The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

March 1, 2023

Recticel Annual Results 2022

Regulated information, Brussels, 28/02/2023 — 06:59 CET, 28.02.2023

- Net sales increase from €449.2 million in 2021 to €561.5 million (+25.0%) in 2022, of which €129.2 million contribution from Trimo and a €48.9 million reduction following the phasing out of sales of chemicals to divested Automotive companies

- Adjusted EBITDA: from €48.4 million to €62.2 million (+28.4%)

- Result of the period (share of the Group): from €53.5 million to €63.2 million

- Closing of the divestment of Engineered Foams expected at the end of 1Q2023

- Proposal to pay an increased gross dividend of €0.31 per share

Olivier Chapelle (CEO Recticel): “The European construction market has become increasingly challenging as the year 2022 unfolded, with growing economic uncertainties and historically high inflation and rising interest rates weighing progressively more and more on construction activities. In that environment, I am proud of all our employees and want to thank them. In 2022, their focus and contributions have allowed to deliver, when compared to 2021, slightly higher volumes in Insulation Boards and flat volumes in Insulated Panels. Reactivity on pricing and margin management have in turn contributed to deliver solid results.

The divestment of Engineered Foams is expected to close at the end of the first quarter of 2023. It follows the decision on 26 January 2023 by the Competition and Markets Authority in the UK, to approve the Final Undertakings, which execution is now entering its final phase.

With the acquisition of Trimo on 1 May 2022, now fully integrated, we have created a broader basis for further internal and external growth.

With regard to ESG and sustainable development, after having announced our commitment to the SBTi, we can report a 11.2% reduction in our Scope 1 & 2 carbon emissions in 2022 versus reference year 2021.”

OUTLOOK

The year 2022 has been very challenging due to the consequences of the geopolitical turmoil. During that year, our business has resisted well and is well positioned at the beginning of 2023, despite the current lack of visibility. Margin management, growth initiatives and further progress on ESG are the priorities in 2023.

At this stage, the Company does not provide guidance related to its full year 2023 expected results.

https://www.recticel.com/recticel-annual-results-2022.html-0

March 1, 2023

US Bankruptcy Filings Surge At Fastest Pace Since 2009

by Tyler Durden

Wednesday, Mar 01, 2023 – 07:45 AM

For the past year, both the Biden White House and the Fed have been desperate to usher in a (mild) recession in the US to break the back of runaway inflation and the wage-price spiral with little success. But judging by the surge in bankruptcy filings, they are about to get their wish.

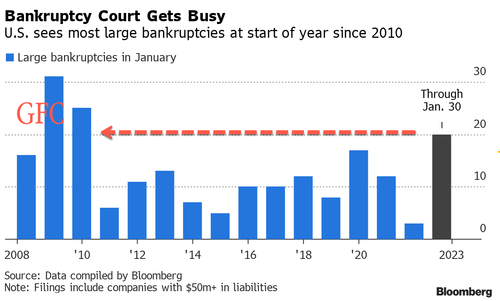

One month ago, when looking at the recent pace of large bankruptcy filings (those with more than $50MM in liabilities), we noted a troubling trend: in the first month of the year, the number of US bankruptcies topped 20, the highest in any other January dating back to 2010. Back then, 25 filings were seen as the economy was still reeling from the aftermath of the GFC.

The spike in defaults was not a fluke, and according to Bloomberg data, one month later – as of the end of February – no less than 39 large companies had filed for bankruptcy in the US so far this year, as February’s pace matches that of January; the YTD total represents the fastest pace of companies filing for bankruptcy since the immediate aftermath of the global financial crisis in 2009. By comparison, US bankruptcy courts had seen 63 large filings at this point in 2009.

Last week’s seven large filings — those tied to at least $50 million of liabilities — include the liquidation of generic drugmaker Akorn and the Chapter 11 filing of Covid-19 testmaker Lucira Health

This year, some of the most notable bankruptcy filings have been festive retailer Party City Holdco Inc, mattress maker Serta Simmons Bedding LLC, and cryptocurrency lender Genesis Global Holdco.

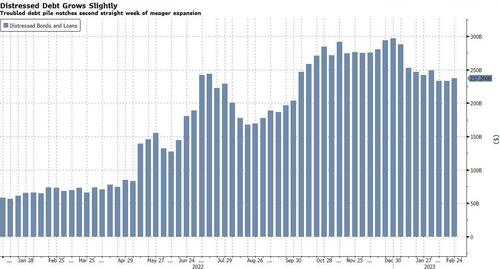

The pile of dollar-denominated corporate bonds and loans in the Americas trading at distressed levels rose to $237.2 billion in the week ended Friday, about a 1.63% increase from $233.4 billion a week earlier, according to BBG data.

Some more details from Bloomberg:

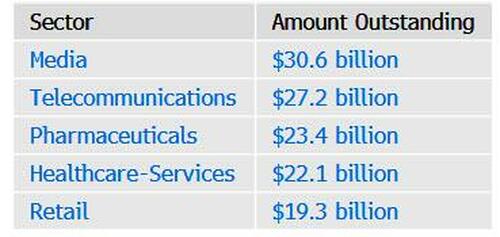

- The US accounts for the greatest volume of distressed debt in the Americas

- The media sector had the greatest amount of distressed debt as of the latest week

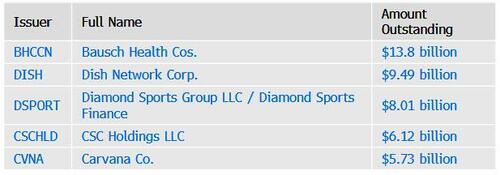

- Bausch Health Cos. had the most distressed debt outstanding of any issuer as of Feb. 17, data compiled by Bloomberg shows

https://www.zerohedge.com/economics/us-bankruptcy-filings-surge-fastest-pace-2009

February 28, 2023

European Benzene Pressure Continues to Mount, Phenol Prices are on the Rise, MDI Producer Idles Unit

- 22-Feb-2023 3:18 PM

- Journalist: Robert Hume

Hamburg (Germany): In the European market, the continuous increase in Benzene prices has made headlines, and producers have failed to face the heat of the rising prices. In the latest turn of events, Huntsman Corporation announced the idling of one of their Methylene Diphenyl Diisocyanate (MDI) plants in Rotterdam. The company announced that the unfeasible economics and sluggish demand drove the announcement.

Earlier, Huntsman Corporation has already idled one of their MDI units in Geismar, Louisiana.

In Europe, Benzene prices have increased by more than 50% since the beginning of the year, and the mounting pressure of rising prices has been more than evident.

Benzene forms a critical intermediate to several fundamental petrochemicals, MDI, Phenol, Cyclohexanone, and many others. MDI goes into Polyurethane production; while Cyclohexanone is a crucial part of Polyamide value chains and Phenolic Resins, Caprolactam is an important source of the demand for Phenol.

The incessant rise in Benzene prices has disrupted the economics of several downstream value chains. The high energy price pressure and firm cost support have translated into rising Cumene prices. Furthermore, the unbearable pressure of the Benzene prices has translated not only on the direct downstream but also on their derivatives; the sharp rise in Phenol has been a case in point.

Europe has been facing a double whammy, rising cost pressure and weak downstream demand, which has made the producers swallow a tough pill. The producers have become the shock absorbers between the soaring energy prices and the ultimate consumers. Huntsman has stated that they won’t be carrying on being the shock absorbers anymore.

Huntsman Corporation has implemented energy surcharges since the sharp climb in energy prices; however, the impact of energy surcharges has been limited at the very most. Thus the idling of production units comes as the last resort for the MDI producer to stay afloat.

China has eased covid restrictions and increased in demand since the conclusion of the Lunar New Year holidays, suggesting the changing market dynamics after the 2022 debacle. The improving economics in China also bodes well for the global economy as China forms a crucial production house as well as a key end-use market for several products that the Western market exports heavily.

February 28, 2023

Evonik is moving its North America headquarters to Piscataway, New Jersey

MOSCOW (MRC) — Evonik, one of the world’s leading specialty chemicals companies, is moving its North America headquarters from Parsippany, N.J., to Piscataway, N.J., said the company.

The official address change took effect on January 1, 2023. The Parsippany location will be closed with the end of its lease later this year.

The relocation is part of Evonik’s larger site rationalization plan to ensure efficient operations and future growth in North America. Evonik has embraced a hybrid work model in the region to consolidate office space, enhance employee engagement, and increase employer attractiveness.

“For Evonik, moving towards a hybrid workplace is a strategic opportunity to attract and retain diverse talent and to enable an efficient real estate footprint,” says Bonnie Tully, president North America region. “We want to foster conditions for growth, creativity, and innovation.”

The new Piscataway headquarters, located approximately 35 miles southwest of New York City, consists of administrative offices, laboratories for Research & Development, and the largest Collaboration Hub in the North America region – designed to support a hybrid and creative work environment for more than 160 employees. Evonik has recently opened similar hubs at its sites in Richmond, Va., and Mobile, Ala., and will eventually feature them at six locations in North America.

The uniquely designed spaces offer open areas and meeting rooms for employees to work onsite without needing individual offices. Employees have access to collaboration technology like digital whiteboards and tools for video conferencing. “The Collaboration Hubs promote interactions across our business lines and functions,” says Tully. “It will shape the future of work at Evonik and contribute to our culture of innovation.”

North America is an essential growth market for Evonik. The region contributed roughly a quarter (23%) to Evonik’s annual sales in 2021, making it the second-largest revenue source after Europe (EMEA). By 2030, Evonik aims to invest more than USD3 billion in Next Generation Solutions — products with superior sustainability benefits. Evonik will invest an additional USD700 million in Next Generation Technologies to optimize production processes and infrastructure and avoid CO2 emissions.

We remind, Evonik is pooling its expertise and integrating its alkoxides business into the Catalysts Business Line. The extensive portfolio of heterogeneous catalysts is thus now complemented by homogeneous catalysts. An international network of production sites and the highly experienced alkoxides team will additionally strengthen the Catalysts Business Line, one of Evonik’s growth areas, from January 2023.

February 28, 2023

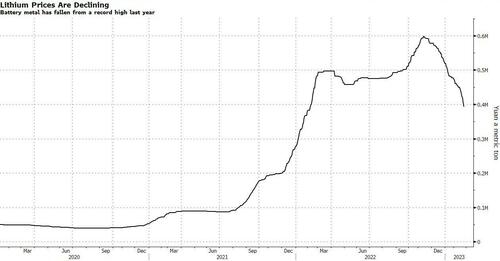

Lithium Industry Reeling After China Shutters 10% Of Global Supply

by Tyler Durden

Monday, Feb 27, 2023 – 06:00 PM

That’s a nice little EV industry you got over there in the US, it’s be a shame if suddenly it found itself without the most important commodity.

That’s one way to interpret what just happened in China; another – a less cynical – is the way Bloomberg described it, namely that China’s lithium industry itself is reeling as its top production hub – responsible for around a 10th of the world’s supply – faces sweeping closures amid a government probe of environmental infringements.

The crackdown in Yichun, Jiangxi province, also known as the country’s “Lithium capital” follows a local lithium frenzy over the past year as miners raced to feed rampant demand for the battery material — and to benefit from record global prices. Now, they’re grappling with a close-up inspection by environment officials sent from Beijing.

According to Yicai newspaper, ore-processing operations in Yichun have been ordered to stop as investigators probe alleged violations at lithium mines. That, Bloomberg notes, threatens somewhere between 8% and 13% of global supply, according to various analyst estimates, although it’s unclear for how long the immediate shutdowns will last.

The sudden probe injects a big dose of uncertainty into a lithium market that has seen prices drop, bringing some relief to EV manufacturers, as more global output emerges. Jiangxi province was expected to be a big source of extra supply, from a lithium-bearing mineral known as lepidolite.

“This supervision may mean that the inspection and control over lepidolite mining in China will be more stringent in the future,” said Susan Zou, analyst at Rystad Energy. Companies with operations in Yichun include major battery manufacturers Contemporary Amperex Technology Co. and Gotion High-Tech Co., whose shares both fell more than 1% on Monday.

Due to the ongoing probe, all lepidolite mining in Yichun aside from those by a state-owned company have been suspended, but refineries are still operational, Daiwa analysts Dennis Ip and Leo Ho said.

Global lithium prices soared to a record high last year as demand from China’s booming electric-vehicle industry outstripped production. And, as so often happens in commodities, where the cure to high prices is more supply, leading to lower prices, this high-profit, high-demand environment has encouraged miners to skirt regulations.

Some companies had already been targeted for infringements, including incidents of pollution, over the past year. This is a much wider crackdown, and involves officials from central government departments including the Ministry of Natural Resources.

Yucai added that Beijing will mainly look at violations at lithium mines and seek to guide the “healthy development” of the industry; they will largely target those mining without permits or with expired licenses.

Curiously, a recent Goldman report found that the Chinese car industry’s demand for lithium has fallen by more than half in recent months, a dramatic reversal that will drive a further slump in the market. Meanwhile, Chinese prices have dropped more than 30% from last year’s peak.

According to calculations form Citic Securities analyst Bai Junfei, a month-long mining halt in Yichun would reduce lithium output by an amount equivalent to around 13% of the world’s total. Rystad Energy, a consultancy, estimated the amount at 8%.

“At present, the market speculation is that the probe may stop after the two sessions in China next month,” Rystad’s Zou said, referring to the annual parliamentary meetings due early March.

https://www.zerohedge.com/markets/lithium-industry-reeling-after-china-shutters-10-global-supply