Epoxy

September 7, 2022

Currency Fluctuations

Japan, China On Edge After Record Dollar Surge Sparks “Explosive” Yen Plunge; China’s Yuan Not Far Behind

by Tyler DurdenWednesday, Sep 07, 2022 – 02:04 PM

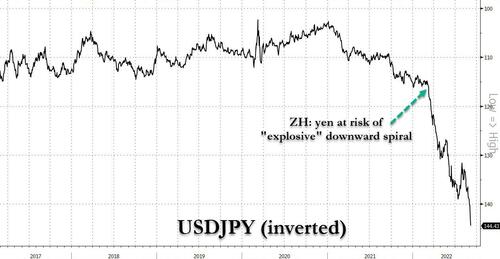

Back in late March, when USDJPY was at 121, we warned that the “Yen Was At Risk Of “Explosive” Downward Spiral With Kuroda Trapped… And Why China May Soon Devalue“, and since then the yen has… well, see for yourselves:

In short, we were right.

Having been in freefall for months, due to the “impossible dilemma” facing the BOJ which can’t have i) a stable currency and ii) yield curve control at the same time, the BOJ has clearly picked an interest rate cap instead of intervening in the yen, and containing the record freefall in the Japanese currency which is set for its worst annual drop on record – the yen this morning plunged as low as 144.99, the lowest level since 1998 and there is no end in sight to the drop.

Furthermore, and just to make it very clear that the BOJ sees nothing wrong with the precipitous drop in the yen which makes Japan seem like a B-grade emerging market, overnight the BOJ said it would buy 550BN yen of 5-10 year bonds at the latest scheduled operation, up from 500BN previously to protect the YCC yield caps; as Goldman notes, “BOJ is really the odd man out in global policy and it seems the market is piling on pressure into the yen ahead of the BOJ meeting at the end of this month.”

To be sure, the ongoing crash in the yen is not exactly shocking and is a result of Japan’s widening yield and policy divergence with the US. Still, the move which could unleash an inflationary shock across the otherwise sleepy, deflationary and demographically doomed islands, has prompted politicians to intervene if only verbally, and overnight, Japan’s top spokesman Hirokazu Matsuno said he was concerned about recent rapid, one-sided moves in yen and the government would need to take necessary action if these movements continue.

“We’re concerned about the rapid and one-sided moves being seen recently in foreign exchange markets,” Matsuno said at a press conference in Tokyo adding that “the government will continue to watch forex market moves with a high sense of urgency, and take necessary responses if this sort of move continues.”

Of course, it’s not just the yen that is getting demolished: with the Bloomberg dollar index hitting another, and another, and another all time high day after day with the Fed clearly oblivious of the impact its supertighte monetary policy is having on the world…

… it was China’s yuan that also got hammered overnight, and with the offshore currency trading just shy of 7.00, it forced the PBOC to scramble and stem the currency depreciation with a yuan fixing that was set at a record 454 pips stronger than the average estimate!

The good news is that as Bloomberg’s Simon Flint notes, the yuan tends to be rather dull after big gaps between offshore levels and the fix. To wit: “historical experience is that the yuan stabilizes after a similarly high premium is hit. Selecting for days with a similar (average) premium, I find 78 individual days when this occurred and more than 20 clusters since Bloomberg started to collect fixing consensus data. The average change in USD/CNH and CNH-CFETS was less than 0.1% one day, five days and 21 days after this premium was hit. It seems like a combination of the PBOC’s ability to pick tops in the dollar (as implied by stability in CFETS) and their resistance to appreciation is sufficient to stop the rot. Furthermore, the maximum range of outcomes over these periods is narrower than the series average. Of course, this episode may not be “average”. PBOC resistance has hit record breaking levels, suggesting a greater disconnect that the premium alone indicates.”

The bad news is that according to Goldman, it is only a matter of time before we trade through 7.00, for one simple reason: the collapse in China’s trade demands it and the export data in particular is a concern as the large trade surplus had been one of the main pushbacks to USDCNH going higher (the August surplus declined to 79.3BN vs 101BN last month). As Goldman concludes, “At this juncture it seems inevitable that China will have to accept a weaker currency to support trade/growth.“

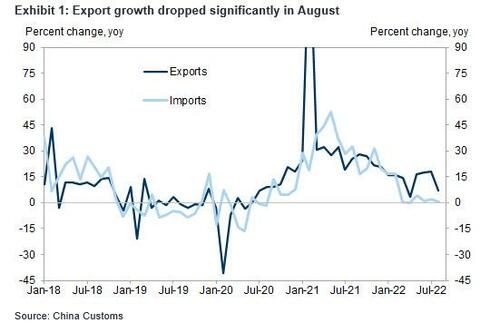

For those who missed it, overnight China reported that export growth slowed more than expected in August, as the entire world careens into a recession. Specifically, China’s export growth dropped to +7.1% Y/Y in August, well below consensus expectations of a 13% increase and a sharp drop from the 18.0% in July. Import growth decelerated to +0.3% Y/Yin August, also missing the consensus estimate of 1.1%, and down from 2.3% in July.

According to Goldman, the large deceleration of year-over-year export growth was partially driven by a high base last August, when the adverse impact from Typhoon In-fa unwound. Trade surplus in August fell to US$79.4bn on weaker-than-expected exports.

That said – when setting the stage for a 7.00 yuan print – Goldman says that it isn’t such a big deal, and explains why:

In Aug 2019, when USDCNY first traded above 7, the PBoC issued comment that “7 is not the age of man”, by which they meant it is not a number from which there is no return. The PBoC has made it clear in the press conference earlier this week that China’s monetary policy is mainly serving domestic purpose and they still have ample room. The RMB weakness is mainly due to USD strength, with RMB outperforming non-USD majors and so far there has not been meaningful spillover impact from currency depreciation on other Chinese assets (SHCOMP has been outperforming SPX of late). Another indicator to look at is onshore 1m risk reversal, which came off the highs. All these suggest there is not much to worry onshore about the PBoC allowing USDCNY to trade above 7.0 amid continued USD strength.

All of the above is why Goldman has shifted its USDCNH target to 7.20 area.

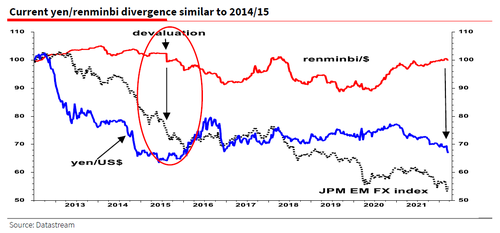

But perhaps an even bigger question is how China will react to the absolute monkeyhammering that the yen has taken in recent months, and as Albert Edwards noted back in March, maybe China will react just like they did in August 2015 when the PBoC devalued: “Back then persistent yen weakness had dragged down other competing regional currencies and left the renminbi overvalued.”

Wait, yen weakness leading to China devaluation? According to Edwards, that indeed was the sequence: as he shows in the chart below, the super weak yen of 2013-15, by driving down other competing Asian currencies, ultimately led us to the August 2015 renminbi devaluation.

Fast forward to today when the aggressive relentless easing by the BoJ – which is terrified of losing control over the JGB curve – comes at a time when the PBoC has resolutely refused to join the global tightening posture and instead is shifting towards an easier stance (after all, China has an imploding property sector it must stabilize at any cost).

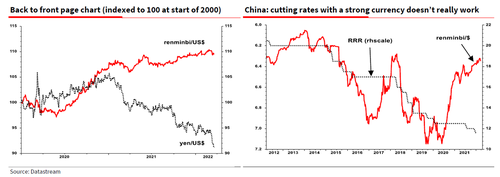

Edwards concluded that the one thing to watch out for, especially in the current febrile geopolitical environment, is if China once again is ‘forced’ to devalue because of the weak yen. Economists will tell you that cutting interest rates or the reserve requirement ratio (RRR- r/h chart below) is neutralized when you have a strong currency.

https://www.zerohedge.com/markets/japan-china-edge-after-record-dollar-surge-sparks-explosive-yen-plunge-chinas-yuan-not-far

September 6, 2022

Evonik Invests in Allentown

- 05 September, 2022

- Anna Larionova

Evonik opens new Innovation Hub in Pennsylvania

MOSCOW (MRC) — Evonik, one of the world’s leading specialty chemicals companies, has opened a new Innovation Hub at its Allentown, Pa., site, said the company.

The Hub consists of several state-of-the-art testing and processing labs as well as a pilot plant. It also features a newly designed collaboration space to support a hybrid and creative work environment. The expansion will create 50 highly paid jobs for scientists, engineers, and lab technicians in the Lehigh Valley region around Allentown.

The Innovation Hub is part of a broader globalization strategy for Research, Development & Innovation (RD&I) at the Germany-based company. “We are strengthening regional RD&I hubs in Asia and North America to benefit from innovative ideas outside of Europe and be closer to our customers in those regions,” said Evonik Chief Financial Officer Ute Wolf at the Ribbon Cutting Ceremony for the Allentown Innovation Hub. “The new Hub will transform the Allentown site into our premier center for research, business, and innovation in North America.”

By 2030, Evonik aims to invest more than USD3 billion in Next Generation Solutions – products with superior sustainability benefits. Evonik will invest an additional USD700 million in Next Generation Technologies to optimize production processes and infrastructure and avoid CO2 emissions.

North America is an essential growth market for Evonik. The region contributed roughly a quarter (23%) to Evonik’s annual sales in 2021, making it the second-largest revenue source after Europe (EMEA). Evonik has invested several billion dollars in North America since 2017, when the company acquired the specialty additives business of Allentown-based industrial gas producer Air Products.

Evonik currently employs 300 people at the Allentown site, which is close to Philadelphia, New York City, and many premier research institutions.

Evonik’s new High Performance Polymers lab in Allentown allows the processing and testing of plastics for 3D printing, medical implants, or performance foams in airplanes or cars. Another lab enables the formulation and testing of additives for industrial coatings. Allentown’s best-in-class polyurethane spray foam testing and emission chamber helps Evonik customers meet environmental and emission standards.

The Innovation Hub also features a flexible collaboration space to support and enhance a hybrid work environment. The uniquely designed space offers open areas for employees to work onsite without needing individual offices. Employees have access to cutting-edge technology like digital whiteboards or tools for video conferencing.

The continued expansion of the Allentown site underscores Evonik’s commitment to the Lehigh Valley community, which goes beyond creating job opportunities. Evonik has recently donated $100,000 to support the Women in Science & Engineering (WISE) initiative of the Da Vinci Science Center, Allentown’s award-winning science museum. WISE was established as part of the Science Center’s broader commitment to supporting women and girls in STEM (Science, Technology, Engineering, and Math). The donation highlights Evonik’s ongoing support of education and diversity in STEM fields.

We remind, Evonik Coating Additives business expands production capacity in Taiwan. MOSCOW (MRC) — Business line Coating Additives of Evonik Industries AG (Essen, Germany) is expanding production capacity of ACEMATT precipitated matting agents at its Taiwan manufacturing facility. The significant capacity increase will help meet growing demand for matting agents in Asia, with the capacity expansion expected to be completed by the second half of 2023.

https://www.mrchub.com/news/403907-evonik-opens-new-innovation-hub-in-pennsylvania

September 6, 2022

Evonik Invests in Allentown

- 05 September, 2022

- Anna Larionova

Evonik opens new Innovation Hub in Pennsylvania

MOSCOW (MRC) — Evonik, one of the world’s leading specialty chemicals companies, has opened a new Innovation Hub at its Allentown, Pa., site, said the company.

The Hub consists of several state-of-the-art testing and processing labs as well as a pilot plant. It also features a newly designed collaboration space to support a hybrid and creative work environment. The expansion will create 50 highly paid jobs for scientists, engineers, and lab technicians in the Lehigh Valley region around Allentown.

The Innovation Hub is part of a broader globalization strategy for Research, Development & Innovation (RD&I) at the Germany-based company. “We are strengthening regional RD&I hubs in Asia and North America to benefit from innovative ideas outside of Europe and be closer to our customers in those regions,” said Evonik Chief Financial Officer Ute Wolf at the Ribbon Cutting Ceremony for the Allentown Innovation Hub. “The new Hub will transform the Allentown site into our premier center for research, business, and innovation in North America.”

By 2030, Evonik aims to invest more than USD3 billion in Next Generation Solutions – products with superior sustainability benefits. Evonik will invest an additional USD700 million in Next Generation Technologies to optimize production processes and infrastructure and avoid CO2 emissions.

North America is an essential growth market for Evonik. The region contributed roughly a quarter (23%) to Evonik’s annual sales in 2021, making it the second-largest revenue source after Europe (EMEA). Evonik has invested several billion dollars in North America since 2017, when the company acquired the specialty additives business of Allentown-based industrial gas producer Air Products.

Evonik currently employs 300 people at the Allentown site, which is close to Philadelphia, New York City, and many premier research institutions.

Evonik’s new High Performance Polymers lab in Allentown allows the processing and testing of plastics for 3D printing, medical implants, or performance foams in airplanes or cars. Another lab enables the formulation and testing of additives for industrial coatings. Allentown’s best-in-class polyurethane spray foam testing and emission chamber helps Evonik customers meet environmental and emission standards.

The Innovation Hub also features a flexible collaboration space to support and enhance a hybrid work environment. The uniquely designed space offers open areas for employees to work onsite without needing individual offices. Employees have access to cutting-edge technology like digital whiteboards or tools for video conferencing.

The continued expansion of the Allentown site underscores Evonik’s commitment to the Lehigh Valley community, which goes beyond creating job opportunities. Evonik has recently donated $100,000 to support the Women in Science & Engineering (WISE) initiative of the Da Vinci Science Center, Allentown’s award-winning science museum. WISE was established as part of the Science Center’s broader commitment to supporting women and girls in STEM (Science, Technology, Engineering, and Math). The donation highlights Evonik’s ongoing support of education and diversity in STEM fields.

We remind, Evonik Coating Additives business expands production capacity in Taiwan. MOSCOW (MRC) — Business line Coating Additives of Evonik Industries AG (Essen, Germany) is expanding production capacity of ACEMATT precipitated matting agents at its Taiwan manufacturing facility. The significant capacity increase will help meet growing demand for matting agents in Asia, with the capacity expansion expected to be completed by the second half of 2023.

https://www.mrchub.com/news/403907-evonik-opens-new-innovation-hub-in-pennsylvania

September 6, 2022

Used Cars

“Sell My Car” Search Trends Explode 222% To All Time High In September

by Tyler DurdenTuesday, Sep 06, 2022 – 03:05 PM

It looks as though the spike in used car prices that we endured through 2021, and that continued as a result of the devastating inflation we have had so far in 2022, may finally be coming to an unceremonious end.

That’s because search trends for the terms “sell my car” have exploded higher leading into September 2022, a new study from findthebestcarprice.com found this week.

The site performed an analysis of Google search data and found that “searches for ‘sell my car’ exploded to over three times the average volume in September, an unprecedented increase in people searching for ‘sell my car’”,

The terms ‘how to sell my car’ and ‘sell car’ also spiked higher, by 145% and 104%, respectively.

Between August 25 and September 1, searches for ‘sell my car’ rose by 177%, the report said. They rose another 15% on September 4 after the the U.S. Labor Department announced that the unemployment rate has risen from 3.5% to 3.7%, the study says.

“The U.S. has already dealt with rising bills over the past few months due to inflation and the soaring costs of gas,” a spokesperson for the site said.

“Now, as experts such as Stephen Roach are predicting that a recession is looming, consumers are having to make cutbacks in order to save money. Google Trends data reveals that more households are looking to sell their car to bring in some extra income. We will likely see this trend continue if the cost of living remains high and the U.S. continues negative growth into the fall.”

The top 10 states with the most search data on selling cars were:

- Michigan

- Arizona

- California

- Nevada

- South Carolina

- Oklahoma

- Florida

- Ohio

- Texas

- Colorado

We noted just days ago that used car pricing had plunged to a one year low.

The latest Manheim Used Vehicle Value Index that tracks what dealers pay for used cars at auction is at a one-year low of 211.6. https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfdGltZWxpbmVfbGlzdCI6eyJidWNrZXQiOlsibGlua3RyLmVlIiwidHIuZWUiXSwidmVyc2lvbiI6bnVsbH0sInRmd19ob3Jpem9uX3RpbWVsaW5lXzEyMDM0Ijp7ImJ1Y2tldCI6InRyZWF0bWVudCIsInZlcnNpb24iOm51bGx9LCJ0ZndfdHdlZXRfZWRpdF9iYWNrZW5kIjp7ImJ1Y2tldCI6Im9uIiwidmVyc2lvbiI6bnVsbH0sInRmd19yZWZzcmNfc2Vzc2lvbiI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9LCJ0ZndfY2hpbl9waWxsc18xNDc0MSI6eyJidWNrZXQiOiJjb2xvcl9pY29ucyIsInZlcnNpb24iOm51bGx9LCJ0ZndfdHdlZXRfcmVzdWx0X21pZ3JhdGlvbl8xMzk3OSI6eyJidWNrZXQiOiJ0d2VldF9yZXN1bHQiLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NlbnNpdGl2ZV9tZWRpYV9pbnRlcnN0aXRpYWxfMTM5NjMiOnsiYnVja2V0IjoiaW50ZXJzdGl0aWFsIiwidmVyc2lvbiI6bnVsbH0sInRmd19leHBlcmltZW50c19jb29raWVfZXhwaXJhdGlvbiI6eyJidWNrZXQiOjEyMDk2MDAsInZlcnNpb24iOm51bGx9LCJ0ZndfZHVwbGljYXRlX3NjcmliZXNfdG9fc2V0dGluZ3MiOnsiYnVja2V0Ijoib24iLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3R3ZWV0X2VkaXRfZnJvbnRlbmQiOnsiYnVja2V0Ijoib2ZmIiwidmVyc2lvbiI6bnVsbH19&frame=false&hideCard=false&hideThread=false&id=1564602105201152003&lang=en&origin=https%3A%2F%2Fwww.zerohedge.com%2Fmarkets%2Fsell-my-car-search-trends-explode-222-all-time-high-september&sessionId=1adbc83d97c59092b029e0f3743cc6c48df8b2c0&siteScreenName=zerohedge&theme=light&widgetsVersion=1bfeb5c3714e8%3A1661975971032&width=550px

The index declined 3.6% from July in the first 15 days of August but is still up 8.8% from August 2021. The monthly slump was the most significant drop since April 2020.

Cox Automotive analysts said sliding wholesale used-vehicle values should continue through August. SUVs and pickups saw the most declines in value at auctions while minivans fell less — likely a function of thin supply, according to analysts. They said compact cars saw auction prices stable, noting it was likely due to more demand because elevated fuel costs have pushed consumers to more efficient vehicles.

A metric called “days of inventory” – how long it would take dealers to sell out of cars at the current sales rate if they couldn’t acquire new stock – was eight days higher than a year ago as the nationwide supply of used vehicles (as of Aug. 15) was improving.

Cox analysts noted consumers’ views of buying conditions for vehicles declined in August due to elevated prices and soaring rising interest rates. They said the only prior time consumers felt this pessimistic about purchasing a car was when auto loan interest rates were sky high in the early 1980s.

https://www.zerohedge.com/markets/sell-my-car-search-trends-explode-222-all-time-high-september

September 6, 2022

Used Cars

“Sell My Car” Search Trends Explode 222% To All Time High In September

by Tyler DurdenTuesday, Sep 06, 2022 – 03:05 PM

It looks as though the spike in used car prices that we endured through 2021, and that continued as a result of the devastating inflation we have had so far in 2022, may finally be coming to an unceremonious end.

That’s because search trends for the terms “sell my car” have exploded higher leading into September 2022, a new study from findthebestcarprice.com found this week.

The site performed an analysis of Google search data and found that “searches for ‘sell my car’ exploded to over three times the average volume in September, an unprecedented increase in people searching for ‘sell my car’”,

The terms ‘how to sell my car’ and ‘sell car’ also spiked higher, by 145% and 104%, respectively.

Between August 25 and September 1, searches for ‘sell my car’ rose by 177%, the report said. They rose another 15% on September 4 after the the U.S. Labor Department announced that the unemployment rate has risen from 3.5% to 3.7%, the study says.

“The U.S. has already dealt with rising bills over the past few months due to inflation and the soaring costs of gas,” a spokesperson for the site said.

“Now, as experts such as Stephen Roach are predicting that a recession is looming, consumers are having to make cutbacks in order to save money. Google Trends data reveals that more households are looking to sell their car to bring in some extra income. We will likely see this trend continue if the cost of living remains high and the U.S. continues negative growth into the fall.”

The top 10 states with the most search data on selling cars were:

- Michigan

- Arizona

- California

- Nevada

- South Carolina

- Oklahoma

- Florida

- Ohio

- Texas

- Colorado

We noted just days ago that used car pricing had plunged to a one year low.

The latest Manheim Used Vehicle Value Index that tracks what dealers pay for used cars at auction is at a one-year low of 211.6. https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfdGltZWxpbmVfbGlzdCI6eyJidWNrZXQiOlsibGlua3RyLmVlIiwidHIuZWUiXSwidmVyc2lvbiI6bnVsbH0sInRmd19ob3Jpem9uX3RpbWVsaW5lXzEyMDM0Ijp7ImJ1Y2tldCI6InRyZWF0bWVudCIsInZlcnNpb24iOm51bGx9LCJ0ZndfdHdlZXRfZWRpdF9iYWNrZW5kIjp7ImJ1Y2tldCI6Im9uIiwidmVyc2lvbiI6bnVsbH0sInRmd19yZWZzcmNfc2Vzc2lvbiI6eyJidWNrZXQiOiJvbiIsInZlcnNpb24iOm51bGx9LCJ0ZndfY2hpbl9waWxsc18xNDc0MSI6eyJidWNrZXQiOiJjb2xvcl9pY29ucyIsInZlcnNpb24iOm51bGx9LCJ0ZndfdHdlZXRfcmVzdWx0X21pZ3JhdGlvbl8xMzk3OSI6eyJidWNrZXQiOiJ0d2VldF9yZXN1bHQiLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NlbnNpdGl2ZV9tZWRpYV9pbnRlcnN0aXRpYWxfMTM5NjMiOnsiYnVja2V0IjoiaW50ZXJzdGl0aWFsIiwidmVyc2lvbiI6bnVsbH0sInRmd19leHBlcmltZW50c19jb29raWVfZXhwaXJhdGlvbiI6eyJidWNrZXQiOjEyMDk2MDAsInZlcnNpb24iOm51bGx9LCJ0ZndfZHVwbGljYXRlX3NjcmliZXNfdG9fc2V0dGluZ3MiOnsiYnVja2V0Ijoib24iLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3R3ZWV0X2VkaXRfZnJvbnRlbmQiOnsiYnVja2V0Ijoib2ZmIiwidmVyc2lvbiI6bnVsbH19&frame=false&hideCard=false&hideThread=false&id=1564602105201152003&lang=en&origin=https%3A%2F%2Fwww.zerohedge.com%2Fmarkets%2Fsell-my-car-search-trends-explode-222-all-time-high-september&sessionId=1adbc83d97c59092b029e0f3743cc6c48df8b2c0&siteScreenName=zerohedge&theme=light&widgetsVersion=1bfeb5c3714e8%3A1661975971032&width=550px

The index declined 3.6% from July in the first 15 days of August but is still up 8.8% from August 2021. The monthly slump was the most significant drop since April 2020.

Cox Automotive analysts said sliding wholesale used-vehicle values should continue through August. SUVs and pickups saw the most declines in value at auctions while minivans fell less — likely a function of thin supply, according to analysts. They said compact cars saw auction prices stable, noting it was likely due to more demand because elevated fuel costs have pushed consumers to more efficient vehicles.

A metric called “days of inventory” – how long it would take dealers to sell out of cars at the current sales rate if they couldn’t acquire new stock – was eight days higher than a year ago as the nationwide supply of used vehicles (as of Aug. 15) was improving.

Cox analysts noted consumers’ views of buying conditions for vehicles declined in August due to elevated prices and soaring rising interest rates. They said the only prior time consumers felt this pessimistic about purchasing a car was when auto loan interest rates were sky high in the early 1980s.

https://www.zerohedge.com/markets/sell-my-car-search-trends-explode-222-all-time-high-september