Epoxy

September 9, 2022

Quiet First Half of Hurricane Season

Quiet Start To US Hurricane Season Takes Heat Out Of Oil Prices: Kemp

by Tyler DurdenFriday, Sep 09, 2022 – 12:10 PM

By John Kemp, Senior Market Analyst at Reuters

The Atlantic hurricane season is nearing its halfway point and so far no hurricanes have made landfall on the coast of the United States, contributing to the recent downward pressure on oil and fuel prices.

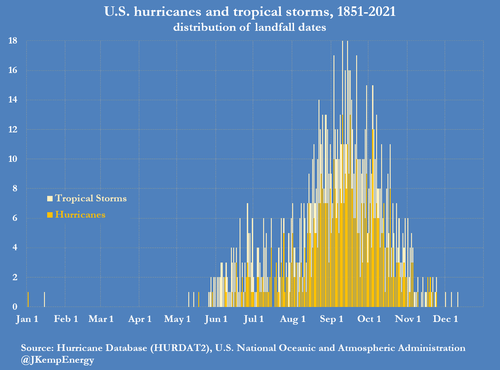

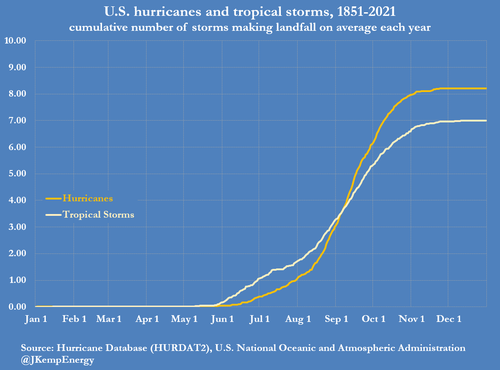

The Atlantic season lasts from June 1 to Nov. 30, with half of the storms usually occurring before Sept. 12, based on records compiled by the U.S. National Oceanic and Atmospheric Administration (NOAA).

On average, four hurricanes made landfall somewhere on the Atlantic or Gulf Coasts of the United States by Sept. 12 each year between 1851 and 2021 (“Hurricane database”, HURDAT2, NOAA).

But this year the start of the hurricane season has been the quietest for 25 years. There were no Atlantic hurricanes in the month of August for the first time since 1997 and only the third time since 1950 (“Quiet start to hurricane season“, Wall Street Journal, Sept. 7).

No hurricanes have made landfall on the Atlantic or Gulf Coasts so far in 2022, ensuring crude and fuel production has continued uninterrupted and helping ease concerns about the low level of inventories.

Hurricanes tracking through the oilfields of the western Gulf or making landfall near the refining centres of Texas and Louisiana have the potential to interrupt offshore crude production and onshore gasoline and diesel refining. Severe storms in these areas often create a short-term spike in crude and fuel prices and traders anticipate potential moves by bidding up futures contracts for deliveries in September and October.

In May, NOAA forecast this year would see an above-average number of hurricanes and tropical storms, based in part on La Niña conditions in the Pacific (“NOAA predicts above-normal Atlantic hurricane season”, May 24). The agency reiterated this forecast as recently as the start of August (“NOAA still expects above-normal Atlantic hurricane season”, Aug. 4).

The possibility of hurricanes disrupting oilfield output or gasoline and diesel refining was especially worrisome given sanctions on Russia’s oil and diesel exports and the low level of oil inventories especially diesel stocks.

Hurricane risk likely contributed to rapidly rising prices for crude and abnormally high refining margins for gasoline and especially diesel through the end of July.

But the forecast storms have not materialized.

Falling Prices

Half the hurricane season still lies ahead so there is plenty of time for significant damage to offshore platforms and onshore refineries. In statistical terms, however, the risk is now much lower than it seemed between June and early August, which has likely taken some of the heat out of crude and fuel prices.

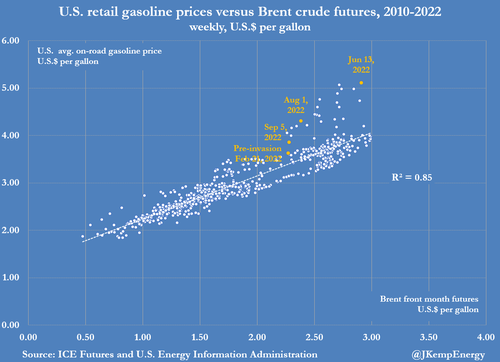

Prices for gasoline, in particular, have been falling much faster than for crude in recent weeks as the risks to the refining system have dropped.

Gasoline pump prices, including taxes, were at a premium of $1.58 per gallon ($66 per barrel) to Brent crude on Sept. 5 compared with $2.35 per gallon ($99 per barrel) in the middle of June.

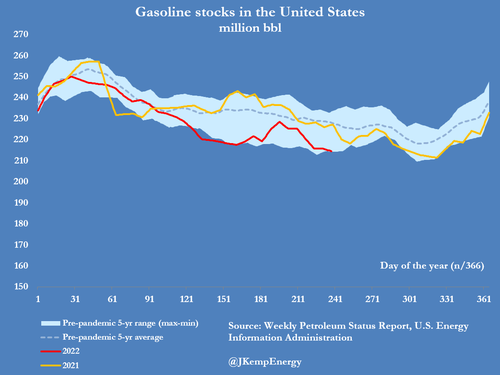

The gasoline premium has fallen close to its lowest levels since Russia invaded Ukraine in late February and is broadly similar to the premium a year ago, as some hurricane risk has evaporated. Premiums have narrowed even though gasoline inventories at the end of August were 14 million barrels (6%) below the pre-pandemic five-year average for 2015-2019.

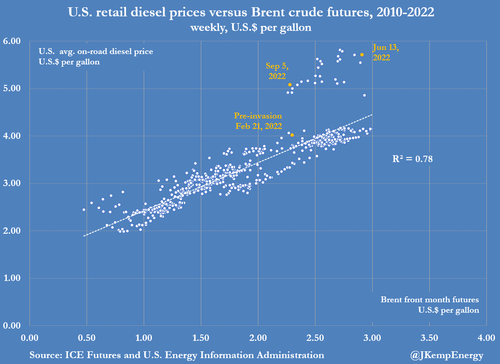

Diesel prices have remained firmer, in part because inventories remain much lower and manufacturing and freight activity has proved more resilient than expected a couple of months ago.

Distillate fuel oil inventories near the end of August were 32 million barrels (22%) below the pre-pandemic five-year seasonal average.

As a result, on-road diesel prices were at a premium of $2.80 per gallon ($118 per barrel) to Brent on Sept. 5 which was little changed from $3.10 per gallon ($130 per barrel) in the middle of June.

But it is likely that diesel prices would have moved even higher if the hurricane season had been much more active so far.

The quiet start to the season has removed one source of production risk while high prices and a slowing economy have started to dampen consumption.

The combined impact has been a significant reduction in the risk of fuel shortages with prices retreating from their mid-year highs.

https://www.zerohedge.com/commodities/quiet-start-us-hurricane-season-takes-heat-out-oil-prices-kemp

September 9, 2022

German Support

“Wide Rescue Umbrella”: Germany Plans To Support Companies As Energy Crisis Worsens

by Tyler DurdenFriday, Sep 09, 2022 – 05:45 AM

Natural gas and electricity prices have become so expensive in Germany that the economic engine of Europe is shutting down and at risk of a ‘Lehman-style’ collapse. To mitigate energy cost burdens, the German government unveiled a new proposal to increase a pandemic-era rescue fund to save small and medium size companies that could face a wave of bankruptcies amid the worsening energy crisis.

On Thursday, Bloomberg quoted German Economy Minister Robert Habeck as saying new financial aid for businesses to cover energy costs could soon be made possible.

“We will open a wide rescue umbrella,” Habeck told lawmakers in Berlin. “We will open it widely so that small and medium enterprises can come under it,” he said.

Habeck’s comments come after German Chancellor Olaf Scholz’s coalition agreed on a 65 billion euro program to support millions of struggling households with soaring power bills.

A participant at a parliamentary committee late Wednesday said Habeck was willing to use an existing pandemic-era aid program to support companies — about 20% of the 5 billion euros has already been spent.

Habeck said at the closed-door meeting that drawing funds from the Covid program could spark constitutional debt limit issues, according to the participant, who asked not to be named.

In his speech to lawmakers, Habeck said the energy crisis could persist well beyond this winter, adding financial support for businesses will be temporary as Germany and the EU work to reform energy supply chains away from Russia.

“We are looking at the electricity market design,” said Habeck. “If this doesn’t work immediately and solidly, then we also consider the option of a windfall levy and give this back to the citizens.”

Besides Germany, UK Prime Minister Liz Truss also laid out a plan to support households and businesses amid energy hyperinflation as Russia’s energy giant shuttered the Nord Stream 1 pipeline to Europe last week.

European politicians are maneuvering ahead of a pivot meeting Friday, where they will discuss plans to reduce energy costs, consumption, possible price caps on energy products, and even suspension of power derivatives trading — as the bloc races against time to thwart what could be a ‘Minsky’ moment as we reported European energy trading risks grinding to a halt unless governments extend liquidity to cover margin calls of at least $1.5 trillion.

September 9, 2022

German Support

“Wide Rescue Umbrella”: Germany Plans To Support Companies As Energy Crisis Worsens

by Tyler DurdenFriday, Sep 09, 2022 – 05:45 AM

Natural gas and electricity prices have become so expensive in Germany that the economic engine of Europe is shutting down and at risk of a ‘Lehman-style’ collapse. To mitigate energy cost burdens, the German government unveiled a new proposal to increase a pandemic-era rescue fund to save small and medium size companies that could face a wave of bankruptcies amid the worsening energy crisis.

On Thursday, Bloomberg quoted German Economy Minister Robert Habeck as saying new financial aid for businesses to cover energy costs could soon be made possible.

“We will open a wide rescue umbrella,” Habeck told lawmakers in Berlin. “We will open it widely so that small and medium enterprises can come under it,” he said.

Habeck’s comments come after German Chancellor Olaf Scholz’s coalition agreed on a 65 billion euro program to support millions of struggling households with soaring power bills.

A participant at a parliamentary committee late Wednesday said Habeck was willing to use an existing pandemic-era aid program to support companies — about 20% of the 5 billion euros has already been spent.

Habeck said at the closed-door meeting that drawing funds from the Covid program could spark constitutional debt limit issues, according to the participant, who asked not to be named.

In his speech to lawmakers, Habeck said the energy crisis could persist well beyond this winter, adding financial support for businesses will be temporary as Germany and the EU work to reform energy supply chains away from Russia.

“We are looking at the electricity market design,” said Habeck. “If this doesn’t work immediately and solidly, then we also consider the option of a windfall levy and give this back to the citizens.”

Besides Germany, UK Prime Minister Liz Truss also laid out a plan to support households and businesses amid energy hyperinflation as Russia’s energy giant shuttered the Nord Stream 1 pipeline to Europe last week.

European politicians are maneuvering ahead of a pivot meeting Friday, where they will discuss plans to reduce energy costs, consumption, possible price caps on energy products, and even suspension of power derivatives trading — as the bloc races against time to thwart what could be a ‘Minsky’ moment as we reported European energy trading risks grinding to a halt unless governments extend liquidity to cover margin calls of at least $1.5 trillion.

September 7, 2022

European Update

How will the European energy crisis affect freight markets?

A slowing eurozone may pull ocean container rates down further

John Paul HampsteadWednesday, September 7, 2022 4 minutes read

Listen to this article 0:00 / 5:35 BeyondWords

Volatility in European power markets stemming from EU and U.K. sanctions against Russian energy — imposed in retaliation for Russia’s invasion of Ukraine in February — may soon cool off, but only after carving a slice out of the continent’s economy.

On Monday, U.K. Prime Minister Liz Truss announced plans to cap household energy bills at the equivalent of $2,300 annually. Meanwhile, German Chancellor Olaf Scholz unveiled a 65 billion euro relief package to ease the pain of energy prices that have quadrupled in his country.

These crisis measures are meant to reduce the economic damage caused by a continentwide natural gas supply crunch following the cancellation of Nord Stream 2 and Russia’s shutdown of Nord Stream 1. Historically high energy prices could sap consumers’ ability to spend money on other goods and services, dragging down economic growth.

But last week, Goldman Sachs analyst Alberto Gandolfi wrote that his team did not think that the scope of the price caps being contemplated would be nearly enough to avert a 1970s-style energy crisis.

“We see scope for the introduction of price caps in power generation, which we estimate could save Europe c.€650 bn pa,” Gandolfi wrote in a client note on Saturday. “Yet, price caps would not fully solve the affordability issue: the increase in energy bills would still be of +€1.3 tn, or c.10% of GDP, we estimate.”

Europe’s economy was relatively healthy until the energy crisis, growing GDP by 3.9% year over year (y/y) or 0.6% quarter on quarter in the second quarter of 2022. But now the eurozone manufacturing PMI has slipped to 49.6, and the S&P Global Germany Composite PMI for August was revised lower to 46.9.

Slowing economic growth in the EU has been exacerbated by high inflation, which hit 9.7% y/y in August. That has put a jumbo interest rate hike of 75 bps on the table as European Central Bank President Christine Lagarde meets with her colleagues in Jackson Hole, Wyoming, this week.

Ocean container rates from Asia to Europe have already fallen dramatically this year — and have dropped especially sharply since the beginning of August.

The Freightos Baltic Daily spot rate from China to North Europe, displayed in white in the chart above, has fallen 24% since July 3, from $10,397.55 per forty-foot equivalent unit to $7,869.10. Drewry’s spot rate from Shanghai to Rotterdam, Netherlands, displayed in green, dropped 18% over the same period, from $9,280 per FEU to $7,583.

Those recent ocean container rate cuts came after the market had already been softening for months; container rates on the Asia-Europe trade peaked last October. The sudden, violent step-down in spot rates may indicate that the incremental goods spending is way off in Europe, and ocean carriers are starting to optimize for asset utilization rather than EBIT per shipment.

If the steamship lines follow their well-established playbook, their response to soft demand could be to trim capacity, switching out vessels on the main services with smaller ships and deploying those assets elsewhere. The problem is that they might not have anywhere to go: Trans-Pacific ocean container spot rates are also way down on softening demand.

Upstream ocean container bookings data from FreightWaves Container Atlas reveals that European exports are set to slow markedly as well. Ocean container bookings outbound from Rotterdam to all global ports have experienced downward pressure since July:

The Ocean Booking Volume Index from Rotterdam to all global ports is down by 25.4% since July 5, a sharp downward trend, albeit the index is still at an elevated level compared to pre-pandemic freight flows. Lead times out of Rotterdam run a little over 10 days, so the trend lines above reflect booking activity approximately 1.5 weeks ahead of the freight physically moving on a vessel.

The widely cited European Road Freight Rates Benchmark is at all-time highs but appears to be inclusive of fuel costs (diesel in the EU is up 69% since January). The Russian invasion of Ukraine has restricted the supply of truck drivers in Germany, where migrants make up 24% of the driver workforce, as Ukrainian men returned home to fight. European road freight analysts are betting that weakening economic growth will keep rates from rising higher.

“The effect of rising costs in 2022 is now very evident with road freight rates across the European continent reaching new all-time highs,” wrote Transportation Intelligence economic analyst Nathaniel Donaldson. “Initial fuel price rises following the invasion of Ukraine have held and produced a much more costly environment for European road carriers whilst industrial action and a worsening driver shortage keep capacity tight. A range of indicators are pointing towards a drastic slowdown in consumption and production, which will ease further increases while high costs keep rates elevated.”

The EU energy crisis has already taken a bite out of Europe’s consumption and production, weakening demand for transportation capacity in, through and out of the region. Recently announced fiscal relief measures will likely not be large enough to avert an acute economic slowdown, with knock-on effects for global transportation markets like ocean container freight.

September 7, 2022

European Update

How will the European energy crisis affect freight markets?

A slowing eurozone may pull ocean container rates down further

John Paul HampsteadWednesday, September 7, 2022 4 minutes read

Listen to this article 0:00 / 5:35 BeyondWords

Volatility in European power markets stemming from EU and U.K. sanctions against Russian energy — imposed in retaliation for Russia’s invasion of Ukraine in February — may soon cool off, but only after carving a slice out of the continent’s economy.

On Monday, U.K. Prime Minister Liz Truss announced plans to cap household energy bills at the equivalent of $2,300 annually. Meanwhile, German Chancellor Olaf Scholz unveiled a 65 billion euro relief package to ease the pain of energy prices that have quadrupled in his country.

These crisis measures are meant to reduce the economic damage caused by a continentwide natural gas supply crunch following the cancellation of Nord Stream 2 and Russia’s shutdown of Nord Stream 1. Historically high energy prices could sap consumers’ ability to spend money on other goods and services, dragging down economic growth.

But last week, Goldman Sachs analyst Alberto Gandolfi wrote that his team did not think that the scope of the price caps being contemplated would be nearly enough to avert a 1970s-style energy crisis.

“We see scope for the introduction of price caps in power generation, which we estimate could save Europe c.€650 bn pa,” Gandolfi wrote in a client note on Saturday. “Yet, price caps would not fully solve the affordability issue: the increase in energy bills would still be of +€1.3 tn, or c.10% of GDP, we estimate.”

Europe’s economy was relatively healthy until the energy crisis, growing GDP by 3.9% year over year (y/y) or 0.6% quarter on quarter in the second quarter of 2022. But now the eurozone manufacturing PMI has slipped to 49.6, and the S&P Global Germany Composite PMI for August was revised lower to 46.9.

Slowing economic growth in the EU has been exacerbated by high inflation, which hit 9.7% y/y in August. That has put a jumbo interest rate hike of 75 bps on the table as European Central Bank President Christine Lagarde meets with her colleagues in Jackson Hole, Wyoming, this week.

Ocean container rates from Asia to Europe have already fallen dramatically this year — and have dropped especially sharply since the beginning of August.

The Freightos Baltic Daily spot rate from China to North Europe, displayed in white in the chart above, has fallen 24% since July 3, from $10,397.55 per forty-foot equivalent unit to $7,869.10. Drewry’s spot rate from Shanghai to Rotterdam, Netherlands, displayed in green, dropped 18% over the same period, from $9,280 per FEU to $7,583.

Those recent ocean container rate cuts came after the market had already been softening for months; container rates on the Asia-Europe trade peaked last October. The sudden, violent step-down in spot rates may indicate that the incremental goods spending is way off in Europe, and ocean carriers are starting to optimize for asset utilization rather than EBIT per shipment.

If the steamship lines follow their well-established playbook, their response to soft demand could be to trim capacity, switching out vessels on the main services with smaller ships and deploying those assets elsewhere. The problem is that they might not have anywhere to go: Trans-Pacific ocean container spot rates are also way down on softening demand.

Upstream ocean container bookings data from FreightWaves Container Atlas reveals that European exports are set to slow markedly as well. Ocean container bookings outbound from Rotterdam to all global ports have experienced downward pressure since July:

The Ocean Booking Volume Index from Rotterdam to all global ports is down by 25.4% since July 5, a sharp downward trend, albeit the index is still at an elevated level compared to pre-pandemic freight flows. Lead times out of Rotterdam run a little over 10 days, so the trend lines above reflect booking activity approximately 1.5 weeks ahead of the freight physically moving on a vessel.

The widely cited European Road Freight Rates Benchmark is at all-time highs but appears to be inclusive of fuel costs (diesel in the EU is up 69% since January). The Russian invasion of Ukraine has restricted the supply of truck drivers in Germany, where migrants make up 24% of the driver workforce, as Ukrainian men returned home to fight. European road freight analysts are betting that weakening economic growth will keep rates from rising higher.

“The effect of rising costs in 2022 is now very evident with road freight rates across the European continent reaching new all-time highs,” wrote Transportation Intelligence economic analyst Nathaniel Donaldson. “Initial fuel price rises following the invasion of Ukraine have held and produced a much more costly environment for European road carriers whilst industrial action and a worsening driver shortage keep capacity tight. A range of indicators are pointing towards a drastic slowdown in consumption and production, which will ease further increases while high costs keep rates elevated.”

The EU energy crisis has already taken a bite out of Europe’s consumption and production, weakening demand for transportation capacity in, through and out of the region. Recently announced fiscal relief measures will likely not be large enough to avert an acute economic slowdown, with knock-on effects for global transportation markets like ocean container freight.