Pricing and Markets

June 9, 2022

Natural Gas Update

European Gas Soars After US LNG Terminal Explosion Halts Exports For Weeks

by Tyler DurdenThursday, Jun 09, 2022 – 10:50 AM

Europe’s natural gas prices jumped Thursday after one of the US’ largest liquefied natural gas (LNG) export terminals experienced an explosion on Wednesday and has been shut down. A large share of the terminal’s LNG has been destined for Europe as the continent weens off Russian supplies.

Been in the Freeport area all day for an “incident” at LNG facility on Quintana Island. Freeport PD and witnesses say no doubt about it: it was an explosion. The fire/release has been contained and employees are accounted for. Investigation underway. pic.twitter.com/8wuGEGazb2 — Erica Simon (@EricaOnABC13) June 8, 2022

According to Bloomberg, the Freeport LNG export terminal in Texas will be shuttered for at least three weeks, which will impact 20% of all US LNG exports. In the last four months, 75% of all US LNG exports have been sent to Europe.

“In the last three months, 68% of all Freeport cargoes were delivered into European markets,” said Tom Marzec-Manser, head of gas analytics at ICIS.

Ole Hansen, head of the commodity strategy at Saxo Bank A/S, said the situation at Freeport has upended European gas markets after “calm trading seen in recent weeks.”

Dutch front-month gas, the European benchmark, traded as high as 16% before giving up some gains and trading at 84 euros per megawatt-hour.

After the reports of the explosion, we noted that US natgas was sold due to export halt fears would build supplies on the domestic grid; inversely, EU natgas would soar because of a decline in export shipments.

For those puzzled by the price action, US NatGas’s slump is in response to the prospect that fewer LNG exports would mean more supply domestically, though inversely, it would mean higher prices in Europe since the US has been increasingly sending LNG across the Atlantic to ween European countries off Russian supplies.

Since the incident at Freeport, US natgas prices have plunged 15%.

Analysts at Houston-based energy firm Criterion Research said, “very little information is known about the extent of the damage and how long it will take to repair.”

https://www.zerohedge.com/commodities/european-gas-soars-after-us-freeport-lng-terminal-explosion

June 9, 2022

Natural Gas Update

European Gas Soars After US LNG Terminal Explosion Halts Exports For Weeks

by Tyler DurdenThursday, Jun 09, 2022 – 10:50 AM

Europe’s natural gas prices jumped Thursday after one of the US’ largest liquefied natural gas (LNG) export terminals experienced an explosion on Wednesday and has been shut down. A large share of the terminal’s LNG has been destined for Europe as the continent weens off Russian supplies.

Been in the Freeport area all day for an “incident” at LNG facility on Quintana Island. Freeport PD and witnesses say no doubt about it: it was an explosion. 💥 The fire/release has been contained and employees are accounted for. Investigation underway. pic.twitter.com/8wuGEGazb2 — Erica Simon (@EricaOnABC13) June 8, 2022

According to Bloomberg, the Freeport LNG export terminal in Texas will be shuttered for at least three weeks, which will impact 20% of all US LNG exports. In the last four months, 75% of all US LNG exports have been sent to Europe.

“In the last three months, 68% of all Freeport cargoes were delivered into European markets,” said Tom Marzec-Manser, head of gas analytics at ICIS.

Ole Hansen, head of the commodity strategy at Saxo Bank A/S, said the situation at Freeport has upended European gas markets after “calm trading seen in recent weeks.”

Dutch front-month gas, the European benchmark, traded as high as 16% before giving up some gains and trading at 84 euros per megawatt-hour.

After the reports of the explosion, we noted that US natgas was sold due to export halt fears would build supplies on the domestic grid; inversely, EU natgas would soar because of a decline in export shipments.

For those puzzled by the price action, US NatGas’s slump is in response to the prospect that fewer LNG exports would mean more supply domestically, though inversely, it would mean higher prices in Europe since the US has been increasingly sending LNG across the Atlantic to ween European countries off Russian supplies.

Since the incident at Freeport, US natgas prices have plunged 15%.

Analysts at Houston-based energy firm Criterion Research said, “very little information is known about the extent of the damage and how long it will take to repair.”

https://www.zerohedge.com/commodities/european-gas-soars-after-us-freeport-lng-terminal-explosion

June 7, 2022

Stepan Announces Increase

“Effective July 1, 2022, or as contracts allow, Stepan will increase the price for STEPANPOL® and TERATE® Rigid Polyester

Polyols used in the Americas by $0.12 per pound. This increase is necessary due to the rapid and significant escalation in

feedstock and transportation prices in North America.”

June 7, 2022

Stepan Announces Increase

“Effective July 1, 2022, or as contracts allow, Stepan will increase the price for STEPANPOL® and TERATE® Rigid Polyester

Polyols used in the Americas by $0.12 per pound. This increase is necessary due to the rapid and significant escalation in

feedstock and transportation prices in North America.”

June 6, 2022

Natural Gas Prices Spike

Perfect Storm Of Factors Sends US Natural Gas Prices Soaring

by Tyler DurdenMonday, Jun 06, 2022 – 03:25 PM

U.S. natural gas fundamentals remain bullish as above-normal temperatures drive cooling demand and dwindling supplies that would’ve been used for the next winter season cause market tightness, sending futures for July delivery soaring 9.5% to $9.340/mmbtu as of 1315 ET.

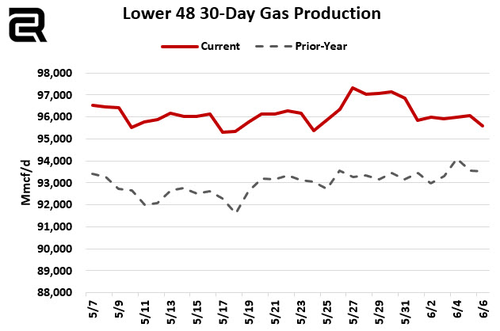

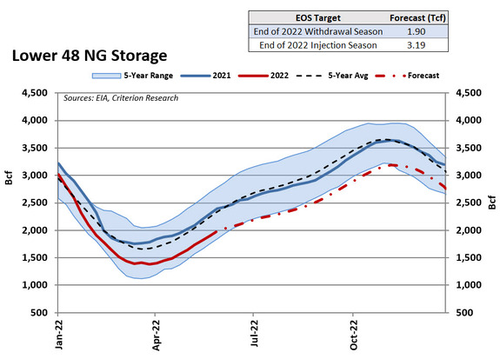

Houston-based energy firm Criterion Research sheds more color on the natgas fundamentals driving prices higher. They report a combination of factors, including above-average temperatures in the Lower U.S. 48, natgas demand, slumping natgas production, and below-average national stockpiles, which have driven July contracts above $9.

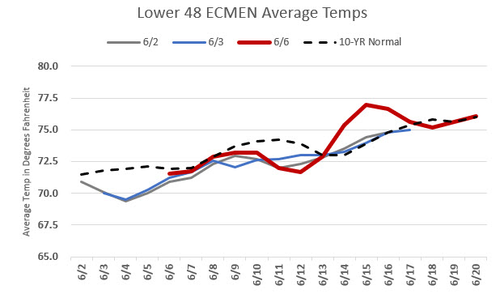

The Lower 48’s weather outlook has come in warmer this morning, with the latest models showing a warmer than average forecast for mid-June (versus the ten-year average.)

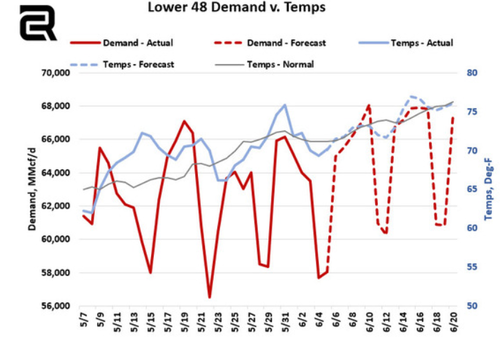

The week ending 6/17 should bring impressive natural gas demand numbers of 65.5 Bcf/d, marking the highest we’ve seen this summer.

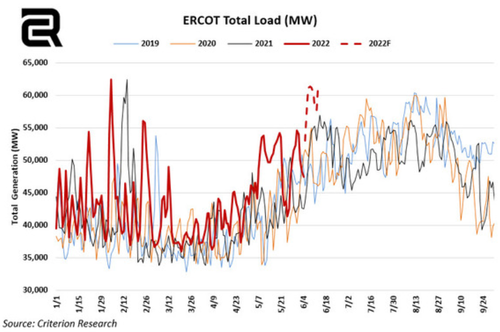

The warmer trend can especially be seen in states such as Texas, where ERCOT is forecasting record-high summer generation.

While the demand side of the equation comes in strong, U.S. natural gas production has been struggling since the start of June. Volumes quickly fell after June 1 and have remained off of the May highs.

Although general production growth is widely expected through year-end by most energy analyses, the speed at which that production comes online is the main concern. Higher production rates will be needed to fill national storage inventories before the winter, especially if summer temperatures continue to come in above-average.

At Criterion, the latest iteration of our long-term supply & demand forecast, we have adjusted our Fall EOS target to a lower 3.19 Tcf, which marked a drop from the last forecast for a 3.25 Tcf level.

The current situation may remain uber bullish and could push natgas prices even higher as summer begins and driving season is underway, which puts upward pressure on energy markets.

Higher U.S. demand versus Europe has compressed the E.U.-U.S. natgas spread (1mo ahead vs. futs).

And in fact, US natgas futures are now trading at a premium to Day-Ahead EU NatGas prices.

Soaring natgas prices will only mean the cost of power will rise. We outlined the cities where power bills will skyrocket this summer as threats of rolling blackouts increase.

https://www.zerohedge.com/commodities/perfect-storm-factors-sends-us-natural-gas-prices-soaring