Asian Markets

November 30, 2023

Chlorohydrin Process Propylene Oxide in China

The Evolution of Chlorohydrination Process for Manufacturing PO

PUdaily | Updated: November 30, 2023

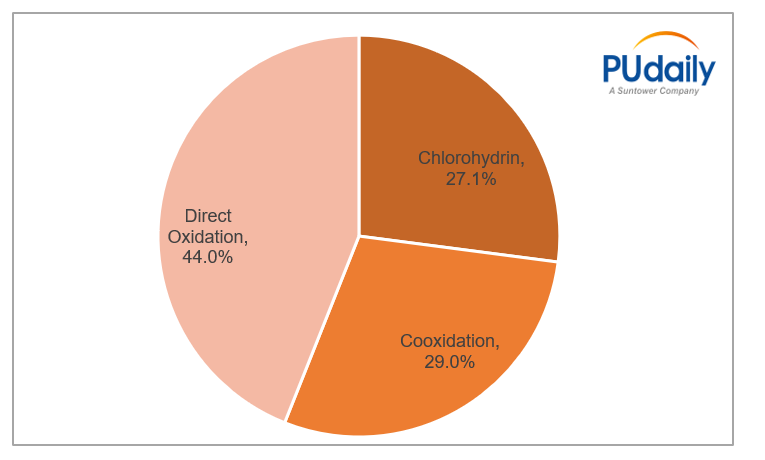

On July 14, the National Development and Reform Commission issued the National Industrial Restructuring Guidance Catalogue (2023 Edition) to seek public comments. In the new edition of the Catalogue, PO projects using chlorohydrination process based on calcium saponification are included in the eliminated category for the petrochemical and chemical industries (such projects are required to be eliminated by December 31, 2025). Restrictions on PO projects using chlorohydrination process can be traced back to the National Industrial Restructuring Guidance Catalogue (2011 edition).By the end of 2022, the share of PO projects using chlorohydrination process in China had decreased to 27.1%.

In chlorohydrination process, PO is manufactured using propylene and chlorine as the raw materials through chlorohydrination, saponification and rectification. Firstly, excess propylene is added to the mixture of water and chlorine to produce chloropropanol through chlorohydrination. The remaining propylene as well as hydrogen chloride and some organic chlorides (such as dichloropropane) produced in the reaction are discharged from the top of the reactor. and the hydrogen chloride and organic chlorides are removed through condensation for recovering the propylene. The chloropropanol solution containing 4% hydrochloric acid was discharged from the bottom of the reactor. Secondly, saponifier is added (caustic soda, instead of lime milk used in the traditional chlorohydrination process, is used in modified chlorohydrination process) to saponify chloropropanol for making crude PO. Thirdly, crude PO is transferred to the rectification column for separation and refining. The chlorohydrination process is composed of chlorohydrination, saponification and rectification.

As a mature technology, chlorohydrination process features production of a single product, easy operation of the facilities, low purity requirement for propylene and low building costs for the facilities. But it consumes a large amount of lime, chlorine and water, and results in a large amount of waste water and residue, which not only pollute the environment, but also cause corrosion to the equipment. Over the past decades, many firms at home and abroad have refined the process in different ways, represented by

1. Dow Chemical: The company replaces lime milk (Ca(OH)2) with electrolyte NaOH (mass fraction between 10% and 20%) in the saponification to significantly reduce the mass concentration of propanediol and dichloropropane in the saponified waste liquid and thus obtain relatively pure saline solution (NaCl and H2O). The saline solution is refined to make it saturated one, which is then transferred to the electrolytic bath for electrolysis that produces chlorine, hydrogen and sodium hydroxide. The chlorine is used as a raw material for the chlorohydrination process, and the sodium hydroxide is again used in the saponification. The recycling makes the process more economical. This refinement dramatically reduces the amount of waste water and residues (mainly composed of CaCl2) produced from saponification and as a result reduces the pollution of soil and water sources. However, the electrolytic process is energy-intensive.

2.ABB Lummus Global: The company comes up with the concept of closed-loop circulation, in which Cl2 and NaOH react with isobutanol to produce butyl hypochlorate as the chlorohydrating agent to reduce the use of Cl2; butyl hypochlorate react with propylene in the organic solvent to produce isobutanol and chloropropanol;and chloropropanol is saponified with the electrolyte to manufacture propylene oxide. Compared with the traditional chlorohydrination process, this refined process greatly reduces industrial wastewater, waste gases and residues. With a high mass concentration, the saline solution produced from saponification can be transferred to the electrolytic plant for electrolysis. The produced Cl2 and NaOH can be reused. But the process also has drawbacks, including large consumption of isobatyalcohol and high building costs for the facility.

A domestic firm has also developed its own environmentally friendly process for manufacturing PO, in which the recovered lime milk is saponified with the waste water and CaCl2 in the residual liquid. This process has been industrialized, producing significant social, environmental and economic benefits.

November 28, 2023

Chairman’s Letter

Wanhua Chemical : Converging Passion, Moving Forward Together – A Letter of Gratitude from Chairman to All Wanhua Staff

November 28, 2023 at 10:07 am

Share

Converging Passion, Moving Forward Together – A Letter of Gratitude from Chairman to All Wanhua Staff

TIME :2023-11-28

Dear Colleagues,

As sure as day turns to night, another year has flown by, bringing us back to our annual day of gratitude at Wanhua. On this meaningful day, I want to extend my sincere regards to all our teammates, the families of Wanhua teammates, and our friends from every corner who’ve had our back – a massive thank you! We’re truly grateful for your understanding, support, trust, and belief in us.

The year 2023 holds exceptional significance. We’ve seen the international order was going through some real roller coaster changes. As we came out of the pandemic, the global economy is picking itself up, dusting off, and moving forward amidst challenges and opportunities. In this game-changing time, every one of us at Wanhua has pulled together, bringing our surging momentum, and fueling our drive for high-quality development.

Thank you for your contributions that have brought success to Wanhua. Our front-line production crew has been great like never before, fine-tuning our lean manufacturing process. Your dedication to excellence makes our products the go-to choice for customers. Our marketing team has been nailing it with the “broadening sales channels, cooperating in a win-win relationship” approach, continuously delivering value to our customers with standout products and services, and beefing up Wanhua’s global reach. The procurement team, focusing on business needs, has been sticking to the rules and making progress in securing feedstock supply, supplier diversification, and equipment localization. You all have played a part in Wanhua’s success story, winning rave reviews from customers with our stellar products.

A round of applause for sparking Wanhua’s innovation. With continuous innovation, our R&D folks have brought to reality our seventh-gen MDI manufacturing tech, pushing the boundaries of the polyurethane industry and leading a wave globally. You’re driving us towards greater efficiency, better quality, and lower energy consumption. Seizing the opportunities, you’ve made breakthroughs in advanced materials, helping Wanhua’s high-quality development and standing on the cutting edge with world-class products and technology, with your innovative spirit. In an era of ‘innovation inside the box,’ creating an environment where innovation isn’t just encouraged but a norm. Your collective efforts are the fuel that’s propelling Wanhua forward.

Thanks for mapping out Wanhua’s journey. You’ve been trailblazers, across continents, leaving a mark of Wanhua’s diligence everywhere. Our Penglai low-carbon industrial park is rising with the construction of mega ethylene project phase II, not to mention Fujian TDI, Ningxia MDI, Ningbo HDI phase II, and Meishan NMP started operation. You’re painting a picture of Wanhua’s growth day by day, pushing us towards greater heights.

I feel thankful to every unsung hero at Wanhua, for your tireless work and contributions, as even a bit of effort counts and deserves a salute. The sweat, and tears on this journey, the heroes who’ve stepped up when it is the time, and the incredible achievements we’ve accomplished together, have merged into an unstoppable force, moving us confidently towards an extraordinary future of Wanhua.

While the prospects are bright, the road has twists and turns. We’ve ridden the waves of a momentous journey and are now gearing up for even more remarkable glory! Fellow teammates, let’s carry the spirit of gratitude, our grand mission, and our heartfelt passion, and unite as one for exponential growth. Let’s aim to build a world-class enterprise, a legacy that will last for centuries, and write a dazzling story!

A heartfelt gratitude to every one of Wanhua for your unwavering dedication!

Liao Zengtai

November 23, 2023

November 21, 2023

Chinese PU Market

China’s PU Market Experienced Sluggishness in October

PUdaily | Updated: November 16, 2023

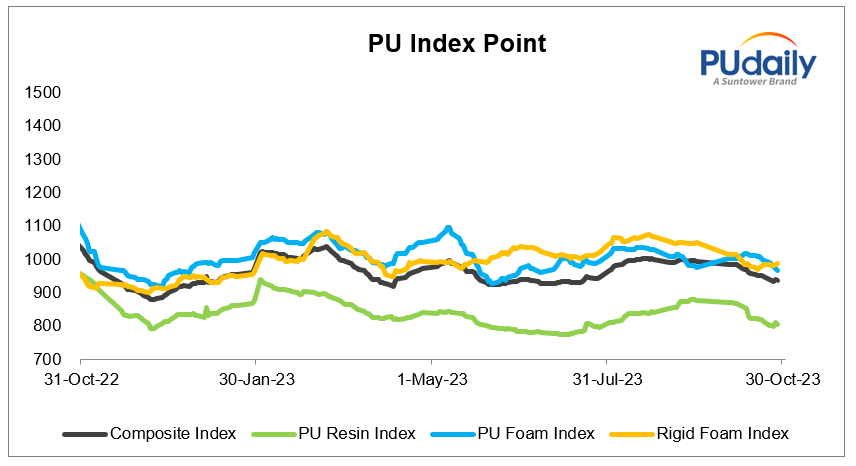

The PU composite index for October fluctuated. September saw a weaker-than-expected PU market. in October, the market became even more sluggish.Amid few inquiries, trading in PU raw materials was thin, resulting in a consolidating PU market.

The flexible PU foam index declined in October Earlier this month, spot TDI supply was tight as Wanhua(Xinjiang), Wanhua(Fujian) and Gansu Yinguang Chemical Industry shut their plants.In addition, some manufacturers needed to fulfill orders placed in September, and Covestro (Shanghai) stopped selling to boost the market. As a result, the TDI market rose significantly. Later, however, as demand became weak and spot supply increased with facilities restarted, manufacturers had to reduce prices to facilitate sale, resulting in a sharp fall in the TDI market. Flexible slabstock polyols manufacturers discussed prices with buyers.

In October, the rigid PU foam index consolidated at a low level. In the month, demand for rigid PU foam was sluggish.Specifically, demand from refrigerator manufacturers continued to rise, thanks to the double-digit year-on-year growth in refrigerator exports; that from insulated pipeline project in North China shrank; and that from the cold chain and OCF sectors remained weak. Late this month, due to tight MDI supply, the market bottomed out. With ample supply and finding it hard to sell, rigid polyols manufacturers discussed prices with buyers.

The resin index remained low in October. In the month, the AA market dipped. The high costs lent some support, but demand was sluggish as buyers made purchases as needed. The BDO market was down. In the month, the prices of feedstocks calcium carbide and methanol fell, lending decreased support to the BDO market. The supply rose significantly as maintenance was completed. However, demand was sluggish. Due to cost pressure, manufacturers were loath to reduce prices and decreased supply. but this provided limited support. traders were keen to sell. The THF market was soft-to-stable in October. The industry operating rate decreased, while operating rates in downstream sectors increased. traders sold goods according to market conditions. The PTMEG market remained stable in October. The operating rates in spandex industry remained stable, but the inventory cycle was extended. In the non-spandex products industry, synthetic leather resin manufacturers kept their operating rates low and made purchases as needed.

November 13, 2023

Sinochem PO

Sinochem International 400kT PO Facility Set to Produce Qualified Products in December

PUdaily | Updated: November 8, 2023

Since 2022, Sinochem International has successively completed and put into operation major facilities such as phenol acetone, bisphenol A, epoxy chloropropane, and epoxy resin as part of its first-phase C3 project. The 600 ktpa propane dehydrogenation (PDH) facility was recently commissioned for trial production, marking the complete integration of the entire epoxy resin industry chain at Sinochem International’s site in Lianyungang.

Over the years, Sinochem International has undergone a strategic transformation, evolving from a trading-oriented company into an internationally operated conglomerate primarily focused on fine chemical production. Through investments and acquisitions, the company has acquired a significant number of high-quality assets, including majority stakes in companies like Sennics, Yangnong Chemical, Elix Polymers, among others, laying a strong foundation for a successful industrial transformation. The company’s business encompasses chemical intermediates, polymer additives, new materials, new energy, and other traditional sectors, with complementary advantages between industries. Leveraging a green and circular economy industrial chain, Sinochem International has achieved continuous product diversification and efficient resource utilization, establishing a core competitive edge. The products offered include chlorobenzene series, nitrochlorobenzene series, widely used in industries such as pharmaceuticals, agrochemicals, and dyes. In the field of new materials, the company deals with high-performance fiber materials like aramid and high-strength polyethylene, as well as materials like epoxy chloropropane and epoxy resin used in industries such as coatings and electronics. They also handle lightweight materials such as PU, PC, PS, ABS, and others.

It’s worth mentioning that Sinochem International’s C3 project, with a production capacity of 400 ktpa of propylene oxide (PO), is expected to start commissioning on November 8 and is projected to produce qualified products in early December.

In the context of increasingly stringent environmental regulations, traditional chlorohydrin processes, which have not effectively addressed the “three wastes” issue, are gradually being phased out. In the draft of China’s 2023 Catalogue for Guiding Industry Restructuring, issued by National Development and Reform Commission on July 14, 2023, the calcium saponification chlorohydrin process should be eliminated by December 31, 2025. Following the elimination of a 50 ktpa chlorohydrin-based facility in Shandong, in recent years, chlorohydrin-based PO facilities, such as those in Jinpu, Tianjin, and Fujian, have successively ceased operations. As a result, the proportion of chlorohydrin processes has decreased from 55.9% in 2018 to 27.1% in 2022.

Currently, new PO facilities primarily use direct oxidation (HPPO) and cooxidation (PO/SM, PO/TBA) processes.

Sinochem International is expanding its capacity by 400 ktpa using the direct oxidation process for PO production, and its scale and technology are at the forefront domestically. The C3 project includes a 400 ktpa HPPO facility with supporting facilities, in line with national environmental protection policies. As an environmentally encouraged process, the direct oxidation process can overcome the drawbacks of severe equipment corrosion and high waste generation associated with chlorohydrin processes. This method features a simple process, high product yield, and only generates PO and water during production. Raw materials and auxiliary agents can be recycled, resulting in lower raw material and energy consumption and a significant reduction in production costs. It is also environmentally friendly and non-polluting. Furthermore, the direct oxidation process is expensive and challenging to acquire, with a high entry barrier. Once the facility is operational, Sinochem International will hold a leading position in terms of production capacity and technology in the domestic market.

Dimethyl carbonate (DMC) is a co-product produced by ester exchange in the production of propylene glycol. Thanks to green chemistry, new energy promotion, and sustainable development, DMC has gained attention due to its low toxicity and excellent environmental performance. It finds wide applications in various industrial fields. Apart from its traditional uses in adhesives, coatings, developers, and polycarbonates, DMC has seen significant growth in the downstream applications of lithium-ion battery electrolyte solvents, which now account for 30% of its usage. High purity is crucial for these applications, with industrial-grade DMC primarily used in traditional downstream applications and polycarbonates (PC), while battery-grade DMC requires higher purity. Currently, suppliers of battery-grade DMC include Shida Shenghua (75 ktpa), Oxiranchem (20 ktpa), etc. New entrants in this market include Capchem, Sinochem Quanzhou, Zhejiang Petrochemical, and Hualu Hengsheng. In the next 3-5 years, the newly established production capacity for carbonates in China is expected to exceed 4 mtpa, contributing to the increased demand for PO.

October 29, 2023

Wind Turbine Prices Fall

Profit At China’s Top Wind Firm Slumps 98%

by Tyler Durden

Friday, Oct 27, 2023 – 05:00 AM

By Charles Kennedy of Oilprice.com

Lower prices for turbines amid a price war in China have resulted in a 98% plunge in the net profit of the top Chinese wind turbine maker, Xinjiang Goldwind Science & Technology Co.

While investments in renewable energy projects in China are booming, intensified competition has led to a race to the bottom for wind turbine prices—a race that has dented profits at the biggest Chinese manufacturer.

Goldwind booked $1.28 million in net income for the third quarter of 2023, down by a massive 98% compared to the same period of 2022, a company statement quoted by Bloomberg showed on Thursday.

Chinese clean energy technology manufacturers have also come under EU scrutiny as the bloc fears cheaper products from China would undermine the European Union’s goals of having a strong EU clean energy manufacturing industry.

Globally, the wind power industry faces additional challenges. Offshore projects are being scrapped amid rising costs and interest rates and supply chain issues.

In August, Siemens Energy initiated a review of its wind business after taking a large hit to earnings and expected full-year revenues and profits due to problems at its unit Siemens Gamesa, one of the largest wind turbine makers in the world. At the end of June, Siemens Energy withdrew the profit guidance for the company due to problems with wind turbines at Siemens Gamesa.

“Following a substantial increase in failure rates of certain wind turbine components, an extended technical review suggested that significantly higher costs will be incurred than previously assumed to reach the targeted quality level,” Siemens Energy said in August.

On Thursday, October 26, Siemens Energy shares plunged by more than 30% to an all-time low after the company said it is in preliminary talks with different stakeholders, including banking partners and the German government, to ensure access to guarantees for long-term projects. More than $3 billion of Siemens Energy’s market value was wiped out by the early afternoon in Frankfurt today.

https://www.zerohedge.com/markets/profit-chinas-top-wind-firm-slumps-98