The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

December 17, 2019

US Single-Family Building Permits Reach 12-Year High

After a big rebound in October, analysts expected a more mixed picture for November with starts expected to extend gains while permits are seen falling. However, the data was much more positive:

- Housing Starts +3.2% MoM (vs +2.4% exp)

- Building Permits +1.4% MoM (vs expectations of a 3.5% drop)

The second monthly rise in a row…

Source: Bloomberg

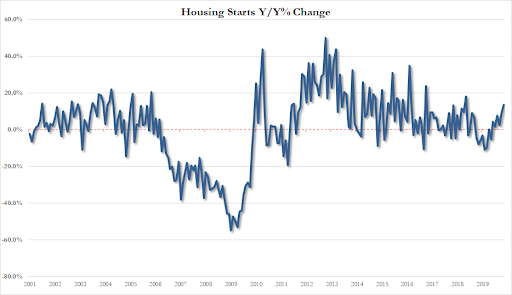

Housing Starts rose 13.6% YoY – the most since May 2018…

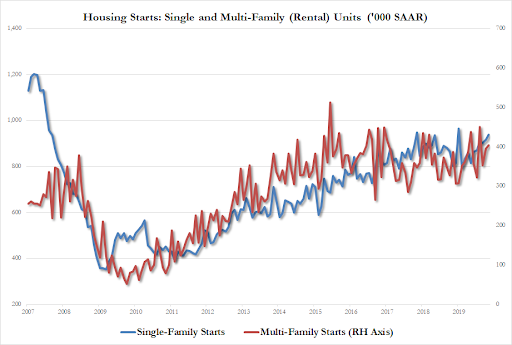

Single Family Starts accelerated back near cycle highs and multi-family also rose in November.

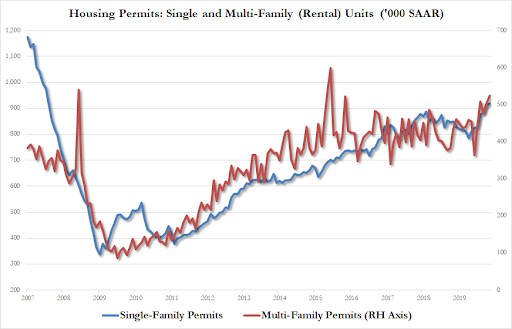

And single-family permits hit 918k – the highest since August 2007…

Two of four regions posted a gain in starts, led by a jump in the South to the fastest pace since March 2007. Starts in the West also advanced.

All-in-all, very positive – corroborating other housing data, such as Homebuilder sentiment soaring to a 20-year high in December – as long as Powell keeps rates low.

The data indicate residential construction may add to fourth-quarter growth after contributing in the previous quarter for the first time since the end of 2017.

https://www.zerohedge.com/economics/us-single-family-building-permits-reach-12-year-high

December 17, 2019

US Single-Family Building Permits Reach 12-Year High

After a big rebound in October, analysts expected a more mixed picture for November with starts expected to extend gains while permits are seen falling. However, the data was much more positive:

- Housing Starts +3.2% MoM (vs +2.4% exp)

- Building Permits +1.4% MoM (vs expectations of a 3.5% drop)

The second monthly rise in a row…

Source: Bloomberg

Housing Starts rose 13.6% YoY – the most since May 2018…

Single Family Starts accelerated back near cycle highs and multi-family also rose in November.

And single-family permits hit 918k – the highest since August 2007…

Two of four regions posted a gain in starts, led by a jump in the South to the fastest pace since March 2007. Starts in the West also advanced.

All-in-all, very positive – corroborating other housing data, such as Homebuilder sentiment soaring to a 20-year high in December – as long as Powell keeps rates low.

The data indicate residential construction may add to fourth-quarter growth after contributing in the previous quarter for the first time since the end of 2017.

https://www.zerohedge.com/economics/us-single-family-building-permits-reach-12-year-high

December 14, 2019

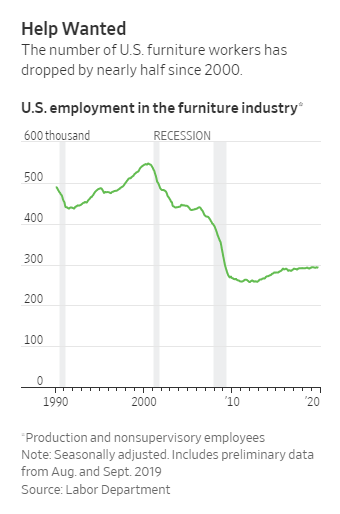

The Booming US Furniture Industry Has Sparked A Desperate Scramble To Find Workers

The U.S. furniture industry is humming right along, with names like Crate & Barrel and Williams-Sonoma the beneficiaries of expanding manufacturing domestically. The tailwind has been sustained growth since the financial crisis and a trade policy that is encouraging more production in the U.S.

But the one problem the industry has now is a lack of skilled workers, according to the Wall Street Journal.

Furniture manufacturers across the United States are having trouble filling open slots with the job market as tight as it has ever been in the U.S.

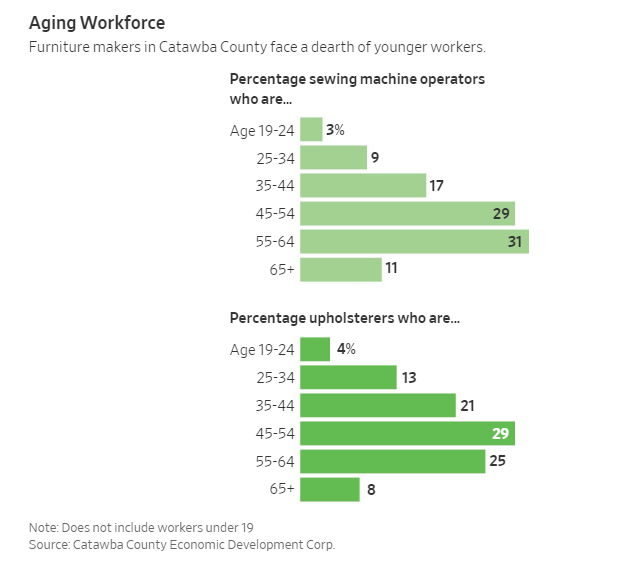

Meanwhile, a generation of sewers and upholsterers have simply avoided the industry, leaving it reliant on an aging workforce.

These bottlenecks show up in metrics like delivery times. For instance, at Century Furniture in Hickory, N.C., delivery times have been stretched to nearly 9 weeks.

Alex Shuford III, chief executive of RHF Investments Inc., owner of Century, said: “I walk around our factories every other day and am spooked by what I see. The retirements are coming and I can’t find enough people.”

The turnaround in the industry can be attributed to the internet, which allows consumers to demand and customize their choice of fabrics and features. China acts as competition for the U.S. in this regard, often able to customize and ship furniture with a much quicker lead time than 2 months. Tariffs continue to keep pressure on manufacturers to keep production in the U.S.

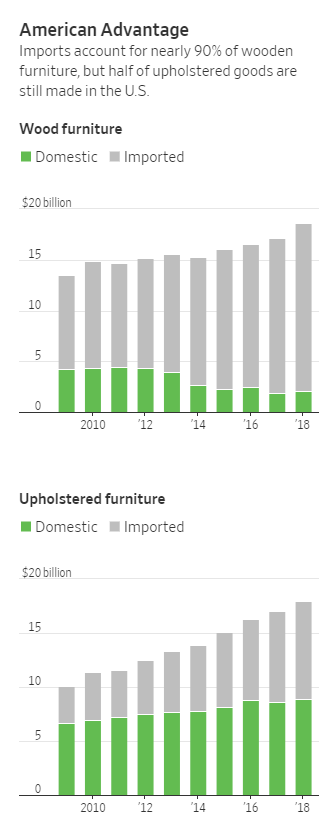

But 90% of all dining tables, bookcases and other wooden furniture are made overseas. U.S. factories crank out about half of upholstered furniture in the country.

It’s the custom upholstery that requires skilled labor and isn’t suited well for assembly line style mass production. Upholstered products are also more difficult to ship, because they can’t be stacked or reassembled.

John Bray, chief executive of Vanguard Furniture Co., which has about 600 employees, said: “Pretty much all the companies that survived the last crisis have been in a growth mode. When business picked up, there just weren’t enough skilled people.”

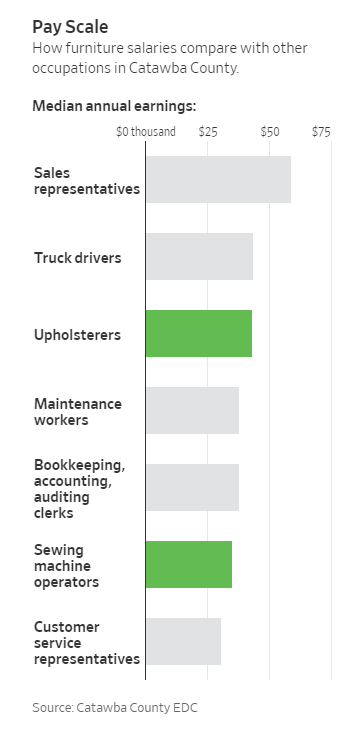

28 year old Chad Ballard took on an entry level job at Century and is now studying upholstery at a local community college. It’s a skill that could boost his annual pay to as high as $75,000 if he can master the craft. Hiring Ballard was a “small victory” for Century, which has a constant opening for about 35 sewers at any given time.

Century’s VP of human resources said of his hiring: “He came to us through a temporary agency. We won the lottery.”

In his county, 42% of sewing machine operators and 33% of upholsterers are 55 of older.

Bill McBrayer, director of human resources for Lexington Home Brands, asked: “How do we get the young and old to come back to the industry?”

One attempt has been the Catawba Valley Furniture Academy, which was created by local companies to train furniture makers and offers benefits like free health clinics. The academy launched in 2014 and students spend 8 months studying manual cutting or sewing. The total cost ranges between $425 and $600. It graduates about 150 people a year – but the industry requires about 800 to 1,000 people.

But it isn’t all optimism surrounding the industry. One executive asked: “The toughest question is the one that haunts us forever: What makes me think that if my child goes into this industry it will be there in two years?”

Nathaniel Kaylor, a 21-year-old student at the academy concluded: “My dad has been in furniture his whole life. He told me from the get-go to stay out of it. You get old fast. Go to college.”

https://www.zerohedge.com/personal-finance/booming-us-furniture-industry-has-sparked-desperate-scramble-find-workers

December 14, 2019

The Booming US Furniture Industry Has Sparked A Desperate Scramble To Find Workers

The U.S. furniture industry is humming right along, with names like Crate & Barrel and Williams-Sonoma the beneficiaries of expanding manufacturing domestically. The tailwind has been sustained growth since the financial crisis and a trade policy that is encouraging more production in the U.S.

But the one problem the industry has now is a lack of skilled workers, according to the Wall Street Journal.

Furniture manufacturers across the United States are having trouble filling open slots with the job market as tight as it has ever been in the U.S.

Meanwhile, a generation of sewers and upholsterers have simply avoided the industry, leaving it reliant on an aging workforce.

These bottlenecks show up in metrics like delivery times. For instance, at Century Furniture in Hickory, N.C., delivery times have been stretched to nearly 9 weeks.

Alex Shuford III, chief executive of RHF Investments Inc., owner of Century, said: “I walk around our factories every other day and am spooked by what I see. The retirements are coming and I can’t find enough people.”

The turnaround in the industry can be attributed to the internet, which allows consumers to demand and customize their choice of fabrics and features. China acts as competition for the U.S. in this regard, often able to customize and ship furniture with a much quicker lead time than 2 months. Tariffs continue to keep pressure on manufacturers to keep production in the U.S.

But 90% of all dining tables, bookcases and other wooden furniture are made overseas. U.S. factories crank out about half of upholstered furniture in the country.

It’s the custom upholstery that requires skilled labor and isn’t suited well for assembly line style mass production. Upholstered products are also more difficult to ship, because they can’t be stacked or reassembled.

John Bray, chief executive of Vanguard Furniture Co., which has about 600 employees, said: “Pretty much all the companies that survived the last crisis have been in a growth mode. When business picked up, there just weren’t enough skilled people.”

28 year old Chad Ballard took on an entry level job at Century and is now studying upholstery at a local community college. It’s a skill that could boost his annual pay to as high as $75,000 if he can master the craft. Hiring Ballard was a “small victory” for Century, which has a constant opening for about 35 sewers at any given time.

Century’s VP of human resources said of his hiring: “He came to us through a temporary agency. We won the lottery.”

In his county, 42% of sewing machine operators and 33% of upholsterers are 55 of older.

Bill McBrayer, director of human resources for Lexington Home Brands, asked: “How do we get the young and old to come back to the industry?”

One attempt has been the Catawba Valley Furniture Academy, which was created by local companies to train furniture makers and offers benefits like free health clinics. The academy launched in 2014 and students spend 8 months studying manual cutting or sewing. The total cost ranges between $425 and $600. It graduates about 150 people a year – but the industry requires about 800 to 1,000 people.

But it isn’t all optimism surrounding the industry. One executive asked: “The toughest question is the one that haunts us forever: What makes me think that if my child goes into this industry it will be there in two years?”

Nathaniel Kaylor, a 21-year-old student at the academy concluded: “My dad has been in furniture his whole life. He told me from the get-go to stay out of it. You get old fast. Go to college.”

https://www.zerohedge.com/personal-finance/booming-us-furniture-industry-has-sparked-desperate-scramble-find-workers

December 11, 2019

US small-business sentiment jumps most in 18 months

Dec. 10, 2019, 09:15 AM

- US small-business sentiment rose 2.3 points to 104.7, the biggest jump since May 2018, according to the November optimism survey from the National Federation of Independent Business.

- It shows a reversal from “previous months of clatter” about a looming recession, the report noted. Positive earnings and expectations that business conditions will get better drove the results, according to the survey.

- “Owners are aggressively moving forward with their business plans, proving that when they’re given relief from the government, they put their money where their mouth is, and they invest, hire, and increase wages,” said William Dunkelberg, the chief economist at NFIB.

- Read more on Business Insider.

Small businesses are showing signs of high optimism, seemingly thwarting any fear that a recession will hit before the end of the year, according to the November National Federation of Independent Business sentiment survey released Tuesday.

Small-business optimism spiked 2.3 points to 104.7 in November, the biggest jump since May 2018, survey results showed. Positive earnings, owners who want to continue to expand business, and those expecting business conditions to improve drove the second straight monthly gain for the index.

The report comes after Friday’s blockbuster jobs numbers showed that the US economy continues to gain at a steady clip. The “historic run may defy the expectations of many, but it comes as no surprise to small business owners,” wrote William Dunkelberg, the chief economist at NFIB, in a press release.

National Federation of Independent Business

That’s because small business owners “understand what a supportive tax and regulatory environment can do for their companies,” Dunkelberg wrote. Small businesses have benefited from the Tax Cuts and Jobs Act of 2017, he said, and are using savings from the tax break to expand their businesses.

The positive November report is a stark contrast from the “previous months of clatter” about a possible recession, Dunkelberg wrote. In addition, it looks like impeachment proceedings have had little impact on small business sentiment, the report showed.

“Owners are aggressively moving forward with their business plans, proving that when they’re given relief from the government, they put their money where their mouth is, and they invest, hire, and increase wages,” said Dunkelberg.

Here are other highlights from the report:

- Earnings, or the frequency that owners report positive profit trends, rose 10 points. It’s now one point below the May 2018 record.

- Net 12% of all owners (seasonally adjusted) reported higher nominal sales in the past three months. That’s the highest level since May 2018.

- Job creation jumped to the highest level since May. And, a net 30% of small business owners reported raising compensation, while 26% plan to do so in the coming months – the highest level since December 1989.

- Stronger profits negated some cost pressure, especially labor. That limited the need to raise prices.

- Sixty percent of small-business owners reported making capital outlays, up from October.

- Three percent said that their borrowing needs were not being met, near a record low.

- Inflationary pressures are weak – the net percent of owners raising average selling prices rose to 12%, up 2 percentage points, seasonally adjusted. Price hikes were the highest in retail trade and construction.

https://markets.businessinsider.com/news/stocks/us-small-business-sentiment-jumps-the-most-18-months-november-2019-12-1028751482