The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

March 22, 2022

Recticel expands its Insulation activities with the acquisition of the insulated panel specialist Trimo

Regulated information, Brussels, 22/03/2022 — 07:00 CET, 22.03.2022

Recticel announces that it has entered into final agreements with Central European private equity fund Innova Capital to acquire 100% of Trimo d.o.o. in cash for an enterprise value of EUR 164.3 million. This represents a 9.5x 2021A normalized EBITDA multiple. The transaction is subject to customary conditions precedent, including regulatory approvals.

Trimo is specialized in the production of sustainable premium insulated panels for the construction industry. Predominantly geared towards the industrial and commercial building segments, it perfectly complements the current insulation boards activities of Recticel.

This acquisition will allow Recticel to:

- expand its insulation product portfolio into the adjacent and growing insulated panel market;

- accelerate its geographic expansion into the Central and South-Eastern European markets;

- increase its profit margin, as of the first full year of consolidation.

Financing is secured by the existing credit facilities, and ultimately by the proceeds from the disposals of the Bedding and Engineered Foams business lines, expected to close respectively at the end of 1Q2022 and around mid-2022.

The closing of the transaction is expected to be completed in the third quarter of 2022.

Olivier Chapelle (CEO) : “The acquisition of Trimo marks another important milestone in Recticel’s strategic portfolio reorientation. Following our announced divestments of the Bedding and Engineered Foams business lines, leading Recticel to become a pure player in insulation, today’s announcement represents an important step in the insulation centered growth path of the company. Moreover, this acquisition enables Recticel to expand in an adjacent Insulation category and to increase its geographic reach. During the process, we have been impressed by the Trimo team, and are looking forward to welcome our new and highly skilled colleagues in Recticel.”

Trimo was founded in 1961 and has been owned by Innova Capital since early 2016. Trimo was originally established as a manufacturer of thermal insulated panels but gradually developed into a high quality-producer of aesthetic prefabricated building components such as façades, walls, roofs and modular space solutions. The group is headquartered in Trebnje, Slovenia and operates from two sites (Trebnje, Slovenia and Šimanovci, Serbia). It sells its insulated panels and building solutions in more than 60 countries around the world. In 2021, Trimo employed about 480 people and generated net sales of EUR 138.4 million.

For more information on Trimo : www.trimo-group.com

March 22, 2022

Recticel expands its Insulation activities with the acquisition of the insulated panel specialist Trimo

Regulated information, Brussels, 22/03/2022 — 07:00 CET, 22.03.2022

Recticel announces that it has entered into final agreements with Central European private equity fund Innova Capital to acquire 100% of Trimo d.o.o. in cash for an enterprise value of EUR 164.3 million. This represents a 9.5x 2021A normalized EBITDA multiple. The transaction is subject to customary conditions precedent, including regulatory approvals.

Trimo is specialized in the production of sustainable premium insulated panels for the construction industry. Predominantly geared towards the industrial and commercial building segments, it perfectly complements the current insulation boards activities of Recticel.

This acquisition will allow Recticel to:

- expand its insulation product portfolio into the adjacent and growing insulated panel market;

- accelerate its geographic expansion into the Central and South-Eastern European markets;

- increase its profit margin, as of the first full year of consolidation.

Financing is secured by the existing credit facilities, and ultimately by the proceeds from the disposals of the Bedding and Engineered Foams business lines, expected to close respectively at the end of 1Q2022 and around mid-2022.

The closing of the transaction is expected to be completed in the third quarter of 2022.

Olivier Chapelle (CEO) : “The acquisition of Trimo marks another important milestone in Recticel’s strategic portfolio reorientation. Following our announced divestments of the Bedding and Engineered Foams business lines, leading Recticel to become a pure player in insulation, today’s announcement represents an important step in the insulation centered growth path of the company. Moreover, this acquisition enables Recticel to expand in an adjacent Insulation category and to increase its geographic reach. During the process, we have been impressed by the Trimo team, and are looking forward to welcome our new and highly skilled colleagues in Recticel.”

Trimo was founded in 1961 and has been owned by Innova Capital since early 2016. Trimo was originally established as a manufacturer of thermal insulated panels but gradually developed into a high quality-producer of aesthetic prefabricated building components such as façades, walls, roofs and modular space solutions. The group is headquartered in Trebnje, Slovenia and operates from two sites (Trebnje, Slovenia and Šimanovci, Serbia). It sells its insulated panels and building solutions in more than 60 countries around the world. In 2021, Trimo employed about 480 people and generated net sales of EUR 138.4 million.

For more information on Trimo : www.trimo-group.com

March 21, 2022

Inventory growth hits all-time high as warehouse prices soar in latest LMI

Zach Strickland, FW Market Expert & Market Analyst Follow on Twitter Saturday, March 19, 2022 3 minutes read Listen to this article 0:00 / 4:28 BeyondWords

Chart of the Week: Logistics Managers’ Index – Inventory Levels, Inventory Costs, SONAR: LMI.INVL, LMI.INVC

The February Logistics Managers’ Index (LMI), which measures directional changes in transportation and warehousing activity, showed inventories growing at the fastest pace since the index was created in 2016 with a monthly value of 80.16. With companies finally making significant headway in restocking, orders may begin to slow, which may allow for supply chains to stabilize.

Companies have been struggling to replenish depleted inventory levels for the past 18 months thanks in large part to unprecedented surges in demand and production disruptions resulting from the pandemic. Inventory-to-sales ratios have been averaging about 12% lower than pre-pandemic levels over the past year with no sign of improvement, according to the Census Bureau.

After about a month of sheltering at home in April 2020, consumers got busy ordering items online and revamping their houses. This activity was completely unexpected as many companies stopped ordering goods due to the uncertainty of what was to happen next. The result was a rapid depletion of existing inventory that pushed truckload tender volumes to record levels.

The Outbound Tender Volume Index (OTVI), which measures total truckload tenders from shippers requesting capacity, increased by 70% from May to September as inventory levels plummeted.

With inventories beginning to recover at a much faster pace in January and February, trucking demand appears to be showing early signs of waning in March with the OTVI falling 7.5% through the first three weeks of March — hitting its lowest non-holiday point since February 2021.

On this week’s Freightonomics episode, Zac Rogers, a main contributor to the LMI from Colorado State University, discussed how many large retailers like Amazon and Walmart are holding inventory upstream in the supply chain as demand has waned slightly from peak levels.

It is no secret that inflation is thought to be the primary culprit of eroding demand as the CPI is up nearly 8% over the past year with gas (up 38%) and food being heavy contributors. Consumer debt for credit cards has also rebounded as savings rates have dropped, indicating consumers may not have the discretionary income for goods that they had in 2021.

Rogers states that some demand-side erosion is probably a good thing as the current level of chaos is unsustainable and unhealthy in the long run. The Fed increased interest rates a quarter point this week because it also knows this is true. The main concern is over the “bullwhip effect” to the economy as prices inflate too rapidly leading to a sudden drop in demand — potentially creating a recession.

There is no sign of a recession at this point as there is still plenty of growth arising from a lagging industrial sector, a white-hot construction environment and consumers still spending well beyond pre-pandemic levels on retail goods. Services have also made a comeback.

Rogers used the analogy that a 65-degree day in June feels a lot cooler than a 65-degree day in February, basically stating any cooling of an overheated environment feels substantial even though it is still overheated.

The logistics environment remains unstable regardless of the inventory build. Warehouse vacancies are at or near all-time lows, according to ProLogis, while imports are still flowing into the country. These goods have to go somewhere and inventory and supply chain managers still have a long way to go before they can relax.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new datasets each week and enhancing the client experience.

To request a SONAR demo, click here.

March 21, 2022

Inventory growth hits all-time high as warehouse prices soar in latest LMI

Zach Strickland, FW Market Expert & Market Analyst Follow on Twitter Saturday, March 19, 2022 3 minutes read Listen to this article 0:00 / 4:28 BeyondWords

Chart of the Week: Logistics Managers’ Index – Inventory Levels, Inventory Costs, SONAR: LMI.INVL, LMI.INVC

The February Logistics Managers’ Index (LMI), which measures directional changes in transportation and warehousing activity, showed inventories growing at the fastest pace since the index was created in 2016 with a monthly value of 80.16. With companies finally making significant headway in restocking, orders may begin to slow, which may allow for supply chains to stabilize.

Companies have been struggling to replenish depleted inventory levels for the past 18 months thanks in large part to unprecedented surges in demand and production disruptions resulting from the pandemic. Inventory-to-sales ratios have been averaging about 12% lower than pre-pandemic levels over the past year with no sign of improvement, according to the Census Bureau.

After about a month of sheltering at home in April 2020, consumers got busy ordering items online and revamping their houses. This activity was completely unexpected as many companies stopped ordering goods due to the uncertainty of what was to happen next. The result was a rapid depletion of existing inventory that pushed truckload tender volumes to record levels.

The Outbound Tender Volume Index (OTVI), which measures total truckload tenders from shippers requesting capacity, increased by 70% from May to September as inventory levels plummeted.

With inventories beginning to recover at a much faster pace in January and February, trucking demand appears to be showing early signs of waning in March with the OTVI falling 7.5% through the first three weeks of March — hitting its lowest non-holiday point since February 2021.

On this week’s Freightonomics episode, Zac Rogers, a main contributor to the LMI from Colorado State University, discussed how many large retailers like Amazon and Walmart are holding inventory upstream in the supply chain as demand has waned slightly from peak levels.

It is no secret that inflation is thought to be the primary culprit of eroding demand as the CPI is up nearly 8% over the past year with gas (up 38%) and food being heavy contributors. Consumer debt for credit cards has also rebounded as savings rates have dropped, indicating consumers may not have the discretionary income for goods that they had in 2021.

Rogers states that some demand-side erosion is probably a good thing as the current level of chaos is unsustainable and unhealthy in the long run. The Fed increased interest rates a quarter point this week because it also knows this is true. The main concern is over the “bullwhip effect” to the economy as prices inflate too rapidly leading to a sudden drop in demand — potentially creating a recession.

There is no sign of a recession at this point as there is still plenty of growth arising from a lagging industrial sector, a white-hot construction environment and consumers still spending well beyond pre-pandemic levels on retail goods. Services have also made a comeback.

Rogers used the analogy that a 65-degree day in June feels a lot cooler than a 65-degree day in February, basically stating any cooling of an overheated environment feels substantial even though it is still overheated.

The logistics environment remains unstable regardless of the inventory build. Warehouse vacancies are at or near all-time lows, according to ProLogis, while imports are still flowing into the country. These goods have to go somewhere and inventory and supply chain managers still have a long way to go before they can relax.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new datasets each week and enhancing the client experience.

To request a SONAR demo, click here.

March 17, 2022

US Housing Starts Surged To 16 Year High In Feb

by Tyler DurdenThursday, Mar 17, 2022 – 08:35 AM

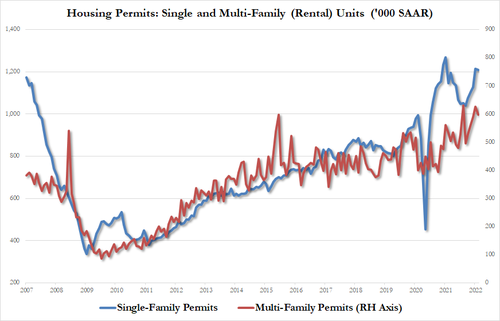

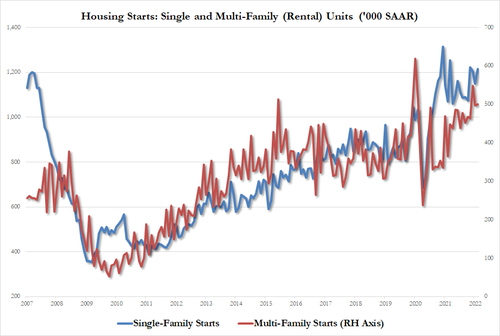

After January’s surprise drop in Housing Starts MoM, analysts expected February to see a rebound and vice verse, following Jan’s rise, February was expected to see Permits drop MoM, and that is what we saw with Starts surging 6.8% MoM (better than the +3.8% exp) and Permits dropped 1.9% MoM (better than the -2.4% expected).

Source: Bloomberg

Single-family permits were down -0.5% but multi-family permits tumbled 4.5% MoM…

The surge in Starts was driven by a 5.7% MoM spike in Single-family (from 1.150MM to 1.215MM). Multi-family starts rose 0.8% from 497K to 501K

This pushed Housing Starts to their highest SAAR since June 2006 as Permits pulls back from similar highs…

Source: Bloomberg

This surge in starts comes as homebuilder sentiment for sales six-months ahead tumbles and mortgage rates soar.

https://www.zerohedge.com/personal-finance/us-housing-starts-surged-16-year-high-feb