The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

October 20, 2021

Ships await to enter the ports of Los Angeles and Long Beach on Oct. 14, 2021. (John Fredricks/The Epoch Times) Economy

Record Number of Container Ships Waiting Off Ports of Long Beach, Los Angeles: Executive

By Jack Phillips October 19, 2021 Updated: October 19, 2021 biggersmallerPrint

The United States’ largest container port now has a record backlog of ships and containers, according to Gene Seroka, the executive director of the Port of Los Angeles.

“We have about two weeks’ worth of work sitting at anchor right now,” Seroka told CNN, adding that port workers are currently trying to prioritize the cargo that needs to move from the port as soon as possible.

Some 200,000 shipping containers remain on ships off the coast, he added.

“There’s product that needs to get out there in super-fast speed,” he said. “Think about the toys, the other Christmas product, and parts and components for factories.”

His comment comes just days after President Joe Biden announced that the Ports of Los Angeles and Long Beach have committed to 24/7 shifts to alleviate supply chain bottlenecks ahead of the Christmas shopping season. The White House also said it secured agreements with UPS, Walmart, and FedEx to increase the number of shifts.

“We had 25 percent of all cargo on our dock sitting here for 13 days or longer [and] that’s been cut in just about half over the last week,” Seroka said.

Phillip Sanfield, director of media relations for the port, noted that although the Port of Los Angeles now operates on a 24/7 schedule, its terminals remain closed between 3 a.m. and 8 a.m. The terminals are privately owned and operated.

“Currently there seems to be no cargo owners who are looking to use the 3 am. to 8 a.m. window,” he told CNN. “Terminals don’t want to be open if there is no interest in using the gates. We’re not yet seeing demand by cargo owners to come get their cargo during the overnight hours.”

“The Port of LA is ready now. We have plenty of longshore workers. The issue is truckers and more importantly, cargo to be picked up,” he added. “We’re working with importers, terminals, etc. to get a demand for that window. There’s no one single lever to pull.”

Meanwhile, Danielle Inman, a spokesperson for the National Retail Foundation, told Politifact that Assembly Bill 5—which critics have said triggered a wave of owner-operator truckers and trucking fleets to stop doing business in California—may be part of the issue why there’s a shipping backlog at the ports. However, she stressed it’s not the only reason.

“The overwhelming increase in volume, lack of available equipment such as chassis, empty container return policies, lack of available warehouse space are all contributing to the ongoing congestion issues at the ports,” Inman told the website.

October 19, 2021

China Jawbones Coal Markets With Meaningless “Market Intervention” Headlines As It Becomes Desperate

by Tyler DurdenTuesday, Oct 19, 2021 – 05:45 PM

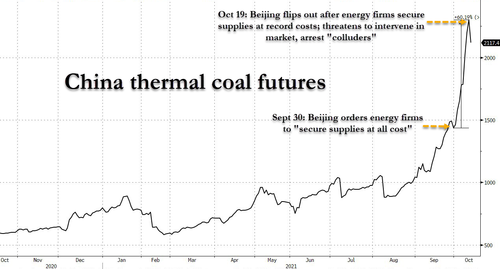

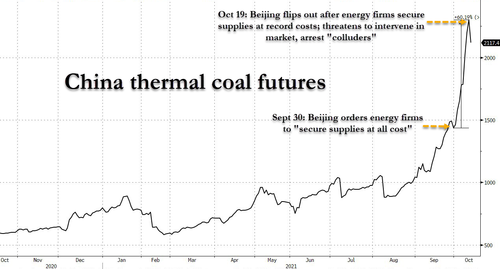

What’s wrong with communism? The latest example comes from China, where central planners told state-owned energy companies to panic buy coal which sent prices to the moon. Now the communist government is battling market forces with meaningless headlines to jawbone prices lower.

Just as thermal coal futures on the Zhengzhou Commodity Exchange catapulted to new heights, the National Development and Reform Commission (NDRC), China’s top economic planner, announced in the Tuesday overnight Asian session that it has a plan to intervene in coal markets to halt the rally, according to Bloomberg.

The headlines were empty and meaningless. It may suggest that Beijing is running out of options to stymie the price rally ahead of the Northern Hemisphere winter, where national stockpiles of fossil fuels are at extremely low seasonal levels. NDRC said it would examine various measures to intervene in markets. It said it had a “zero tolerance” for market participants spreading fake news or conspiring with others to push prices higher.

Here’s NDRC’s most desperate headline:

“The current price increase has completely deviated from the fundamentals of supply and demand,” NDRC said in a statement published on WeChat.

Seriously? The reason prices are sky-high is because of supply and demand dynamics. The agency went on to say it “will study-specific measures to intervene in coal prices and promote the return of coal prices to a reasonable range,” adding that it would increase coal output to 12 million per day and give coal transportation through ports and railroads the highest priority.

Beijing even sent Vice Premier Han Zheng on China National Radio Tuesday to praise the “powerful measures to curb speculation and hoarding in energy markets.” Still, we have no idea how the communist government plans to intervene in markets – just jawboning markets at this point.

What caused the latest leg up in coal prices was when Beijing’s state-asset regulator last month ordered state-owned energy companies to acquire coal supplies at all costs. This forced coal prices higher and resulted in more power blackouts across the country.

China derives 50% of its power from coal. If prices continue to rise, local authorities will have to continue shutting down energy-intensive industries to protect the grid. In return, this will weigh on not just the domestic economy but also the global economy.

Central planners have already told state-owned mines in Yulin, a major coal hub in Shaanxi province, to reduce coal prices by 100 yuan per ton less than spot.

An analyst with Daiwa Capital Markets told clients in a note that favorable supply and demand dynamics suggest elevated coal prices will remain through winter. More or less, whatever Beijing has up its sleeves, could be uneventful in reigning in coal prices back to normal levels.

China has also taken additional steps to alleviate the energy crunch by allowing coal-fired power prices to fluctuate by up to 20%, enabling power plants to pass on more of the high costs of generation to commercial and industrial end-users.

The bottom line is that Beijing is throwing the proverbial “kitchen sink” to reign in coal prices with meaningless statements that may fail to arrest prices in the months ahead as supply and demand dynamics show central planning is the wrong way to manage an economy.

https://www.zerohedge.com/commodities/coal-prices-drop-beijing-studies-market-interventions

October 19, 2021

China Jawbones Coal Markets With Meaningless “Market Intervention” Headlines As It Becomes Desperate

by Tyler DurdenTuesday, Oct 19, 2021 – 05:45 PM

What’s wrong with communism? The latest example comes from China, where central planners told state-owned energy companies to panic buy coal which sent prices to the moon. Now the communist government is battling market forces with meaningless headlines to jawbone prices lower.

Just as thermal coal futures on the Zhengzhou Commodity Exchange catapulted to new heights, the National Development and Reform Commission (NDRC), China’s top economic planner, announced in the Tuesday overnight Asian session that it has a plan to intervene in coal markets to halt the rally, according to Bloomberg.

The headlines were empty and meaningless. It may suggest that Beijing is running out of options to stymie the price rally ahead of the Northern Hemisphere winter, where national stockpiles of fossil fuels are at extremely low seasonal levels. NDRC said it would examine various measures to intervene in markets. It said it had a “zero tolerance” for market participants spreading fake news or conspiring with others to push prices higher.

Here’s NDRC’s most desperate headline:

“The current price increase has completely deviated from the fundamentals of supply and demand,” NDRC said in a statement published on WeChat.

Seriously? The reason prices are sky-high is because of supply and demand dynamics. The agency went on to say it “will study-specific measures to intervene in coal prices and promote the return of coal prices to a reasonable range,” adding that it would increase coal output to 12 million per day and give coal transportation through ports and railroads the highest priority.

Beijing even sent Vice Premier Han Zheng on China National Radio Tuesday to praise the “powerful measures to curb speculation and hoarding in energy markets.” Still, we have no idea how the communist government plans to intervene in markets – just jawboning markets at this point.

What caused the latest leg up in coal prices was when Beijing’s state-asset regulator last month ordered state-owned energy companies to acquire coal supplies at all costs. This forced coal prices higher and resulted in more power blackouts across the country.

China derives 50% of its power from coal. If prices continue to rise, local authorities will have to continue shutting down energy-intensive industries to protect the grid. In return, this will weigh on not just the domestic economy but also the global economy.

Central planners have already told state-owned mines in Yulin, a major coal hub in Shaanxi province, to reduce coal prices by 100 yuan per ton less than spot.

An analyst with Daiwa Capital Markets told clients in a note that favorable supply and demand dynamics suggest elevated coal prices will remain through winter. More or less, whatever Beijing has up its sleeves, could be uneventful in reigning in coal prices back to normal levels.

China has also taken additional steps to alleviate the energy crunch by allowing coal-fired power prices to fluctuate by up to 20%, enabling power plants to pass on more of the high costs of generation to commercial and industrial end-users.

The bottom line is that Beijing is throwing the proverbial “kitchen sink” to reign in coal prices with meaningless statements that may fail to arrest prices in the months ahead as supply and demand dynamics show central planning is the wrong way to manage an economy.

https://www.zerohedge.com/commodities/coal-prices-drop-beijing-studies-market-interventions

October 19, 2021

Houston, October 18, 2021

Dear Valued Customer,

The industry is experiencing an increasing number of social engineering activities, scams and other cyber-

crime activities. We care about our customers and want to reinforce practices that can support you in preventing damage caused by these activities.

Below we reinforce a few principles that will help you to protect your company and its assets.

• Our customers pay their invoices on the bank account mentioned on the invoice; we suppose that you

have in place electronic system alerts in case the account number on the invoice does not match the LYB

account number active in your systems.

• Any LyondellBasell request to change the remit-to bank account where you pay your invoices,comes only

in writing from us by email from your LyondellBasell key account manager or contact mentioned in

the Notice section of the relevant Contract.

• In case of doubt, prior to making any payment, and in case you receive written instructions to pay the

invoice on another bank account then mentioned on the invoice you are always supposed to do a double

verification by

• i) get this change confirmed by email from the person and by the email account mentioned

in the Notice section of the Contract / Regular (sales) contact and

• ii) have this change confirmed by phone by your regular Sales contact.

• Only email addresses with the @lyb.com and @lyondellbasell.com annotation originate from our

company. In the event you do not recognize the name of the sender or it is misspelled, please do not open

the email or any of the attachments and contact your IT department immediately.

• Please reach out immediately, to your LyondellBasell Sales contact, in case of any suspicious email

communication or other activity from which it appears that it originates from LyondellBasell.

We will never ask for your personal information, or password.

Please always remain vigilant, and do not hesitate to reach out to your Sales contact regarding

any questions you might have. Together, we can reduce the potential for loss for our companies as it

relates to web-criminality.

Kind regards,

October 19, 2021

Houston, October 18, 2021

Dear Valued Customer,

The industry is experiencing an increasing number of social engineering activities, scams and other cyber-

crime activities. We care about our customers and want to reinforce practices that can support you in preventing damage caused by these activities.

Below we reinforce a few principles that will help you to protect your company and its assets.

• Our customers pay their invoices on the bank account mentioned on the invoice; we suppose that you

have in place electronic system alerts in case the account number on the invoice does not match the LYB

account number active in your systems.

• Any LyondellBasell request to change the remit-to bank account where you pay your invoices,comes only

in writing from us by email from your LyondellBasell key account manager or contact mentioned in

the Notice section of the relevant Contract.

• In case of doubt, prior to making any payment, and in case you receive written instructions to pay the

invoice on another bank account then mentioned on the invoice you are always supposed to do a double

verification by

• i) get this change confirmed by email from the person and by the email account mentioned

in the Notice section of the Contract / Regular (sales) contact and

• ii) have this change confirmed by phone by your regular Sales contact.

• Only email addresses with the @lyb.com and @lyondellbasell.com annotation originate from our

company. In the event you do not recognize the name of the sender or it is misspelled, please do not open

the email or any of the attachments and contact your IT department immediately.

• Please reach out immediately, to your LyondellBasell Sales contact, in case of any suspicious email

communication or other activity from which it appears that it originates from LyondellBasell.

We will never ask for your personal information, or password.

Please always remain vigilant, and do not hesitate to reach out to your Sales contact regarding

any questions you might have. Together, we can reduce the potential for loss for our companies as it

relates to web-criminality.

Kind regards,