The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 18, 2023

Adnoc Is Said to Increase Covestro Takeover Bid to €11 Billion

Aaron Kirchfeld, Dinesh Nair and Eyk Henning, Bloomberg News

Officials arrive for a tour of the ADNOC Ruwais refinery and petrochemical complex in Al Ruwais, United Arab Emirates. Photographer: Christophe Viseux/Bloomberg , Photographer: Christophe Viseux/Bloomberg

(Bloomberg) — Abu Dhabi National Oil Co. has increased its takeover offer for Covestro AG to about €11 billion ($12.4 billion) as it seeks to convince the German chemical producer to enter talks, people familiar with the matter said.

Adnoc’s latest proposal values Covestro at about €57 per share, up from its first informal bid of around €55, the people said, asking not to be identified because the information is private. The state-backed firm voiced confidence in Covestro’s strategy and management, according to the people.

Shares of Covestro jumped 5.6% in late Frankfurt trading to close at €50.30, the highest level since February 2022.

Last month, Leverkusen-based Covestro rejected Adnoc’s earlier proposal as too low, people familiar with the matter said at the time. Covestro also raised questions around Adnoc’s plans for its specialties operations.

Adnoc has tried to address Covestro’s concerns about its offer, including over how it would help the German company’s management develop the specialty chemical operations, according the people. If negotiations are entered, there could be scope for further increases in Adnoc’s bid.

Deliberations are ongoing, and it’s unclear how Covestro will respond to the latest proposal. Representatives for Adnoc and Covestro declined to comment.

Adnoc, which produces almost all the oil in the United Arab Emirates, plans to invest $150 billion to expand production capacity for crude, natural gas and chemicals.

It’s also in separate talks with Austria’s OMV AG about a potential merger of two petrochemical firms they back, Borouge Plc and Borealis AG.

July 15, 2023

Massive explosion at Dow chemical plant in Plaquemine near Baton Rouge

- Jul 14, 2023 Updated 15 hrs ago

PLAQUEMINE, La. — Emergency officials were on the scene of multiple explosions in Iberville Parish on Friday night.

Officials say the blast appears to be near the area of the Dow Chemical Plant.

No word yet on any injuries reported.

Iberville emergency preparedness sent out an alert (see below) advising residents to stay indoors and turn off their a/c units.

OFFICIAL STATEMENT:

THIS IS A MESSAGE FROM THE IBERVILLE PARISH OFFICE OF EMERGENCY PREPAREDNESS

OUR OFFICE WAS MADE AWARE OF AN INCIDENT AT DOW PLAQUEMINE (7/14). THE IBERVILLE PARISH COUNCIL OFFICE OF EMERGENCY PREPAREDNESS HAS ISSUED A HALF-MILE RADIUS SHELTER IN PLACE FOR RESIDENTS NEAR THE DOW CHEMICAL FACILITY IN PLAQUEMINE.

WE HAVE BEEN INFORMED BY DOW THAT ALL PERSONNEL HAS BEEN ACCOUNTED FOR. THE SHELTER-IN-PLACE HAS BEEN ISSUED OUT OF AN ABUNDANCE OF CAUTION UNTIL WE ARE CERTAIN THE PUBLIC IS NO LONGER IN DANGER.

DOW HAS ADVISED OUR OFFICE THEY ARE DOING AIR MONITORING AND ARE NOT PICKING UP ANY READINGS AT THIS TIME.

More links:

Fire, explosions at Dow Chemical in Plaquemine prompts shelter in place; all accounted for

- BY LARA NICHOLSON and DAVID J. MITCHELL| Staff writers

- Jul 14, 2023 Updated 6 hrs ago

1 of 2

File photo

Law enforcement officers block off the road about two miles from the entrance to the Dow Chemical complex near Plaquemine on Friday, July 14, 2023.

The massive Dow Chemical complex near Plaquemine caught fire late Friday night and experienced multiple explosions, forcing about 350 households nearby to shelter inside and for La. 1 to be shut down, state and local officials said.

West Baton Rouge Parish Sheriff’s Office spokesman Landon Groger said crews were still battling a fire on the premises as of 11 p.m. Friday, though no chemical leak had been detected from the Mississippi River facility.

The incident occurred in Dow’s Gylcol 2 Unit, which makes and handles the potent flammable and explosive chemical, ethylene oxide, parish officials said. It is a human carcinogen with years of exposure, federal authorities say.

But Clint Moore, Iberville homeland security director, said Dow officials have been conducting air monitoring throughout the incident and have not detected releases that would pose on offsite impact. Dow’s monitors are inside the complex and on its perimeter.

Moore said Dow is calling a third-party contractor to set up air monitors within the community as well as a precaution.

Greg Langley, spokesman for the state Department of Environmental Quality, said the agency was sending its own crews to conduct air monitoring as well.

“There is a fire. It is still burning, and La. 1 is shut down. That’s all have right now,” Langley said shortly after 10 p.m.

By 11:40 p.m., DEQ crews were close to starting their air monitoring, Langley said. He added that firefighters were still putting water on the blaze at that time.

He said that the prevailing winds then were blowing back into the plant and toward the river.

Shortly before 9:50 p.m. Friday, the Iberville Office of Emergency Preparedness advised residents to stay indoors and turn off air conditioning and ceiling fans due to the emergency at Dow.

The shelter-in-place order extends in a half-mile radius around the Dow plant, parish officials said in a Facebook post. Moore, the homeland security official, said the order is a precaution until officials are sure there isn’t a risk to the public.

Christian Reed, State Police Troop A spokesman, said La. 1 between Sid Richardson and Bayou Jacob roads has been closed.

Dow’s emergency operations center was managing the fire late Friday, company officials said on Facebook, and the company is working with local officials

“All people are accounted for,” the company added in the statement. A Dow spokeswoman didn’t immediately return an email for comment late Friday.

Videos circulating on social media show large fires at the chemical plant. Some show a large, fiery mushroom cloud bilowing from the Dow.

The fire comes about a year after a large leak of dangerous chlorine at Dow’s neighbor, Olin Chemical, which is inside the 1,500-acre complex north of Plaquemine.

DEQ and parish officials said later that the extent of the leak, which sent of huge plume of gas into the sky in April 2022, appeared to be underreported by Olin and Dow.

Can’t see the video below? Click here.

That leak sent 39 people to area hospitals with mostly mild symptoms, and DEQ inspectors later raised questions about the efficacy of the placement of Dow air monitors in the community near the plant and on its perimeter in relation to prevailing winds at the time and the gas plume.

The fire on Friday isn’t the first time the Glycol 2 Unit at Dow has encountered significant problems. In November 2019, a tank in the unit ruptured on a Sunday morning after a large power outage, sending a white steam cloud into the air and causing a large shock wave that rensonated in homes as far away as Zachary across the river.

The unit makes ethylene oxide, a sterilizing agent that is also used in anti-freeze and many other applications, but that federal authorities have said is far more dangerous to human health than previously understood.

The unit also makes derivative chemicals and had been expanding last year to add a new production line to make polyethylene glycol, state permit records say.

Ethylene oxide is a human carcinogen due to years of exposure but, in acute short-term exposure, it can cause headaches, dizziness, nausea, fatigue, respiratory problems and even vomiting, the U.S. Environmental Protection Agency says.

At 9:53 p.m. Friday, officials with DEQ hadn’t been notified about any incident at Dow Chemical but were investigating. DEQ officials had a report of the incident minutes later.

By then, though, parish officials had already notified the public near the facility.

The Dow site straddles Iberville and West Baton Rouge parishes. Located along a bend in the Mississippi River, Dow is one of Louisiana’s largest petrochemical facilities, with more than 3,000 company and contract employees and 12 production units.

July 12, 2023

BASF Group achieves Q2 2023 EBIT before special items in line with analyst consensus and adjusts outlook for 2023

Q2 2023:

- Sales of €17.3 billion

- EBIT before special items of €1.0 billion

Outlook 2023:

- Sales expected between €73 billion and €76 billion

(previously: €84 billion to €87 billion) - EBIT before special items expected between €4.0 billion and €4.4 billion (previously: €4.8 billion to €5.4 billion)

Ludwigshafen – July 12, 2023 – BASF has released preliminary figures for the second quarter of 2023. Sales declined by an expected 25% in the second quarter of 2023 to €17,305 million (Q2 2022: €22,974 million). This was mainly driven by considerably lower prices and volumes; negative currency effects also contributed to the sales decline. Sales were thus lower than average analyst estimates for the second quarter of 2023 (Vara: €19,355 million).

EBIT before special items of BASF Groupamounted to an expected €1,007 million, a decline of 57% compared with the strong prior-year quarter (Q2 2022: €2,339 million) but in line with analyst consensus for the second quarter of 2023 (Vara: €1,018 million). Compared with the prior-year quarter, the earnings contributions of the Chemicals and Materials segments were particularly weaker.

BASF Group’s EBIT amounted to an expected €974 million in the second quarter of 2023, below the figure for the prior-year quarter (Q2 2022: €2,350 million) and almost at the level of analyst consensus (Vara: €1,003 million).

Net income reached an expected €499 million, below the figure in the prior-year quarter (Q2 2022: €2,090 million) and below average analyst estimates for the second quarter of 2023 (Vara: €729 million).

Outlook for the full-year 2023

According to current estimates, global gross domestic product in the first half of 2023 grew stronger than previously expected (+2.4% instead of +1.6%). However, this development was solely driven by a global increase in the service sector. Growth in global industrial production, on the other hand, continued to slow. As a result, global chemical production declined perceptibly in the first half of 2023. For the second half of 2023, BASF does not expect any further weakening in demand at the global level, as inventories of chemical raw materials in customer industries have already been greatly reduced. However, BASF is assuming only a tentative recovery because global demand for consumer goods will be lower than previously assumed. With this, margins will also remain under pressure.

Against this background BASF adjusts its assumptions regarding the global economic environment in 2023 as follows (previous assumptions from the BASF Report 2022 in parentheses; current assumptions rounded):

- Growth in gross domestic product: 2.0% (1.6%)

- Growth in industrial production: 1.0% (1.8%)

- Growth in chemical production: 0.0% (2.0%)

- Average euro/dollar exchange rate of $1.10 per euro ($1.05 per euro)

- Average annual oil price (Brent crude) of $80 per barrel ($90 per barrel)

With this, BASF also expects a weaker sales and earnings development than previously forecast and adjusts its outlook for the full-year 2023. The company now anticipates sales of between €73 billion and €76 billion in 2023 (previous outlook 2023: €84 billion to €87 billion; analyst consensus 2023: €79,810 million; full year 2022: €87,327 million). EBIT before special items is now expected to reach between €4.0 billion and €4.4 billion in 2023 (previous outlook 2023: €4.8 billion to €5.4 billion; analyst consensus 2023: €4,883 million; full year 2022: €6,878 million).

Further information

The overview of analyst estimates, which is compiled monthly by Vara Research on behalf of BASF, can be found at: www.basf.com/analysts-estimates.

BASF will publish its Half-Year Financial Report 2023 on Friday, July 28, 2023, at 7:00 a.m. CEST and will comment on the figures in a conference call for journalists (from 8:00 a.m. CEST) and a conference call for analysts and investors (from 10:00 a.m. CEST).

About BASF

At BASF, we create chemistry for a sustainable future. We combine economic success with environmental protection and social responsibility. More than 111,000 employees in the BASF Group contribute to the success of our customers in nearly all sectors and almost every country in the world. Our portfolio comprises six segments: Chemicals, Materials, Industrial Solutions, Surface Technologies, Nutrition & Care and Agricultural Solutions. BASF generated sales of €87.3 billion in 2022. BASF shares are traded on the stock exchange in Frankfurt (BAS) and as American Depositary Receipts (BASFY) in the United States. Further information at www.basf.com.

July 10, 2023

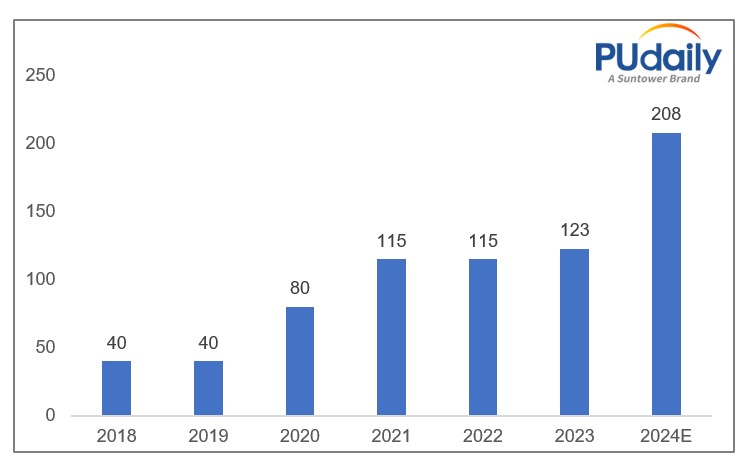

Wanhua Chemical’s Polyether Polyols Capacity will Exceed 2 mtpa in 2024!

PUdaily | Updated: July 7, 2023

Wanhua Rongwei Co., Ltd is a subsidiary of Wanhua Chemical Group, specifically part of the Polyol Business Unit. Wanhua Chemical has three major production bases located in Yantai, Ningbo, and Foshan. It is the largest polyols supplier and service provider in terms of production capacity, with the most diverse product portfolio and a well-established industry supply chain. Wanhua is also the largest exporter of polyether polyols in China.

In order to fully leverage the synergies between polyether polyols and MDI/TDI, Wanhua Group aims to further expand its market share in polyether polyols, enhance its brand image, and consolidate its dominant position in the polyether polyols industry.

Against this background, leveraging the advantageous port location, public infrastructure, and industrial chain advantages of Ningbo Daxie Development Zone, Wanhua Chemical (Ningbo) Rongwei Polyurethane Co., Ltd. continues to expand its production capacity based on the operational experience of its existing polyether polyols plant. Its annual production capacity of polyether polyols will be increased from 110 ktpa to 280 ktpa through the expansion project, aiming to meet the demand for polyurethane raw materials and lead the industry’s long-term stability and development, while establishing a new brand presence for Wanhua in the polyurethane industry. Currently, Wanhua’s 280kt polyether polyols expansion and transformation project has been completed and the commissioning phase has begun, scheduled from July 1, 2023, to October 1, 2023.

As of 2023, Wanhua’s total capacity of polyether polyols reached 1.23 mtpa. Furthermore, Wanhua Chemical Group announced a 850 ktpa polyether polyols expansion project at the end of 2021. This includes a 120kt ordinary flexible slabstock polyols production line, a 120kt flexible high resilience polyols production line, a 72kt differentiated polyols production line, a 58kt PPG230 polyols production line, a 240kt polymer polyols (POP) production line, a 240kt continuous DMC polyols production line, as well as supporting public works and facilities for storage, transportation and environmental protection. With these expansions, Wanhua Chemical’s total production capacity of polyether polyols is expected to exceed 2 mtpa.

June 30, 2023

Now at $0.335lb