Current Affairs

October 27, 2022

EVERCHEM UPDATE: VOL. 04 – Cost Cutting and Quiet Quitters

When times are good, monster bureaucratic companies go on hiring sprees. They fill a few much-needed positions, double up key roles, triple their salesforce and quadruple their dinner outings with the expectation of quintupling MoM sales. Bull markets, baby. When things naturally take a turn downward, implementation of the infamous cost-cutting begins.

Subscribe to the Urethane blog for more Everchem Updates here

October 25, 2022

Home Prices Tumble

Home Prices Plunge Most Since 2009, Pulte CEO Fears “Financial & Psychological Hurdles” Ahead For Homebuyers

by Tyler Durden

Tuesday, Oct 25, 2022 – 09:06 AM

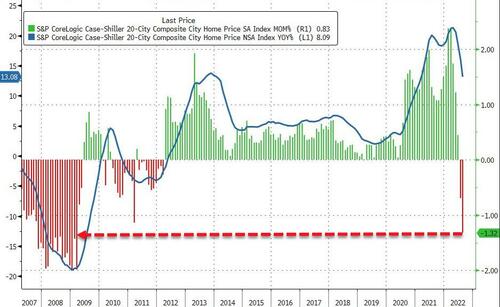

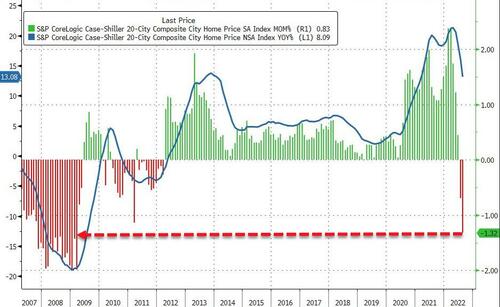

After tumbling for the first time since 2012 in July, Case-Shiller’s 20-City Composite Home Price index was expected to drop even faster in August (the latest data available) as mortgage rates soared, crushing affordability. Analysts were right as the 20-City Composite index plunged 1.32% MoM (far larger than the 0.8% drop expected), diving the YoY growth in the 20-City Composite to 13.08% (well down from the 14.0% exp)

Source: Bloomberg

That is the biggest MoM drop since March 2009 and the slowest YoY growth since Feb 2021.

“The forceful deceleration in U.S. housing prices that we noted a month ago continued,” Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

“Price gains decelerated in every one of our 20 cities. These data show clearly that the growth rate of housing prices peaked in the spring of 2022 and has been declining ever since.”

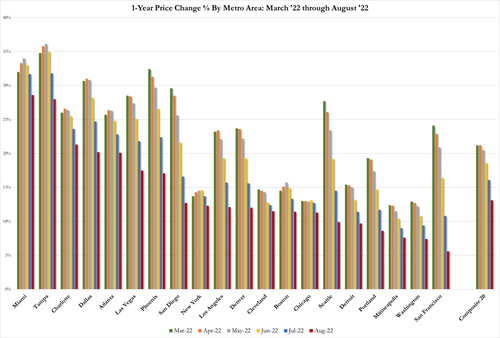

Miami, Tampa, Charlotte reported highest year-over-year gains among 20 cities surveyed, while on a seasonally-adjusted basis, prices fell the most in August (MoM) in San Francisco (-4.3%), Seattle (-3.9%), San Diego (-2.8%), and Los Angeles (-2.3%).

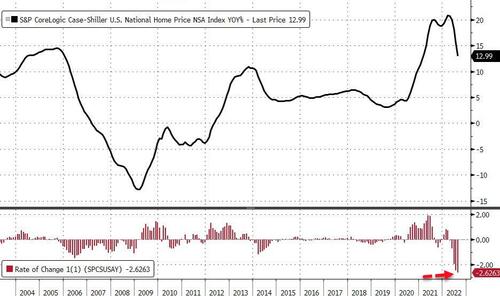

The growth in the national home price index has now slowed for 5 straight months (now below 13% YoY for the first time since Feb 2021). The absolute drop in the growth rate of 2.62 percentage points is the largest ever…

Source: Bloomberg

Finally, given the unprecedented explosion in mortgage rates, just where will home prices end?

Source: Bloomberg

We would like to think Powell’s plan does not involve that kind of collapse… or maybe it is – since prices will have to fall considerably more to become affordable for the average American to follow his ‘dream’.

As Lazzara previously concluded, “as the Federal Reserve continues to move interest rates upward, mortgage financing has become more expensive, a process that continues to this day. Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate.”

And by way of example, Pulte Homes today, during their earnings conference call, said that it was expanding incentives, including price-cuts, as sales slump.

“Demand clearly slowed in the period as dramatically higher interest rates created financial and psychological hurdles for potential homebuyers,” Ryan Marshall, PulteGroup’s president and chief executive officer, said in the statement.

Additionally, contracts were canceled in 24% of deals in the period, up from 15% in the second quarter, the Atlanta-based builder said in a statement Tuesday. Purchase contracts fell 28% from a year earlier to 4,924, missing the average estimate of 5,715 from analysts surveyed by Bloomberg. And bear in mind that this is for Q3 (after the heavily lagged Case-Shiller Index) with Pulte warning in today’s call that “demand got even more challenging in October”.

October 25, 2022

Home Prices Tumble

Home Prices Plunge Most Since 2009, Pulte CEO Fears “Financial & Psychological Hurdles” Ahead For Homebuyers

by Tyler Durden

Tuesday, Oct 25, 2022 – 09:06 AM

After tumbling for the first time since 2012 in July, Case-Shiller’s 20-City Composite Home Price index was expected to drop even faster in August (the latest data available) as mortgage rates soared, crushing affordability. Analysts were right as the 20-City Composite index plunged 1.32% MoM (far larger than the 0.8% drop expected), diving the YoY growth in the 20-City Composite to 13.08% (well down from the 14.0% exp)

Source: Bloomberg

That is the biggest MoM drop since March 2009 and the slowest YoY growth since Feb 2021.

“The forceful deceleration in U.S. housing prices that we noted a month ago continued,” Craig J. Lazzara, managing director at S&P Dow Jones Indices, said in statement.

“Price gains decelerated in every one of our 20 cities. These data show clearly that the growth rate of housing prices peaked in the spring of 2022 and has been declining ever since.”

Miami, Tampa, Charlotte reported highest year-over-year gains among 20 cities surveyed, while on a seasonally-adjusted basis, prices fell the most in August (MoM) in San Francisco (-4.3%), Seattle (-3.9%), San Diego (-2.8%), and Los Angeles (-2.3%).

The growth in the national home price index has now slowed for 5 straight months (now below 13% YoY for the first time since Feb 2021). The absolute drop in the growth rate of 2.62 percentage points is the largest ever…

Source: Bloomberg

Finally, given the unprecedented explosion in mortgage rates, just where will home prices end?

Source: Bloomberg

We would like to think Powell’s plan does not involve that kind of collapse… or maybe it is – since prices will have to fall considerably more to become affordable for the average American to follow his ‘dream’.

As Lazzara previously concluded, “as the Federal Reserve continues to move interest rates upward, mortgage financing has become more expensive, a process that continues to this day. Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate.”

And by way of example, Pulte Homes today, during their earnings conference call, said that it was expanding incentives, including price-cuts, as sales slump.

“Demand clearly slowed in the period as dramatically higher interest rates created financial and psychological hurdles for potential homebuyers,” Ryan Marshall, PulteGroup’s president and chief executive officer, said in the statement.

Additionally, contracts were canceled in 24% of deals in the period, up from 15% in the second quarter, the Atlanta-based builder said in a statement Tuesday. Purchase contracts fell 28% from a year earlier to 4,924, missing the average estimate of 5,715 from analysts surveyed by Bloomberg. And bear in mind that this is for Q3 (after the heavily lagged Case-Shiller Index) with Pulte warning in today’s call that “demand got even more challenging in October”.

October 24, 2022

Diesel Prices an Issue

Runaway diesel prices top trucking industry’s critical issues list

Driver shortage slips to second-most critical issue after 5 years in top spot

Alan AdlerSaturday, October 22, 2022

3 minutes read

Listen to this article

0:00 / 4:24BeyondWords

SAN DIEGO — Soaring diesel prices displaced the driver shortage after five years in the top spot in the American Transportation Research Institute’s 18th annual Critical Issues in the Trucking Industry.

“It certainly brings attention to it when it overtakes something [like driver shortage],” Rebecca Brewster, ATRI president and COO, told FreightWaves.

The independent research group that works closely with the American Trucking Associations released its 18th annual survey Saturday during the ATA’s Management Conference and Exhibition.

Truck parking showed up No. 10 on the motor carrier’s side and No. 1 on the driver’s list. It finished third overall, up from fifth in 2021. The issue of where drivers stop to rest has finished no lower than sixth since 2013.

‘Tremendous issue for their driver workforce’

“I think this is an acknowledgement this year that the motor carriers see what a tremendous issue this is for their driver workforce because it has so many tentacles,” Brewster said. “You see it show up in our ability to recruit drivers, to retain drivers, to bring more women into the profession.

“When you think about all the attention on the truck parking issue from the U.S. DOT [Department of Transportation], from the Biden administration, and every time you see it written about, it references that drivers have identified this as their top concern,” she said.

Florida and Tennessee recently won $37.6 million in competitive grants from the DOT for trucking parking projects in their states. The Federal Motor Carrier Safety Administration is keenly aware of the issue as well, Robyn Hutcheson, FMCSA administrator, told a gathering of ATA conference attendees Saturday.

“We’re working very closely with the Federal Highway Administration,” which recently published an 80-page Truck Parking Development Handbook.

“We have a very clear direction to prioritize this,” Hutcheson said. “For our part, Jack VanSteenburg, our executive director, has communicated with every division administrator to use this guide.”

In addition to diesel prices and truck parking, carriers and drivers both listed driver detention while waiting to pick up or drop off a load, and the economy, as issues on which they agreed.

Driver shortage is still top motor carrier concern

Carriers continued to rank the driver shortage, estimated by the American Trucking Associations at 80,000, as the top issue. Drivers ranked the lack of parking as their top issue.

The rest of the ATRI Top 10 were:

4. Driver compensation

5. Economy

6. Driver detention/delay

7. Driver retention

8. CSA [Compliance, Safety, Accountability]

9. Speed limiters

10. Lawsuit abuse reform

October 24, 2022

Diesel Prices an Issue

Runaway diesel prices top trucking industry’s critical issues list

Driver shortage slips to second-most critical issue after 5 years in top spot

Alan AdlerSaturday, October 22, 2022

3 minutes read

Listen to this article

0:00 / 4:24BeyondWords

SAN DIEGO — Soaring diesel prices displaced the driver shortage after five years in the top spot in the American Transportation Research Institute’s 18th annual Critical Issues in the Trucking Industry.

“It certainly brings attention to it when it overtakes something [like driver shortage],” Rebecca Brewster, ATRI president and COO, told FreightWaves.

The independent research group that works closely with the American Trucking Associations released its 18th annual survey Saturday during the ATA’s Management Conference and Exhibition.

Truck parking showed up No. 10 on the motor carrier’s side and No. 1 on the driver’s list. It finished third overall, up from fifth in 2021. The issue of where drivers stop to rest has finished no lower than sixth since 2013.

‘Tremendous issue for their driver workforce’

“I think this is an acknowledgement this year that the motor carriers see what a tremendous issue this is for their driver workforce because it has so many tentacles,” Brewster said. “You see it show up in our ability to recruit drivers, to retain drivers, to bring more women into the profession.

“When you think about all the attention on the truck parking issue from the U.S. DOT [Department of Transportation], from the Biden administration, and every time you see it written about, it references that drivers have identified this as their top concern,” she said.

Florida and Tennessee recently won $37.6 million in competitive grants from the DOT for trucking parking projects in their states. The Federal Motor Carrier Safety Administration is keenly aware of the issue as well, Robyn Hutcheson, FMCSA administrator, told a gathering of ATA conference attendees Saturday.

“We’re working very closely with the Federal Highway Administration,” which recently published an 80-page Truck Parking Development Handbook.

“We have a very clear direction to prioritize this,” Hutcheson said. “For our part, Jack VanSteenburg, our executive director, has communicated with every division administrator to use this guide.”

In addition to diesel prices and truck parking, carriers and drivers both listed driver detention while waiting to pick up or drop off a load, and the economy, as issues on which they agreed.

Driver shortage is still top motor carrier concern

Carriers continued to rank the driver shortage, estimated by the American Trucking Associations at 80,000, as the top issue. Drivers ranked the lack of parking as their top issue.

The rest of the ATRI Top 10 were:

4. Driver compensation

5. Economy

6. Driver detention/delay

7. Driver retention

8. CSA [Compliance, Safety, Accountability]

9. Speed limiters

10. Lawsuit abuse reform