The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

February 14, 2023

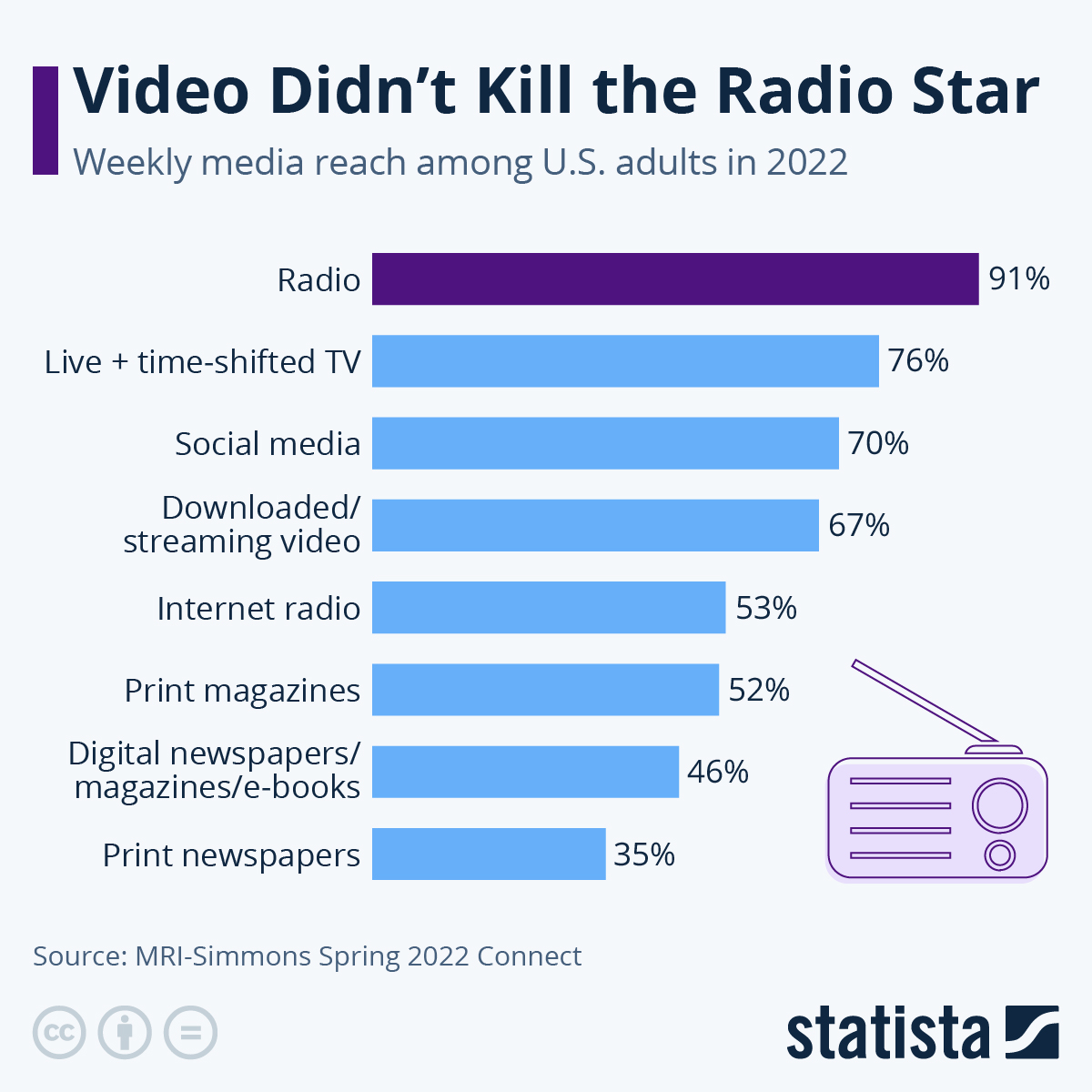

Turns Out, Video Didn’t Kill The Radio Star…

by Tyler Durden

Monday, Feb 13, 2023 – 06:55 PM

More than 40 years after The Buggles released “Video Killed the Radio Star”, radio is still alive and well.

As Statista’s Felix Richter notes, with all the chatter about about streaming and other digital media, it’s easy to forget how powerful traditional media such as radio and television still are. Radio in particular rarely gets credited for what it still is: a true mass medium.

According to MRI-Simmons, radio even trumps TV in terms of its weekly reach among U.S. adults.

You will find more infographics at Statista

According to MRI-Simmons, 91 percent of U.S. adults listen to the radio at least once a week, far exceeding the reach of live and time-shifted TV at 76 percent, social media at 70 percent an online video at 67 percent.

While radio does win in terms of sheer reach, TV remains unparalleled with respect to average daily usage.

According to Nielsen, U.S. adults spent an average of 3 hours and 41 minutes watching live and time-shifted TV in Q3 2020, which is roughly 2.5 times the amount of time they spent listening to the radio (1 hour and 31 minutes).

https://www.zerohedge.com/technology/turns-out-video-didnt-kill-radio-star

February 13, 2023

Leggett & Platt, Incorporated (LEG) Q4 2022 Earnings Call Transcript

Feb. 07, 2023 9:45 AM ETLeggett & Platt, Incorporated (LEG)

Q4: 2023-02-06 Earnings Summary

EPS of $0.39 misses by $0.09 | Revenue of $1.20B (-10.29% Y/Y) misses by $39.77M

Leggett & Platt, Incorporated (NYSE:LEG) Q4 2022 Earnings Conference Call February 7, 2023 8:30 AM ET

Company Participants

Susan McCoy – Vice President, Investor Relations

Mitch Dolloff – President & Chief Executive Officer

Jeff Tate – Executive Vice President & Chief Financial Officer

Steve Henderson – Executive Vice President & President of Specialized Products and Furniture, Flooring & Textile Products

Tyson Hagale – Senior Vice President & President of the Bedding Products

Cassie Branscum – Senior Director of Investor Relations

Mitch Dolloff

Good morning and thank you for participating in our fourth quarter call. Leggett & Platt diverse portfolio of businesses, strong cash discipline and the ingenuity and agility of our employees helped us deliver solid results in 2022 despite weak demand in residential end markets.

Sales grew 1% in 2022 to a record from continuing operations of $5.15 billion, primarily from acquisitions. Organic sales were flat, with volume declines of 7% and negative currency impact of 2%, offset by raw material-related selling price increases of 9%. Acquisitions, net of divestitures, added 1% to sales growth.

Volume declines were driven by demand softness in residential end markets, partially offset by growth in automotive and industrial end markets. 2022 EBIT was $485 million, a decrease of $111 million versus 2021 EBIT and a decrease of $83 million versus 2021 adjusted EBIT, primarily from lower volume, lower overhead absorption from reduced production, operational inefficiencies in specialty foam, and higher raw material and transportation costs and operational inefficiencies in automotive. These decreases were partially offset by metal margin expansion in our Steel Rod business and pricing discipline in the Furniture, Flooring and Textile Products segment.

EBIT margin was 9.4%, down from 2021’s EBIT margin of 11.7% and adjusted EBIT margin of 11.2%. Earnings per share in 2022 was $2.27, a decrease of 23% versus EPS of $2.94 in 2021 and a decrease of 18% versus adjusted EPS of $2.78.

Cash flow from operations was $441 million, a 63% increase versus 2021. The current global macroeconomic environment and its impact on the consumer negatively impacted our fourth quarter results.

Sales were $1.2 billion, EBIT was $91 million, and earnings per share was $0.39. Sales in the quarter were down 10% versus fourth quarter 2021, primarily from lower volume and currency impact, partially offset by raw material-related price increases.

Now, moving on to the segments. Sales in our Bedding Products segment were down 19% versus fourth quarter of 2021 and decreased 4% for the full year. Demand in the US bedding market softened during the fourth quarter as macroeconomic impacts on consumer spending persisted. We expect demand in 2023 to remain consistent with levels experienced in 2022 with relatively consistent sequential volumes continuing in the first half of the year and modest increases in the second half of the year.

Volume in US Spring was down 22% in 2022, which is comparable to the domestic mattress market. After a mid-single-digit share loss early in the pandemic related to supply shortages, we estimate that our share of the innerspring mattress market has remained stable over the last two years despite a volatile environment.

Although, consistent demand is assumed in 2023, we expect to increase production after limiting output in 2022 to align inventory with lower demand levels. Strong trade demand for rod and wire provided earnings benefit in the first half of the year. However, trade raw demand slowed considerably in the back half of 2022. And as a result, we cut production significantly to reduce inventory.

Steel rod production in 2023 is expected to be in line with 2022 but remain well below normal levels. We expect higher internal consumption to offset lower trade demand. Increased metal margin provided earnings benefit throughout the year but to a lesser extent in the latter part of the year as steel prices soften.

While it is difficult to predict steel pricing, we anticipate continued softening in 2023. However, we expect rod pricing and metal margins to remain at historically elevated levels due to higher conversion costs. Demand in European bedding has stabilized in recent months, and we expect demand in 2023 to be relatively flat with 2022.

The actions we took in 2022 to reduce inventory across the segment have brought levels back in line with those needed to support current demand. With the capacity we have in place, we are prepared to respond quickly to changing demand, and we remain focused on servicing customer requirements.

Full year 2022 segment earnings were significantly impacted by difficulties experienced in our specialty foam business. About two-thirds of the earnings challenge in specialty foam was a result of low demand, which dropped quickly in the fourth quarter of 2021 and remained at depressed levels throughout 2022.

Demand was impacted from three areas. The first being the general bedding market decline of approximately 20% following demand surges in 2020 and 2021, and chemical shortages in 2021.

The second was channel-focused. Finished goods production in specialty foam is weighted heaviest to digitally native brands, which declined more than the overall market due to changes in consumer privacy laws and customer cash constraints. And finally, we suffered share loss from a small number of customers with sales shifting from finished goods to components in some cases.

Specialty Foam earnings were also impacted by the volatile chemical supply environment. Like all other phone producers, we experienced significant chemical inflation through the course of 2021, and costs remained at historically high levels in 2022. Given the level of material costs, additionally, pouring and converting foam is of even greater importance than normal. However, because of high demand in 2021 and chemical shortages, our first priority became servicing customers. Between paused integration and the need to service customers, we have not operated at target material efficiency levels.

Material inefficiencies at these high chemical costs had a detrimental impact on earnings. While it will take some time to see improvements in specialty phone, especially with the continued challenging demand environment, we’re confident in our recovery plan and are making progress.

Our team has a strong pipeline of opportunities influenced by our Specialty Foam technologies. We’ve also focused on driving improvement in material margins through both process and equipment changes. We remain confident that our Specialty Foam business will drive long-term profitable growth for the segment and are placing our highest level of attention on short-term improvements in sales and material management.

Sales in our Furniture, Flooring & Textile Products segment were down 12% versus fourth quarter of 2021 and up 3% for the full year. Home Furniture demand slowed during the quarter at both the mid- and high end of the market, and customer backlogs largely have been depleted.

Demand at lower price points remained extremely weak and customers across all price points are working to reduce inventory levels. This demand softness also impacted volume in fabric converting. We expect lower market volume through at least the first half of 2023.

Work Furniture sales decreased in the fourth quarter as contract demand slowed and demand for products with residential exposure continued to soften. We expect this trend to continue into 2023.

Susan Maklari

My question is — and thank you for all the details in the prepared comments, I think it was very helpful. When you think about the efforts in Specialty Foam and you walk through some of those changes that you’re making, can you give us a sense of where you are within that process? And how we should be thinking about the benefits of that starting to flow through to the results perhaps later this year, or is it something that will be more of a 2024 event?

Mitch Dolloff

Yes, that’s a great question, Susan, and thanks for listening in on the comments. I know it was long, but we wanted to try and provide some clarification there. Tyson, I’ll let you comment on ECS. I know you’ve been working really diligently with the team there to assess where we are and put some recovery plans in place.

Tyson Hagale

Sure, thanks and, good morning Susan. I’ll start with the commercial side of our plans. As was noted in the prerecorded remarks, it’s tough in a slow demand environment, especially where we’ve weighted our business historically, but our commercial team has done a really good job even in the slow environment building our commercial pipeline and looking at opportunities to diversify our customer base. So despite some near-term headwinds just with the overall market slowness, I feel good about our pipeline there.

And especially, because we’re able to really return and our customers are interested in returning to looking at some of our specialty foam technologies. When chemicals got really short, our development team really had to pivot and spend more of their time and resources working on formulations just to make sure we could continue servicing our customers. But as those have improved as our constraints have eased and our customers have returned to looking at differentiation and other new product introductions, we’ve been able to get back to that as well.

So I feel good about our pipeline, both from the quality of leads and opportunities that we have, and those are developing throughout the year. We’ll start to see some of the benefits in the back half of the year, I think, from some of the business were being awarded. But still, overall, with slow demand and the full benefit probably coming into next year, but also the fact that we’re using our specialty phone technologies as part of those projects as well.

So, on the commercial side of things, that’s how we feel about it. The operations, which we’ve mentioned as well, working through challenges there, I feel good about the team that’s being put together both from the team that came along with the acquisition and also filling in some gaps along the way. So we’re in a good place with our operational leadership. Some of the things that we’ve talked about, I think, before as well, just being able to really get back to the integration of four companies now being brought under the L&P umbrella. But heavy focus just on our overall data and process control, and I feel good about the steps we’re taking there. And I think we’ll see those really take hold as we move through the year. We’re also investing and rolling out an improved IT system that’s already underway, but we’re being – I would – not cautious but realistic about the time frame to install the IT system across all of our specialty phone business.

We also, during the pandemic made investments in equipment, especially focused on automation and helping us control material efficiency that equipment is starting to arrive. But like a lot of investments over the last couple of years, lead times are pretty long. So even if they start to show up, it will take some time to get it integrated and up and running to full efficiency. So I would say back half of this year and into next year, we’ll start to see more of the benefits from our equipment investments. So I know that was a lot, but just to give you a little bit of a frame reference, both on the commercial and operational side just how things are rolling out.

Susan Maklari

Yeah. No, that’s very helpful. Thank you. And I guess following up on that, as we do think about the outlook that you gave us for 2023, especially as it does relate to some of the different parts of the bedding business. How are you thinking about the cadence of the margins in that segment for this year? When you think about normal seasonality on top of some of these company-specific dynamics that are coming through, any thoughts on how we should be thinking about where that margin eventually gets to and the path of getting from where we are today to that endpoint?

Mitch Dolloff

Susan, Cassie, do you have any detail there that you’d like to share? I think for us, the biggest – one of the biggest impact is what happens from a scratch or rod spread. And it’s really difficult to precisely predict that we have anticipated some contraction over the course of the year. That’s probably that in volume would be the biggest impact.

Susan Maklari

Okay.

Tyson Hagale

And also just one more comment. Yes, we do see the market returning to more normal seasonal patterns. And also, we talked about this before as well. But over the course of the last year, as demand was soft, but we were also really intentional about bringing down our inventory. Our production was below even the demand level so that we could control that, which is tough to do in a slow demand environment, but our team really did a good job in pushing that through reason towards the end of the year.

So, I think even as we get back to this year and more seasonal patterns, we should be back to a place we’re producing and have better overhead recovery. So, that was a real challenge for us over the last year.

Mitch Dolloff

Yes, particularly at the end of the year. I think that’s a great point, Tyson. So, if we looked at the first half of the year, call it, or even a little longer, we had really strong trade rod volume, right? And now we’re anticipating that to be a little bit lower than last year, but pretty similar, but much more consistent, right, as opposed to the big — high levels we had the first part of the year and lower in the last half of the year. And then similarly, as you said, with just overall production being more similar. So, I think it would just be a bit more normalized hopefully than what we saw last year.

Susan McCoy

Okay, Susan that’s very helpful. Yes. Susan a little bit specific on your margin question. We talked about lower first quarter expectations for the company overall that holds true with bedding with a return to more seasonal patterns as we move through the year.

So, that all helps treat bedding with, again, their historically highest seasonal quarter has been third quarter. So, a step-up in margins as we move through the year from a margin percentage perspective, what we’re showing.

Peter Keith

Great. Thanks. And then secondly, can you walk us through the Furniture segment and maybe explain why the year-over-year volumes in Furniture are starting to kind of chop off.

Mitch Dolloff

Yes, sure. Steve, I’ll ask you to jump in there. But it’s really a couple of dynamics. I mean we have to — after a big surge in Home Furniture that we saw over last year and in the beginning of this year, we really saw that soften across the industry. That’s not — shouldn’t really be new news.

And then if we look at Work Furniture, that is probably the change where after being so soft, we saw a strong recovery in the first three quarters of 2022 and then really started to see the contract business, which had been recovering slowdown in the fourth quarter. So, that’s been the biggest change there. But Steve, I’ll let you chime in as well.

Steve Henderson

Yes, thanks good morning. Yes, from a Home Furniture perspective, the answer is much, much lower retail demand. So, we had seen the low end drop, but then we saw the mid and high price points drop even further than what we expected. And that’s led to some fairly significant inventory levels, which we couldn’t see earlier in 2022, and we expect those to be worked off here hopefully in the first half of 2023 and start to return to a more normalized demand level.

And from a Work Furniture perspective, as Mitch said, our customers are reporting volume declines and incoming contract orders. And that’s really driven by the surge of back to office that they saw and that’s worked its way through, and now they’re seeing a little bit more lower level of return to office trends, particularly in the Americas, which is lowering that demand. And then you can add on top of that the retail residential slowdown that we spoke to from a Home Furniture perspective. So, those are the two big issues that are impacting Work Furniture at this point in time.

Mitch Dolloff

Yes. Steve, if I remember right, this forecast, which would be for North America was down about 8% or so for this year.

Steve Henderson

Yes, 8% or 9%.

Mitch Dolloff

Yes, yes. So in line with industry dynamics there, unfortunately. And as we’ve mentioned before, so the fabric converting side of our Textiles business also moves along largely with Bedding and Home Furniture. So, we see that down. But what does not is the geo textiles component side of that, and we see that driven by industry to be — continue to be strong as we go into 2023.

February 13, 2023

Holcim Acquiring Duro-Last in $1.29 Billion Agreement

The Swiss company makes another major acquisition to solidify its presence in North America’s roofing market

By Chris Gray

February 7, 2023

Holcim is further expanding its presence in North America with the acquisition of roofing systems manufacturer Duro-Last for $1.29 billion.

The Michigan-based Duro-Last currently employs around 840 workers and has an annual sales of roughly $540 million. The deal is expected to complement Holcim’s integrated roofing offerings, with expected synergies of $60 million per year.

“I’m excited to welcome Duro-Last into Holcim’s broad range of innovative and sustainable building solutions,” said Holcim CEO Jan Jenisch in a release. “Duro-Last is a perfect strategic fit for our roofing business. Its proprietary technologies and leading brands complement our offering in the fast-growing North American market. Its energy-efficient systems and excellence in recycling will further advance our leadership in sustainability.”

The acquisition is one of the largest deals Holcim has made in North America. In early 2022, it acquired Malarkey Roofing Products for $1.35 billion. Holcim also acquired Firestone Building Products in April 2021.

Duro-Last’s systems include cool roofs, enhancing buildings’ energy efficiency and its award-winning “Recycle Your Roof” program, which drives circularity in roofing. Duro-Last is the first company in the U.S. to offer third-party verified environmental product declarations for its thermoplastic roofing solutions.

“Over the past 45 years, our family business has continually reinvested in Duro-Last to create the solid, financially strong and well-recognized company we are today,” said Tom Saeli, CEO of Duro-Last, in a release. “We are delighted to be joining the Holcim family, which shares our core values, and we look to the future to accelerate our success. Holcim recognizes the opportunities at Duro-Last and we are confident it will support us in our future growth plans.”

Holcim expects its roofing systems will exceed $4 billion in net sales ahead of schedule. This acquisition advances Holcim’s “Strategy 2025 – Accelerating Green Growth” with the goal to expand its Solutions & Products business to 30% of Group net sales by 2025. The Duro-Last acquisition is expected to close by the second quarter of 2023.

https://www.roofingcontractor.com/articles/97911-holcim-acquiring-duro-last-in-129-billion-agreement

February 13, 2023

Wanhua Chemical Group: Net profit for 2022 about 16.239 billion yuan, down 34.12% YoY

NBD

13, February, 2023,16:20 GMT+8

NBD AI Bulletin – Wanhua Chemical Group Co Ltd (SH 600309, close price: 97.97 yuan) on February 13 briefed its annual results for 2022. Operating income for the year was about 165.565 billion yuan, showing an increase of 13.76% from a year ago. Net profit attributable to the shareholders of the listed company was about 16.239 billion yuan, down 34.12% year on year. Basic earnings per share was 5.17 yuan, showing a 34.14% reduction.

Wanhua Chemical Group Co Ltd’s chairman is Liao Zengtai, male, 60 years old, with a master’s degree; The general manager is Kou Guangwu, male, 57 years old, with a master’s degree.

As at the press time, the market value of Wanhua Chemical Group Co Ltd was 307.6 billion yuan.

(By Lan Suying)

http://www.nbdpress.com/articles/2023-02-13/44873.html

February 9, 2023

Elastomer entrepreneur Michel Baulé passes away

With great sadness Covestro and its employees learned about the death of Michel Baulé, entrepreneur in the cast polyurethane industry, who has passed away January 13th at the age of 79.

“Our thoughts and condolences are with Michel’s family,” said Thomas Braig, Head of Elastomers at Covestro. “We will forever and fondly remember the entrepreneur, the exceptional man and our friend who was at the origin of Covestro Elastomers.”

Graduating with a PhD in chemistry, the native of Cavaillon, France embarked on entrepreneurship in 1976 at the age of 33 by creating a moulding company for cast polyurethane parts in Romans-sur-Isère, France. Fate, circumstances and his passion for innovation made him establish a second business in 1983, specialising in the formulation of cast elastomers systems. Together with companions such as Philippe Jeantin, currently Head of the Machines business at Covestro Elastomers, Antonio Alvarez and Mauro Modugno, he then founded yet another business in 1987, dedicated to the design and manufacture of low pressure dispensing machines.

These businesses became a leader in its realm as a co-operation. It later divested its molding entity to its executives to become EXSTO, while Baulé, combining the material formulation and the machines manufacturing, successfully established a Joint Venture with the MaterialScience division of the Bayer company in 2008. In 2012, this turned into a merger and Baulé’s former business became officially part of the Bayer group. In 2015, it became part of the carve out of Covestro from its parent company Bayer. Today, this business finds its heritage in the Elastomers Business Entity of Covestro, still headquartering in Romans-sur-Isère.

“We pay tribute to the genius that was Michel Baulé, for inspiring dozens of innovations in the cast polyurethane industry, among them the development of three-components systems with quasi-MDI-prepolymers and many innovative processing concepts that lead us to maintain and promote the brand Baulé® for our machine technology. He will be missed dearly,” Abdel Arhzaf, Managing Director of Covestro Elastomers SAS, added.

After a valuable contribution to the growth of the cast polyurethane industry, Michel Baulé developed a family office called EXIMIUM which has maintained all its entrepreneurial culture through acquisitions and participations while developing financial activities and support services. Until his last days he remained very active and energetic in his entrepreneurial role.

https://polymerspaintcolourjournal.com/news/elastomer-entrepreneur-michel-baul%C3%A9-passes-away