The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 9, 2023

The rise and fall of a $500M company: A look at Klaussner’s shutdown

Sheila Long O’Mara//Executive Editor, Furniture Today//August 9, 2023

ASHEBORO – The news that 60-year-old Klaussner Home Furnishings is out of business shook the industry this week, leaving retailers scrambling for new resources and wondering how a company that had sales in excess of $500 million at one time could falter.

Founded in 1963 by Stuart Love as Stuart Furniture, the company announced its closing with an open letter on its website saying its lender was no longer willing to fund operations.

During its earlier days, the company grew into an upholstery powerhouse with its focus on quick-delivery sofa programs that are now a mainstay in the category. Love’s practice was to ship finished product to retailers a week after the order was placed, helping retailers cut down on their inventory loads. Under Love’s ownership, the company’s sales grew to $90 million. Furniture Today estimated Klaussner’s 2020 sales at $270 million, a 10% decline from estimated sales of $300 million in 2019. In 2009, Klaussner’s estimated sales were $500 million.

Former executive J.B. Davis joined the company in 1970, retiring 40 years later in 2010 as president and CEO. In 1979, Love sold Stuart Furniture to German furniture executive Hans Klaussner, and in 1986, the company’s name was changed to Klaussner Furniture.

In 2001, Klaussner expanded its product offering beyond upholstery to include case goods with the rollout of the Dick Idol collection, a licensed offering with the wildlife artist and sculptor.

Under Davis’ leadership, Klaussner Furniture grew quickly through acquisitions of companies such as upholstery producer Stylecraft and case goods resource JDI and by capturing considerable floor space at many of the biggest furniture retailers in the business.

The company also launched a high-end upholstery line called Comfort Design in 2009 and unveiled its Enso Bedding brand a year later.

Industry executive Bill Wittenberg succeeded Davis as president and CEO in 2010, and the following year, he led a management buyout of the company with Dave Bryant, chief financial officer at the time, from Hans Klaussner.

The new ownership also moved the company away from its Asheboro-based showroom where the company had traditionally shown new products during High Point Market, to its new 90,000-square-foot showroom located in the heart of the market district at 101 N. Hamilton St.

The company once again entered into a new category with its introduction in 2014 of outdoor furniture and later exited the category at the height of the COVID-19 pandemic in 2021.

Klaussner moved into the country music scene in 2015 when it signed a licensing agreement with Trisha Yearwood to design a whole home collection. Since that initial partnership, the company has introduced nine collections with Yearwood.

In 2017, private investment firm Monomoy Capital Partners acquired Klaussner. At the time of the announcement, the private equity group said the current management team would remain in place and maintain minority equity stake in the business.

At the time the company employed more than 1,800. As of yesterday, the company’s total employment was 884.

Two years after the Monomoy investment, Wittenberg transitioned to a strategic advisory role on the company’s board of directors, and Terry McNew took the reins as CEO.

McNew left the position last July, and Monomoy tapped David Cybulski for the job in August after serving first as the company’s chief financial officer and later in the interim CEO position.

August 8, 2023

Tempur Sealy International, Inc. (TPX) Q2 2023 Earnings Call Transcript

Aug. 03, 2023 2:47 PM ETTempur Sealy International, Inc. (TPX)

139.53K Followers

Q2: 2023-08-03 Earnings Summary

EPS of $0.58 beats by $0.02 | Revenue of $1.27B (4.85% Y/Y) beats by $29.20M

Tempur Sealy International, Inc. (NYSE:TPX) Q2 2023 Earnings Conference Call August 3, 2023 8:00 AM ET

Company Participants

Aubrey Moore – VP, IR

Scott Thompson – Chairman, CEO & President

Bhaskar Rao – EVP & CFO

Scott Thompson

Thank you, Aubrey. Good morning, everyone, and thank you for joining us on our 2023 Second Quarter Earnings Call.

I’ll start by sharing some highlights from our second quarter performance and then Bhaskar will review our worldwide financial performance in more detail. After that, I’ll share some closing comments before we open the call up for Q&A.

Today, we are pleased to report one of the strongest second quarters in the company’s history, second only to the same period in 2021. Importantly, these results were delivered against headwinds from a less-favorable market than we expected, the impact of which was partially mitigated by company-specific performance.

Sales growth for the quarter was 5%. Adjusted EPS for the quarter was consistent with prior years after absorbing higher interest costs, major launch costs and elevated taxes. GAAP EPS grew 2%. We believe these results are a reflection of our innovative products, strong sales culture, solid expense controls and our passion for execution.

In our largest market, the U.S., we believe industry units declined at least low double digits in the quarter, resulting in historically low aggregate industry volumes for the quarter and first half of the year. Overall, we believe the U.S. market has stabilized at trough unit levels, with the upper end of the market demonstrating a bit more resilience compared to the entry-level market.

Today’s results demonstrate the robust earnings power and cash flow attributes of the business, as we realized solid earnings and cash flow against this challenging backdrop. As we look to the back half of the year, we anticipate U.S.-produced mattress units trends will slowly improve but remain negative year-over-year. Bhaskar will have more information on the 2023 guidance in a minute.

Turning to a few highlights for the quarter. First, we continued to extend our lead as the largest global bedding company in the world. All 3 of our leading U.S. brands, Tempur, Sealy and Stearns & Foster performed well in the quarter, significantly ahead of where we believe the industry trended. We were pleased with the second quarter performance of our International business. The successful Tempur International launch combined with Dreams’ crisp retail execution are driving continued outperformance worldwide and positioning us well for the future.

Second, we opened our third domestic foaming pouring plant in Crawfordsville, Indiana, expanding our manufacturing capacity to meet expected demand for years to come. We designed the state-of-the-art facility to optimize our manufacturing capabilities across bedding products and components. In addition to pouring Tempur-Pedic material, we have the flexibility to leverage the plant’s foaming pouring capacity to manufacture bedding products and components for our Sealy and Stearns & Foster brands as well as our non-branded OEM operations.

The facility enhances our ability to service our customers in the Northeast market, creating opportunities to shorten lead times and reduce per-unit logistics costs. This plant also provides additional storage for chemicals, mitigating the risks of future supply or pricing disruption.

With the opening of this facility, we’ve completed our 3-year strategic CapEx program and expect to see CapEx investments moderate significantly going forward. In the second half of this year, we expect CapEx to be down by 50% versus the same period last year, certainly beneficial to free cash flow.

Third highlight. We completed the rollout of our new TEMPUR-Breeze products and our new smart base in the U.S. Next-generation TEMPUR-Breeze mattress builds on the success of our proven legacy Breeze products to deliver next-level sleep solutions with enhanced Tempur-Pedic feel characteristics. Featuring new technologies designed by our Tempur-Pedic scientists, the new lineup presents the next generation of consumer-centric solutions focused on helping to alleviate aches and pains.

We also continue to raise the bar in cooling performance with our new LuxeBreeze model, dealing 10 degrees cooler all night long, presenting the best-in-class solution for the more than 60% of the households that have at least one person who sleeps hot. Retailers’ and consumers’ response to these incremental technologies have been overwhelmingly positive, and we and retailers are seeing positive mix and higher average ASP.

In tandem with the Breeze mattress refresh, we also introduced an updated adjustable base lineup, which is driving all-time-high retailer advocacy and attachment rates, reaching new records in May and June. Our new smart base features, our new Sleeptracker 2.0 technology, the accuracy of which was validated by a Stanford medical study; and offers industry-leading automatic snore detection and response, addressing a leading sleep concern among consumers. This new lineup also features incremental multisensory relaxation features to help consumers wind down and prepare their bodies and minds for deep, rejuvenating sleep.

Over the Memorial holiday, we supported these Tempur lineups with all-new breeze and smart-based multimedia advertising campaigns. These efforts drove incremental search interest in Tempur year-over-year and drove solid e-commerce traffic trends over the Memorial Day selling period. All of our new Tempur products and supporting advertising initiatives are strengthening Tempur’s appeal to the premium wellness-minded consumer and driving improvements in attach rates and ASP for our third-party retailers.

Fourth highlight. Our investments in Stearns & Foster products, distribution and marketing continue to drive meaningful sales growth and expand brand recognition. In the second quarter, Stearns delivered its third sequential quarter of year-over-year sales growth, significantly outperforming broader market trends. This was possible, thanks to the recent investments in brand and the rollout of our all-new Stearns & Foster collection with superior innovation and elevated design and enhanced step-up opportunities.

The new product lineup is delivering strong results. We have grown Stearns’ third-party retail distribution by more than 20% compared to the previous collection with gains in both legacy and incremental Stearns’ retailers. We’re seeing this product resonate with historically underserved premium innerspring consumer, resulting in strong mix and again driving ASP expansion.

Our channel diversification strategy is also driving strong brand momentum. The Stearns & Foster e-commerce site we launched last year continues to drive brand recognition and highly profitable incremental sales.

Finally, our launch of our all-new international Tempur products continue to track with our expectations. We are launching the new international lineup in over 90 markets worldwide. In the first half of the year, we kicked off our Tempur European and Asian markets. We expect to be fully floored in our last market in the U.K. in the first half of 2024.

The U.K. has some country-specific fire retardant regulations, which adds some complexity to the product launch. The consumer-centric innovation and new collection will appeal to our legacy ultra-premium consumers at prices of 3,000 and above but also broadening our price points to expand our addressable market to meet the needs of consumers shopping for mattresses between 2,000 and 3,000.

We are streamlining the manufacturing process with this lineup to unlock this incremental price point without materially altering the margin profile of our Tempur International business. As we continue to stagger the rollout by individual markets, we are currently manufacturing both with new line and the old line of products in our international Tempur plant. We plan to optimize production of the new line after the transition period, providing a tailwind to gross margins in 2024.

Scott Thompson

Thanks, Bhaskar. Great job. Before opening the call up for questions, I want to provide a couple of updates. First, I want to address the cybersecurity event affecting certain parts of our IT system, which was disclosed Monday in our 8-K. Following the discovery of the event, our team activated its CEO-approved incident response and business continuity plan.

The plan was approved years ago and is designed to contain incidences. The plan included proactively shutting down certain IT systems, resulting in the planned temporary interruption of our operations. We began bringing our systems back online last Friday and expect it to take time to return to normal operations.

Our investigation remains ongoing and we continue to work to determine the impact of the disruption. If we determine that any personal information was involved, we would, of course, comply with any reporting obligations we have under the applicable law. Currently we’re working hard to catch up with the lost production from the shutdown. In total, our systems were down for a week, and we are currently working to get back to full production. We expect cyber-related expenses net will be adjusted from our third quarter financial results.

Lastly, I’d like to provide a brief update on our pending acquisition of Mattress Firm. We’re currently responding to the Federal Trade Commission’s second request and continue to expect to close the transaction in mid- to late 2024. Over this interim period, Mattress Firm’s leadership team provides us with a high-level update of their financial performance. Mattress Firm’s recently — quarterly results, which they reported yesterday, were consistent with our expectations. And we look forward to bringing the Mattress Firm team onboard.

Robert Griffin

Our first one is to just maybe follow up on the guidance reduction and just maybe get a little more clarity on some of the moving parts assumed in there. So is the reduction in earnings and sales all just a function of the industry maybe being a little bit softer than we originally anticipated and we laid out? Or are you baking in some conservatism that this IT event or the cyber event will have some type of impact on earnings and revenue in the second half?

Scott Thompson

Yes, let me — it’s kind of a — let me answer it because it’s a little bit of a long answer, but let me be clear about it. First of all, from the cyber event, great job by the IT, internal IT department. They did a great job. In fact, it was an enterprise-wide effort. And congratulations to all the people internally. We also had a lot of help from external IT teams that we had on retainer for these kind of events and a great job by Microsoft’s elite team.

Let me go — kind of go through the estimates of what we know today. Obviously, this is not an easy estimate, but let me tell you what we know based on all the information that we have right now. First of all, the event itself is certainly not material to the intrinsic value of the enterprise. The event is not material to our 2023 expected sales or EBITDA.

Before insurance — and we have an insurance limit of $5 million, but before any insurance, our best estimate is about $10 million to $20 million negative impact in EBITDA in the third quarter. We expect the vast majority will qualify as an add-back adjustment in the third quarter. In the estimate that I gave you on the impact of EBITDA, it really breaks out into kind of 2 pieces, 1 which is clearly incremental costs related to the activity and should be cleared by — covered by insurance at some point, but of course, we’ll account for that as we receive it. And then 50% of it is from potential lost sales.

When you look at the potential lost sales for the third quarter, you’re talking about $20 million to $30 million. That’s about maybe 2%-ish, give or take, of the quarter sales; and again that’s potential. And the vast majority of that would be Sealy U.S., okay, because we have plenty of inventory in the Tempur organization. We’ve not experienced any material changes in our balance of share. And retailers, quite frankly, have been very understanding in the situation.

Now lastly, more kind of directly to your guidance question. For the 2023 guidance, the event has been considered, but as we mentioned before, we would expect an add-back in the third quarter for the costs. And certainly we’ll account for the — like I said, the insurance. Whenever we ever file a claim, we’ll call that out.

Any other impact on changing the guidance, totally macro. When you look at the second quarter and — okay, well, let’s say we kind of scraped out the second quarter. The market wasn’t as strong as we expected it to be, but we also performed better and outperformed the industry by a greater extent than we expected. And when you net the two, we had it relatively solid, in fact very solid, relative to others in the industry in the second quarter. And looking forward, we brought back — we brought down our expectations for the industry; and that required us to fine-tune 3%-ish from a guidance standpoint.

Susan Maklari

Yes. I think staying on the theme of demand, Scott. As you think about the macro setup with rates possibly at or very close to the peak, housing getting a little better, it feels like maybe the consumer will start reengaging and spending in some of these other categories as travel starts to moderate a bit in there. How are you thinking about the industry’s ability to start to see some level of improved demand as we move through the next couple of quarters; and your ability to continue to outperform relative to that as some of your peers perhaps move up off of these industry declines of the 25%, 30% range?

Scott Thompson

Thank you for the 33 questions you asked me, Susan. Let me speak to it and see if I can answer like 30 and leave 3 unattended. First of all, yes, we’re very happy with the performance in the quarter. We think it gives us an opportunity to show the strength of the business even in a little bit of a down cycle in its cash flow generation. I would highlight in our numbers, because this goes to the consumer question you asked. If you look at our ASP, it was up 13% in the quarter. And all but about — let’s call it 2% of that is price.

The vast majority of that is people mixing up. And so what that would tell you is the top end of the consumers are doing very well and where you’re seeing sales pressure is at the lower end. If I do it by brand standpoint, our high-end brands did better than our low-end brands. i.e., Stearns & Foster did better than Sealy. And Stearns & Foster grew double digits in a market that — I don’t know, pick your number, but it was clearly down double digits. It grew double digits.

So I’m going to say the strength of the high-end customer everywhere we looked, looked very good. We look at individual mattresses within the Tempur lineup. The high-end Tempur products did much better than the low-end Tempur products. So we’re — we continue to be fairly bullish on a high-end customer. Where you feel the pressure is in the low end, and the low end is — has gotten hit very hard.

So you had a question in there about outlook, as far as consumers going forward. We’ve been bouncing around the bottom in the bedding industry for probably 3 quarters, and so I don’t know. Next quarter or 2, we certainly think that the industry should start doing better. Some people can point to green shoots. Yes, we see some, but you have some good weeks and you have some slower weeks. But the main thing from our perspective is we see our products incrementally performing very well in the marketplace against the competition. And part of her question, I missed, Bhaskar, that you can remember?

Keith Hughes

Yes. You had talked earlier about raw material costs, I guess, coming down [indiscernible]. Can you give me a kind of quantification how much they’re down either in the quarter or your estimates for the second half of the year?

Bhaskar Rao

Sure. So let me think about it this way. Is that we did have an expectation from a commodity standpoint as we entered the year. Largely speaking is that those commodities are coming in very much in line with those — with our expectations. We would expect to continue to see incremental commodity benefit as we get into the back half; however, all contemplated in our initial thoughts as it relates to what we thought commodities were going to do. As it relates to the commodity benefit that we saw in our GP rate, is we’ll have a little bit more information in our queue. It’s going to drop here in a little bit, but I’ll go ahead and give you a peek on it. It’s from a commodity standpoint is what we’d want to expect to see is about 150 basis points of improvement.

August 8, 2023

Klaussner Home Furnishings closes

August 7, 2023 | 5:17 pm CDT

Photo By Klaussner Furniture website

ASHEBORO, N.C. – Klaussner Home Furnishings is shuttering its operations effective immediately.

The residential furniture company manufactured more than 70 percent of its products domestically through its five manufacturing campuses in North Carolina, including at its Asheboro headquarters. Klaussner was ranked #36 on the FDMC 300, a listing of the largest North American wood products producers, with estimated sales of more than $300 million in 2022.

A statement posted on Klaussner’s website reads in part:

“As the result of challenging and unexpected business circumstances impacting our operations, Klaussner Furniture Industries, Inc. and its direct and indirect subsidiaries (“Klaussner” or the “Company”) must unexpectedly wind down the operations.

“Klaussner’s lending source has unexpectedly refused to continue to fund the Company’s operations. This outcome was not reasonably foreseeable, but due to these unexpected circumstances, Klaussner can no longer sustain its operations. As a result, Klaussner has made the difficult decision to permanently cease operations and is providing as much notice as possible.

“Klaussner anticipates closing all of its facilities entirely, and that process is underway as of today, August 7, 2023.

Klaussner is working to provide information and resources to assist with next steps for displaced employees as it becomes available. This information will be communicated directly to employees via the contact information we have on file.”

Founded in 1963, Klaussner Home Furnishings has been a leading provider of residential furniture, including upholstery, motion, sleepers, bedroom, dining occasional and accent furniture. Its licensed lifestyle collections included Trisha Yearwood Home Collection and Stacey Garcia Home. It is also affiliated with Prestige Fabricators Inc., a foam manufacturing company based in Asheboro.

https://www.woodworkingnetwork.com/management/fdmc-300/klaussner-home-furnishings-closes

August 7, 2023

CRE Turmoil Worsens As Office Delinquencies Accelerate

by Tyler Durden

Monday, Aug 07, 2023 – 04:40 PM

Readers have been well informed about the deteriorating state of the commercial real estate sector, with reports from major banks showing a downturn amid high-interest rates and tightened credit, which has pushed up borrowing costs and forced a rise in defaults.

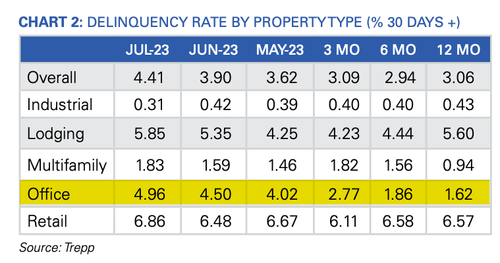

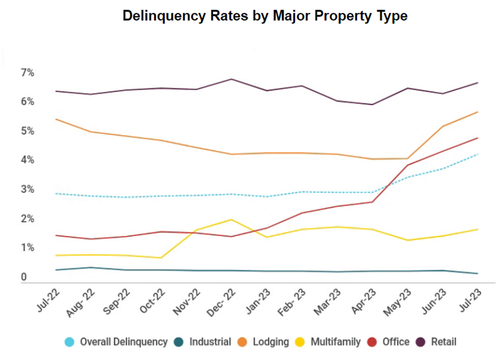

The latest data from Trepp, which tracks commercial mortgage-backed securities (CMBS) securities market data, shows the delinquency rate of commercial property loans packaged up by Wall Street jumped again in July, with four of the five major property segments posting increases.

“While the rest of the US economy has seen relief in terms of higher equity prices, better-than-expected corporate earnings, and falling inflation numbers, the commercial real estate (CRE) market continues to be left behind,” Trepp wrote in the report.

Trepp data found the delinquency rate rose 51 basis points to 4.41% last month — the highest level since December 2021. Office delinquencies increased by 46 basis points to 4.96% — up more than 350 basis points since the end of 2022. The deterioration in the office segment is intensifying at an alarmingly rapid pace.

A broad overview of the US CMBS market shows the delinquency rate increased to 4.41%, a 51bps rise compared to the previous month, but still significantly lower than the 10.34% rate recorded in July 2012. The rate peaked at 10.32% in June 2020 during the government-forced Covid lockdowns.

Here are more highlights from the report:

- Year over year, the overall US CMBS delinquency rate is up 135 basis points.

- Year to date, the rate is up 137 basis points.

- The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or non-performing balloons) is now 3.92%, up 20 basis points for the month.

- If defeased loans were taken out of the equation, the overall headline delinquency rate would be 4.64%, up 51 basis points from June.

- One year ago, the US CMBS delinquency rate was 3.06%.

- Six months ago, the US CMBS delinquency rate was 2.94%.

To better understand what might come next for the CRE market, Kiran Raichura, Capital Economics’ deputy chief property economist, recently warned in a note to clients that the office segment might experience a 35% plunge in values by the second half 2025 and “is unlikely to be recovered even by 2040.”

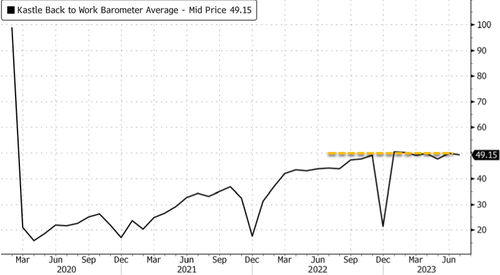

According to swipe data from Kastle Systems, the US office occupancy rate is less than 50%. The figure has plateaued since September, indicating a new reality of remote work.

One major hurdle for CRE space is that “more than 50% of the $2.9 trillion in commercial mortgages will need to be renegotiated in the next 24 months when new lending rates are likely to be up by 350 to 450 basis points,” Lisa Shalett, chief investment officer for Morgan Stanley Wealth Management, wrote in a note to clients.

Shalett expects a “peak-to-trough CRE price decline of as much as 40%, worse than in the Great Financial Crisis.”

Bank of America analysts expect challenges in the CRE space but noted, “They are manageable and do not represent a systemic risk to the US economy.”

Meanwhile, analysts at UBS warned:

“About $1.3 billion of office mortgage loans are currently slated to mature over the next three years.

“It’s possible that some of these loans will need to be restructured, but the scope of the issue pales in comparison to the more than $2 trillion of bank equity capital. Office exposure for banks represents less than 5% of total loans and just 1.9% on average for large banks.”

We’ve already seen major building owners returning their office towers and malls to lenders in California (here & here) and elsewhere (here). This will result in an uptick in CMBS delinquencies moving forward.

… and remember what we wrote during the regional bank crisis earlier this year — the note was titled “Nowhere To Hide In CMBS”: CRE Nuke Goes Off With Small Banks Accounting For 70% Of Commercial Real Estate Loans.

https://www.zerohedge.com/markets/cre-turmoil-worsens-office-delinquencies-accelerate

August 7, 2023

Privacy Storm Brewing As Zoom’s Updated Terms Greenlight AI Model Training With User Data

by Tyler Durden

Monday, Aug 07, 2023 – 12:25 PM

Zoom has added a clause to its Terms-of-Service (TOS) which allows the video conferencing company to use customer-generated content for any purpose they see fit, including to train artificial intelligence (AI) models, with no opt-out.

Zoom’s TOS, last revised on July 26th, conceals a concerning caveat. Nestled within section 10.4, for those brave enough to venture, is language that confers upon Zoom a carte blanche right to exploit what it coins as “Service Generated Data” (SGD). This expansive designation encompasses a cornucopia of user-generated information – from innocuous telemetry data to incisive diagnostic insights – all grist for the AI mill.

Section 10.4 also describes the company’s use of Customer Content (defined as “data, content, files, documents, or other materials”), not just telemetry data and the like, which it can use “for the purpose of product and service development, marketing, analytics, quality assurance, machine learning, artificial intelligence, training, testing, improvement of the Services, Software, or Zoom’s other products, services, and software, or any combination thereof.”

The company makes clear that it will be using data for, among other things, fine-tuning AI models and algorithms. The potential consequences are manifold, raising red flags for privacy pundits and sparking debates over the boundaries of user consent.

Zoom’s data net is cast even wider with a perpetual, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license. This legal carte blanche emboldens Zoom to undertake a multitude of actions that span the entire data lifecycle. From reconstituting, republishing, and accessing user content to the deep recesses of data modification, redistribution, and algorithmic processing, the breadth of Zoom’s dominion over user-generated data now defies conventional comprehension.

Zoom contends that these data maneuvers are vital to service provision, bolstering software quality, and enhancing the broader Zoom ecosystem. The augmentation of AI capabilities, epitomized by Zoom IQ, has been touted as a beacon of collaboration, promising efficient meeting summaries, task automation, and optimized follow-ups, all enabled by the seamless integration of user data.

“With the introduction of these new capabilities in Zoom IQ, an incredible generative AI assistant, teams can further enhance their productivity for everyday tasks, freeing up more time for creative work and expanding collaboration,” said Zoom chief product officer, Smita Hashim. “There is no one-size-fits-all approach to large language models, and with Zoom’s federated approach to AI, we are able to bring powerful capabilities to our customers and users through Zoom’s own models as well as our partners’ models.”

In 2021, Zoom agreed to settle a class-action privacy lawsuit for $86 million, after plaintiffs accused the company of violating the privacy of millions of users by sharing personal data with Facebook, LinkedIn and Google.

The controversial section of the TOS reads (emphasis ours):

Customer License Grant. You agree to grant and hereby grant Zoom a perpetual, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license and all other rights required or necessary to redistribute, publish, import, access, use, store, transmit, review, disclose, preserve, extract, modify, reproduce, share, use, display, copy, distribute, translate, transcribe, create derivative works, and process Customer Content and to perform all acts with respect to the Customer Content: (i) as may be necessary for Zoom to provide the Services to you, including to support the Services; (ii) for the purpose of product and service development, marketing, analytics, quality assurance, machine learning, artificial intelligence, training, testing, improvement of the Services, Software, or Zoom’s other products, services, and software, or any combination thereof; and (iii) for any other purpose relating to any use or other act permitted in accordance with Section 10.3. If you have any Proprietary Rights in or to Service Generated Data or Aggregated Anonymous Data, you hereby grant Zoom a perpetual, irrevocable, worldwide, non-exclusive, royalty-free, sublicensable, and transferable license and all other rights required or necessary to enable Zoom to exercise its rights pertaining to Service Generated Data and Aggregated Anonymous Data, as the case