Current Affairs

February 8, 2024

U.S. Housing

2023 Review and 2024 Outlook For US Housing Market

PUdaily | Updated: February 7, 2024

2023 has come and gone in a rush. In the past year, the US housing market witnessed a notable storm, with one of the most talked-about topics being the skyrocketing mortgage rates. Since the end of 2022 when the 30-year fixed mortgage rate broke 6% for the first time, it climbed to over 7% in 2023, and even approached the high of 8%, undoubtedly shattering many people’s home-buying dreams. At this point, rumours about the burst of housing bubble spread everywhere. Looking back, to find a similar scenario of high mortgage rates, we have to go back over 20 years to the turn of the century. Over the years, people have gradually grown accustomed to a low interest rate environment. Since the real estate market recovery in 2012, the average 30-year mortgage rate has only been 4.14%, making the current figure of over 7% exceptionally glaring.

Despite the record-high mortgage rates in 2023, housing prices did not fall as expected, but instead continued to stand firm. An expert pointed out, “High rates reduce housing demand, but also more significantly reduce housing supply”. The US housing inventory is only equivalent to a 2.5-month supply at the current sales pace, far below the balanced level of 6-month.

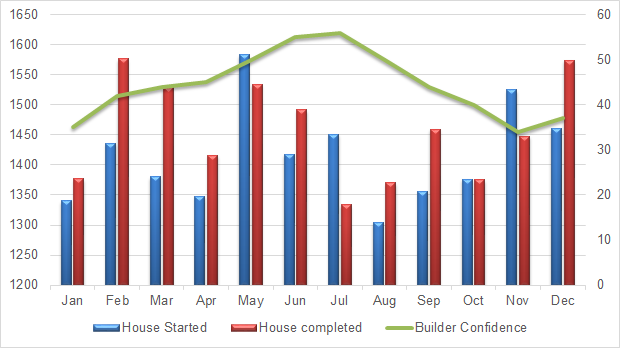

In 2023, housing starts in the US totaled 16.98 million, a year-on-year decrease of 8.8%, according to FRED. Meanwhile, housing completions increased by 5.5% to 17.48 million. In addition, the Housing Market Index (HMI) published by the National Association of Home Builders (NAHB) dropped to 44% in 2023, a 15% decrease from the previous year, further confirming the view that “high rates reduce housing demand, but also more significantly reduce housing supply”.

Figure 1: US Housing Completions, Housing Starts & HMI 2023 (1,000 units, %)

Data source: FRED, NAHB

In 2023, the available housing inventory was relatively low due to sellers unwilling to give up previously locked-in low interest rates. Luckily, in 2024, buyers can expect to see an improvement in the number of homes for sale. Lawrence Yun, chief economist at National Association of Realtors (NAR), stated that overall housing inventory could increase by as much as 30%, with some markets experiencing even more rapid growth.

The number of mortgage applications for home purchases in the US rose to the highest level since April 2023, indicating an increase in housing loan demand due to borrowing costs remaining below 7%. Data from the Mortgage Bankers Association (MBA) showed that mortgage applications for home purchases in the US increased 7.5% to 174.3 in the week ended January 19. Real estate websites like Zillow predicted that rates will remain between 7% and 7.5% throughout the year, while NAR was more optimistic, expecting rates to average below 7% in early spring (home buying season) and to drop to around 6.3% by the end of the year. In contrast, Realtor.com predicted that rates would average 6.5% by the end of 2024.

In summary, with mortgage rates averaging 6.61% and trending downward by the end of December, the US real estate market may experience a recovery in 2024.

January 25, 2024

Propylene Dynamics

US propylene market surges during January amidst PDH outage

MRC — The US Propylene market experienced a turbulent January 2024, marked by relentless price hikes fueled by a confluence of factors, said Chemanalyst.

The trend, already bullish throughout December, gained further momentum due to a combination of limited supply and surging demand. While a scheduled maintenance shutdown at Enterprise Products Partners’ Mont Belvieu plant contributed to the tight supply, the adverse effect was the December 4th outage of their newest 750,000 mt/year PDH unit. This unexpected event, triggered by an operational issue, sent shockwaves through the Propylene landscape. The sudden removal of a major production artery from the equation drastically reduced readily available Propylene, sending scarcity levels soaring.

As per the recent assessment, the Propylene market in the USA keeps on rising with a hike of 10% at the beginning of January 2024 due to supply constraints. Therefore, Propylene Polymer Grade DEL US Gulf assessed at 1090 USD/tonne with a surge of 100 USD during the third week of January 2024. This bullish trend was attributed to an outage of the PDH plant in Texas whose immediate impact was a tightening of supply with a major production artery suddenly out of commission, and readily available propylene dwindling.

Adding fuel to the fire, US Propane and Propylene inventories dipped below more than 90 million barrels for the first time in three months, according to data from the US Energy Information Administration. This declining stockpile further exacerbated the scarcity, creating a perfect storm for price hikes. The affected PDH units have hampered the production of Propylene, leading to a decrease in the overall supply. The magnitude of the impact depends on the duration of an outage which keeps on affecting the margins. As supply falls, the price of the product has skyrocketed during this timeframe. This reflects the increased demand for the limited available product, which is a vital feedstock for many downstream industries, especially Polypropylene production. A shortage of the product can lead to production slowdowns or shutdowns in these industries, impacting sectors like packaging, textiles, and automotive components. The spot export US Polypropylene market, heavily reliant on readily available Propylene and the tightened conditions, slowed movement, and skyrocketing prices became the new reality. This domino effect also intensified inflationary pressures across the industry, as cost burdens stemming from increased supplier prices for metals and plastics, coupled with higher transportation charges, cascaded down the chain.

As per ChemAnalyst, the price of Propylene in the US market is expected to sustain its uptrend throughout January 2024. While the immediate shock of the Enterprise outage may have subsided, its long-term effects continue to ripple through the Propylene landscape. The spot exports US Propylene market, though recovering from the initial shock, still grapples with the consequences of the disrupted supply chain. The unexpected outage, coupled with pre-existing scarcity and inflationary pressures, created a complex landscape with a bullish future.

We remind, Pengerang Refining and Petrochemical (PRefChem), a collaborative venture between Malaysia’s major petrochemical entity Petronas and the state-owned Saudi oil company Saudi Aramco, recently announced a tender on January 19. The tender is for the sale of a spot shipment of propylene with the intention of swift shipment scheduled for the conclusion of January. Specifically, the batch, totalling 5 thousand tons, is slated to be shipped from PRefChem’s facility in Pengerang, located in Johor, Malaysia, on January 28-30.

https://www.mrchub.com/news/411204-us-propylene-market-surges-during-january-amidst-pdh-outage

January 22, 2024

American Manufacturing

The Reality of American “Deindustrialization”

Manufacturing in the United States has not disappeared but has been transformed and very much remains a vital part of the country’s economic fabric.

October 24, 2023 • Publications

- Despite rhetoric from some politicians that decades of unfettered globalization have hollowed out the U.S. industrial base, the United States remains a manufacturing powerhouse, accounting for a larger share of global output than Japan, Germany, and South Korea combined. In key industries such as autos and aerospace, the United States ranks among the global leaders and is the second‐largest manufacturing economy overall.

- That manufacturing employs fewer Americans and accounts for a lower percentage of gross domestic product than in decades past is not cause for serious concern, unique to the United States, or primarily owed to globalization. These trends have instead been largely driven by productivity gains and shifting consumer preferences in favor of services.

- The premium placed by policymakers on manufacturing employment is misplaced. Unlike most of the post–World War II era, jobs in this sector now provide lower compensation than similar roles elsewhere in the economy, while the diversified nature of the U.S. economy is a source of economic resiliency, not weakness.

An unfortunate perception among many commentators and political leaders is that the United States “doesn’t make anything anymore.” According to this narrative, the country is a former manufacturing titan brought low by the forces of globalization that have left the rusting hulks of once‐humming factories in its wake. Instead of producing their wares in locations such as Pittsburgh and Peoria, some globalization critics claim U.S. corporations have shifted their operations to take advantage of vastly lower wages in China, Mexico, and elsewhere. Factory closures, these critics insist, have forced American workers to trade well‐paid work on the assembly line for less financially rewarding jobs in the service sector. In this telling, trade liberalization’s legacy is one of industrial decline, wrecked lives, and ruined communities.

Reports of American manufacturing’s death, however, are greatly exaggerated. While it is undeniably true that certain manufacturing industries—particularly labor‐intensive, low‐tech ones—are no longer primarily located in the United States, many other, more advanced ones have flourished. Thus, factories producing consumer staples such as textiles and furniture, for example, have made way for facilities that produce products less often found in retail stores, such as chemicals and machinery. At the same time, productivity gains unleashed by automation and other technologies have enabled manufacturing output to remain near record highs even as direct manufacturing employment has declined. Many other Americans, meanwhile, still work in manufacturing or are involved in the manufacturing process through the design of new products, even if their employers don’t operate actual factories.

In short, manufacturing in the United States has not disappeared but has been transformed and very much remains a vital part of the country’s economic fabric.

Deindustrialization Worries Are Nothing New

Politicians have sought to advance and capitalize on worries of industrial decline for decades. During his 1984 presidential campaign, Walter Mondale told steelworkers in Cleveland that President Ronald Reagan’s policies were “turning our industrial Midwest into a “rust bowl”—a turn of phrase soon modified and popularized by the media as “Rust Belt.” This region’s misfortunes—and the broader alleged plight of American manufacturing—have been an enduring feature of the political discourse ever since.

Some of this focus is the natural result of politicians’ and the media’s long‐standing attraction to bad news and nostalgia: Factory closures make news (or even movies); factory expansions don’t. And the industrial Midwest’s long‐standing importance to the U.S. presidential election means that the region will always receive outsized political attention, regardless of economic realities elsewhere in the country.

Yet certain statistics also lend a superficial plausibility to claims of domestic manufacturing’s dire state. U.S. manufacturing employment peaked in 1979 at 19.5 million employees, stood at just over 17 million in 2000, and has since dropped to approximately 13 million as of January 2023. In relative terms, the percentage of workers employed in manufacturing has more than halved since 1980 as did its share of gross domestic product (GDP) from 1978 to 2018.

Such declines also correlate with a growing embrace of trade liberalization over this period via such initiatives as the North American Free Trade Agreement, conclusion of the Uruguay Round of trade negotiations and agreement to establish the World Trade Organization (WTO), and China’s accession to the WTO (although the decline was already underway when each of these took place).

No great effort is therefore required to grasp why many Americans believe that the country’s industrial sector—and the well‐paying jobs that go with it—has received a hammer blow at the hand of globalized commerce more generally and China in particular. But that doesn’t mean it’s true. A fuller and more accurate picture reveals a sector in remarkably good health whose indications of decline are far less worrisome when placed in proper context.

What Is Manufacturing?

Before delving into the state of U.S. manufacturing, it is worth examining what the industry entails. Although the term may conjure images of glowing hot steel or new automobiles rolling off the assembly line, manufacturing runs a wide gamut of activities. According to the Bureau of Labor Statistics, manufacturers are “… establishments engaged in the mechanical, physical, or chemical transformation of materials, substances, or components into new products.” These include not only the production of heavy machinery and sophisticated devices but also other items, such as fruit and vegetable preserves, stationary, and beverages. By this definition, Coca‐Cola is every bit the manufacturer as Boeing, General Motors, or U.S. Steel.

But the dividing line can sometimes be ambiguous. U.S.-headquartered Nike, for example, engages in the design and marketing—key parts of the manufacturing process—of footwear, apparel, and sports equipment. The actual production of these items, however, is outsourced to independent contractors. Global semiconductor leader Nvidia follows much the same approach. Should these “factoryless goods producers” be considered manufacturers? So far, the government’s answer is no. Nevertheless, such firms are key contributors to the manufacturing process and generate considerable value, jobs, and innovations.

The United States Remains a Manufacturing Powerhouse

Regardless of how one defines manufacturing, the United States is clearly one of its heavy hitters. In 2021, it ranked second in the share of global manufacturing output at 15.92 percent—greater than Japan, Germany, and South Korea combined—and the sector by itself would constitute the world’s eighth‐largest economy. The United States was the world’s fourth‐largest steel producer in 2020, second‐largest automaker in 2021, and largest aerospace exporter in 2021.

That the United States has achieved these rankings with a relatively small industrial workforce is a testament to its world‐beating productivity: the country ranks number one in real manufacturing value‐added per worker by a large margin. With value‐added of over $141,000 per worker in 2019, the United States bested second‐ranked South Korea by over $44,000. The gap with China was over $120,000 per worker (Figure 1).

Manufacturing output has also remained strong in historical terms, at only 5 percent lower than its all‐time high achieved in the final quarter of 2007 (Figure 2). Measured by real value‐added, the sector reached its highest level in 2022 (Figure 3).

Read more here: https://www.cato.org/publications/reality-american-deindustrialization#united-states-remains-manufacturing-powerhouse

January 21, 2024

Existing Home Sales Near Bottom

2023 Was The Worst Year On Record For Existing Home Sales

by Tyler Durden

Friday, Jan 19, 2024 – 10:35 AM

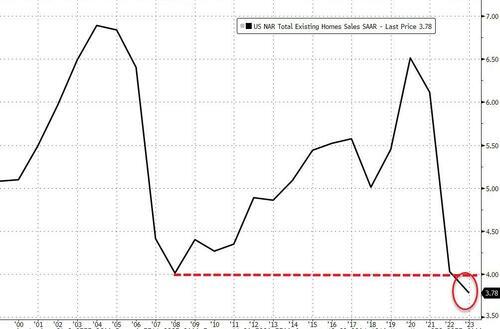

Existing Home Sales fell 1.0% MoM in December, worse than the +0.3% expected, leaving sales down

Source: Bloomberg

Total Existing Home Sales in December 2023 were 3.78mm – the lowest SAAR since 2010…

Source: Bloomberg

But, on an annual basis, this is the worst year on record (back to at least 1995)..

Source: Bloomberg

“The latest month’s sales look to be the bottom before inevitably turning higher in the new year,” said NAR Chief Economist Lawrence Yun. “Mortgage rates are meaningfully lower compared to just two months ago, and more inventory is expected to appear on the market in upcoming months.”

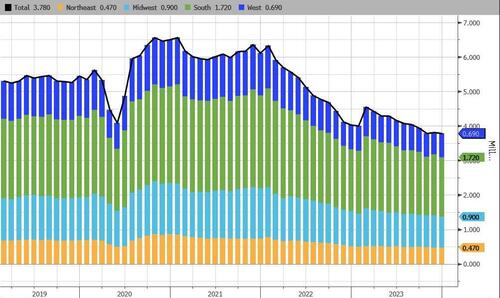

Existing Home Sales were flat in the Northeast, lower in the MidWest and the South, and up marginally in the West (driven by single-family-home sales as condo sales declined)…

Source: Bloomberg

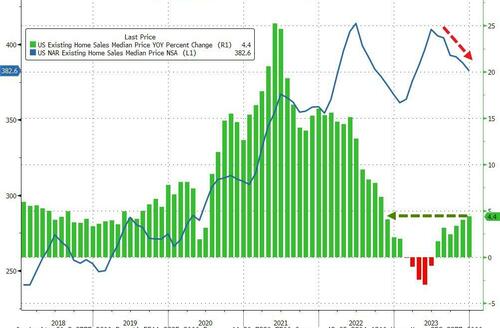

Last month, the number of previously owned homes for sale dropped to 1 million, the lowest since March.

At the current sales pace, selling all the properties on the market would take 3.2 months.

Realtors see anything below five months of supply as indicative of a tight resale market.

That lack of inventory is helping to keep prices elevated.

The median selling price climbed 4.4% to $382,600 in December from a year ago, reflecting increases in all four regions. Prices hit a record of $389,800 in 2023.

Source: Bloomberg

But, with mortgage rates having tumbled (and given the lagged responses), are sales about to start rising again?

Source: Bloomberg

https://www.zerohedge.com/markets/2023-was-worst-year-record-existing-home-sales

January 8, 2024

German Deindustrialisation

De-industrialisation in Germany dramatically reduces emissions in 2023

Germany led Europe in reducing emissions in 2023, but the fall had more to do with the painful de-industrialisation the country is going through as a result of the end of cheap Russian gas rather than green policies. / bne IntelliNews

By bne IntelliNewsJanuary 5, 2024

Germany led the way in reducing emissions in 2023, but the fall had more to do with the dramatic de-industrialisation due to the effects of the war in Ukraine and soaring energy costs than it did with green policies.

Greenhouse gas emissions in Germany fell by approximately 20% in 2023, reaching their lowest level since the 1950s, according to a report by Berlin-based think-tank Agora Energiewende, as reported by the Financial Times on January 4.

The country emitted 673mn tonnes of carbon dioxide equivalent in 2023, with about half of the reduction attributed to a decline in coal-fired power generation.

However, emissions from the construction and transport industries remained largely unchanged in 2023, following several years of failure to reach reduction targets. The chemical industry, Germany’s third largest industrial sector, has also lost 23% of its production volume within two years, Handelsblatt reports. As a result, Germany is expected to miss EU-wide emission reduction goals as set out under the so-called Effort Sharing Regulation, Agora said.

Leading industrial managers in the German chemistry are sceptical as to whether the industry will be able to return to the production volume of 2021 in the next few years. “We are in the middle of a deep, long valley,” Markus Steilemann, president of the Chemical Industry Association (VCI) and CEO of Covestro, told Handelsblatt, one of Germany’s leading business newspapers.

0124 EURO German chemical production index HANDELSBLATT

This failure highlights that the headline reduction in emissions has more to do with Germany’s economic slowdown than successful implementation of green policies. Lethargic German industrial activity, influenced by the war in Ukraine and energy price crises, played a crucial role, accounting for half of the emissions drop, the report found, whereas the growth in renewable energy contributed 15% to the fall in emissions.

However, the leading German industrial companies report that the fall in customer orders since spring 2023 is now slowing and the market appears to be finding a new, albeit lower, equilibrium, according to leading suppliers such as BASF and the world’s largest chemical retailer Brenntag. But that’s not enough to create any optimism, because there is a lack of real growth. German companies’ hopes are based on a slow recovery starting in the second half of 2024.

As reported by bne IntelliNews, the sanctions on Russia and the halt in delivery of Russian piped gas after the Nord Stream 1 & 2 gas pipelines were destroyed last September have had a heavy impact on Germany’s heavy industry.

Accounting for about a quarter of German GDP – twice the level of other large European powers – some 10% of heavy industry has been forced to close down or dramatically reduce production.

German chemical companies are now very cautious when it comes to investing at home: around 40% of them will reduce their investments in Germany in 2023 and 2024, according to recent industry survey. However, the majority of companies are planning to increase foreign investments or leave completely.

Up to a third of Germany’s heavy industry is either planning to move, or has already started the process of moving, abroad to lower-cost markets. The biggest hope for the chemical industry is China, where almost half of global chemical demand already comes from.

The German industrial lobby has said that German heavy industry should start recovering in 2025, but that assumes energy prices will fall to previous levels. A recent IMF white paper concluded that the higher prices, caused by the remake of Europe’s energy markets and the end of cheap Russian gas imports, means the higher energy prices are likely to be a permanent change that will fundamentally affect Germany’s business model.

Germany’s economy has already stalled as a result of the seismic changes to its economic make-up. Agora said that while preliminary figures showed German economic output dropped 0.3% in 2023, the equivalent figure for energy-intensive production in industries such as chemicals and steel was 11%, the FT reports.

German Vice-Chancellor Robert Habeck acknowledged the decline in fossil fuel use but highlighted the importance of distinguishing between the impact of the war and energy price crises on industrial production. He emphasised the need to maintain Germany as a strong industrial location while transitioning to climate neutrality.

Siegfried Russwurm, president of Germany’s industrial lobby, criticised the government for not grasping the critical situation facing manufacturing businesses, the FT reported. Rising energy costs and a lack of government support were identified as challenges for industries aiming to be both green and globally competitive.

Agora Energiewende stressed the importance of preventing emissions from being relocated abroad and called for a stable framework to encourage investment in climate-friendly technologies. The think-tank highlighted the need for an “investment offensive” to achieve long-term goals, including the rollout of hydrogen pipelines and improvements to electricity grids.

While the 21% drop in emissions is a positive development, after Germany shuttered its six nuclear power stations last year it has been forced to start importing electricity. However, that also contributed to the drop in its emissions, as almost half of electricity imports came from renewable sources, mainly hydro and wind, and another quarter from nuclear. Coupled with a 5% increase in domestic renewable energy supplies thanks to record solar and wind production investments, this took the share of total renewable energy in Germany to more than 50% for the first time.

https://intellinews.com/de-industrialisation-in-germany-dramatically-reduces-emissions-in-2023-306518