The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

February 18, 2024

Today’s Topics Hello! In years gone by a game of golf, a bike ride or a dog walk might have topped the list of potential Sunday activities. But, today, hundreds of thousands of people across America are increasingly turning to pickleball, the racket sport that’s still taking America by storm. Boredom, the mother of invention

Tracing its roots all the way back to 1965 when it was invented by a group of 3 dads who couldn’t find a shuttlecock to play badminton on a summer’s day, pickleball has had a slow-then-fast-then-really–fast rise in America. On that day in Washington nearly 60 years ago, the trio improvised with what they had: table tennis paddles, a plastic ball, and a badminton court — a combination that, once the net was lowered a few feet, proved an entertaining and accessible game to a variety of ages and abilities.

From those humble beginnings, it took the sport decades to really capture people’s interest, spreading organically across America, eventually being played in every state by 1990. But, cut to the present day, and pickleball has taken the US by storm: according to the Sport & Fitness Industry Association, 8.9 million players played the sport in 2022, up more than 80% on the prior year, making it the fastest growing sport in America.

Serving everyone

Arguably the main driver of pickleball’s popularity boom is its low-commitment versatility. Thanks to its perforated ball — which slows the game down — and smaller court, pickleball demands less raw athletic ability than many other sports, giving it a broad appeal, with many kids and seniors picking up the game.

In 2021, almost 73% of all record pickleball participants were ‘casual’ players who played fewer than 7x per year. In that same year, roughly 29% of pickleball players were aged 18-34 years old, while 21% were kids, ~20% were 35-54, and a whopping ~18% were 65+ — an astonishingly even demographic split for an increasingly mainstream sport. Out of those who play the most frequently, the older demographic was the dominant force, accounting for nearly one-third of that “core” player group.

Space invaders

Played on a badminton-size court, pickleball can be played indoors or outdoors, standing up or in wheelchairs, and it’s relatively space-efficient. In fact — much to the chagrin of die-hard tennis players everywhere (including Chartr’s editor) — you can nearly squeeze playing space for 4 pickleball courts in the same area needed for 1 tennis court.

To meet the booming demand, the SFIA estimates that a further 25,000 pickleball courts — equating to a $900m infrastructure investment — are needed to keep up with demand, on top of the ~44,000 courts that are estimated to already exist nationwide.

Check the rules

As the sport continues to pick up momentum at both a grassroots and professional level (yes, there are a lot of pro pickleball tournaments now), people are increasingly flocking to the first online port of call when you want a quick summary of something you’d never heard of until recently: Wikipedia.

It wasn’t until the Covid era when the paddle sport really ratcheted up in earnest. Since then, as pickleball’s grown into a bonafide passion for millions of people — rather than a faddy pandemic pastime (looking at you, breadmaking and online yoga) — page views on the sport’s Wikipedia page have soared, as curious players look up the rules, the sport’s history and why on Earth it’s called pickleball (nothing to do with pickles and everything to do with… rowing). Hits to the Wikipedia page even surpassed those of tennis in 2020, according to data from Pageviews.

Brokeback

Although the game can be enjoyed by all ages, pickleball is not without its risks. As its popularity has skyrocketed, so too have pickleball-related injuries: the American Academy of Orthopaedic Surgeons recently reported that bone fractures resulting from pickleball have increased 90x over the last 20 years, the majority of which resulted from falls in the 60-69 age group.

That may put a strain on doctors in Utah, Arizona, Minnesota and Florida, where data from Google Trends reveals search interest in pickleball has been the highest over the past 12 months.

Big pickle

It’s fair to say that the Super Bowl isn’t under threat as the jewel in corporate America’s sporting crown, but pickleball is increasingly big business. Manufacturers of pickleball equipment are selling hundreds of millions of dollars worth of paddles, shoes and apparel every year, while developers are eyeing up unused retail space, spending millions to convert them into prestige pickleball playing spaces around the country.

As the pro scene begins to take off, a battle for pickle supremacy has been quietly taking place between rival leagues. Last September two of the biggest — Major League Pickleball and the PPA Tour — announced a merger, with private equity investors injecting $50m into the combined venture.

Although prize funds at most pro events remain relatively small, top players can reportedly make 7 figures from sponsorship deals, prize money and appearance fees.

Love it or hate it, we haven’t had peak pickleball yet.

Not a subscriber to Chartr?

Sign up for free below.

Subscribe

February 15, 2024

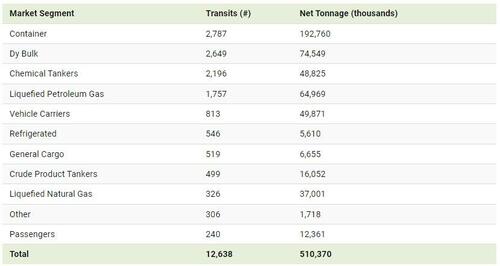

Panama Canal Traffic By Shipment Category And Tonnage

by Tyler Durden

Wednesday, Feb 07, 2024 – 11:35 PM

Daily Panama Canal traffic has been steadily restricted to start the year, with an expected peak reduction of over 40% by February 2024 due to severe drought. The problem is already affecting supply chains for U.S. and Asian importers.

In the graphic below, Visual Capitalist’s Omri Wallach illustrates the number of shipping crossings by market segment at the Canal and the net tonnage carried during the Annual Fiscal 2023 (October 2022 to September 2023). Data is from the Panama Canal Authority.

About the Panama Canal

The Panama Canal is an artificial 82-kilometer (51-mile) waterway that connects the Pacific Ocean with the Atlantic Ocean, built between 1904 and 1914.

The Canal locks at each end lift ships to Gatun Lake, an artificial freshwater lake 26 meters (85 ft) above sea level. The shortcut dramatically reduces the time for ships to travel between the two oceans, enabling them to avoid the route around the southernmost tip of South America via the Drake Passage or Strait of Magellan.

The Panama Canal moves roughly $270 billion worth of cargo annually–it’s the trade route taken by 40% of all U.S. container traffic alone and handles about 5% of all global maritime trade.

The Driest October in 70 Years

Last October, however, Panama received 41% less rainfall than usual, leading to the driest October in 70 years in what was supposed to be Panama’s rainy season, bringing the level of the Gatun Lake almost six feet below where it was a year ago. Additionally, infrastructure constraints led the Panama Canal Authority to restrict the number of ships that could pass each day.

The principal commodity groups carried through the Canal are motor vehicles, petroleum products, grains, coal, and coke.

According to the Panama Canal Authority, most of its traffic came from containers and dry bulk like soybeans. The world’s largest operator of chemical tankers (Stolt-Nielsen) typically also uses the Canal. However, due to the drought and the backup at the crossing, the operator has decided to reroute its fleet to the Suez Canal.

Although representing the smaller number of crossings, the Canal is also an important route for passengers, with many ocean cruise lines offering popular Panama Canal itineraries that sail through the Canal in the approximately 8-hour passage to their next destination in the opposite ocean.

https://www.zerohedge.com/geopolitical/panama-canal-traffic-shipment-category-and-tonnage

February 11, 2024

US Trade With Mexico Surges To No. 1 Position

by Tyler Durden

Thursday, Feb 08, 2024 – 10:05 PM

Mexico was the biggest trade partner of the U.S. in 2023 and the biggest source of the country’s imports ahead of China.

As Statista’s Katharina Buchhoz details below, trade with Mexico – both imports and exports – totaled close to $800 billion last year as efforts to source closer to home and reduce dependence on China are ongoing in the U.S. and other Western countries.

The U.S. has also intensified trade with its neighbor to the North.

Canada is currently the country’s top 2 trade partner and top 3 source of imports, only slightly behind China for the latter metric.

Trade with two more close allies, Japan and Germany, also grew over the last couple of years.

You will find more infographics at Statista

China has traditionally bought fewer goods from the U.S. than Mexico and Canada so when its imports to the U.S. dropped last year, so did its overall trade balance with its North American partner.

China was the biggest trade partner of the U.S. between 2015 and 2018.

Canada and Mexico then became top partners at the height of the U.S.-China trade war in 2019.

2020 and the outbreak of the coronavirus caused a trade slump in the U.S. and saw China reemerge as the country’s biggest partner since the pandemic affected it only from a later date.

When the pandemic subsided in 2022 and 2023 and critique of China soared, first Canada and then Mexico got ahead, according to the U.S. Census Bureau.

https://www.zerohedge.com/economics/us-trade-mexico-surges-no-1-position

February 8, 2024

Tempur Sealy International, Inc. (TPX) Q4 2023 Earnings Call Transcript

Feb. 08, 2024 1:02 PM ETTempur Sealy International, Inc. (TPX) Stock

143.91K Followers

Q4: 2024-02-08 Earnings Summary

EPS of $0.53 misses by $0.01 | Revenue of $1.17B (-1.42% Y/Y) misses by $5.01M

Tempur Sealy International, Inc. (NYSE:TPX) Q4 2023 Earnings Conference Call February 8, 2024 8:00 AM ET

Company Participants

Aubrey Moore – Investor Relations

Scott Thompson – Chairman, President & Chief Executive Officer

Bhaskar Rao – Executive Vice President & Chief Financial Officer

Scott Thompson

Thank you, Aubrey. Good morning, everyone, and thank you for joining us on our 2023 fourth quarter and full year earnings call. I’ll begin with some highlights from the quarter and full year, and then turn the call over to Bhaskar to review our financial performance in more detail and discuss our 2024 guidance. After that, I’ll provide an update of our proposed acquisition of Mattress Firm, before opening up the call for Q&A.

In the fourth quarter of 2023, net sales were approximately $1.2 billion, and adjusted EPS was $0.53. Our results were in line with our expectation for the quarter, with sales and adjusted EPS approximately consistent with prior years.

Turning to a few highlights for 2023. First, I’d like to highlight our resilience of our business model, our robust cash flow and industry-leading balance sheet. Our solid financial position has given us flexibility to capitalize on the industry’s opportunities. We’re delivering strong operating cash flow, investing in the business and outperforming the broader bedding market in North America and internationally.

In the last three years, we’ve generated over $1.0 billion in cash flow after investing $1.3 billion in advertising and over $600 million in CapEx. We believe the strategic investments in our brands, capabilities and capacity enabled us and our retailers to succeed in a dynamic environment. Versus the prior year, adjusted EBITDA to net debt leverage declined from 3.1 to 2.87. We expect to continue to reduce our leverage in the coming quarters as we prepare for the closing of the proposed Mattress for transaction.

The US bedding industry, which is our largest market, was challenged in 2023. Based on preliminary figures, we believe the category units were down double-digits versus the prior year, and the US produced mattress units were below the 20-year trough for the industry. However, we have recently seen stabilization of the category demand. The international markets we operate in have generally demonstrated similar trends on a consolidated basis.

Over the prior two decades, the bedding industry has consistently grown through both ASP and unit expansion over time. We anticipate that the category will return to his historical trends of consistent growth. With our strong financial position, resilient operating model and the recent investments we’ve made in the business, Tempur Sealy is uniquely positioned to reap the benefits of an improving market.

The second item I’d like to highlight is our successful rollout of our new iconic premium products and continued expansion of extensive manufacturing capabilities. These actions in 2023, solidified our position as a leading vertically integrated global bedding company. Internationally, we successfully launched and all new lineup of timber mattresses, pillows and bed bases in over 90 markets, introducing new innovation and expanding our total addressable market globally. The consumer-centric innovation and expanded price points in the new collections for driving positive traction and broad range of customers, including our legacy ultra-premium consumers that mattress prices at 3,000 and above as well as consumer shopping for mattresses starting at 2000. The reaction to the new products has been positive. On the cost side, we have streamlined the construction of the new product to maximize manufacturing efficiencies, enhance our ability to efficiently customize products to meet customers’ needs in diverse markets and channels.

In the US, the new TEMPUR-breeze and Stearns & Foster product portfolio completed their rollout in 2023 and realized notable year-over-year growth. The TEMPUR-breeze portfolio achieved double-digit sales growth and a 5% increase in mattress and foundation ASP, while Stearns & Foster portfolio also delivered strong sales growth over the same period. These premium brands significantly outperformed the market and drove higher ASP for the entire category at a time when retailers are dealing with reduced floor traffic.

In 2024, we expect to complete the full refresh of our US Tempur portfolio by introducing our next generation of Adapt products. The new Adapt products are focused on meeting one of the highest consumer needs in mattresses, reduced aches and pains. This line includes our most advanced Tempur Material, uniquely designed to deliver 20% more pressure relief than the standard Tempur Material.

The Adapt products paired with our own proven line of innovative smart adjustable bases will build on the success of prior generations and Tempur Sealy’s robust R&D track record.

We have over 60,000 new Adapt mattresses ready as we prepare for the rollout to begin in the first quarter and expect to reach substantial completion before the Memorial Day holiday.

In 2023, we also opened our newest and largest state-of-the-art plant in Crawfordsville, Indiana. This new facility located in the Midwest, complements our existing manufacturing footprint, enhances our ability to serve Northeast customers.

Our expanded US manufacturing footprint will allow us to capture the projected long-term demand for our products and to support our rapidly growing OEM business. The new facility has the capabilities to manufacture a wide variety of bedding products and components for branded and non-branded operations.

Our third highlight is the diversification of our business model and go-to-market approach. One of our long-term initiatives is to increase the visibility with the consumer wherever and however they choose to shop. We follow the customers’ lead and aim to provide quality products at every price point, both on and offline.

In support of our broader portfolio diversification strategy, we are pursuing growth initiatives through innovation and development of industry-leading products. growing our wholesale business through existing and new retail relationships and increasing our investments in Stearns & Foster brand.

We’ll also look to expand further into the OEM market and grow our direct-to-consumer business through the expansion of our e-commerce channels and company-owned stores.

All these initiatives are in line with our pursuit of long-term sustainable growth. For example, our direct-to-consumer channel has increased from $150 million in 2015 to over $1.2 billion in 2023, a compound annual growth rate of 30%. This was in part thanks to the expansion into hundreds of new company-owned stores around the world and the successful launch of our Stearns & Foster and Sealy e-commerce websites. Additionally, we began offering OEM and private label products in 2020. And today, we generate hundreds of millions of dollars in profitable private label and OEM sales with further opportunities for growth in 2024 and beyond.

Lastly, our growth in wholesale has been broad-based across existing and new distribution. In fact, in April, we’ll be expanding our products into additional big-box stores with one of the largest U.S. bedding retailers.

Fourth, I’d like to highlight significant expansion in our year-over-year consolidated gross margin. We delivered year-over-year improvement of 260 basis points in our consolidated gross margin to 44.2%, in the fourth quarter of 2023. This is a result of efforts from the team to drive profitability by leveraging our fixed cost structure over multiple growth initiatives.

As mentioned, our new product innovation investments in manufacturing processes and plant and diversification of our go-to-market strategy have all contributed to improved gross margin. As we continue to drive greater efficiency, we increase our ability to invest in advertising, product development and our people. We also benefit from a larger pool of free cash flow to drive EPS growth and reduce our net leverage. While we expect the retail environment to remain dynamic, we have a track record of delivering results during challenging cycles.

In fact, we generated $4.9 billion in sales and $2.2 billion in gross profit for the full year 2023, both of which were just shy of our highest ever annual sales and gross profit figures. In 2024, we plan to stay focused on our long-term initiatives stay agile to capture opportunities and deliver higher sales and profits.

Our last highlight is on our commitment to protect and improve our communities and the environment, as we detailed in our recently published 2024 corporate social values report. The report is available on our IR website. We are proud of our achievements over the last year, including our zero waste to landfill status at our Canadian and Mexican manufacturing facilities and maintaining our zero waste landfill status at our U.S. and European manufacturing operations. This year, we contributed over $800,000 in shared contributions through our Tempur Sealy Foundation and donated more than 12,100 mattresses worth approximately $16.9 million, bringing our cumulative 10-year donation total to over $100 million.

Scott Thompson

Thank you, Bhaskar. Nice job. Before opening up the call for questions, let me provide a brief update on our pending acquisition of Mattress Firm. In the fourth quarter, we certified substantial completion with the FTC second request. We continue to work with the FTC to advance the transaction approval process. We anticipate these conversations will continue through the first quarter. As previously, disclosed we continue to expect the transaction to close in mid to late 2024. In connection with and contingent upon the acquisition, we are proactively pursuing a divestiture plan and engaging with Mattress Firm suppliers. In parallel, Tempur Sealy and Mattress Firm continue to make joint progress on integration planning.

Lastly, a brief comment on Mattress Firm’s financial performance. Mattress Firm recently made their quarterly results available on their website, which were consistent with our expectations. We encourage you to review Mattress Firm’s website for more information on their financial performance for the most recent quarter. In summary, our progress towards the transaction close is on track and we look forward to joining with the Mattress Firm team.

Susan Maklari

Good morning, Scott. Maybe to start with why don’t we talk a little bit about demand? You mentioned that it seems like we have bottomed out in the fourth quarter and that this year we could see a sequential improvement as we move through. How are you thinking about that, I guess relative to the macro backdrop the potential for rates to come down? And what else do you think is stimulating the consumer a bit perhaps to start to see some improvement on the unit side?

Scott Thompson

Well, obviously we have easier comps, which is probably the first thing that’s got to be pointed out. Second thing obviously, we are at an all-time low when we’re talking about the US in volume. So we are really at rock bottom from a historical standpoint. And as you mentioned, there are some green shoots. Obviously, we’re in an environment where interest rates are trending down. We’re also — if you look at the bedding industry and we just got back from the Vegas bedding show there’s good innovation in the industry. We’ve got some new product coming out and others have some new product coming out that’s very interesting.

We’ve also seen some of our larger retailers, I’m going to say, refocus on advertising and we’ve got several of them increasing their advertising budgets going into 2024. So, yeah, in general it feels like I’ve used the term balancing around the bottom. We’re kind of bouncing around the bottom. If you go back and look at the fourth quarter and kind of look at it parse it by month, October was not good in the US and then it got better throughout the quarter.

And then you get to the January period. And obviously, it’s very difficult in this world to forecast. If we look at our own order book in January, it’s positive. If I look at our online sales in January it’s up double digits. So it looks like some green shoots, but you have to dampen that when you look at some of the details, the order book is positive, but it’s concentrated in some larger customers. It’s not as broad-based as we’d like to see. If you go talk to the retailers and listen to them, floor traffic is down double digits. And their January — when you talk to the retailers in general are talking about being down 10%. And then you think about January it’s only 30% of the quarter. So what I’m kind of saying, it’s all mixed and we are continuing to get some mixed signals, but clearly bouncing around the bottom seems to be the best description currently.

Keith Hughes

Thank you. A question on the new facility in Indiana. Once you get up to full capacity, how much of your pouring will that represent? And will you actually hit full capacity in the second quarter?

Scott Thompson

Really complicated question. Let me put some words around it. No, we will not hit full capacity in the second quarter. And it depends on when you talk about capacity, whether you’re running one shift, two shifts all that kind of stuff. The way you should probably think about it is look first quarter a little bit of a drag to get it going by the time you’re into the second and third quarter, Crawfordsville is contributing, okay?

But you should think about optimize — optimized it’s probably a couple of years out as far as being totally optimized depending on what the bedding market is and it gives us great flexibility. But we’ve — with Crawfordsville and the other plants we have and the ability to go to second shifts, you should think about Tempur has capacity for the foreseeable future, both in pouring OEM foam and regular foam.

Keith Hughes

Okay. One follow-up question to that.

Scott Thompson

Go ahead.

Keith Hughes

Do you think you’re going to — in terms of like spring production, do you think you’ll do some more backward integration on spring production in the future as well? Particularly, given the volume you’re starting to move in the industry?

Scott Thompson

Yes. I don’t know. That’s something we’ve always looked at. We’ve got a great partnership with Leggett for sure. They do a fabulous job for us. We’ve got some other manufacturers that are doing good job for us. And we make a good bit of our springs already. We make our own springs in the Asian market.

William Reuter

Hi. Just kind of follows on that last question. But you mentioned you expect ASP to be flat. Are you seeing a trade down currently? Are you currently seeing ASP flat? Or are you seeing greater strength at lower price points? I know you have Stearns & Foster rollout last year so that may be contributing to some greater success there. But any comments on mix?

Scott Thompson

Yeah. On mix, we’re generally seeing the higher priced units do better than the lower-priced units. That’s a trend that has been around for a year or so. I would say the gap has narrowed some, but we continue to see that mix. We haven’t seen any deterioration in the strength of the higher end. And I think in general, what I think Bhaskar’s talked about correct me if I’m wrong, on a like-for-like basis we aren’t expecting to see ASP increases as there’s quite a bit of pricing put in the market over the last few years due to commodity increases. And it feels like the commodity thing is behind us and price on a like-for-like basis is stabilized.

Read more here:

February 8, 2024

2023 Review and 2024 Outlook For US Housing Market

PUdaily | Updated: February 7, 2024

2023 has come and gone in a rush. In the past year, the US housing market witnessed a notable storm, with one of the most talked-about topics being the skyrocketing mortgage rates. Since the end of 2022 when the 30-year fixed mortgage rate broke 6% for the first time, it climbed to over 7% in 2023, and even approached the high of 8%, undoubtedly shattering many people’s home-buying dreams. At this point, rumours about the burst of housing bubble spread everywhere. Looking back, to find a similar scenario of high mortgage rates, we have to go back over 20 years to the turn of the century. Over the years, people have gradually grown accustomed to a low interest rate environment. Since the real estate market recovery in 2012, the average 30-year mortgage rate has only been 4.14%, making the current figure of over 7% exceptionally glaring.

Despite the record-high mortgage rates in 2023, housing prices did not fall as expected, but instead continued to stand firm. An expert pointed out, “High rates reduce housing demand, but also more significantly reduce housing supply”. The US housing inventory is only equivalent to a 2.5-month supply at the current sales pace, far below the balanced level of 6-month.

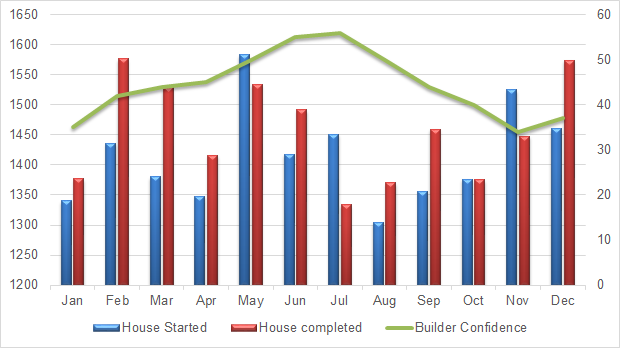

In 2023, housing starts in the US totaled 16.98 million, a year-on-year decrease of 8.8%, according to FRED. Meanwhile, housing completions increased by 5.5% to 17.48 million. In addition, the Housing Market Index (HMI) published by the National Association of Home Builders (NAHB) dropped to 44% in 2023, a 15% decrease from the previous year, further confirming the view that “high rates reduce housing demand, but also more significantly reduce housing supply”.

Figure 1: US Housing Completions, Housing Starts & HMI 2023 (1,000 units, %)

Data source: FRED, NAHB

In 2023, the available housing inventory was relatively low due to sellers unwilling to give up previously locked-in low interest rates. Luckily, in 2024, buyers can expect to see an improvement in the number of homes for sale. Lawrence Yun, chief economist at National Association of Realtors (NAR), stated that overall housing inventory could increase by as much as 30%, with some markets experiencing even more rapid growth.

The number of mortgage applications for home purchases in the US rose to the highest level since April 2023, indicating an increase in housing loan demand due to borrowing costs remaining below 7%. Data from the Mortgage Bankers Association (MBA) showed that mortgage applications for home purchases in the US increased 7.5% to 174.3 in the week ended January 19. Real estate websites like Zillow predicted that rates will remain between 7% and 7.5% throughout the year, while NAR was more optimistic, expecting rates to average below 7% in early spring (home buying season) and to drop to around 6.3% by the end of the year. In contrast, Realtor.com predicted that rates would average 6.5% by the end of 2024.

In summary, with mortgage rates averaging 6.61% and trending downward by the end of December, the US real estate market may experience a recovery in 2024.