The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

November 30, 2022

EPA Proposes Significant TSCA Fee Increase

- November 28, 2022

- Government Affairs

- Contact: Riaz Zaman

Share via:

- On Nov. 16, the U.S. Environmental Protection Agency (EPA) published a proposed Toxic Substances Control Act (TSCA) fee rule, modifying its 2021 proposal for an increase in fees set in 2018. Under TSCA, EPA can collect fees from the regulated community to offset 25% of program costs for implementation of TSCA Sections 4, 5 and 6.

EPA’s new cost estimates would expect agency collection of collecting $45.5 million each year, as compared to the $22 million expected from the 2021 proposed rule.

EPA based the revised fee rule on estimates and information collected since the 2016 amendments, noting that it previously estimated fees based on data collected prior to 2016.

EPA proposes significant increases in fees, summarized in Table 5 of the proposed rule, including:

- PMN fee of $45,000 increased from $19,020.

- LVE fee of $13,200 increased from $5,590.

- EPA-initiated risk evaluation fee of $5,081,000 collectively, increased from $2,560,000.

- Test order fee $25,000, increased from $11,650.

Because of adverse feedback received, including comments from ACA, EPA is not finalizing fees for submission of a Bona Fide Notice or a Notice of Commencement as it had previously proposed.

EPA is holding a public webinar on Dec. 6, from 1:00 pm – 2:30 pm (EST) to provide an overview to stakeholders about the proposed rulemaking. Register for the webinar here. EPA will accept public comments on the supplemental proposed rule through Jan.17, 2023 via docket EPA-HQ-OPPT-2020-0493 at www.regulations.gov.

ACA will be submitting comments by the EPA deadline.

Details of the Proposal

Exemptions from Fee Payment

EPA is including exemptions it proposed in 2021, with minor changes. Exemptions apply to fees for test orders, test rules, and risk evaluations. The following would be exempted:

- Import of articles;

- Production of a chemical as a byproduct that is not used or distributed for a commercial purpose;

- Manufacture of intermediates;

- Manufacture of small quantities used for research and development; and

- Manufacture (including import) of a chemical in a quantity below 1,100 lbs./yr. for test orders and test rule fees and 2,500 lbs./yr. for risk evaluation fees.

Exemptions apply to fee payment only. They do not impact scope of test orders, test rules or risk evaluations that can include consideration of small amounts. To qualify for the exemptions for manufacture and import of small quantities, a company must meet thresholds by averaging manufacture and import volumes over the prior five years and the subsequent five years. Qualifying companies must also submit records of manufacture / import volumes for the three years prior to EPA’s publication of a preliminary list of manufacturers and importers. The exemption would not apply when the manufacturers and importers of small quantities are the only manufacturers and importers of a chemical.

EPA will use records to identify manufacturers and importers of small quantities for fee payment, if necessary. ACA had previously commented that small quantity thresholds, although useful, can lead to a regulatory gap where a downstream user relies on a Safety Data Sheet (SDS) where trace amounts are not disclosed, and the chemical is inadvertently imported in amounts above proposed thresholds over a year. ACA had requested an additional threshold based on SDS disclosure requirements.

Partial Refunds of the PMN Fee

EPA is proposing changes to partial Premanufacture Notice (PMN) fee refunds, so that 75% of the PMN fee would be refunded if the submitter withdraws a PMN within 10 days after the agency initiates review. EPA also proposes refunding 20% if the PMN submitter withdraws a PMN within five (5) days after receiving notification of EPA’s completion of the PMN review process, but prior to initiating risk mitigation activities. Withdrawal would require the PMN submitter to resubmit as a new PMN, if it intends to conduct any commercial activity with the chemical in the future.

Risk Evaluation Fee Calculation for Manufacturers and Importers

Where manufacturers and importers do not form a consortium for fee payment, EPA proposes that it will allocate fees so that companies with manufacture and import volumes in the top 20th percentile will be responsible for 80% of the risk evaluation fee, split equally amongst those companies. The bottom 80% of companies ranked by production volume would be responsible for 20% of the risk evaluation fee. Both fees would be reduced by an adjusted amount paid by small business, subject to the 80% discount for small businesses.

Contact ACA’s Riaz Zaman for more information.

November 26, 2022

Brenntag Is Said to Explore Takeover of Chemicals Rival Univar

Michelle F. Davis, Kiel Porter and Aaron Kirchfeld, Bloomberg News

(Bloomberg) — Germany’s Brenntag SE is exploring a potential acquisition of US rival Univar Solutions Inc. that would cement its position as the world’s biggest chemical distributor and create a company with more than $30 billion in sales, people familiar with the matter said.

The two firms have held preliminary talks about the feasibility of a combination, the people said, asking not to be identified because the matter is private. If discussions go smoothly, Brenntag and Univar may decide as soon as the next couple months whether to proceed with a transaction, the people said.

Brenntag has declined 14% this year, valuing the Essen-based firm at €10.6 billion ($11 billion). Downers Grove, Illinois-based Univar is up more than 9%, giving it a market capitalization of more than $5 billion.

Deliberations are at a preliminary stage and there’s no certainty they will lead to a transaction, the people said. Representatives for Brenntag and Univar couldn’t immediately comment.

The potential tie-up would rank as a top three transaction in the chemical industry this year and mark a late bright spot for big cross-border dealmaking. Global mergers and acquisitions are down almost 30% this year to $2.4 trillion, according to data compiled by Bloomberg, hurt by economic headwinds and difficult financing markets.

While Brenntag is a serial acquirer of smaller assets, a Univar takeover would mark its largest purchase by far and be a bold move for Chief Executive Officer Christian Kohlpaintner. The German company unveiled a new growth plan earlier this month to “shape the future of its industry” including organic re-investments and “value creating M&A activities.”

Univar is no stranger to dealmaking itself. It merged with rival Nexeo Solutions Inc. in 2018 and then sold its plastics business in 2019. David Jukes has served as Univar’s CEO since 2018.

A combination would create an opportunity to boost growth and cut costs, but could also face tough antitrust reviews as national governments more closely scrutinize sector tie-ups.

Brenntag reported $20.3 billion of sales over the trailing 12 months, compared with $11.4 billion at Univar, according to data compiled by Bloomberg. The German company is the global market leader in chemical and ingredients distribution with over 17,000 employees in 78 companies, according to its website.

Univar boasts one of the industry’s largest private transportation fleets as well as a sales force and logistics team that helps connect chemical makers and buyers across sectors.

–With assistance from Eyk Henning and Dinesh Nair.

©2022 Bloomberg L.P.

https://www.bnnbloomberg.ca/brenntag-is-said-to-explore-takeover-of-chemicals-rival-univar-1.1851291

November 26, 2022

Brenntag Is Said to Explore Takeover of Chemicals Rival Univar

Michelle F. Davis, Kiel Porter and Aaron Kirchfeld, Bloomberg News

(Bloomberg) — Germany’s Brenntag SE is exploring a potential acquisition of US rival Univar Solutions Inc. that would cement its position as the world’s biggest chemical distributor and create a company with more than $30 billion in sales, people familiar with the matter said.

The two firms have held preliminary talks about the feasibility of a combination, the people said, asking not to be identified because the matter is private. If discussions go smoothly, Brenntag and Univar may decide as soon as the next couple months whether to proceed with a transaction, the people said.

Brenntag has declined 14% this year, valuing the Essen-based firm at €10.6 billion ($11 billion). Downers Grove, Illinois-based Univar is up more than 9%, giving it a market capitalization of more than $5 billion.

Deliberations are at a preliminary stage and there’s no certainty they will lead to a transaction, the people said. Representatives for Brenntag and Univar couldn’t immediately comment.

The potential tie-up would rank as a top three transaction in the chemical industry this year and mark a late bright spot for big cross-border dealmaking. Global mergers and acquisitions are down almost 30% this year to $2.4 trillion, according to data compiled by Bloomberg, hurt by economic headwinds and difficult financing markets.

While Brenntag is a serial acquirer of smaller assets, a Univar takeover would mark its largest purchase by far and be a bold move for Chief Executive Officer Christian Kohlpaintner. The German company unveiled a new growth plan earlier this month to “shape the future of its industry” including organic re-investments and “value creating M&A activities.”

Univar is no stranger to dealmaking itself. It merged with rival Nexeo Solutions Inc. in 2018 and then sold its plastics business in 2019. David Jukes has served as Univar’s CEO since 2018.

A combination would create an opportunity to boost growth and cut costs, but could also face tough antitrust reviews as national governments more closely scrutinize sector tie-ups.

Brenntag reported $20.3 billion of sales over the trailing 12 months, compared with $11.4 billion at Univar, according to data compiled by Bloomberg. The German company is the global market leader in chemical and ingredients distribution with over 17,000 employees in 78 companies, according to its website.

Univar boasts one of the industry’s largest private transportation fleets as well as a sales force and logistics team that helps connect chemical makers and buyers across sectors.

–With assistance from Eyk Henning and Dinesh Nair.

©2022 Bloomberg L.P.

https://www.bnnbloomberg.ca/brenntag-is-said-to-explore-takeover-of-chemicals-rival-univar-1.1851291

November 23, 2022

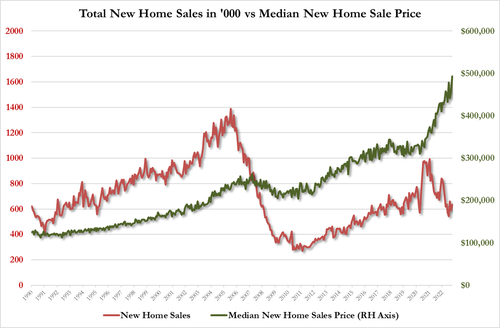

New Home Sales Unexpectedly Jump In October, Prices Surged To Record Highs

by Tyler Durden

Wednesday, Nov 23, 2022 – 10:18 AM

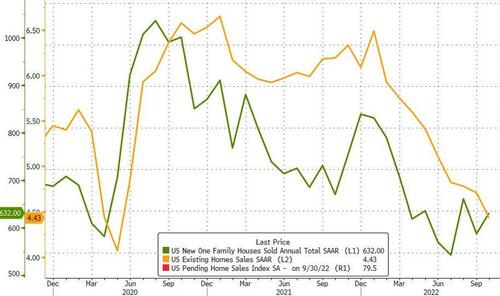

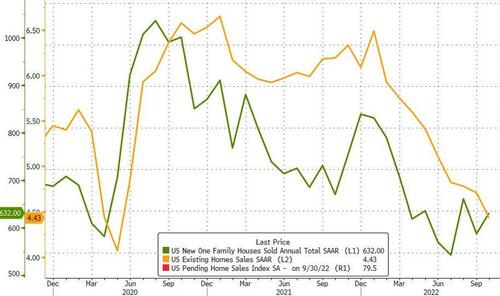

After existing home sales tumbled, new home sales were expected to follow suit amid soaring borrowing costs and ever-higher prices (despite building inventories and incentives by homebuilders). They didn’t…

The magical numbers from NAR showed new home sales rose 7.5% MoM (massively different from the 5.5% decline expected) which leaves new home sales down 5.8% YoY…

Source: Bloomberg

The total new home sales SAAR is hovering around the COVID lockdown lows…

Source: Bloomberg

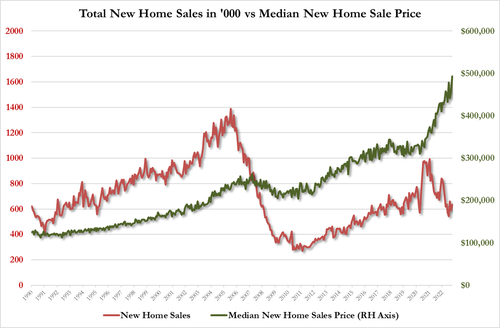

Analysts suggest massive incentive programs drove this surprise jump in sales but median new home prices shot up to a record $493,000!!

Sales in the South rebounded after a sharp retreat a month earlier when Hurricane Ian slammed into Florida and parts of Georgia and South Carolina. The October pace in the South was still slower than in August.

There were 470,000 new homes for sale as of the end of last month, though the overwhelming majority remain under construction or not yet started. The number of for-sale dwellings under construction, however, was the smallest in six months. At the current sales pace, it would take 8.9 months to exhaust the supply of new homes.

Earlier this month, Michael Murray, co-chief operating officer at D.R. Horton Inc., one of the largest US homebuilders, said the company closed fewer homes than expected in the latest quarter due to slower sales, more cancellations and continued construction delays.

Finally, given the total collapse in homebuilder confidence (about future sales), which still has a long way to go to catch down to the collapse in homebuyer confidence, we would suggest real estate agents ‘brace, brace, brace’…

Source: Bloomberg

November 23, 2022

New Home Sales Unexpectedly Jump In October, Prices Surged To Record Highs

by Tyler Durden

Wednesday, Nov 23, 2022 – 10:18 AM

After existing home sales tumbled, new home sales were expected to follow suit amid soaring borrowing costs and ever-higher prices (despite building inventories and incentives by homebuilders). They didn’t…

The magical numbers from NAR showed new home sales rose 7.5% MoM (massively different from the 5.5% decline expected) which leaves new home sales down 5.8% YoY…

Source: Bloomberg

The total new home sales SAAR is hovering around the COVID lockdown lows…

Source: Bloomberg

Analysts suggest massive incentive programs drove this surprise jump in sales but median new home prices shot up to a record $493,000!!

Sales in the South rebounded after a sharp retreat a month earlier when Hurricane Ian slammed into Florida and parts of Georgia and South Carolina. The October pace in the South was still slower than in August.

There were 470,000 new homes for sale as of the end of last month, though the overwhelming majority remain under construction or not yet started. The number of for-sale dwellings under construction, however, was the smallest in six months. At the current sales pace, it would take 8.9 months to exhaust the supply of new homes.

Earlier this month, Michael Murray, co-chief operating officer at D.R. Horton Inc., one of the largest US homebuilders, said the company closed fewer homes than expected in the latest quarter due to slower sales, more cancellations and continued construction delays.

Finally, given the total collapse in homebuilder confidence (about future sales), which still has a long way to go to catch down to the collapse in homebuyer confidence, we would suggest real estate agents ‘brace, brace, brace’…

Source: Bloomberg