Asian Markets

October 19, 2021

China Coal

China Jawbones Coal Markets With Meaningless “Market Intervention” Headlines As It Becomes Desperate

by Tyler DurdenTuesday, Oct 19, 2021 – 05:45 PM

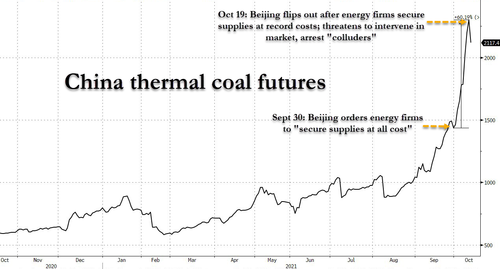

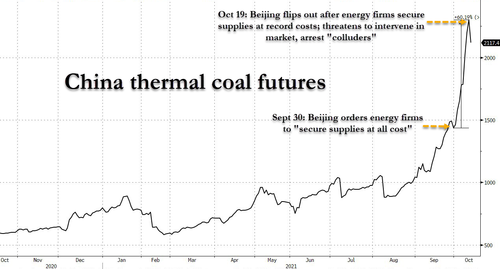

What’s wrong with communism? The latest example comes from China, where central planners told state-owned energy companies to panic buy coal which sent prices to the moon. Now the communist government is battling market forces with meaningless headlines to jawbone prices lower.

Just as thermal coal futures on the Zhengzhou Commodity Exchange catapulted to new heights, the National Development and Reform Commission (NDRC), China’s top economic planner, announced in the Tuesday overnight Asian session that it has a plan to intervene in coal markets to halt the rally, according to Bloomberg.

The headlines were empty and meaningless. It may suggest that Beijing is running out of options to stymie the price rally ahead of the Northern Hemisphere winter, where national stockpiles of fossil fuels are at extremely low seasonal levels. NDRC said it would examine various measures to intervene in markets. It said it had a “zero tolerance” for market participants spreading fake news or conspiring with others to push prices higher.

Here’s NDRC’s most desperate headline:

“The current price increase has completely deviated from the fundamentals of supply and demand,” NDRC said in a statement published on WeChat.

Seriously? The reason prices are sky-high is because of supply and demand dynamics. The agency went on to say it “will study-specific measures to intervene in coal prices and promote the return of coal prices to a reasonable range,” adding that it would increase coal output to 12 million per day and give coal transportation through ports and railroads the highest priority.

Beijing even sent Vice Premier Han Zheng on China National Radio Tuesday to praise the “powerful measures to curb speculation and hoarding in energy markets.” Still, we have no idea how the communist government plans to intervene in markets – just jawboning markets at this point.

What caused the latest leg up in coal prices was when Beijing’s state-asset regulator last month ordered state-owned energy companies to acquire coal supplies at all costs. This forced coal prices higher and resulted in more power blackouts across the country.

China derives 50% of its power from coal. If prices continue to rise, local authorities will have to continue shutting down energy-intensive industries to protect the grid. In return, this will weigh on not just the domestic economy but also the global economy.

Central planners have already told state-owned mines in Yulin, a major coal hub in Shaanxi province, to reduce coal prices by 100 yuan per ton less than spot.

An analyst with Daiwa Capital Markets told clients in a note that favorable supply and demand dynamics suggest elevated coal prices will remain through winter. More or less, whatever Beijing has up its sleeves, could be uneventful in reigning in coal prices back to normal levels.

China has also taken additional steps to alleviate the energy crunch by allowing coal-fired power prices to fluctuate by up to 20%, enabling power plants to pass on more of the high costs of generation to commercial and industrial end-users.

The bottom line is that Beijing is throwing the proverbial “kitchen sink” to reign in coal prices with meaningless statements that may fail to arrest prices in the months ahead as supply and demand dynamics show central planning is the wrong way to manage an economy.

https://www.zerohedge.com/commodities/coal-prices-drop-beijing-studies-market-interventions

October 19, 2021

China Coal

China Jawbones Coal Markets With Meaningless “Market Intervention” Headlines As It Becomes Desperate

by Tyler DurdenTuesday, Oct 19, 2021 – 05:45 PM

What’s wrong with communism? The latest example comes from China, where central planners told state-owned energy companies to panic buy coal which sent prices to the moon. Now the communist government is battling market forces with meaningless headlines to jawbone prices lower.

Just as thermal coal futures on the Zhengzhou Commodity Exchange catapulted to new heights, the National Development and Reform Commission (NDRC), China’s top economic planner, announced in the Tuesday overnight Asian session that it has a plan to intervene in coal markets to halt the rally, according to Bloomberg.

The headlines were empty and meaningless. It may suggest that Beijing is running out of options to stymie the price rally ahead of the Northern Hemisphere winter, where national stockpiles of fossil fuels are at extremely low seasonal levels. NDRC said it would examine various measures to intervene in markets. It said it had a “zero tolerance” for market participants spreading fake news or conspiring with others to push prices higher.

Here’s NDRC’s most desperate headline:

“The current price increase has completely deviated from the fundamentals of supply and demand,” NDRC said in a statement published on WeChat.

Seriously? The reason prices are sky-high is because of supply and demand dynamics. The agency went on to say it “will study-specific measures to intervene in coal prices and promote the return of coal prices to a reasonable range,” adding that it would increase coal output to 12 million per day and give coal transportation through ports and railroads the highest priority.

Beijing even sent Vice Premier Han Zheng on China National Radio Tuesday to praise the “powerful measures to curb speculation and hoarding in energy markets.” Still, we have no idea how the communist government plans to intervene in markets – just jawboning markets at this point.

What caused the latest leg up in coal prices was when Beijing’s state-asset regulator last month ordered state-owned energy companies to acquire coal supplies at all costs. This forced coal prices higher and resulted in more power blackouts across the country.

China derives 50% of its power from coal. If prices continue to rise, local authorities will have to continue shutting down energy-intensive industries to protect the grid. In return, this will weigh on not just the domestic economy but also the global economy.

Central planners have already told state-owned mines in Yulin, a major coal hub in Shaanxi province, to reduce coal prices by 100 yuan per ton less than spot.

An analyst with Daiwa Capital Markets told clients in a note that favorable supply and demand dynamics suggest elevated coal prices will remain through winter. More or less, whatever Beijing has up its sleeves, could be uneventful in reigning in coal prices back to normal levels.

China has also taken additional steps to alleviate the energy crunch by allowing coal-fired power prices to fluctuate by up to 20%, enabling power plants to pass on more of the high costs of generation to commercial and industrial end-users.

The bottom line is that Beijing is throwing the proverbial “kitchen sink” to reign in coal prices with meaningless statements that may fail to arrest prices in the months ahead as supply and demand dynamics show central planning is the wrong way to manage an economy.

https://www.zerohedge.com/commodities/coal-prices-drop-beijing-studies-market-interventions

October 13, 2021

Propylene Naptha Spread in Asia

Asia’s propylene-naphtha spread touches near six-week high on stronger propylene

Propylene-naphtha spread at $332.75/mt

FOB Korea propylene at four-month high of $1,105/mt

Asia’s propylene-naphtha spread touched a near six-week high Oct. 12 as China’s mandated curbs on power consumption lifted domestic propylene prices, while benchmark C+F Japan naphtha saw volatility in crude markers as prices dipped day on day.

The spread between FOB Korea propylene and C+F Japan naphtha cargo rose 44% on the week to $332.75/mt at the Asian close Oct. 12, Platts data showed. The spread was last higher Sept. 2 at $337/mt, S&P Global Platts data showed. This is above the typical breakeven spread of $250/mt.

China’s mandated dual control on power consumption and production boosted domestic propylene prices over the weekend as buyers raised their inventory anticipating a supply shortage.

Firmer crude oil and other propylene-making feedstock aided the spot market.

The East China propylene price rose Yuan 1,100/mt from Oct. 7 to Yuan 9,000/mt ex tank price Oct. 12 , while the Shandong propylene price rose Yuan 1,600/mt to Yuan 9,700/mt ex tank price over the same period.

Chinese industry sources said that the government continued to be strict on its double control policy and there was little leeway for propylene producers to increase their run rates after the National Day holidays, as the country still faced lack of coal and other energy resources, Platts reported earlier.

“Many provinces face power cuts, and many propylene productions units are operating on reduced run rates, but the demand for propylene is still there because downstream polypropylene demand, buoyed by strong PP futures, is gaining traction and now there is a shortage of propylene,” said a China-based trader.

FOB Korea propylene rose $130/mt week on week to $1,105/mt Oct. 12, Platts data showed.

Meanwhile, the olefin producers’ margin for ethylene production was weak, as it narrowed $3.375/mt week on week and $18.625/mt month on month to $387.75/mt at the Asian close Oct. 12. This remained above the breakeven level of $350/mt for non-integrated producers and is likely to support the high cracker run rates, market sources said.

Volatility in crude markers saw benchmark C+F Japan naphtha fall $1.125/mt day on day but rise $28.375/mt week on week to $772.25/mt at the Asian close Oct. 12, Platts data showed. The mixed picture was also reflected as the CFR Japan naphtha physical crack against front-month ICE Brent crude futures narrowed $0.975/mt day on day, but rose $12.025/mt week on week to $142.475/mt at the Asian close Oct. 12, Platts data showed.

Cracker feedstock demand for naphtha was also tepid as prices of LPG eased on the day. This narrowed the propane-naphtha spread $10.375/mt on the day and $54.875/mt on the week to $99.75/mt at the Asian close Oct. 12, Platts data showed. LPG typically becomes economically viable as a steam cracking feedstock when its price is 90% that of naphtha, or lower.

October 13, 2021

Propylene Naptha Spread in Asia

Asia’s propylene-naphtha spread touches near six-week high on stronger propylene

Propylene-naphtha spread at $332.75/mt

FOB Korea propylene at four-month high of $1,105/mt

Asia’s propylene-naphtha spread touched a near six-week high Oct. 12 as China’s mandated curbs on power consumption lifted domestic propylene prices, while benchmark C+F Japan naphtha saw volatility in crude markers as prices dipped day on day.

The spread between FOB Korea propylene and C+F Japan naphtha cargo rose 44% on the week to $332.75/mt at the Asian close Oct. 12, Platts data showed. The spread was last higher Sept. 2 at $337/mt, S&P Global Platts data showed. This is above the typical breakeven spread of $250/mt.

China’s mandated dual control on power consumption and production boosted domestic propylene prices over the weekend as buyers raised their inventory anticipating a supply shortage.

Firmer crude oil and other propylene-making feedstock aided the spot market.

The East China propylene price rose Yuan 1,100/mt from Oct. 7 to Yuan 9,000/mt ex tank price Oct. 12 , while the Shandong propylene price rose Yuan 1,600/mt to Yuan 9,700/mt ex tank price over the same period.

Chinese industry sources said that the government continued to be strict on its double control policy and there was little leeway for propylene producers to increase their run rates after the National Day holidays, as the country still faced lack of coal and other energy resources, Platts reported earlier.

“Many provinces face power cuts, and many propylene productions units are operating on reduced run rates, but the demand for propylene is still there because downstream polypropylene demand, buoyed by strong PP futures, is gaining traction and now there is a shortage of propylene,” said a China-based trader.

FOB Korea propylene rose $130/mt week on week to $1,105/mt Oct. 12, Platts data showed.

Meanwhile, the olefin producers’ margin for ethylene production was weak, as it narrowed $3.375/mt week on week and $18.625/mt month on month to $387.75/mt at the Asian close Oct. 12. This remained above the breakeven level of $350/mt for non-integrated producers and is likely to support the high cracker run rates, market sources said.

Volatility in crude markers saw benchmark C+F Japan naphtha fall $1.125/mt day on day but rise $28.375/mt week on week to $772.25/mt at the Asian close Oct. 12, Platts data showed. The mixed picture was also reflected as the CFR Japan naphtha physical crack against front-month ICE Brent crude futures narrowed $0.975/mt day on day, but rose $12.025/mt week on week to $142.475/mt at the Asian close Oct. 12, Platts data showed.

Cracker feedstock demand for naphtha was also tepid as prices of LPG eased on the day. This narrowed the propane-naphtha spread $10.375/mt on the day and $54.875/mt on the week to $99.75/mt at the Asian close Oct. 12, Platts data showed. LPG typically becomes economically viable as a steam cracking feedstock when its price is 90% that of naphtha, or lower.

October 8, 2021

Energy Price Increases Hit Korea

Soaring LPG prices rapidly deteriorate Korean petrochem makers’ profitability

|

| [Photo by Kim Ho-young] |

| <이미지를 클릭하시면 크게 보실 수 있습니다> |

A sharp surge in liquefied petroleum gas (LPG) prices driven by a surge in oil prices is threatening the profitability of South Korean petrochemical companies that heavily relay on propane to produce plastic materials.

According to industry sources on Tuesday, LPG prices soared nearly 30 percent in seven months from over $500 per ton in March to over $800 in September. The higher crude oil prices have led to a jump in LPG prices given that LPG is produced in the process of refining crude oil. The recent hike, however, is seen as excessive, sources say.

The anticipated higher demand for heating during the upcoming winter season should hike LPG prices further, industry observers concerned.

With the surge in LPG prices, Korean petrochemical companies are rapidly losing profit because they rely on import propane to make and sell plastic products.

Removing hydrogen from LPG-categorized propane creates propylene, which is a feedstock to make plastics. Petrochemical companies usually produced naphtha from crude oil before changing it to propylene but because the abundant supply of U.S. Shale gas had helped significantly lower LPG prices, producing propylene using propane began to generate more profit.

In recent years, major Korean petrochemical players such as Lotte Chemical, LG Chem, and Hanwha Total, expanded facility that produces propylene using propane. With the surge in LPG prices, however, the companies started losing price competitiveness.

Industry sources noted that in general, producing propylene using LPG creates more profit when LPG price per ton falls to below 90 percent of naphtha.

Until last year, LPG prices were kept low, leading many petrochemical companies to rush to ramp up propylene production using LPG instead of naphtha. But tith LPG prices hitting multi-year highs near naphtha prices, local petrochemical players are under mounting pressure to change their feedstock diversification strategies.