Epoxy

June 7, 2022

Azelis M&A Focus

Azelis Strengthens Executive Leadership to Support Group’s Growth Strategy

June 7, 2022 by admin

ANTWERP, Belgium–(WORK TEL)–Regulatory Information:

Azelis (Brussels:AZE), a number one world innovation providers supplier within the specialty chemical substances and meals elements business, introduced the appointment of Laurent Nataf as Head of Mergers and Acquisitions (M&A), a brand new strategic perform on the group’s Government Committee. Sertaç Sürür, who was appointed as the brand new CEO and President of Azelis Asia Pacific, joined the Government Committee in his new place, growing the manager management of Azelis to 6 members.

As a part of Azelis’ technique to speed up development, Laurent Nataf, at the moment the CEO and President of Azelis Asia Pacific, will assume the function of Chief M&A Officer efficient September 1, 2022. The creation of this new function on the Government Committee displays the continued significance of the Group’s M&A program to enhance its natural development growth in strengthening its footprint and market management. Laurent will additional develop and drive Azelis’ world M&A method consistent with the group’s bold development plans and also will oversee post-acquisition integration applications. Laurent will leverage his management abilities and enterprise growth expertise by main the acquisition of 17 firms for Azelis in Asia Pacific. Below Laurent’s management, the group’s Asia Pacific enterprise grew from 8% to over 15% of group income, increasing Azelis’ footprint to incorporate 12 nations within the area.

Sertaç Sürür, who’s at the moment the Common Supervisor of Azelis Turkey, will take over the management of the Asia Pacific area from Laurent Nataf. Since becoming a member of in 2015, Sertaç has taken on numerous native and regional management roles, driving the group’s Turkey enterprise to develop into a number one specialty chemical substances distributor within the home market, rising from 2% to roughly 6% of Azelis’ EMEA income. Previous to becoming a member of Azelis, Sertaç held numerous business and administration management positions at world industrial and chemical distribution and manufacturing firms, together with DSM and Ravago.

Laurent and Sertaç, as members of the Government Board, will report back to the Group CEO,Dr. Hans Joachim Muller. They may quickly start to transition into their new roles to make sure a easy and seamless handover.

Dennis Verhaert, present Group M&A Director, will tackle a brand new function at Azelis, particulars of which shall be introduced quickly.

Azelis CEO Dr. Remark by Hans Joachim Müller:

“I’m happy to announce to the management of the group these strategic appointments that mark the following stage in our evolution to develop into the reference innovation service supplier within the specialty chemical substances and meals elements distribution market. Including M&A performance to the Government Committee is a logical step given our technique to enhance natural development with acquisitions to strengthen our facet worth chain and world footprint.

I wish to thank Dennis for his contribution to the event of a powerful M&A group that has supported the group’s speedy development over the previous 4 years. Laurent and Sertaç have a formidable monitor document of growing enterprise for the group and I’ve full confidence that they are going to proceed to efficiently fulfill their new roles.”

About Azelles

Azelis is a number one world innovation service supplier within the specialty chemical substances and meals elements business, with greater than 3,000 staff positioned in additional than 50 nations worldwide. Every of our educated groups of business, market and technical specialists is devoted to a selected market inside Life Sciences and Industrial Chemical compounds. We provide greater than 51,000 prospects a lateral complementary product worth chain, backed by roughly 2,300 key relationships, producing turnover of €2.8 billion (2021). Azelis Group NV is listed on Euronext Brussels with the code AZE.

Throughout our intensive community of greater than 60 software labs, our award-winning workers help within the growth of formulations and supply technical steerage for purchasers all through the product growth course of. We mix a world market attain with an area footprint to offer a dependable, built-in and distinctive digital service to native prospects and enticing job alternatives for principals. With an EcoVadis Platinum ranking, Azelis is a frontrunner in sustainability. We imagine in establishing and nurturing stable, sincere and clear relationships with our staff and companions.

Affect via concepts. Innovation via formulation.

www.azelis.com

https://webringnet.com/azelis-strengthens-executive-leadership-to-support-groups-growth-strategy/

June 7, 2022

Azelis M&A Focus

Azelis Strengthens Executive Leadership to Support Group’s Growth Strategy

June 7, 2022 by admin

ANTWERP, Belgium–(WORK TEL)–Regulatory Information:

Azelis (Brussels:AZE), a number one world innovation providers supplier within the specialty chemical substances and meals elements business, introduced the appointment of Laurent Nataf as Head of Mergers and Acquisitions (M&A), a brand new strategic perform on the group’s Government Committee. Sertaç Sürür, who was appointed as the brand new CEO and President of Azelis Asia Pacific, joined the Government Committee in his new place, growing the manager management of Azelis to 6 members.

As a part of Azelis’ technique to speed up development, Laurent Nataf, at the moment the CEO and President of Azelis Asia Pacific, will assume the function of Chief M&A Officer efficient September 1, 2022. The creation of this new function on the Government Committee displays the continued significance of the Group’s M&A program to enhance its natural development growth in strengthening its footprint and market management. Laurent will additional develop and drive Azelis’ world M&A method consistent with the group’s bold development plans and also will oversee post-acquisition integration applications. Laurent will leverage his management abilities and enterprise growth expertise by main the acquisition of 17 firms for Azelis in Asia Pacific. Below Laurent’s management, the group’s Asia Pacific enterprise grew from 8% to over 15% of group income, increasing Azelis’ footprint to incorporate 12 nations within the area.

Sertaç Sürür, who’s at the moment the Common Supervisor of Azelis Turkey, will take over the management of the Asia Pacific area from Laurent Nataf. Since becoming a member of in 2015, Sertaç has taken on numerous native and regional management roles, driving the group’s Turkey enterprise to develop into a number one specialty chemical substances distributor within the home market, rising from 2% to roughly 6% of Azelis’ EMEA income. Previous to becoming a member of Azelis, Sertaç held numerous business and administration management positions at world industrial and chemical distribution and manufacturing firms, together with DSM and Ravago.

Laurent and Sertaç, as members of the Government Board, will report back to the Group CEO,Dr. Hans Joachim Muller. They may quickly start to transition into their new roles to make sure a easy and seamless handover.

Dennis Verhaert, present Group M&A Director, will tackle a brand new function at Azelis, particulars of which shall be introduced quickly.

Azelis CEO Dr. Remark by Hans Joachim Müller:

“I’m happy to announce to the management of the group these strategic appointments that mark the following stage in our evolution to develop into the reference innovation service supplier within the specialty chemical substances and meals elements distribution market. Including M&A performance to the Government Committee is a logical step given our technique to enhance natural development with acquisitions to strengthen our facet worth chain and world footprint.

I wish to thank Dennis for his contribution to the event of a powerful M&A group that has supported the group’s speedy development over the previous 4 years. Laurent and Sertaç have a formidable monitor document of growing enterprise for the group and I’ve full confidence that they are going to proceed to efficiently fulfill their new roles.”

About Azelles

Azelis is a number one world innovation service supplier within the specialty chemical substances and meals elements business, with greater than 3,000 staff positioned in additional than 50 nations worldwide. Every of our educated groups of business, market and technical specialists is devoted to a selected market inside Life Sciences and Industrial Chemical compounds. We provide greater than 51,000 prospects a lateral complementary product worth chain, backed by roughly 2,300 key relationships, producing turnover of €2.8 billion (2021). Azelis Group NV is listed on Euronext Brussels with the code AZE.

Throughout our intensive community of greater than 60 software labs, our award-winning workers help within the growth of formulations and supply technical steerage for purchasers all through the product growth course of. We mix a world market attain with an area footprint to offer a dependable, built-in and distinctive digital service to native prospects and enticing job alternatives for principals. With an EcoVadis Platinum ranking, Azelis is a frontrunner in sustainability. We imagine in establishing and nurturing stable, sincere and clear relationships with our staff and companions.

Affect via concepts. Innovation via formulation.

www.azelis.com

https://webringnet.com/azelis-strengthens-executive-leadership-to-support-groups-growth-strategy/

June 6, 2022

Natural Gas Prices Spike

Perfect Storm Of Factors Sends US Natural Gas Prices Soaring

by Tyler DurdenMonday, Jun 06, 2022 – 03:25 PM

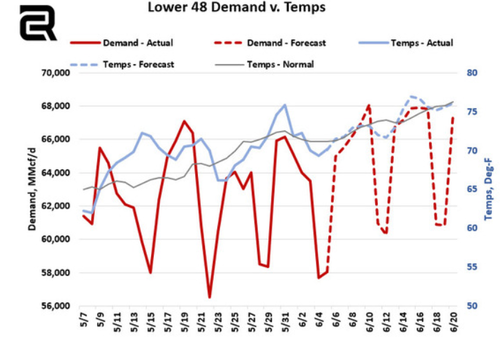

U.S. natural gas fundamentals remain bullish as above-normal temperatures drive cooling demand and dwindling supplies that would’ve been used for the next winter season cause market tightness, sending futures for July delivery soaring 9.5% to $9.340/mmbtu as of 1315 ET.

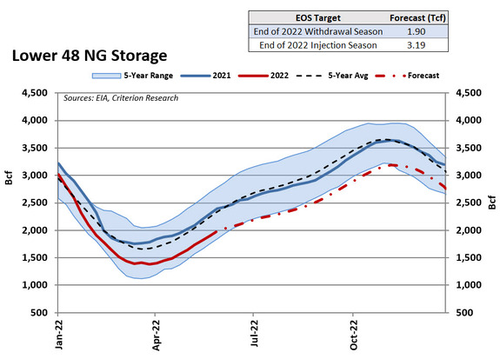

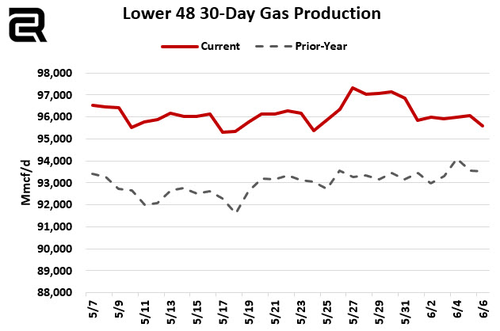

Houston-based energy firm Criterion Research sheds more color on the natgas fundamentals driving prices higher. They report a combination of factors, including above-average temperatures in the Lower U.S. 48, natgas demand, slumping natgas production, and below-average national stockpiles, which have driven July contracts above $9.

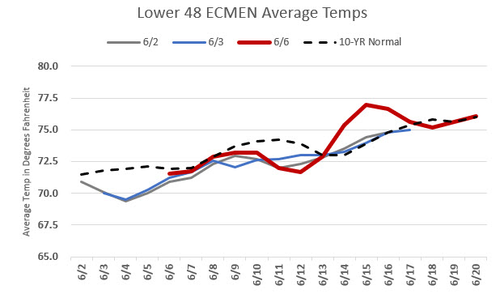

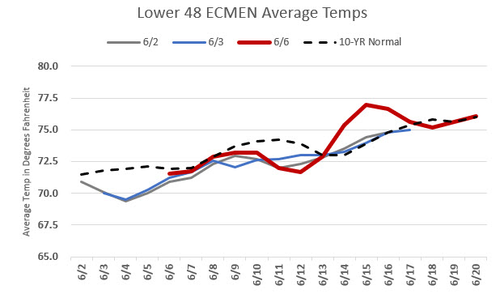

The Lower 48’s weather outlook has come in warmer this morning, with the latest models showing a warmer than average forecast for mid-June (versus the ten-year average.)

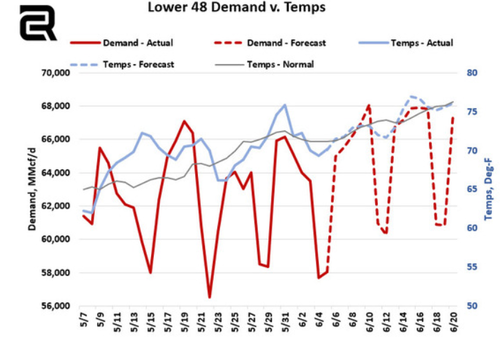

The week ending 6/17 should bring impressive natural gas demand numbers of 65.5 Bcf/d, marking the highest we’ve seen this summer.

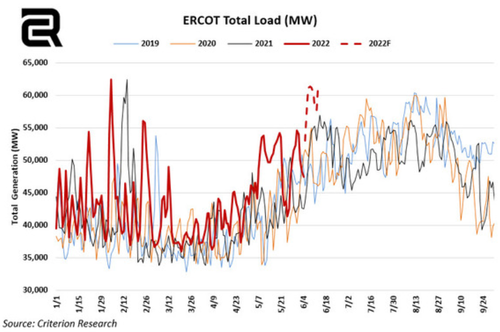

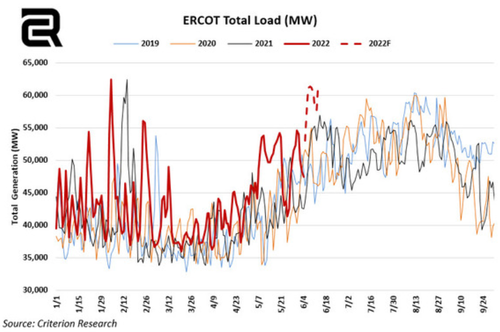

The warmer trend can especially be seen in states such as Texas, where ERCOT is forecasting record-high summer generation.

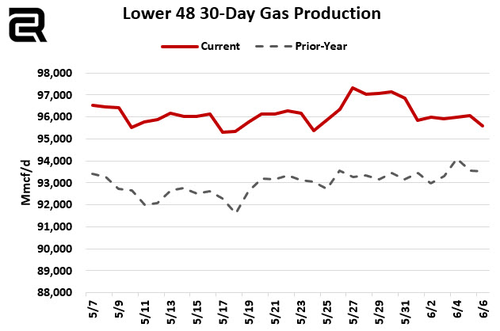

While the demand side of the equation comes in strong, U.S. natural gas production has been struggling since the start of June. Volumes quickly fell after June 1 and have remained off of the May highs.

Although general production growth is widely expected through year-end by most energy analyses, the speed at which that production comes online is the main concern. Higher production rates will be needed to fill national storage inventories before the winter, especially if summer temperatures continue to come in above-average.

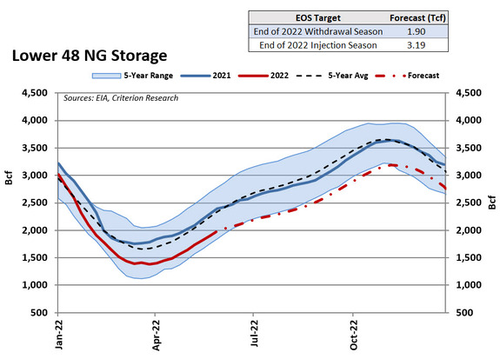

At Criterion, the latest iteration of our long-term supply & demand forecast, we have adjusted our Fall EOS target to a lower 3.19 Tcf, which marked a drop from the last forecast for a 3.25 Tcf level.

The current situation may remain uber bullish and could push natgas prices even higher as summer begins and driving season is underway, which puts upward pressure on energy markets.

Higher U.S. demand versus Europe has compressed the E.U.-U.S. natgas spread (1mo ahead vs. futs).

And in fact, US natgas futures are now trading at a premium to Day-Ahead EU NatGas prices.

Soaring natgas prices will only mean the cost of power will rise. We outlined the cities where power bills will skyrocket this summer as threats of rolling blackouts increase.

https://www.zerohedge.com/commodities/perfect-storm-factors-sends-us-natural-gas-prices-soaring

June 6, 2022

Natural Gas Prices Spike

Perfect Storm Of Factors Sends US Natural Gas Prices Soaring

by Tyler DurdenMonday, Jun 06, 2022 – 03:25 PM

U.S. natural gas fundamentals remain bullish as above-normal temperatures drive cooling demand and dwindling supplies that would’ve been used for the next winter season cause market tightness, sending futures for July delivery soaring 9.5% to $9.340/mmbtu as of 1315 ET.

Houston-based energy firm Criterion Research sheds more color on the natgas fundamentals driving prices higher. They report a combination of factors, including above-average temperatures in the Lower U.S. 48, natgas demand, slumping natgas production, and below-average national stockpiles, which have driven July contracts above $9.

The Lower 48’s weather outlook has come in warmer this morning, with the latest models showing a warmer than average forecast for mid-June (versus the ten-year average.)

The week ending 6/17 should bring impressive natural gas demand numbers of 65.5 Bcf/d, marking the highest we’ve seen this summer.

The warmer trend can especially be seen in states such as Texas, where ERCOT is forecasting record-high summer generation.

While the demand side of the equation comes in strong, U.S. natural gas production has been struggling since the start of June. Volumes quickly fell after June 1 and have remained off of the May highs.

Although general production growth is widely expected through year-end by most energy analyses, the speed at which that production comes online is the main concern. Higher production rates will be needed to fill national storage inventories before the winter, especially if summer temperatures continue to come in above-average.

At Criterion, the latest iteration of our long-term supply & demand forecast, we have adjusted our Fall EOS target to a lower 3.19 Tcf, which marked a drop from the last forecast for a 3.25 Tcf level.

The current situation may remain uber bullish and could push natgas prices even higher as summer begins and driving season is underway, which puts upward pressure on energy markets.

Higher U.S. demand versus Europe has compressed the E.U.-U.S. natgas spread (1mo ahead vs. futs).

And in fact, US natgas futures are now trading at a premium to Day-Ahead EU NatGas prices.

Soaring natgas prices will only mean the cost of power will rise. We outlined the cities where power bills will skyrocket this summer as threats of rolling blackouts increase.

https://www.zerohedge.com/commodities/perfect-storm-factors-sends-us-natural-gas-prices-soaring

June 6, 2022

Inventories

Massive US retail inventory pile-up a big warning for chems

Joseph Chang

18-May-2022Full storyRelated newsRelated contentContact us SHARE THIS

NEW YORK (ICIS)–A massive pile-up in inventories at key US big-box retailers may be a warning sign for chemicals demand, which has partly been propped up by the overbooking of orders.

- Walmart and Target disappointing Q1 results show huge inventory builds

- Retailers to start unwinding stocks through next couple quarters

- Retail destocking to trickle down to chemicals demand

The Q1 downside earnings shocker at No 1 US retailer Walmart on 17 May was followed up by much of the same at Target on 18 May. The main culprit? A huge inventory build-up, as the companies misjudged consumer demand for certain products. Inflation was also a factor in the higher inventory numbers.

Logistics tangles didn’t help either, as some products arrived too early and others too late.

Walmart’s Q1 inventories rose 8.3% from Q4 2021 and a stunning 32.0% year on year to $61.2bn. Target’s Q1 inventories were up 8.5% quarter on quarter and 43.1% year on year.

The magnitude of the retail earnings misses and huge inventory builds were a key factor in the collapse of the US stock market on 18 May. Chemical equities were also hit hard but suffered less than the overall market.

For Walmart, inventories ballooned to 43% of total Q1 sales versus 34% in the year-ago period. Walmart saw US consumer spending shifting away from discretionary items such as apparel, patio furniture and landscaping supplies and more towards food and consumables.

“Most of the increased inventory and related costs were related to buying over the past several quarters with a keen focus on in-stock, and now we’re in a short period of rightsizing it,” said Walmart chief financial officer Brett Biggs on the company’s Q1 earnings conference call.

INVENTORY UNWIND ON ITS WAY

The period of “aggressive inventory buys” through the past several quarters is now over, and a big inventory unwind is on its way.

Target’s inventories stood at 61% of Q1 sales versus 44% from a year ago. It underestimated the magnitude of the consumer shift away from certain goods and towards services, leading to burgeoning inventories in “bulky categories” such as kitchen appliances, TVs and outdoor furniture.

These bulkier items tend to have a high chemicals component. Home and kitchen appliances use plastics such as polypropylene (PP), polystyrene (PS) and acrylonitrile butadiene styrene (ABS), which have largely replaced metals, ceramics and glass for electrical appliances such as food blenders, according to website Kitchen Buds.

TVs likewise use ABS and high impact PS (HIPS), along with polycarbonate (PC) and polymethyl methacrylate (PMMA). Outdoor furniture such as tables, chairs, benches and table lamps contain a good amount of high density polyethylene (HDPE) as well as PMMA.

Target sees consumer spending instead shifting to categories such as food and beverage, beauty and personal care, and household essentials.

“Our team is focused on doing everything necessary to ensure we enter the fall season with an appropriate level of inventory by category,” said Michael Fiddelke, chief financial officer of Target.

It will likely take several quarters for the big inventory builds to normalise (Walmart also estimates a couple of quarters), and impairments are also probable, especially for seasonal items.

GOODS INFLATION MAY EASE

On the bright side, bloated inventories will likely lead to price markdowns as retailers look to move excess stock. Walmart estimates it took a $100m hit to gross profit in Q1 from higher-than-normal markdowns. Management would not quantify potential gross margin impact in the coming quarters. Target likewise marked down items to move inventory in Q1.

CONSUMER SPENDING STILL HEALTHY

On a macro level, US retail sales overall rose 0.9% in April from March and was up 8.2% year on year – not surprising given the level of inflation.

“A good leading indicator is combined sales for furniture and furnishings (0.7% gain month on month), and electronics and appliances (1.0% gain month on month), and it was a good showing here. Consumers are still in the game,” said ICIS senior economist Kevin Swift.

“However, the inventory figures for those companies (Walmart, Target) are worrisome, and could result in destocking,” he added.

The US consumer is clearly still spending, and the year-on-year gains in overall sales for both Walmart and Target bear that out. But what is just as clear is that retailers severely overestimated the magnitude of consumer demand for goods – the so-called bulkier goods in particular.

It’s shocking to see some of the largest US big box retailers caught so flat-footed on inventory management when you’d expect this to be a core capability.

Perhaps it would be slightly less shocking if one paid more attention to ecommerce retailer Amazon’s Q1 earnings results on 28 April where it saw inventories rise 7% from Q4, and 47% year on year to $35.0bn.

Shares of Walmart fell 11.4% when it announced earnings on 17 May, and declined a further 6.8% on 18 May. Target’s stock plunged almost 25% on its earnings announcement on 18 May, underscoring the market’s surprise.

CHEMICALS TO FEEL DESTOCKING IMPACT

US chemicals companies mostly reported solid Q1 earnings, with essentially no signs of demand destruction even in the face of continuing price hikes.

This could be due to customers overbooking orders and continuing to build inventory given the dismal state of the supply chain.

Panellists at the 12th ICIS World Surfactants Conference on 10 May indicated that the trend of buyers overbooking to ensure sufficient supply is unlikely to end anytime soon as logistics constraints persist.

However, the burgeoning inventories at big box retailers may be the canary in the coal mine. As retailers wind down inventories in the quarters ahead, this impact should start to be felt down the supply chain, all the way down to chemicals and plastics.

Insight article by Joseph Chang