The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

February 23, 2023

Hanwha Solutions shares slump on spin-off, no dividend plans

|

| [Courtesy of Hanwha Solutions] |

| <이미지를 클릭하시면 크게 보실 수 있습니다> |

Shares of Hanwha Solutions Corp. fell as trading the stock will be suspended for about a month on its spin-off plan, lower solar module prices and its decision to pay no dividends for three consecutive years.

The shares fell about 5 percent during past month until Tuesday to 43,150 won and dropped 24 percent from the previous high on Nov. 25. This contrasts with a rise in its rivals as the Korea Exchange Energy & Chemical Index rose by 9.9 percent to 3250 from 2955 during the same period as China’s reopening is expected to generate demand. The index includes many major domestic chemical companies, including LG Chem Ltd., Lotte Chemical Corp. and Kumho Petrochemical Co.

Hanwha Solutions will be suspended from trading from Feb. 27 to March 30 ahead of its planned spin-off of its department store unit. Institutional investors are likely to sell Hanwha Solutions shares rather than keeping them tied to a share that’s suspended for about a month. According to the Korea Exchange, institutional investors net sale of Hanwha Solutions shares reached 142.3 billion won this year and from Feb. 10 to 21, they were net sellers for eight consecutive trading days.

Shares are also lower because export prices of solar modules recently fell about 15 percent from the previous peak as prices of alternative energy sources dropped. The chemical industry had its worst year in 2022 on slowing demand and rising inventory. Given that the company’s renewable energy division, which produces solar cell modules, has been the driving force behind its corporate value, the recent decline is due to rising concerns that the division’s earnings could underperform.

Hanwha Solutions said in a conference call on Feb. 16 that it will take steps to improve shareholder returns, including share buybacks and dividend payouts, when its investment plans to grow the business start to reflect into its earnings. The company plans to spend 2.7 trillion won in U.S. facilities this year.

Investors reacted negatively by saying that Hyundai Energy Solutions Co., which runs a similar solar module business, and Hyosung Corp., which runs a chemical business, are implementing cash dividend policies.

However, some observers say that Hanwha Solutions’ stock will be able to rebound as its performance is expected to improve from this year, helped by falling raw material prices.

“The impact of the price decline in solar cell modules is expected to be offset by an increase in sales in the U.S. following its module production expansion in the U.S.,” Mirae Asset Securities analyst Lee Jin-ho said.

Hanwha Solutions’ chemical material business can also improve its performance from the first quarter of this year. In its earnings announcement this year, Hanwha Solutions predicted that demand for products such as low-density polyethylene, PVC and toluene diisocyanate could recover, helped by demand in China following its shift to live with Covid and measures to stimulate its economy.

February 22, 2023

Inflation a Bit Warmer, Still Stubborn

Dan North | February 2023

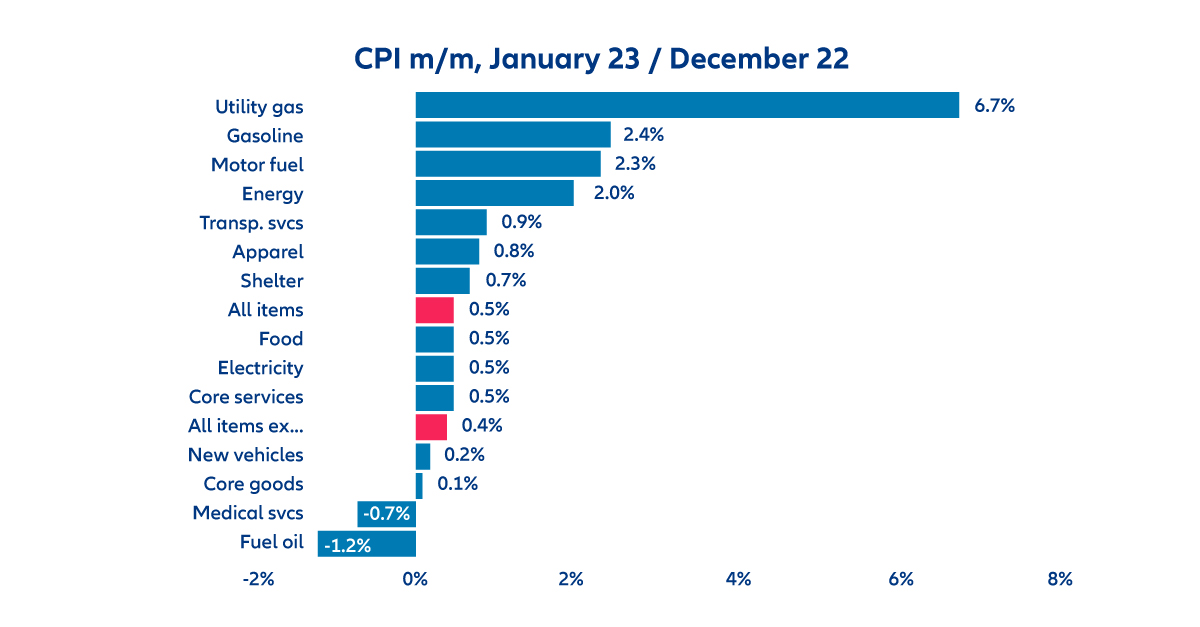

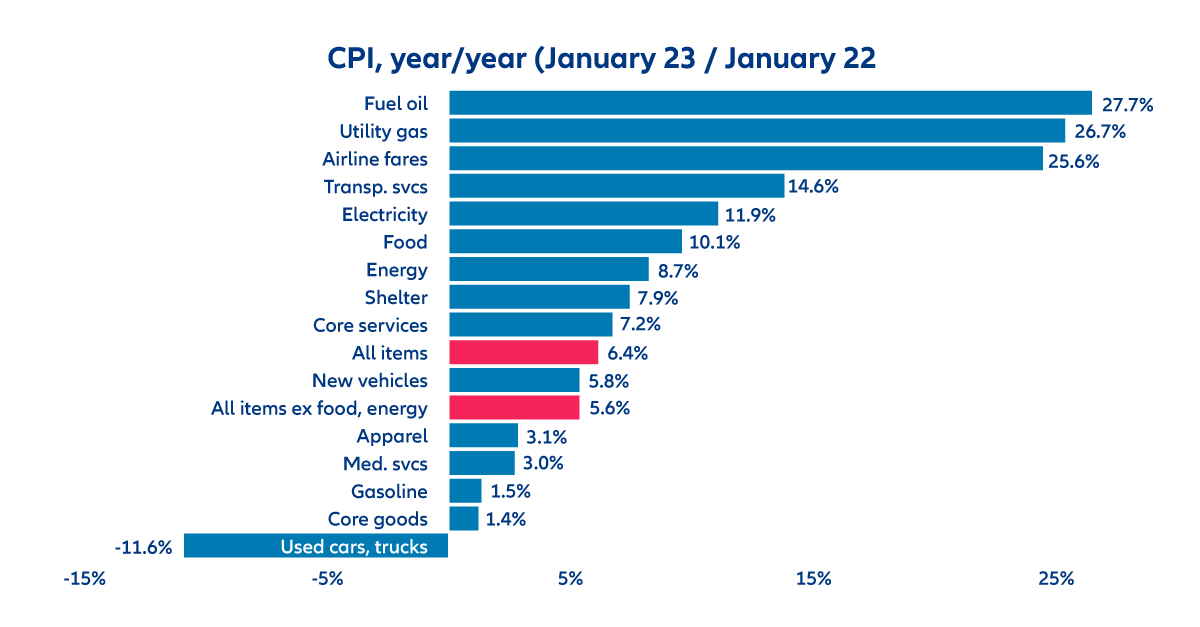

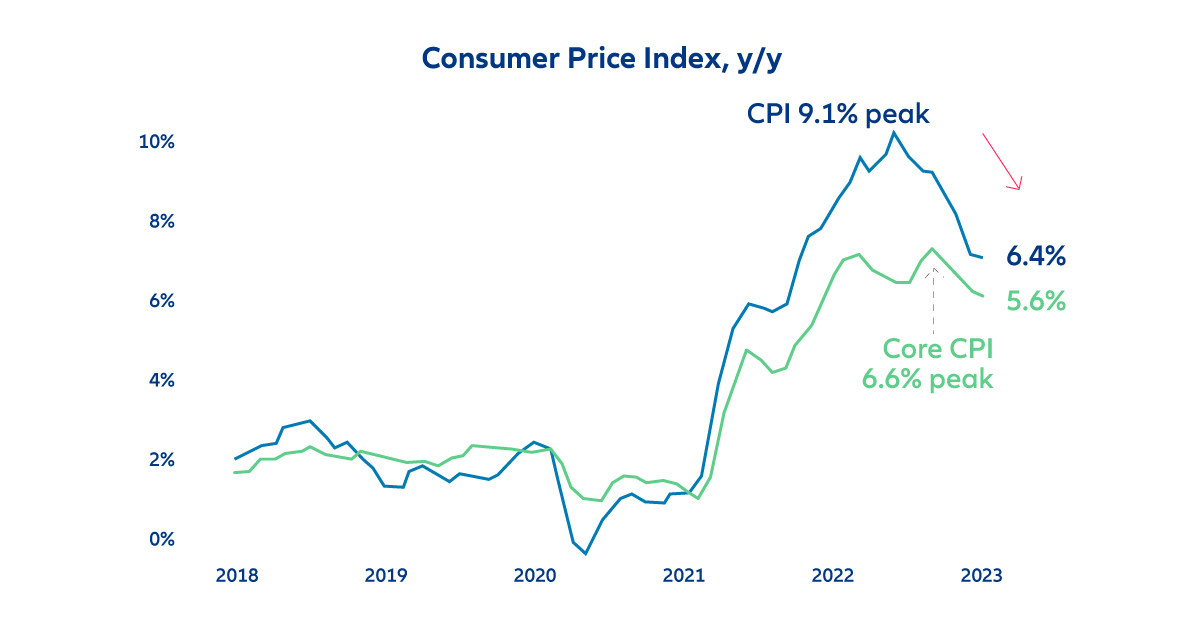

Inflation was a little warmer than expected in January. The headline Consumer Price Index (CPI) rose 0.5% m/m which was a bit higher than expectations of 0.4%. The y/y rate landed at 6.4, which was higher than expectations of 6.2%, and also only a slight improvement from last month’s 6.5%. The core rate, which strips out volatile food and energy prices, rose 0.4% m/m, again exceeding expectations of 0.3%, while the y/y rate came in at 5.6%, just above expectations of 5.5% and again also only a slight improvement from last month’s 5.7%. Energy prices drove the m/m increase with a 6.7% increase in utility gas and a notable 2.4% increase in gasoline prices. On a y/y basis, fuel out and utility gas have been big drivers, while gasoline has only risen 1.5%. Used cars and truck prices which were driven up in the pandemic due to scarcity, have now fallen 11.6% over the past year.

By the way, December’s report, which showed the first m/m decline in the headline CPI in the post Covid-era at -0.1%, was revised back up to +0.1% in this report.

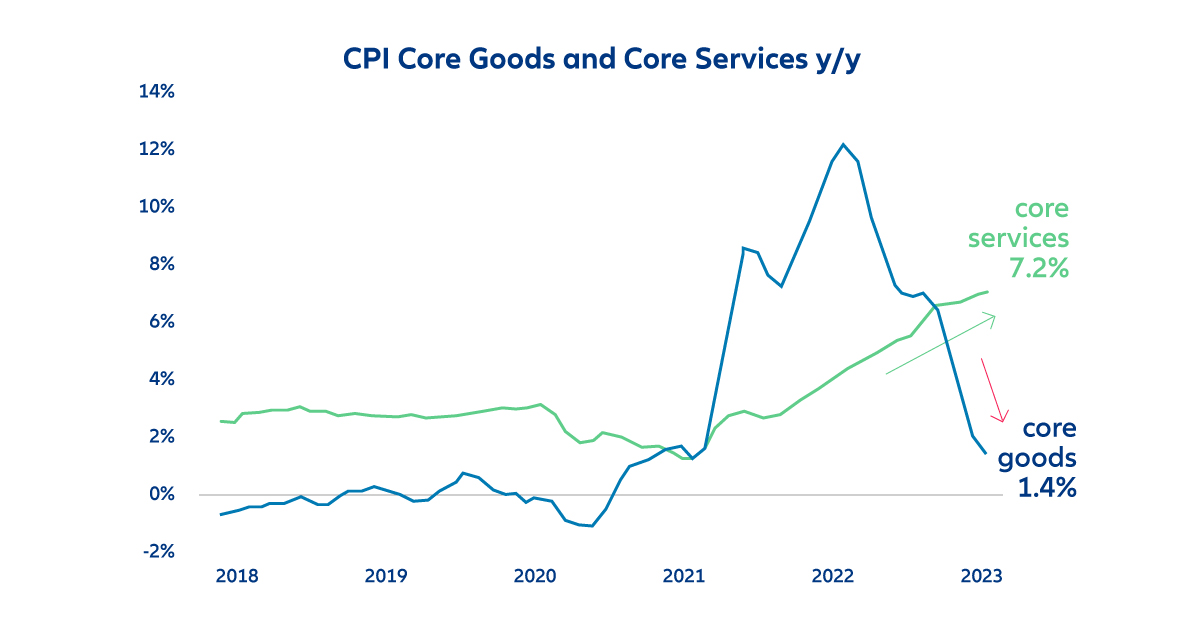

As shown in the first chart below, the headline y/y rate has fallen for seven consecutive months, dropping a total of 2.6% from June’s peak of 9.1%. However, the core rate has been more stubborn and has only fallen for four consecutive months, from the September peak, and has only dropped 1%. That is worrisome for the Fed since it focuses on core inflation. More worrisome still is that while core goods inflation is falling rapidly, core services inflation continues to rise and is now running at a very hot 7.2% y/y rate, the highest in over 40 years. The Fed is now concentrating more on services because 1. it is far outstripping goods inflation, and 2. services are more likely to be driven by labor costs, which in theory the Fed could influence more easily than the cost of goods.

Finally, the Fed has been focusing on “super core” inflation, which is core services excluding housing. Housing accounts for about one-third of the overall index, but it does not include all rental prices, only those that are signed in the month. Since those normally take a year to renew, housing inflation in the CPI lags market prices. And since market prices are falling, so will housing in the CPI going forward. In a sense then, housing inflation is already taken care of, so it makes sense to strip it out to see what’s happening underneath. Super core inflation is now running at 4% y/y, twice the Fed’s 2% target.

So the overall report was a bit warmer than expected, the core is being stubborn, core services are very high and rising, and super core isn’t good either. This report will keep the Fed on track for another 25 bps hike in March.

https://www.allianz-trade.com/en_US/insights/inflation-a-bit-warmer.html

February 21, 2023

Huntsman Corporation (HUN) Q4 2022 Earnings Call Transcript

Feb. 21, 2023 1:14 PM ETHuntsman Corporation (HUN)

Huntsman Corporation (NYSE:HUN) Q4 2022 Earnings Conference Call February 21, 2023 10:00 AM ET

Company Participants

Ivan Marcuse – Vice President of Investor Relations

Peter Huntsman – Chairman, President and Chief Executive Officer

Phil Lister – Executive Vice President and Chief Financial Officer

Peter Huntsman

Thank you, Ivan. Good morning, everyone. Thank you for taking the time to join us.

Let’s start out here on slide number five. Adjusted EBITDA for our Polyurethanes division in the fourth quarter was $37 million. Significant destocking across our markets, specifically in Europe and North America, combined with competitive pricing and historically high energy costs placed unprecedented pressure on the Polyurethanes business throughout the fourth quarter. Overall sales volume in the quarter declined 22% year-on-year, and 9% sequentially. The Americas and European regions accounted for all the declines as lower demand and significant destocking significantly impacted sales volumes.

Our Asian markets, primarily China, did experience modest volume growth in the quarter due to slightly improved demand in insulation and automotive when compared to the fourth quarter a year ago. Europe demand remained subdued. And from our vantage point, we’re still clearly in a recessionary economic environment. While energy costs remained historically higher, those headwinds have improved. This improvement will help to relieve some of the pressure on our European business as we move through the first-half of 2023. That said, falling costs and lower demand has triggered increasing pricing pressure on MDI, and that offset some of the benefit from lower natural gas prices.

As we indicated on our previous earnings call, we are restructuring our business in Europe to better reflect the high energy cost environment. In the short-run, we are also idling our smaller MDI line in Rotterdam for an extended period until end market demand improves. We have no intention of remaining an industry shock absorber as has been the case these past quarters. To be clear, Europe remains a core region for our Polyurethanes business. We will benefit for many years to come from the region’s needed drive for improved energy conservation and efficiency. We remain well-positioned to bring energy saving solutions to both residential and commercial construction markets as well as innovative improvement to the lightweighting of automobiles.

There is some optimism that economic conditions and demand in China will improve as 2023 unfolds due to the removal of the Chinese government’s Zero-COVID policies. How this optimism translate into increased consumer spending and industrial activity remains to be fully seen. Post Chinese New Year’s, we are seeing early signs of improved conditions in pricing trends and moderate demand improvement in areas such as cold chain, infrastructure, and certain consumer-related markets including furniture. China is the world’s largest MDI market accounting for approximately 40% of global capacity and demand. A steadily improving demand situation and potential economic stimulus would be a catalyst for our Polyurethanes business.

Lower propylene oxide margins in China drove our equity earnings lower year-over-year. Our joint venture contributed approximately $10 million in equity earnings for the quarter, below the $22 million reported a year ago. One of the greatest headwinds impacting our Q4 was, and continuing to challenge our Polyurethanes business is the high levels of destocking we’ve seen in our Americas region, and especially in our construction markets. Remember that two-thirds of our Polyurethanes Americas business goes into construction-related end markets, approximately half into commercial construction, and half into residential, of which 70% is related to new residential builds.

Our construction markets for composite wood products used in residential and non-residential insulation markets were under significant downward pressure throughout the fourth quarter. These trends have continued into the first-half of Q1 as we continue to see the impact of higher interest rates and their effect on downstream customer decision-making. We are hopeful that destocking in the Americas will ease as we move into the typically seasonally stronger months of March and April. Giving us some confidence in this regard is that our spray foam business, which was the first to see destocking last year, reported flat volumes year-over-year in the fourth quarter.

Our Huntsman Building Solutions spray foam business ended the year with $600 million of annual sales. While the housing market may endure a more difficult year than 2022 due to higher interest rates, we remain on the right side of energy efficiency drive, and we will benefit from both improved building codes and the government’s Inflation Reduction Act. Another positive trend continuing to emerge for our Polyurethanes business is the modest but steady recovery we are seeing in our global automotives platform which saw 7% improvement globally in the fourth quarter, with every region seeing positive volumes during the fourth quarter. Approximately 15% of our Polyurethanes portfolio ended up in automotive in Q4.

As we announced last quarter, we are not waiting for markets to improve, but are taking decisive and proactive steps to make our company more efficient, stronger, better positioned for when the current challenging conditions abate. We discussed last quarter in the short-term in Polyurethanes, we have adjusted MDI production to match demand, we will continue to monitor and to adjust accordingly during 2023, both in Rotterdam and at Geismar to ensure that we aggressively manage our working capital with cash generation as our top priority. Furthermore, we are moving forward aggressively on the cost reduction plans we discussed last quarter. We are on track of delivering as planned.

This includes existing geographies that are not generating acceptable returns and consolidating additional back office functions. Most of these actions will be completed by the end of 2023, and it will lower the overall cost basis for Polyurethanes by at least $60 million. Looking forward into the first quarter, we expect to see improvement over the fourth quarter despite the typically seasonality and lighter quarter due in part to the Chinese New Year. We should expect continued destocking in the United States, but that destocking should moderate as we move through the quarter. Putting it all together as we sit here today, we expect Polyurethanes adjusted EBITDA to the first quarter to be in the range of $55 million to $65 million.

Phil Lister

Thank you, Peter. Good morning.

Let’s turn to slide eight. Adjusted EBITDA for the quarter four was $87 million compared to $327 million in quarter four of 2021, and $271 million in quarter three of 2022. A decline over the prior year was driven by reduced volumes across our portfolio as well as lower unit margins in our Polyurethanes division. Sequentially, volumes declined by 14% driven by the significant destocking in Europe and in North America.

Seasonally, we would normally expect to see a sequential volume decline of approximately 5% across our portfolio. As a reminder, about 40% to 45% of our overall portfolio is linked to worldwide construction by commercial, residential, and infrastructure spend. Unit margins in Performance Products and Advanced Materials improved both year-on-year and sequentially with pricing remaining firm.

Polyurethanes unit margins declined as weakening demand led to price erosion in the fourth quarter while cost of sales increased year-on-year by over $500 million annualized driven by a significant increase in energy costs and raw materials. For the full-year Huntsman’s raw material cost increased by approximately $1 billion. Of which, approximately half was as a result of increased energy cost.

Let’s turn to slide nine. With our European restructuring, we have increased our cost optimization target to $280 million annualized run rate by the end of 2023. As a reminder, approximately half the savings are coming from SG&A reduction and half from cost of sales. We closed the year with an annualized run rate of approximately $190 million compared to $160 million at the end of quarter three. More specifically, for our European restructuring, we have completed the majority of works council discussions. We have some benefit from European restructuring late in the fourth quarter with some early headcount reductions.

The majority of reductions and reshaping of our footprint in Europe will occur during 2023 with a targeted annualized run rate of $40 million of savings by the end of the year. In addition, our move to a new global business service hubs in Poland and Costa Rica continues at pace with approximately one hundred positions already filled. As part of our continued focus on functional spend, we have also completed the handover of certain IT activity to a managed services third-party provider, saving approximately $15 million on an annualized basis

Within Polyurethanes, we continue to reduce headcount we work to align ongoing costs with current profit margins. In quarter one 2023, we will complete the previously announced exits from our Southeast Asia business, which will add to the already completed exit of our South American business in 2022.

As Peter mentioned earlier, we will be idling the smaller of our two Rotterdam MDI units for an extended period due to current end market demand. And we have also idled one of our three lines in Geismar, Louisiana until we see sustained improvements in the North American construction market. Both units can be brought back online as demand dictates. Combined, we expect to save approximately $10 million in cost in 2023.

Peter Huntsman

Thank you, Phil. In conclusion, as we close this chapter on one of our company’s most challenging quarters, I’d like to take a few minutes and express what we are presently seeing in the industry, and what we are doing in response. In the fourth quarter, we saw three major headwinds that impacted our performance.

The first of these was the near record high cost of energy. To move into the first quarter, we are seeing some moderation in energy prices. However, up to the present time, Europe continues to see gas and corresponding utility costs seven to 10 times higher than in North America. The relief that we are seeing has more to do with a mild winter in Europe and industrial demand destruction, rather than the structural change. I do not see a return in the coming years where prices will compete with North American gas and utilities.

To mitigate this, we announced four months ago, a $40 million cost savings plan as we recalibrate our European cost structure. We continue to remain on track to having this completed by the end of this year. It does not mark a retreat from our European market, but rather a longer-term commitment to compete and create shareholder value in the phase of new market realities.

We continue to assess the energy, regulatory and economic future of Europe. We will continue to possibly see further restructuring with our European footprint. The uncompetitive energy situation has caused the second headwind of our business, and inflationary drag on overall demand for our products. In the EU, this has been caused by rising energy costs and poor energy policies.

In the U.S., we’re seeing similar conditions due to rising interest rates. We believe that our Rotterdam MDI plant is one of the more competitive MDI plants in Europe. However, we will only produce that which we can competitively sell, we will idle one of our two lines in Rotterdam that represents about a third of our Rotterdam capacity. Our Geismar Louisiana MDI plant, we have closed one of our three lines that represents about 30% of our output.

While both of these lines can be restarted, we will only do so when conditions justify such a move. We’ve also taken a similar step in our performance products and to a lesser degree, our advanced materials divisions, so that we calibrate production to actual demand. This will allow us to generate better working capital and pass through raw material costs more effectively.

The last negative impacts in the fourth quarter was an unusually strong inventory reduction that was felt across all of our products, but particularly in Europe and North American construction. I believe that for more, we see things in the first quarter that inventory levels are very low on the chemicals portion of our customer’s inventory. However, we have much less visibility in our customers finished product inventory.

Would a building material supplier keep in warehouses, or in unsold houses are all part of an inventory change that impacts our products. These are parts of it. There are parts of the construction material segments, where we continue to see destocking taking place. Other segments are operating their plants and mills around just-in-time delivering. In the aerospace, automotive and spray foam insulation, we see much tighter change than we do in other areas.

We will continue to manage our working capital accordingly. We push for higher prices to recover more of our loss margins. As we looked at the remainder of the first quarter, we continue to see gradual improvements across the board. China continues to show signs of improved demand and gradual improvements in pricing as the economy loosens its previously enforced COVID restrictions. Early visibility into market conditions for Q2 are murky at best.

Regarding the second-half of this year, I could see a number of scenarios; it could mean hundreds of millions of dollars positively or negatively. To give a meaningful full-year outlook at this time would be speculation at best. What we will continue to do is to react with each variability in the macro marketplace and make decisions that create shareholder value. We will do this by remaining open-minded as to our overall portfolio and where we create lasting value. We will continue to assess our global footprint as it pertains to our cost, from where we source our raw materials to our internally-produced products.

David Begleiter

Thank you. Good morning. Peter, you mentioned some strength in MDI pricing in China recently. Could you give a little more color what seeing in the country on the ground right now? Thank you.

Peter Huntsman

Yes, following the Chinese New Year, we’ve seen prices go up to — on average around 15,800 a ton. Now, again, that’s on average. You’re going to see the specialty side of that going up higher, and you’re going to see some of the more commoditized going down lower than that. But that’s up from where we were in the fourth quarter, of around RMB 14,000 per ton. So, we are seeing some progress there in pricing. We are seeing some progress in demand. And, obviously, we hope that it continues. As we think about the Chinese market, think broadly around three broader areas, that which is consumer-related growth, that which is what I would call stimulus-related or infrastructure spending and so forth, and then that which is export.

I think the export, and an end that we play very little in by the way, continues to remain pretty sluggish. Consumer spending, now that would be in automotive and so forth, some of the areas that we compete in is going to be, at this early point, in this early view, that’s going to be the stronger of the three. And then we’re gradually seeing the uplift in infrastructure stimulus spending. And that’s going to be as you think insulation, as you think about some of the infrastructure projects, and so forth, that would require our products across the board, renewable, energy, rewiring of — re-cabling of a lot of the energy infrastructure. So, let’s remember that China has been down many segments, that economy has been down for nearly two years.

And this is not going to be just a post-Chinese New Year’s people come back to work the next week and everything is running at full capacity or not running at full capacity. That means it’s going to be a gradual improvement that we’ll see throughout the first, going into the second quarter. And particularly around that consumer uplift and around the infrastructure uplift, I think that we’re going to continue to see improvements in demand and improvements in pricing.

Aleksey Yefremov

Thank you. Good morning, everyone. Peter, with all the uncertainties — acknowledging all the uncertainties, would you say that the second quarter is likely trending better than the first?

Peter Huntsman

Yes, I would say that it certainly is. Look, I would think that every one of our quarters going throughout the year, I would hope, would be trending better. But I think that there’s just — and I talked in my prepared remarks around the murkiness that we’re seeing in the overall market. I — that suggests that the further out to that we go through 2023 when we think about things like GDP and a possible recession, China continuing to improve, construction in North America, these are going to bet flywheels that really are going to be determining if we got something that’s approaching $1 billion a year or not.

And then we need to see things like the completion of the deinventorying that’s taking place, as I said, on what we’re seeing from the chemical side, a lot of that deinventorying is already done in the chemical side. But again, we’re not going to see building materials, and we’re not going to see customers restock their inventory on the chemical side until they’re finished goods. Then go all the way down into the consumer areas, we’re not going to see our flip until that end of the supply chain and that end of the inventory is cleaned up. We did talk about, in the call, that the — our reliance on construction and home — and in commercial residential construction, particularly in North America.

And that will range anything from what we’re seeing right now in retrofits, which is a stronger end of the business than new starts, spray foam, which is the stronger end of the business and what we’re seeing in OSB, for instance. So, there are various parts within that construction segments that are growing and or — well, I should say at least recovering nicely. And there are other areas that I think we’re going to have to continue to see inventories clear out a little bit more. We’re also going to have to see something happen with interest rates where consumers feel that there’s some stability and gives them some reason to go make what is usually the largest single purchase that people make in their lives around construction.

So, when we think about us hitting our potential, I think that the biggest variables I look towards as — is our inventory, construction returning back to not full out, but certainly better than it is today, particularly in North America, energy being at a competitive rate particularly in Europe. Again, I’m glad to see the lower prices in Europe, but I’m afraid that lower price is because you’ve seen a 25%-30% demand drop on the industrial side, which means a massive deindustrialization that’s taking place. And I think that as we look across the Americas, you’re going to probably see more production, more gas, more oil production in North America that’ll be moderating energy prices throughout 2023. And, of course, China needs to continue to move forward. And again, in all those areas, will need to go through the roof in demand, but I think that we need to see a steady recovery taking place.

Kevin McCarthy

Yes, good morning. Peter, I have a two-part question on your Polyurethanes business. First, for the portion that’s exposed to construction, can you remind us how much goes into new structures versus retrofit of existing structures? And then secondly, what would you need to see to consider restarting the idle lines at Rotterdam and Geismar?

Peter Huntsman

Well, as we look at our North American business, figure that two-thirds of that is going to be around residential and one-third of that is going to be commercial. And in Europe, that’s going to be closer to a 50-50 sort of a number, it’s going to be much more weighted towards commercial than residential. And as we think about our residential side, about 30% of that is going to be retrofitting, and about 70% of that’s going to be new home build, so again, that will fluctuate a little bit, and both of those are opportunities for the states, and I think that again as we see the new build slowdowns, we see retrofit of home remodeling increase — that’s we are losing some on the straight home side, but we are gaining some on the straight home side on the retrofit side.

Frank Mitsch

Thank you, and good morning. I wanted to come back to the idling of the MDI facilities in Rotterdam and in Geismar. When did you bring those units down? What were your operating rates in MDI in 4Q? Where do you think 1Q is going to come out? And where do you think you are relative to the industry?

Peter Huntsman

Well, Frank, first of all good to hear from you. I think that relative to the industry that we are probably pretty close to the industry. There is such little transparency right now. I would guess that the operating rates right now are somewhere around 70% globally. And I base that basis our own. There are some people that are out there I recognize that are putting a priority on volume and — over value, we have looked at various programs, if you take government money, government subsidies in various areas around the world, you can do that. But they might be good on the short-term, but longer term you are kind of locked-in to keeping facilities operating at pretty higher rates. You can’t cut your cost as much as I think you should be able to. And on some degree, you are making a deal with the devil.

So, we looked at and we made a decision that shutdown our Geismar capacity in the fourth quarter of this year. Our Rotterdam facility is presently going through a turnaround right now. And when that restarts, it will not be restarting with all of it’s — with both of its line, just a larger of the lines in Rotterdam. So, but that — before the turnaround, it’s safe to say that we were moderating production at that facility as well.

Phil Lister

And as we said on our call, Frank, if demand dictates we can restart those units relatively quickly. But as Peter says, we are going to make sure that we are matching effectively production to end market demand.

Mike Sison

Hey, good morning. Happy Mardi Gras. In slide eight, where you have adjusted EBITDA bridge polyurethanes is down $180 million or so. And I think you guys said it was mostly volume. So, if the restocking ends, or I’m sorry, destocking ends, how much of that 180 comes back. And if there is a restocking event, as maybe things get better, hopefully, do you get all that back, and then some?

Phil Lister

Yes, Mike. I think if you look at the year-on-year for polyurethane, I think it is a combination of volume down year-on-year both in the Americas and in Europe, as we’ve said, and it is also a unit margin decline. Even though year-on-year, there’s actually a slight price increase year-on-year Q4 to Q4 obviously, there’s been a much more significant impact on variable costs.

I think we indicated a half billion dollar increase on cost of sales year-on-year. As we move forward and we said from Q4 to Q1, we would expect some unit margin improvements from Q4 to Q1 on polyurethanes, particularly with lower those still high natural gas prices. And of course, benzene has started to rise as well. But we would expect some unit margin improvements. It really then becomes a discussion around volume, the things that Pete has talked about in terms of China, and also when instruction comes back overall. But we are expecting improvement in Q4 to Q1 in polyurethanes.

Unidentified Analyst

Hi, good morning, Peter. It’s [indiscernible] on for P.J. What was the EBITDA earnings on your HBS sales of $600 million? And what do you expect sales to go next year with lower new build activity? And how much of it is non-U.S.? And can you talk about your aspirations for growing internationally?

Peter Huntsman

Yes, so we don’t disclose our EBITDA for HBS. Overall, you can obviously track the sales we give, we give that, we look at our integrated margins across that business and drive the business appropriately. As we said, between Q3 and Q4, we could see fairly flat volumes overall. And certainly Q4 over Q4 gives us some part that maybe some of the destocking has finished. In terms of our international business overall, that spray foam is needed more than anywhere over in Europe. And you think about the U.K., you think about some Western Europe, which is needed, it is a relatively smaller part of our business overall sub 10% right now. However, we would expect that to grow over the next three to five years, particularly in the European landscape that really needs energy efficiency.

Phil Lister

I would just note, as we look at expanding that business in Europe, we’re able to do it with our present configuration of assets there, meaning that we will not have to make an investment in system houses or facilities to be able to continue to grow the European market. But we’re also focused on the Asian markets as well. And again, it’s not just us that there’s just not a lot of polyurethane spray foam. Those are very, very ideal markets for us to be expanding in over the coming years, but right now that the Lion’s share of our focus and majority and improvement in earnings. And that business continued recovery will be in North America. And with that operator, why don’t we take one more question, and then we’ll wrap it up. I think we’ve got a little bit over time here.

Hassan Ahmed

Good morning, Peter and Phil, thanks for taking the question. Look, a question around the near and medium-term MDI supply. I mean, you guys talked about your sales sort of matching your supply to the lower demand, right, within MDI. I mean from what I’m seeing the rest of the industry is doing the same. Would you sort of think that that discipline will continue, I mean obviously, you guys will, but for the rest of the industry as demand comes back, so that’s on the near-term side of it. And on the medium term side of it, what are you guys seeing in terms of the industry participants may be rationalizing capacity, may be reconsidering expansions in the like?

Peter Huntsman

Well, obviously I can’t comment on what the competition is doing or how long and to what degree they’ve shut back capacity. So, I think it probably varies from player to player, but I’d only be speculating at that point. Long-term as we look at MDI, I would just remind, it may seem like I’m talking about a decade ago but if we go back just a year-ago, if we go back to pre-COVID times and in the post COVID times, this industry continues to be a very robust industry, MDI, it continues to replace other products, and it continues to grow better than GDP rates. And we were essentially sold out before we saw the meltdown in Europe around energy prices. When I say we, I’m not just talking about Huntsman, I think as an industry, we were sold out, we were in discussions with a number of a very large customers that we’re talking about, wanting multi-year contracts and wanting to buy capacity within our facilities, and so forth, sort of topics that we’ve never had before with customers.

And so, there has not been a lot change on the overall structure of the market, the market is still going to be growing, where it will need at least one world scale facility that come on every nine to 12 months, and most of that demand is going to be taking place in China. And most of that new construction will be taking place in China. But as you look out over the horizon, and you think about the number of new facilities that are going to be, they’re going to be built, there’s what one or two that have even been announced.

And over the course of the next five to seven years, however long it takes to build one of these, I think that there is going to be a very legitimate question about Europe. And as I look at the cost per ton of European MDI crude production, now, again, I’m not talking about the finished product, the crude production, that’s energy intensity, and dependency on the price of crude oil, and specifically benzene. And I look at that crude production in Europe, with the high energy, high regulatory costs and compare that to the Americas. And I compare that to the Middle East, I compare that to Asia, if there is going to be a multi $100 per ton cost differential, it’s now going to be built into Europe, I questioned some of the long-term competitiveness of low cost polymeric MDI, particularly around today’s pricing, and how that survives.

You’ve got producers in MDI, for the more commoditized rates in Europe that are losing money today. And that’s what today’s energy prices. And so, I’m kind of at a loss as to how that really changes that, how that dynamic changes in Europe. And so, my comments and I talked about, we continue to look at our portfolio, we continue to look at where we source not only our raw materials, but where we source our internal supply of crude MDI and the components to make a molecule of MDI.

I don’t think that that I personally don’t feel that we’re done answering that question as to what that global footprint ultimately looks like. Because if you go back two years ago, it’s not I’ll just remind you that in 2021, European prices for a ton of MDI was actually the lowest costs, excuse me, 2020, the close of 2020, European MDI prices for Huntsman on a per ton basis were around 875 per ton, Geismar there around 950, and they were about 925 in [indiscernible].

Now, my point in that is that all three of those regions were within 10s of dollars to each other. You couldn’t afford to move product from region to region, and really be competitive because the manufacturing basis in all three regions was essentially the same. And you’re looking at what, $250 to $350, $400 a ton to move product. Now you’re looking at variable costs to produce a ton of MDI. This last year was as much as $1,000 per ton difference. And as we look at that cost difference today, you’re talking about in excess, from the lowest to the highest within Huntsman in excess of $500 a ton, which obviously covers freight.

And that’s the sort of a spread and sort of a delta that I don’t think you can, if that’s going to continue on a longer-term basis and if what we see today is as good as it’s going to get in Europe, we’ve got to continue to ask ourselves, what sort of footprint do we need in Europe to remain competitive, to create shareholder value and we’re going to continue to look at that and to make sure that we’re moving quickly to try to address some of those sorts of issues. So, sorry, that’s a long rambling answer, but it gets to the heart of what we’re seeing in Europe and the deindustrialization, and a lot of the chemical segments that we are seeing in Europe, and how we need to be responding to it on the short-term and longer terms we look at over the next couple of years, I’m not sure those answers have all been completely satisfied, at least not to my satisfaction.

February 21, 2023

Q4 2022 Stepan Co Earnings Call

Fri, February 17, 2023 at 5:02 a.m. EST·19 min read

Participants

Luis E. Rojo; VP & CFO; Stepan Company

Scott R. Behrens; CEO, COO, President & Director; Stepan Company

David Cyrus Silver; Senior MD & Director of Equity Research; CL King & Associates, Inc., Research Division

David Joseph Storms; Research Analyst; Stonegate Capital Markets, Inc., Research Division

Michael Joseph Harrison; MD & Senior Chemicals Analyst; Seaport Research Partners

Vincent Alwardt Anderson; Associate; Stifel, Nicolaus & Company, Incorporated, Research Division

Scott R. Behrens

Good morning and thank you all for joining us today to discuss our fourth quarter and full year results. To begin, I will share our fourth quarter and full year highlights and strategy outlook, while Luis will provide additional details on our financial results. Despite significant external supply chain challenges in a difficult macro environment, the business was able to deliver another record year. Significant inflation in raw materials, logistics and other expenses were fully offset with pricing actions, mix improvements and productivity efforts.

Michael Joseph Harrison

I was hoping that you could discuss some of the factors that drove the 17% volume decline that you saw in Q4? Maybe help us understand how those split out between destocking, underlying market weakness and other factors? And were there any key differences in the volume impacts, particularly from destocking as you look between the Surfactants business and the Polymers business.

Luis E. Rojo

Thank you, Mike. Look, as you rightly said, so when you think about the minus 17%, you need to think about those three buckets, right? One is demand, one is destocking and the other is the transition to low 1,4 dioxane product, which we clearly communicated in October that we lost a Tier 1 customer, and there are other impacts on the volume side related to the transition. So if you think about those three big buckets and you think about the minus 17%, roughly, each bucket is one-third. So think about 5%, 6% is the impact of each of them. And of course, when you think about polymers, you don’t have the low 1,4 dioxane transition, so you can see more than a half and half situation between the other two buckets. But that’s how we’ll summarize the three big buckets that we saw in the minus 17% in Q4.

Michael Joseph Harrison

All right. And I guess in terms of destocking, that can’t go on forever from your customers. Are you starting to see signs that order patterns are normalizing at some point here in Q1? Maybe talk about what you’re hearing from your customers in surfactants as well as in polymers.

Scott R. Behrens

Yes, Mike, I would say that it can’t go on forever as well. But I would say, incrementally, we may be seeing a little uptick versus what the pattern we saw in Q4, but I don’t think we’re done with destocking activities at this point. As you compare surfactants versus polymers, obviously, two different channels to the retail end use. I would say on the polymer side, it’s — once you get past the manufacture of the rigid insulation panels that our Polyols goes into, it’s a highly fragmented market of distributors and contractors across the country.

Vincent Alwardt Anderson

I just wanted to ask, given your existing alkoxylate portfolio and the PerformanX acquisition last quarter, how quickly do you think you can ramp and then fill the order book for the Pasadena facility once it’s up and running?

Scott R. Behrens

Yes. Good morning Vincent, from an alkoxylation perspective, we have two existing alkoxylation facilities here in the U.S. today. Pasadena will be our third. We also utilize a broad network of third-party toll manufacturers today that we have been using as capacity to continue to grow the product line, which has been doing very well, exceeding our expectations. So upon startup at Pasadena, we will have a very good opportunity to get that utilization up in balance with how we want to manage our external tolling network. So we have, I think, the ultimate flexibility to ensure the proper utilization of our internal assets and allow us to continue to grow using tollers as needed.

Vincent Alwardt Anderson

Perfect. And I’m not going to ask you to predict the future on raw materials and all of that. But if we continue along this slow demand environment through at least the first half of the year, is there any reason that we wouldn’t see a little bit of positive timing impact between price and raws like we’ve seen in past down cycles.

Scott R. Behrens

It’s hard to say, Vince. I would say that raw materials kind of plateaued in Q4. So it’s pretty stable right now. And whether it’s going up or down from here, it’s hard to predict. There’s too many factors that play into that. Our focus is really we will continue our pricing actions to cover our continuing any cost inflation that we have within the business and operations. So I think it’s wait and see, but we expect that we’ll continue with our pricing strategy as needed.

David Cyrus Silver

That’s great color, I appreciate it. My next question would be kind of about new products. And in particular, I think I’ve asked this question some time ago, but does Stepan track, I guess, or calculate internally a vitality index? In other words, percentage of revenues from products that have been developed in the last three years, the last five years, something like that. And if not, I was just wondering if you could call out from a revenue or from a margin impact, however you look at it internally.

Scott R. Behrens

Yes. So I’d first start with where we are focused on strategic end market growth. And that’s within the agricultural chemicals space as well as specialty alkoxylates. So in agricultural chemicals, we’re part of that development pipeline for new active pesticides. And that pipeline is anywhere from 5 to 10 years long for new products to come to market. So we’re deeply embedded in those development pipelines with the large pesticide producers out there, which is a really great place to be, and we have new products being launched in multiple regions (inaudible). The other big focus for us is in specialty alkoxylates.

Luis E. Rojo

What I would add, David, is we are investing and we are making good progress as Scott mentioned in the remark spray foam also. So we are working with new products there. If you think — we also talk about [Chemco] we are relaunching that product line. And actually, when you think about low 1,4 dioxane, right, that’s kind of at the end, a significant investment that we’re making to have a totally new ether sulfate portfolio that meets the new regulation, but that’s at the end, there’s a lot of new volume that is going to be in a new product versus the past.

David Cyrus Silver

Okay. Great. And I should have mentioned 1,4 dioxane, of course. Last question, and this would be on your marketing, and it has to do with your strategy for Tier 2, Tier 3 customer development. But you did mention, I think, a net addition customer base of about 550 for 2022. And I’m just wondering if we should think about a particular target for next year? And more to the point, do you think you’ve kind of, I don’t know, cherry-picked or high-graded the opportunities out there on the Tier 2, Tier 3 base of customers?

Scott R. Behrens

Yeah. No, David, great question. We’ve been, I think, pretty clear that growing this Tier 2, Tier 3 segment is a major portion of our company’s growth strategy. And we continue to invest in sales, marketing and R&D to support our continued growth with this segment on a global basis. We’ve identified that target for a prospective customer list in Tier 2, Tier 3 around the world in the tens of thousands. And becoming more efficient in reaching and securing orders from these customers around the world is our focus. And the $550 million is a good number. We’re proud of that, and that leads to improved profitability for our company. And that’s kind of our expectation going forward is our teams are going to continue to execute and deliver those new customers on a net basis in that hundreds per year.

https://ca.movies.yahoo.com/q4-2022-stepan-co-earnings-100228864.html

February 21, 2023

Increased global supply of PU-based adhesive

improves choice and supply chain resilience

Manufacturers and end users around the world are benefiting from increased availability of PU-

based adhesives following the introduction of the new PearlBond adhesive range produced by

leading Dubai-based system house, Pearl Polyurethane Systems. Previously, manufacturers in many

parts of the world had access to a limited choice of suppliers, constraining production levels and

restricting R&D opportunities. Pearl has increased both choice and improved supply chain resilience

by increasing production levels available globally with the added benefit of ongoing technical

support provided globally by its fly-in fly-out R&D team.

Two major manufacturers are already utilising the new PearlBond adhesive product in their

manufacturing processes and are benefiting from both short delivery times and ongoing technical

support. This means manufacturers can adopt a more efficient ‘Just-In-Time’ (JIT) inventory model,

tying up less capital by reducing the quantity of stock on hand at any one time. Pearl intends to

continue its product roll-out beyond the Middle East region, with its sights set on South-East Asia,

Europe, Africa, and North America.

The new PearlBond product is commonly used as a binder for running tracks, children’s playground

mats, and garden tiles, with a range of other outdoor use cases. PU-based adhesives are also used in

sandwich panel insulation manufacturing as a lamination adhesive, as well as a roof adhesive for a

range of construction applications and wood binders for structural uses. Further applications are

lamination adhesives used in the packaging industry.

Kapil Deshpande, sales head CASE-applications of Pearl

Polyurethane Systems with a drum of the new PearlBond adhesive product

Kapil Deshpande, sales head CASE-applications at Pearl Polyurethane Systems commented, “When

compared to competing rubber and thermoplastic materials, polyurethane-based adhesives can

provide a more cost-effective and durable solution suitable for moulding and processing equipment

when formulated accordingly. This is exactly where the new PearlBond adhesive can help.

“However, our main point of difference is our agility and the ongoing technical support provided by

our experienced R&D team, which provides support to manufacturers in real time using video

conferencing or on a fly-in fly-out basis – especially important when urgent production or application

process needs arise. It is this type of agility and quick response times that are resonating with

manufacturers and end users around the world. By increasing production of PU-based adhesives, we

can react more quickly to customer needs and protect against the risk of delivery delays, enabling

manufacturers around the world to forecast their production plans further into the future.

“Furthermore, a key advantage is our central location in Dubai providing moderate energy costs,

affordable labour, access to optimised raw material sourcing, and excellent connectivity with dropped

shipping rates. We are thrilled by the positive feedback so far which has exceeded our expectations

and resulted in increased orders of our new PearlBond adhesive product.” concluded Deshpande.

In 2021, Pearl’s R&D team won the ‘Innovative Insulation Project of the Year 2021’ award for the first

R&D initiative of its type launched in the Middle East, and again this year for launching its new, more

sustainable EcoPearl insulation product which achieved an overall improvement of up to 20 per cent

in insulation performance over comparable products. In doing so, Pearl is enabling the construction

industry to play its part in the fight against global warming.

Operating since 1996, the company has supplied polyurethane systems for several trailblazing

projects in the Gulf region, including Palm Jumeirah, Downtown Dubai, and Ski Dubai in Mall of the

Emirates, and more recently, the Germany Pavilion at Dubai Expo 2020 and, Bustanica, the world’s

largest vertical farm for Emirates Airlines flight catering in Dubai.

Pearl Polyurethane also offers a comprehensive range of polyurethane formulations and prepolymers

for the production of high-performance polyurethane foams and elastomers.

About Pearl Polyurethane Systems

Pearl Polyurethane Systems LLC, based in Dubai, is the largest system house in the Middle East and Africa

providing customised solutions for all major polyurethane applications and foam systems.

Pearl Polyurethane offers a comprehensive range of polyurethane formulations and prepolymers for the

production of high-performance polyurethane foams and elastomers.

Formerly known as Bayer Pearl and Pearl Covestro, the company has a proven track record of more than 25 years

in the Middle East region, with the company’s roots dating back to Otto Bayer – the German inventor of Polymer

in 1937.

The company provides products and solutions under a range of brand names that offer many benefits:

Polyurethane foam systems that have set the global benchmark in polyurethane foam insulation; Solid

polyurethane elastomers; Polyurethane systems used in the automotive and soft furniture industries to provide

soft and comfortable foam mouldings; and a range of other PU-based products in many fields of application.

Sustainability and research play an important role at Pearl Polyurethane. Polyurethane foams deliver superior

energy savings and reduce CO₂ emissions. With the aim of eliminating waste and ensuring continual use of

resources, the company’s circular economy policies empower its research and development team to constantly

innovate and ensure its products meet world-class standards while reducing impact on the environment.