Government Regulation

January 15, 2020

China Trade Deal Phase I

Here Is The Full Text Of The “Phase One” US-China Trade Deal

The full text of the 94-page US-China “Phase One” Trade deal is below, and here, courtesy of Bloomberg, are some of the top highlights:

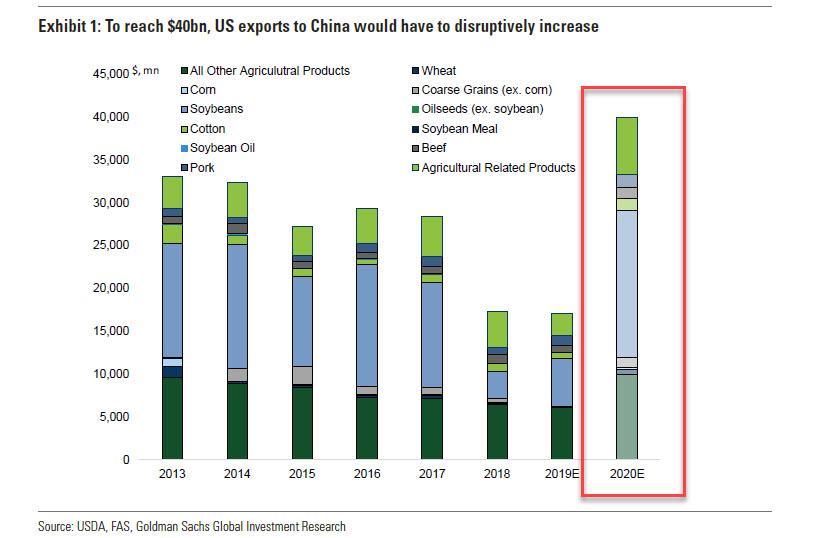

Agriculture details:

- China Purchases to Include Oilseeds, Meat, Cereals, Cotton

- China to Buy Add’l $19.5B U.S. Agriculture Products in 2021

- China to Buy Add’l $12.5B U.S. Agriculture Products in 2020

- China to Approve Pending Applications for U.S. Bond Raters

As Bloomberg notes, China is committing to buying about $32 billion in additional U.S. farm products over the next two years, that’s coming on top of levels seen in 2017 (pre-trade war). Specifically, China committed to importing at least $12.5 billion more agricultural goods this year than in 2017, rising to $19.5 billion next year. It’s unclear just how this will happen without China’s destroying existing supply chains. China will also “strive” to purchase an additional $5 billion a year in farm products.

Energy details:

- China to Buy Add’l $33.9B U.S. Energy Products in 2021

- China to Buy More U.S. Nuclear Power Equipment in Trade Deal

- China Energy Purchases to Include LNG, Oil, Products, Coal

- China to Buy Add’l $18.5B U.S. Energy Products in 2020

Chinese Purchases

- During the two-year period from January 1, 2020 through December 31, 2021, China shall ensure that purchases and imports into China from the U.S. of the manufactured goods, agricultural goods, energy products, and services identified in Annex 6.1 exceed the corresponding 2017 baseline amount by no less than $200 billion.

Intellectual Property

- The U.S. recognizes the importance of intellectual property protection. China recognizes the importance of establishing and implementing a comprehensive legal system of intellectual property protection and enforcement as it transforms from a major intellectual property consumer to a major intellectual property producer. China believes that enhancing intellectual property protection and enforcement is in the interest of building an innovative country, growing innovation-driven enterprises, and promoting high quality economic growth.

Tech Transfer

- The Parties affirm the importance of ensuring that the transfer of technology occurs on voluntary, market-based terms and recognize that forced technology transfer is a significant concern. The Parties further recognize the importance of undertaking steps to address these issues, in light of the profound impact of technology and technological change on the world economy.

Currency, Competitive Devaluation And Enforcement Mechanism

The text contains agreements not to engage in competitive devaluation, to respect one another’s monetary policy and to maintain transparency. Much of that, though, could probably have been inferred from what the U.S. Treasury said the other day in the FX report that saw it remove the tag of currency manipulator from China.

The big questions revolve around the enforcement mechanism. The FX section says points of contention can be referred to a new dispute resolution arrangement that’s being established by the agreement, and if that doesn’t work, the IMF can be called in.

- 1. Issues related to exchange rate policy or transparency shall be referred by either the U.S. Secretary of the Treasury or the Governor of the People’s Bank of China to the Bilateral Evaluation and Dispute Resolution Arrangement established in Chapter 7 (Bilateral Evaluation and Dispute Resolution).

- 2. If there is failure to arrive at a mutually satisfactory resolution under the Bilateral Evaluation and Dispute Resolution Arrangement, the U.S. Secretary of the Treasury or the Governor of the People’s Bank of China may also request that the IMF, consistent with its mandate: (a) undertake rigorous surveillance of the macroeconomic and exchange rate policies and data transparency and reporting policies of the requested Party; or (b) initiate formal consultations and provide input, as appropriate.”

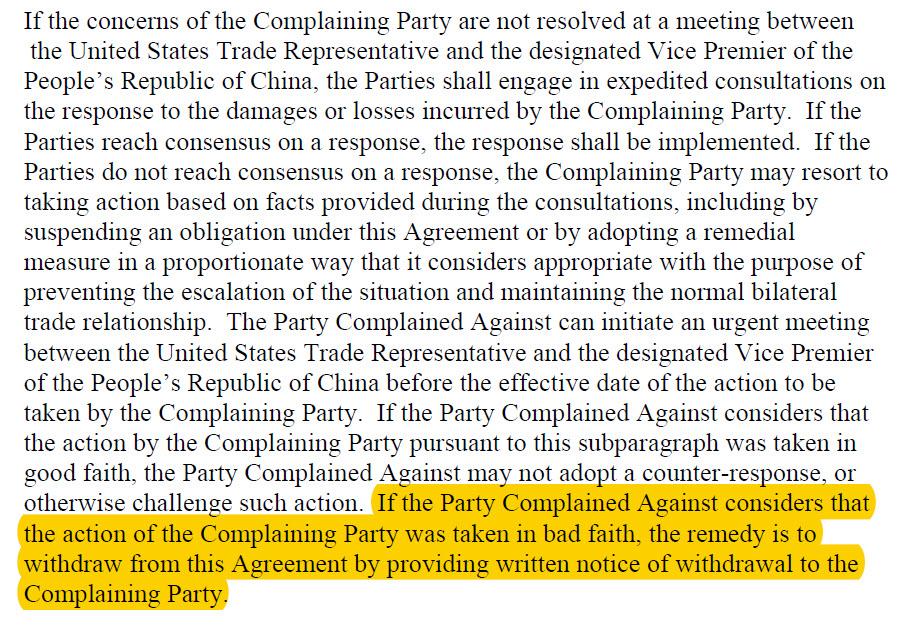

The dispute arrangement itself is outlined in chapter 7, where some of the key sections appear to be as follows:

- If the Parties do not reach consensus on a response, the Complaining Party may resort to taking action based on facts provided during the consultations, including by suspending an obligation under this Agreement or by adopting a remedial measure in a proportionate way that it considers appropriate with the purpose of preventing the escalation of the situation and maintaining the normal bilateral trade relationship.

- If the Party Complained Against considers that the action of the Complaining Party was taken in bad faith, the remedy is to withdraw from this Agreement by providing written notice of withdrawal to the Complaining Party.

Financial Services

- China shall allow U.S. financial services suppliers to apply for asset management company licenses that would permit them to acquire non-performing loans directly from Chinese banks, beginning with provincial licenses. When additional national licenses are granted, China shall treat U.S. financial services suppliers on a non-discriminatory basis with Chinese suppliers, including with respect to the granting of such licenses.

- No later than April 1, 2020, China shall remove the foreign equity cap in the life, pension, and health insurance sectors and allow wholly U.S.-owned insurance companies to participate in these sectors. China affirms that there are no restrictions on the ability of U.S.-owned insurance companies established in China to wholly own insurance asset management companies in China.

- “No later than April 1, 2020, China shall eliminate foreign equity limits and allow wholly U.S.-owned services suppliers to participate in the securities, fund management, and futures sectors.

- China affirms that a wholly U.S.-owned credit rating services supplier has been allowed to rate domestic bonds sold to domestic and international investors, including for the interbank market. China commits that it shall continue to allow U.S. service suppliers, including wholly U.S.-owned credit rating services suppliers, to rate all types of domestic bonds sold to domestic and international investors. Within three months after the date of entry into force of this Agreement, China shall review and approve any pending license applications of U.S. service suppliers to provide credit rating services.

- Each Party shall allow a supplier of credit rating services of the other Party to acquire a majority ownership stake in the supplier’s existing joint venture.”

Full deal text: (pdf link)

https://www.zerohedge.com/economics/here-full-text-phase-one-us-china-trade-deal

January 14, 2020

REACH Impacts Epoxies

The far-reaching consequences of REACH

As the EU REACH legislation enters its final phase, the financial, administrative, occupational health and safety, and R&D challenges for companies in the electrical manufacturing industry are greater than ever before. EEIM secretary Norbert Rudat and epoxy resins expert Ulrich Maßen share their view.

First introduced in 2007, REACH (the registration, evaluation and authorisation of chemicals) is arguably the most important EU legislation in the last 25 years, affecting all producers, importers and downstream users of chemicals in industries as diverse as automotive and textiles manufacturing. The legislation aims to protect human health and the environment and encourage innovation in the chemicals industry through the replacement of hazardous chemicals with safer new ones – but comes at considerable cost. The European Commission estimated that it would cost the chemicals industry a maximum of 5.2 billion euros over 11 years. Other authorities placed the figure as high as 12.8 billion.

Under REACH, all chemicals produced and imported in the EU must undergo comprehensive testing, such as for carcinogenic, mutagenic or reprotoxic effects, and be registered with the European Chemicals Agency (ECHA) in Helsinki. This process can take several years and requires all businesses registering the same substance to share data to limit animal testing and compensate each other financially. During the first registration phase in 2010 for chemicals produced or imported in quantities above 1,000 tonnes per annum, 3,400 substances were registered accompanied by 20,000 dossiers. In 2018, when chemicals with a quantity of 1 to 100 tonnes per annum must be registered, it is expected that applications will be made for 25,000 substances accompanied by 70,000 dossiers.

“This volume of work represents a huge financial and administrative burden for the chemicals industry but also many of our members in the European Electrical Insulation Manufacturers association, who import chemicals and produce their own formulations, as well as manufacturing electrical insulation products,” says Dipl. Ing. Norbert Rudat, EEIM secretary. “It may be that many companies, especially smaller ones, go out of business simply due to the cost involved.”

For electrical insulation manufacturers and their customers – including manufacturers of electric motors, generators, transformers, white goods and consumer electronics – there is also a concern over materials availability. “Depending on whether certain authorisations are granted and timescales are met, we might not have our regular materials available to us and alternatives will need to be found,” he says.

Vital materials under threat

Hexahydrophthalic anhydride (HHPA) and methylhexahydrophthalic anhydride (MHHPA), two hardeners widely used in epoxy resin, for example, may soon become illegal in electrical manufacturing. Following a report brought to ECHA by the Dutch chemicals authority in 2012, ECHA has proposed that these anhydrides be placed on the REACH authorisation list as Substances of Very High Concern (SVHC) (annex XIV) due to their potential as respiratory sensitisers. The proposal was made in November 2015 and three months were given for the industry to comment. A final decision will be taken in the autumn.

“This proposal has been like an earthquake in the epoxy electrical insulation industry,” says Dr. Ulrich Maßen, founder of UM Thermoset Consulting and former chairman of the EEIM polymers group. “I support REACH and the safe handling of chemicals but pretty much the entire industry feels this proposal is unjustified. The industry has been handling these anhydrides for more than 50 years and the effect has been known for decades. Extreme caution is taken with them and to my knowledge in Europe there is not a single person with lowered respiratory functionality related to the work with anhydrides since 10 years. Several companies are working in closed systems so the risk of inhalation is almost zero in this case. I also do not believe they should be placed in the same category as substances that can kill or cause life-limiting conditions. If a person were to become sensitised, they would need to be withdrawn from the factory but otherwise their life would continue as normal.”

A number of the electrical manufacturing industry’s biggest names have formed a taskforce to oppose ECHA’s classification of HHPA and MHHPA as SVHC. Alternatives are also being investigated.

“One option is to find alternative curing agents while maintaining the epoxies. Another is to change the chemistry entirely, replacing epoxies with polyesters, polyurethanes or silicones. But for some applications there are no alternatives and there is a high probability that manufacturing will move to Asia with the finished product coming back to Europe. Passing risk onto workers in other parts of the world – with possibly lower safety standards – is not at all intended by REACH,” he says.

Staying legal

As well as materials availability, occupational health and safety compliance is also an important issue for the entire supply chain. Even if companies do not need to register chemicals themselves, they need to ensure that their suppliers have provided all the necessary paperwork and that their operations comply with the exposition scenarios detailed.

“Safety data sheets used to be quite brief – just five pages or so. Now they can contain as many as 300 pages with specific scenarios and conditions of how each chemical has to be used. You cannot use them however you like or you will be breaking the law,” Rudat says.

Outside of REACH, any companies handling chemicals must also comply with the EU CLP (classification, labelling and packaging) legislation, which replaced the Dangerous Substances and Dangerous Preparations Directives repealed in June 2015, as well as the IED (Industrial Emissions Directive), which governs emissions from factories. Companies may need to make significant investments to ensure operations are legal and that employees and the environment are sufficiently protected.

“The entire supply chain needs to take regulation very seriously and have trained people in-house or use expertise from third party consultants. It’s not only important for staying legal but for also the development and launch of profitable new products. R&D teams need to consider whether a component material will require costly authorization, whether it might become unavailable, or whether it requires special measures and investments to handle it. These are decisions that can spell success or failure for a business,” Rudat concludes

http://www.processindustrymatch.com/technology/2819-the-far-reaching-consequences-of-reach

January 14, 2020

REACH Impacts Epoxies

The far-reaching consequences of REACH

As the EU REACH legislation enters its final phase, the financial, administrative, occupational health and safety, and R&D challenges for companies in the electrical manufacturing industry are greater than ever before. EEIM secretary Norbert Rudat and epoxy resins expert Ulrich Maßen share their view.

First introduced in 2007, REACH (the registration, evaluation and authorisation of chemicals) is arguably the most important EU legislation in the last 25 years, affecting all producers, importers and downstream users of chemicals in industries as diverse as automotive and textiles manufacturing. The legislation aims to protect human health and the environment and encourage innovation in the chemicals industry through the replacement of hazardous chemicals with safer new ones – but comes at considerable cost. The European Commission estimated that it would cost the chemicals industry a maximum of 5.2 billion euros over 11 years. Other authorities placed the figure as high as 12.8 billion.

Under REACH, all chemicals produced and imported in the EU must undergo comprehensive testing, such as for carcinogenic, mutagenic or reprotoxic effects, and be registered with the European Chemicals Agency (ECHA) in Helsinki. This process can take several years and requires all businesses registering the same substance to share data to limit animal testing and compensate each other financially. During the first registration phase in 2010 for chemicals produced or imported in quantities above 1,000 tonnes per annum, 3,400 substances were registered accompanied by 20,000 dossiers. In 2018, when chemicals with a quantity of 1 to 100 tonnes per annum must be registered, it is expected that applications will be made for 25,000 substances accompanied by 70,000 dossiers.

“This volume of work represents a huge financial and administrative burden for the chemicals industry but also many of our members in the European Electrical Insulation Manufacturers association, who import chemicals and produce their own formulations, as well as manufacturing electrical insulation products,” says Dipl. Ing. Norbert Rudat, EEIM secretary. “It may be that many companies, especially smaller ones, go out of business simply due to the cost involved.”

For electrical insulation manufacturers and their customers – including manufacturers of electric motors, generators, transformers, white goods and consumer electronics – there is also a concern over materials availability. “Depending on whether certain authorisations are granted and timescales are met, we might not have our regular materials available to us and alternatives will need to be found,” he says.

Vital materials under threat

Hexahydrophthalic anhydride (HHPA) and methylhexahydrophthalic anhydride (MHHPA), two hardeners widely used in epoxy resin, for example, may soon become illegal in electrical manufacturing. Following a report brought to ECHA by the Dutch chemicals authority in 2012, ECHA has proposed that these anhydrides be placed on the REACH authorisation list as Substances of Very High Concern (SVHC) (annex XIV) due to their potential as respiratory sensitisers. The proposal was made in November 2015 and three months were given for the industry to comment. A final decision will be taken in the autumn.

“This proposal has been like an earthquake in the epoxy electrical insulation industry,” says Dr. Ulrich Maßen, founder of UM Thermoset Consulting and former chairman of the EEIM polymers group. “I support REACH and the safe handling of chemicals but pretty much the entire industry feels this proposal is unjustified. The industry has been handling these anhydrides for more than 50 years and the effect has been known for decades. Extreme caution is taken with them and to my knowledge in Europe there is not a single person with lowered respiratory functionality related to the work with anhydrides since 10 years. Several companies are working in closed systems so the risk of inhalation is almost zero in this case. I also do not believe they should be placed in the same category as substances that can kill or cause life-limiting conditions. If a person were to become sensitised, they would need to be withdrawn from the factory but otherwise their life would continue as normal.”

A number of the electrical manufacturing industry’s biggest names have formed a taskforce to oppose ECHA’s classification of HHPA and MHHPA as SVHC. Alternatives are also being investigated.

“One option is to find alternative curing agents while maintaining the epoxies. Another is to change the chemistry entirely, replacing epoxies with polyesters, polyurethanes or silicones. But for some applications there are no alternatives and there is a high probability that manufacturing will move to Asia with the finished product coming back to Europe. Passing risk onto workers in other parts of the world – with possibly lower safety standards – is not at all intended by REACH,” he says.

Staying legal

As well as materials availability, occupational health and safety compliance is also an important issue for the entire supply chain. Even if companies do not need to register chemicals themselves, they need to ensure that their suppliers have provided all the necessary paperwork and that their operations comply with the exposition scenarios detailed.

“Safety data sheets used to be quite brief – just five pages or so. Now they can contain as many as 300 pages with specific scenarios and conditions of how each chemical has to be used. You cannot use them however you like or you will be breaking the law,” Rudat says.

Outside of REACH, any companies handling chemicals must also comply with the EU CLP (classification, labelling and packaging) legislation, which replaced the Dangerous Substances and Dangerous Preparations Directives repealed in June 2015, as well as the IED (Industrial Emissions Directive), which governs emissions from factories. Companies may need to make significant investments to ensure operations are legal and that employees and the environment are sufficiently protected.

“The entire supply chain needs to take regulation very seriously and have trained people in-house or use expertise from third party consultants. It’s not only important for staying legal but for also the development and launch of profitable new products. R&D teams need to consider whether a component material will require costly authorization, whether it might become unavailable, or whether it requires special measures and investments to handle it. These are decisions that can spell success or failure for a business,” Rudat concludes

http://www.processindustrymatch.com/technology/2819-the-far-reaching-consequences-of-reach

January 14, 2020

SOFFA Act

The AHFA-backed upholstered furniture flammability legislation mandates CPSC adoption of California’s longtime flammability standard.

The House of Representatives passed the Safer Occupancy Furniture Flammability Act (SOFFA) (HR 2647) today. The American Home Furnishings Alliance (AHFA)-backed legislation would make California’s Technical Bulletin 117-2013 a federal flammability standard.

“SOFFA has had bipartisan and broad stakeholder support,” said AHFA CEO Andy Counts, who thanked Rep. Doris Matsui (D-CA) and Rep. Morgan Griffith (R-VA) for co-sponsoring the bill and ensuring it came for a vote. Counts also noted House Energy and Commerce Chairman Rep. Frank Pallone (D-NJ) and Ranking Member Rep. Greg Walden (R-OR), who helped move the measure through the committee process.

Senators Roger Wicker (R-MS) and Richard Blumenthal (D-CT) co-sponsored the Senate version, S1341, introduced in May and passed by the Senate Commerce, Science and Transportation Committee. It now awaits action by the full Senate.

“If SOFFA is now passed by the Senate, it will provide a legislative victory for both parties and, more importantly, a win for American consumers,” said Counts.

California TB 117-2013 outlines performance standards and methods for testing the smolder resistance of cover fabrics, barrier materials, filling materials and decking materials used in upholstered furniture. It had support from a broad coalition of stakeholders, including AHFA, firefighters, fire scientists, environmentalists and consumer groups.

In October 2015, AHFA formally petitioned the U.S. Consumer Product Safety Commission (CPSC) to adopt the performance standards and test methods prescribed by TB 117-2013 as a national, mandatory flammability standard for residential furniture. The agency evaluated the prospective benefits and costs of adopting the measure but, in September 2016, announced it would pursue “alternative approaches that address the hazard through a combination of research, education and outreach, and voluntary standards efforts.” However, no alternative approaches to the TB 117-2013 standard were ever proposed by the Commission.

The CPSC’s 2019 budget called for yet another review of TB 117-2013, but no action other than “data analysis and technical review” took place.

“For four years, AHFA has advocated making TB 117-2013 a national standard. It would ensure all upholstered residential furniture sold in the United States meets a rigorous fire safety threshold. SOFFA would mandate the best test methods and construction standards we have today but, importantly, it would not prohibit the CPSC from future rule making if new fire safety technologies become available,” Counts said.

SOFFA was introduced in both houses in 2017-2018, but the 115th Congress adjourned in January 2019 with no action on the measure.

https://www.furniturelightingdecor.com/house-passes-soffa

January 14, 2020

SOFFA Act

House Passes SOFFA

The AHFA-backed upholstered furniture flammability legislation mandates CPSC adoption of California’s longtime flammability standard.

The House of Representatives passed the Safer Occupancy Furniture Flammability Act (SOFFA) (HR 2647) today. The American Home Furnishings Alliance (AHFA)-backed legislation would make California’s Technical Bulletin 117-2013 a federal flammability standard.

“SOFFA has had bipartisan and broad stakeholder support,” said AHFA CEO Andy Counts, who thanked Rep. Doris Matsui (D-CA) and Rep. Morgan Griffith (R-VA) for co-sponsoring the bill and ensuring it came for a vote. Counts also noted House Energy and Commerce Chairman Rep. Frank Pallone (D-NJ) and Ranking Member Rep. Greg Walden (R-OR), who helped move the measure through the committee process.

Senators Roger Wicker (R-MS) and Richard Blumenthal (D-CT) co-sponsored the Senate version, S1341, introduced in May and passed by the Senate Commerce, Science and Transportation Committee. It now awaits action by the full Senate.

“If SOFFA is now passed by the Senate, it will provide a legislative victory for both parties and, more importantly, a win for American consumers,” said Counts.

California TB 117-2013 outlines performance standards and methods for testing the smolder resistance of cover fabrics, barrier materials, filling materials and decking materials used in upholstered furniture. It had support from a broad coalition of stakeholders, including AHFA, firefighters, fire scientists, environmentalists and consumer groups.

In October 2015, AHFA formally petitioned the U.S. Consumer Product Safety Commission (CPSC) to adopt the performance standards and test methods prescribed by TB 117-2013 as a national, mandatory flammability standard for residential furniture. The agency evaluated the prospective benefits and costs of adopting the measure but, in September 2016, announced it would pursue “alternative approaches that address the hazard through a combination of research, education and outreach, and voluntary standards efforts.” However, no alternative approaches to the TB 117-2013 standard were ever proposed by the Commission.

The CPSC’s 2019 budget called for yet another review of TB 117-2013, but no action other than “data analysis and technical review” took place.

“For four years, AHFA has advocated making TB 117-2013 a national standard. It would ensure all upholstered residential furniture sold in the United States meets a rigorous fire safety threshold. SOFFA would mandate the best test methods and construction standards we have today but, importantly, it would not prohibit the CPSC from future rule making if new fire safety technologies become available,” Counts said.

SOFFA was introduced in both houses in 2017-2018, but the 115th Congress adjourned in January 2019 with no action on the measure.

https://www.furniturelightingdecor.com/house-passes-soffa