Current Affairs

July 13, 2022

Container Rates Falling

Container Rates Slump As “Bullwhip Effect” Enters Terminal Phase

by Tyler DurdenTuesday, Jul 12, 2022 – 08:25 PM

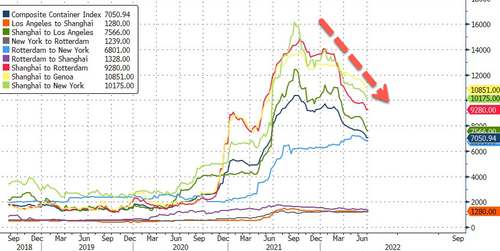

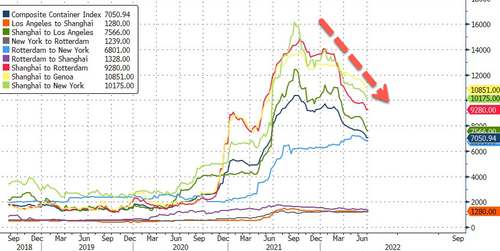

The infamous “bullwhip” effect strikes as inventory gluts force U.S. importers to dial back shipments from overseas, driving down rates for ocean freight, which could end up causing a so-called “freight recession.”

WSJ reports U.S. companies are renegotiating shipping agreements they made during the virus pandemic highs. Some are hedging in the spot market to reduce costs associated with long-term contracts.

San Francisco-based freight forwarder Flexport said softening demand lowers freight rates but remains well above pre-pandemic levels.

Last week, the spot rate to ship a container from China to the U.S. West Coast was still four times higher than the same period in July 2019, online freight marketplace Freightos’ data shows.

A recent shipment by Carbochem Inc., an importer of activated carbon used in water treatment, cost around $16k from China to Chicago, down from $21k a year ago.

“We need to be looking at probably less than $10,000 to get anywhere close to the levels we were before and be competitive,” the firm’s president, Gavin Kahn, said.

Shipping data from Bloomberg shows international freight rates have slumped over the last six months, mainly because of China shutdowns. However, U.S. importers reducing demand for cargo ships has accelerated the downward move.

The $1.5bln slide in U.S. consumer goods in May might have been a clear indication that demand for overseas products was waning and comes as Americans reduced spending on durable goods, something Target and Walmart pointed out last month.

We have detailed for readers in the last two months the terminal phase of the bullwhip effect was upon us:

- Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff

- Deflationary Tsunami On Deck: A “Tidal Wave” Of Discounts And Crashing Prices

- Michael Burry Agrees: “Bullwhip Effect” Will Force Powell To Pivot On Rate Hikes And Q.T.

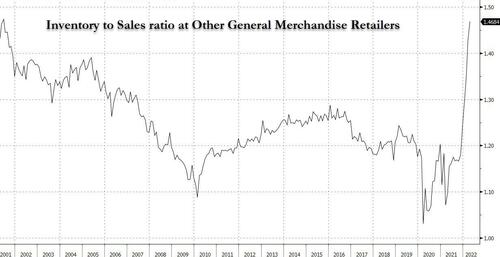

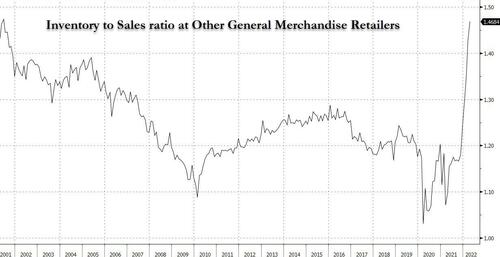

The side effect of soaring inventory to sales ratios is that retailers must liquidate inventories as consumer spending habits change. This causes retailers to reduce demand from overseas suppliers (read: Samsung Asks Component Makers To Delay Shipments Amid Build-Up In Inventories), which diminishes the need for ocean freight shipping.

In late March, FreightWaves CEO Craig Fuller warned that retailers would need to unload inventory amid signs of demand destruction. He correctly said this would cause a freight recession now could be coming true as container rates decline.

https://www.zerohedge.com/markets/shipping-rates-slump-bullwhip-effect-enters-terminal-phase

July 13, 2022

Container Rates Falling

Container Rates Slump As “Bullwhip Effect” Enters Terminal Phase

by Tyler DurdenTuesday, Jul 12, 2022 – 08:25 PM

The infamous “bullwhip” effect strikes as inventory gluts force U.S. importers to dial back shipments from overseas, driving down rates for ocean freight, which could end up causing a so-called “freight recession.”

WSJ reports U.S. companies are renegotiating shipping agreements they made during the virus pandemic highs. Some are hedging in the spot market to reduce costs associated with long-term contracts.

San Francisco-based freight forwarder Flexport said softening demand lowers freight rates but remains well above pre-pandemic levels.

Last week, the spot rate to ship a container from China to the U.S. West Coast was still four times higher than the same period in July 2019, online freight marketplace Freightos’ data shows.

A recent shipment by Carbochem Inc., an importer of activated carbon used in water treatment, cost around $16k from China to Chicago, down from $21k a year ago.

“We need to be looking at probably less than $10,000 to get anywhere close to the levels we were before and be competitive,” the firm’s president, Gavin Kahn, said.

Shipping data from Bloomberg shows international freight rates have slumped over the last six months, mainly because of China shutdowns. However, U.S. importers reducing demand for cargo ships has accelerated the downward move.

The $1.5bln slide in U.S. consumer goods in May might have been a clear indication that demand for overseas products was waning and comes as Americans reduced spending on durable goods, something Target and Walmart pointed out last month.

We have detailed for readers in the last two months the terminal phase of the bullwhip effect was upon us:

- Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff

- Deflationary Tsunami On Deck: A “Tidal Wave” Of Discounts And Crashing Prices

- Michael Burry Agrees: “Bullwhip Effect” Will Force Powell To Pivot On Rate Hikes And Q.T.

The side effect of soaring inventory to sales ratios is that retailers must liquidate inventories as consumer spending habits change. This causes retailers to reduce demand from overseas suppliers (read: Samsung Asks Component Makers To Delay Shipments Amid Build-Up In Inventories), which diminishes the need for ocean freight shipping.

In late March, FreightWaves CEO Craig Fuller warned that retailers would need to unload inventory amid signs of demand destruction. He correctly said this would cause a freight recession now could be coming true as container rates decline.

https://www.zerohedge.com/markets/shipping-rates-slump-bullwhip-effect-enters-terminal-phase

June 30, 2022

Another Attempt to eChange the Chemical Biz

ChemDirect Closes Series A Funding Round Led by Schneider

Specialty chemical marketplace will use funds to expand team and scale platform June 30, 2022 12:00 PM Eastern Daylight Time

GREEN BAY, Wis.–(BUSINESS WIRE)–ChemDirect, the leading B2B online marketplace for specialty chemicals shipped directly from vetted suppliers, today announced the closing of a Series A funding round led by Schneider (NYSE: SNDR). The financing will enable ChemDirect to grow its chemical marketplace, build out new logistics and payment technologies, and scale its go-to-market efforts.

“Today’s supply chain chaos has created a unique opportunity for ChemDirect to disrupt traditional processes, increasing efficiencies like never before and creating a better overall experience for chemical buyers and sellers.”Tweet this

Launched in 2020, ChemDirect was created to deliver significant time and cost savings for chemical buyers and sellers. With integrated logistics planning, credit terms and real-time inventory, ChemDirect makes chemical buying drastically easier than existing channels.

The Series A round follows the recent launch of ChemDirect’s new payment platform, ChemPay, which offers negotiation-free payment terms, real-time logistics and flexible payment methods to simplify the buying process — so suppliers receive payments in days instead of many weeks.

“The chemical industry is a $6 trillion market that largely operates in a pre-digital fashion,” said Tyler Ellison, ChemDirect’s founder and CEO. “Today’s supply chain chaos has created a unique opportunity for ChemDirect to disrupt traditional processes, increasing efficiencies like never before and creating a better overall experience for chemical buyers and sellers.”

By bringing the chemical buying process online, ChemDirect helps buyers save money and avoid long, complex sales cycles and delivery times typically experienced with conventional sourcing. Purchases on ChemDirect have an average fulfillment time of three and a half days and up to 80% in cost savings over other purchasing channels.

“We are encouraged by the efficiency ChemDirect brings chemical shippers and the industry,” said Shaleen Devgun, Schneider Executive Vice President and Chief Innovation and Technology Officer. “With over 500,000 products readily available online and real-time credit terms, ChemDirect is the competitive differentiator today’s chemical buyers need to navigate supply chain challenges successfully.”

To learn how to become a ChemDirect supplier, contact ChemDirect at +1 310-928-1129 or support@chemdirect.com. To learn more about ChemDirect or to request a demo, visit chemdirect.com.

About ChemDirect

ChemDirect is a B2B online marketplace for specialty chemicals designed to deliver significant time and cost savings for chemical buyers and sellers. With integrated logistics planning, credit terms, and real-time inventory shipped directly from vetted suppliers, ChemDirect makes buying chemicals drastically easier than existing channels.

The ChemDirect platform provides an easy-to-use marketplace that creates connections between customers and suppliers across a wide variety of industries, including agriculture, automobile, beauty and personal care, building and construction, cleaning and sanitation, consumer products, electronics, food and nutrition, healthcare, manufacturing, paints and coatings, and printing and packaging.

ChemDirect is backed by leading investors, such as TitletownTech, a venture partnership between Microsoft and the Green Bay Packers. For more information on ChemDirect, visit chemdirect.com, connect with us on LinkedIn and follow us on Twitter.

About Schneider

Schneider is a premier multimodal provider of transportation, intermodal and logistics services. Offering one of the broadest portfolios in the industry, Schneider’s solutions include Regional and Long-Haul, Truckload, Expedited, Dedicated Bulk, Intermodal, Brokerage, Warehousing, Supply Chain Management, Port Logistics, and Logistics Consulting.

With $5.6 billion in annual revenue, Schneider has been safely delivering superior customer experiences and investing in innovation for over 85 years. The company’s digital marketplace, Schneider FreightPower®, is revolutionizing the industry, giving shippers access to an expanded, highly flexible capacity network and provides carriers with unmatched access to quality drop-and-hook freight – Always Delivering, Always Ahead.

For more information about Schneider, visit or follow the company socially on Facebook, LinkedIn and Twitter: @WeAreSchneider.

June 30, 2022

Another Attempt to eChange the Chemical Biz

ChemDirect Closes Series A Funding Round Led by Schneider

Specialty chemical marketplace will use funds to expand team and scale platform June 30, 2022 12:00 PM Eastern Daylight Time

GREEN BAY, Wis.–(BUSINESS WIRE)–ChemDirect, the leading B2B online marketplace for specialty chemicals shipped directly from vetted suppliers, today announced the closing of a Series A funding round led by Schneider (NYSE: SNDR). The financing will enable ChemDirect to grow its chemical marketplace, build out new logistics and payment technologies, and scale its go-to-market efforts.

“Today’s supply chain chaos has created a unique opportunity for ChemDirect to disrupt traditional processes, increasing efficiencies like never before and creating a better overall experience for chemical buyers and sellers.”Tweet this

Launched in 2020, ChemDirect was created to deliver significant time and cost savings for chemical buyers and sellers. With integrated logistics planning, credit terms and real-time inventory, ChemDirect makes chemical buying drastically easier than existing channels.

The Series A round follows the recent launch of ChemDirect’s new payment platform, ChemPay, which offers negotiation-free payment terms, real-time logistics and flexible payment methods to simplify the buying process — so suppliers receive payments in days instead of many weeks.

“The chemical industry is a $6 trillion market that largely operates in a pre-digital fashion,” said Tyler Ellison, ChemDirect’s founder and CEO. “Today’s supply chain chaos has created a unique opportunity for ChemDirect to disrupt traditional processes, increasing efficiencies like never before and creating a better overall experience for chemical buyers and sellers.”

By bringing the chemical buying process online, ChemDirect helps buyers save money and avoid long, complex sales cycles and delivery times typically experienced with conventional sourcing. Purchases on ChemDirect have an average fulfillment time of three and a half days and up to 80% in cost savings over other purchasing channels.

“We are encouraged by the efficiency ChemDirect brings chemical shippers and the industry,” said Shaleen Devgun, Schneider Executive Vice President and Chief Innovation and Technology Officer. “With over 500,000 products readily available online and real-time credit terms, ChemDirect is the competitive differentiator today’s chemical buyers need to navigate supply chain challenges successfully.”

To learn how to become a ChemDirect supplier, contact ChemDirect at +1 310-928-1129 or support@chemdirect.com. To learn more about ChemDirect or to request a demo, visit chemdirect.com.

About ChemDirect

ChemDirect is a B2B online marketplace for specialty chemicals designed to deliver significant time and cost savings for chemical buyers and sellers. With integrated logistics planning, credit terms, and real-time inventory shipped directly from vetted suppliers, ChemDirect makes buying chemicals drastically easier than existing channels.

The ChemDirect platform provides an easy-to-use marketplace that creates connections between customers and suppliers across a wide variety of industries, including agriculture, automobile, beauty and personal care, building and construction, cleaning and sanitation, consumer products, electronics, food and nutrition, healthcare, manufacturing, paints and coatings, and printing and packaging.

ChemDirect is backed by leading investors, such as TitletownTech, a venture partnership between Microsoft and the Green Bay Packers. For more information on ChemDirect, visit chemdirect.com, connect with us on LinkedIn and follow us on Twitter.

About Schneider

Schneider is a premier multimodal provider of transportation, intermodal and logistics services. Offering one of the broadest portfolios in the industry, Schneider’s solutions include Regional and Long-Haul, Truckload, Expedited, Dedicated Bulk, Intermodal, Brokerage, Warehousing, Supply Chain Management, Port Logistics, and Logistics Consulting.

With $5.6 billion in annual revenue, Schneider has been safely delivering superior customer experiences and investing in innovation for over 85 years. The company’s digital marketplace, Schneider FreightPower®, is revolutionizing the industry, giving shippers access to an expanded, highly flexible capacity network and provides carriers with unmatched access to quality drop-and-hook freight – Always Delivering, Always Ahead.

For more information about Schneider, visit or follow the company socially on Facebook, LinkedIn and Twitter: @WeAreSchneider.

June 27, 2022

Durable Goods Jump

US Durable Goods Orders Unexpectedly Jumped In May

by Tyler DurdenMonday, Jun 27, 2022 – 08:35 AM

With PMIs sinking rapidly and macro surprise indices crashing, analysts remained optimistic of a continued rise (albeit a small 0.1% MoM) in US durable goods orders in preliminary May data. It turns out they were ‘under’-optimistic as durable goods orders surged 0.7% MoM (with a small downward revision from +0.5% to +0.4% MoM in April).

Source: Bloomberg

That is the 3rd straight monthly increase in orders and pushes them up 12.0% YoY.

Ex Transports, orders rose 0.7% MoM – beating expectations of +0.3%.

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, rose 0.5% after a 0.3% gain a month earlier.

Finally, Shipments soared by 0.8% MoM – 4 times the 0.2% MoM expected.

None of this data helps the current ‘growth scare dominates inflation fears’ narrative… as ‘good news’ is now ‘bad news’.

https://www.zerohedge.com/economics/us-durable-goods-orders-unexpectedly-jumped-may