Asian Markets

March 21, 2023

MDI Overview

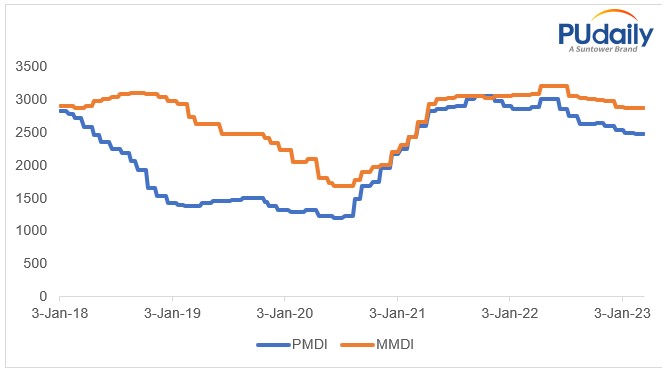

Global MDI Demand Growth Slow Down, MDI Facilities in Europe & USA Idled

PUdaily | Updated: March 17, 2023

On March 2, 2023, Covestro released its 2022 group report: “Fiscal 2022 was impacted by global challenges that had significant and perceptible effects on Covestro’s business performance. In particular, the sharp rise in energy and raw material prices during the year, especially in Europe, put a strain on the company. This was compounded by continuing adverse effects caused by the coronavirus pandemic in China, high inflation and an overall slowdown in global economic growth.” And according to Covestro’s report, the global MDI demand in 2022 was 8,250 k tons, increased by 0.2% year on year. The global MDI demand growth was slow down.

MDI Facilities in Europe & USA Idled, Global MDI Operating Rate Down

On February 21, 2023, Huntsman Corporation disclosed on its fourth quarter 2022 earnings call:

“Our Asian markets, primarily China, did experience modest volume growth in the quarter due to slightly improved demand in insulation and automotive when compared to the fourth quarter a year ago. Europe demand remained subdued…In the short-run, we are idling our smaller MDI line in Rotterdam for an extended period until end market demand improves…In the U.S., we’re seeing similar conditions due to rising interest rates…Our Geismar Louisiana MDI plant, we have closed one of our three lines that represents about 30% of our output.” The company’s spokesperson estimated that the operating rates are presently around 70% globally, which is lower than normal levels.

Huntsman’s MDI capacity in the Netherlands and the United States has reached 470 ktpa and 500 ktpa respectively. It means the idling capacity of Huntsman’s MDI facilities in Rotterdam and in Geismar totals about 300 ktpa.

Due to the declining operating rate of MDI facilities in Europe and the United States, as well as the high cost of upstream energy and raw materials, the PMDI market price in Europe is stable. The contract price is €2,400-2,550 /tonne, and the negotiated price is €2,300 /tonne, showing a weak status between supply and demand.

Construction:

Construction is the most important downstream sector for MDI in Europe and the United States. A major MDI supplier saw that two-thirds of their polyurethane Americas business went into construction-related end markets, approximately half into commercial construction, and half into residential, of which 70% was related to new residential builds.

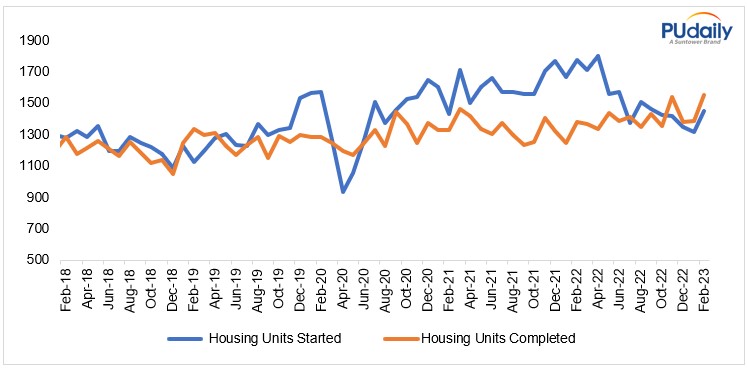

Americas: New housing starts in U.S. totalled 18.67 million in 2022, a year-on-year decrease of 3.1%, according to Federal Reserve Economic Data. From 2020 to 2021, the US housing market revived rapidly amid Covid-19 pandemic and evolved into a real estate boom since the subprime mortgage crisis of 2007. The current housing boom arises from a combined effect of short cycle (post-Covid policy stimulus) and long-term cycle (inventory cycle after the subprime mortgage crisis). Since the Fed tightened monetary policy in 2022, the real estate market has borne the brunt, and drops in indicators such as home sales and market prosperity are comparable to those in the crisis of 2007-2008. Looking ahead to 2023, the U.S. housing market is expected to weaken, while the margin may be small.

New Housing Starts & Completions in U.S., 2018-2023

Europe:

Market instability has been exacerbated by the war in Ukraine and high inflations, which has dampened the intention to invest in new construction projects. In December 2022, construction output in the Euro Area fell by 2.5% month-on-month, reaching the largest decline in the past 18 months, according to Eurostat. Euroconstruct forecasts a significant slowdown in the growth rate of residential construction in Europe to 1.3% in 2024. This results from stagnation trends in both new residential construction and renovation (in 2024, growth is 1.5% and 1.2%, respectively).

Automobile:

Automobile is another major downstream industry for MDI in Europe and U.S.

Europe: On January 18, 2023, the European Automobile Manufacturers’ Association released a report showing that in 2022, as a result of component shortages, the European passenger car market contracted by 4.6% to 9.26 million units, the region’s lowest level since 1993, when 9.2 million units were registered. Agence France-Presse claimed that 2022 is the third difficult year for the European automobile industry. Since the Covid outbreak and the ensuing supply shortages, a large number of factories and showrooms were shuttered. The semiconductor shortage had not eased even after the pandemic stabilized. In 2022, Germany was the only country of the European market to have recorded growth in auto sales, with 1.1% increase. Sales in Italy, France and Spain fell by 9.7%, 7.8% and 5.4% respectively.

Americas:

U.S.A: Many automakers slashed production due to soaring feedstock costs and ongoing shortages of semiconductors and other components, according to Cox Automotive. Full-year 2022 U.S. auto sales are expected to be near 13.9 million units, a decrease of nearly 8.0% from 2021 and down 20% from the market peak in 2016.

Brazil: In contrast, the auto industry in Brazil performed better. The components shortage in Brazil’s auto industry had eased markedly in 2022, driving growth in the country’s auto output, according to Brazilian Association of Automotive Vehicle Manufacturers (Anfavea). Moreover, the increase in Brazilian auto exports to Latin American countries also boosted the rise in the country’s auto industry. Anfavea currently expects that Brazil’s 2023 auto output would rise by 2.2% to 2.42 million units.

http://www.pudaily.com/Home/NewsDetails/35233

March 15, 2023

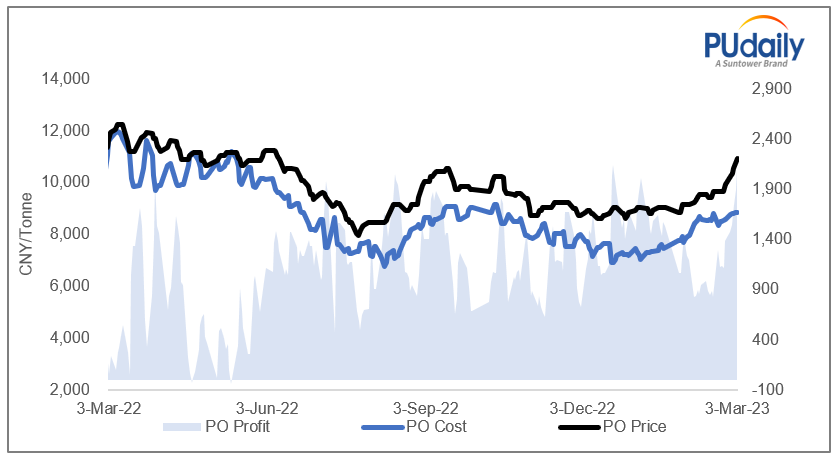

PO Prices Rising in China Dragging Polyol Along for the Ride

Will PO Prices in China Rise to CNY 12,000/tonne in March?

PUdaily | Updated: March 7, 2023

Supply

In February, multiple PO facilities in China experienced overhauls, technical transformation, or output reduction, including Jishen Chemical, Qixiang Tengda, Yida Chemical, Satellite Chemical, Sinopec Tianjin, Sinopec Zhenhai, etc., involving a total capacity of 1.69 mtpa. The capacity utilization was around 60% in February. Moreover, the synchronous maintenance of overseas facilities resulted in a significant shrinkage of imported goods. Therefore, the overall supply of PO in China was tight.

Demand

China’s February manufacturing PMI rose 6.9 percentage points month-over-month to 56.7%, indicating that China’s production activities are accelerating to pick up after getting rid of the impact of Covid-19 pandemic and the Spring Festival factor. Downstream manufacturers gradually recovered operation and saw sales increases in February. Besides, the costs of PO increased as the profit margin of chlorohydrin process further narrowed. As a result, PO prices in China kept moving up since February. On March 6, the prevailing offers of PO in Shandong and North China markets stood at CNY 11,100-11,200/tonne EXW in bulk in cash.

Forecast

In a promising March, polyurethane downstream industries are pinned on new hopes. The market sentiment has grown markedly. Thanks to successively convened exhibitions and consumption-based incentives, the demand is expected to further rise. With the approach of China’s Two Sessions, many local governments have issued control measures for the production and transportation of hazardous chemicals, so that the supply of polyurethane raw materials will be more or less affected. PO prices in China are projected to move around CNY 12,000/tonne.

http://www.pudaily.com/Home/NewsDetails/34965

March 3, 2023

Accident Impacts Chinese MDI Production

MDI Upstream Raw Material Supplier Exploded, the Impact to China MDI Market

PUdaily | Updated: February 28, 2023

On February 24, during the maintenance period of Chongqing Yingtianhui Chlor-alkali Chemicals Co., Ltd, the storage tanks exploded, causing 1 death and 3 injuries, According to Emergency Management Agency of Chongqing Changshou Economic and Technological Development Area report on February 25, the investigation has been launched to determine the reason for the accident.

Yingtianhui is one of the upstream suppliers for BASF Chongqing’s MDI plant, supplying liquid chlorine and caustic soda.

What is the impact of explosion on China’s MDI market?

Due to the unexpected explosion, BASF Chongqing’s MDI facility, which was originally scheduled to restart this week, cannot redetermine the restart schedule. BASF has stopped trading MDI products since February 24. Subsequently, traders turned more reluctant to sell low and hold a wait-and-see stance. Some of them raised their offers slightly over the weekend.

Actually China’s MDI market had shown strong trend signals before the explosion.

February Market Review: In February, China’s MDI market showed a trend of “strong uptrend-pullbacks-rebound”. In early February, the major suppliers raised their list prices, and Covestro’s weekly guide prices were higher than market expectations. The MDI market showed a strong uptrend due to short supply after Spring Festival holiday, and some downstream manufacturers actively stocked up. But the market turned weak since the second week, and demand in industries such as pipe insulation and panels recovered slowly. Meanwhile, more speculative traders lowered offers to sell low-cost sources obtained before holidays, and low-priced Middle Eastern imports flooded into the market, driving market prices to stop hikes and experience slight pullbacks. In late February, prices of aniline, the main feedstock of MDI, kept rising. On February 24, mainstream reference offers of aniline in China had risen to CNY 12,350/tonne, lending a firm support to the MDI market. Most traders speculated that suppliers were willing to boost the MDI market in March, so the market stopped rising and moved sideways. Negotiation prices rebounded slightly.

March Market Forecast: The major MDI suppliers in China will unveil their March list prices and February settlement prices today and tomorrow. Traders have held a strong wait-and-see mood, expecting that suppliers guide prices would be high. Besides, due to ongoing maintenance of MDI facilities in Ningbo and Chongqing, the current operating rate of MDI remains low around 70%. If the Chongqing facility fails to restart as scheduled, the supplier may continue to control its supply in the near future. With probably high list prices in March and controlled supply, traders may raise their offers. And after consumption of low-cost sources, there will also be a support for the uptrend in March MDI market.

March 1, 2023

Chinese Spandex Overview

Spandex market not worry-free in March

Text size

| Spandex price strongly increased after the Spring Festival holiday driven by bullish policies, low operating rate of the whole industrial chain and active downstream procurement. Price of spandex increased the most among major raw materials of textile and apparels. However, the later market is also worrying with inadequate new export orders and surging spandex capacity. Spandex market will encounter bigger pressure. Domestic orders for fabrics better than exports Domestic orders for fabrics were good in Feb, mainly orders for light fabrics for spring and summer. Some fabric mills are hoarding up conventional varieties. The production is anticipated to sustain in the traditional peak season during Mar and Apr. Some companies went abroad to snatch orders in end-2022 and early-2023, while export orders remain insufficient. Overseas consumption is obviously depressed by high inflation and apparently soaring mortgage rate, which ends up with falling orders from Europe and US. Export orders may recover in Mar-Jun, which may be low at first but increase later within 2023. Operating rate of fabric mills apparently rose in Feb, with that of warp knitting plants at 60-70%, that of circular knitting plants and covered yarn plants in Zhejiang and Jiangsu at 50-70% and that of lace knitting plants in Changle, Fujian and circular knitting plants in Foshan at around 40% now. Many downstream plants replenished with optimized pandemic prevention and control policies. Some fabric mills focused on digesting spandex prepared before. Stocks of spandex started rising from late-Feb, which were above 27 days now. Spandex capacity soars By the end of February 2023, the capacity of spandex is revised up by 55kt to 1151.5kt/year in Chinese mainland, up by 5% on the month and 18.5% on the year. Huafon Chongqing, Hyosung Ningxia and Tayho Yantai’s spandex capacity increases by 25kt/year, 20kt/year and 10kt/year respectively. Current operating rate of spandex plants is near 85%. Above 970kt/year of capacity is running now, slanting high in recent two years, up by 7% on the year and 22.6% over the corresponding period of 2021. The run rate of plants with capacity at 30-50kt/year or above was at 72% and that of companies with capacity below 20kt/year approached 61%. BDO price turns to consolidate and PTMEG price may rise slightly Many BDO plants are scheduled to have turnaround in Mar. That means supply of BDO will reduce in short run. The supply from units with expanding capacity does not increase in short run. Therefore, the actual supply of BDO is anticipated to be flat with Feb in Mar. Stocks of BDO are low. Demand for BDO fails to improve much. Price of BDO is estimated to be in range bound in short run. Demand for PTMEG is strong when new spandex units start operation. Price of PTMEG is expected to slightly rise in Mar. In addition, Wanhua Chemical updated MMDI Mar nominations at 24,500yuan/mt, up by 2000yuan/mt on the month, and Feb settlement was at 20,600yuan/mt, up by 2,100yuan/mt on the month. With advancing feedstock prices, the feedstock cost of spandex is anticipated to climb up in Mar. In summary, the support from the feedstock cost remains strong on spandex market but the follow-up of new orders for fabrics and the recovery of consumption is crucial. Players were optimistic toward the domestic and export orders for fabrics earlier, but current export orders are scarce, which will weigh on the increase of run rate in fabric mills to a certain degree. New spandex units gradually commission operation and more products will be put into the market. The operating rate of existing spandex plants is medium-to-high. Supply of spandex rises but downstream buyers focus on digesting spandex prepared before. Price of spandex is likely to be firm in the first half of Mar under cost pressure and may move down in end-Mar or early-Apr with the release of products from new units and mounting inventory among suppliers. |

https://www.ccfgroup.com/newscenter/newsview.php?Class_ID=D00000&Info_ID=2023022830071

February 28, 2023

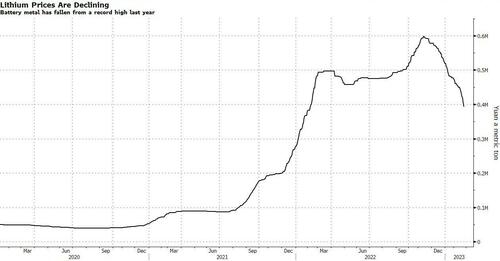

Lithium and China

Lithium Industry Reeling After China Shutters 10% Of Global Supply

by Tyler Durden

Monday, Feb 27, 2023 – 06:00 PM

That’s a nice little EV industry you got over there in the US, it’s be a shame if suddenly it found itself without the most important commodity.

That’s one way to interpret what just happened in China; another – a less cynical – is the way Bloomberg described it, namely that China’s lithium industry itself is reeling as its top production hub – responsible for around a 10th of the world’s supply – faces sweeping closures amid a government probe of environmental infringements.

The crackdown in Yichun, Jiangxi province, also known as the country’s “Lithium capital” follows a local lithium frenzy over the past year as miners raced to feed rampant demand for the battery material — and to benefit from record global prices. Now, they’re grappling with a close-up inspection by environment officials sent from Beijing.

According to Yicai newspaper, ore-processing operations in Yichun have been ordered to stop as investigators probe alleged violations at lithium mines. That, Bloomberg notes, threatens somewhere between 8% and 13% of global supply, according to various analyst estimates, although it’s unclear for how long the immediate shutdowns will last.

The sudden probe injects a big dose of uncertainty into a lithium market that has seen prices drop, bringing some relief to EV manufacturers, as more global output emerges. Jiangxi province was expected to be a big source of extra supply, from a lithium-bearing mineral known as lepidolite.

“This supervision may mean that the inspection and control over lepidolite mining in China will be more stringent in the future,” said Susan Zou, analyst at Rystad Energy. Companies with operations in Yichun include major battery manufacturers Contemporary Amperex Technology Co. and Gotion High-Tech Co., whose shares both fell more than 1% on Monday.

Due to the ongoing probe, all lepidolite mining in Yichun aside from those by a state-owned company have been suspended, but refineries are still operational, Daiwa analysts Dennis Ip and Leo Ho said.

Global lithium prices soared to a record high last year as demand from China’s booming electric-vehicle industry outstripped production. And, as so often happens in commodities, where the cure to high prices is more supply, leading to lower prices, this high-profit, high-demand environment has encouraged miners to skirt regulations.

Some companies had already been targeted for infringements, including incidents of pollution, over the past year. This is a much wider crackdown, and involves officials from central government departments including the Ministry of Natural Resources.

Yucai added that Beijing will mainly look at violations at lithium mines and seek to guide the “healthy development” of the industry; they will largely target those mining without permits or with expired licenses.

Curiously, a recent Goldman report found that the Chinese car industry’s demand for lithium has fallen by more than half in recent months, a dramatic reversal that will drive a further slump in the market. Meanwhile, Chinese prices have dropped more than 30% from last year’s peak.

According to calculations form Citic Securities analyst Bai Junfei, a month-long mining halt in Yichun would reduce lithium output by an amount equivalent to around 13% of the world’s total. Rystad Energy, a consultancy, estimated the amount at 8%.

“At present, the market speculation is that the probe may stop after the two sessions in China next month,” Rystad’s Zou said, referring to the annual parliamentary meetings due early March.

https://www.zerohedge.com/markets/lithium-industry-reeling-after-china-shutters-10-global-supply