Asian Markets

July 27, 2023

China PU Update

China Polyurethane Products Output Dropped 5.5% YoY to 12 Million Tonnes in 2022

PUdaily | Updated: July 25, 2023

In 2022, the global economy experienced a sharp slowdown due to multiple challenges such as the Russia-Ukraine conflict, the European energy crisis, the pandemic, inflation, aggressive interest rate hikes by the Federal Reserve, and significant depreciation of non-US currencies. The rapid decline in the manufacturing sector further incubated the weaker prospects for global economy.

As a new type of high-performance synthetic material, polyurethane products have significant importance in promoting China’s low-carbon economy and improving the living standards of its residents. Polyurethane (PU) is widely used in various industries related to clothing, food, housing, and transportation due to its outstanding properties. Within the complex and volatile economic context, China, being both the largest producer and consumer of polyurethane products, experienced notable impacts on both the production and demand sides. China’s PU products output in 2022 totaled roughly 12 million tonnes, representing a year-on-year decrease of 5.5%, according to Pudaily. The compound annual growth rate from 2018 to 2022 was 1.4%.

PU products mainly include foam plastics, elastomers, fiber plastics, fibers, leather shoe resins, coatings, adhesives, sealants and others. Foam plastics make up the largest proportion among them. PU foam plastics can be divided into rigid foam and soft foam systems, which have excellent elasticity, elongation, compression strength, and flexibility, as well as excellent chemical stability. Moreover, PU foam plastics also possess superior processability, adhesive properties, and insulation properties, making them high-performance cushioning materials.

PU soft foam products are mainly used for furniture cushions, mattresses, car seat cushions, composite fabrics, packaging materials, and soundproofing materials and more. In 2022, China’s PU soft foam products output reached 2.49 million tonnes, a year-on-year decrease of 10.9%.

The upholstered furniture industry is the largest downstream sector of PU soft foam, with a share of 48.8% in 2022. The consumption of PU soft foam products in the furniture industry contracted significantly in 2022 due to the downturn in the building materials and real estate sectors.

PU rigid foam products are mainly used in refrigerators, freezers, pipelines, spraying foam, panels, containers, etc. In 2022, China’s PU rigid foam products output amounted to 1.96 million tonnes, a decrease of 8.1% compared to the previous year. The refrigeration industry took up the largest share in the PU rigid foam products, accounting for 56.5% of the total output in 2022. Due to factors such as COVID-19 recurrences, changes in the supply chain, and a decline in economic growth, as well as the high ownership and low replacement frequency (a refrigerator’s service life is around 10 years), the decline of the real estate dividend, soft demand caused by low consumer confidence, and high inflation, wars, and interest rate hikes in many European and American regions, the overseas demand for refrigerators shrank in 2022. Furthermore, due to the high base in 2021, China experienced a significant decline in both domestic sales and export of refrigerators.

June 13, 2023

Butanediol in China

BDO Market Booms with Growing Demand in Traditional and Emerging Industries

ECHEMI2023-06-12

1,4-butanediol (BDO) is an influential organic and fine chemical raw material, widely used in textile, chemical and other fields. Demand for BDO has formed a significant driving force in recent years with the expansion of applications in emerging fields such as biodegradable plastics and lithium batteries, as well as the recovery of traditional downstream industries such as spandex and PBT plastics.

According to SteelHome, the BDO market is currently extremely hot, with prices rising sharply. The benchmark price of BDO in the East China market has exceeded 11000-11100 yuan/ton, with a growth to the past week. According to research by Shenwan Hongyuan Securities, China’s apparent BDO consumption is expected to reach about 4.47 million tons per year by 2025, and the compound annual growth rate of BDO demand from 2020 to 2025 will be 26.5 percent.

BDO’s traditional application areas are primarily spandex and PBT engineered plastics, with BDO’s downstream applications in the spandex industry chain and PBT engineered plastics reaching 51% and 26% respectively. The spandex market is extremely hot, with product prices up nearly 200 percent, as demand for textiles and clothing recovers and export orders rise. The PBT plastics sector is also showing a clear trend of growth, with increasing applications in new energy vehicles and charging devices.

In addition to traditional application areas, BDO is rapidly expanding its applications in emerging areas such as biodegradable plastics and lithium batteries. With the frequent introduction of domestic plastic reduction policies, the demand for biodegradable plastics is about to enter a period of explosive growth, and PBAT is expected to lead the way in the agricultural plastic film and packaging materials and other biodegradable plastic markets with well-established production technologies and high cost-effectiveness. As a major feedstock for PBAT, PBAT is expected to generate approximately 2.5 million tonnes/year of new demand for BDO by 2025. At the same time, BDO is an essential raw material in the hottest lithium battery industry chain, and its downstream NMP is an important solvent in the production process of lithium battery cathodes, as well as a cleaning agent for semiconductors and integrated circuits.

Due to the long-term low BDO product prices, companies can only barely maintain a break-even point, and the industry’s sluggish business environment severely hinders new capital expenditures. Currently, the d Chinese annual production capacity of BDO is about 1.45 million tons, and the demand gap exceeds 200,000 tons. Only two A-share listed companies, Zhongtai Chemical and Shaanxi Black Cat, have BDO production capacity, with a combined annual capacity of only 330,000 tons. The huge gap between supply and demand has attracted a group of domestic companies to ramp up production on a regular basis. More than 1.5 million tons of new BDO capacity are currently planned in China, but the construction of BDO capacity usually takes about two years and there is a certain commissioning period after completion to achieve stable production. The fastest new capacity will gradually enter the production release period in the second half of 2022. Many industry insiders believe that the mismatch between new capacity and downstream demand growth will keep this cycle of BDO shortages going for more than two years, and that the BDO business environment will continue to improve as a result.

Recently, the world’s largest BDO project with an annual production capacity of 900,000 tons was settled in Fujian. The project will help boost China’s new energy and environmental protection industries by using the large amount of hydrogen produced as a by-product of propane dehydrogenation to produce BDO, a new chemical material that can be used to produce lithium batteries, high-end spandex, fully biodegradable plastics and other products. The move is an important boost for China’s plasticization industry and will help promote the transformation and upgrading of the country’s chemical industry, as well as the development of new energy and environmental protection industries.

https://www.echemi.com/cms/1416474.html

Polybutylene adipate terephthalate

From Wikipedia, the free encyclopedia

PBAT (short for polybutylene adipate terephthalate) is a biodegradable random copolymer, specifically a copolyester of adipic acid, 1,4-butanediol and terephthalic acid (from dimethyl terephthalate). PBAT is produced by many different manufacturers and may be known by the brand names ecoflex, Wango, Ecoworld, Eastar Bio, and Origo-Bi. It is also called poly(butylene adipate-co-terephthalate) and sometimes polybutyrate-adipate-terephthalate[1] (a misnomer) or even just “polybutyrate”.[2] It is generally marketed as a fully biodegradable alternative to low-density polyethylene, having many similar properties including flexibility and resilience, allowing it to be used for many similar uses such as plastic bags and wraps.[3] It is depicted as a block co-polymer here due to the common synthetic method of first synthesizing two copolymer blocks and then combining them. However, it is important to note that the actual structure of the polymer is a random co-polymer of the blocks shown.

Read more here: https://en.wikipedia.org/wiki/Polybutylene_adipate_terephthalate

May 29, 2023

PO Trade Flows in the Future

Will Shutdown of Dow’s PO Plant in U.S. Change Asian Trade Flow?

PUdaily | Updated: May 29, 2023

The end-users of propylene oxide (PO) include industries such as real estate, automobiles, furniture, refrigerators, and freezers, which are closely related to the development of the national economy. An increase in demand for polyurethane due to the rise in the prosperity of these industries will stimulate polyols suppliers to increase production, thereby increasing the demand for PO and driving up prices.

On May 16, it was reported that Dow Chemical plans to close its PO plant in Freeport, Texas, by the end of 2025.

The decision to close the PO plant arose from the fact that the plant is approaching its end-of-life, and the overall chemical industry is not prosperous due to the slowing global economic growth and various uncontrollable factors. The demand from most end-users is weakening, and polyurethane suppliers are paying more attention to higher value-added segments. Therefore, the decision to close the plant is part of Dow Chemical’s efforts to optimize costs and supply conditions.

Dow’s PO plant in Freeport will continue to operate until the end of 2025, while downstream polyether polyol plants will continue to operate after the PO plant is shut down. After 2025, Dow will use resources from other regions or third-party suppliers to supply PO to its polyol plants. Dow is also investing in logistics capabilities, such as PO tanks, pipelines, and new barges to ensure the normal supply.

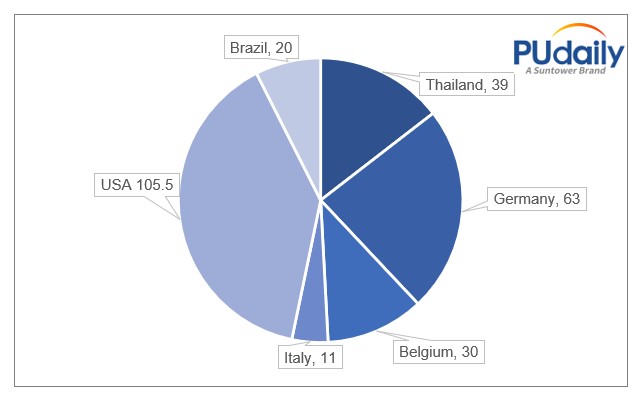

Currently, Dow Chemical is the world’s largest PO producer with an extensive layout of plants in the U.S., Germany, Brazil, Belgium, and Thailand. Its total capacity is 2.685 mtpa, contributing 20.24% of the global PO output.

Dow Chemical’s PO Capacity Layout (10kT)

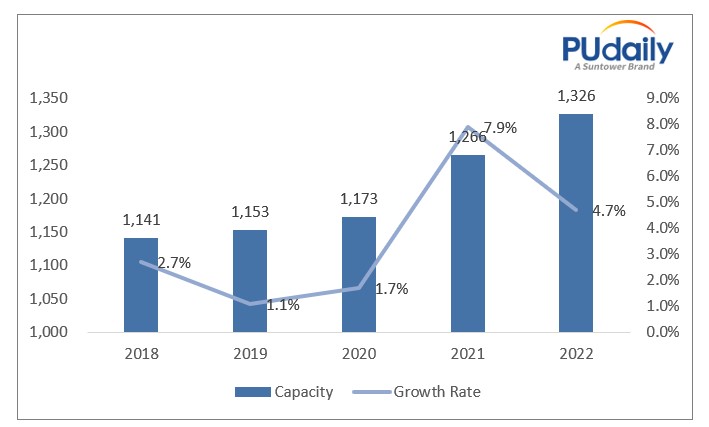

Global PO Capacity & YoY Changes, 2018-2022 (10kT, %)

Dow’s PO production uses the chlorohydrin process technology. The patent owners of the chlorohydrin process are mainly Dow in U.S., Asahi Glass, Mitsui Toatsu and Showa Denko in Japan. The chlorohydrin process was industrialized as early as 1931 and has the advantages of mature technology, short process, low purity requirements for raw materials, and low investment. The key of this technology is the chlorohydrin reactor, and Dow Chemical’s tubular reactor is representative of the chlorohydrin process.

But the chlorohydrin process causes severe environmental pollution, and under the background of increasingly stringent environmental regulations, the use of chlorohydrin technology faces enormous challenges. The US government has already eliminated chlorohydrin technology in 2000, and China has also listed chlorohydrin process as a restricted item in the Guidance Catalogue for Industrial Structure Adjustment (2011), and new facilities cannot adopt this technology.

The shutdown of Dow’s PO plant in the U.S. will cause a supply gap. Part of the gap will be filled by LyondellBasell (In March of this year, LyondellBasell successfully started up the world’s largest PO and TBA plant in Texas. These new assets on the U.S. Gulf Coast have an annual capacity of 470,000 tonnes of PO and 1 million tonnes of TBA and its derivatives). Some PO suppliers in countries such as South Korea, Saudi Arabia, and Thailand will also increase exports to the U.S. China’s PO export is constrained by process requirements and lack of export tax refunds. The tax rebate rate for downstream products of PO, such as polyether polyols, propylene glycol, and propylene glycol methyl ether, has been increased to 13%, further enhancing their export competitiveness.

May 29, 2023

Wanhua Starts TDI Plant

Wanhua’s 250kT TDI Facility in Fujian Starts Production, Phase II 300kT TDI Project is Around The Corner

PUdaily | Updated: May 24, 2023

On May 22, 2023, Wanhua Chemical successfully started its 250kT TDI facility in Fujian with producing qualified products, marking another breakthrough in the TDI industry, according to the company announcement. With this, Wanhua now has four TDI production bases globally, with a total production capacity of 950 ktpa, including 300 ktpa in Yantai, 250 ktpa in Fujian, 250 ktpa in Hungary, and 150 ktpa at former Juli Group’s plant. The company contributes 30% of the global TDI capacity, making it the largest TDI supplier in the world.

Meanwhile, Wanhua Chemical is preparing to launch its Phase II 300 ktpa TDI project in Fujian, according to public information. It is estimated that Wanhua’s TDI capacity in Fujian will exceed 550 ktpa after the operation of its Phase II 300 ktpa facility. Based on the construction speed of Wanhua’s previous projects, it is likely that the Phase II TDI facility in Fujian will start operating at the end of 2024.

The global TDI consumption will be around 2 million tonnes in 2023 and roughly 2.4 million tonnes in 2025, according to Pudaily’s forecast. It is estimated that global TDI capacity will reach 3.515 mtpa after the completion of Wanhua’s Phase II 300 ktpa TDI facility in 2024. In the future, the TDI supply-demand balance will continue to tilt, and the oversupply situation will become prominent, leading to intense competition.

May 16, 2023

Chinese Mattress Exports

China Mattress Exports Increase Significantly in Q1 2023

PUdaily | Updated: May 16, 2023

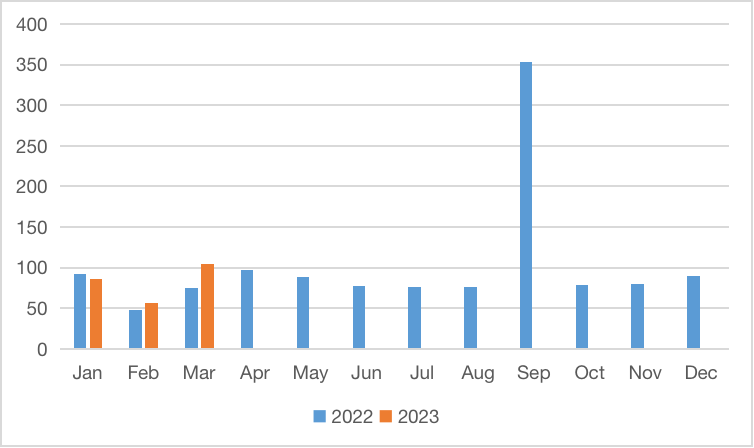

China exported a total of 2.457 million spring mattresses in the first quarter of 2023, a year-on-year increase of 14.8%. The export value reached USD 194.02 million, a year-on-year increase of 2.5%, according to customs data.

Figure 1: China Spring Mattress Export, 2022-2023 (10,000 pieces)

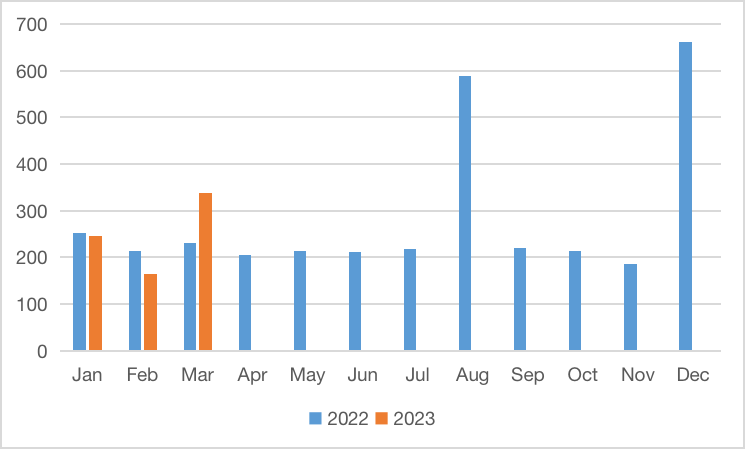

China exported a total of 7.511 million foam mattresses in Q1 2023, a year-on-year increase of 7.9%. The export value was USD 163.93 million, which remained basically stable compared to the same period last year.

Figure 2: China Foam Mattress Export, 2022-2023 (10,000 pieces)

It is noteworthy that although the export volume increased significantly year-on-year, the growth rate of export value was significantly smaller, and the unit price and profit for exports declined year-on-year.

From January to March 2023, the operating revenue of furniture manufacturers above designated size in China totalled CNY 148.59 billion, a year-on-year decrease of 13.2%; operating costs reached CNY 123.12 billion, a year-on-year decrease of 14.3%; and their total profit was CNY 5.56 billion, a year-on-year decrease of 12.6%, according to the National Bureau of Statistics of China.

Looking at the quarterly reports of listed companies in Chinese home furnishing industry, among nearly 120 home furnishing companies that had already published their reports this quarter, 83 companies experienced a decline in revenue and 29 companies suffered losses.

However, the prosperity of China’s real estate industry in the first quarter partially restored, with housing completions accelerating growth in March and home sales keeping recovery. In terms of end-user spending, there have been signs of a rebound in domestic and foreign consumption. Offline store traffic has significantly increased. Under sales promotions, some demand for replacement in mature markets has been boosted. It is predicted that China’s home furnishing market will experience marginal improvement in the near future.