Asian Markets

May 11, 2023

Chinese Furniture and Mattress Overview

Upholstered Furniture Market Situation & Trends

PUdaily | Updated: May 9, 2023

Upholstered furniture refers to furniture added with padding, foam, fabric and other materials. This involves sofas, upholstered beds, mattresses, nightstands, coffee tables and other relative products. Among them, mattresses and sofas are the two main types of upholstered furniture. The industrialization of upholstered furniture began in Europe in the early 20th century. Global upholstered furniture industry has greatly increased its production capacity thanks to continuously advanced manufacturing technologies, and the market demand has also kept growing.

As the upholstered furniture industry is labor-intensive, developed countries are continuing to transfer their manufacturing to developing countries, which have low labor costs and sufficient raw materials. The main upholstered furniture manufacturing countries currently include China, U.S., Poland, India, Italy, and Germany.

China has become one of major producers and consumers of upholstered furniture. China’s modern upholstered furniture industry began in the early 1980s. In recent years, through introduction of advanced furniture design technology and processing technology from abroad, and on the basis of fully leveraging the advantages of raw material resources and labor costs, China’s upholstered furniture industry has developed rapidly. At present, China’s upholstered furniture output value makes up 46.4% of the world, contributing about 30.7% of the global upholstered furniture consumption.

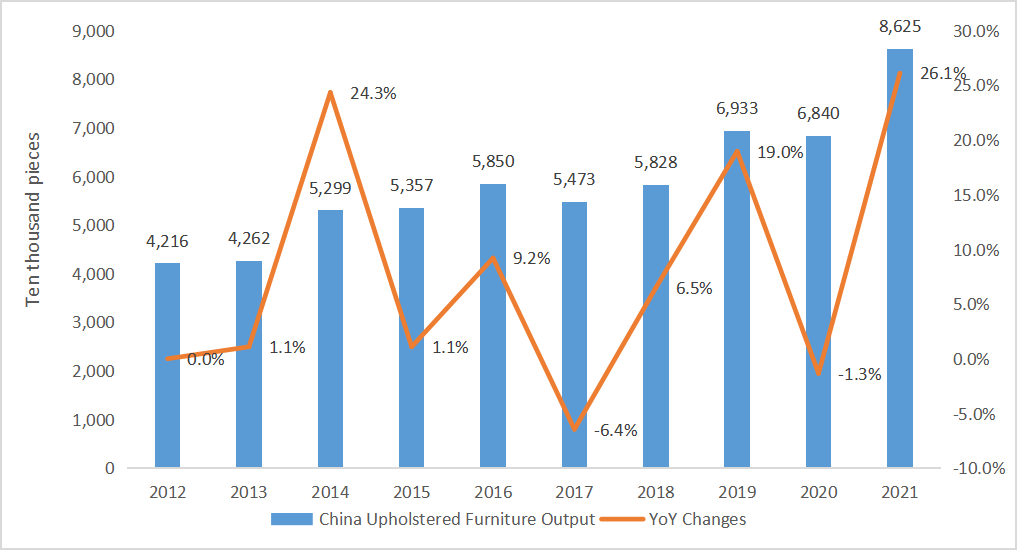

Figure 1 China Upholstered Furniture Outputs & YoY Changes, 2012-2021

The upholstered furniture industry has a long industrial chain that spans agriculture, manufacturing, and retail industries. Its upstream industries mainly include leather, wood, foam, and other raw material industries. Downstream manufacturers mainly sell products to end consumers through channels such as dealers, ODMs, and direct-sale stores. Leather is mainly used for the outer surface of upholstered furniture, primarily natural cowhide. Wood is mainly used for the main structure of upholstered furniture, and the development of forest planting directly affects the wood supply and procurement costs of the upholstered furniture industry. Foam, namely polyurethane foam, is a typical cushioning material mainly used for cushions, armrests, backrests, etc., to improve the softness and comfort of upholstered furniture. It is made from polyurethane through processes such as foaming, hot pressing, and cutting, and is a derivative product in the petrochemical processing industry. Therefore, its price is greatly affected by fluctuations in oil prices. Downstream manufacturers of upholstered furniture mainly sell products to end users through direct-sale stores, dealers, etc., and factors such as household income and real estate industry development drive consumer demand.

Commodity prices have risen sharply since 2021. The low added value and high cost of the upholstered furniture industry have been greatly affected by rising raw material prices. Meanwhile, under the policy of “housing is for living, not for speculation”, the prosperity of the real estate industry has significantly declined, which also brings obvious suppression on the demand for upholstered furniture. Under the dual impact of rising costs and weakening demand, the overall profit margin of the upholstered furniture industry has significantly decreased. Especially for small and micro manufacturers that rely on price advantages, their survival space has been squeezed.

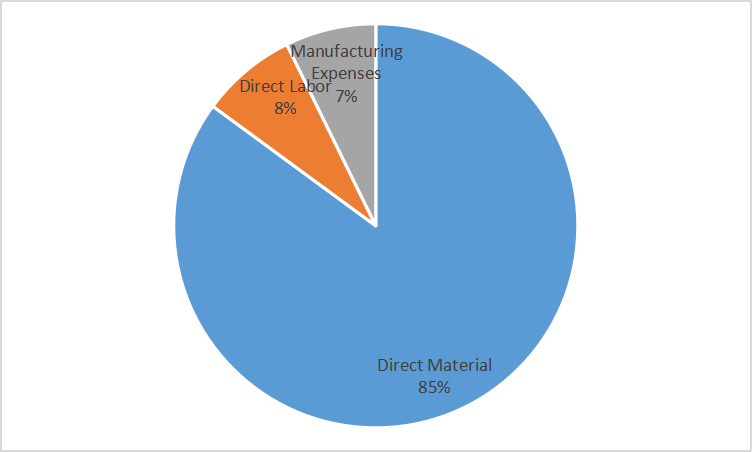

Figure 2 Cost Structure of a Mattress Manufacturer

In the future, China’s upholstered furniture industry could follow two important directions:

1) A boom in established market:

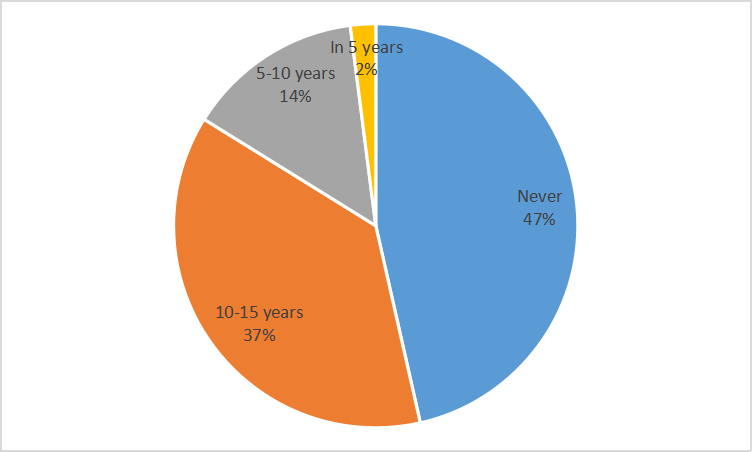

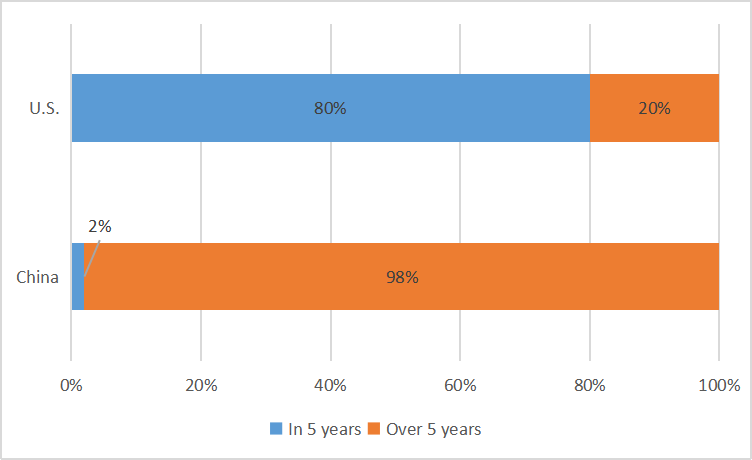

A few decades ago, spring mattresses were popularized in China. For a spring mattress, the lifespan of spring is usually 10-20 years, and that of filler and fabric is about 5-10 years. At present, the frequency of mattress replacement in China is much lower than that in U.S. 37% of Chinese consumers replace mattresses in 10-15 years, while 47% of consumers have never changed them, which are mostly under serviceability limit state. We believe that increasingly frequent mattress replacement and higher requirements for comfort level of beddings may boost the demand for mattresses.

Figure 3 Mattress Replacement Frequency in China

Figure 4 Comparison of Mattress Replacement Frequency in China and U.S.

2) Rising industrial concentration:

At present, China’s sofa industry is fragmented. CR4 (the concentration ratio of the top four manufacturers) in China was only 30% in 2021, with Man Wah holding the largest market share (about 12%); the concentration of U.S. sofa industry was higher, with CR4 reaching 51% and CR10 reaching 79% in 2017, and the market share of top manufacturers la-z-boy/Ashley/Man Wah reached 21%/11%/10% respectively.

In terms of the mattress industry, the U.S. market is dominated by a few top brands, while Chinese mattress market is inundated with small and medium-sized manufacturers.

The top 5 brands in U.S., (CR5), Sealy, Simmons, Serta, Tempur-Pedic and Sleep Number, together occupied 69.40% of the mattress market. CR3 and CR8 in China’s mattress market are only 11.43% and 18.66%. The market share of top three brands – Sleemon, Serta and DeRucci – is 4.38%, 3.88% and 3.17% respectively.

With the improvement of residents’ consumption levels and the broad demand for mattress replacement, top manufacturers with advantages in brand, channels, and services are expected to usher in a significant growth in the next few years.

May 8, 2023

Hydrogen Peroxide Accident Impacts HPPO Production in China

Impact of Explosion at Luxi Chemical’s Hydrogen Peroxide Plant

PUdaily | Updated: May 6, 2023

On May 1 at 12:20 pm, an explosion occurred at the hydrogen peroxide production area of Luxi Chemical, a subsidiary of Sinochem Holdings. The preliminary investigation found that when recovering the fluid, a large amount of 70% hydrogen peroxide had leaked into the kettle of the hydrogen peroxide device. The impurities in the kettle caused the hydrogen peroxide to decompose, causing overpressure explosions in the kettle that triggered explosions in the adjacent octanol storage tanks and pipeline leaks. Nine workers died, one was injured, and one is still missing.

The trigger for this accident was hydrogen peroxide, which is commonly used in medicine, sterilization, oxygen preparation, oxidants, bleaching agents, and dechlorinators. As a strong oxidiser, it is unstable and prone to decomposition. During decomposition, a large amount of heat is released. If metals, salts, and impurities are mixed in, the decomposition process may be intensified, leading to an explosion.

The HPPO process, which uses hydrogen peroxide as a raw material to directly oxidize propylene into propylene oxide (PO), is a new green technology, and the process patents are mainly held by companies such as Degussa, Uhde, Dow Chemical, and BASF. In China, Sinopec, Dalian Institute of Chemical Physics of the Chinese Academy of Sciences, and East China University of Science and Technology also have independent technologies. The process is relatively simple and does not produce too many byproducts, nor does it cause pollution to the surrounding environment. The produced propylene oxide is the only product allowed for export in China at present.

In the HPPO process, it’s key to ensure the quality of hydrogen peroxide. The most direct impact of the explosion at the hydrogen peroxide production area of Luxi Chemical is twofold:

First, the shutdown and transformation, which means that all devices that do not meet safety and environmental standards are immediately shut down, rectified, and closed within a certain time limit. The company’s current shutdown and associated devices involve hydrogen peroxide, caprolactam/nylon 6, and polyol units, and the resumption time is not decided yet.

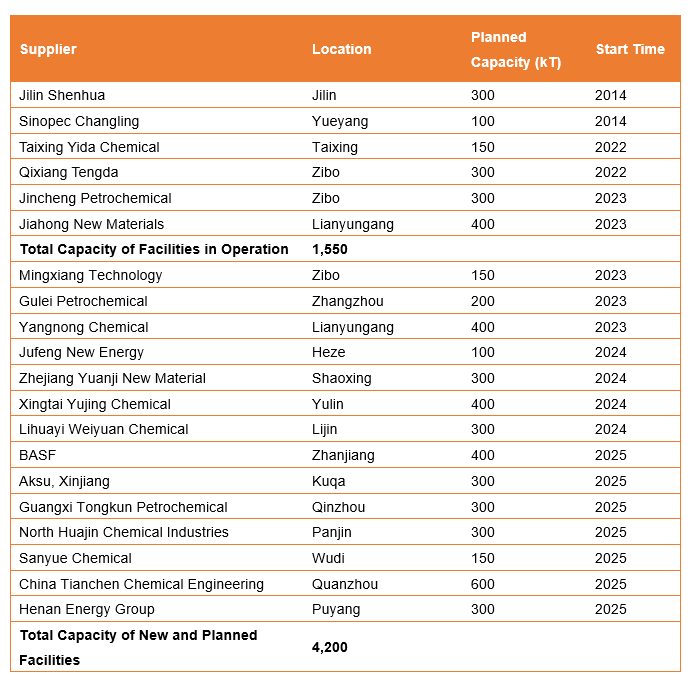

Second, the safety production supervision has been strengthened, and the entry threshold for HPPO process to produce propylene oxide has been raised. In China, the currently operating HPPO facilities include those at Jilin Shenhua and Sinopec Changling, which were put into operation in 2014, Taixing Yida Chemical and Qixiang Tengda, which were put into operation in 2022, and Jincheng Petrochemical and Jiahong New Materials, which were put into operation in 2023. China’s total annual capacity of propylene oxide is presently1.55 million tonnes, and the future new and planned projects will add an annual capacity of 4.2 million tonnes, according to PUdaily.

Moreover, the hydrogen peroxide explosion incident has to some extent delayed the restart of some HPPO process facilities, and the reduction in supply of propylene oxide is one of the reasons for the recent price increase. On May 5, the prevailing offers of propylene oxide in China have risen to CNY 10,000-10,100/tonne from CNY 9,600-9,700/tonne before the May Day holiday, and the uptrend will continue in the short term.

Future impacts include accelerating the relocation and transformation of hazardous chemical production companies in urban areas, increasing efforts to rectify, reduce, shift, and transform chemical companies outside of industrial parks.

April 18, 2023

Chinese Economy Overview

“The Recovery Is On Track”: China Economy Rebounds Strongly With 4.5% GDP Jump In Q1

by Tyler Durden

Tuesday, Apr 18, 2023 – 05:58 AM

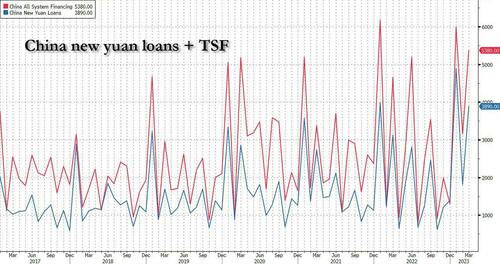

Last week, when discussing the latest record – for the month of March – Chinese credit injection which saw a massive 5.4 trillion yuan in Total Social Financing, beating estimates by almost CNY 1 trillion…

… and sparking a surge in China’s all-important Credit Impulse…

… we said that China’s delayed “liftoff was imminent”, and that “the 2008 deja vu meter just went off the charts, because while the US is about to sink into a recession with commercial real estate set to fall all off a cliff, it is once again China that is – willingly or otherwise – set to serve as the world’s growth dynamo at a time when the entire developed world is about to max out at the same time. This is precisely what happened in 2008 when China unleashed the biggest credit expansion in modern history, sparking not only historic growth spree but also an exponential debt increase that sent China’s debt to over 300% of GDP.”

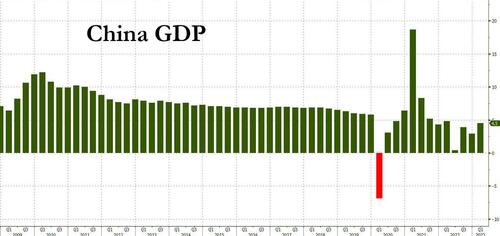

Since then, we have seen China report stellar trade data with both exports and imports sharply higher than expected, more solid real estate prints as housing prices have clearly rebounded from two years of decline, and most importantly, overnight China’s Q1 GDP also surprised to the upside, rising at a 4.5% annual clip in the first quarter – the strongest quarter for the Chinese economy since Q1 2022 – as strong growth in exports and infrastructure investment as well as a rebound in retail consumption and property prices drove a recovery in the world’s second-largest economy.

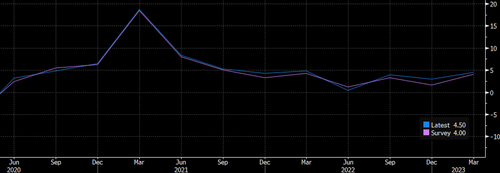

The official figure, which exceeded analyst expectations of a 4% rise and was the third consecutive beat of the median forecast…

… followed efforts by Chinese leader Xi Jinping’s government to restore business confidence damaged by pandemic controls last year and abrupt policy changes.

That said, the Q1 growth rate was just short of the government’s recently upgraded full-year target of 5%, held back by a nationwide Covid-19 outbreak at the start of this year, but economists expect it to pick up pace as the year progresses.

Xi, who formally embarked on an unprecedented third term as China’s president last month, is keen to revive economic growth following China’s shocking reversal of its covid-zero policy. Last year, GDP expanded just 3%, missing the official target of 5.5% which was already the lowest in decades.

“Definitely, the recovery’s on track,” said Tao Wang, UBS chief China economist. “The momentum at the beginning of the year was stronger than expected.”

Echoing what we said last week, the FT writes that “China’s rebound is crucial to global economic growth this year as developed nations grapple with persistently high inflation, rising interest rates and sluggish expansion in the wake of the pandemic and Russia’s full-scale invasion of Ukraine.”

“The national economy showed a steady recovery and made a good start,” China’s National Bureau of Statistics said. But the agency cautioned the situation was “complex and volatile, inadequate domestic demand remains prominent and the foundation for economic recovery is not solid yet”.

Curiously, while Chinese commodities markets rallied following Tuesday’s data release, equities failed to hold on to early gains. That’s because the data may have snuffed out recent hopes that bad news is good news and would lead to more stimulus. As Bloomberg reports Sofia Horta e Costa writes, “It’s clear markets are setting a high bar for China’s economy. So China data beats estimates yet again, but hardly anything moves in local assets. What’s going on?”

In March I wrote about how some traders were betting on a consumption-driven recovery, and others believed more stimulus would be forthcoming. You were either in one camp or the other. The issue for markets right now is that the macro picture is falling somewhere in the middle. Yes, the data is good — in some ways much better than expected — but not good enough for bulls to make a compelling case for a reopening boom in the economy.

The rebound is fragile, with pockets of weakness including the property market and factories. It’s also uneven: consumers may be spending more but they’re mainly focused on restaurants and jewelry. And the central bank is erring on the cautious side of stimulus. The bar is increasingly getting higher for any meaningful market reaction. We either need a blowout set of data across the board or more action from Beijing.

Indeed, while the Chinese data has been strong so far, it is certainly not blowout, at least not yet.

China abandoned zero-Covid restrictions in December amid popular opposition to the rolling lockdowns that paralyzed cities across the country for most of the year. The easing unleashed pent-up demand in the retail sector, where sales rose 5.8% year on year in the first quarter and 10.6% in March, both coming in well above expectations. But the base of comparison with last year was low, given that Shanghai started a months-long lockdown in late February 2022.

Premier Li Qiang, Xi’s new number two, signalled at China’s rubber-stamp parliament last month that the government would relax a crackdown on business that has wiped billions of dollars from property developers and internet platforms.

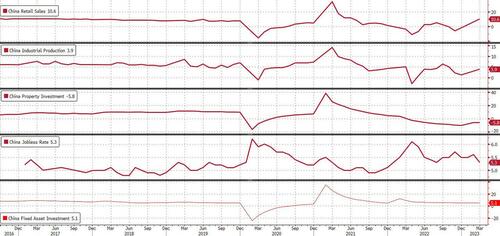

Elsewhere, manufacturing investment rose 7% year on year in the first quarter and industrial output gained 3%. Exports showed strong growth, up 8.4% in the first quarter, and state-led infrastructure investment climbed 8.8%, while overall fixed asset investment rose 5.1%, a modest miss to expectations. Private investment was weak, up just 0.6 %, suggesting a decline in March. The jobless rate fell to 5.3% in March from 5.6% in February, but youth unemployment hit the second-highest mark on record, at 19.6%.

At the same time, while home prices may be rising, housing sector woes persisted: the property sector’s woes continued, with new housing starts tumbling 19.2% year on year in the first quarter. Home sales by area declined 1.8% but sales by value rose 4.1%, pointing to a nascent recovery in prices. Indeed, in March, new home prices rose at their fastest pace in 21 months.

Following the news, Citigroup economists upgraded their forecast for 2023 GDP growth to 6.1% from 5.7% previously after strong data Tuesday. “Consumption recovery continued to be divergent across sectors, with services outperforming,” economists led by Xiangrong Yu wrote in a Tuesday research note. “Normalization in savings and improvement in employment” has provided “potential upside”

The property sector also improved steadily in March compared to the first two months of the year, especially for sales. The growth pickup “perhaps further lowers the necessity of stimulus,” the economists wrote, adding that they “don’t expect anything major” in the upcoming April Politburo meeting. This year could be a “window of opportunities for policymakers to address structural issues, such as weak private confidence, youth unemployment and local government debt.”

Other economists also said momentum would pick up in the second quarter, helped by the low base effect, but warned that consumption and property might struggle to maintain strong growth, while exports could be threatened by weaker developed markets.

Xi’s administration also remained hamstrung by a lack of credibility after hobbling the private sector, experts said.

Keyu Jin, a professor at the London School of Economics and author of The New China Playbook, said the biggest obstacle was the gap in private sector demand, both in consumption and investment.

“It will take time for confidence to come back to the Chinese economy,” she said, although what she really meant is that it would take a lot of new debt and credit. And as we showed last week, Beijing is already injecting record amounts of it as it prepares to become the world’s growth pillar now that the US is set to slide into recession.

https://www.zerohedge.com/markets/recovery-track-china-economy-rebounds-strongly-45-gdp-jump-q1

April 10, 2023

Spandex Product Development

New Breakthrough in Differentiated Spandex May Trigger New Growth Points for PTMEG

PUdaily | Updated: April 10, 2023

On March 29, during Yarn Expo Spring 2023, Lianyungang LDZ New Aoshen Spandex Co., Ltd. launched two differentiated spandex products, temperature-sensitive shape memory spandex and deodorant spandex, at its own new product launch event. According to the manufacturer’s introduction, the elasticity of temperature-sensitive shape memory spandex can change with temperature, achieving characteristics of easy wear below the transition temperature and high resilience at or above the transition temperature; while deodorant spandex maintains water resistance while having the function of neutralizing and decomposing odor molecules.

In China’s total synthetic fiber output, spandex accounts for only 1-2%. It is usually used in the manufacturing of some elastic fabrics, especially sportswear and leisurewear. With the improvement of mass consumption, people’s requirements for fabrics have gradually increased. At present, China’s spandex industry has become quite mature, and the industry’s growth rate has been greater than 10% in recent years, especially the demand for differentiated and high-end spandex has grown significantly. As the main downstream product of PTMEG, spandex accounts for about 90% of PTMEG consumption. In recent years, the growth of the spandex industry has also driven the stable development of the PTMEG industry.

Recent Market Trends: Since the beginning of March, China’s spandex market has been showing a sustained mild weakness. The post-pandemic demand recovery was not strong as expected, and the national consumption sentiment in the textile industry was not high. The peak season for spandex was slightly shorter than in previous years, and prices fell slightly during the month. By the end of March, spandex manufacturers’ orders gradually decreased, and there were few summer orders obtained by them. Although the operating rate could still be maintained at around 80%, due to the inability of spandex to be stored for a long time, spandex manufacturers’ confidence declined, and their enthusiasm for purchasing feedstocks was difficult to sustain. Against this backdro, it has been difficult for PTMEG suppliers to continue supporting the market, and prices have fallen.

Market Outlook: Owing to the international political situation and economic conditions, some countries in the Middle East and South Asia are facing difficulties in approving letters of credit, and the strike wave in many European countries is affecting port operations. The pattern of weak overseas demand may be difficult to change in the short term. Chinese demand has rebounded visibly, but the speed of economic recovery is still unable to quickly boost the textile industry. Downstream manufacturers in the PTMEG-spandex industry chain mainly made replenishment purchases on rigid demand, and it is difficult to change the market weakness in the short term. However, in the long run, the textile industry is still one of the pillar industries in China’s economy. With the growth of the national economy, the demand for textile and its upstream feedstocks will continue to grow. Moreover, the emergence of differentiated spandex will expand the application fields from simple knitted fabrics to medical bandages, healthcare products, car interiors, artificial organ materials and many other areas, thus opening up broader market space. In the industry landscape with multiple growth points, there is still considerable room for growth in the spandex industry, which will drive the positive expectation for PTMEG consumption.

March 28, 2023

Mitsui Reducing TDI Capacity

Mitsui Chemicals : to Optimize TDI Production Capacity

03/28/2023 | 12:48am EDT

2023.03.28

Mitsui Chemicals, Inc.

Mitsui Chemicals, Inc. (Tokyo: 4183; President & CEO: HASHIMOTO Osamu) today announced plans to optimize the production capacity of its Omuta Works’ toluene diisocyanate (TDI) plant in July 2025. TDI is used as a raw material in the production of polyurethane.

1. Objectives and Background

Mitsui Chemicals currently manufactures and sells TDI (Production capacity 120,000 tons per annual) for use as a basic material in the isocyanate chain at the Omuta Works. However, given supply and demand trends in Japan and overseas, Mitsui Chemicals has decided that a reduced output of around 50,000 tons per year will be optimal going forward.

While maintaining a stable supply setup to meet domestic demand for TDI, the Omuta Works will contribute to expansion in growth domains as part of Mitsui Chemicals’ business portfolio transformation by bolstering competitiveness as the company’s principal center for the manufacture of high-performance products, including ophthalmic lens materials and agrochemical products. 【Overview of the TDI plant】

| Manufacturing facility | Mitsui Chemicals Omuta Works (https://jp.mitsuichemicals.com/en/corporate/ds/works.htm) |

| Production capacity | 120,000 tons/year (currently) → around 50,000 tons/year (following optimization) |

| Timing | Planned for July 2025 |

The TDI plant in Omuta Works 2. Future of the Polyurethane Business

As part of its VISION 2030 Long-Term Business Plan, Mitsui Chemicals positioned polyurethane as one of several businesses in the Basic & Green Materials Business Sector that would be subject to restructuring.

In addition to the forthcoming optimization of TDI production capacity, the restructure will encompass the development of high value-added products, including high-performance methylene diphenyl diisocyanate and high-performance polyols such as polypropylene glycol. Pursuing these efforts will allow Mitsui Chemicals to reduce earnings volatility, improve capital investment efficiency and lay the business foundations for generating stable earnings.

Mitsui Chemicals also intends to bring about a circular economy transformation by setting up a chemical recycling scheme for polyurethane foam and considering the use of ISCC PLUS-certified bio-based toluene produced at the Osaka Works to manufacture greener TDI.