The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

April 29, 2024

Recticel Trading update first quarter 2024

• Net sales increase from EUR 127.7 million in 2023 to EUR 140.6 million (+10.1%) in 2024, including REX sales in 20241

• Net cash position: EUR 74.9 million (31 December 2023: EUR 161.9 million), reflecting the REX acquisition in the first quarter of 2024 and seasonal working capital investment

Jan Vergote (CEO Recticel):

“New construction is not recovering as yet in the first quarter, but renovation activities are resilient at the vanguard of the European renovation wave.

First quarter sales are up 10.1%, including a 0.8% currency effect and 8.1% attributable to the acquisition of REX Panels & Profiles, which we completed on 10 January 2024.

Organic revenue growth is 1.2% resulting from the balance of substantial raw material deflation and significantly higher sales volumes, both in our Insulation Boards and Insulated Panels divisions.

Price pressures, especially in Insulation Boards, continue to be very high, but are being offset by operational improvements.

We are currently facing price hikes for our most important chemicals and are implementing price increases in all key geographies.

We confirm our confidence in the significant increase of our full year adjusted EBITDA.”

1 REX Panels & Profiles is fully consolidated as of 10 January 2024.

https://www.recticel.com/recticel-trading-update-first-quarter-2024.html

April 29, 2024

MDI Facility Disruptions Resurface? China PMDI Market Review – April 2024

PUdaily | Updated: April 29, 2024

MDI Facility Disruptions Resurface?

The MDI facility dynamics in North America are attracting market attentions. According to market sources, unplanned shutdowns have occurred at some North American MDI facilities, including BASF and Covestro. Their combined capacity contributes 44% of the total MDI capacity in North America. The impact on their supply and deliveries are under assessment. Before it, and in late March, BorsodChem Hungary declared force majeure on MDI products supply, which led to increasing PMDI exports from China to Europe in March. In March 2024, China exported 37 kT PMDI to Europe, a 345.1% increase from this February, according to China’s customs statistics. If excluding the factors related to Chinese New Year holiday, China’s PMDI exports to Europe in March increased by 62.2% compared to this January.

China PMDI Market Review – April 2024

As of April 26, 2024, the average price of spot PMDI goods in China is around CNY 16,438/tonne, showing a 0.5% increase compared to this March (CNY 16,350/tonne), according to PUdaily. In this month, Chinese PMDI market showed a trend of bottoming out. The PMDI market prices climbed gradually from CNY 15,700-16,300/tonne on April 1 to CNY 16,400-17,000/tonne on April 29. The increase trend was attributed by the supports both from supply and demand sides.

In terms of supply, The settlement prices from major PMDI suppliers were higher than market expectations; Covestro also increased its weekly contract prices to distributors week-by-week. All above provided strong support for the April market because the purchase costs from distributors and traders kept at relatively high levels. Major PMDI suppliers also reduced supplies to direct and/or indirect customers, alleviating ovearll sales pressures in distribution market. In terms of demand, the refrigerator and formaldehyde-free panel sectors continued their year-on-year growths in sales and outputs; following destocking measures, downstream manufacturers in construction sectors significantly increased their purchases for PMDI this month to gear up for the May Day holiday.

China PMDI Market Outlook – May 2024

In terms of supply, MDI facilities of BASF Shanghai and Wanhua Ningbo are scheduled to shut down for maintenance in this May, which may lead to supply allocations. In terms of demand, refrigerator, one of major PMDI downstream sectors, the production in May is forecasted to reach 8.5 million units, the highest level since the year of 2005, and will increase by 13.4% year-on-year, according to ChinaIOL.com. The robust demand provides a support for Chinese PMDI market.

April 29, 2024

Wanhua Chemical’s TDI Expansion to Lead Global Production

PUdaily | Updated: April 25, 2024

Wanhua Chemical, a significant player in the chemical industry, recently announced key developments in its TDI (toluene diisocyanate) production capacity expansion plans. The company’s official website disclosed the Environmental Impact Assessment Reports for two crucial projects.

On April 18, the Phase II Expansion Project of TDI, with a capacity of 360,000 tons per year, was unveiled by Wanhua Chemical (Fujian) Co., Ltd. This expansion project marks a notable step forward in the company’s strategic growth initiatives.

Shortly thereafter, on April 23, Wanhua Chemical’s official website released the Environmental Impact Assessment Report for the Phase I Technological Improvement and Capacity Expansion Project of TDI, also with a capacity of 360,000 tons per year.

The Phase I project involves significant upgrades to existing TDI production units, including nitration, acid concentration, hydrogenation, phosgenation, and refining units. These enhancements will boost the production capacity from 250,000 tons per year to 360,000 tons per year.

Meanwhile, the Phase II Expansion Project of TDI by Wanhua Chemical (Fujian) Co., Ltd. is poised to have a notable impact. Situated in the Jiangyin Industrial Concentration Zone in Fuzhou, Fujian Province, this project covers an area of 49,065 square meters. It encompasses the construction of advanced process units, including nitration, hydrogenation, and phosgenation units, alongside auxiliary and public engineering units. Once operational, the facility will produce 360,000 tons of TDI annually.

Together, these expansion projects will increase Wanhua Chemical’s TDI production capacity by 470,000 tons. With a total TDI production capacity of 1.42 million tons per year, Wanhua Chemical is poised to solidify its position as a significant player in the global chemical industry landscape.

April 24, 2024

Europe styrene output to rise as force majeures lifting in H2 April

A force majeure was declared on polyolefins in March at LyondellBasell’s and Covestro’s jointly-owned propylene oxide styrene monomer (POSM) plant in Maasvlakte, the Netherlands. The POSM plant had been taken offline in mid-December as a preventative measure and came back online in second half February. A spokesperson for LyondellBasell confirmed OPIS Tuesday that the “unit at Maasvlakte is up and running.”

LyondellBasell’s site at Maasvlakte produces 680,000 metric tons/year of styrene, the largest styrene manufacturing unit in Europe, and 313,000 mt/year of propylene oxide, according to data from Chemical Market Analytics (CMA) by OPIS, a Dow Jones company. TotalEnergies produces 600,000 mt/year styrene at Gonfreville, the second largest European production site, CMA data showed.

April 24, 2024

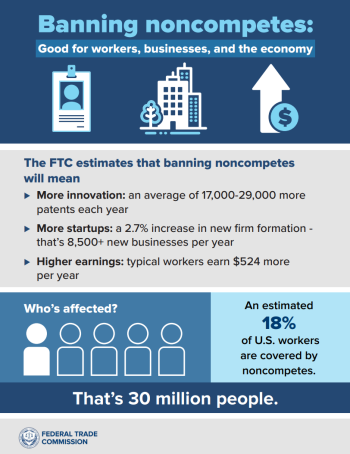

FTC Announces Rule Banning Noncompetes

FTC’s final rule will generate over 8,500 new businesses each year, raise worker wages, lower health care costs, and boost innovation

Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

The FTC estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per year, and it is expected to lower health care costs by up to $194 billion over the next decade. In addition, the final rule is expected to help drive innovation, leading to an estimated average increase of 17,000 to 29,000 more patents each year for the next 10 years under the final rule.

Noncompetes are a widespread and often exploitative practice imposing contractual conditions that prevent workers from taking a new job or starting a new business. Noncompetes often force workers to either stay in a job they want to leave or bear other significant harms and costs, such as being forced to switch to a lower-paying field, being forced to relocate, being forced to leave the workforce altogether, or being forced to defend against expensive litigation. An estimated 30 million workers—nearly one in five Americans—are subject to a noncompete.

Under the FTC’s new rule, existing noncompetes for the vast majority of workers will no longer be enforceable after the rule’s effective date. Existing noncompetes for senior executives – who represent less than 0.75% of workers – can remain in force under the FTC’s final rule, but employers are banned from entering into or attempting to enforce any new noncompetes, even if they involve senior executives. Employers will be required to provide notice to workers other than senior executives who are bound by an existing noncompete that they will not be enforcing any noncompetes against them.

In January 2023, the FTC issued a proposed rule which was subject to a 90-day public comment period. The FTC received more than 26,000 comments on the proposed rule, with over 25,000 comments in support of the FTC’s proposed ban on noncompetes. The comments informed the FTC’s final rulemaking process, with the FTC carefully reviewing each comment and making changes to the proposed rule in response to the public’s feedback.

In the final rule, the Commission has determined that it is an unfair method of competition, and therefore a violation of Section 5 of the FTC Act, for employers to enter into noncompetes with workers and to enforce certain noncompetes.

The Commission found that noncompetes tend to negatively affect competitive conditions in labor markets by inhibiting efficient matching between workers and employers. The Commission also found that noncompetes tend to negatively affect competitive conditions in product and service markets, inhibiting new business formation and innovation. There is also evidence that noncompetes lead to increased market concentration and higher prices for consumers.

Alternatives to Noncompetes

The Commission found that employers have several alternatives to noncompetes that still enable firms to protect their investments without having to enforce a noncompete.

Trade secret laws and non-disclosure agreements (NDAs) both provide employers with well-established means to protect proprietary and other sensitive information. Researchers estimate that over 95% of workers with a noncompete already have an NDA.

The Commission also finds that instead of using noncompetes to lock in workers, employers that wish to retain employees can compete on the merits for the worker’s labor services by improving wages and working conditions.

Changes from the NPRM

Under the final rule, existing noncompetes for senior executives can remain in force. Employers, however, are prohibited from entering into or enforcing new noncompetes with senior executives. The final rule defines senior executives as workers earning more than $151,164 annually and who are in policy-making positions.

Additionally, the Commission has eliminated a provision in the proposed rule that would have required employers to legally modify existing noncompetes by formally rescinding them. That change will help to streamline compliance.

Instead, under the final rule, employers will simply have to provide notice to workers bound to an existing noncompete that the noncompete agreement will not be enforced against them in the future. To aid employers’ compliance with this requirement, the Commission has included model language in the final rule that employers can use to communicate to workers.

The Commission vote to approve the issuance of the final rule was 3-2 with Commissioners Melissa Holyoak and Andrew N. Ferguson voting no. Commissioners’ written statements will follow at a later date.

The final rule will become effective 120 days after publication in the Federal Register.

Once the rule is effective, market participants can report information about a suspected violation of the rule to the Bureau of Competition by emailing noncompete@ftc.gov

.

The Federal Trade Commission develops policy initiatives on issues that affect competition, consumers, and the U.S. economy. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Follow the FTC on social media, read consumer alerts and the business blog, and sign up to get the latest FTC news and alerts.