The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

June 12, 2024

Leggett & Platt to close High Point plant

By Larry Adams

June 11, 2024 | 1:03 pm CDT

As part of a restructuring plan announced in January, Leggett & Platt is closing a High Point, North Carolina, facility, resulting in 158 jobs lost.

The action, reported in Furniture Today, affects the plant at 1629 Blandwood Drive in High Point. Leggett & Platt said the closure will be permanent and that the first people to lose their jobs will occur in July and the remaining staff will be let go by the end of September.

According to the Triad Business Journal, of the 158 positions, 134 are in production and production support, while nine are clerical and administrative, and 15 are in management spots.

In January, Leggett & Platt announced it was implementing a restructuring plan that will see the closure of 15 manufacturing and distribution facilities primarily in its Bedding Products segment and to a lesser extent, in its Furniture, Flooring & Textile Products segment.

The plan calls for the consolidation of manufacturing and distribution and reduce the number of its plants from 50 to 30 to 35 in its bedding products segment, and a small number of production facilities in home furniture and flooring products to “better align capacity with regional demand and drive operating efficiencies.”

In Furniture, Flooring & Textile Products we plan to consolidate a small number of production facilities in Home Furniture and Flooring Products to better align capacity with regional demand and drive operating efficiencies.

The 141-year-old supplier of bedding components and private label finished goods; home and work furniture components; and products for a diverse range of industries.

June 10, 2024

China TDI Market Review & Outlook (May-June 2024)

PUdaily | Updated: June 5, 2024

Market Review – May 2024

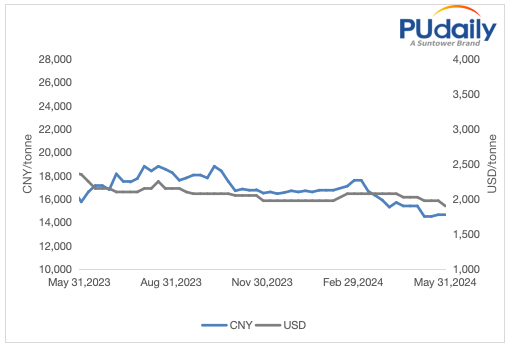

China TDI market remained range-bound in May, showing weakness followed by a slight strengthening. Due to suppliers’ settlement prices for April being close to market trends and mostly lower than market expectations, coupled with weak demand, traders actively offered discounts to stimulate sales. Post the May Day holiday, the market continued its weakness with prices falling rapidly. As TDI prices hit their lowest level dating to 2021 and approached some TDI suppliers’ cost lines, inquiries and purchases increased. Downstream manufacturers sought lower-priced goods. TDI prices stabilized in early May. With subsequent supply controls or trading halt by major suppliers such as Wanhua Chemical and Covestro, low-priced goods reduced and traders slightly raised their offers. However, low prices disappeared after a slight rebound following the bottoming out of the TDI market. Purchasing enthusiasm waned, resulting in narrow market fluctuations. Towards the end of the month, impacted by suppliers’ bullish stance and tightening supply, traders adopted a cautious approach and made small price increases. Despite this, the trading atmosphere was still tepid. Besides, the demand was pent up in the off season. Transactions were sluggish, resulting in a market stalemate.

Market Outlook – June 2024

China TDI market is expected to remain subdued and stable in June. In terms of supply, BASF Shanghai commenced facility maintenance on May 22 for 25 days, resulting in no inventory pressures. Its settlement price for May is also slightly higher than market expectations, providing a mild boost to the market. But other suppliers are running steadily without short-term maintenance plans. Besides, June is the traditional off-season for downstream industries like foam. And there is no significant increase in overseas demand. Consequently, it is expected that the market will remain relatively loose in June, with downstream manufacturers’ acceptance of high prices being low. Barring unforeseen circumstances such as force majeure, a significant price surge is unlikely to occur. Nonetheless, with persistently high production costs for TDI arising from high toluene prices, the current prices for TDI are nearing the cost lines of some suppliers and hitting record highs in recent years. The likelihood of a significant price decline is also low. It is forecasted that Chinese TDI market will remain subdued and stable in June, with prices experiencing narrow fluctuations.

EVERPOL TME-610 is a trimethylolpropane-initiated (TMP) ethoxylated polyether polyol. The resulting material has a functionality of three with a nominal hydroxyl value of 610 mgKOH/g. This specialized triol is polymerized with ethylene oxide. The outcome is a highly reactive pure triol that yields increased hardness and durability in coatings applications. Additionally EVERPOL TME-610 provides significant improvements in cell elasticity and compression sets for higher density flexible foams.

REPLACE PEG | USE 50% LESS | 3-FUNCTIONALITY

Everchem has developed a new polyether polyol in conjunction with one of our long-term production partners that will provide unique advantages to your polyurethane formulation challenges.

EVERPOL TME-610 Market Applications:

- – CASE (coatings, adhesives, sealants, elastomers)

- – High Performance Flexible Foams.

- – High Density Visco Elastic foams

- – Low Density Rigid Systems

| TYPICAL PROPERTIES | VALUE |

| Hydroxyl Value | 610 mg KOH/g |

| Boiling Point | 300 °C |

| pH | 7.0 |

| Appearance | Free and clear |

| Viscosity (cP) | ~ 700 cps @ 25 C |

REACTIVE TRIOL

Get a quote or a sample of our new specialty additive TME-610

June 5, 2024

Polyurethane Foam Association Fall Meeting Addresses Sustainability, Industry Innovation

Manning and Gallagher Win Dr. Herman T. Stone Technical Excellence Award

Dr. Herman Stone Technical Excellence Award Winners: Michael Gallagher of The Mattress Recycling Council and Liz Manning of Econic Technologies were winners of the Dr. Herman Stone Technical Excellence Award for their presentations on New Markets for Recycled Foam and CO2-Based Polyols. The Award is voted on by the audience in PFA’s Technical program. Gallagher and Manning tied in the voting, so two awards were given.

ST. PETERSBURG, FL (May 31, 2024)—

The Polyurethane Foam Association’s

Spring Meeting in St. Petersburg featured a

spectrum of presentations on topics of

interest to the flexible polyurethane foam

industry, many focusing on a common

theme: Sustainability.

PFA’s Industry Issues Session provided updates on isocyanates, end use markets, sustainability programs, and “Made In USA” claims.

In the Technical Program on the following day, presentations covered foam recycling, new polyol technology, equipment for process controls, memory foam evaluations, sustainability certifications and circular economy.

Philippe Knaub of FXI, PFA’s President, recognized new PFA members including Midwest Foam and Dynamic Systems, and noted that the association’s work for its membership is more valuable than ever.

“PFA has earned a reputation as a resource for good science and accurate information about flexible polyurethane foam,” Knaub said. “This credibility is important as we address challenges such as sustainability, reliable testing and proposed regulations that may affect our business. PFA has proven that cooperative efforts by its members can be much more effective than any individual company managing such challenges alone.”

After PFA’s Technical Program, two presenters were named as winners of the Dr. Herman Stone Technical Excellence Award. The award is voted on by the audience at the Technical Program, and the vote resulted in a tie. Liz Manning of Econic Technologies won for her presentation, “Update: CO2-Based Polyols for Polyurethane Applications,” and Michael Gallagher of the Mattress Recycling Council won for his presentation, “Developing New Markets For Recycled Foam.”

The award is named for Dr. Herman T. Stone, who served as PFA’s first Technical Director. In 2007, Dr. Stone was inducted into the Flexible Polyurethane Foam Hall of Fame.

“A number of attendees told me that this year’s technical presentations were exceptionally good,” said Bill Gollnitz of Plastomer Corporation, Past PFA President and moderator of the Technical Program. “It’s very fitting that we were able to provide awards to two presenters.”

To learn more, visit www.pfa.org.

June 5, 2024

CalFibre raising funds to restart rice-straw MDF plant

By Larry Adams

June 4, 2024 | 9:52 am CDT

CalPlant was the manufacturer of Eureka MDF, the world’s first no-added-formaldehyde rice straw-based MDF. In 2023, it liquidated its assets. The original inventor of the material has put together a group that is looking to restart the plant.

Photo By CalFibre

WILLOWS, Calif. — CalFibre, a California-based bio-material company, is seeking $75 million in funding to acquire and reopen a factory to produce 300,000 tons per year of tree-free boards.

The factory, strategically located in Willows, at the heart of the Californian rice growing region, spans 276-acre and at one point was the world’s first commercial-scale producer of annually renewable, rice straw-base MDF.

Last year, in May, CalPlant I Holdco LLC, the original owner of the facility, focused on creating a no-added-formaldehyde, rice straw-based medium-density fiberboard, Eureka MDF, liquidated its assets. In October 2021, CalPlant entered into a plan support agreement with its senior bondholders, while pursuing a sale of the company. To facilitate the sale process, CalPlant voluntarily filed for Chapter 11 protection in the U.S. Bankruptcy Court for the District of Delaware.

It took California rice farmer Jerry Uhland 20 years, 8 months, and 17 days to raise $325 million to achieve his mission to convert rice straw, a residue of rice farming, historically burned after each harvest, into the MDF product, a common construction material conventionally made of wood, and used for a variety of interior purposes like cabinets, doors, floors, and molding.

It took so long to convince funders to support his first-of-its-kind rice straw board plant because the raw material supply, the manufacturing plan, and the markets all had to be perfect. “I had 20-year contracts with fellow farmers and balers for 400,000 tons of rice straw, a full guarantee from the equipment-maker to make my technology work at scale, and a 20-year purchase contract for 100% of the production from the plant,” said Uhland.

Construction was completed on the plant in 2020, and beginning in early 2021, hundreds of truckloads of formaldehyde-free and tree-free 100% rice straw fiber boards started reaching the marketplace. Uhland said, “the buyers loved getting a product with our substantial green credentials, and at the same quality and price as their everyday wood-based boards.”

Hard luck all around

But, the production and distribution of products were fraught with problems. According to Uhland, first it was about a $100 million “laundry list of bad luck.”

There were the major construction costs over-runs from an over-promising and under-delivering contractor. The Federal Aviation Administration demanded the company lower the height and move one of its major installations, a dryer tower. Then came Covid shutdowns, and if that wasn’t enough, a dry lightning storm caused a fire and burned 50,000 tons of stored straw. After construction completed, the final financial blow came when a small but critical part of the guaranteed equipment line didn’t work properly, causing the plant to only reach 40% of the designed manufacturing capacity.

“The creditors carried us through the hard times during the challenges of the construction phase with additional investments, but the expense of a long shutdown to solve that one process issue exceeded what they were willing to invest. They were then forced to choose bankruptcy and asset liquidation,” according to Uhland.

CalFibre to the rescue

Uhland joined forces with several industry allies to form CalFibre LLC. CalFibre is currently seeking investors for a capital raise of $75 million to acquire, repair, restart, and operate the distressed asset. There have been numerous bids on the asset, according to Uhland, but none of the potential buyers have committed to restart the plant using local crop residues as the raw material, and the intention of some is to disassemble the mill and ship out the pieces.

“CalFibre has all the elements for success in hand: 150,000 tons of rice straw at the plant site and 400,000 tons per year of ongoing straw contracts; a guaranteed equipment fix; a full turnaround team from line workers to the CEO; unwavering support of the local community, and buyers lined up for our MDF products,” he said. “Once CalFibre is up and running, we have a ready-made solution for the rest of the world to save trees, to reduce greenhouse gas, to reduce harmful construction chemicals, and to demonstrate the potential of the bio economy and circular economy.”