The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

December 12, 2022

China shipyards feast on record LNG tanker orders as South Korea builders are full up

By Chen Aizhu

Summary

- Companies

- Chinese yards win nearly 30% of this year’s record orders

- Order books for Chinese yards triple as LNG freight soars

- Steep learning curves for shipbuilders new to LNG

- China needs vessels to ship U.S. LNG for energy security

SINGAPORE, Dec 12 (Reuters) – China is making fast inroads in the market for newbuild liquefied natural gas (LNG) tankers as local and foreign shipowners turn to its shipbuilders for the specialty vessels because long dominant yards in South Korea are fully booked.

Three Chinese shipyards – only one of them having experience building large LNG tankers – won nearly 30% of this year’s record orders for 163 new gas carriers, claiming ground in a sector where South Korea usually captures most of the business.

LNG tanker order books for Chinese yards tripled as China’s gas traders and fleet operators sought to secure shipping after freight rates soared to records following the upending of global energy supply flows by Russia’s invasion of Ukraine.

With South Korean shipbuilders swamped by orders to service Qatar’s massive North Field expansion, Chinese yards also attracted more foreign bookings, including first overseas orders for some ship makers only recently certified to build membrane-type LNG carriers.

“As more Chinese gas traders engage local shipyards, they will be forced to climb the learning curve and eventually grow the whole industry,” said Li Yao, founder of Beijing-based consultancy SIA Energy.

Chinese shipyards this year won 45 LNG tanker orders worth an estimated $9.8 billion, about five times their 2021 order values, according to shipping data provider Clarksons Research.

By late November, Chinese yards had grown their LNG order books to 66 from 21, giving them 21% of global orders worth around $60 billion.

Comparatively, Chinese shipyards built just 9% of the existing global LNG fleet, according to Clarksons.

STEEP CURVE

Shanghai-based Hudong-Zhonghua Shipbuilding is the only Chinese yard with experience building large LNG carriers, delivering dozens going back to 2008. This year, it took 75% of China’s new orders.

Hudong-Zhonghua shared 26 orders from local owners – versus nine the last two years – with fellow China State Shipbuilding Corporation units, Dalian Shipbuilding Industry and Jiangnan Shipyard (Group), according to Clarksons and industry officials.

Two other yards – China Merchants Heavy Industry (CMHI) and Yangzijiang Shipbuilding (YAZG.SI) – were certified to build large LNG carriers this year and have attracted interest from local and foreign shippers.

LNG tankers, like aircraft carriers, are among the most difficult vessels to build, taking up to 30 months. For membrane-type containment tanks alone, 200 workers spend two months welding barrier walls made of paper-thin steel and 130 km (81 miles) of connecting lines.

Workers on these systems for housing gas chilled to minus 160 Celsius (minus 260 Fahrenheit) for shipping also have to be certified by Gaztransport & Technigaz (GTT) (GTT.PA), a French engineering company that holds the patents and licences its designs to shipbuilders.

“The learning curve will be steeper for the newer builders … We’ll also face a shortage of skilled workers,” said Hu Keyi, corporate technology chief at Jiangnan Shipyard.

Jiangnan is building its first 80,000 cubic metre (cu m) tanker for Guangdong-based trader JOVO Energy (605090.SS) and won an order in March from Abu Dhabi National Oil Company (ADNOC) for two 175,000 cu m LNG carriers.

“Considering relatively low financing costs thanks to Chinese banks’ support … investing in a newbuild offers greater security versus term chartering,” said Jacky Cai, a director at JOVO Energy, which is considering ordering a larger tanker.

U.S. GAS

China’s demand for LNG tankers is propelled by a need to ship 20 million tonnes a year of gas from the United States, part of a boom set to swell the global LNG fleet by a third over the next five years, said Robert Songer, analyst at commodity consultancy ICIS.

China needs about 80 vessels to transport U.S. LNG, said SIA Energy’s Li.

“Apart from servicing Chinese demand … the vessels may also be used to trade cargoes on other routes,” said Stephen Gordon, managing director of Clarksons Research.

Strong local shipbuilding benefits state energy giants PetroChina , China National Offshore Oil Corporation (CNOOC) and Sinopec , and private firm ENN Natural Gas Co (600803.SS), helping to better secure a fuel key to meeting China’s 2060 carbon-neutral target.

PetroChina and CNOOC lined up orders at Hudong-Zhonghua earlier than their peers, mostly via joint ventures with state shippers COSCO Shipping Energy Transportation (600026.SS) and China Merchants Energy Shipping (CMES) (601872.SS), following President Xi Jinping’s call for energy security.

Sinopec, a minority stakeholder of CMES, is also in talks to secure newbuilds at Jiangnan and Dalian, industry officials told Reuters. Sinopec declined to comment.

COSCO Shipping Energy is “ready to work hand-in-hand with shipowners and yards,” Qin Jiong, a company vice president, told an industry seminar last month, pointing to another advantage of using local shipyards.

FOREIGN ORDERS

While their labour costs are higher, Korean yards – such as Hyundai Heavy Industries (329180.KS) and Daewoo Shipbuilding & Marine Engineering (042660.KS) – are more efficient in design and construction and have a local supply chain, said Sunny Xu, founder of Singapore-based LNG solution provider C-LNG.

“Shipowners seem to have a more positive view about Korean shipyards … to realise the design shipowners want, ability to meet deadlines, and problem-free operation,” said a South Korean shipbuilding industry source who declined to be identified.

Still, Chinese yards received 19 foreign orders for LNG tankers this year and that number is likely to grow.

“Chinese yards have become more attractive because of the South Korean backlog, as well as rising costs,” said ICIS analyst Songer.

Chinese yards’ relationship with GTT also helps, he said.

“It is a fair assumption that China will start building a lot more vessels in the future.”

December 12, 2022

China shipyards feast on record LNG tanker orders as South Korea builders are full up

By Chen Aizhu

Summary

- Companies

- Chinese yards win nearly 30% of this year’s record orders

- Order books for Chinese yards triple as LNG freight soars

- Steep learning curves for shipbuilders new to LNG

- China needs vessels to ship U.S. LNG for energy security

SINGAPORE, Dec 12 (Reuters) – China is making fast inroads in the market for newbuild liquefied natural gas (LNG) tankers as local and foreign shipowners turn to its shipbuilders for the specialty vessels because long dominant yards in South Korea are fully booked.

Three Chinese shipyards – only one of them having experience building large LNG tankers – won nearly 30% of this year’s record orders for 163 new gas carriers, claiming ground in a sector where South Korea usually captures most of the business.

LNG tanker order books for Chinese yards tripled as China’s gas traders and fleet operators sought to secure shipping after freight rates soared to records following the upending of global energy supply flows by Russia’s invasion of Ukraine.

With South Korean shipbuilders swamped by orders to service Qatar’s massive North Field expansion, Chinese yards also attracted more foreign bookings, including first overseas orders for some ship makers only recently certified to build membrane-type LNG carriers.

“As more Chinese gas traders engage local shipyards, they will be forced to climb the learning curve and eventually grow the whole industry,” said Li Yao, founder of Beijing-based consultancy SIA Energy.

Chinese shipyards this year won 45 LNG tanker orders worth an estimated $9.8 billion, about five times their 2021 order values, according to shipping data provider Clarksons Research.

By late November, Chinese yards had grown their LNG order books to 66 from 21, giving them 21% of global orders worth around $60 billion.

Comparatively, Chinese shipyards built just 9% of the existing global LNG fleet, according to Clarksons.

STEEP CURVE

Shanghai-based Hudong-Zhonghua Shipbuilding is the only Chinese yard with experience building large LNG carriers, delivering dozens going back to 2008. This year, it took 75% of China’s new orders.

Hudong-Zhonghua shared 26 orders from local owners – versus nine the last two years – with fellow China State Shipbuilding Corporation units, Dalian Shipbuilding Industry and Jiangnan Shipyard (Group), according to Clarksons and industry officials.

Two other yards – China Merchants Heavy Industry (CMHI) and Yangzijiang Shipbuilding (YAZG.SI) – were certified to build large LNG carriers this year and have attracted interest from local and foreign shippers.

LNG tankers, like aircraft carriers, are among the most difficult vessels to build, taking up to 30 months. For membrane-type containment tanks alone, 200 workers spend two months welding barrier walls made of paper-thin steel and 130 km (81 miles) of connecting lines.

Workers on these systems for housing gas chilled to minus 160 Celsius (minus 260 Fahrenheit) for shipping also have to be certified by Gaztransport & Technigaz (GTT) (GTT.PA), a French engineering company that holds the patents and licences its designs to shipbuilders.

“The learning curve will be steeper for the newer builders … We’ll also face a shortage of skilled workers,” said Hu Keyi, corporate technology chief at Jiangnan Shipyard.

Jiangnan is building its first 80,000 cubic metre (cu m) tanker for Guangdong-based trader JOVO Energy (605090.SS) and won an order in March from Abu Dhabi National Oil Company (ADNOC) for two 175,000 cu m LNG carriers.

“Considering relatively low financing costs thanks to Chinese banks’ support … investing in a newbuild offers greater security versus term chartering,” said Jacky Cai, a director at JOVO Energy, which is considering ordering a larger tanker.

U.S. GAS

China’s demand for LNG tankers is propelled by a need to ship 20 million tonnes a year of gas from the United States, part of a boom set to swell the global LNG fleet by a third over the next five years, said Robert Songer, analyst at commodity consultancy ICIS.

China needs about 80 vessels to transport U.S. LNG, said SIA Energy’s Li.

“Apart from servicing Chinese demand … the vessels may also be used to trade cargoes on other routes,” said Stephen Gordon, managing director of Clarksons Research.

Strong local shipbuilding benefits state energy giants PetroChina , China National Offshore Oil Corporation (CNOOC) and Sinopec , and private firm ENN Natural Gas Co (600803.SS), helping to better secure a fuel key to meeting China’s 2060 carbon-neutral target.

PetroChina and CNOOC lined up orders at Hudong-Zhonghua earlier than their peers, mostly via joint ventures with state shippers COSCO Shipping Energy Transportation (600026.SS) and China Merchants Energy Shipping (CMES) (601872.SS), following President Xi Jinping’s call for energy security.

Sinopec, a minority stakeholder of CMES, is also in talks to secure newbuilds at Jiangnan and Dalian, industry officials told Reuters. Sinopec declined to comment.

COSCO Shipping Energy is “ready to work hand-in-hand with shipowners and yards,” Qin Jiong, a company vice president, told an industry seminar last month, pointing to another advantage of using local shipyards.

FOREIGN ORDERS

While their labour costs are higher, Korean yards – such as Hyundai Heavy Industries (329180.KS) and Daewoo Shipbuilding & Marine Engineering (042660.KS) – are more efficient in design and construction and have a local supply chain, said Sunny Xu, founder of Singapore-based LNG solution provider C-LNG.

“Shipowners seem to have a more positive view about Korean shipyards … to realise the design shipowners want, ability to meet deadlines, and problem-free operation,” said a South Korean shipbuilding industry source who declined to be identified.

Still, Chinese yards received 19 foreign orders for LNG tankers this year and that number is likely to grow.

“Chinese yards have become more attractive because of the South Korean backlog, as well as rising costs,” said ICIS analyst Songer.

Chinese yards’ relationship with GTT also helps, he said.

“It is a fair assumption that China will start building a lot more vessels in the future.”

December 9, 2022

Remote-Work Revolution Has Wiped Out $453 Billion In Commercial Real Estate Value

by Tyler Durden

Thursday, Dec 08, 2022 – 07:20 PM

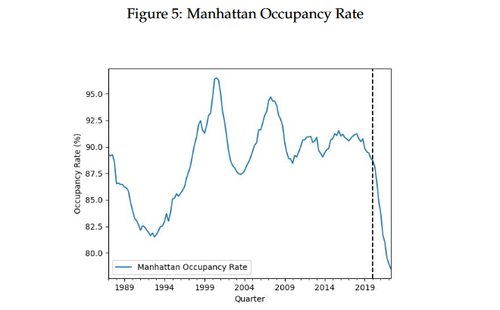

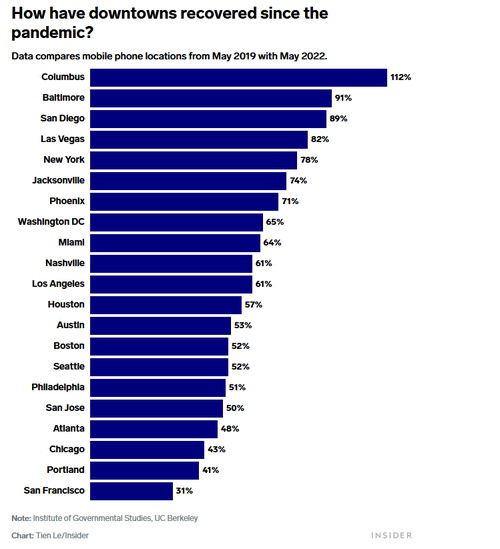

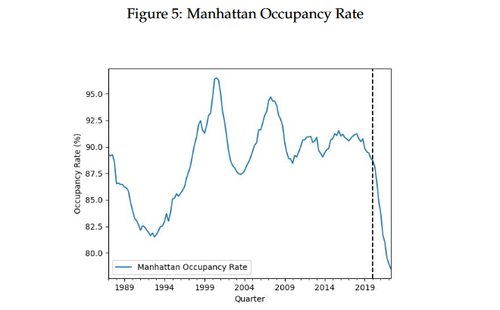

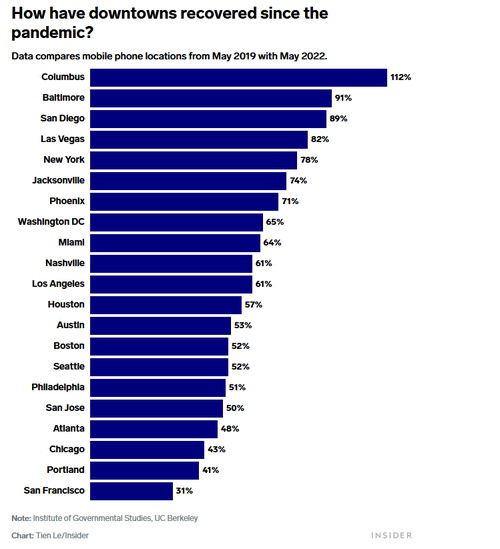

Leading up to the Covid-19 pandemic, roughly 95% of commercial office space was occupied across the United States, according to US National Bureau of Economic Research (NBER) – a nonprofit, non-government organization. By March 2020, occupancy plummeted to 10%, and has only recovered to 47%, according to a new NBER report which claims $453 billion in office commercial real estate value has been wiped out in an “office real estate apocalypse.”

Around the US, that resulted in a 17.5 percent decrease in lease revenue between January 2020, and May 2022, and not only because fewer offices were being occupied, but also because those that are being rented are going for shorter terms, lower prices per month, and a lot less floor space is needed as staff are told they can work from home for most or all the week.

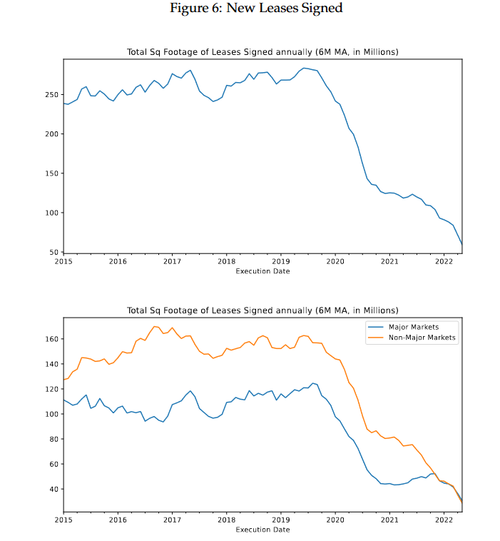

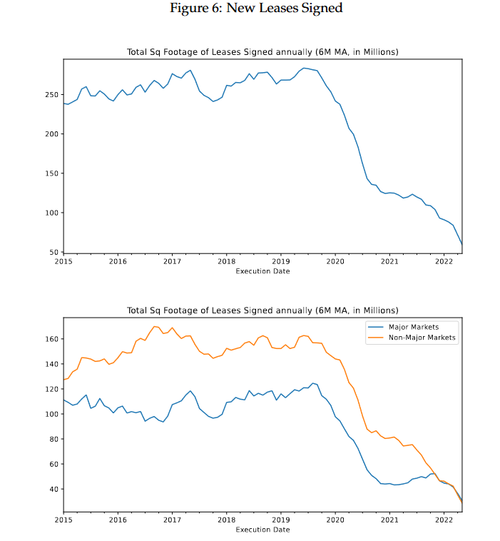

Prior to the pandemic, 253 million square feet were rented per year; as of May 2022, just 59 million square feet had been rented, NBER’s data indicates. “This indicates a massive drop in office demand from tenants who are actively making space decisions,” NBER said. –The Register

What’s more, while vacancy rates have hit a 30-year high, 61.7% of in-force commercial leases haven’t come up for renewal since the pandemic – meaning that “rents may not have bottomed out yet.”

What this means is that commercial real estate – a popular choice for pension fund managers and investors alike – may not be the best idea for the foreseeable future, given the continuing work-from-home options adopted by corporate America.

A common method used to invest in office real estate is commercial mortgage-backed securities (CMBS), which are managed and traded via commercial mortgage-backed indexes (CMBX) made up of pools of CMBSes.

According to NBER, more recent CMBXes tend to include a higher percentage of office collateral than earlier vintages. Those newer, office-heavy CMBXes, NBER said, are what’s losing the most money. -The Register

NBER says that in 2019, commercial real estate assets topped $4.7 trillion – offices being the largest component.

https://www.zerohedge.com/economics/remote-work-revolution-has-wiped-out-453-billion-commercial-real-estate-value

December 9, 2022

Remote-Work Revolution Has Wiped Out $453 Billion In Commercial Real Estate Value

by Tyler Durden

Thursday, Dec 08, 2022 – 07:20 PM

Leading up to the Covid-19 pandemic, roughly 95% of commercial office space was occupied across the United States, according to US National Bureau of Economic Research (NBER) – a nonprofit, non-government organization. By March 2020, occupancy plummeted to 10%, and has only recovered to 47%, according to a new NBER report which claims $453 billion in office commercial real estate value has been wiped out in an “office real estate apocalypse.”

Around the US, that resulted in a 17.5 percent decrease in lease revenue between January 2020, and May 2022, and not only because fewer offices were being occupied, but also because those that are being rented are going for shorter terms, lower prices per month, and a lot less floor space is needed as staff are told they can work from home for most or all the week.

Prior to the pandemic, 253 million square feet were rented per year; as of May 2022, just 59 million square feet had been rented, NBER’s data indicates. “This indicates a massive drop in office demand from tenants who are actively making space decisions,” NBER said. –The Register

What’s more, while vacancy rates have hit a 30-year high, 61.7% of in-force commercial leases haven’t come up for renewal since the pandemic – meaning that “rents may not have bottomed out yet.”

What this means is that commercial real estate – a popular choice for pension fund managers and investors alike – may not be the best idea for the foreseeable future, given the continuing work-from-home options adopted by corporate America.

A common method used to invest in office real estate is commercial mortgage-backed securities (CMBS), which are managed and traded via commercial mortgage-backed indexes (CMBX) made up of pools of CMBSes.

According to NBER, more recent CMBXes tend to include a higher percentage of office collateral than earlier vintages. Those newer, office-heavy CMBXes, NBER said, are what’s losing the most money. -The Register

NBER says that in 2019, commercial real estate assets topped $4.7 trillion – offices being the largest component.

https://www.zerohedge.com/economics/remote-work-revolution-has-wiped-out-453-billion-commercial-real-estate-value

December 8, 2022

End Of An Era: Final Boeing 747 Rolls Off Assembly Line

by Tyler Durden

Wednesday, Dec 07, 2022 – 08:00 PM

The last Boeing 747 jumbo jet rolled off the production line at the company’s factory in Everett, Washington, on Tuesday night, marking a close to a significant chapter in aviation history.

Aviation historians call the 747 the original jumbo jet was first produced in 1967. Three years later, Pan Am started flying the double-decker jumbo jet that could haul over 500 passengers worldwide.

“For more than half a century, tens of thousands of dedicated Boeing employees have designed and built this magnificent airplane that has truly changed the world. We are proud that this plane will continue to fly across the globe for years to come,” Kim Smith, Boeing vice president and general manager, 747 and 767 programs, wrote in a press release.

Last night, the 1,574th 747 rolled out of the Everett factory.

The 747 was once the premiere choice of aircraft for airlines and has since been replaced with a twin-engine, wide-body aircraft that is more fuel-efficient. Still, 341 of these jumbos are in use but only as freighters.

“The 747-8 is an incredibly capable aircraft, with capacity that is unmatched by any other freighter in production,” UPS wrote in a statement in 2020 when Boeing said production of the jet would end in late 2022.

“With a maximum payload of 307,000 lbs., we use them on long, high-volume routes, connecting Asia, North America, Europe and the Middle East,” the shipper continued.

The last 747 was sold to air freighter Atlas Air which will use the aircraft to haul goods worldwide.

https://www.zerohedge.com/markets/end-era-final-boeing-747-rolls-assembly-line