The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

February 21, 2023

Huntsman Announces Fourth Quarter 2022 Earnings; Approximately $1.2 Billion in Buybacks and Dividends in 2022; Huntsman Board Approves 12% Dividend Increase

Download as PDFFebruary 21, 2023 6:00am EST

Related Documents

Fourth Quarter and Recent Highlights

- Fourth quarter 2022 net loss of $91 million compared to net income of $597 million in the prior year period; fourth quarter 2022 diluted loss per share of $0.48 compared to diluted earnings per share of $2.73 in the prior year period.

- Fourth quarter 2022 adjusted net income of $8 million compared to adjusted net income of $195 million in the prior year period; fourth quarter 2022 adjusted diluted earnings per share of $0.04 compared to adjusted diluted earnings per share of $0.89 in the prior year period.

- Fourth quarter 2022 adjusted EBITDA of $87 million compared to adjusted EBITDA of $327 million in the prior year period.

- Fourth quarter 2022 net cash provided by operating activities from continuing operations was $297 million. Free cash flow from continuing operations was $211 million for the fourth quarter 2022 compared to free cash flow from continuing operations of $648 million in the prior year period.

- Repurchased approximately 9.1 million shares for approximately $250 million in the fourth quarter 2022.

- On February 17, 2023, the Board approved a 12% increase to the quarterly dividend.

- Huntsman has secured all regulatory approvals required to complete the sale of its Textile Effects division to Archroma, a portfolio company of SK Capital Partners. The transaction is expected to close on February 28, 2023. Huntsman expects the net after tax cash proceeds to be approximately $540 million before customary post-closing adjustments.

| Three months ended | Twelve months ended | |||||||

| December 31, | December 31, | |||||||

| In millions, except per share amounts | 2022 | 2021 | 2022 | 2021 | ||||

| Revenues | $ 1,650 | $ 2,112 | $ 8,023 | $ 7,670 | ||||

| Net (loss) income attributable to Huntsman Corporation | $ (91) | $ 597 | $ 460 | $ 1,045 | ||||

| Adjusted net income (1) | $ 8 | $ 195 | $ 636 | $ 726 | ||||

| Diluted (loss) income per share | $ (0.48) | $ 2.73 | $ 2.27 | $ 4.72 | ||||

| Adjusted diluted income per share(1) | $ 0.04 | $ 0.89 | $ 3.13 | $ 3.28 | ||||

| Adjusted EBITDA(1) | $ 87 | $ 327 | $ 1,155 | $ 1,246 | ||||

| Net cash provided by operating activities from continuing operations | $ 297 | $ 733 | $ 892 | $ 915 | ||||

| Free cash flow from continuing operations(2) | $ 211 | $ 648 | $ 620 | $ 589 |

| See end of press release for footnote explanations and reconciliations of non-GAAP measures. |

THE WOODLANDS, Texas, Feb. 21, 2023 /PRNewswire/ — Huntsman Corporation (NYSE: HUN) today reported fourth quarter 2022 results with revenues of $1,650 million, net loss of $91 million, adjusted net income of $8 million and adjusted EBITDA of $87 million.

Peter R. Huntsman, Chairman, President, and CEO, commented:

“In 2022 we delivered almost $1.2 billion of adjusted EBITDA and Free Cash Flow of over $600 million. We increased our dividend and in total returned approximately $1.2 billion to shareholders. We made great progress in our cost reduction programs to offset historically high inflation and energy costs and strengthen our core businesses. We also announced the agreement to sell our Textile Effects business, which we expect to be completed at the end of this month.

“Turning to 2023, we are optimistic that destocking will end in the first part of 2023 and fundamentals in our businesses will begin to modestly improve as we move through the year, but visibility into the second half is still low. We are seeing some green shoots in areas like China, automotive, and aerospace, but construction demand globally is still under pressure. Regardless of how much demand improves through the year, we will remain focused on delivering our previously announced cost reduction programs, returning cash to shareholders, and looking for strategic investments to improve our core business while maintaining a strong balance sheet. We look forward to updating you of our progress as we move through 2023.”

Segment Analysis for 4Q22 Compared to 4Q21

Polyurethanes

The decrease in revenues in our Polyurethanes segment for the three months ended December 31, 2022 compared to the same period of 2021 was primarily due to lower sales volumes and the negative impact of weaker major international currencies against the U.S. dollar, partially offset by higher MDI local prices. Sales volumes decreased primarily due to lower demand, particularly in our European and American regions. The decrease in segment adjusted EBITDA was primarily due to lower sales volumes, lower MDI margins, the negative impact of weaker major international currencies against the U.S. dollar and lower equity earnings from our minority-owned joint venture in China, partially offset by lower fixed costs.

Advanced Materials

The decrease in revenues in our Advanced Materials segment for the three months ended December 31, 2022 compared to the same period of 2021 was primarily due to lower sales volumes, partially offset by higher average selling prices. Sales volumes decreased primarily due to deselection of lower margin business and lower customer demand in industrial markets, partially offset by higher demand in our Aerospace market. Average selling prices increased largely in response to higher raw material, energy, and logistics costs as well as improved sales mix. The decrease in segment adjusted EBITDA was primarily due to lower sales volumes, partially offset by higher sales prices and improved sales mix.

February 21, 2023

My Toughest Challenge: Jerry Lebold of BASF Geismar

By

–

December 4, 2022

THE CHALLENGE

One thing BASF’s Jerry Lebold has learned over the years is the importance of having the right team with the right skills and talents.

That’s particularly important now, given the wave of retirements impacting the industry. “There’s a lot of knowledge that gets lost when someone who has worked for 30 or 40 years retires,” Lebold says. “Our challenge is knowledge retention and getting new team members to learn from that.”

Another hurdle—a cultural preference for four-year college degrees over manufacturing careers. “Students today want to work for Google or Microsoft or Tesla,” Lebold says. “Many of them don’t recognize the opportunities that manufacturing provides in their own backyard. It’s simply a failure to get the word out, and that’s unfortunate given the urgent need for skilled, capable team members and the proliferation of manufacturing jobs.”

THE RESOLUTION

Lebold has learned that the best way to change that perception is through a system of constant engagement. BASF starts early by grooming its future workforce while they’re still in elementary school.

“When I came here three years ago, I began to notice a real value in engaging our local schools,” he adds. “In Ascension Parish, we start very early with kids in the 4th grade. We sponsor the BASF Kids’ Lab at the Louisiana Arts & Science Museum, and we get them excited about the possibilities of a future in STEM.”

It doesn’t stop there. The company targets rising juniors and seniors through its BASF Tech Academy, whereby students visit the Geismar site for a week and are exposed to a variety of jobs in manufacturing, such as process technician, engineering or the skilled trades.

“Later, we offer them mentorships, internships and scholarships, while also guiding the curriculum at local community colleges and universities through advisory panels. That way, we ensure that the programs they’re offering put students in the best position to get hired.”

Lebold’s hope is that BASF will keep students in the local communities “constantly engaged” throughout their education. “In doing so, we’re creating a local pipeline,” he adds. “We hope to see those students who first came to BASF Kids Day in 4th grade also go through the TECH Academy as high schoolers, then eventually land a summer internship and even a full-time job.”

Upon attracting top talent, BASF shifts its focus to retainage through its learning and development program and learning coordinators. In the process, they promote the continuous development of those skillsets.

THE TAKEAWAY

Over the last three years, Lebold has broadened his diversification efforts by focusing more on local minority communities, as well as attracting more women to the manufacturing sector. “I think there’s a great opportunity to work with local underserved communities so that they’re aware of the jobs and opportunities, then put them in a position so that they can successfully be a part of this industry up and down the river,” he adds.

BASF has begun working with advocacy groups in the region such as the Greater Baton Rouge Industry Alliance, Louisiana Chemical Association and Louisiana Association of Business and Industry to make it happen. “We’re in the early stages of trying to figure out what that looks like, but I think it gets solved collaboratively and with the industry as a whole,” he adds.

“We have to look at those hurdles that are preventing these kids from advancing. We’re going to need operators, millwrights and technicians … so we need to work right here in this region to make sure we provide those opportunities.”

February 19, 2023

Wanhua Chemical Launched a Molded Pallet Solution with MDI-based Binder

TIME :2023-02-17

Wanhua Chemical has introduced an MDI binder-based molded pallet solution. The molded pallets use wood and crop waste as raw materials, and are recyclable through shredding and pressing processes.

The MDI-based binders provide high bonding strength and have higher moisture tolerance. Compared to conventional solution, the new solution significantly reduces the amount of binder usage.

During pallet production, the binder requires less heating for preparation, and required time for heat-pressing is reduced by 50%, thus saving electricity consumption and reducing carbon emissions.

The formaldehyde-free molded pallets reduce VOCs in production, benefiting the health of both workers and end-users.

The molded pallet with MDI binder provides a new option for logistics and packaging. Wanhua Chemical is committed to making its products more low-carbon, environment-friendly and high-performance, and becoming a supplier of high-quality solutions.

https://en.whchem.com/cmscontent/638.html

This is probably easier than trying to recycle wood pallets, with all the nails, etc.

February 15, 2023

Thomas Toepfer to leave Covestro as of August 31, 2023

02/15/2023 | 12:38pm EST

The Supervisory Board of Covestro has today acceded to the request from CFO and Labor Director Dr. Thomas Toepfer for the early termination of his current contract, which expires on March 31, 2026. Dr. Toepfer will leave the company as of August 31, 2023 to pursue a new role as CFO at the European aircraft manufacturer Airbus. Until then, Dr. Toepfer will continue his work as CFO and Labor Director to the full extent and with the same high level of commitment. The Supervisory Board has started its search for a successor and will make an announcement in due course.

Dr. Thomas Toepfer has been a member of Covestro’s Board of Management since April 2018 and, as Chief Financial Officer, is responsible for Accounting, Controlling, and Finance, among others. He has additionally held the position of Labor Director since January 2019. “We respect Thomas Toepfer’s personal wish to terminate his contract early in order to pursue his professional career outside the Group. Since he assumed office, he has made a major contribution to Covestro’s successful development,” says Dr. Richard Pott, Chairman of the Supervisory Board of Covestro. “In the past few years, he and his team have continually expanded the company’s financial structure and established the Group’s Finance board department very well at all levels. Thanks also to his commitment, Covestro enjoys a high level of trust by the capital market and today has all the tools to ensure the long-term Group strategy is sustainably financed. On behalf of the entire Supervisory Board, I thank Thomas Toepfer and wish him good luck and every success in his new role.”

Covestro’s CEO Dr. Markus Steilemann says: “Through his tremendous commitment, Thomas Toepfer has played an important role in developing and implementing our strategy. Together with our strong management team, we have successfully driven Covestro’s organizational realignment and in this way created the conditions necessary for Covestro to successfully generate sustainable growth.”

February 14, 2023

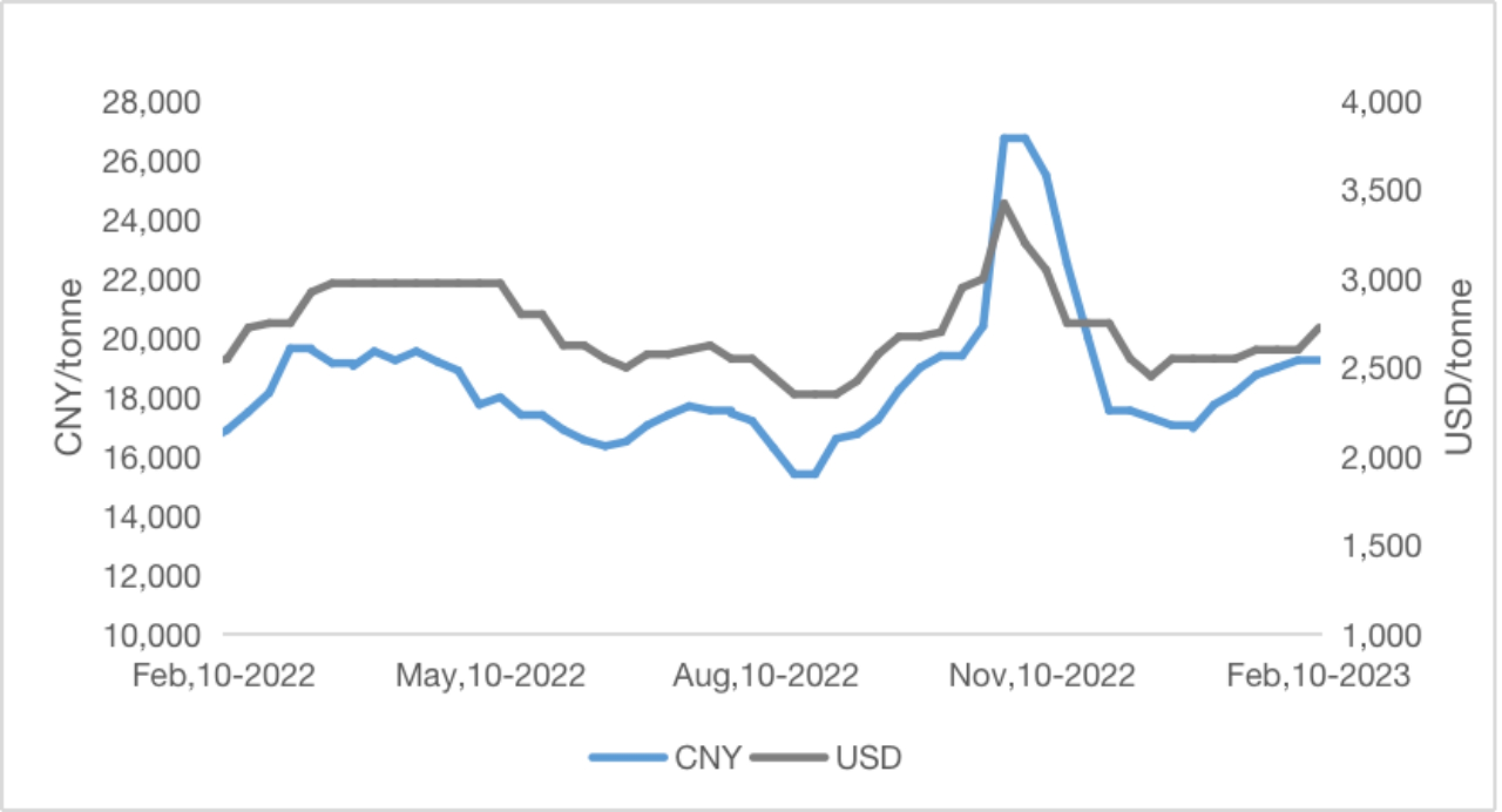

China TDI Price Forecast for 2023

PUdaily | Updated: February 14, 2023

After returning from the Spring Festival holiday in 2023, the already high TDI price not only did not fall, but began another round of rapid rise: Covestro and BASF guidance prices increased sharply, and the market rumored that Wanhua Chemical will permanently close the old TDI production plant in Fujian on February 1. At the end of January, the market price rose rapidly to 20500~21000 CNY/tonne. However, after the Lantern Festival, the downstream industry basically resumed work, and was cautious in the face of high prices, and just needed procurement. Subsequently, as the trading continued to be light, some traders began to waver, driven by the low-price shipment of the profit order, some chose to let the profit shipment, the market price loosened slightly, the quotation range converged significantly, and the market price returned to around 20200~20600 CNY/tonne.

Table 1 Price influencing factors and forecast of China TDI market in2023

For the subsequent price trend, Pudaily combined the raw material side, supply side and demand side information to predict the TDI market price for the whole year of 2023:

Table 1 :Influencing Factors & Forecast for China TDI Market Price in 2023

| Influencing Factor | Impact on TDI Price | |

| Feedstock | It is projected that the impact of Russia-Ukraine conflict and OPEC’s oil output cuts would continue, and global crude oil prices would fluctuate at high levels in 2023. | – |

| Supply | It’s expected that Gansu Yinguang’s new 150kT facility would resume production in February 2023, and Wanhua Chemical’s new 250kT facility in Fujian would be put into production in June 2023. | ↓↓↓ |

| Demand | Domestic demand: Under China’s principle of “houses for living in, not speculation”, the demand in the main downstream industry of TDI – upholstered furniture- is unlikely to increase significantly. However, in view of the liberalization of anti-epidemic measures, demand may recover somewhat under the government’s initiatives to stimulate consumption. | ↑ |

| External demand: As many foreign TDI facilities are outmoded, their overall supply capacity is declining, thereby widening the gap between supply and demand. Meanwhile, Chinese TDI suppliers and traders have paid more attention to exports in recent years, especially after China has lifted registration system for foreign trade authorization. China’s TDI exports are expected to maintain year-on-year growth in 2023. | ↑ | |

| Comprehensive Prediction | In 2023, China’s TDI market is expected to open high and move downward, with weak fluctuations. The demand in China is projected to revive in 2023, with a slight year-on-year increase. However, owing to the increase of 300kT TDI supply capacity, and the low possibility of substantial growth of Chinese and global economy, especially the demand in the upholstered furniture industry, Chinese TDI market is forecasted to be oversupplied, and prices may open high and decline weakly in 2023. TDI prices in China would move between CNY 14,000/tonne and CNY 20,000/tonne. |

NOTE: “↑” represents positive, “↓” represents negative, and “-” represents neutral. The more the number of arrows, the greater impact the influencing factor is likely to have.

On the whole, it is expected that China’s TDI price will open high and low in 2023, which will be weak and volatile. In summary, demand is expected to recover in 2023, with a slight year-on-year increase. However, due to the supply-side production capacity will increase by 300,000 tons, and the substantial growth of China and the global economy in 2023, especially the possibility of a substantial increase in demand in the upholstered furniture industry, the overall TDI market in 2023 has a high probability of supply exceeding demand, and the price may open high and go low, weak and volatile, and the expected operating range: 14,000 yuan / ton ~ 22,000 yuan / ton.