Current Affairs

January 4, 2024

Spot Container Rates Rise

Spot Container Rates Surge By 173% Due To Red Sea Disruptions

by Tyler Durden

Thursday, Jan 04, 2024 – 07:45 AM

Drone and missile attacks by Yemen’s Iran-backed Houthi militants on commercial vessels in one of the world’s busiest shipping lanes have resulted in firms sending ships around the Cape of Good Hope, entirely avoiding the Red Sea region. Reroutings have added a week or more to sailings, thus straining cargo capacity, which, in return, has sent containerized shipping rates soaring.

Bloomberg cites new data from Freightos, a cargo booking and payment platform, that shows the spot rate for a 40-foot container from Asia to northern Europe has jumped 173% to $4,000 since mid-December.

The price for a 40-foot container from Asia to the Mediterranean has increased to $5,175, as reported by Freightos. Additionally, they noted that major shippers have announced even higher prices, surpassing the $6,000 mark for this route in the next two weeks. Shipping rates from Asia to the East Coast of North America also soared 55% to $3,900.

The Red Sea connects to Egypt’s Suez Canal and is the fastest way to transport consumer goods, petroleum products, and food from Asia and the Middle East to Europe and North America. About 10% to 12% of global trade flows through the critical waterway.

On Wednesday, no container ships with destinations to North America and Europe were transiting the Red Sea. These vessels were rerouted to Africa’s southern Cape of Good Hope to avoid the attacks – adding anywhere from 7 to 20 days to their voyages. This indicates that the Pentagon’s Operation Prosperity Guardian has failed to protect commercial vessels in the region.

Spot container rates are moving higher because diversions around the Cape of Good Hope add extra time to sailings, reducing capacity.

New data from the International Monetary Fund’s PortWatch platform, produced with Oxford University, shows that for the ten days through Monday, sails through the vital Suez Canal trade route plunged 28% compared with a year earlier. This means about 3.1% of global trade has been rerouted from the Red Sea.

Even though container prices are far off Covid highs, prices are more than double from early 2019 levels and come at a time when central banks have unleashed more than a year of interest rate hikes to combat inflation.

Meanwhile, Red Sea disruptions are spreading across the shipping industry, leading to a surge in oil tanker shipping costs.

Shipbroker Braemar said daily shipping costs for a tanker from the Mediterranean to Japan through the Suez jumped from $8,000 a day in early December to $26,000 earlier this week.

“Any route involving the Red Sea is red hot,” the Braemar analysts said.

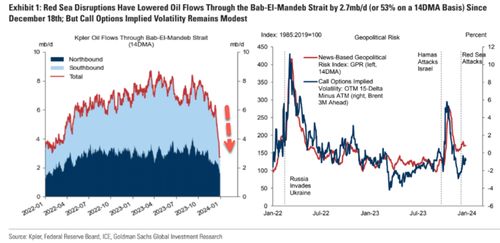

In a separate note, Goldman’s Daan Struyven shows oil flows via tankers through the Bab-El-Mandeb strait at the southern end of the Red Sea have plunged.

Struyven said, “We estimated a potential $3-4/bbl boost to crude prices from a hypothetical prolonged and full redirection of all oil flows through the Bab-El-Mandeb strait at the southern end of the Red Sea…”

The biggest fear for energy prices, shipping costs, and supply chains is if a regional conflict erupts across the Middle East.

https://www.zerohedge.com/commodities/spot-container-rates-surge-173-due-red-sea-disruptions

January 2, 2024

5 Years of U.S. Vehicle Sales

January 1, 2024

Gasoline Consumption Keeps Growing

Record Global Gasoline Consumption Defies IEA Forecast

By Tsvetana Paraskova – Dec 28, 2023, 1:30 PM CST

Global gasoline consumption hit a record 26.9 million barrels per day (bpd) this year, exceeding the 2019 peak and defying estimates that the last pre-pandemic year was the time when gasoline demand worldwide would peak.

The data, reported by Bloomberg Opinion columnist Javier Blas, shows the latest figures from the International Energy Agency (IEA). The same agency, which has been strongly advocating for a faster energy transition for years, had predicted just this year that 2019 was the peak demand for gasoline globally.

Back in June, in its Oil 2023 annual report, the IEA said that “Growth is set to reverse after 2023 for gasoline and after 2026 for transport fuels overall.”

“Gasoline demand will be disproportionately impacted as EVs progressively replace vehicles with internal combustion engines (ICE),” the IEA said, adding that “This means that the fuel is likely to exhibit the earliest and most pronounced peak in demand.”

And it also said that “Usage will never return to 2019 levels and the post

pandemic peak could come as early as 2023. Following a brief plateau, the decline is forecast to accelerate from 2026 onwards.”

However, the IEA’s latest figures not only show that 2019 wasn’t the peak demand year for global gasoline consumption, but that demand in both 2023 and 2024 would surpass the pre-pandemic levels.

Per the latest data reported by Bloomberg’s Blas, gasoline demand globally is set to further rise next year, to top 27 million bpd.

In the June report, the IEA predicted that “Following a brief plateau, the decline is forecast to accelerate from 2026 onwards, with 2028 demand 900 kb/d below that of 2019.”

The IEA also famously said earlier this year that global demand for all three fossil fuels – oil, natural gas, and coal – is set to peak before 2030, which undermines the case for increasing investment in fossil fuels.

By Tsvetana Paraskova for Oilprice.com

December 28, 2023

Car Prices Continue to Grow

Visualizing The Growth Of New Car Prices In The US

by Tyler Durden

Thursday, Dec 28, 2023 – 05:45 AM

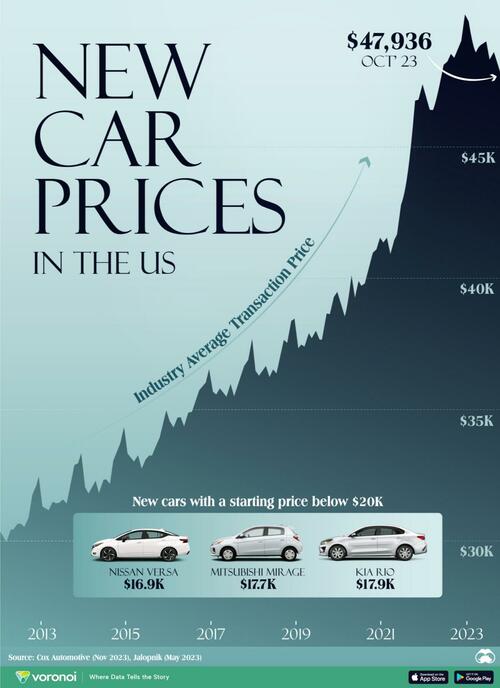

New car prices have soared in recent years.

As a result, those looking for a cheap new car have very few options in today’s market. While average transaction prices for new cars declined 1.4% year-over-year as of October, they have increased to an average price of $47,936—roughly a 60% increase over the last decade.

In the following graphic, Visual Capitalist’s Marcus Lu shows the steep rise in new car costs, with data from Cox Automotive.

New Vehicle Price Growth

A host of factors can explain the jump in new car prices.

These include more standard features (which drives up the base cost of a vehicle), as well as shifting consumer preferences towards pricier crossovers & SUVs.

Supply chain issues during the COVID-19 pandemic also sent prices skyrocketing, though they’ve come down slightly throughout 2023.

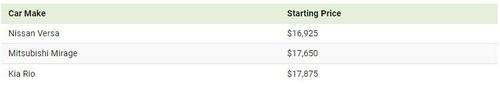

While the average transaction price of a Tesla falls around $53,000, there are options from other car makers that are more affordable. Here are new cars with a starting price below $20,000:

The above low cost vehicles are all from legacy car makers. These companies have the advantage of accessing large amounts of capital, manufacturing skills, and powerful brands.

Still, as the industry evolves, the new companies driving electric vehicle production could reshape the industry, presenting challenges for legacy companies.

https://www.zerohedge.com/personal-finance/visualizing-growth-new-car-prices-us

December 26, 2023

Good Update on Chinese Furniture and Mattresses

Upholstered Furniture: The Leader in Polyether Polyols

PUdaily | Updated: December 19, 2023

Furniture industry status

China’s furniture industry has intensified competition and increased concentration: China’s furniture industry has developed into an important industry with mainly mechanized production, continuous improvement of technical content and continuous emergence of well-known brands. With the country’s attention to the quality of architectural decoration products and the rise of consumer brand awareness, China’s furniture market is gradually moving towards brand competition. By improving the technical level, strengthening quality management, and increasing investment in advertising and marketing, the brand advantages of leading enterprises in the furniture industry have gradually emerged, which has led to the continuous upgrading of the level of industrial competition, and promoted the development trend of the whole industry driven by brand enterprises and continuous innovation, thus improving the concentration of China’s furniture industry.

China’s furniture industry will develop in the direction of new retail, new marketing and new services: With the rise of a new generation of consumer groups, people’s lifestyle and life concept have undergone changes, furniture products have also put forward higher requirements, the choice of furniture products more pursuit of personalized and fashionable, the future of customized furniture personality, fashion, time saving, labor saving, will conquer more consumer groups. Furniture companies need to pay more attention to brand building and product design to meet the new needs of consumers for furniture products, and the furniture industry as a whole is developing in the direction of new retail, new marketing and new services.

Furniture industry anti-dumping policy impact

With the continuous development of global trade, trade barriers and tariffs between countries have become an important factor hindering the process of globalization. Among them, anti-dumping measures, as a means of trade protection, have been frequently used by many countries in recent years. As the world’s largest mattress producer, China’s mattress exports are also facing anti-dumping pressure from the United States.

Under the influence of the anti-dumping strategy of the United States for China’s mattress, China’s furniture enterprises have gone through two stages. The first phase is from 2018 to 2021, given that the United States has imposed tariffs of up to 25 percent on almost all household categories in China, of which mattresses are also subject to anti-dumping duties. During this period, China’s foreign trade household industry began to transfer to Southeast Asia, through Vietnam, Thailand and other Southeast Asian countries to export to Europe and the United States. The second stage is from 2021 to the present, and in April 2021, the US Department of Commerce officially announced the high anti-dumping tax rate against the seven countries. Chinese home furnishing enterprises have to adjust their strategy again, on the one hand, to dig deep into the domestic domestic market, on the other hand, to build factories in the United States and Europe. For the domestic domestic market, furniture companies will focus on expanding the sinking market. Sinking market is one of the biggest consumption growth points in China, with a huge market size and increasing purchasing power. According to data from the National Bureau of Statistics, the per capita disposable income of rural residents in China has increased year by year, with a year-on-year growth of 7.6% from January to September 2023, bringing more opportunities for “high-quality and low-cost” mattresses. For overseas demand, even in the face of Chinese workers to sea difficulties, high labor costs in the United States pain points, furniture companies still choose to build factories in Europe and the United States. In the case of Dream Lily, under the influence of anti-dumping policies, the company accelerated the production capacity of the factory in the eastern United States, and at the same time built a new factory in the western United States to meet the order demand of the American market. Pudaily believes that furniture companies with forward-looking layout of U.S. production capacity can better meet the local market demand, thus benefiting from this round of anti-dumping.

Us mattress dumping timeline

| Targeted Country | Timeline | Content |

| China | 2018/10/10 | In response to the application submitted by a number of mattress companies in the United States on September 18, the United States Department of Commerce announced the launch of an anti-dumping investigation on mattresses imported from China |

| China | 2019/10/18 | On October 18, 2019, the US Department of Commerce announced a final anti-dumping ruling on mattresses imported from China: ruled that the compulsory response enterprise Healthcare Co., Ltd. The dumping rate is 57.03%, the dumping rate of Jinorsi Light Industrial Products Co., LTD., JiNorsi (Xiamen) Light Industrial Products Co., LTD., JiNorsi (Zhangzhou) Light Industrial Products Co., Ltd. is 192.04%, the dumping rate of other exporters with separate tax rates is 162.76%, and the general dumping rate of China is 1731.75%. |

| China, Cambodia, Indonesia, Malaysia, Serbia, Thailand, Turkey and Vietnam | 2021/4/21 | The US International Trade Commission (ITC) voted to make a final determination of anti-dumping industrial injury for Mattresses imported from Cambodia, Indonesia, Malaysia, Serbia, Thailand, Turkey and Vietnam, and a final determination of anti-subsidy industrial injury for mattresses imported from China. |

| Mexico, Philippines, Poland, Slovenia, Spain, Taiwan, Bosnia and Herzegovina, Bulgaria, Myanmar, India, Italy, Kosovo | 2023/7/28 | The U.S. mattress industry and several trade associations filed anti-dumping duty complaints (AD) against mattresses from 13 countries and regions, including Mexico, the Philippines, Poland, Slovenia, Spain and Taiwan, as well as Bosnia and Herzegovina, Bulgaria, Myanmar, India, Italy and Kosovo, as well as against mattresses from Indonesia. Filing a Countervailing Duty Complaint (CVD) |

Demand for polyether polyols in furniture industry

Sofas and mattresses consume more polyether in upholstered furniture, accounting for more than 80% of the total consumption. Sofa fillings are basically polyurethane, a single sofa products, ordinary polyether accounted for about 45%-60%, 10kg sponge about x kg x kg polyether; The proportion of ordinary polyether in the thin mattress is about 50%-60%, and the 10kg sponge is about x kg-x kg of ordinary polyether. In the soft furniture industry, although the overall demand is limited under the influence of the real estate downturn, under the development trend of “everyone lives” and customized integration, the growth of leading enterprises and high-quality enterprises is significantly higher than the industry as a whole, which has led to the steady growth of polyether consumption in the soft furniture industry. According to estimates, in 2023, the polyether consumption of China’s upholstered furniture industry is about xx million tons, with a growth rate of about xx%.

If you are interested in the Chinese furniture market in 2023 and the consumption of polyether polyols,

Welcome to inquire and subscribe: PUdaily’s “2023 Asia-Pacific PPG Market Research Report”.