Epoxy

June 6, 2022

Inventories

Massive US retail inventory pile-up a big warning for chems

Joseph Chang

18-May-2022Full storyRelated newsRelated contentContact us SHARE THIS

NEW YORK (ICIS)–A massive pile-up in inventories at key US big-box retailers may be a warning sign for chemicals demand, which has partly been propped up by the overbooking of orders.

- Walmart and Target disappointing Q1 results show huge inventory builds

- Retailers to start unwinding stocks through next couple quarters

- Retail destocking to trickle down to chemicals demand

The Q1 downside earnings shocker at No 1 US retailer Walmart on 17 May was followed up by much of the same at Target on 18 May. The main culprit? A huge inventory build-up, as the companies misjudged consumer demand for certain products. Inflation was also a factor in the higher inventory numbers.

Logistics tangles didn’t help either, as some products arrived too early and others too late.

Walmart’s Q1 inventories rose 8.3% from Q4 2021 and a stunning 32.0% year on year to $61.2bn. Target’s Q1 inventories were up 8.5% quarter on quarter and 43.1% year on year.

The magnitude of the retail earnings misses and huge inventory builds were a key factor in the collapse of the US stock market on 18 May. Chemical equities were also hit hard but suffered less than the overall market.

For Walmart, inventories ballooned to 43% of total Q1 sales versus 34% in the year-ago period. Walmart saw US consumer spending shifting away from discretionary items such as apparel, patio furniture and landscaping supplies and more towards food and consumables.

“Most of the increased inventory and related costs were related to buying over the past several quarters with a keen focus on in-stock, and now we’re in a short period of rightsizing it,” said Walmart chief financial officer Brett Biggs on the company’s Q1 earnings conference call.

INVENTORY UNWIND ON ITS WAY

The period of “aggressive inventory buys” through the past several quarters is now over, and a big inventory unwind is on its way.

Target’s inventories stood at 61% of Q1 sales versus 44% from a year ago. It underestimated the magnitude of the consumer shift away from certain goods and towards services, leading to burgeoning inventories in “bulky categories” such as kitchen appliances, TVs and outdoor furniture.

These bulkier items tend to have a high chemicals component. Home and kitchen appliances use plastics such as polypropylene (PP), polystyrene (PS) and acrylonitrile butadiene styrene (ABS), which have largely replaced metals, ceramics and glass for electrical appliances such as food blenders, according to website Kitchen Buds.

TVs likewise use ABS and high impact PS (HIPS), along with polycarbonate (PC) and polymethyl methacrylate (PMMA). Outdoor furniture such as tables, chairs, benches and table lamps contain a good amount of high density polyethylene (HDPE) as well as PMMA.

Target sees consumer spending instead shifting to categories such as food and beverage, beauty and personal care, and household essentials.

“Our team is focused on doing everything necessary to ensure we enter the fall season with an appropriate level of inventory by category,” said Michael Fiddelke, chief financial officer of Target.

It will likely take several quarters for the big inventory builds to normalise (Walmart also estimates a couple of quarters), and impairments are also probable, especially for seasonal items.

GOODS INFLATION MAY EASE

On the bright side, bloated inventories will likely lead to price markdowns as retailers look to move excess stock. Walmart estimates it took a $100m hit to gross profit in Q1 from higher-than-normal markdowns. Management would not quantify potential gross margin impact in the coming quarters. Target likewise marked down items to move inventory in Q1.

CONSUMER SPENDING STILL HEALTHY

On a macro level, US retail sales overall rose 0.9% in April from March and was up 8.2% year on year – not surprising given the level of inflation.

“A good leading indicator is combined sales for furniture and furnishings (0.7% gain month on month), and electronics and appliances (1.0% gain month on month), and it was a good showing here. Consumers are still in the game,” said ICIS senior economist Kevin Swift.

“However, the inventory figures for those companies (Walmart, Target) are worrisome, and could result in destocking,” he added.

The US consumer is clearly still spending, and the year-on-year gains in overall sales for both Walmart and Target bear that out. But what is just as clear is that retailers severely overestimated the magnitude of consumer demand for goods – the so-called bulkier goods in particular.

It’s shocking to see some of the largest US big box retailers caught so flat-footed on inventory management when you’d expect this to be a core capability.

Perhaps it would be slightly less shocking if one paid more attention to ecommerce retailer Amazon’s Q1 earnings results on 28 April where it saw inventories rise 7% from Q4, and 47% year on year to $35.0bn.

Shares of Walmart fell 11.4% when it announced earnings on 17 May, and declined a further 6.8% on 18 May. Target’s stock plunged almost 25% on its earnings announcement on 18 May, underscoring the market’s surprise.

CHEMICALS TO FEEL DESTOCKING IMPACT

US chemicals companies mostly reported solid Q1 earnings, with essentially no signs of demand destruction even in the face of continuing price hikes.

This could be due to customers overbooking orders and continuing to build inventory given the dismal state of the supply chain.

Panellists at the 12th ICIS World Surfactants Conference on 10 May indicated that the trend of buyers overbooking to ensure sufficient supply is unlikely to end anytime soon as logistics constraints persist.

However, the burgeoning inventories at big box retailers may be the canary in the coal mine. As retailers wind down inventories in the quarters ahead, this impact should start to be felt down the supply chain, all the way down to chemicals and plastics.

Insight article by Joseph Chang

June 6, 2022

Inventories

Massive US retail inventory pile-up a big warning for chems

Joseph Chang

18-May-2022Full storyRelated newsRelated contentContact us SHARE THIS

NEW YORK (ICIS)–A massive pile-up in inventories at key US big-box retailers may be a warning sign for chemicals demand, which has partly been propped up by the overbooking of orders.

- Walmart and Target disappointing Q1 results show huge inventory builds

- Retailers to start unwinding stocks through next couple quarters

- Retail destocking to trickle down to chemicals demand

The Q1 downside earnings shocker at No 1 US retailer Walmart on 17 May was followed up by much of the same at Target on 18 May. The main culprit? A huge inventory build-up, as the companies misjudged consumer demand for certain products. Inflation was also a factor in the higher inventory numbers.

Logistics tangles didn’t help either, as some products arrived too early and others too late.

Walmart’s Q1 inventories rose 8.3% from Q4 2021 and a stunning 32.0% year on year to $61.2bn. Target’s Q1 inventories were up 8.5% quarter on quarter and 43.1% year on year.

The magnitude of the retail earnings misses and huge inventory builds were a key factor in the collapse of the US stock market on 18 May. Chemical equities were also hit hard but suffered less than the overall market.

For Walmart, inventories ballooned to 43% of total Q1 sales versus 34% in the year-ago period. Walmart saw US consumer spending shifting away from discretionary items such as apparel, patio furniture and landscaping supplies and more towards food and consumables.

“Most of the increased inventory and related costs were related to buying over the past several quarters with a keen focus on in-stock, and now we’re in a short period of rightsizing it,” said Walmart chief financial officer Brett Biggs on the company’s Q1 earnings conference call.

INVENTORY UNWIND ON ITS WAY

The period of “aggressive inventory buys” through the past several quarters is now over, and a big inventory unwind is on its way.

Target’s inventories stood at 61% of Q1 sales versus 44% from a year ago. It underestimated the magnitude of the consumer shift away from certain goods and towards services, leading to burgeoning inventories in “bulky categories” such as kitchen appliances, TVs and outdoor furniture.

These bulkier items tend to have a high chemicals component. Home and kitchen appliances use plastics such as polypropylene (PP), polystyrene (PS) and acrylonitrile butadiene styrene (ABS), which have largely replaced metals, ceramics and glass for electrical appliances such as food blenders, according to website Kitchen Buds.

TVs likewise use ABS and high impact PS (HIPS), along with polycarbonate (PC) and polymethyl methacrylate (PMMA). Outdoor furniture such as tables, chairs, benches and table lamps contain a good amount of high density polyethylene (HDPE) as well as PMMA.

Target sees consumer spending instead shifting to categories such as food and beverage, beauty and personal care, and household essentials.

“Our team is focused on doing everything necessary to ensure we enter the fall season with an appropriate level of inventory by category,” said Michael Fiddelke, chief financial officer of Target.

It will likely take several quarters for the big inventory builds to normalise (Walmart also estimates a couple of quarters), and impairments are also probable, especially for seasonal items.

GOODS INFLATION MAY EASE

On the bright side, bloated inventories will likely lead to price markdowns as retailers look to move excess stock. Walmart estimates it took a $100m hit to gross profit in Q1 from higher-than-normal markdowns. Management would not quantify potential gross margin impact in the coming quarters. Target likewise marked down items to move inventory in Q1.

CONSUMER SPENDING STILL HEALTHY

On a macro level, US retail sales overall rose 0.9% in April from March and was up 8.2% year on year – not surprising given the level of inflation.

“A good leading indicator is combined sales for furniture and furnishings (0.7% gain month on month), and electronics and appliances (1.0% gain month on month), and it was a good showing here. Consumers are still in the game,” said ICIS senior economist Kevin Swift.

“However, the inventory figures for those companies (Walmart, Target) are worrisome, and could result in destocking,” he added.

The US consumer is clearly still spending, and the year-on-year gains in overall sales for both Walmart and Target bear that out. But what is just as clear is that retailers severely overestimated the magnitude of consumer demand for goods – the so-called bulkier goods in particular.

It’s shocking to see some of the largest US big box retailers caught so flat-footed on inventory management when you’d expect this to be a core capability.

Perhaps it would be slightly less shocking if one paid more attention to ecommerce retailer Amazon’s Q1 earnings results on 28 April where it saw inventories rise 7% from Q4, and 47% year on year to $35.0bn.

Shares of Walmart fell 11.4% when it announced earnings on 17 May, and declined a further 6.8% on 18 May. Target’s stock plunged almost 25% on its earnings announcement on 18 May, underscoring the market’s surprise.

CHEMICALS TO FEEL DESTOCKING IMPACT

US chemicals companies mostly reported solid Q1 earnings, with essentially no signs of demand destruction even in the face of continuing price hikes.

This could be due to customers overbooking orders and continuing to build inventory given the dismal state of the supply chain.

Panellists at the 12th ICIS World Surfactants Conference on 10 May indicated that the trend of buyers overbooking to ensure sufficient supply is unlikely to end anytime soon as logistics constraints persist.

However, the burgeoning inventories at big box retailers may be the canary in the coal mine. As retailers wind down inventories in the quarters ahead, this impact should start to be felt down the supply chain, all the way down to chemicals and plastics.

Insight article by Joseph Chang

June 6, 2022

Congestion Eases

Ports get ‘much needed respite’ as container-ship traffic jam eases

Ship queues down off Southern California, Virginia and Charleston

Greg Miller Follow on Twitter Wednesday, June 1, 2022 3 minutes read

Listen to this article 0:00 / 4:11 BeyondWords

It could be the relative calm before the peak-season, post-Shanghai-lockdown storm. Or it could be the final unwinding of COVID-era congestion as inflation takes hold. What happens next is still highly uncertain. But as of now, U.S. port queue numbers remain down from highs.

“This appears to be a much needed respite for some ports that have seen significant delays over the course of the year to date,” said S&P Global Commodity Insights.

“Congestion is easing in [some] areas,” said Flexport. It advised importers to “take advantage of currently available space.”

There were only 25 container ships waiting to berth in the ports of Los Angeles and Long Beach on Friday, according to data from the Marine Exchange of Southern California. That’s the lowest tally since July 28, 2021. As of Wednesday, there were 28 ships waiting. Current numbers are far below the all-time high of 109 ships waiting on Jan. 9.

The reduction in the Los Angeles/Long Beach ship queue is partially due to cargo being redirected to East Coast ports. Yet even East Coast ports are down from peaks.

In late February, ship-position data from MarineTraffic showed 70 container ships waiting offshore of East and Gulf Coast ports. By mid-May, the count had fallen to 45.

As of Wednesday, it had climbed back up to 58. Traffic jams off Virginia and Charleston, South Carolina, are down. The biggest queues now are off New York/New Jersey — 17 container ships — and Savannah, Georgia, where 25 vessels are waiting. Savannah’s numbers are the main driver of the recent East Coast uptick in recent days; Hapag-Lloyd reported only seven ships at anchor there on Friday.

A temporary reprieve?

Inbound arrivals could soon increase, according to Sea-Intelligence. If so, port congestion improvements are temporary.

Sea-Intelligence said that offered trans-Pacific capacity jumped 21% from 535,200 twenty-foot equivalent units for departures in the week of May 15-21 to 646,500 TEUs this week.

Ships departing overseas ports this week will arrive by the end of June. Last year, the queue numbers in Los Angeles/Long Beach fell through the third week of June, then reversed, heading back up thereafter.

Asia-West Coast freight rates appear to have stabilized at high levels, at least temporarily, after significant recent declines. The Drewry Shanghai-Los Angeles assessment was at $8,720 per forty-foot equivalent unit last week. The Freightos Baltic Daily Index (FBX) assessment for that route (which includes premiums) was at $10,762 per FEU as of Tuesday.

Freight futures traded against the FBX show expectations for rebounding rates.

Peter Stallion of brokerage Freight Investor Services wrote in a market update on Wednesday: “Trans-Pacific westbound has seen a severe erosion of freight rates. [But] forward market sentiment, rather than carrying down any further significant price decreases, has flattened out the curve.”

The calendar-year 2023 futures contract for Asia-West Coast is now trading above the current price, at $11,500 per FEU. That contract price “held steady through the month [of May],” said Stallion.

“This is a drastic change since the start of the year, and indeed through most of 2021,” when current prices were at a premium to forward contract prices.

June 6, 2022

Congestion Eases

Ports get ‘much needed respite’ as container-ship traffic jam eases

Ship queues down off Southern California, Virginia and Charleston

Greg Miller Follow on Twitter Wednesday, June 1, 2022 3 minutes read

Listen to this article 0:00 / 4:11 BeyondWords

It could be the relative calm before the peak-season, post-Shanghai-lockdown storm. Or it could be the final unwinding of COVID-era congestion as inflation takes hold. What happens next is still highly uncertain. But as of now, U.S. port queue numbers remain down from highs.

“This appears to be a much needed respite for some ports that have seen significant delays over the course of the year to date,” said S&P Global Commodity Insights.

“Congestion is easing in [some] areas,” said Flexport. It advised importers to “take advantage of currently available space.”

There were only 25 container ships waiting to berth in the ports of Los Angeles and Long Beach on Friday, according to data from the Marine Exchange of Southern California. That’s the lowest tally since July 28, 2021. As of Wednesday, there were 28 ships waiting. Current numbers are far below the all-time high of 109 ships waiting on Jan. 9.

The reduction in the Los Angeles/Long Beach ship queue is partially due to cargo being redirected to East Coast ports. Yet even East Coast ports are down from peaks.

In late February, ship-position data from MarineTraffic showed 70 container ships waiting offshore of East and Gulf Coast ports. By mid-May, the count had fallen to 45.

As of Wednesday, it had climbed back up to 58. Traffic jams off Virginia and Charleston, South Carolina, are down. The biggest queues now are off New York/New Jersey — 17 container ships — and Savannah, Georgia, where 25 vessels are waiting. Savannah’s numbers are the main driver of the recent East Coast uptick in recent days; Hapag-Lloyd reported only seven ships at anchor there on Friday.

A temporary reprieve?

Inbound arrivals could soon increase, according to Sea-Intelligence. If so, port congestion improvements are temporary.

Sea-Intelligence said that offered trans-Pacific capacity jumped 21% from 535,200 twenty-foot equivalent units for departures in the week of May 15-21 to 646,500 TEUs this week.

Ships departing overseas ports this week will arrive by the end of June. Last year, the queue numbers in Los Angeles/Long Beach fell through the third week of June, then reversed, heading back up thereafter.

Asia-West Coast freight rates appear to have stabilized at high levels, at least temporarily, after significant recent declines. The Drewry Shanghai-Los Angeles assessment was at $8,720 per forty-foot equivalent unit last week. The Freightos Baltic Daily Index (FBX) assessment for that route (which includes premiums) was at $10,762 per FEU as of Tuesday.

Freight futures traded against the FBX show expectations for rebounding rates.

Peter Stallion of brokerage Freight Investor Services wrote in a market update on Wednesday: “Trans-Pacific westbound has seen a severe erosion of freight rates. [But] forward market sentiment, rather than carrying down any further significant price decreases, has flattened out the curve.”

The calendar-year 2023 futures contract for Asia-West Coast is now trading above the current price, at $11,500 per FEU. That contract price “held steady through the month [of May],” said Stallion.

“This is a drastic change since the start of the year, and indeed through most of 2021,” when current prices were at a premium to forward contract prices.

June 4, 2022

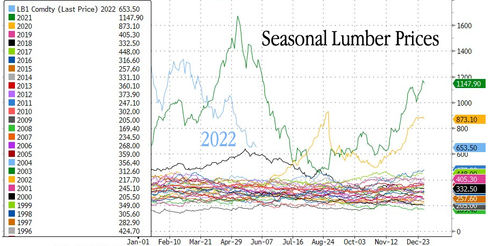

Lumber Prices

Lumber Prices Crash 50% As Fed Tightens

by Tyler DurdenFriday, Jun 03, 2022 – 08:40 PM

Lumber prices have been halved since the Federal Reserve embarked on its most aggressive interest rate tightening campaign in decades as the pandemic boom in housing slows.

Lumber contracts trading on the CME crashed to $653 per thousand board feet, down 51% from a high in late February of $1,336. The decline in wood prices occurred about two weeks before the Fed began hiking interest rates in mid-March.

The Fed is expected to continue raising rates this summer. Interest rate probabilities show the Fed could hike by 50bps at three of the next FOMC meetings to suppress consumption and get inflation under control ahead of the midterm elections. However, that’s going to be a challenging task, which may cause a hard landing in the economy.

Fed Chair Jerome Powell’s pursuit of finding the neutral rate has already unleashed a rate shock in the housing market, with the 30-year fixed-rate mortgage shooting up more than 200bps this year, from 320 bps to 557 bps. This has crushed activity for refinancing houses (remodeling) and sent mortgage applications (home construction) plunging, a sign the housing market is cooling.

Signs of a slowdown in construction are already materializing: “Buyers don’t have the same mentality of having to go out and buy 10 when they only need five,” Ash Boeckholt, co-founder and chief revenue officer at online wood-products marketplace MaterialsXchange, told WSJ.

A monthly survey from John Burns Real Estate Consulting of building-products dealers shows only 12% had tight lumber inventories in April, down 61% from last year. Lumber is a leading indicator and suggests higher prices and soaring interest rates have helped fix shortages that were stoked during the pandemic lockdowns of easy money and robust demand for housing.

Lumber is still double the price of the three-decade trend of $359. Matthew Saunders, who leads John Burns Real Estate Consulting, said that prices are expected to stay above pre-pandemic levels despite improving supply chains and falling demand for wood.

“We believe that they will trade above long-term averages for the balance of the year. However, in the short term, lumber is down more than 50% from the most recent peak. The market is trying to determine where the new price equilibrium compared to slowing demand and increased supply,” Josh Goodman, vice president of inventory and purchasing at Sherwood Lumber, told GlobeSt.com.

Another sign lumber demand is declining is directly from one of the largest wood producers in North America, Canfor Corp, who reduced operating schedules at sawmills in Western Canada. Since March, Canfor has operated sawmills at 80% of production capacity.

On the retail side, traders and analysts have noticed slumping demand for lumber at Home Depot and Lowe’s as consumers shift away from home-improvement projects to spending money on vacations.

The Fed will frontload interest rate hikes this summer which could pressure lumber prices even lower. Perhaps, if some readers have been waiting to build a deck or fence and didn’t want to pay crazy COVID prices, now could be the time to build (despite paying high labor costs).

https://www.zerohedge.com/commodities/lumber-prices-crash-50-fed-tightens