The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

June 29, 2023

Serta Simmons Bedding Completes Financial Restructuring and Emerges from Chapter 11

Serta Simmons Bedding, LLC (“SSB” or the “company”), a leading global sleep company, today announced that it has concluded its financial restructuring and emerged from Chapter 11, marking the completion of a critical step in the company’s turnaround effort.

“The financial restructuring process we completed today signifies an important step forward that will enable us to accelerate our turnaround and strengthen our leadership position in the market,” said Shelley Huff, CEO, SSB. “The Serta and Beautyrest brands in our portfolio have a deep heritage in innovation and have played meaningful roles in the lives of consumers for generations. With our financial restructuring behind us, we are taking steps to drive growth by getting back to our innovation roots, reinvesting in our iconic brands, and nailing the fundamentals of our business with a focus on commercial and supply chain excellence.”

SSB, which has been executing on its strategic initiatives over the past 18 months, is advancing its turnaround across the following pillars:

- Leading with Product Innovation – The company is bringing significant newness to the market this year through the refresh of the vast majority of its product portfolio. Looking ahead, SSB will more frequently update its product mix to deliver consumer-driven innovations as well as high-value products across brands and price points.

- Brand Reinvigoration – Alongside SSB’s commitment to innovation, the company is increasing marketing investments and sharpening its brand positioning to create greater differentiation for the brands in its portfolio, as well as maximize the potential of each brand.

- Commercial Excellence – As it brings new products to market, SSB is focused on better supporting retail partners and their sales associates to drive sales growth. The company is also leveraging its direct-to-consumer platforms to test new shopping concepts and improve the omnichannel consumer experience.

- Operating a HighPerforming Supply Chain – The investments SSB continues to make in its supply chain are enabling the company to efficiently deliver quality products and excellent service levels to retail partners and sleepers. Supply chain enhancements include the implementation of new processes and technology as well as the optimization and upgrading of its manufacturing network.

“As we execute our turnaround, we will become an even stronger partner to retailers and will help them better serve their customers with our trusted brands and refreshed product portfolio,” added Huff.

As SSB emerges from Chapter 11, a new Board of Directors has been appointed to oversee the company. Previous board members Huff and Brandi Thomas (Group Vice President and Chief Audit Executive, General Electric) will continue to hold board positions. Established private equity investor Mark Genender (Managing Partner, Bristol Growth Capital, LLC), who previously sat on the Simmons Board, will serve as Chairman. The rest of the Board is made up of business leaders with relevant experience in manufacturing, consumer durables and retail, including Charlie Eitel (Former CEO, Simmons Bedding Company), Jim Fogarty (CEO, FULLBEAUTY Brands), Alan Shaw (Former President and CEO, North America, Electrolux), and an additional board member to be announced.

“I look forward to partnering with Shelley and the management team, as well as the rest of the Board of Directors and the company’s investors, to help advance SSB’s turnaround effort,” said Genender. “Serta and Beautyrest are among the most valuable brands in the industry. These brands, in combination with SSB’s strategic areas of focus, executive leadership, and investor support, will drive the next phase of growth for the company.”

SSB is emerging with ample liquidity and a more flexible capital structure that will enable it to execute its turnaround. As a result of the Chapter 11 process, SSB successfully reduced its funded debt from approximately $1.9 billion to approximately $315 million. The nearly $1.6 billion debt reduction lowers the company’s annual cash interest expense by more than $100 million, enabling more investments back into the business. In addition, in connection with emergence, SSB has obtained a $100 million revolving credit facility which, along with substantial cash on hand and cash generated from operations, will provide additional financial flexibility to support the company’s strategic initiatives.

During the Chapter 11 process, Weil, Gotshal & Manges LLP served as SSB’s legal counsel, Evercore Group L.L.C. served as SSB’s investment banker and FTI Consulting, Inc. served as SSB’s financial and restructuring advisor. Gibson, Dunn & Crutcher LLP served as legal counsel, and Centerview Partners served as financial advisor and investment banker, to an ad hoc group of SSB’s priority lenders.

June 29, 2023

We are deeply saddened by the recent unexpected passing of John E. Turnour.

John has been a key part of our US Team since 2008, in his multiple roles ranging from sales and continuing through being REPI LLC’s first General Manager in Gastonia. John was instrumental in REPI’s successes in the US, including the growth of the early years. His personality allowed him to make friends anywhere he visited and was very well respected throughout the polyurethane industry worldwide.

He will be missed.

Communication John E. Turnour

John started his career in urethanes at Firestone, which later became Foamex. He then worked at Rebus and at Everchem, and later went full time at Rebus.

After that he joined Repi and worked there until retirement. He was a good friend and will be missed by everyone here at Everchem–Editor.

June 27, 2023

US New Home Sales Unexpectedly Explode Higher In May

by Tyler Durden

Tuesday, Jun 27, 2023 – 10:09 AM

New home sales have been dramatically outperforming existing- and pending-home sales as unprecedentedly low inventories send buyers into the arms of incentivizing homebuilders. However, expectations were for a 1.2% MoM decline in May but instead new home sales exploded 12.2% MoM!!!

Source: Bloomberg

That is the 3rd straight month of MoM gains and sends new home sales up 20% YoY!!!

New home sale completely decoupled from existing-home sales, now at their highest since Feb 2022…

Source: Bloomberg

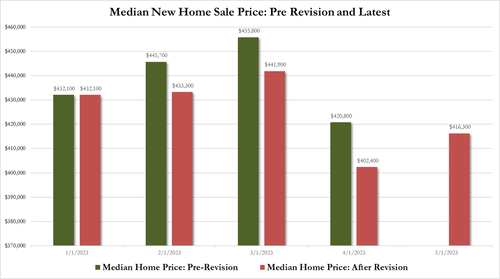

The median home sale price $416,300 which was an increase from last month but only after huge downward revisions for past 4 months

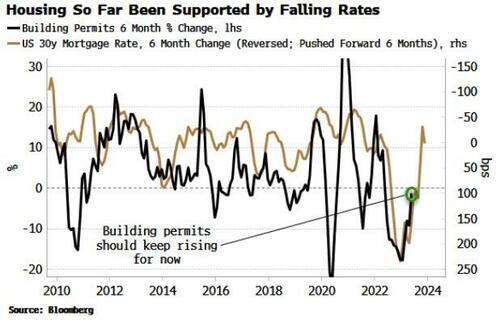

Housing activity has seen a resurgence this year, as anticipated by a very simple leading indicator: the change in the level of mortgage rates…

Source: Bloomberg

As Bloomberg’s Simon White notes, while longer-term yields are still much higher than they were a few years ago, they have essentially gone nowhere in the last nine months. Thus the change in mortgage rates has been falling.

That’s been enough to give housing and other interest-rate sensitive sectors such as autos a boost. But that impulse will soon start to fade unless yields and mortgage rates start to fall.

https://www.zerohedge.com/personal-finance/us-new-home-sales-unexpectedly-explode-higher-may

June 22, 2023

RV Bust Kicks Into High Gear As Winnebago Records Big Revenue Miss

by Tyler Durden

Thursday, Jun 22, 2023 – 08:00 PM

Let’s look back at our coverage of the boom and bust in the RV industry over the previous two years:

- April 2021: RV Sales Just Hit An All-Time High

- March 2022: RV Shipments Soar To Record For This Time Of Year

- July 2022: “All Of A Sudden, It Came To A Halt”: After Posting Fresh Records Just Months Earlier, RV Industry Grinds To A Halt

- Nov 2022:RV Boom Over? Monthly Shipments Plunge As Dealerships Overflow With Campers

- May 2023:RV Bust Worsens As Dealers Discount Trailers

We previewed last month that RV dealerships nationwide were heavily discounting motorhomes and towable trailers. The RV bust has now clobbered motorhome maker Winnebago Industries, who reported the third quarter (ended May 27) revenues that missed amid higher discounts and waning sales volumes.

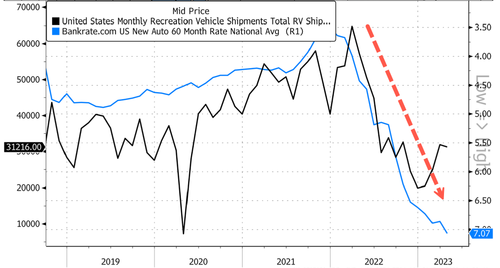

Winnebago reported a 38.2% year-over-year plunge in the quarter due to sliding unit sales related to souring RV retail market conditions. Discounts were much higher than in the same quarter last year, an attempt by management to spark demand. However, high interest rates are curbing demand.

Revenue fell the most in the Towable RV segment, down 52% to $384.1 million. The decline is primarily due to lower unit volume associated with ‘challenging’ retail market conditions and discounts and allowances versus a year ago. Revenues declined 27.5% in the Motorhome RV segment.

Winnebago shares were flat in Wednesday morning trading in New York while investors digested the news. Shares remain 26% below the peak established in early 2021 during the boom.

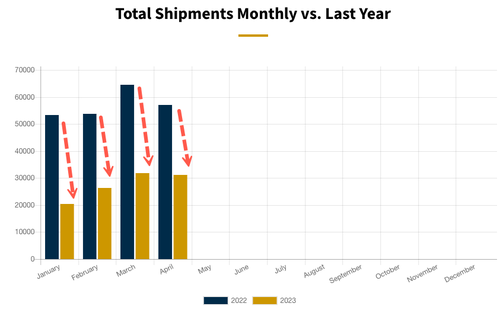

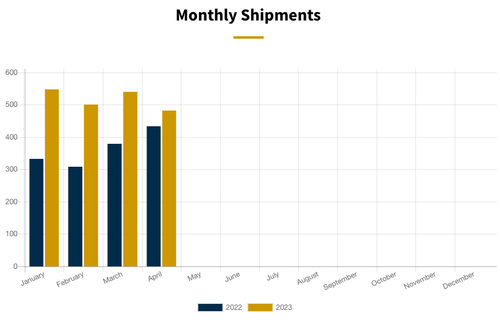

Taking a look at the results from the RV Industry Association’s April 2023 survey of all manufacturers showed that total RV shipments ended the month with 31,216 units, a decrease of (-45.4%) compared to the 57,192 units shipped in April 2022. RV shipments are down (-52.1%) through April, with 109,816 units.

A record monthly drop in data going back three decades is an ominous sign of an impending recession.

Gues who killed the RV bubble? Well it’s the very same ones who allowed for record low interest rates…

Towable RVs, led by travel trailers, ended the month down (-48.6%) compared with last April with 26,860 shipments. Motorhomes finished the month down (-12.4%) compared to last year’s with 4,356 units.

One surprising data point from the report is that parked mobile home shipments continue to surge because of the worst housing affordability in a generation. For some, the ‘American Dream’ consists of a trailer home, or as millennials call it, a ‘tiny home,’ as inflation eats away wages for two years.

The boom is over. The bust is underway. Those who didn’t panic during the Covid era can find great deals this summer.

https://www.zerohedge.com/markets/rv-bust-kicks-high-gear-winnebago-records-big-revenue-miss

June 20, 2023

Abu Dhabi’s ADNOC in almost $11 billion approach for Covestro -sources

Story by By Emma-Victoria Farr, Ludwig Burger and Patricia Weiss • 2h ago

FILE PHOTO: A general view of ADNOC headquarters in Abu Dhabi© Thomson Reuters

(Reuters) -Abu Dhabi National Oil Company (ADNOC) has approached German plastics and chemicals maker Covestro AG with a takeover proposal worth more than 10 billion euros ($10.9 billion), two people familiar with the matter said on Tuesday.

The energy giant has made an informal offer for a per share price in the mid-50 euros, which compares with a Monday closing price of 40.31 euros, said the sources, asking not to be named because the matter is confidential.

ADNOC and Covestro declined to comment.

Covestro, a maker of transparent polycarbonate plastics, as well as chemicals for insulation and upholstery foams, in April issued earnings guidance that reassured markets about its growth prospects. It also resumed a share buyback programme.

Earlier on Tuesday it confirmed its outlook for 2023.

Shares in Covestro were up 14% at 46 euros at 1400 GMT, trading at their highest in more than a year.

A combination would give energy giant ADNOC, also a maker of refined products and petrochemicals, access to more advanced materials that go into electric vehicles, thermal insulation for buildings as well as coatings, adhesives and engineering plastics.

It would also support Abu Dhabi’s plans to diversify the economy away from energy.

As part of that transformation strategy, which also invited foreign investment, ADNOC began floating units in late 2017.

Over the past two years, it has separately listed businesses offering investors exposure to its petrochemicals, fertilisers, drilling services, gas as well as logistics businesses.

ADNOC Chief Executive Sultan al-Jaber is leading the company’s push into new energy, low carbon fuels, such as ammonia and hydrogen, as well as liquefied natural gas and chemicals.

ADNOC has expanded in Europe previously, agreeing to buy 24.9% of Austrian oil and gas group OMV last December.

The OMV deal would indirectly also increase ADNOC’s holding in both European petrochemicals maker Borealis and Abu Dhabi-listed petrochemicals company Borouge.

A move for Covestro would mirror the expansion of other Middle Eastern energy and petrochemical players into European materials and plastics businesses.

Saudi Aramco in 2018 acquired the shares it did not already own in synthetic-rubber maker Arlanxeo from German co-owner Lanxess for 1.4 billion euros.

SABIC, also of Saudi Arabia, in the same year purchased a stake of almost 25% in Swiss chemicals maker Clariant.

Thanks to a 2007 deal to buy GE’s plastics unit, SABIC competes with Covestro in polycarbonate plastics.