Asian Markets

September 12, 2023

Flexible Foam in Bangladesh

Foam industry firming up

Around 200 companies have entered the polyurethane foam industry of Bangladesh over the past 30 years. Photo: Collected

The market for polyurethane foam is growing in Bangladesh as the material is being increasingly used for making upholstered furniture as well as packaging and insulation, according to industry insiders.

For example, the automotive industry is contributing to the increased use as many car seats and door panels now incorporate foam fillings, they said.

As such, around 200 companies have entered the polyurethane foam industry over the past 30 years.

Besides, big companies like EuroAsia, Pran-RFL, Swan, Karmo, Bengal, Apex, Expo Group, Akhter, HomeTex, Hatil, and Classical Home have already established a firm grip on the market.

Pran-RFL Group entered the market in 2016 under the brand name “Comfy”.

The company produces several polyurethane foam products of varying density that have different uses.

These include soft and supper soft foam for mattresses and pillows, rigid foam for fridge insulation, flexible foam for footwear, and high-density foam for car accessories such as seats and panelling.

Kamruzzaman Kamal, director of marketing at Pran-RFL Group, said his company has grabbed about 15 percent of the market for foam products over the past seven years.

According to him, they have invested at least Tk 100 crore so far only for the manufacturing segment.

Kamal believes the business has potential for more branded companies to enter as demand has been increasing by about 10 percent annually for the past three decades.

Echoing the same, Shubhrajit Sarker, head of corporate at Euroasia, said the market for foam products is currently worth around Tk 360 crore annually.

Having entered the foam making business in 2015, Euroasia has grabbed a substantial share of the market since then by delivering quality products and after-sales service.

“By virtue of our quality and commitment, Euroasia has won the minds of customers as an authentic brand in Bangladesh,” Sarker added.

Referring to their market analysis, he said the overall demand for foam is worth Tk 30 crore per month.

Besides, the sector has so far created at least 1.5 lakh opportunities for direct and indirect employment.

But other than making furniture and footwear, foam is also used for packaging and insulation.

“So, the growth of e-commerce and subsequent rise in shipping of fragile products has further boosted the demand for foam packaging materials,” he said.

Furthermore, the construction industry in Bangladesh has witnessed a surge in foam usage for thermal insulation purposes, Hossain added.

Ali Hossain, general manager of Swan Foam, a leading foam manufacturer, said they have been in the business for more than 30 years and never compromised on quality.

According to him, there is no market data regarding the foam segment even though the material’s usage has been increasing in making furniture and other purposes.

Foam usage was once furniture centric but now, it is used in cars, fridges, footwear and more.

Also, the demand in rural areas has increased in line with the peoples’ growing purchasing power.

And while around 200 companies are currently involved with the business as it requires little investment, the quality of products made by most manufacturers is considerably limited, he added.

Selim H Rahman, chairman and managing director of Hatil, said they set up a foam production unit as a backward linkage industry so that they can ensure good quality materials in their furniture products.

However, this means that none of the foam produced at their unit is sold in the market.

According to him, the usage of foam is multidimensional, so the market is growing in line with the country’s economy.

Also, different sectors develop silently when a country’s economy develops like that of Bangladesh, which is not understood by the common people, Rahman added.

Quazi Anwarul Haque, proprietor of M/S RR Enterprise in the Baitul Mukarram area, said the foam making sector is unorganised as the market is still dominated by informal traders.

https://www.thedailystar.net/business/economy/news/foam-industry-firming-3401586

August 29, 2023

PMDI Inflows and Outflows to and from China

China PMDI Imports and Exports in July 2023

PUdaily | Updated: August 29, 2023

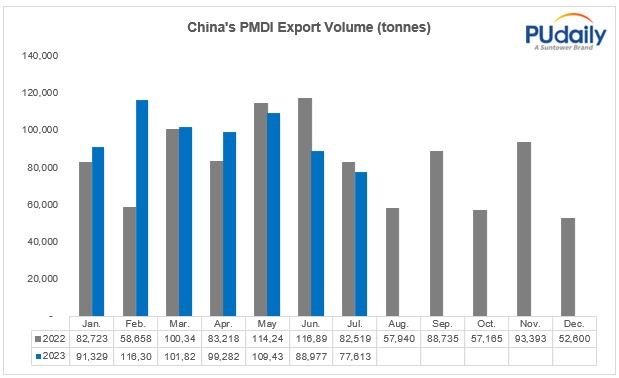

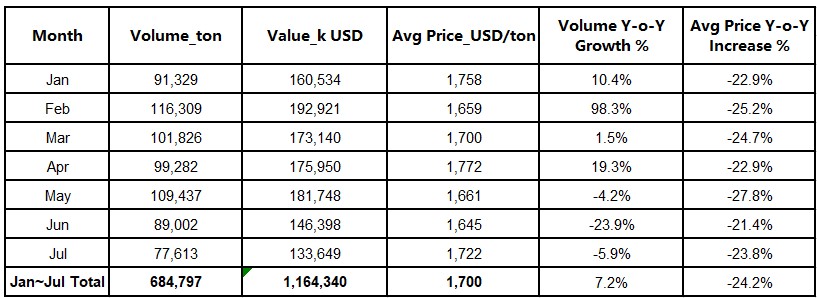

PMDI Export

China’s PMDI exports totaled 77.6 thousand tonnes in July 2023, experiencing a month-on-month decrease of 12.8% and a year-on-year decrease of 5.9%, according to the latest data from China Customs. From January to July 2023, China’s cumulative exports of PMDI reached 684.8 thousand tonnes, which showed a year-on-year increase of 7.2% compared to the same period last year.

The average exporting price of PMDI in this July was USD 1,722/tonne, which represents a year-on-year decrease of 23.8%, but increased by 4.7% from the price in this June.

China PMDI Export Volume, Value & Avgerage Exporting Price from January to July 2023

By region, the United States was the largest destination for China’s PMDI exports from this January to July. The cumulative export volume of PMDI from China to the United States during this period reached 162 thousand tonnes, with a year-on-year growth of 2.8% but a month-on-month decrease of 31.6%. Besides, during the same period, the total volume of PMDI imported from China to countries of Belt and Road Initiative (BRI) reached 287 thousand tonnes, showing a year-on-year growth of 34.5%. (Note: As of January 6, 2023, China had signed over 200 cooperation documents with 151 countries and 32 international organizations under the BRI framework. BRI countries are important markets for China’s export trade.)

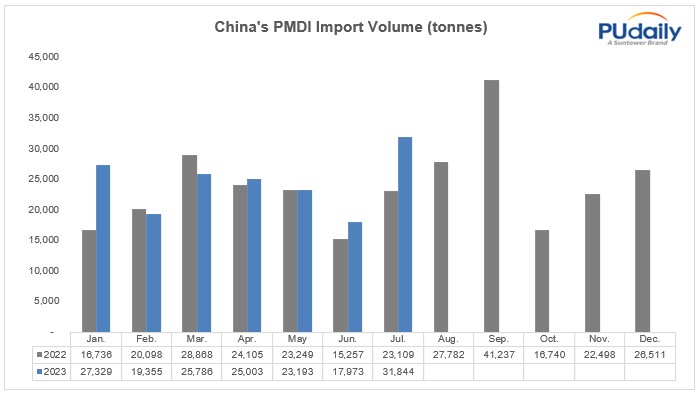

PMDI Import

China’s imports of PMDI (including crude MDI) totaled 31.8 thousand tonnes in July 2023, showing a month-on-month growth of 77.2% and a year-on-year growth of 37.8%. The month-on-month growth was mainly due to the recovery of imports from Saudi Arabia and Japan, reaching the normal levels seen in previous months. From January to July 2023, the cumulative imports of PMDI in China reached 170.6 thousand tonnes, representing a year-on-year increase of 12.6% compared to the same period last year.

In July, China imported 13.3 thousand tonnes of PMDI from Saudi Arabia, which has returned to normal levels. Imports of PMDI and crude MDI from Japan reached 9 thousand tonnes, showing a month-on-month growth of 89.0%. This increase was mainly due to the completion of maintenance at Tosoh Japan, resulting in the recovery of supply. However, during the same period, China imported 7 thousand tonnes of PMDI from South Korea, experiencing a month-on-month decrease of 8.3%.

August 14, 2023

Gulbrandsen Expands Tin Catalyst Production in India

Gulbrandsen commissions its new Tin Catalyst productionplant at its site in Dahej, India.

DAHEJ, GUJARAT, INDIA — August 14, 2023 — Gulbrandsen, a global specialty

chemicals leader, and one of the world’s largest producers of tin catalysts for the

polyurethane foaming industry, has completed the commissioning and safe start-up of

its new Tin Catalyst production plant at its site in Dahej, India. The unit will produce

Stannous Octoate and Stannous Neodecanoate.

Joerg Duebel, Global Business Director for Polyurethane Additives at Gulbrandsen,

commented on the occasion “Thanks to the well-coordinated efforts of our teams across

the globe, we completed the safe start-up of this unit ahead of schedule. This facility

will help us in meeting the growing demand for these products while also strengthening

our commitment to delivering high-quality catalysts to the polyurethane foaming

industry.”

About Gulbrandsen: Gulbrandsen is a manufacturer of industrial chemical

intermediates, fine chemicals and catalysts used in process industries. For more

information, please visit our website at www.gulbrandsen.com.

August 1, 2023

MDI Restructuring in China

BASF, Huntsman, and Chinese partners agree to petrochemical deal in China

MOSCOW (MRC) — BASF and Huntsman together with their Chinese partner companies – Shanghai Hua Yi (Group Company), Sinopec Shanghai Gaoqiao Petrochemical Co., Ltd. and Shanghai Chlor-Alkali Chemical Co., Ltd. – announce the planned separation of their joint MDI (diphenylmethane diisocyanate) production at Shanghai Lianheng Isocyanate Co., Ltd. (SLIC), said Hydrocarbonprocessing.

Going forward, the companies will operate the two MDI plants located at the site in Caojing, China independently. Huntsman together with Shanghai Chlor-Alkali Chemical Co., Ltd, and BASF together with Shanghai Hua Yi (Group Company) and Sinopec Shanghai Gaoqiao Petrochemical Co., Ltd will each take over one of the MDI plants.

“The SLIC joint venture has been an important partnership to establish MDI production in China as one of the pioneers at the Shanghai Chemical Park,” said Ramkumar Dhruva, President Monomers division at BASF. “The new organizational setup will allow BASF and our partners Shanghai Hua Yi and Sinopec Shanghai Gaoqiao Petrochemical Co., Ltd. to further develop our MDI operations in Shanghai while serving the demand of our customers in the region even more effectively.”

“Through the production of crude MDI in the SLIC joint venture over almost 20 years, Huntsman together with its partner, Shanghai Chlor-Alkali Chemical Co., Ltd, has been able to successfully build its polyurethanes business in China. As we move to integrate these assets into our downstream operations, we will be even better positioned to meet the future innovation and growth needs of our customers,” said Tony Hankins, President of Huntsman Polyurethanes.

Huntsman, together with Shanghai Chlor-Alkali Chemical Co., Ltd, will own and operate the original MDI plant that started commercial production in 2006, along with a hydrogen chloride recycling unit for the production of chlorine, a precursor for MDI, that was added in 2018. BASF will own and operate the MDI plant that was added in 2018, including the manufacturing facilities for the precursors aniline and nitrobenzene. All employees currently employed in the Joint Venture will be transferred to the respective organizations.

The new operational setup is in preparation and is expected to become effective during the fourth quarter of 2023, and is subject to pending regulatory authority approvals, permits and other customary closing conditions.

In addition to the plant in Caojing, BASF operates MDI production sites in Chongqing, China as well as in Yeosu, South Korea; Antwerp, Belgium; and Geismar, Louisiana. Following the restructuring of the joint venture, BASF’s global production capacity for MDI will total around 1.9 million tons.

Huntsman operates world-scale MDI production and splitting facilities in Rotterdam, the Netherlands, and Geismar, Louisiana, in addition to its Caojing facilities.

MDI is an important precursor in the manufacture of polyurethanes – versatile polymers that are used in the automotive and construction industries, in appliances such as refrigerators, and in footwear.

We remind, BASF and Zhejiang Guanghua Technology Co.,Ltd. (KHUA) have signed a Letter of Intent (LoI) for the supply of Neopentyl Glycol (NPG) from BASF’s Zhanjiang Verbund site to KHUA. This agreement marks a significant milestone in the long-term partnership between both parties. KHUA, a reputed manufacturer of saturated polyester resins for the powder coatings industry in China, is planning to build a 100 kilotons per annum (KT/a) production plant for high-end powder coatings resins in Donghai Island, Zhanjiang Economic & Technological Development Zone, where BASF is building a world-scale NPG plant with an annual production capacity of 80,000 metric tons.

August 1, 2023

Wanhua First Half Results

Wanhua Chemical Group Co., Ltd. Reports Earnings Results for the Half Year Ended June 30, 2023

July 27, 2023 at 05:47 am

Wanhua Chemical Group Co., Ltd. reported earnings results for the half year ended June 30, 2023. For the half year, the company reported sales was CNY 87,178.76 million compared to CNY 88,856.73 million a year ago. Revenue was CNY 87,626.38 million compared to CNY 89,118.77 million a year ago.

Net income was CNY 8,568.24 million compared to CNY 10,383.02 million a year ago. Basic earnings per share from continuing operations was CNY 2.73 compared to CNY 3.31 a year ago.