The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

February 15, 2021

LyondellBasell, Covestro declare force majeure on styrene from Maasvlakte POSM unit

12:24 PM | February 15, 2021 | Fahima Mathe, OPIS

Mechanical failure caused shutdown on 10 February; unit produces 680,000 metric tons/year of styrene, 313,000 metric tons/year of propylene oxide.

February 15, 2021

S-Oil expected to continue recovery this year

신문5면 1단 기사입력 2021.02.14. 오후 4:42 최종수정 2021.02.14. 오후 4:45 기사원문스크랩 좋아요 좋아요 평가하기 2 댓글 글자 크기 변경하기인쇄하기 보내기  S-Oil’s residue upgrading facility (S-Oil)

S-Oil’s residue upgrading facility (S-Oil)

S-Oil, South Korea’s No. 3 refiner, is expected to see an improvement in profits this year, continuing a recovery momentum from the final quarter of 2020, according to the industry sources Sunday.

S-Oil said the company expects a recovery based on the increasing profitability of the company’s petrochemical products, including propylene oxide and polypropylene.

S-Oil noted the company plans to increase production capacity for propylene oxide through which the company managed to offset the weak refining margin in the last quarter.

During the October-December period, S-Oil’s refining business posted an operating loss of 89.7 billion won. However, the company’s petrochemical and lube oil units posted 72.7 billion won and 110 billion won of operating profits.

S-Oil was the only refiner — among four local refiners in the nation — that avoided plunging into the red.

Increasing profitability of propylene oxide, in particular, helped the company, the firm said.

The price of propylene oxide per metric ton in the fourth quarter last year reached an all-time high since December 2014, increasing 85 percent to reach $1,098 from $595 in the previous quarter.

The refiner said it plans to add its production capacity for propylene oxide by 30,000-40,000 tons to maximize profits from the petrochemical product.

The company also anticipated a recovery in refining margins in the wake of the global rollout of COVID-19 vaccines, which will boost travel demand worldwide.

According to Meritz Securities here, S-Oil’s operating profit this year is expected to hit 1.02 trillion won, turning around from the operating loss of 1.08 trillion won in 2020.

By Shim Woo-hyun (ws@heraldcorp.com)

February 15, 2021

S-Oil expected to continue recovery this year

신문5면 1단 기사입력 2021.02.14. 오후 4:42 최종수정 2021.02.14. 오후 4:45 기사원문스크랩 좋아요 좋아요 평가하기 2 댓글 글자 크기 변경하기인쇄하기 보내기  S-Oil’s residue upgrading facility (S-Oil)

S-Oil’s residue upgrading facility (S-Oil)

S-Oil, South Korea’s No. 3 refiner, is expected to see an improvement in profits this year, continuing a recovery momentum from the final quarter of 2020, according to the industry sources Sunday.

S-Oil said the company expects a recovery based on the increasing profitability of the company’s petrochemical products, including propylene oxide and polypropylene.

S-Oil noted the company plans to increase production capacity for propylene oxide through which the company managed to offset the weak refining margin in the last quarter.

During the October-December period, S-Oil’s refining business posted an operating loss of 89.7 billion won. However, the company’s petrochemical and lube oil units posted 72.7 billion won and 110 billion won of operating profits.

S-Oil was the only refiner — among four local refiners in the nation — that avoided plunging into the red.

Increasing profitability of propylene oxide, in particular, helped the company, the firm said.

The price of propylene oxide per metric ton in the fourth quarter last year reached an all-time high since December 2014, increasing 85 percent to reach $1,098 from $595 in the previous quarter.

The refiner said it plans to add its production capacity for propylene oxide by 30,000-40,000 tons to maximize profits from the petrochemical product.

The company also anticipated a recovery in refining margins in the wake of the global rollout of COVID-19 vaccines, which will boost travel demand worldwide.

According to Meritz Securities here, S-Oil’s operating profit this year is expected to hit 1.02 trillion won, turning around from the operating loss of 1.08 trillion won in 2020.

By Shim Woo-hyun (ws@heraldcorp.com)

February 13, 2021

New Video Shows Massive California Container Ship Traffic Jam

by Tyler DurdenFriday, Feb 12, 2021 – 19:40

By Greg Miller of American Shipper

Newly released U.S. Coast Guard video offers visceral proof of just how extreme the congestion has become at the ports of Los Angeles and Long Beach. The new view from above reveals a vast armada of container ships scattered at anchor across California’s San Pedro Bay.

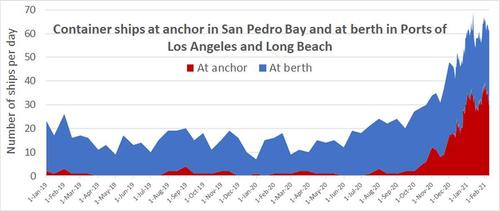

As the Coast Guard footage paints the picture, the latest data from the Port of Los Angeles and from the Marine Exchange of Southern California tells the story behind those images.

The data confirms that there has been no real let-up in the historic container-ship traffic jam off California’s coast.

As of Thursday, there were 25 container ships at berth in Los Angeles and Long Beach. Thirty-two container ships were at anchorage. That’s roughly the same level that has been at anchor since the beginning of this year. (The record of 40 container ships at anchor was hit on Feb. 1).

The Port of Los Angeles, via its platform, The Signal, recently began disclosing the number of days at anchor for specific container ships. The numbers confirm that some vessels are spending almost as much time at anchor as it takes to traverse the Pacific Ocean.

As of Thursday, the Ever Envoy, with a capacity of 6,332 twenty-foot equivalent units (TEUs), had been at anchor for 11 days. Other ships that had just gone to berth had been waiting just as long: As of Tuesday , the 9,400-TEU MSC Romane had been at anchor for 12 days. The 11,356-TEU CMA CGM Andromeda, 8,452-TEU Ever Liven and 4,888-TEU NYK Nebula for 11 days.

The Signal indicated that the average time at anchor for ships calling in Los Angeles was 8 days as of Thursday, up from 6.9 days on Tuesday. The Signal has provided information on ship waiting times since Jan. 27. Waiting time has remained at an average of around one week since then.

What’s Causing the Traffic Jam

Extended anchorage times have forced some ocean carriers to cancel multiple sailings this month. Not due to lack of cargo demand, but rather, due to lack of available ships to handle those services.

Delays on the landside are causing the logjam at sea. Extremely high inbound volumes combined with logistical complications both inside and outside the ports are causing the landside delays. One of the challenges inside the ports involves COVID infections among dockworkers. The International Longshore and Warehouse Union (ILWU) reported 694 of its members had tested positive as of Jan. 17. By Jan. 25, the number had jumped to 803.

Charting the course of congestion

As previously reported by American Shipper, the number of container ships at anchor already exceeds the number during the labor dispute between the ILWU and their employers in 2014-15.

The Marine Exchange provided American Shipper with historical data starting in January 2019 to put the current backlog of container ships into perspective.

The data shows that the number of container ships at berth started to ramp up in July. A steady rise in the number of ships at anchor began in November. By year end, the number of container ships at anchor had risen to 30. It has remained between the high 20s and up to 40 ships ever since. Meanwhile, the number of ships at the berths in Los Angeles and Long Beach has remained in the high 20s and low 30s.

Kip Louttit, executive director of the Marine Exchange of Southern California, told American Shipper: “We seem to have settled into a new, new normal of roughly 30 container ships at anchor. Whether that will continue or not, I don’t know.”

Consumers to see emptier shelves

That new, new normal will be increasingly felt by consumers. Lauren Brand, president of the National Association of Waterfront Employers, testified at a House subcommittee hearing on Tuesday that ships currently offshore hold around 190,000 truckloads of goods.

“Right now, there are containers holding parts for manufacturing and assembly sites in the United States. We’re going to see some of those start to falter in their schedules the longer this goes on.

“I asked one of my local retailers, Chico’s, if they had certain spring colors. They said ‘no,’ because they were stuck at the port,” said Brand.

“We’re seeing a decline in the fashion market. Maybe some Valentine’s Day goods are stuck. We’ll see Easter goods getting stuck. And we’ll see things that are actually arriving too late to go to market. So, there will be an economic impact, from consumer goods to manufacturing.”

https://www.zerohedge.com/commodities/new-video-shows-massive-california-container-ship-traffic-jam

February 13, 2021

New Video Shows Massive California Container Ship Traffic Jam

by Tyler DurdenFriday, Feb 12, 2021 – 19:40

By Greg Miller of American Shipper

Newly released U.S. Coast Guard video offers visceral proof of just how extreme the congestion has become at the ports of Los Angeles and Long Beach. The new view from above reveals a vast armada of container ships scattered at anchor across California’s San Pedro Bay.

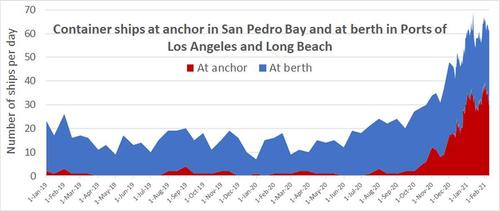

As the Coast Guard footage paints the picture, the latest data from the Port of Los Angeles and from the Marine Exchange of Southern California tells the story behind those images.

The data confirms that there has been no real let-up in the historic container-ship traffic jam off California’s coast.

As of Thursday, there were 25 container ships at berth in Los Angeles and Long Beach. Thirty-two container ships were at anchorage. That’s roughly the same level that has been at anchor since the beginning of this year. (The record of 40 container ships at anchor was hit on Feb. 1).

The Port of Los Angeles, via its platform, The Signal, recently began disclosing the number of days at anchor for specific container ships. The numbers confirm that some vessels are spending almost as much time at anchor as it takes to traverse the Pacific Ocean.

As of Thursday, the Ever Envoy, with a capacity of 6,332 twenty-foot equivalent units (TEUs), had been at anchor for 11 days. Other ships that had just gone to berth had been waiting just as long: As of Tuesday , the 9,400-TEU MSC Romane had been at anchor for 12 days. The 11,356-TEU CMA CGM Andromeda, 8,452-TEU Ever Liven and 4,888-TEU NYK Nebula for 11 days.

The Signal indicated that the average time at anchor for ships calling in Los Angeles was 8 days as of Thursday, up from 6.9 days on Tuesday. The Signal has provided information on ship waiting times since Jan. 27. Waiting time has remained at an average of around one week since then.

What’s Causing the Traffic Jam

Extended anchorage times have forced some ocean carriers to cancel multiple sailings this month. Not due to lack of cargo demand, but rather, due to lack of available ships to handle those services.

Delays on the landside are causing the logjam at sea. Extremely high inbound volumes combined with logistical complications both inside and outside the ports are causing the landside delays. One of the challenges inside the ports involves COVID infections among dockworkers. The International Longshore and Warehouse Union (ILWU) reported 694 of its members had tested positive as of Jan. 17. By Jan. 25, the number had jumped to 803.

Charting the course of congestion

As previously reported by American Shipper, the number of container ships at anchor already exceeds the number during the labor dispute between the ILWU and their employers in 2014-15.

The Marine Exchange provided American Shipper with historical data starting in January 2019 to put the current backlog of container ships into perspective.

The data shows that the number of container ships at berth started to ramp up in July. A steady rise in the number of ships at anchor began in November. By year end, the number of container ships at anchor had risen to 30. It has remained between the high 20s and up to 40 ships ever since. Meanwhile, the number of ships at the berths in Los Angeles and Long Beach has remained in the high 20s and low 30s.

Kip Louttit, executive director of the Marine Exchange of Southern California, told American Shipper: “We seem to have settled into a new, new normal of roughly 30 container ships at anchor. Whether that will continue or not, I don’t know.”

Consumers to see emptier shelves

That new, new normal will be increasingly felt by consumers. Lauren Brand, president of the National Association of Waterfront Employers, testified at a House subcommittee hearing on Tuesday that ships currently offshore hold around 190,000 truckloads of goods.

“Right now, there are containers holding parts for manufacturing and assembly sites in the United States. We’re going to see some of those start to falter in their schedules the longer this goes on.

“I asked one of my local retailers, Chico’s, if they had certain spring colors. They said ‘no,’ because they were stuck at the port,” said Brand.

“We’re seeing a decline in the fashion market. Maybe some Valentine’s Day goods are stuck. We’ll see Easter goods getting stuck. And we’ll see things that are actually arriving too late to go to market. So, there will be an economic impact, from consumer goods to manufacturing.”

https://www.zerohedge.com/commodities/new-video-shows-massive-california-container-ship-traffic-jam