders and the shareholders. So this principle is embedded in and also secured by a regular exchange with the Supervisory Board. I hope that gives you some clarity around your questions.

Geoffery Haire

Okay, thank you. And thanks Thomas for all your help over the years.

Jaideep Pandya

Yes, thanks a lot. The question really is just around your asset network, specifically in Europe. I mean Markus, you mentioned about the 20% volume uplift, but it sort of looks like we might be in a cycle where that is a bit far away. So — and then if I look at the Chinese plants that are coming up, the nameplate capacity is at par with yours or even higher than yours.

So in that context, does Europe need to shut down maybe 15%, 20% of polyurethane capacity to actually balance and have a situation where you just don’t get swamped from imports? Or can you actually survive a benign demand environment in Europe and still maintain profitability or breakeven or above breakeven? Just want to understand what is your European profitability today? And if volumes don’t improve, where do we go? Thanks.

Markus Steilemann

Yes. Jaideep, thanks for your follow-up question. And on spot so to say, I would say, because for sure, we also having all those questions in mind. But let me elaborate a little bit of that. I don’t know whether you call — recall the year 2015. In 2015, we had also quite significantly underutilized European assets, and we made it in about a year. Those assets were filled. Then if you look at today’s situation and the industry cost curves, we are in almost every product, in every let’s say, plant that — where we produce that the cost leader and where we haven’t been the cost leader, we invested in the plants, for example, Tarragona, Spain into chlorine production, which now puts this asset from our perspective into the cost-leading position in Europe. Then it also has been mentioned, I think by Thomas a little bit earlier, the closure of the TDI/BSF plant held, as already said. And in that context the imports that we are currently seeing is mainly coming from high-cost producers, which have assets outside of Europe and try to import Asia Pacific to supply their customers with their own demand.

So in general terms, I see that MDI demand should accelerate because the MDI demand is driven by energy-efficient buildings, as you know. And we think next to the fact that there is a construction industry decline refurbishment of existing buildings will get more and more important to get to the carbon dioxide emission reduction targets that the European Union has. And that’s why there will be sufficient and additional demand for MDI returning plus that assets are the ones that are leased underutilized. That means the assets that should be first, if I may say so, back into the positives is definitely MDI then followed by TDI, once again, BSF closure helps and then the polycarbonates, but here only the standard polycarbonates, whereas we have more or less now 4/5 of our external sales in the non-standard polycarbonates, so they’re highly blended grades for special applications.

So long story short, it’s about cost leadership in Europe. It is about that we see opportunities that demand will come back in industries where it counts and that at current energy price levels with a leading cost position, we also feel comfortable and competitive against attempts to import material from outside Europe. So all in all, you could only look at the negative side. But as an individual company, we feel very well positioned to also master this challenge and also return back may I call it to enjoyable margin levels. Currently, we deliver positive results, but they’re definitely not at an enjoyable level. Let me put it that way.

Thomas Toepfer

Well, thank you very much, Carston [Ph]. I just wanted to steal two minutes of your time for thanking, first of all, Markus, thank you very much for your kind words. I can only say it was always a pleasure and a real privilege to be part of the Covestro team. I think it’s an absolutely fascinating and great company, and I really felt privileged to be part of it over the last 5 years.

And secondly, I would like to thank everybody on the call for – for the many discussions that we had over the last 5 years for following Covestro through some ups and downs and for challenging us with your questions. It was also always a real pleasure to be in touch with you.

And I’m really looking forward to at least meet some of you again in the future. Again, let me conclude by saying I’m really very attached to Covestro and it’s also, to some degree, with a heavy heart that I’m leaving. But of course, it’s a little bit of a personal decision because it will be — because it will bring me back to Hamburg, which is my home city. And therefore, it’s kind of a homecoming for the family. So with that, Carston, back to you and — or back to Ronald, I think to conclude the call, and I wish everybody a nice summer holiday.

August 3, 2023

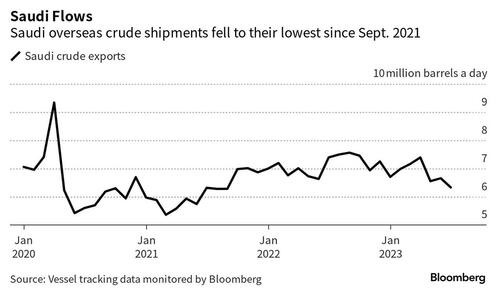

Oil Rebounds After Reports That Saudis Will “Extend, Deepen” Voluntary Production Cuts

by Tyler Durden

Thursday, Aug 03, 2023 – 09:00 AM

Update (0900ET): Well, we appear to have our answer to the most anticipated question for oil traders.

We noted earlier (below): “We see no looming change in the group’s current supply cadence, nor the required production adjustments set to take effect in 2024,” says Helima Croft at RBC Capital Markets, in a note.

“The question that market participants remain focused on is whether Saudi Arabia will sunset its unilateral 1 mb/d cut at summer’s end or roll it over for another month.”

The Saudi Press Agency is reporting:

An official source from the Ministry of Energy announced that the Kingdom of Saudi Arabia will extend the voluntary cut of one million barrels per day, which has gone into implementation in July, for another month to include the month of September that can be extended or extended and deepened.

In effect, the Kingdom’s production for the month of September 2023 will be approximately 9 million barrels per day.

The source also noted that this cut is in addition to the voluntary cut previously announced by the Kingdom in April 2023, which extends until the end of December 2024.

The source confirmed that this additional voluntary cut comes to reinforce the precautionary efforts made by OPEC Plus countries with the aim of supporting the stability and balance of oil markets.

This has prompted gain in WTI, erasing much of yesterday’s DOE-driven dump…

* * *

As Bloomberg’s Grant Smith detailed earlier, the biggest question in oil markets is how long Saudi Arabia will extend its 1 million-barrel-a-day supply cut. Riyadh’s handling of a previous strategy offers some guidance — and reassurance — for crude bulls.

The kingdom launched the unilateral cutback last month in a bid to shore up global oil markets, undertaking the solo effort as its comrades in the OPEC+ coalition had already cut output as much as they could bear. It’s had some qualified success, boosting Brent prices to a three-month high above $85 a barrel in London.

The Saudis have committed to extending the measure into August, and OPEC-watchers expect that Riyadh will announce a further continuation into September this week. Traders are bracing for a statement from Saudi state media in the next couple of days, before an OPEC+ monitoring committee convenes to assess markets on Friday.

To understand what the world’s biggest crude exporter may do after that, it’s useful to consider how it handled a similar intervention two years ago.

In January 2021, the Saudis announced a unilateral 1 million-barrel cut to amplify the efforts of its OPEC+ brethren, to take effect in February and March. It was subsequently extended for one more month, and then unwound in stages over the following three months.

One lesson to draw is that the kingdom is prepared to go it alone with supply curbs for a considerable period; it’s quite possible that the restraints adopted in early 2021 could have lasted longer if others in OPEC+ hadn’t been so eager to increase production.

But at the same time, the limited three-month span of the move shows the Saudis won’t make such sacrifices indefinitely. Energy Minister Prince Abdulaziz bin Salman has described this summer’s curbs as a “lollipop” for markets — and at some point all treats must be taken away.

Perhaps the most important final lesson is that, when it comes to restoring shuttered supplies, Riyadh prefers a cautious and gradual approach rather than any sudden moves.

As a result, we may see the latest 1 million-barrel reduction eventually unwound in piece-meal stages. And that ought to give confidence to oil bulls betting that the current rally can go further.

https://www.zerohedge.com/markets/oil-bulls-edge-ahead-saudi-production-cut-extension

August 2, 2023

Huntsman Corporation (HUN) Q2 2023 Earnings Call Transcript

Aug. 01, 2023 3:57 PM ETHuntsman Corporation (HUN)

139.11K Followers

Q2: 2023-07-31 Earnings Summary

EPS of $0.22 misses by $0.08 | Revenue of $1.60B (-32.43% Y/Y) misses by $91.65M

Huntsman Corporation (NYSE:HUN) Q2 2023 Results Conference Call August 1, 2023 10:00 AM ET

Company Participants

Ivan Marcuse – Vice President, Investor Relations and Corporate Development

Peter Huntsman – Chairman, CEO and President

Phil Lister – Executive Vice President and CFO

Peter Huntsman

Thank you for joining us this morning. We hope that you like our new format that is designed to give our results to the market earlier and to provide more time for meaningful review questions and comments. Before opening the line for questions, I’d like to take a moment and summarize some of the broader observations that we see at this present time. As we have an early but still rather murky view of the third quarter, some fundamental trends are shaping up. Now North American markets, particularly around MDI and construction demand, I believe that we’re seeing the end of prolonged inventory destocking. While this is not the case for all products and applications, we are seeing demand follow more seasonal trends. There are currently fewer homes and commercial real estate projects being built than we saw 12 or 18 months ago. However, order patterns would tell us that much of this destocking has ended and we are in the early recovery of building starts as we move into the next year. Commercial construction may take a bit longer to recover. We continue to see growth in our Asian and specifically our Chinese markets. This growth would be best characterized as modest, while pricing trends for MDI are also inching upward. Short of a major government initiative to spur faster economic growth, it appears that the second half of 2023 will continue to see modest seasonally adjusted improvements.

A broader European recovery still feels as though it is yet to come. Pricing is very aggressive as companies fight for what demand is available. Energy prices are down from the recent historical highs, but still multiple times higher than energy costs in the Americas or Asia. Energy and economic policies and regulations in Europe do not seem to adequately address the growing uncompetitiveness and the industrialization that is taking place. Europe is losing its ability to export while also seeing more raw materials imported from abroad, particularly in products where new capacity has been added and demand in domestic markets are unable to absorb new production. As I look at our overall portfolio of products, unlike past recessions and downturns in the economy, we have maintained decent margins in many of our businesses. Our biggest problem today is simply demand. While we do not expect any sudden improvements in the second half of the year, we do see green shoots in many areas of North America and China, but less so in Europe. I believe that the worst of the de-inventorying, particularly in North America, is behind us and we’re obviously much closer to a more fulsome recovery. We’re in a unique position to take advantage of this coming recovery given our product portfolio, lower cost, global footprint and quality of customers and applications. So I think about a recovery and the steps that we need to get there, I can’t help but think you of Churchill’s quote in ’42, perhaps we are at the end of the beginning. To this end, we will continue to preserve our balance sheet and review our portfolio for both possible divestitures and acquisitions. We are ahead in our efforts to streamline our costs and we’ll continue to not only look at cost but working capital as well. We are dedicated to returning value to shareholders in the form of earnings, dividends and share repurchases.

David Begleiter

Peter, as recovery occurs in polyurethanes, I know it’s early, but how do you think about the trajectory of earnings growth in 2024?

Peter Huntsman

I think much of this is going to depend on the speed of the recovery. So I do believe that — and again, I’m going to be particularly talking about North America here because I think that a recovery — again, this is just my opinion. I think a recovery is going to happen sooner in North America and China than it will in Europe. But as I look at North America, in particular, I think that the supply chains and the inventory levels are getting precariously thin. Now this may be a new normal. But typically, when we see very thin supply chains of inventory, anything like a sudden spurt of demand or even a perceived spurt of demand outages that might occur in the industry, an MDI plant comes down or something like that or if there should be a sudden increase in the price of crude oil. You look at the price of crude oil and where we’ve kind of come from the lows of where we were just a quarter ago to where we are today, we’ve seen an increase of about $10 per barrel or so. If that starts to translate into where people are thinking, I’ve eventually got to refill or start to refill inventory and prices seemingly are going up, that might cause — I don’t want to — well, I shouldn’t use the word stampede. But it might cause a more aggressive buying than we would be used to, and you would see something rather more suddenly.

Personally, I — again, when we give the forecast for the second half and even looking to early ’24, I don’t — we’re not anticipating that but that wouldn’t surprise me either. I mean, that kind of is more of the trend. As you know, Dave, as long as you’ve been in this industry it’s kind of more of the trend of the industry that they’re very rarely or they’re gradual declines and gradual improvements to take place over a year or two. It’s usually sudden events that have a tendency to shock the industry. So yes, we do have a large percentage of our North American sales going into housing, construction, energy insulation and so forth. That’s not a market that we’re trying to shy away from and it’s not something that we’re ashamed of. I think that we continue to see an improvement in building materials and energy conservation and lightweighting and a whole number of opportunities, bioretardancy, better coatings and applications and so forth in the housing industry. It’s going to continue to be an area of growth for many years to come. But I think that’s where the biggest turnaround will come. And I believe that it will probably, again, in my opinion, happen sooner rather than later. But right now, the numbers would tell us we’re looking for a gradual recovery throughout the second half.

David Begleiter

And just on the Shanghai MDI JV, are there any benefits to Huntsman on the new configuration of the LD operations?

Peter Huntsman

I’m going to let Phil comment on any of the financial side of that. We’ve had a great relationship with our Chinese partners and a very strong relationship with BASF. They’ve been an excellent operating partner with us and we can both go to the marketplace and fight like hell beating each other up over prices and applications and market share and so forth. But from a manufacturing point of view, it’s been a great partnership, and I don’t see any material change to the business. They’ll be able to operate an MDI technology of their own and we’ll be able to operate an MDI technology of our own on our side. So it’s a natural separation and one that’s been planned for, for many, many years. You can obviously tell this kind of an equal divide here of technologies and companies and so forth. Phil, anything you’d add to that from a financial point of view?

Phil Lister

I think we said, David, in our prepared remarks, no material impacts on adjusted EBITDA, free cash flow and over time on liquidity. I think we may see some slight benefits to EBITDA and free cash flow next year as we move through the course of the year, we will get one crude MDI plant, as Peter said, we’ll also get the strategically important hydrochloric acid recycle plant. So that’s a good balance for us to have. And we will be able to improve some of the split ratios that we have coming off of that crude plant and therefore, target some more of the differentiated businesses and grow those. So look, it’s a win-win for everyone. And essentially, it was a forced joint venture decades ago with BASF and three Chinese partners. But overall, from your perspective and modeling, no material impact.

Alex Yefremov

Peter, you talked about improvements in China and polyurethanes business, maybe [Technical Difficulty]. could you tell us what’s going on there? There’s talk about stimulus. Any signs that [Technical Difficulty] could be much stronger next year?

Peter Huntsman

Well, I believe that when you have an economy of the size of China that’s been in lockdown for as long as it has, I don’t think that we’ve seen the full impact of China reopening. As I look at polymeric pricing where it stands right now being around 16.8, 16.9, that’s about where it was a year ago. But it’s also, I think, healthy to note that’s as high as it’s been in the last year as well. In the last year, it’s been down from there. So we’re seeing this — and it’s a gradual recovery, which I think is healthy to see. I always get [leery] when I see a spike that occurs in a week or two period because usually what goes up that quickly comes down that quickly. So it feels to me like there’s just a slow, steady recovery. I did note in the Wall Street Journal this morning talking about the recovery is not happening as quickly and so forth. But what we’re seeing around auto, around infrastructure, energy conservation, building materials and so forth, we continue to see a pretty good recovery there.

Alex Yefremov

And then in your spray foam business, you’re talking about volumes in North America being flat. How is profitability? Are you able to hold spray foam prices maybe to a better degree than underlying [Technical Difficulty]?

Phil Lister

So you note, and I think it’s a positive that volumes were flat year-on-year. Spray foam, as you’ll recall, was the first really to go down from a demand perspective. And so in terms of any orange or green shoots, as we’ll call them spray foam is indicating that on the volume front. Pricing has been under pressure and you can probably see that as you talk to contractors. So pricing on spray foam has undoubtedly been under pressure as the market has been depressed over time, we’d expect that to reverse out as you move forward one, two years and spray continues to replace fiberglass.

Jeff Zekauskas

Can you talk about sequential pricing trends in MDI in your three major regions, the United States, Europe and China?

Peter Huntsman

Well, I mean, as we look at this, we are able to, I think, see stronger margins. And as we look into urethanes into the US and into APAC I think that we’re gradually making some recovery in those areas. Again, Europe continues to look pretty tough and it continues to — I think pricing there is tracking raw materials and perhaps a bit more. And so I think there’s — again, there’s a real struggle, I think, going on in Europe and a fight for market share there. I’m more optimistic about pricing gains or at least margin staying flat to maybe gradually improving in the US and I see it getting better in Asia.

Jeff Zekauskas

When you assess the MDI market in 2023, how fast do you think global MDI demand will either grow or contract and how much incremental capacity do you think has been added because of Chinese expansion?

Peter Huntsman

Well, the Chinese expansion, I’m going to let Phil answer that one because that — he’ll need a second just to look up the data. In the meantime, as we look at 2023 growth in MDI, we’re really seeing about a flat market, zero growth. Last year, we saw a contraction of 3% which in the 25 years that I’ve been in the MDI business, we’ve never seen two consecutive years of negative growth. As a matter of fact, I’m not sure MDI seen two executive years in MDI growth in 30 or 40 years, that’s during the recession and so forth. So again, I don’t want to sound overly bullish on the second half. I have a tendency to be an optimist, which after this many years in this industry, you have to be or you’d probably be diagnosed with some form of insanity or mental illness. But I think that you’ve — as you look at this — the latter part of this year, MDI continues to be a great product. It’s replacing materials, it’s making in-roads and replacing applications in UPR and rubber and thermoplastic elastomers and so forth and it’s going to continue to do so. I think the fundamental positive growth for MDI is going to continue on the longer term basis. And as you look out over the course of the next five years or so, we’re still going to see — if we see something around a 4%, 5% growth, that’s still going to outstrip the projected capacity additions that will be coming on in that time period. I think the fundamental balances over the future, you’re going to see more years that look like 2022 in MDI, the beginning part of than you do 2023.

Phil Lister

Just to follow up, Jeff. So as Peter said, it is unusual to have two years where it’s either negative to flat in MDI and typically, the history is that that snaps back and snacks back pretty quickly from a demand perspective. In terms of your question around supply, one what brought on the Fujian Province facility this year, that’s a 400-kilotonne facility overall. They’ve indicated that they will build over time, quite frankly, out some of the Fujian, some of the Yantai assets further. The history of Wanhua is their discipline, they have a 50%, 55% market share. We expect that to come in over time and probably matching a 5% demand growth increase over the coming year. MDI utilization rates are low right now and again, you’d expect those to snap back as demand recovers.

Matthew DeYoe

And with new home construction data points have obviously kind of ticked up. Peter, you talked about that a bit. I think is there any reason why the mix of houses and who’s building and maybe the price point would that lend to spray foam insulation underperforming or outperforming the rebound that we see in just data from new construction in the US?

Peter Huntsman

No, I don’t believe that that’s going to have nearly the impact as the number of homes that are being built. The spray foam, we’ll have about the same percentage of penetration, that percentage should continue to grow. Actually, if you look at smaller homes that are supposed to be more economical, I believe that there’s more to be saved in utilities and so forth, and this would be a great selling point. What we need to see in housing, in my opinion, is to first get back to what I would considered to be an equilibrium. So we saw housing in 2021, 2022, kind of peak out at around that $1.7-ish sort of a, right, 1.7 million units on a housing start on an annualized basis. And that number dropped down at about 1.3%, is the run rate where we see it today, 1.3, maybe up a bit from that. And that’s a decrease of around 10% to 12%, 13%. When I look at the volume drop off, the volume drop off was more like 30% in the housing construction, so 30%, 40%. That obviously fell far greater than the housing starts fell because of the inventory. And so what we need to do first and I think this is what the US — what we’re going to see in the second half is that we get back to what I would consider to be a new normal which perhaps is where we were back in ’21, ’22 minus that 12%, that sort of volume adjusted from 1.6 million, 1.7 million starts to 1.3 million to 1.4 million. Now last time, housing was at 1.3 million to 1.4 million, we were doing quite well.

So I’d much rather see a higher number. But there is a tremendous amount of difference in pricing and demand. When you’re looking at 30% to 40% drop versus a 10% to 12% drop. So when we talk about new normal, I think that that’s what we’ll see and that will be impacted as well by typical seasonality is that when homes are being built and the time of year they’re being built. But I think that recovery is well underway. When we start looking at the demand for CWP quarter-on-quarter for us from first quarter to second quarter was up 16% on a global basis, insulation was up about the same amount. Our spray foam was up a little bit less than that but still up from quarter-to-quarter. So we’re seeing that quarter-to-quarter buildup from the first quarter to second quarter, which is again starting to get back into a more normalized environment. We’re also seeing the SPF spray foam, OSB prices starting to stabilize, if not going back up in a lot of applications through North America. So these are all positive signs, I would say, would continue to give me more optimism that the housing recovery is underway, more importantly than the housing recovery is the end of this massive de-inventorying.

Phil Lister

And Matt, obviously, from our perspective on housing starts, single family homes matters, still well below the replacement level that is required. And therefore, we look forward to 2024.

Kevin McCarthy

Peter, I was intrigued by your comments at the top of the call that you’re exploring possible divestitures. I also think you indicated in the remarks released yesterday that you’re evaluating inorganic growth opportunities as well. So maybe without getting into specific details, can you discuss what you would like to do with the portfolio conceptually over the next couple of years?

Peter Huntsman

Well, first of all, I think that any management team has got to come into the office every morning and look at your portfolio, look at the present market conditions and the projected market conditions and make sure that your portfolio that your attention, your capital spend, your management and your focus is around the right asset base. And so we used to be in a lot of intermediates, we used to be in textile chemicals, we used to be in pigments and so forth. And time came when we looked at a lot of these products and we just felt we weren’t the right owner for these assets. And there were also opportunities that we saw when we can expand further in MDI into spray foam energy conservation more greening portfolio, if you will, we could expand into hardeners and into adhesions and structural composites and so forth in our epoxy businesses and so forth. We continue to look very aggressively in some of these downstream applications, particularly in our performance products and even more particularly in our advanced materials as I think about lightweighting, I think about adhesion, I think about a lot of the green polymers and chemistry, I think about fire retardancy and construction, energy conservation and so forth. These are all going to be areas of the future that we want to be looking into.

As we look at other areas of assets, particularly those that might be underperforming financially or may not be particular sciences that we add a great deal, then we’ve got to make some painful decisions at times and look at these assets from a financial point of view and look at a possible divestiture. But I’ve always been leery of somebody, particularly in an industry that changes as fast as our industry, if somebody says we’ve got the right mix, the right portfolio and there’s no need for change. I mean there’s always a need for improvement for change and so we’re going to continue to stay focused on that.

Phil Lister

As a reminder, Kevin, I mean, as Peter says, we’re always looking at the portfolio. We have sold some smaller assets, right? We sold our DIY business in India, we exited out of our Southeast Asia businesses, our South American businesses. We’ve said very clearly that we’re looking to exit the Russian market as well, and we’ll continue to always look at financial performance around the world.

Vincent Andrews

Just given the weak macro conditions continuing, maybe you could give us an update on what you think the splitter contribution is going to be and maybe frame it a little bit?

Peter Huntsman

Well, the splitter — again, this is a project that I’m very glad that we put it in when we did. It’s much better today that we’re out trying to sell a differentiated product than we are more commodity MDI, if you will. And I think that there’s — the premium per pound that we represented to the market still holds, but there is definitely less volume out there, and I see that as a temporary issue that will be recovering — that will be correcting itself here over the next couple of quarters. And that project, I think, will continue to be a success.

Phil Lister

I mean we’d originally said $35 million, that was in a much stronger volume environment, we’ll still get up to that $35 million as volumes come back, as Peter says, that premium of differentiated over the component side still holds. So it’s a volume leverage and a recovery as we look forward to 2024.

Michael Sison

Peter, on your Analyst Day, you talked about in polyurethanes kind of splitting that portfolio up in three different areas, commodities, formulary systems, especially solutions. And so when I think about where your margins are right now, any thoughts on how those three buckets have performed this year and what the potential is for those to get back to double digits over time?

Peter Huntsman

So I think no. As we look at it, the upper end of that split, if you will, of those three areas, I think that the lower end of that split, we’re seeing margin erosion that has taken place and we’re struggling with margins in those areas. As we think about the upper end of that, the elastomers end and that would be the product that’s going into your iPhone protector and cabling and so forth, the high end running shoes, what have you, the higher end of that, the elastomers end, we continue to see very strong margins. There’s been no erosion in the margins and it’s just a question of volume. So I think that in the middle part of that, that I would consider to be that which is going into the insulation, the spray foam and so forth, that certainly is under pressure but nothing like the commodity and polymeric down at the very bottom of that split. And so yes, I think that we’re probably — at this time, we’re probably seeing an even greater bifurcation of margins and of the vitality and health of the three sections between that high end, the midrange and the low end than we did at the time of the Investor Day.

Michael Sison

And then I guess when I did the math, it looks like your volumes this year and last year in total, maybe down $1 billion or so in sales. If you get that back are we back to that $800 million, $900 million EBITDA range longer term?

Peter Huntsman

I’d like to think that that’s — yes, I’d like to think that’s something that should be happening in the MDI business, and it’s really on a longer term basis that ought to be the average of the business. Again, I’m not sure this is a question for Huntsman at least where we presently are at least, a question of volume as much as it is value. And I think that we’ve got a real opportunity here to take the molecules that we have and to upgrade those and reliably see a 15%, 16% to 18% business on normal times and we’d like to see that being pushed closer to 20%. And as we move further downstream as we get more and more and build up the elastomers into the business and so forth, this is an opportunity for us to create more reliable and consistent earnings.

Hassan Ahmed

Appreciate the commentary, a lot of commentary around polyurethane demand and potentially destocking being behind us and how historically, the restock tends to be fairly sort of impressive. If we could just move away from the demand side, could you talk a bit about the supply picture? I mean, could we — because obviously, we’ve come across sort of number of announcements around potential capacity addition delays and the like. So could we be in a situation where as the restock happens in the near to medium term, it’s in the face of relatively sort of limited supply?

Phil Lister

So Hassan, I think we said. So right now, relatively low utilization, unusual for MDI to go two years on the demand side where it’s pretty low. So looking forward, we’d expect that demand profile to to tighten out with 5% plus growth per annum going forward. On the supply side, honestly, there’s really only one way that you can point to, BSS on some small debottlenecking in North America. Covestro, obviously, announced the delay of any expansion in either North America or in China, which confirms your point, Dow has not announced anything and no Huntsman. So it’s really down to one. And as we said, an tends to be relatively disciplined, they will bring on capacity over the next five years but they’ll do it in a pretty disciplined manner, particularly with the 50% to 55% market share that they have in China. The fact that the other majors aren’t really doing any expansions that can lead to some of the tightness that you described.

Hassan Ahmed

And just moving on a bit on the M&A side of things. I mean historically, you guys as well as a bunch of industry participants have talked about valuations being unrealistic. Now with several quarters of relatively tepid or negative demand, interest rates where they are and the like, I mean, what are you guys seeing in the M&A market? It certainly seems private equity has gotten more active. So have valuations become a little more realistic, are there more opportunities you guys are seeing on the inorganic growth side of things?

Peter Huntsman

Not really. I’m not seeing a fundamental shift in the market. I think that you’re seeing a little bit of — valuations are coming down a bit. Obviously, capital cost something nowadays where a year ago, costs nothing. And I continue to just be befuddled as the companies that trade at 5 times, 6 times EBITDA, buying assets that are 15 times, 12 times, 10 times, not seeing any impact on their stock and then seemingly shareholders don’t really care. So I think that we have to be — remain disciplined. I know that, that sounds a bit of a cliche. But I think we’ve demonstrated that if we can’t buy it, sometimes the multiple is going to be a little bit higher than we’d like to see. But in those rare instances, we will have a very quick and a very thorough plan of action to be able to grow the business, simultaneously to integrating and cutting costs and we’ll justify that to the market with a very clear map going forward. If not, we will continue to invest in our own company and buy our own stock and make sure that we maintain and stay focused on a dividend. But we’ve got to remain disciplined because — just because everybody else wants to pay these multiples doesn’t mean it’s the right thing to do.

John Roberts

I think of the MDI industry being relatively unintegrated back into oil and benzene. If Abu Dhabi is successful in their bid for Covestro, does that significantly change the structure of the industry in your opinion?

Peter Huntsman

I’m not sure that it does. And again, I want to make sure my comments don’t have anything to do with — speaking on behalf of Abu Dhabi or Covestro, I have zero information on either of what’s happening there. But I would just say that as you look at Yantai, I think that from their integration into coal, I would kind of consider them to be a little more integrated than other MDI producers. But look, at the end of the day, we’re going to have the greatest value that will come to a molecule of MDI, it’s going to be being able to push that into a formulated mix downstream and get a premium price for the MDI. In my opinion, that will be far better than looking at it on an integrated basis going upstream up through benzene and nitrobenzene and crude oil and crude oil production and refining. Because all of those products, all of our basic raw materials have a market value to them, right? I mean just because you produce benzene and I don’t produce benzene, we essentially have to value that benzene the same. You may be able to get an integrated cost on that benzene, integrated value on the benzene. But if you just subsidize your MDI because you’ve got benzene that you’re making, I’m not sure that necessarily gives you an advantage unless you want to just move the benzene at a loss to market. So I’ve never thought of MDI in particular as being terribly advantaged or disadvantaged by lack of integration. I think MDI is going to — the value of MDI is going to be far more of what you do downstream than what you do upstream.

John Roberts

And is the problem in epoxy more the delay in the wind turbine projects or is it more the raw material position that the Chinese producers have that they’re lower than the Western producers, which is more of a problem for the industry right now?

Peter Huntsman

I’m not sure — when we think about epoxy for us, at Huntsman, that’s just not a big end use market for us and it’s not a market where we really compete on 10 years ago, that was the whole BLR. You’ll remember that we used it 10 years ago, we used to talk all the time about wind and the impact of wind. And we largely traded those molecules up over the last decade into aerospace and into — I’d much rather be investing in the grid system that’s going to hook all these wind mills up in the electrical infrastructure that’s going to try to make sense of all these wind projects than the wind projects themselves.

Phil Lister

John, think about [AdMat] portfolio as being about 20% aerospace, 20% auto, about 20% into construction, and the remainder into infrastructure but excluding any wind, where we don’t participate in those markets. Now we participate in things like the power grid, which ultimately is why we can deliver 18% margins even in a lower volume environment.

Mike Harrison

Peter, I was wondering if you could talk about how you’re feeling about your cost structure in Europe at this point? It seems like you’re kind of indicating a more extended period of softer demand and elevated energy costs.

Peter Huntsman

Well, something that we look at all the time. I mean I think it was about a year ago at this time that we were announcing some pretty radical closures, restructurings and so forth, moving a lot of our back offices to crack out. Those projects are largely coming to conclusion here in the next couple of — next quarter or so. And I think that we’re benefiting from having made those decisions. Now if Europe continues to be industrialized and we see — my bigger concern is that you start to see the customers, the OEMs and so forth start to leave Europe and they go to China, they go to North America, they go to the Middle East. And you continue to see this industrialization taking place in Europe, we may well have to reassess that market and the cost structure. I’m quite comfortable where we are today as I look out over the course of the next year or two to what we can see and what we’re hearing from customers and so forth. I think that we took the right moves at the time I know we were being accused of being over reactionary in some of these decisions. I think, though, looking back on it, we moved with all haste at the first signs that we saw that there was this fundamental shift and I’m glad we did it. And we’re better in Europe because of it. It’s an area that we need to continue to, as I said earlier, we need to count every morning and just continue to look at the area and how do we adapt and how do we restructure around having the right people in the right locations and the right cost structure. I don’t want to survive in Europe. We’ve got a prosper in Europe. We’ve got to have a good return in Europe and we’ve got to have a supply chain in Europe that makes sense, and I think there’s still work to be done.

Matthew Blair

Peter, could you discuss MDI operates by region on just an overall industry basis? And in regards to Huntsman, how are things going at the Rotterdam MDI plant that you restarted earlier this year, and then is the Geismar line still down?

Peter Huntsman

I think that, yes, globally, we’re probably in, yes, the low 80s bouncing around that area. Geismar, we’re around 70% and working, I would say, still under inventory control. Rotterdam, we’ve got all the lines running Rotterdam across the board about 80%. And Asia, well, we’ve been a shutdown in Asia, doing maintenance work there. But when we can, that plant will be running full out.

Matthew Blair

And then another company recently mentioned that China competitors in their space were benefiting from getting paid to take chlorine which clearly improved the cost position. Is the similar dynamic occurring in MDI and is that having any sort of material impact on global cost curves?

Peter Huntsman

I’m not aware of that happening in MDI, but if you can give me the name of a supplier that will pay me to take chlorine, I will take as much as they will give me.

Phil Lister

Yes, I mean in the price of the process of producing MDI, you produce byproduct HCL, right, and that goes downstream into the PVC market. It’s quite normal as part of the overall process in China, we have an HCL recycle unit where you don’t need to move that down into the PVC market, but it’s quite a normal part of the overall MDI process.