Epoxy

September 15, 2022

Railroad Update

Railroads And Unions Reach “Tentative Agreement” To Avert Rail Strike

by Tyler Durden

Thursday, Sep 15, 2022 – 06:31 AM

Update (0751ET):

WSJ noted the White House didn’t provide details of the tentative agreement between freight rail companies and unions.

The latest headlines show the tentative agreement goes back to unions for a vote:

- RAIL PARTIES AGREE TO COOLING OFF PERIOD AS PART OF DEAL, A STANDARD PART OF RATIFICATION PROCESS IN CASE VOTE FAILS IN ORDER TO AVERT ANY SHUTDOWN -SOURCE

- TENTATIVE U.S. RAIL DEAL GOES BACK TO UNIONS FOR A VOTE -SOURCE FAMILIAR WITH THE SITUATION

Some more good news is Amtrak “is working quickly to restore canceled long-distance trains” following the announcement of the tentative deal this morning, avoiding a rail strike Friday.

* * *

A rail stoppage that threatened to unleash widespread economic damage by snarling critical supply chains appears to have been averted after freight rail companies and union leaders reached a tentative agreement.

“Following 20 consecutive hours of negotiations at the Department of Labor, rail companies and union negotiators came to a tentative agreement that balances the needs of workers, businesses, and our nation’s economy,” according to a Labor Department statement Thursday morning.

It was a “hard-fought, mutually beneficial deal,” the statement said. “Our rail system is integral to our supply chain, and a disruption would have had catastrophic impacts on industries, travelers, and families across the country.”

President Biden commented on the agreement between railroads and unions:

“The tentative agreement reached tonight is an important win for our economy and the American people.”

A White House statement said:

“These rail workers will get better pay, improved working conditions, and peace of mind around their health care costs: all hard-earned. The agreement is also a victory for railway companies who will be able to retain and recruit more workers for an industry that will continue to be part of the backbone of the American economy for decades to come.”

The breakthrough tentative agreement was announced one day before more than 100,000 rail workers were set to strike. Even though most rail unions already agreed on labor contracts, multiple unions holding out represented a large swath of rail workers. Such a disruption would’ve cost the US economy $2 billion per day, shuttering about 30% of domestic freight traffic and stoking inflationary pressures.

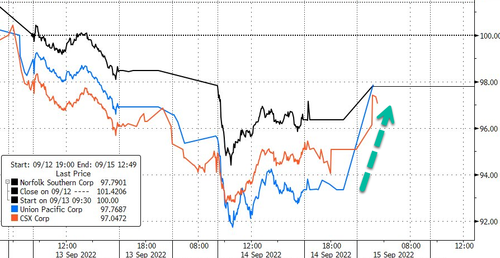

Railroad companies are moving higher premarket on the news.

Norfolk Southern is up 1.5%, with shares in Union Pacific surging nearly 5%. CSX is up about 2%.

https://www.zerohedge.com/markets/railroads-and-unions-reach-tentative-agreement-avert-rail-strike

September 13, 2022

Arsenal Flips Meridian Adhesives to American Securities

American Securities Acquires Meridian Adhesives Group from Arsenal Capital Partners New York, NY, September 1, 2022 – American Securities LLC (“American Securities”) and Arsenal Capital Partners (“Arsenal”) today announced that an affiliate of American Securities has acquired Meridian Adhesives Group (“Meridian” or the “Company”), in partnership with the management team and funds affiliated with Arsenal. Financial terms of the transaction were not disclosed.

Meridian is a leading producer of high-performance advanced adhesives for electronics, infrastructure, and industrial end markets. The Company sells a broad portfolio of chemistries and focuses on niche applications that require custom solutions and complex formulations. Meridian operates 25 facilities and serves over 5,000 customers in North America, Asia Pacific, and Europe. The Company is headquartered in Houston, TX and employs approximately 560 people globally.

“We are grateful for the support of Arsenal over the past four years as we established Meridian as the go-to solution provider in the industry,” said Dan Pelton, Chief Executive Officer of Meridian. “We are excited about Meridian’s next phase of growth and our new partnership with American Securities.”

“The time that we have spent evaluating and investing in companies in the adhesives space gives us immense appreciation for Meridian’s leadership positions in attractive and growing end markets and applications,” commented Scott Wolff, a Managing Director of American Securities. “We are excited to support the Company’s organic growth and M&A strategies, innovation, and continued operational excellence so that Meridian can continue to solve problems for its customers.”

“Meridian’s growth has been a result of focusing on positive long-term trends in technologies and end markets, coupled with hard work from a talented leadership team and employee base,” said Roy Seroussi, an Investment Partner of Arsenal. “We look forward to our continued partnership with the Company and American Securities as we build a leading, global adhesives company.”

Morgan Stanley & Co. LLC acted as financial advisors to American Securities and Weil, Gotshal & Manges LLP served as legal counsel. Citi and Moelis & Company LLC acted as financial advisors to Meridian and Benesch, Friedlander, Coplan & Aronoff LLP served as legal counsel with respect to the transaction.

About Meridian Adhesives Group Meridian Adhesives Group is a leading manufacturer of high-value adhesive technologies. With a broad portfolio of dynamic solutions, Meridian serves the electronics, infrastructure, and industrial (flooring, packaging, and product assembly) markets. The group’s operations are located in the Americas, EMEA and Asia, with a multitude of sales/service offices worldwide that are positioned to serve Meridian’s global customer base. For more information, visit https://meridianadhesives.com.

About American Securities LLC Based in New York with an office in Shanghai, American Securities is a leading U.S. private equity firm that invests in market-leading North American companies with annual revenues generally ranging from $200 million to $2 billion. American Securities and its affiliates have more than $26 billion under management. For more information, visit www.american-securities.com.

About Arsenal Capital Partners Arsenal Capital Partners is a leading private equity firm that specializes in investments in industrial growth and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds totaling over $10 billion, completed more than 250 platform and add-on acquisitions, and achieved more than 30 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value-add. For more information, visit www.arsenalcapital.com.

September 13, 2022

Arsenal Flips Meridian Adhesives to American Securities

American Securities Acquires Meridian Adhesives Group from Arsenal Capital Partners New York, NY, September 1, 2022 – American Securities LLC (“American Securities”) and Arsenal Capital Partners (“Arsenal”) today announced that an affiliate of American Securities has acquired Meridian Adhesives Group (“Meridian” or the “Company”), in partnership with the management team and funds affiliated with Arsenal. Financial terms of the transaction were not disclosed.

Meridian is a leading producer of high-performance advanced adhesives for electronics, infrastructure, and industrial end markets. The Company sells a broad portfolio of chemistries and focuses on niche applications that require custom solutions and complex formulations. Meridian operates 25 facilities and serves over 5,000 customers in North America, Asia Pacific, and Europe. The Company is headquartered in Houston, TX and employs approximately 560 people globally.

“We are grateful for the support of Arsenal over the past four years as we established Meridian as the go-to solution provider in the industry,” said Dan Pelton, Chief Executive Officer of Meridian. “We are excited about Meridian’s next phase of growth and our new partnership with American Securities.”

“The time that we have spent evaluating and investing in companies in the adhesives space gives us immense appreciation for Meridian’s leadership positions in attractive and growing end markets and applications,” commented Scott Wolff, a Managing Director of American Securities. “We are excited to support the Company’s organic growth and M&A strategies, innovation, and continued operational excellence so that Meridian can continue to solve problems for its customers.”

“Meridian’s growth has been a result of focusing on positive long-term trends in technologies and end markets, coupled with hard work from a talented leadership team and employee base,” said Roy Seroussi, an Investment Partner of Arsenal. “We look forward to our continued partnership with the Company and American Securities as we build a leading, global adhesives company.”

Morgan Stanley & Co. LLC acted as financial advisors to American Securities and Weil, Gotshal & Manges LLP served as legal counsel. Citi and Moelis & Company LLC acted as financial advisors to Meridian and Benesch, Friedlander, Coplan & Aronoff LLP served as legal counsel with respect to the transaction.

About Meridian Adhesives Group Meridian Adhesives Group is a leading manufacturer of high-value adhesive technologies. With a broad portfolio of dynamic solutions, Meridian serves the electronics, infrastructure, and industrial (flooring, packaging, and product assembly) markets. The group’s operations are located in the Americas, EMEA and Asia, with a multitude of sales/service offices worldwide that are positioned to serve Meridian’s global customer base. For more information, visit https://meridianadhesives.com.

About American Securities LLC Based in New York with an office in Shanghai, American Securities is a leading U.S. private equity firm that invests in market-leading North American companies with annual revenues generally ranging from $200 million to $2 billion. American Securities and its affiliates have more than $26 billion under management. For more information, visit www.american-securities.com.

About Arsenal Capital Partners Arsenal Capital Partners is a leading private equity firm that specializes in investments in industrial growth and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds totaling over $10 billion, completed more than 250 platform and add-on acquisitions, and achieved more than 30 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value-add. For more information, visit www.arsenalcapital.com.

September 13, 2022

Rail Deals Lining Up

Three More Unions Reach Tentative Agreements With Freight Railroads

by Tyler Durden

Monday, Sep 12, 2022 – 05:40 PM

By Noi Mahoney of FreightWaves

Three more railroad unions have reached tentative agreements with U.S. freight railroads on a new labor contract, announced the National Carriers’ Conference Committee (NCCC).

The tentative agreements announced Sunday include the Brotherhood of Maintenance of Way Employes Division of the International Brotherhood of Teamsters; the International Brotherhood of Boilermakers; and the International Association of Sheet Metal, Air, Rail and Transportation Workers-Mechanical Department.

“The tentative agreements … include a 24% wage increase during the five-year period from 2020 to 2024 — with a 14.1% wage increase effective immediately — and five annual $1,000 lump sum payments. Portions of the wage increases and lump sum payments are retroactive and will be paid out promptly upon ratification of the agreements by the unions’ membership,” said the NCCC, the group representing Class I railroads in the contract negotiations.

The tentative agreement also adds an additional paid day off that can be used as a personal day, vacation day or on the employee’s birthday.

The three unions represent more than 86,000 freight rail employees. Eight unions have accepted tentative deals they will be taking to their members for ratification. Altogether, there are over 140,000 employees at the bargaining table employed by the U.S. operations of Class I railroads.

A new labor deal has been in the works since January 2020, but the negotiations had failed to progress. A federal mediation board took up the negotiations but released the parties from those efforts earlier this summer.

Per the Railway Labor Act, the remaining unions would be able to legally stage a work stoppage or strike after a cooling-off period ends Sept. 16.

Unions respond to potential hazardous shipments embargo

The heads of two rail unions said Sunday that the freight railroads’ decision to begin delaying shipments of security-sensitive and hazardous material ahead of this week’s looming strike deadline is only an attempt to get shippers to increase pressure on Congress to intervene and block a work stoppage.

Several major Class I railroads said Friday they would begin curtailing shipments of hazardous materials and other chemicals in the event loads could be left unattended on a rail network. A strike or lockout is not allowed until Friday.

“This completely unnecessary attack on rail shippers by these highly profitable Class I railroads is no more than corporate extortion,” the heads of the unions that represent engineers and conductors — Jeremy Ferguson, president of the Sheet Metal, Air, Rail and Transportation Workers-Transportation Division union, and Dennis Pierce, president of the Brotherhood of Locomotive Engineers and Trainmen union — said in a joint statement.

“Our unions remain at the bargaining table and have given the rail carriers a proposal that we would be willing to submit to our members for ratification, but it is the rail carriers that refuse to reach an acceptable agreement. In fact, it was abundantly clear from our negotiations over the past few days that the railroads show no intentions of reaching an agreement with our unions, but they cannot legally lock out our members until the end of the cooling-off period. Instead, they are locking out their customers beginning on Monday and further harming the supply chain in an effort to provoke congressional action.”

https://www.zerohedge.com/economics/three-more-unions-reach-tentative-agreements-freight-railroads

September 13, 2022

Rail Deals Lining Up

Three More Unions Reach Tentative Agreements With Freight Railroads

by Tyler Durden

Monday, Sep 12, 2022 – 05:40 PM

By Noi Mahoney of FreightWaves

Three more railroad unions have reached tentative agreements with U.S. freight railroads on a new labor contract, announced the National Carriers’ Conference Committee (NCCC).

The tentative agreements announced Sunday include the Brotherhood of Maintenance of Way Employes Division of the International Brotherhood of Teamsters; the International Brotherhood of Boilermakers; and the International Association of Sheet Metal, Air, Rail and Transportation Workers-Mechanical Department.

“The tentative agreements … include a 24% wage increase during the five-year period from 2020 to 2024 — with a 14.1% wage increase effective immediately — and five annual $1,000 lump sum payments. Portions of the wage increases and lump sum payments are retroactive and will be paid out promptly upon ratification of the agreements by the unions’ membership,” said the NCCC, the group representing Class I railroads in the contract negotiations.

The tentative agreement also adds an additional paid day off that can be used as a personal day, vacation day or on the employee’s birthday.

The three unions represent more than 86,000 freight rail employees. Eight unions have accepted tentative deals they will be taking to their members for ratification. Altogether, there are over 140,000 employees at the bargaining table employed by the U.S. operations of Class I railroads.

A new labor deal has been in the works since January 2020, but the negotiations had failed to progress. A federal mediation board took up the negotiations but released the parties from those efforts earlier this summer.

Per the Railway Labor Act, the remaining unions would be able to legally stage a work stoppage or strike after a cooling-off period ends Sept. 16.

Unions respond to potential hazardous shipments embargo

The heads of two rail unions said Sunday that the freight railroads’ decision to begin delaying shipments of security-sensitive and hazardous material ahead of this week’s looming strike deadline is only an attempt to get shippers to increase pressure on Congress to intervene and block a work stoppage.

Several major Class I railroads said Friday they would begin curtailing shipments of hazardous materials and other chemicals in the event loads could be left unattended on a rail network. A strike or lockout is not allowed until Friday.

“This completely unnecessary attack on rail shippers by these highly profitable Class I railroads is no more than corporate extortion,” the heads of the unions that represent engineers and conductors — Jeremy Ferguson, president of the Sheet Metal, Air, Rail and Transportation Workers-Transportation Division union, and Dennis Pierce, president of the Brotherhood of Locomotive Engineers and Trainmen union — said in a joint statement.

“Our unions remain at the bargaining table and have given the rail carriers a proposal that we would be willing to submit to our members for ratification, but it is the rail carriers that refuse to reach an acceptable agreement. In fact, it was abundantly clear from our negotiations over the past few days that the railroads show no intentions of reaching an agreement with our unions, but they cannot legally lock out our members until the end of the cooling-off period. Instead, they are locking out their customers beginning on Monday and further harming the supply chain in an effort to provoke congressional action.”

https://www.zerohedge.com/economics/three-more-unions-reach-tentative-agreements-freight-railroads