The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 16, 2022

Cool, Sustainable, Feature-Rich Foams in Demand

Value-added offerings help manufacturers bolster higher-priced mattress collections

Value-added polyurethane foams are in high demand in the mattress marketplace, producers say. And they are adding features that today’s consumers want, such as cool-sleeping and sustainable foams and foams offering a variety of health benefits.

Producers say they have added foams and will introduce more soon to help mattress makers stand apart from the competition and to bolster their mattress offerings at higher price points.

While consumer demand for mattresses is down, the polyurethane foam producers are not slowing their efforts to develop innovative products for mattress makers, they say.

“Customers are looking for products and solutions that offer them some sort of value added,” says Chris Bradley, executive vice president of consumer products at Mount Airy, North Carolina-based NCFI Polyurethanes. “Whether that’s reduced cost or a tangible benefit such as cooling, customers are looking for an advantage.”

Polyurethane foam producers are not slowing their efforts to develop innovative products.

Read more here: https://bedtimesmagazine.com/2022/08/cool-sustainable-feature-rich-foams-in-demand/

August 16, 2022

Arsenal Capital Partners Announces Final Closes of Two New Funds Totaling $5.4 Billion Fund VI Closes with $4.3 Billion and Surpasses $3.0 Billion Target Inaugural Growth Fund Closes at its Hard Cap with $1.1 Billion and Surpasses $750 Million Target

New York, August 15, 2022 – Arsenal Capital Partners (“Arsenal”), a leading private equity firm that specializes in investments in industrial growth and healthcare companies, announced today that it has completed fundraising for two new funds, totaling $5.4 billion in capital commitments. Arsenal Capital Partners VI LP (together with its parallel funds, “Fund VI”) closed with $4.3 billion in capital commitments, well exceeding its $3.0 billion target of limited partner commitments and well above the size of its $2.4 billion predecessor fund. In addition, Arsenal Capital Partners Growth LP (together with its parallel funds, the “Growth Fund”) closed with $1.1 billion in capital commitments at its hard cap and exceeded its $750 million target of limited partner commitments.

“We are extremely grateful for the support from and relationships with our long-time investors,“ said Terry Mullen, Managing Partner of Arsenal. “We achieved a gratifying, high re-up rate from our existing institutional investors, who on average increased their commitments by 59% from the previous fund, and we are delighted to have attracted an exceptional group of new investors that will further bolster our market-leading institution.”

Over its 22-year history, Arsenal has built a leading private equity institution with two market-leading franchises in the industrials and healthcare sectors. Within its two focus sectors, Arsenal aims to create highly valuable, technology- and innovation-rich, growth companies that are strategically important to their markets. Arsenal’s team of more than 85 professionals and 55 senior advisors combines specialized investment, industry, and operating expertise into one integrated and balanced team to provide differentiated strategic insights, combine diverse perspectives, and leverage expert capabilities.

“The success of these fundraises reflects the strength of our market-leading franchises and our track record of building strategically valuable businesses. We and our investors see exciting opportunities to invest in technology- and innovation-rich companies in the industrial and healthcare sectors,” commented Jeff Kovach, Managing Partner of Arsenal. “Moreover, investors have acknowledged the depth of our domain and technical expertise that provides Arsenal the access, relevance, and credibility to compete and win in our target markets.”

Fund VI will focus on investments in industrials and healthcare businesses with proven technologies and solutions positioned to deliver high performance and value-add to their customers. The Growth Fund will execute a similar strategy in the same markets but pursue investments in next generation, emerging technology businesses poised to apply innovation to generate very high growth. In both of these funds, Arsenal will apply its high-impact company building capabilities to help businesses achieve significant organic growth and facilitate strategic acquisitions to extend their offerings and to solidify leadership positions in their respective markets.

Patricia Grad, Partner and Head of Investor Relations of Arsenal, added, “We are grateful for this global group of institutions and individuals who have supported our firm and greatly appreciate the collaborative dialogue that we had with them as we crafted these investment opportunities, particularly our debut Growth Fund. We look forward to deepening and strengthening our partnerships with our investors for years to come.”

Fund VI and the Growth Fund’s investor base is comprised of leading public and corporate pension plans, family offices, endowments and foundations, and financial institutions, including The University of California’s Office of the Chief Investment Officer (UC Investments), California State Teachers’ Retirement System, California Public Employees’ Retirement Systems, affiliates of APG Asset Management, The Oregon Public Employees Retirement Fund, affiliates of IIP A/S, and Minnesota State Investment Board. Kirkland & Ellis LLP served as legal counsel for Arsenal, Fund VI, and the Growth Fund.

About Arsenal Capital Partners Arsenal Capital Partners is a leading private equity firm that specializes in investments in industrial growth and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds totaling over $10 billion, completed more than 250 platform and add-on acquisitions, and achieved more than 30 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value-add. For additional information, please visit www.arsenalcapital.com.

Contact: Jackie Schofield at Prosek Partners Pro-Arsenal@prosek.com

August 16, 2022

Arsenal Capital Partners Announces Final Closes of Two New Funds Totaling $5.4 Billion Fund VI Closes with $4.3 Billion and Surpasses $3.0 Billion Target Inaugural Growth Fund Closes at its Hard Cap with $1.1 Billion and Surpasses $750 Million Target

New York, August 15, 2022 – Arsenal Capital Partners (“Arsenal”), a leading private equity firm that specializes in investments in industrial growth and healthcare companies, announced today that it has completed fundraising for two new funds, totaling $5.4 billion in capital commitments. Arsenal Capital Partners VI LP (together with its parallel funds, “Fund VI”) closed with $4.3 billion in capital commitments, well exceeding its $3.0 billion target of limited partner commitments and well above the size of its $2.4 billion predecessor fund. In addition, Arsenal Capital Partners Growth LP (together with its parallel funds, the “Growth Fund”) closed with $1.1 billion in capital commitments at its hard cap and exceeded its $750 million target of limited partner commitments.

“We are extremely grateful for the support from and relationships with our long-time investors,“ said Terry Mullen, Managing Partner of Arsenal. “We achieved a gratifying, high re-up rate from our existing institutional investors, who on average increased their commitments by 59% from the previous fund, and we are delighted to have attracted an exceptional group of new investors that will further bolster our market-leading institution.”

Over its 22-year history, Arsenal has built a leading private equity institution with two market-leading franchises in the industrials and healthcare sectors. Within its two focus sectors, Arsenal aims to create highly valuable, technology- and innovation-rich, growth companies that are strategically important to their markets. Arsenal’s team of more than 85 professionals and 55 senior advisors combines specialized investment, industry, and operating expertise into one integrated and balanced team to provide differentiated strategic insights, combine diverse perspectives, and leverage expert capabilities.

“The success of these fundraises reflects the strength of our market-leading franchises and our track record of building strategically valuable businesses. We and our investors see exciting opportunities to invest in technology- and innovation-rich companies in the industrial and healthcare sectors,” commented Jeff Kovach, Managing Partner of Arsenal. “Moreover, investors have acknowledged the depth of our domain and technical expertise that provides Arsenal the access, relevance, and credibility to compete and win in our target markets.”

Fund VI will focus on investments in industrials and healthcare businesses with proven technologies and solutions positioned to deliver high performance and value-add to their customers. The Growth Fund will execute a similar strategy in the same markets but pursue investments in next generation, emerging technology businesses poised to apply innovation to generate very high growth. In both of these funds, Arsenal will apply its high-impact company building capabilities to help businesses achieve significant organic growth and facilitate strategic acquisitions to extend their offerings and to solidify leadership positions in their respective markets.

Patricia Grad, Partner and Head of Investor Relations of Arsenal, added, “We are grateful for this global group of institutions and individuals who have supported our firm and greatly appreciate the collaborative dialogue that we had with them as we crafted these investment opportunities, particularly our debut Growth Fund. We look forward to deepening and strengthening our partnerships with our investors for years to come.”

Fund VI and the Growth Fund’s investor base is comprised of leading public and corporate pension plans, family offices, endowments and foundations, and financial institutions, including The University of California’s Office of the Chief Investment Officer (UC Investments), California State Teachers’ Retirement System, California Public Employees’ Retirement Systems, affiliates of APG Asset Management, The Oregon Public Employees Retirement Fund, affiliates of IIP A/S, and Minnesota State Investment Board. Kirkland & Ellis LLP served as legal counsel for Arsenal, Fund VI, and the Growth Fund.

About Arsenal Capital Partners Arsenal Capital Partners is a leading private equity firm that specializes in investments in industrial growth and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds totaling over $10 billion, completed more than 250 platform and add-on acquisitions, and achieved more than 30 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value-add. For additional information, please visit www.arsenalcapital.com.

Contact: Jackie Schofield at Prosek Partners Pro-Arsenal@prosek.com

August 15, 2022

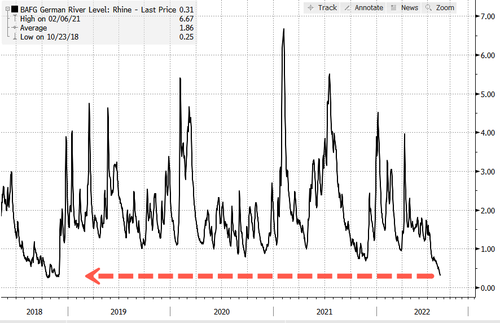

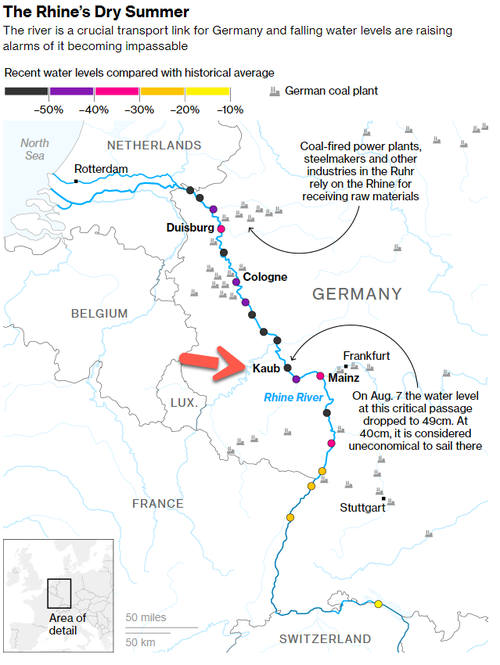

Shocking Footage Reveals Rhine’s Dried Up Riverbeds As Water Levels Continue To Fall

by Tyler DurdenMonday, Aug 15, 2022 – 12:40 PM

Water levels on Germany’s Rhine River continued to decline Monday, hitting a new threshold as an extended period of dry weather exacerbated Europe’s energy-supply crunch. Falling water levels have also revealed shocking photos of partially dried riverbeds that would make the Rhine impassible at certain points, according to Euronews.

“The current water levels on the Middle and Lower Rhine are currently at an exceptionally low level for this time of year,” the Rhine Waterways and Shipping Authority (WSA), said in a statement. “They are the result of the lack of precipitation in recent weeks and months.”

Levels at Kaub, a narrow and shallow point of the river west of Frankfurt, Germany, fell to 30 centimeters (11.8 inches) on Monday and could hold those levels through Thursday.

The Rhine is one of Europe’s most important inland waterways for the transport of fuel and other industrial goods. Many shippers find it uneconomical to operate barges past Kaub when water levels drop below 40 centimeters (15.7 inches).

As of Monday, it wasn’t clear how the drop to 30 centimeters at Kaub would affect river traffic. We noted last week at least one German shipper said barge operations would be halted — and this would impact the flow of industrial goods, especially coal used for power generation.

Last week, we pointed out the top companies exposed to falling water levels that would disrupt barge traffic, implying they would have to resort to trucks or rail to transport goods.

Not all barge traffic has been halted, and some shippers have dramatically reduced cargo sizes on vessels to improve draft to navigate shallow parts of the river — this has caused barge transport prices to skyrocket.

It’s distressing enough to see data on the Rhine’s water levels dropping, but actually seeing footage is reveals just how much impact it’s going to have on transport networks for Germany to move around commodities and goods.

Kaub’s reading is just 6 centimeters (2.4 inches) from 2018’s record low of 25 centimeters (9.9 inches), which then caused the waterway to close and unleashed an economic downturn in the EU’s largest economy. The same is likely to happen and possibly be much worse as a persisting energy crisis amplifies the downturn.

https://www.zerohedge.com/weather/rhine-river-water-levels-sink-further-european-drought-worsens

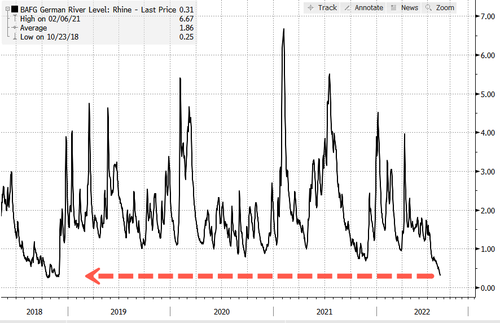

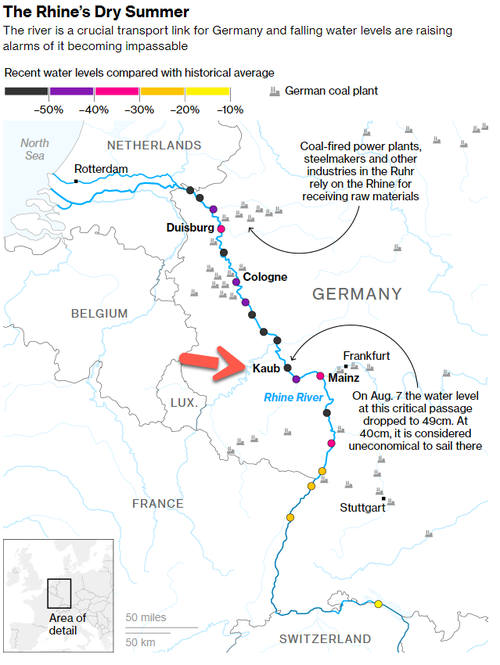

August 15, 2022

Shocking Footage Reveals Rhine’s Dried Up Riverbeds As Water Levels Continue To Fall

by Tyler DurdenMonday, Aug 15, 2022 – 12:40 PM

Water levels on Germany’s Rhine River continued to decline Monday, hitting a new threshold as an extended period of dry weather exacerbated Europe’s energy-supply crunch. Falling water levels have also revealed shocking photos of partially dried riverbeds that would make the Rhine impassible at certain points, according to Euronews.

“The current water levels on the Middle and Lower Rhine are currently at an exceptionally low level for this time of year,” the Rhine Waterways and Shipping Authority (WSA), said in a statement. “They are the result of the lack of precipitation in recent weeks and months.”

Levels at Kaub, a narrow and shallow point of the river west of Frankfurt, Germany, fell to 30 centimeters (11.8 inches) on Monday and could hold those levels through Thursday.

The Rhine is one of Europe’s most important inland waterways for the transport of fuel and other industrial goods. Many shippers find it uneconomical to operate barges past Kaub when water levels drop below 40 centimeters (15.7 inches).

As of Monday, it wasn’t clear how the drop to 30 centimeters at Kaub would affect river traffic. We noted last week at least one German shipper said barge operations would be halted — and this would impact the flow of industrial goods, especially coal used for power generation.

Last week, we pointed out the top companies exposed to falling water levels that would disrupt barge traffic, implying they would have to resort to trucks or rail to transport goods.

Not all barge traffic has been halted, and some shippers have dramatically reduced cargo sizes on vessels to improve draft to navigate shallow parts of the river — this has caused barge transport prices to skyrocket.

It’s distressing enough to see data on the Rhine’s water levels dropping, but actually seeing footage is reveals just how much impact it’s going to have on transport networks for Germany to move around commodities and goods.

Kaub’s reading is just 6 centimeters (2.4 inches) from 2018’s record low of 25 centimeters (9.9 inches), which then caused the waterway to close and unleashed an economic downturn in the EU’s largest economy. The same is likely to happen and possibly be much worse as a persisting energy crisis amplifies the downturn.

https://www.zerohedge.com/weather/rhine-river-water-levels-sink-further-european-drought-worsens